Another delegation of US politicians visited Taiwan over the weekend as China cut policy rates

Taiwan received a delegation of US congressmembers despite the significant military exercises on the Strait after Pelosi’s visit. Ukraine struck back across Russian lines after receiving better equipment from the US. The People’s Bank of China cut its policy rates after weaker economic data in July. Argentina’s Finance Minister reshuffled the Energy Secretariat. Brazil had lower than expected inflation. Colombia unveiled a more sensible tax reform. Indonesia’s external accounts remained solid. Kenya presidential election still not fully counted. Malaysian GDP growth more solid than expected. Mexico hiked policy rate by 75bps to 8.5%. Philippines remittances had another record month in June.

Geopolitics

China ended military drills and exercises in the Strait of Taiwan last week but pledged to keep a more active role in the area. The announcement of the end of exercises coincided with a visit to mainland China from a delegation of the Taiwanese opposition party Kuomintang (KMT), including vice-chairman Andrew Hsia, under the guise of supporting Taiwanese citizens living in China, a trip criticised by the Taiwanese cabinet. The KMT accepts Taiwan as part of one China but reserves a different interpretation than Mainland China. Taiwan reported aircraft and ships from the People’s Liberation Army (PLA) continued to surround Taipei and cross the Strait median line last Friday. Over the weekend, a delegation of US Congressmen led by Senator Ed Markey landed in Taiwan for a two-day visit to “encourage stability and peace across the Taiwan Strait”. In response to the provocation, China announced it will conduct further military patrols and drills around Taiwan on Monday. It is not clear what is the US strategy – if any – behind such acts of provocation, particularly at a time when its ability to influence the global balance of power is challenged by the conflict in Ukraine. The Chinese President Xi Jinping is scheduled to meet his US counterpart at the G-20 meeting in Bali on the 15-16 November.

In Ukraine, the situation on the ground seems to have evolved more favourable to Kyiv in recent weeks. Ukraine has been hitting several Russian ammunition stores since it received advanced weapons from the US and Europe. Last week explosions at a Russian military base in Crimea destroyed several aircraft and were recorded by Russian tourists on the Black Sea Island. Russia claims the explosions were an accident, not the result of a Ukraine attack. However, the images of the site before and after the explosions suggests the possibility of a Ukrainian strike. If confirmed, a Ukrainian strike on the Crimea base would be a big blow to Russia’s ambitions of controlling Ukrainian territory and could lead to a more forceful escalation in the short term. There were also reports that a key unit of the Wagner Group – the Kremlin private army – was hit by US supplied HIMAR missiles. In other news, a pro-Moscow official said Thursday the Zaporizhzhia nuclear plant in Russian-controlled southern Ukraine had once again come under the Ukrainian army's rocket and artillery fire.1

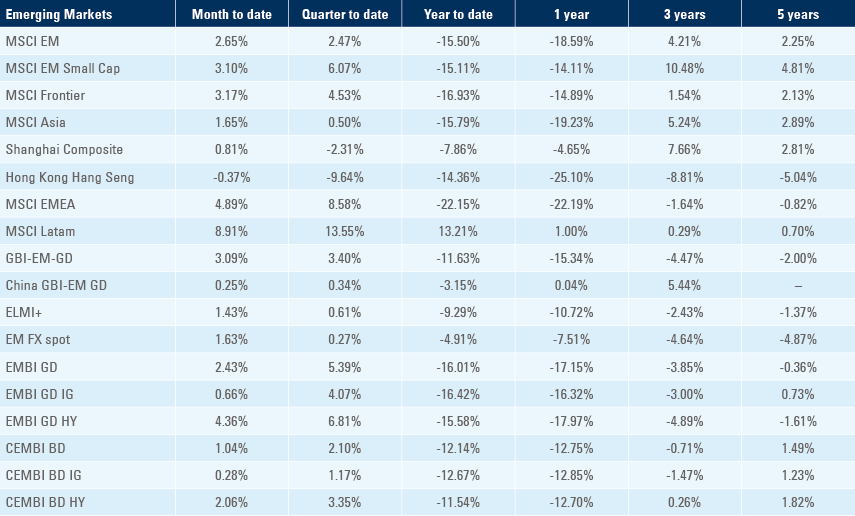

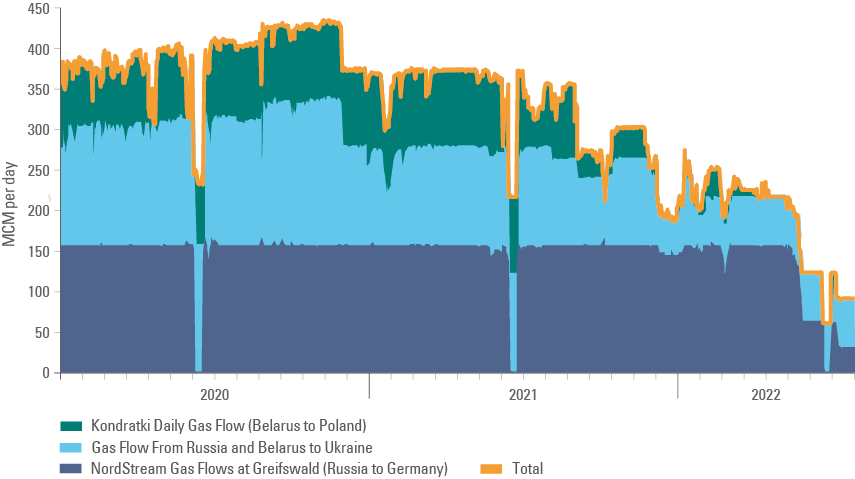

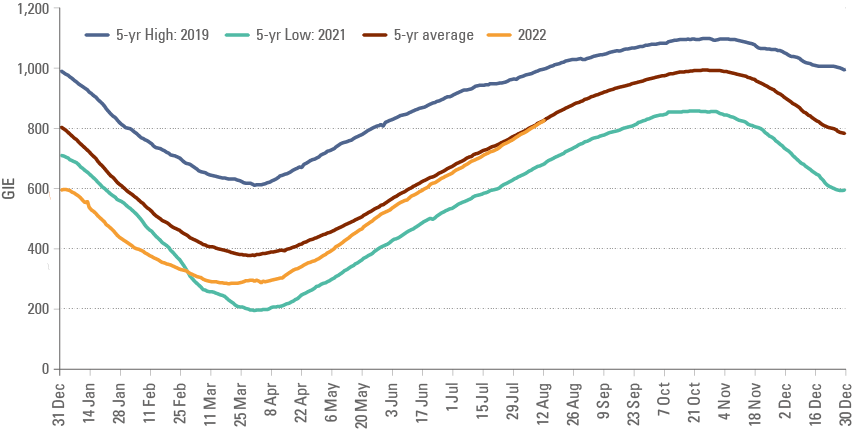

On the energy front, despite much lower gas flows from Russia (Figure 1) as well as multiple supply reductions from Norway hydroelectric to French nuclear, Europe continues to replenish its inventories of natural gas from the lowest levels in five years to in line with average as per Figure 2.

Figure 1: Russian Gas flow to Europe from selected pipelines (MCM/Day)

Figure 2: European Gas Storages (GIE)

In other news, the Central Bank of Russia said it was considering buying currencies from friendly countries such as China, India, and Turkey for its National Wealth Fund since the country lost the ability to hold USD and EUR due to sanctions. The CBR said it sees no reason to keep capital controls in place once the risks to the country’s financial stability subsides. The authority expects the economy to return to growth in 2024 after two years of contraction, as inflation is likely to slow to the 4% target by then.

Emerging markets

China: Weaker than expected retail sales (+2.7% yoy vs 4.9% consensus) and industrial production (+3.8% yoy vs 4.3% consensus), as well as weak credit demand last week motivated the People’s Bank of China to cut its 7-day reverse repo and one-year medium term lending facility policy rates by 10bps to 2.00% and 2.75% respectively. Fixed asset investment was resilient rising 5.7% yoy, only 50bps below consensus, but property investment declined 6.4% yoy (-5.7% yoy consensus). The yoy rate of CPI inflation rose 20bps to 2.7%, 20bps below consensus as PPI inflation declined 190bps to 4.2% yoy, 70bps below consensus. The narrowing between the PPI and CPI allowed the PBoC leeway to move monetary policy to more accommodative levels given lower wholesale inflationary pressures. Aggregate financing slowed to RMB 756bn in July from RMB 5.2tn in June, significantly lower than consensus as new loans slowed to RMB 679bn from RMB 2.8trn in June over the same period. Most of the decline was related to low mortgage intake. Electricity consumption rose at a yoy rate of 6.3% in July from 4.7% in June led by higher household consumption amidst a heatwave while the secondary sector (mostly manufacturing) declined 0.1% yoy (from +0.8%). The slower energy consumption by manufacturing sector confirms the poor economic activity. In other news the Henan Province announced RMB 4.2trn to build 602 infrastructure construction projects, including energy, railways, and urban railway projects. Infrastructure and renewable energy have been the only bright spots in the economy as electric vehicle (EV) sales continues to rise. Close to 60% of all EVs are sold in China.

Argentina: Sergio Massa reformulated the entire energy sector team, appointing Flavia Royon as new Secretary of Energy after the resignation of Christina Kirchner’s ally Dario Martinez. Santiago Yanotti was appointed as Undersecretary for Electric Power, Federico Bernal as the Undersecretary for Hydrocarbons, and Cecilia Garibotti as the Undersecretary for Planning. Massa pointed out that the objective of the new team is to develop Argentina's "energy sovereignty" and ensure "the transformation of Argentina as a power" in the energy sector. Argentina has ample reserves of oil and gas both in traditional and shale fields which have been underexplored due to poor policies. In economic news, CPI inflation rose to 7.4% mom in July from 5.3% in June, the fastest pace since 2002, bringing the yoy rate up by 700bps to 71.0%. In response to high inflation, the central bank hiked its 28-day Leliq policy rate by 950bps to 69.5%, following an 800bps hike in late July. Industrial production dropped to a yoy rate of 6.9% in June from 12.1% in May and construction activity slowed to 7.2% yoy from 20.0% over the same period.

Brazil: Consumer prices declined by 0.7% mom in July (deflation) after rising 0.7% mom in June, bringing the yoy rate down to 10.1% from 11.9% over the same period. Core CPI slowed to 0.5% mom in July from 0.9% in June, taking the yoy rate down 10bps to 10.4%. The diffusion index slowed to 62.9% from 66.6% over the same period as service inflation remained elevated, suggesting the central bank will be inclined to signal monetary policy to remain at restrictive levels for longer. Other economic data was mixed as retail sales declined 1.4% mom in June after dropping 0.4% in May, taking the yoy rate to -0.3% from 0.0% over the period, but the volume of services rose 0.7% mom from 0.4% over the same period (ahead of consensus), as the yoy growth rate slowed to 6.3% in June from 9.1% in May. In political news, polls continue to show a narrowing of voting intentions in favour of incumbent President Jair Bolsonaro, a trend that coincided with the increase in the monthly stipend to poorest individuals by BRL 200 to BRL 600 (c. USD 118) per month.

Colombia: Finance Minister Ocampo presented his tax reform seeking COP 25trn (USD 5.8th or 1.7% of GDP) in new revenue in 2023, thus much lower than the COP 50trn promised by President Gustavo Petro in the campaign trail. Most of the increase will come from higher income tax on incomes over COP 10m (USD 2.3k per month), which represents the top 3.2% income in Colombia and introduces thoughtful taxes, including on carbon, single-use plastic, sugary beverages, and processed food. A 10% tax on natural resources will apply if prices exceed a certain threshold, albeit the prices are relatively low levels (USD 46 per barrel in oil, for example). Corporate income tax will have some exemptions removed and the surcharge on financial institutions becomes permanent. The pragmatic bill reflects Ocampo’s orthodox approach and should allow for upside to very discounted Colombian assets, in our view. In other news, consumer confidence dropped to -10.4 in July from +2.9 in June. The yoy rate of retail sales slowed to 17.2% in June, in line with consensus and manufacturing production slowed to 12.3% in June, 140bps below consensus.

Indonesia: The trade surplus narrowed to USD 4.2bn in July from USD 5.2bn in June as the yoy rate of exports narrowed to 32% (from 41%) and imports rose 40% yoy (from 22%). The consumer confidence declined five points to 123.2 in July but remained close to the highest levels over 20 years and significantly above the 105 average line since 2002.

Kenya: Presidential elections were disputed between Deputy President William Ruto and former Prime Minister Raila Odinga on the 9 August. Official results with more than 80% of constituents counted show Ruto leading with 50.9% of the votes against 48.5% of Odinga. The constitution mandates the Electoral commission to issue results by Tuesday. Odinga, a fifth time Presidential contender, pledged to “restructure the country’s debt to achieve debt sustainability for generations”, while Ruto pledged to rein in government borrowing. Kenyan bonds performed well amidst a general positive sentiment to EM high yield assets as well as absence of violence during the ballot.

Malaysia: GDP growth remained on a solid track at 3.5% qoq in Q2 2022 from 3.8% in Q1 2022, significantly outperforming consensus at 1.0% qoq, taking the yoy rate up 390bps to 8.9%. Most of the growth upside was due to a fast recovery in private consumption. Industrial production rose at a yoy rate of 12.1% in June from 4.1% in May and manufacturing sales accelerated to 23.4% yoy from 15.7% over the same period, both significantly higher than consensus.

Mexico: In a unanimous decision, the central bank hiked its policy rate by 75bps to 8.5%, in line with consensus. Inflation risks remained "considerably skewed to the upside" according to the statement, but moved to a data-dependent mode, a sign that future hikes may be smaller if inflation stops increasing and/or if the US Federal Reserve slows down the pace of hikes. CPI inflation declined to 0.7% mom in July from 0.8% in June lifting the yoy rate by 20 bps to 8.2%, while core CPI inflation rose by 20bps to 7.7%, both slightly above consensus. Inflation declined sequentially on the second fortnight of July, but nominal wages increased 290bps to 9.5% yoy in July, the fastest pace since 2001. Industrial production slowed to 0.1% mom in June from 0.2% in May, 20bps better than consensus, as the yoy rate rose 30bps to 3.8%.

Philippines: Overseas remittances from workers living abroad rose to USD 2.8bn in June from USD 2.4bn in May, representing a 4.4% increase in yoy terms. The unemployment rate was unchanged at 6.0% in June. The yoy rate of real GDP growth slowed to 7.4% in Q2 2022 from 8.2% in Q1 2022 and the trade deficit widened to USD 5.8bn in June from USD 5.5bn in May as exports slowed to 1.0% yoy from 6.4% and imports slowed to 26.0% yoy from 30.2% over the same period.

Snippets

- Chile: CPI inflation rose by 1.4% mom in July from 0.9% in June, 10bps above consensus, lifting the yoy rate by 60bps to 13.1% over the same period. The trade account was broadly balanced in July for the second consecutive month as exports dropped to USD 7.96bn and imports to USD 7.89bn.

- Czechia: CPI inflation slowed to 1.3% mom in July from 1.6% in June, allowing the yoy rate to rise only 30bps to 17.5%, 40bps below consensus. The trade deficit narrowed to CZK 12.1bn in June from CZK 25.1bn in May, significantly better than consensus, but the current account deficit widened to CZK 45.4bn from CZK 22.8bn over the same period, which was below consensus. The yoy rate of industrial output slowed to 1.7% in June from 6.3% in May and construction was down 250bps to 0.8% yoy

- Egypt: urban CPI rose to 1.3% mom in July from -0.1% mom in June, taking the yoy rate 40bps higher to 13.6%.

- Ghana: The government doubled the size of its financial assistance request to the IMF to USD 3.0bn after the rating agencies S&P and Fitch downgraded the government’s credit rating below B-.

- Hungary: CPI inflation rose 2.3% mom in July from 1.5% mom in June, taking the yoy rate up by 200bps to 13.7% over the same period. The trade deficit widened to EUR 471m in June from EUR 95bn in May.

- India: The yoy rate of CPI inflation slowed 30bps to 6.7% in July, broadly in line with consensus and industrial production slowed to 12.3% yoy in June from 19.6% in May, 200bps ahead of consensus.

- Peru: The central bank hiked its policy rate by 50bps to 6.5%, in line with consensus, and mentioned the ex-ante policy rate now is at a level close to neutral levels while explaining higher inflation in July was a result of the increase in the international food and fuel prices.

- Poland: The current account deficit was unchanged at USD 1.47bn in June, significantly better than consensus as the trade deficit narrowed to 849m in June from USD 1,157m in May thanks to lower imports.

- Romania: CPI inflation rose to 0.9% mom in July from 0.8% mom in June, 50bps ahead of consensus, taking the yoy rate to 15.0%.

- Russia: The Wellbeing fund declined to USD 198.3bn in July from USD 210.6bn in June. CPI inflation dropped 0.4% mom for the second consecutive month in July, allowing the yoy rate to slowdown 80bps to 15.1% as core CPI declined 80bps to 18.4%.

- South Africa: The yoy rate of manufacturing production dropped 3.5% in June form -1.8% in May as mining production dropped 1.4% mom in June, 200bps more than consensus, after rising 1.2% in May.

- South Korea: The unemployment rate was unchanged at 2.9% in July, in line with consensus.

- Taiwan: The trade surplus rose to USD 5.1bn in July from USD 4.6bn in June, surprising consensus to the upside as exports rose at a yoy rate or 14.2% (310bps above consensus) and imports by 19.4% (70bps below consensus).

- Thailand: The Bank of Thailand hiked its policy rate by 25bps to 0.75%, in line with consensus. Consumer confidence improved marginally and the yoy rate of GDP growth improved to 2.5% in Q2 2022 from 2.3% in Q1, slightly below consensus.

- Turkey: The unemployment rate declined 30bps to 10.3%. The current account deficit narrowed to USD 3.5bn in June from USD 6.6bn in May. Industrial production rose 1.3% mom in June from 0.5% in May, as the yoy rate slowed 50bps to 8.5% (consensus 6.7%)

Developed markets

United States: Inflation was better than expected with consumer prices stable (0.0% mom) in July (consensus +0.2%) after rising 1.3% mom in June, allowing the yoy rate to decline to 8.5% from 9.2% over the same period. Core CPI slowed to 0.3% mom from 0.7% mom, keeping the yoy rate flat at 5.9%. Energy prices declined 0.4% mom after rising 0.7% in June and shelter inflation slowed, albeit remaining at elevated levels, as food price inflation accelerated. The yoy rate of unit labour costs rose by 10.8% in Q2 2022, down from 12.7% yoy in Q1 while nonfarm productivity increased to -4.6% yoy from -7.4% over the same period. PPI inflation dropped 0.5% mom in July from +1.0% mom in June, allowing the yoy rate to drop 150bps to 9.8% as PPI ex-food and energy dropped to 0.2% mom in July from +0.4% in June, taking the yoy rate down 80bps to 7.6%. Elevated inventories and lower energy prices suggest more disinflation in August as wholesale inventories rose another 1.8% mom in June from 1.9% mom in May, as wholesale sales increased to 1.8% mom in June from 0.7% mom in May. Initial jobless claims rose to 262k on 6 August from 248k in the previous week (revised form 260k).

In political news, former President Donald Trump had his residence in Florida raided by the Federal Bureau of Investigation, which took several boxes with documents. Trump had returned documents taken from the White House, but the raid suggests authorities believe other key documents were kept. The investigation is a serious challenge to an eventual Trump candidacy in 2024, but in the short term is likely to exacerbate political divisions within the US, in our view. Last week Attorney General Laetitia James interrogated Trump under oath on a long-running civil probe into business practices, but Trump invoked his Fifth Amendment right to remain silent to avoid incriminating himself. The raid and interrogation led to pro-Trump mobilisations and increased the rift in the country.

Europe: Industrial production slowed to 0.7% mom in June from 2.1% in May, taking the yoy rate 80bps higher to 2.4%, significantly better than 1.0% yoy consensus.

1. See https://twitter.com/RALee85/status/1558852348646248449

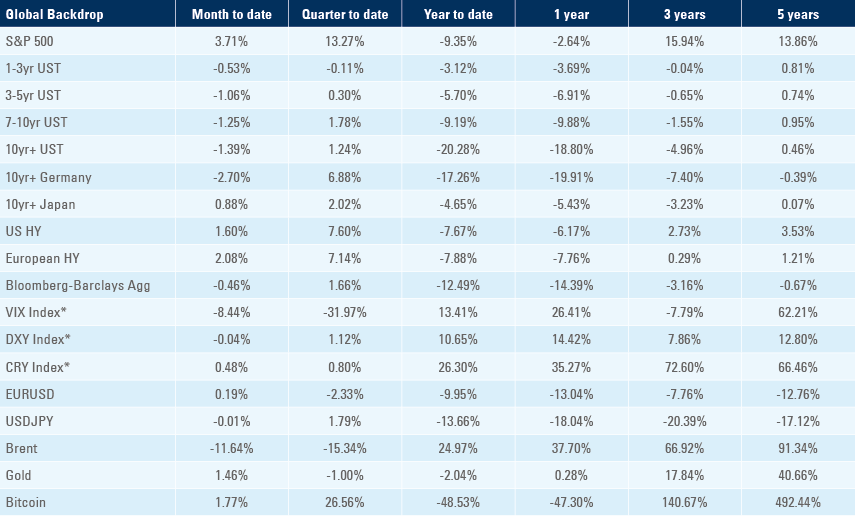

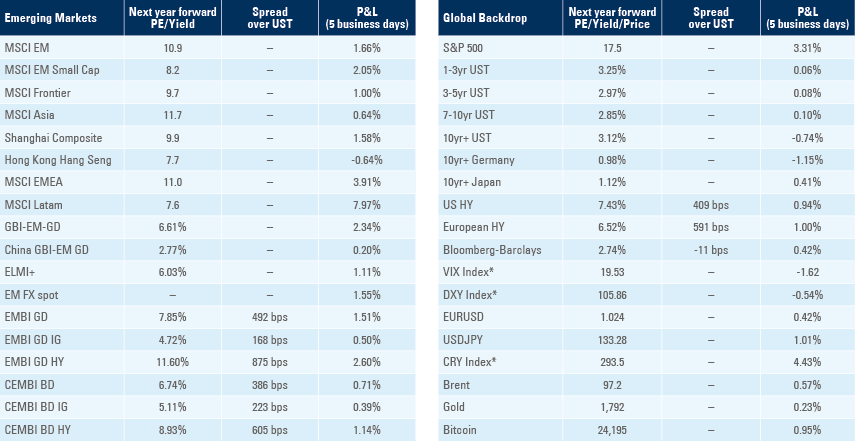

Benchmark performance