Argentina gets closer to the IMF as China eases monetary policy

Most EM countries remained in a moderate expansion according to the PMI survey by Markit. Argentina and the IMF nodded to each other. The Brazilian Senate approved a constitutional amendment clearing the path for the 2022 budget. China showed it is in full control of the real estate situation as the risk of ADR de-listing kept volatility high. In Chile, Gabriel Boric increased his lead according to polls for the presidential election run-off. Colombian economic data showed signs of overheating. Ecuador approved a key tax reform. The Hungarian central bank tightened monetary policy further. India backtracked on the agricultural reform. Despite all sabre rattling, Russia signalled it does not intend to invade Ukraine.

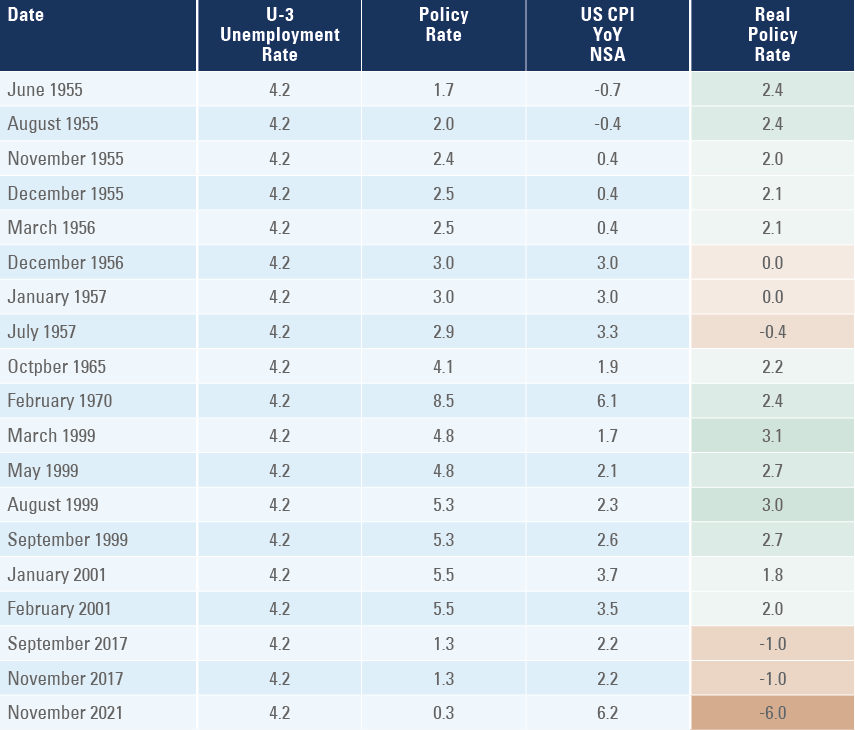

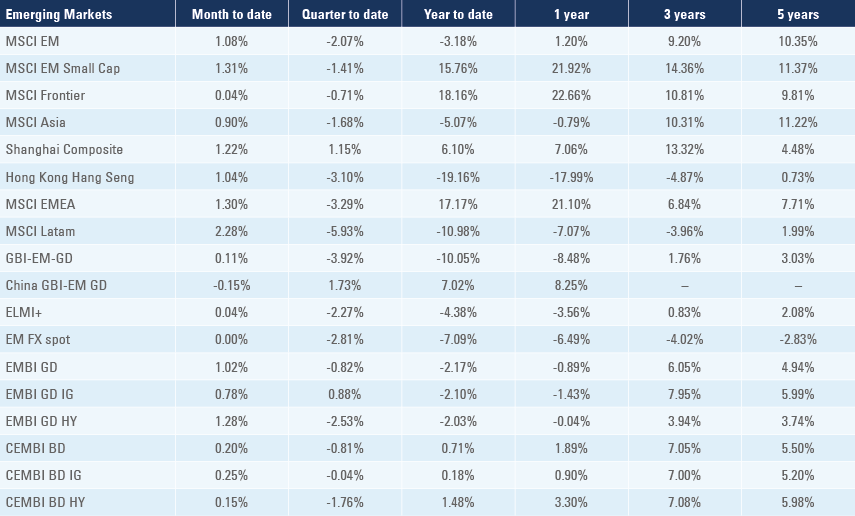

Emerging Markets (EM)

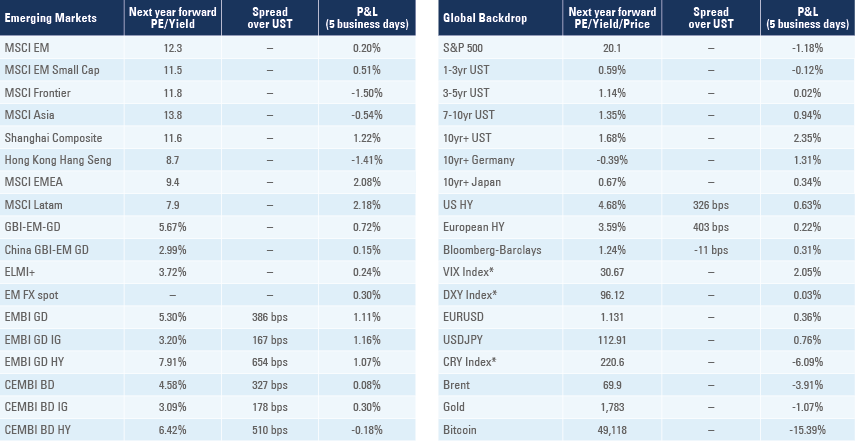

Markit Purchasing Managers Index (PMI)

The Markit Global Manufacturing PMI Index declined 0.1 to 54.2 in November as EM dropped 0.4 to 51.2 while developed markets (DM) rose 0.3 to 56.9. Most of the deterioration in the EM PMIs came from new orders index, which dropped 1.4 to 50.8, while the (current) output index improved 1.0 to 51.7. The EM employment sub-index dropped 0.5 to 49.4, but delivery times and stock purchases improved 2.0 to 46.6 and 1.4 to 51.2 respectively.

The manufacturing PMI improved the most in:

- South Africa (+3.6 to 57.2)

- Czech Republic (+2.0 to 57.1)

- India (+1.7 to 57.6)

and declined the most in:

- Indonesia (-3.3 to 53.9)

- Brazil (-1.9 to 49.8)

- China (-0.7 to 49.9).

The PMI remained above 50.0 in 16 out of 19 EM countries and improved last month in 12 countries as per Figure 1:

Figure 1: EM Manufacturing PMI: October levels and 1 month change

The global services PMI was unchanged at 55.6 as EM services PMI declined 1.2 to 53.0 and DM rose 0.5 to 56.6. Within EM, the services PMI declined 1.3 to 53.6 in Brazil, 1.7 to 52.1 in China, 0.3 to 58.1 in India, and 1.7 to 47.1 in Russia.

Argentina: Vice President Cristina Kirchner said she never advocated repudiating the International Monetary Fund (IMF) debt and that the responsibility for a new agreement lies with President Alberto Fernandez and Congress. The IMF Chief Kristalina Georgieva said the IMF is thinking of a ‘balanced’ programme, considering both fiscal consolidation and social needs. In economic news, tax revenue rose to ARS 1.035bn in November from ARS 1.019bn in October as vehicle sales and exports rose 2.5k to 27.8k and 6.6k to 32.5k respectively, over the same period.

Brazil: Brazilian assets outperformed last week after the Senate approved a constitutional amendment opening up approximately BRL 100bn of expenditure above the expenditure ceiling, in order to fund the mandatory court debt repayments (precatorios) and Bolsonaro’s new social programme “Auxilio Brasil” that replaces and expands the Bolsa Familia. The bill is a negative macro development, but was incorporated into asset prices and the risk was a non-approval leading to a worse (more expensive) alternative. In economic news, inflation measured by the producer price index (PPI) declined to 0% mom in November from 0.6% mom in October, bringing the yoy rate down to 17.9% from 21.7% yoy over the same period. The yoy rate of real GDP growth slowed to 4.0% in Q3 2021 from 12.4% yoy in the previous quarter. GDP growth dropped 0.1% in qoq terms after dropping 0.4% in the previous quarter, taking the economy to a technical recession (more than two quarters with negative output). Industrial production dropped 7.8% in October from -4.0% in September, significantly below consensus. The trade balance moved to a USD 1.3bn deficit in November from a USD 2.0bn surplus in October. Fiscal accounts were better than expected again with the primary surplus rising to BRL 35.4bn in October from BRL 12.9bn in the previous month allowing the ratio of net debt to GDP to decline 1.2% to 57.6%.

China: The US Secretary of Treasury Janet Yellen said that lowering the Trump-era tariffs on imported goods from China could ease some inflationary pressures, another sign of a possible rapprochement between the countries. The People’s Bank of China (PBoC) cut the reserve requirement ratio by 50bps to 11.5% after Premier Li Keqiang signalled support the economy and in particular small businesses. In the real estate sector, the Guangdong government summoned Evergrande’s Chairman and sent a working team to the company after it announced a potential default of USD 260m guarantee obligations, which can trigger cross-default into Eurobonds. The PBoC, the CBIRC and the MHURD issued concomitant statements saying the Evergrande crisis was a result of the company’s poor management and the spillover effect was manageable given financial liabilities accounted for about one-third of the firm’s total debt, and the delivery of ongoing projects is ensured.1 Lastly, the CBIRC stated its intention to support demand for both first homes and housing upgrades (second homes), the first time in six years that Beijing has signalled support for second-house demand. In other news, the US Securities and Exchange Commission adopted regulatory amendments allowing it to delist companies if the Public Company Accounting Oversight Board is not able to audit reports for three consecutive years, potentially leading to the de-listing of Chinese ADRs. The sell-off in Chinese stocks listed in the US is largely technical, in our view, as investors with ADR exposure seek to reduce the risk of conversion in fully fungible ADRs or de-listing in Variable Interest Entities (VIEs).2 In economic news, NBS Manufacturing PMI rose 0.9 to 50.1 in November, converging to the Markit PMI both around 50, while the services PMI declined 0.1 to 52.3, both slightly above consensus.

Chile: Two polls showed leftist candidate Gabriel Boric leading the vote intentions in the run-off on 23 December. A poll by Cadem showed Boric with 39% of vote intentions (unchanged) vs. Jose Antonio Kast 33% (-6%) and 28% undecided while Pulso Cuidadano, another pollster, reported Boric had 40% of vote intentions vs. Kast's 25%. In economic news, the unemployment rate dropped 0.3% to 8.1% in October while copper production rose 24k tons to 475k tons, still below the 492k average production for the month over the last 10 years. The yoy rate of retail sales rose 2.8% to 22.7% as industrial production rose 2.0% to 1.3% yoy, both above consensus.

Colombia: The Colombian economy shows signs of overheating with higher inflation, growth and wider external deficits. The yoy rate of Consumer Price Index (CPI) inflation rose to 5.3% in November from 4.6% yoy in October, while core CPI rose 0.5% to 3.4% yoy over the same period. The urban and national unemployment rates dropped 0.7% to 12.3% and 0.3% to 11.8% respectively in October, slightly better than consensus. The current account deficit widened to USD 5.1bn in Q3 2021 from USD 4.3bn in Q2 2021, a concerning situation for currency stability as Colombia heads towards an election year in 2022.

Ecuador: In a major victory for the government, the tax reform was approved under the fast-track rule as Congress failed to reject the measure within 30 days. The opposition party led by former President Rafael Correa tactically supported the government, whilst the Indigenous parties opposed. Tax revenues are estimated to increase by USD 1.9bn after the reform (c. 2% of GDP), which is likely to improve the 2022 fiscal deficit to 2.5% of GDP from 3.4% in the original budget (and 4.0% in 2021). The government may even register a surplus in 2022 considering the conservative oil price assumption of USD 59.2 per barrel. The tax reform was a key milestone for the completion of another review of the IMF programme, which will allow for a USD 700m disbursement.

Hungary: The National Bank of Hungary (NBH) purchased only HUF 29bn of government bonds in the week ending in 27 November, lower than the weekly target of 40bn forint. The NBH has been buying a lower amount than its target since October as it shifts its focus to monetary tightening. Last week the NBH hiked the one-week deposit rate (effective policy rate) by 0.2% to 3.1% as inflationary pressures remain: PPI inflation rose by 4.5% mom in October equivalent to a yoy rate of 18.5% (up from 14.0% yoy in September) and gross wages rose 0.2% to 9.1% in September. In other news, the yoy growth or retail sales softened 0.1% to 5.7% in October, better than consensus.

India: Prime Minister Narendra Modi decided to repeal the agricultural reform aimed at de-regulating the sales of farm produce exclusively through government-approved wholesale markets, which are often dominated by traders and intermediaries. The bill was intended to boost the efficiency of the farming sector as well as remove subsidies but was faced with mass protest in a few regions. Modi can still implement important administrative reforms such as monetization of state owned companies, asset divestments and banking sector reforms. In economic news, the yoy rate of real GDP growth declined to 8.4% in Q3 2021 from 20.1% in Q2 2021, slightly better than consensus. The trade deficit widened to USD 23.3bn in November from USD 19.7bn in October as exports declined 9.4% mom and imports were down 2.3% mom. Overall, the current account is on track to move from a 0.9% of GDP surplus in financial year (FY) 2021 to a 1.6% of GDP deficit in FY 2022.3

Russia: Russia informed Washington it is not preparing any aggressive plans against Ukraine. Most of the tension escalation with Ukraine started after Belarus sent immigrants to Eastern Europe and received most attention in Western media, with very little activity in the Donbass region – annexed by pro-Russian separatist group in 2014. There appears to be very little incentive for Western authorities to back Ukraine joining the North Atlantic Treaty Organisation (NATO), a key redline for Russia. In other news, the Russian Central Bank Governor Elvira Nabiullina said she will consider to hike policy rate by another 100bps in the final meeting on 17 December. In economic news, unemployment rate was unchanged at 4.3% in October as the yoy rate of retail sales dropped 1.5% to 4.1% over the same period.

Turkey: The qoq rate of real GDP growth rose 2.7% in Q3 2021, slightly below the 3.3% consensus, while Q2 2021 real GDP was revised higher to +1.5% qoq (from 0.9% qoq), keeping the yoy rate in line with consensus at 7.4%. The yoy rate of CPI inflation rose 1.4% to 21.3% in November, while PPI inflation rose by a whopping 10.0% mom or 54.6% yoy over the same period driven by higher energy prices and a weaker TRY, suggesting inflationary pressures are not over, yet.

Snippets

Angola: The central bank kept its policy rate unchanged at 20%.

Czech Republic: The yoy rate of real GDP growth increased 0.3% to 3.1% in Q3 2021, slightly better than consensus.

Dominican Republic: The central bank hiked its policy rates by 50bps with the overnight policy rate reaching 3.5% and the 1-day repo rate 4.0% after CPI inflation rose to a yoy rate of 7.7%.

Kenya: The central bank kept its policy rate unchanged at 7.0%, in line with consensus as the yoy rate of CPI inflation dropped to 5.8% in November from 6.5% in the previous month.

Malaysia: The trade surplus was unchanged at MYR 26bn in October, slightly better than consensus

Mexico: The unemployment rate dropped to 3.9% in October from 4.2% in September, slightly better than consensus. Total foreign exchange remittances rose to USD 4.8bn in October from USD 4.4bn in September – a new historical record. Lastly, domestic vehicle sales rose 7.2k to 83.8k, remaining at the lowest level in 10 years.

Pakistan: The yoy rate of CPI inflation rose 2.2% to 11.5% in November, significantly above consensus expectations.

Peru: The yoy rate of CPI inflation declined 0.1% to 5.7% in the city of Lima, slightly above consensus.

Poland: The yoy rate of CPI inflation rose 0.9% to 7.7% in November, above consensus expectation at 7.3%. The yoy rate of real GDP growth accelerated 0.2% to 5.3% in Q3 2021.

Romania: The yoy rate of retail sales declined to 5.5% in October from 7.5% in September as the yoy rate of PPI inflation surged 7.2% to 26.8% in October, in line with large inflationary pressures across other Eastern Europe countries. The unemployment rate was unchanged at 5.3%

South Africa: The trade surplus narrowed to ZAR 19.8bn in October from ZAR 22.1bn in September, below consensus and the monthly budget deficit deteriorated to ZAR 36.8bn (ZAR 33.0bn consensus) from ZAR 7.3bn over the same period. Lastly, the unemployment rate rose 0.5% to 34.9% in Q3 2021.

South Korea: The yoy rate of real GDP growth was unchanged at 4.0% in Q3 2021, in line with consensus while industrial production dropped 3.0% mom in October from -1.1% mom in September. The yoy rate of CPI inflation rose 0.5% to 3.7% in November, higher than consensus at 3.1% yoy. Higher agriculture prices due to climate conditions and higher energy prices were the main culprits as the yoy rate of core CPI declined 0.5% to 2.3% yoy over the same period.

Sri Lanka: The opposition party SJB said Sri Lanka foreign exchange (FX) reserves plunged to a record low of USD 1.2bn. The government did not refute the statement. The yoy rate of CPI inflation rose 2.3% to 9.9% in November.

Global backdrop

Covid-19: China will send one billion covid-19 vaccines to Africa, announced President Xi Jinping during the latest Forum on China-Africa Cooperation (FOCAC), enough to vaccinate approximately 35% of the entire continent with two doses, or more than 50% of the entire adult population since approximately 40% of Africa’s population is younger than 16 years old. China also said it would encourage native Chinese firms to invest at least USD 10bn in Africa over the next three years.

The new omicron variant was detected in more than 30 countries by last Sunday covering most regions in the world only ten days after it was first identified in South Africa. The rise of omicron cases and sequencing of data suggests the new variant can infect three to six times as many people as delta over the same period, estimates Tom Wenseleers, an evolutionary biologist at the Catholic University of Leuven in Belgium. Cases continue to rise in the Gauteng province in South Africa, the main identified epicentre of the virus, with a larger share of younger population admitted to hospital, potentially due to low vaccination rate.4 There are still many uncertainties associated with the new variant, but the positive scenario is that the disease seems to be highly contagious and less virulent than previous coronavirus variants, which could reduce the risk of economic lockdowns associated with the stress on healthcare systems.

Commodities: Prices of natural gas rose above EUR 100 per mega-watt hour on the European ICE exchange.

United States (US): The Federal Reserve (Fed) Chairman Jerome Powell said it was time to “retire” the word transitory when describing inflation and signalled a faster reduction in the pace of quantitative easing (QE) is likely. The statement opens the door for the Fed to end QE in Q1 2022 and to hike policy rates in Q2 2022, in line with Eurodollar futures.

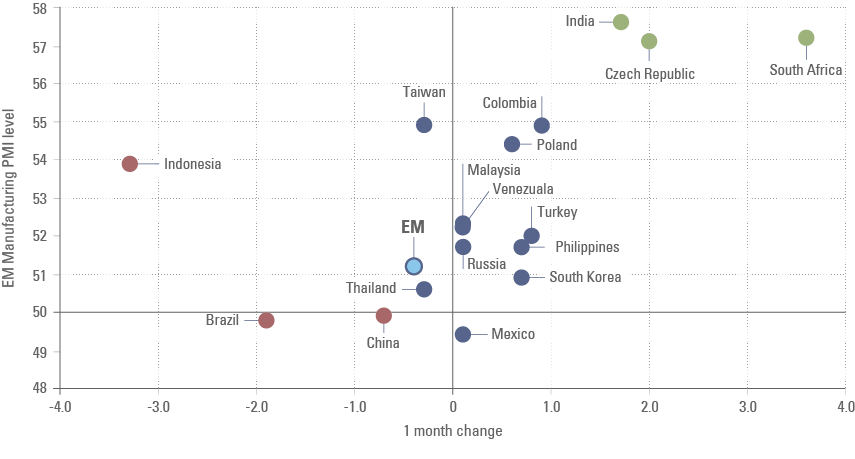

The labour market remains very tight as initial jobless claims rose marginally to 222k in the week of the 27 November from 194k in the previous week, still close to the lowest levels since the inception of the series in 1966. The non-farm payrolls survey showed job gains rising only 210k in November, down from 546k in October and lower than the 550k consensus expectation. On the other hand, the household survey showed employed population increased by 1.14m individuals in November as participation rate increased by 0.2% and unemployment dropped by 0.4% to 4.2%. Hourly earnings were unchanged at a yoy rate of 4.8%, but the number of hours worked per employee increased. To put it into perspective, the unemployment rate only reached 4.2% nine years after the 2008 recession when the effective Fed Fund rates was at 1.25% and CPI inflation was running at 2.2%. This time, it took only 1.5 years for the unemployment rate to reach 4.2%. the Fed fund rates remains unchanged at 0.25% and inflation reached 6.2%, resulting in the lowest level of effective Fed fund rates in real terms since the inception of the series 70 years ago, as per Figure 2. In other economic news, the Chicago PMI dropped to 61.8 in November, the lowest level since February 2021 and significantly below 67.0 consensus and 68.4 in October, but the ISM manufacturing and services surveys rose 0.3 to 61.1 and 2.4 to 69.1 respectively as ISM prices paid softened 3.3 to 82.4. Factory orders rose 1.0% in October from 0.5% in September and durable goods declined 0.4% in October, similar to the -0.5% in the previous month.

Figure 2: US Effective Policy Rate and CPI inflation in months when unemployment rate reached 4.2%:

Europe: Inflation surprised to the upside across Europe. In Italy, PPI inflation rose 9.4% mom in October, bringing the yoy rate to 25.3%, from 15.6% yoy in September. In Germany, the yoy rate of EU harmonised CPI inflation rose to 6.0% in November from 4.6% yoy in October (from -0.7% yoy in November 2020). The yoy rate of CPI rose 0.8% to 4.9% across the Euro Area in November with core CPI rising 0.6% to 2.6% yoy, both significantly above consensus. Despite higher inflation, the European Central Bank (ECB) Vice President Luis de Guindos said they are likely to keep buying bonds through 2022 to boost the bloc's economy and could even resume pandemic emergency purchases after they end in March 2022. In other news, Fitch upgraded Italy’s credit rating by one notch to BBB (stable) due to an improvement in growth and fiscal backdrop.

In political news, France and Italy signed a cooperation treaty to enhance their position when dealing with Germany and other northern European countries. The tenure of Mario Draghi is likely to end between 2022 and 2023. In France, Valerie Pecresse won the nomination of the centre-right party, Les Republicains. Pecresse presented herself as the voice of moderation in a bid to unite the party after security and immigration issues dominated the primary race. She likens herself to Margaret Thatcher and Angela Merkel.

1. CBIRC: China Banking and Insurance Regulatory Commission MHURD: Ministry of Housing and Urban-Rural Development.

2. VIEs are legal business structures mostly established as special purpose vehicles (SPVs) to hold financial assets in ADRs. VIEs do not give investors direct ownership stake (only a special contract that specify the rules and percentage of profits). In some cases, VIEs also have no fungibility with shares listed in other exchanges.

3. India’s financial year runs from 1 April to 31 March.

4. Data from the National Institute for Communicable Diseases (NICE) from Tshwane/Pretoria for the week to 27 November indicated that 68% of Covid-19 hospital admissions were below 40 years of age against 66% of cases in the above 50 years old in the third wave.