Argentina has a new ‘Super’ Economy Minister with a broad mandate and Peronist support

Argentina named Sergio Massa as a new ‘Super’ Economy Minister last week, with a big mandate and Peronist support, in the hope that he can stabilise the economy ahead of the 2023 elections. Brazil’s economic indicators appear to be pointing in the right direction, but this is not currently showing up in Bolsonaro’s popularity ratings. China’s economic indicators dipped again in July, and the Politburo all but abandoned their 5.5% GDP growth target for 2022. They nevertheless outlined their plans for Evergrande and announced the creation of a fund to support the real estate sector. European GDP data for Q2 surprised on the upside, while the US Q2 GDP release (-0.9% qoq saar) missed consensus estimates by a whopping 1.3%. Fed chair Powell managed the incredible feat of delivering a 75bps ‘dovish hike’.

Geopolitics

Russia cut the flow of gas delivered through the Nord Stream pipeline to 20% of capacity, down from 40%, citing a technical issue1. Germany accused Russia of bluffing and accused them of breaching their supply contract. The front month contract for European gas futures went back above EUR 200 /MWh for the first time since early March.

Emerging markets

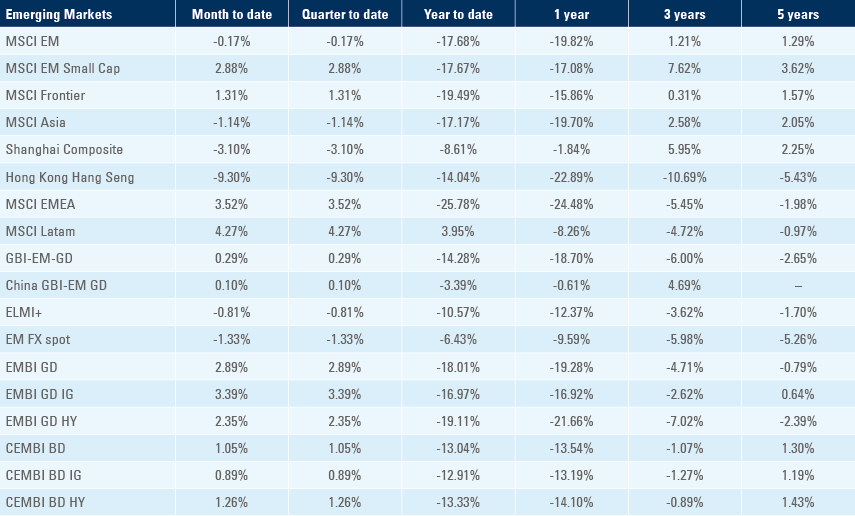

Argentina: President Alberto Fernandez replaced the finance minister for the second time in less than one month and named Sergio Massa as Economy Minister, with expanded powers including production, agriculture, labour and relations with the IFIs. Massa is a pragmatic Peronist party politician and a former Mayor of Tigres, who came third in the 2015 presidential election. Massa’s appointment received strong support from the Peronist leadership, who seem to be looking for ways to muddle through until the 2023 election. He most likely accepted the position in the belief that he can turn around the country’s dire economic trajectory and position himself as a successor to Alberto Fernandez. This is a tall order given the lack of confidence in Argentina by both local and foreign investors, but he was given sweeping powers and the market cheered the change in policy direction: the gap between the parallel and official exchange rates tightening to 122% from 156% in the two days since Massa’s appointment (Figure 1). In our opinion, to stand a chance, Massa needs a sharp turn towards policy orthodoxy, including a large 30%-50% devaluation to incentivise exporters to convert their USD into ARS. This may not be politically possible. It would also need to be accompanied by a large and front-loaded fiscal consolidation allowing the government to curtail monetary financing, which has been responsible for the sharp increase in inflation from 35.8% in December 2020 to 64% yoy in June. The monetary and fiscal reforms would encourage locals to repatriate USD and discourage outflows, allowing the central bank to accumulate foreign exchange reserves again.

Figure 1: Argentinian Peso: Official vs. parallel exchange

Brazil: CPI inflation increased by 0.1% mom in the first fortnight of July from 0.7% in the same period in June taking yoy CPI down to 11.39% from 12.04%. President Jair Bolsonaro’s approval rate rose 2% to 28% as his disapproval rate declined 2% to 45%. His approval rates are significantly lower than previously re-elected presidents. Fernando Henrique Cardoso had a 38% approval rate and 19% disapproval in July 1998, similar to Lula’s in July 2006. Dilma’s approval / disapproval rates were at 32% / 29% in July 2014. The economy continues to outperform expectations as payrolls increased by 278k in June (240k consensus), close to the highest level of job creation in the month of June in 10-years. The central government posted a BRL 14.4bn primary surplus in June, in line with consensus, bringing the 12m cumulative primary surplus to BRL 72bn (0.8% GDP). This is likely to be the highest level since pre-election and therefore social expenditure is likely to increase significantly over the next months. In other news, Petrobras cut gasoline prices by 3.9%, the second cut in less than one month, keeping local prices at parity with international ones.

China: The Politburo held an important meeting where they all but abandoned the 2022 growth target of 5.5% instead focusing on achieving “a stable employment environment and keep the economy operating within a reasonable range striving to achieve best results”. The politburo suggested there is room for more fiscal and monetary policy support, particularly infrastructure investment funded by front loading local government bond issuance. The Politburo stuck to the motto that “house is for living not speculation” but emphasized the need for more coordination on policy supporting the property sector, and also maintained its zero covid-19 strategy. The announcement of a real estate fund to support property under construction was an important step: the fund secured CNY 50bn from China Construction Bank and a CNY 30bn relending facility from PBoC. The fund may eventually raise up to CNY 300bn (USD 44bn). The use of proceeds is not specified but we believe it is more likely to be used for financing the construction of properties as the Politburo asked for “ensuring home delivery” last week. This should help stabilise homebuyer’s confidence and hope to address the mounting contagion effect of mortgage boycott.

In other policy news, Xi Jinping held a “constructive” two-hour call with US President Joe Biden where they discussed China’s dissatisfaction with Nancy Pelosi’s plans to visit Taiwan, as well as the possibility of a face-to-face summit between the two presidents. In economic news, the Official manufacturing PMI dropped by 1.2 points to 49.0 in July, while our preferred PMI proxy, the Caixin Manufacturing PMI fell similarly to 50.4 in July from 51.7. The official non-manufacturing PMI dropped by 0.9 point to 53.8. The non-manufacturing PMI was mainly supported by the construction sector as the services sector softened and industrial profits rose at a yoy rate of 0.8% in June, following a 6.5% yoy decline in May.

Evergrande new Chief Executive Officer Shawn Siu said that the company will focus on completing construction projects, and will not sacrifice the interests of investors, according to an interview with 21st Century Business Herald. Last Friday, Evergrande announced preliminary restructuring principles, without providing a detailed restructuring plan. A broad framework was released with an asset package named for restructuring, and the scope of debt to be covered in the offshore restructuring. Notable assets in the package include Evergrande’s equity stake in HK listed EV and Properties Services subsidiaries.

Colombia: The central bank hiked its policy rate by 150bps to 9.0%, in line with consensus. The post meeting statement kept the door open to further hikes as GDP growth expectations were raised by 60bps to 6.9%. Governor Leonardo Villar mentioned that inflation is likely to remain at elevated levels for longer than expected. The unemployment rate rose to 11.3% in June from 10.6% in May, as urban unemployment rose 70bps to 11.7%, significantly above consensus. President-elect Gustavo Petro named Luis Gilberto Murillo as Ambassador to the US. He is a mining engineer with a long history of government service. In a press conference, he said that his priorities would be climate change, immigration, and security. He will also look for a modification of the country’s free trade agreement with the United States.

Ghana: The Bank of Ghana kept its policy rate unchanged at 19.0%, in line with consensus. FX reserves declined to USD 7.7bn in June, down USD 2.1bn year to date and the current account deficit widened to 1.5% of GDP in Q2 2022 from 0.6% in Q1, mostly due to income and services, as the trade balance remained in surplus at USD 1.4bn or 2% of GDP. Ghana pledged to lower its fiscal deficit to 6.6% of GDP, which is 2.5% below consensus, but the improvement seems to be driven by higher GDP estimates as inflation surprised to the upside. There is a significant risk that the government may rely on Central Bank financing ahead of a deal with the International Monetary Fund.

India: The fiscal deficit widened to INR 148bn in June from INR 129bn in May, broadly in line with the average of the last five years. In the April to June quarter, India's fiscal deficit was about 21.2% of the full year estimate. The headwinds to fiscal balance are rising fertilizer subsidies, but tax collections are ahead of estimates. The Ministry of Finance is of the view that the fiscal deficit should be well within the target 6.8% of GDP deficit. Monsoon rainfalls are running 21% above normal in the first four weeks of July allowing storage at reservoirs to improve, but 7 out of 32 subdivisions in the north of the country are reporting deficient rainfall, a deficit that may be covered by irrigation networks.

Mexico: President Andres Manuel Lopez Obrador (AMLO) said Grupo Mexico is no longer in charge of building a 61-kilometers segment of the Maya Train from Playa del Carmen to Tulum, a contract worth MXN 15.4bn (USD 752m). The section was designated a “national security project”, to prevent it from being stopped or delayed by legal challenges (including challenges on environmental damages grounds) and the contract was handed over to the Defense Ministry. In economic news, the trade deficit widened to USD 4.0bn in June from USD 2.2bn in May as exports increased USD 1.2bn to USD 51.2bn and imports rose USD 3.0bn to USD 55.2bn over the period. The unemployment rate rose to 3.4% in June from 3.3% in May and the yoy rate of GDP growth improved to 2.1% in Q2 2022 from 1.8% in Q1 2022, 60bps ahead of consensus.

South Korea: The yoy rate of real GDP growth declined 10bps to 2.9% in Q2 2022, 30bps ahead of consensus. Industrial production rose 1.9% mom in June from 0.2% in May, significantly ahead of consensus. Leading indicators were soft as consumer confidence dropped 10.4 points to 86.0 in July, only 13 and 18 points higher than the lows in 2020 and 2008 respectively, while business survey remained elevated, dropping 5 points to 78 for the manufacturing sector and by 1-point to 80 in the non-manufacturing sector.

Turkey: House prices increased by a yoy rate of 145.5% in May from 126.9% in April as confidence indicators declined only marginally, remaining at relatively elevated levels despite the drop in the TRY. The trade deficit narrowed to USD 8.2bn in June from USD 10.6bn in May. A total of 5m tourists visited the country in July, very close to the highest levels recorded over the last 10-years. Alas, the peak of the tourism season is not leading to any accumulation of FX reserves which remained below USD 60bn in gross terms and at deep negative levels after excluding FX swaps and other non-immediate sources of USD.

Snippets

- Chile: The unemployment rate was unchanged at 7.8% in June. Other economic activity indicators were weaker than consensus: copper production declined to 462k tons in June from 480k tons in May, industrial production declined by a yoy rate of 1.5% in June (from 1.8% in May), manufacturing dropped 2.5% yoy (from +3.5% yoy in May) and retail sales dropped contracted 6.1% yoy (from -5.6% in May).

- Czech Republic: The yoy rate of real GDP growth slowed to 3.6% in Q2 2022 from 4.9% in Q1, 30bps above consensus. The government agreed to increase police and firefighters’ salaries by 10%, thus below the rate of inflation over the last 12-months (17.2%).

- El Salvador: President Nayib Bukele tweeted that he is sending a set of laws to Congress to allow the buybacks of sovereign bonds maturing in 2023, ‘24 and ‘25.

- Hungary: The National Bank of Hungary hiked its policy rate by 100bps to 10.75%, in line with consensus. The yoy rate of gross wages slowed 30bps to 14.9% in May, 100bps below consensus, but PPI inflation rose 270bps to 35.0% yoy in June and consumer confidence dropped another 1.8 points to -41.7 – the lowest level since 2013.

- Indonesia: headline inflation jumped to 4.94% yoy in July from 4.35% in June; Core inflation rose more moderately to 2.86% yoy in July from 2.63% in the previous month.

- Kazakhstan: The central bank of Kazakhstan hiked its policy rate by 50bps to 14.5%.

- Paraguay: Moody’s affirmed the sovereign’s Ba1 credit rating and upgraded the outlook to positive.

- Philippines: The fiscal deficit widened to PHP 215.5bn in June from PHP 146.8bn in May, the widest deficit 10-years

- Poland: The yoy rate of CPI inflation was unchanged at 15.5% in July, in line with consensus and the unemployment rate dropped 20bps to 4.9% in June, 10bps ahead of consensus. The fiscal surplus improved to PLN 27.8bn from January to June, the best level over the last 10-years

- Russia: The yoy rate of industrial production declined 10bps to -1.8% in June (60bps better than consensus) and retail sales improved 50bps to -9.6% yoy (20bps below consensus) as the unemployment rate was unchanged at 3.9%.

- South Africa: The trade surplus narrowed to ZAR 24.2bn in June (ZAR 21.2bn consensus) from ZAR 30.9bn in May (revised from ZAR 28.3bn). The yoy rate of PPI inflation rose 150bps to 16.2% in June, 60bps above consensus. Private sector credit rose by a yoy rate of 7.5% in June, 220bps above May and 160bps ahead of consensus.

- Taiwan: The yoy rate of real GDP growth was unchanged at 3.1% in Q2 2022, in line with consensus.

- Thailand: The trade surplus improved by USD 0.1bn to USD 2.1bn in June and the current account deficit narrowed to USD 1.9bn from USD 3.7bn over the same period, significantly better than consensus. FX reserves improved by USD 2.2bn to USD 218bn in 22 July, but are down USD 41.2bn from their highest levels in January 2021.

- Zimbabwe: Launched gold coins as legal tender to tackle hyperinflation.

Global backdrop

United States: The Federal Reserve hiked its policy rate by 75bps to 2.5%, in line with consensus expectations and market pricing. In addition, the Fed kept the USD 95trn monthly sales of US treasuries and mortgage-backed securities. The statement acknowledged that leading indicators of spending and production “softened” but job gains remain robust. Chair Powell’s Q&A was viewed as dovish as he mentioned “it likely will become appropriate to slow the pace of increases”. This should not have been a big surprise, as the Fed has not hiked in 75bps increments for a long time, and the market is already pricing in a smaller hike of 50bps in September.

Powell’s comments during the press conference were nuanced and full of contradictions. He said the Fed would not offer precise forward guidance, but nevertheless mentioned that they considered policy had reached neutral levels and should move to mildly contractionary “around 3.0% to 3.5%” by year end. Powell mentioned several times how the strong labour market is supporting demand, but employment is a lagging indicator subject to reviews. In any event, the market bought into the dovish tone and pushed risk asset prices sharply higher. In our view, forward looking economic indicators are falling off a cliff and forward-looking anecdotal employment from company results are also poor.

Economic data was soft with the annualised QoQ rate of real GDP growth declining 0.9% in Q2 2022 (consensus +0.4%) after dropping 1.6% in Q1 2022 as consumer demand softened leading inventories higher. The yoy rate of core PCE deflator rose 10bps to 4.8% in June and durable goods rose 1.9% mom (0.8% in May and -0.4% consensus) over the same period. Leading indicators are still in downward trend as the Dallas Fed Manufacturing survey dropped another 4.9 points to -22.6 in July (-18.5 consensus) the university of Michigan survey rose only 0.4 to 51.5, the consumer confidence measured by the conference board dropped 2.7 points to 95.7 over the same period and the Chicago PMI declined 3.9 points to 52.1 in July. The housing market remained weak as new home sales dropped 8.1% mom to 590k in June and the pending home sales index dropped another 8.6% to 91, only 19 points above the lowest level in April 2020 and 37 points below the highest in August 2020. Initial jobless claims declined to 256k in the week of 23 July from 261k in the previous week (revised from 251k).

In other policy news, Senator Joe Manchin and Lower House leader Chuck Schumer reached an agreement to reduce the price of drugs and give tax incentives for energy transition industries funded by higher taxes on big corporations. Meanwhile, Senator Marco Rubio wants the US to sanction China’s purchases of oil and other energy supplies from Russia to cut off funding for the war in Ukraine. China’s imports of Russian crude have surged this year as the world’s biggest energy importer picked up barrels at discounted prices shunned by European buyers. Cutting off the flow of Russian crude to China could leave Beijing competing more fiercely with other large buyers, like India, for oil from the Middle East and Africa, potentially raising prices.

Europe: The yoy rate of CPI inflation rose 30bps to 8.9% in Europe, 20bps above consensus, and core CPI also rose by 30bps to 4.0%, 10bps above consensus. GDP growth declined to 4.0% in Q2 2022 from 5.4% in Q1 but was 60bps above consensus as the French and Italian GDP surprised to the upside while Germany activity surprised to the downside.

Japan: Japan announced it would restart decommissioned nuclear plans to boost energy availability. The yoy rate of CPI inflation in Tokyo rose 20bps to 2.5% in July, 10bps ahead of consensus and ex-fresh food and energy CPI rose by a similar magnitude to 1.2% yoy. Retail sales dropped 1.4% mom in June after rising 0.7% in May, but industrial production rebounded 8.9% mom in June after plunging 7.5% in May.

Canada: GDP growth increased to a yoy rate of 5.6% in May from 5.1% yoy in April, 20bps ahead of consensus.

Australia: The yoy rate of CPI inflation rose 100bps to 6.1%, 20bps less than consensus but the trimmed mean CPI rose 120bps to 4.9%, 20bps above consensus and PPI inflation rose 70bps to 5.6%.

1. See https://www.mesit.com/en/projects/2/compression-station-portovaya-gazprom.html

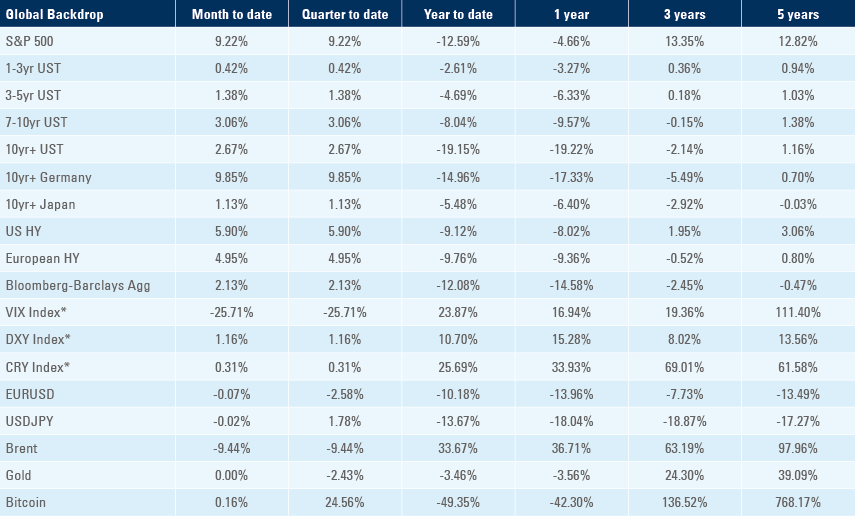

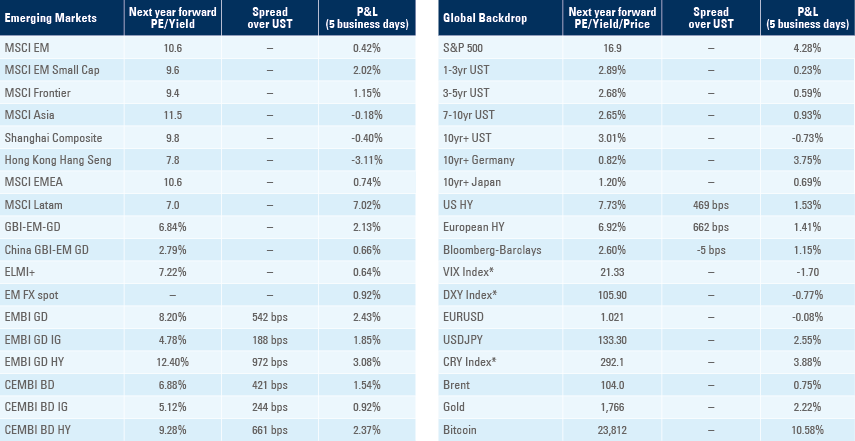

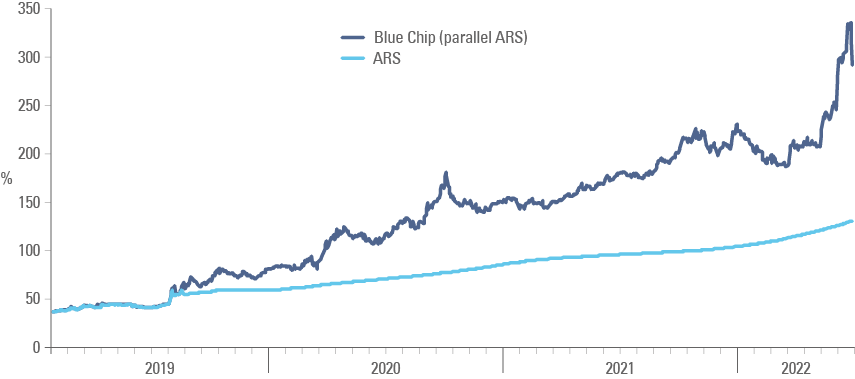

Benchmark performance