Inflation rose above expectations in most Emerging Market (EM) countries. Inflation is at far from concerning levels, but may slow down the pace of rate cuts in a few countries in our view. Last week, US Treasury (UST) yields declined after the statement from US Federal Reserve (Fed) Chair Powell and the European Central Bank (ECB) rate decision and press conference. Taiwan exports softened, but remained positive. Argentinians increased dollar-denominated deposits in the banking sector. Vehicle production and exports increased across Latin America as foreign direct investment (FDI) increased in Brazil. Venezuela announced presidential elections to take place on 28 July. Egypt let the Pound float, hiked rates and announced an International Monetary Fund (IMF) agreement.

Global Macro

China kept its growth target at “around 5%” at its large policy gathering, however Premier Li Qiang mentioned challenges in achieving this growth target. Chinese inflation surprised to the upside due to higher food and recreation prices during the Lunar New Year.

In a two-day testimony to Congress, Fed Chair Jerome Powell kept the guidance to cut rates at some stage this year. His statement lowered the risks of rates remaining unchanged or increasing in 2024. Powell also mentioned the risk of regional banks failing due to exposure to commercial real estate (CRE). Powell’s financial stability concern underpins his willingness to keep to the message that the next move is a rate cut. We believe, a significant UST sell-off could trigger more acute problems for CRE and US regional banks. ECB Governor Christine Lagarde also signalled that a rate cut this year is likely, and the ECB seems to be more poised to potentially start its cycle in May, but most likely in June, in our view.

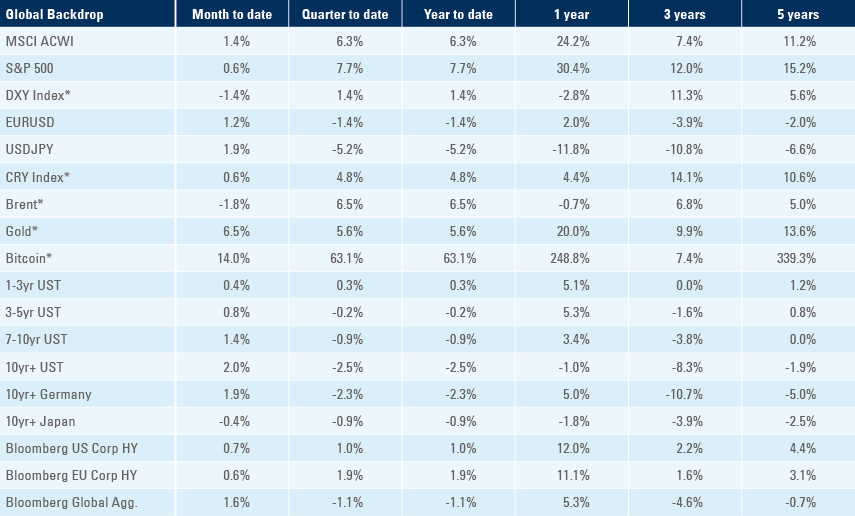

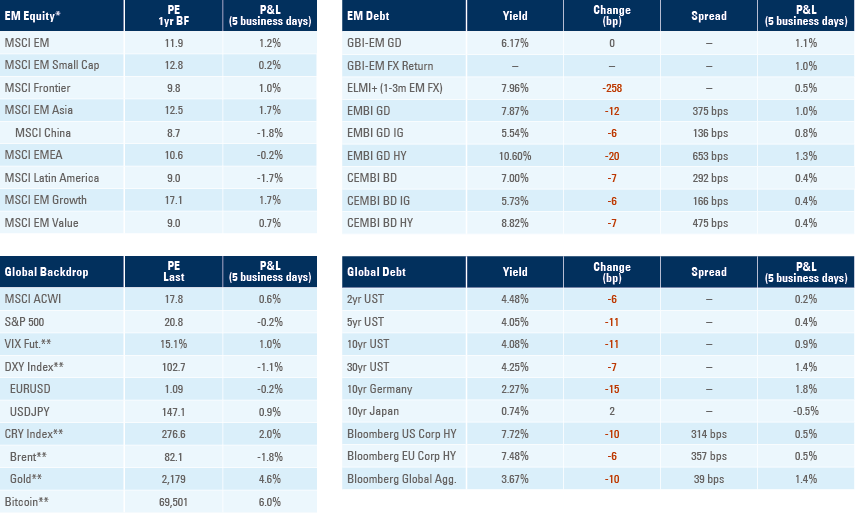

The payroll report had higher-than-expected headline hiring numbers, which are now increasing on the three- and six-month moving averages that incorporate the usual revisions. However, the unemployment rate increased and hourly earnings rose less than expected. Overall, the labour market is still softening, evidenced by lower quit rates and earnings, but remains ‘too hot’ to justify cuts, should inflation remain elevated, in our view. Next week, inflation data will likely be key on whether May becomes a ‘live meeting’. The market now prices the first cut both by the Fed and the ECB in June. USTs maturing in two, five, 10 and 30 years declined by 6, 11, 11, and 7bps, to 4.48%, 4.05%, 4.08%, and 4.25%, respectively. These levels suggest that bond market participants attribute a higher likelihood of an economic slowdown from here, in sharp contrast with US equities pricing, in our view.

Lower yields have, in the past, led to higher stock market prices. However, despite yields moving lower, the volatility in the equity market increased last week. The mega-cap companies have been struggling to compete with locals in China as iPhone and Tesla car sales reportedly declined in China year-to-date. Several of these companies priced in very little US-China tension risks, which will increase closer to the elections, in our view.

Investors are also questioning whether artificial intelligence (AI) promises went too far compared with their actual capabilities. Google and ChatGPT bots have come under pressure for politically-biased content, and declining capabilities of solving quantitative problems. There are paradoxical problems like model autophagy disorder (MAD) where the quality of the bots deteriorates as it stops using third-party data to ‘learn’ and relies on its own self-feed content. Bot models are also prone to the occasional ‘hallucination’ when AI generates nonsensical answers due to their inability to answer the question. The high-profile challenges could lead to more cautious adoption and investments. Last Friday, Nvidia shares hit a record high of USD 974 before plunging to USD 875, erasing USD 250bn of market cap in an afternoon with massive volumes (111m shares) traded – larger than on earnings day – and typically a sign of a ‘blowoff’ top.

Lower yield and higher volatility were supportive of gold, which rallied 4.6% to USD 2,179 per ounce – another record high. Gold has been rallying despite continuous outflows from gold exchange-traded funds (ETFs), suggesting long-term investors keep adding exposure. It was also the first time in a year when the stock closed down after opening with a gap. Bitcoin rose 6.0% to 69.5k, also just shy of its all-time high, aided by inflows to ETFs.

Emerging Markets

EM Asia

China: The yoy rate of consumer price index (CPI) inflation rose by 150bps to 0.7% in February, above consensus at 0.3%, as food and recreation prices rose driven by the Lunar New Year holiday season demand. Producer price index (PPI) inflation dipped 20bps further into deflation to -2.7% yoy against the consensus for no change. The trade surplus rose to USD 125.2bn in February from USD 106.8bn in January as exports rose by 10.3% yoy and imports by 6.7% yoy.

Malysia: Bank Negara Malaysia kept its policy rate at 3.0%, in line with consensus. Foreign exchange (FX) reserves declined by USD 1bn to USD 114.3bn.

Philippines: CPI inflation was unchanged in mom terms at 0.6% in February and rose by 60bps in yoy terms to 3.4%, above consensus at 3.0%. The unemployment rate rose by 1.4% to 4.5% in February. Bank lending slowed to 8.3% yoy in January from 9.6% yoy in December, and FX reserves declined to USD 102.7bn in February from USD 103.3bn in January.

South Korea: CPI inflation rose 0.5% mom in February, leading to an increase of 30bps in yoy terms to 3.1% yoy (3.0% consensus). Real gross domestic product (GDP) growth slowed to 1.4% in 2023, from 2.6% in 2022, but was unchanged in Q4 2023 at 2.2% yoy, in line with consensus.

Taiwan: The yoy rate of CPI inflation rose to 3.1% yoy in February from 1.8% in January, 50bps above consensus as core CPI rose by 130bps to 2.9% yoy. The trade surplus increased to USD 7.8bn in February from USD 2.5bn in January, significantly above consensus at USD 4.1bn. However, the improvement was driven by imports, which declined 17.8% yoy (consensus -2.5%) as exports rose by only 1.3% yoy (consensus +2.0% yoy). Electronic exports disappointed, despite the strong performance in the semiconductor industry.

Thailand: CPI inflation rose by 0.2% mom in February (in line) as the yoy rate increased by 30bps but remained in deflation at -0.8% yoy. Core CPI declined 10bps to 0.4% in yoy terms, a bit below consensus. Consumer confidence rose one point to 63.8.

Latin America

Argentina: Vehicle sales increased to 33.2k in February from 15.9k in January as production increased to 37.5k from 22.6k over the same period, the highest level for the month in five years, but still below the average over the last 10 years. Vehicle exports rose to 23.6k from 15.3k (highest since 2015). Construction activity dropped by 10.3% mom in January, a drop of 21.7% in yoy seasonal-adjusted terms. The central bank continued to accumulate FX reserves and Bloomberg reported locals have deposited USD 2.3bn in dollar-denominated accounts in local banks since Javier Milei took office, a 17% increase to USD 16.4bn.

Brazil: Vehicle production increased to 190k in February from 153k in January as sales rose by 3k to 165k and exports by 12k to 31k. PPI posted a 0.4% mom deflation, declining 4.0% in yoy terms in February accelerating from -0.3% mom and 3.6% yoy. The ratio of net debt to GDP declined to 60.0% in February from 60.8% in January. FDI rose to USD 8.7bn in January after -USD 0.4bn in December, nearly double the consensus and accumulating USD 64.2bn in 12 months. The trade surplus slowed by USD 1.1bn to USD 5.4bn in February but posted the best result on record for the first two months of the year.

Chile: CPI inflation rose by 0.6% mom in February, lifting the yoy rate up 70bps to 4.5%, 40bps above consensus. The trade surplus slowed to USD 1.5bn in February from USD 2.6bn in Jan. Exports declined by USD 1.7bn to USD 7.5bn and imports slowed by USD 0.5bn to USD 6.0bn. Copper exports were unchanged at USD 3.5bn. Nominal wage growth slowed to 6.5% yoy in January from 7.7% yoy in December.

Colombia: The yoy rate of CPI inflation declined 65bps to 7.7% yoy in February and core CPI dropped 60bps to 9.1% yoy. In sequential terms, headline inflation rose to 1.0% mom from 0.9% and core +1.1% mom from 1.0%. Exports slowed to USD 3.7bn in January from USD 4.4bn prior (USD 3.9bn est.), led by lower petrol and coal volumes.

Mexico: CPI inflation slowed to 0.1% mom in February, or 4.4% in yoy terms, from 0.9% mom in January (4.9% yoy), in line with consensus. Core CPI 0.5% rose mom in February from 0.4% mom in January but declined by 20bps to 4.6% in yoy terms (4.8%), also in line. Private consumption slowed to 4.4% yoy in December from 5.7% in November (in line). Formal job creation rose by 156k in February from 109k in January. Vehicle production rose to 318.7k in February, following 307k in January, as vehicle sales increased by 1k to 113.3k in February and exports rose by 22k to 282.6k.

Peru: The central bank unexpectedly held its policy rate at 6.25%, as inflation increased to 3.3%, which was 40bps more than expected.

Venezuela: Nicolas Maduro announced presidential elections will take place on 28 July. The electoral authority invited foreign commissioners to watch the election process.

Central and Eastern Europe

Czechia: Wages growth slowed to 6.3% in yoy terms in Q4 2023 from 7.1% in Q3. The unemployment rate was unchanged at 4.0% in February. The trade surplus slowed to CZK 3.7bn in January (consensus CZK 12.2bn) from CZK 5.3bn (revised from CZK 3.5bn).

Hungary: CPI inflation was unchanged at 0.7% mom in February and the yoy rate declined by 10bps to 3.7%, 20bps below consensus. Industrial production declined 1.1% mom in January from +0.2% in December, but base effects brought the yoy rate up to -4.1% from -7.6% (below consensus at -3.5%). Retail sales rose to a yoy rate of 0.6% in January from -0.2% in December, in line with consensus. The trade balance moved to a EUR 497m surplus in January from a EUR 271m deficit in December.

Poland: The National Bank of Poland kept its policy rate unchanged at 5.75%, in line with consensus. Governor Adam Glapiński said inflation was likely to increase sharply as subsidies are likely to be lifted soon but will decline again in 2025. FX reserves were down to EUR 188.0bn in February from EUR 189.6bn in January.

Romania: The unemployment rate rose 10bps to 5.7%. PPI inflation declined by 0.1% mom in January from -0.6% in February as the yoy rate dipped 60bps further into deflation to -6.0%. Retail sales rose by 3.8% mom in January from -0.4% mom in December, lifting the yoy rate up to 5.1% from 1.4% yoy over the same period. Real GDP contracted 0.5% qoq in Q4 2023 (+3.0% yoy) from -0.4% qoq in Q3 2023 (2.9% yoy).

Central Asia, Middle East, and Africa

Egypt: The central bank hiked its deposit and lending policy rates by 600bps to 27.25% and 28.25%, respectively, just before allowing the currency to depreciate by 37.6% to 49.15 last week. This orthodox stance was anchored by the large strategic investment from the United Arab Emirates announced last week and an upsized IMF programme, which will see the IMF lend USD 8bn instead of the original USD 3bn.

Nigeria: The trade balance moved to NGN 1.4bn deficit from an NGN 1.3bn surplus in Q3 2023.

Saudi Arabia: The All Economy Purchasing Managers’ Index (PMI) rose to 57.2 from 55.4.

South Africa: Real GDP growth rose 0.1% qoq (+1.2% yoy) in Q4 2023 from -0.2% qoq in Q3 2023 (-0.7% yoy). The current account deficit increased to 2.3% GDP in Q4 2023 from 0.5% in Q3 2023. Electricity production increased +0.8% yoy in Jan after 4.3% yoy in December.

Türkiye: CPI inflation rose by 4.5% mom in February (est. 3.9%) from 6.7% mom in January, lifting the yoy rate up by 220bps to 67.1%. Core CPI rose 240bps to 72.9% yoy and PPI rose +310bps to 47.3% yoy.

Developed Markets

United States: The labour market disappointed as the ISM Non-Manufacturing Index declined one point to 52.6. The S&P Global Services PMI rose one point to 52.3 as employment dropped 2.5 to 48.0, prices paid fell 5.4 points to 58.6. The labour market data was mixed. Non-farm payrolls rose by +275k in February, above consensus at 200k and prior at 229k. However, the previous numbers were revised lower, and unemployment increased by 20bps to 3.9%. Further, average hourly earnings declined by 10bps to 4.3%. The Job Openings And Labor Turnover (JOLTS) survey reported a decline to 8,863k in February (in line) after 8,889k in January and the Challenger Job Cuts rose to 85k in February, slightly above 82k in January, but a meaningful increase from the average of the last 12 months at 59k. Finally, continuing claims inched up to 1,906k from 1,898k, above consensus at 1,880k.

Eurozone: The ECB kept its deposit, refinancing and lending policy rates unchanged at 4.0%, 4.5% and 4.75%, respectively, in line with consensus. Governor Lagarde signalled a first policy rate cut in June was possible, but not yet decided, and will depend on inflation convergence to its 2.0% target process. In economic news, PPI inflation was unchanged at 0.9% mom deflation in January, as the yoy rate increased by 210bps to -8.6%. Retail sales rose 0.1% mom in January after declining 0.6% in December as the yoy rate declined 1.0% (-1.3% consensus) from -0.5% in December.

Japan: Tokyo’s CPI inflation rose by 80bps to 2.6% yoy in February, 10bps above consensus, but core CPI slowed by 20bps to 3.1% yoy, in line with consensus. Earnings inflation rose to a yoy rate of 2.0% in January from 0.8% yoy in December, taking real earnings closer to unchanged levels. Several Bank of Japan officials have been advocating normalising its negative interest rate policy, citing higher wage inflation as a signal that they have managed to escape the deflationary trap, in our view.

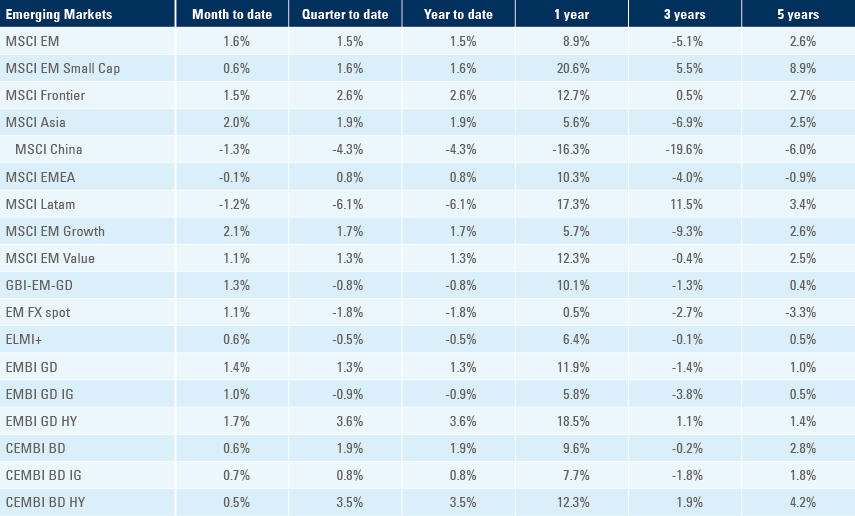

Benchmark performance