Relief rally in overvalued US stocks contrasts with a turning point in undervalued Chinese stocks

Stock markets posted a sharp relief rally last week after lower-than-expected inflation in the United States led to a sharp reversal of “bearish” positioning. Chinese assets outperformed again as China unveiled 20 measures setting up a framework for relaxing mobility restrictions as well as 16 measures to improve liquidity in the property sector. Brazilian assets underperformed as President-elect Lula requested that Congress bring social spending out of the expenditure ceiling enshrined in the country’s constitution.

Geopolitics

The Ukrainian army retook the city of Kherson – an important logistical hub at the mouth of the Dnipro River – also known as “the essence of Ukraine”. Kherson was also a key position for Russia to maintain the stronghold over the land bridge to Crimea, putting Ukraine in a favourable position to regain more territory over the next weeks as the autumn/winter season has so far been warmer than expected in Europe.

All eyes this week are on Bali, Indonesia, where the leaders of the largest 20 countries in the world meet to discuss global affairs. The possibility of a better relationship between the United States and China, after the first personal meeting between Joe Biden and Xi Jinping, could reduce geopolitical risks over the next months and quarters.

Emerging markets

Brazil: Brazilian assets underperformed after President-elect Lula personally negotiated a constitutional amendment with Congress to breach the expenditure ceiling by BRL 150bn to BRL 200bn to finance social programmes. The fact that Lula has started to negotiate such radical matters before taking power (transition ceremony on 31 December) and even before appointing a finance minister goes against the idea that Lula would be a pragmatist when it comes to economic and fiscal matters.

In economic news, vehicle production was virtually unchanged at 206k in October, as domestic sales dropped by 13k to 181k in October, but exports increased by 15k to 43k over the same period. Retail sales rose by 1.1% in September from 0.1% in August lifting the yoy rate by 160bps to 3.2% while the volume of services increased 0.9% mom from 1.1% mom over the same period, taking the yoy rate up 100bps to 9.7%. CPI inflation rose 0.6% in October after declining 0.3% in September, taking the yoy rate down 70bps to 6.5%, which was 10bps above consensus.

China: The National Health Commission published detailed measures to “optimise” Covid controls, including cutting the quarantine period for inbound travellers and people with close contact with Covid patients. China also changed the language around the policy, highlighting the need to minimise the impact of the policy on people’s lives and vowed to scrap flight suspensions.

It is not surprising that China is changing its stance on normalising mobility conditions. Politicians needed to balance the desire for a conservative healthcare approach to save lives with a liberal approach that favours livelihoods. Even Japan, a very conservative country, has recently opted to reopen its economy recently as new variants of concern present lower fatality risks. Furthermore, several studies show the Chinese native vaccines such as the CoronaVac are effective in reducing hospitalisations and deaths (less effective than Pfizer, but still effective), even amongst the oldest cohort.1 People may not want to take the vaccine if they don't trust the government, but this problem can be addressed with effective public information campaigns.

In 2020/21, there was general willingness across China for lockdowns to preserve lives, which was popular given the significant uncertainties on the coronavirus and lack of vaccines. However, since Q4 2021, the lockdowns have been much more due to geopolitical and economic reasons, in our view. In a world faced with excessive fiscal stimulus and demand as well as supply constraints, China may have felt the need to boost energy inventories. Furthermore, China’s elevated debt levels meant that the country had to avoid inflationary spikes at all costs. China is one of the few countries in the world with low inflation precisely because of mobility restrictions and tight liquidity in its real estate markets. In October, the producer price index posted a 1.3% deflation in yoy terms from 0.9% inflation in September as the yoy rate of CPI inflation declined by 70bps to 2.1%. Therefore, it makes sense that in 2023, as the world enters a recession due to monetary policy tightening and a levered balance sheet, China can reopen without fearing massive inflationary spikes or shortages of commodities.

The policy U-turn was extended to property as the National Association of Financial Market Institutional Investors will support RMB 400bn of bond financing of private companies (including developers) with relending funds from the People’s Bank of China (PBOC). In addition, the PBOC and the Banking and Insurance Regulatory Commission jointly issued 16 measures to rescue the property sector, including broad extensions of loans due over the next six months and support to buy-back onshore and offshore bonds as well as a temporary easing of the three red lines leverage limits for developers. In addition, China will allow qualified property developers to access as much as 30% of pre-sale funds which have been frozen in escrow accounts. The comprehensive measures are likely to stimulate growth as better confidence in mobility conditions and less depressed sentiment on real estate allows for higher consumption.

In other economic news, aggregate financing declined to RMB 908bn in October from RMB 3,527bn in September as new loans slowed to RMB 615bn from RMB 2,474bn over the same period.

Mexico: Thousands of protesters took to the street across the country against President Andres Manuel Lopez Obrador’s (AMLO) attempts to overhaul the country’s electoral system. AMLO wants electoral regulators to be chosen by direct vote and to eliminate state-level election agencies in favour of a federal one, claiming the National Electoral Institute (INE) became too partisan and that the cost of elections had become too high. The proposed bill would change the process for selecting both the regulators of the INE and the judges who sit on the electoral court, and includes a sharp reduction in the number of congressional representatives and a cut in political parties funding. In economic news, the central bank hiked its policy rate by 75bps to 10%, in line with consensus, but director Gerardo Esquivel voted for a 50bps hike instead. The yoy rate of CPI inflation declined 30bps to 8.4% in October, but core CPI rose 10bps to 8.4% over the same period. Vehicle production rose 5k to 278.5k in October and exports increased by 8k to 267.9k over the same period. A total of 208k new formal jobs were created in October from 172.5k in September. Industrial production was unchanged at 3.9% yoy in September, slightly below consensus.

Hungary: The European Union said Hungary “accepted the Commission's conditions on the milestone for the independence of the judiciary. This is not the end of the negotiations, but a significant step," according to an anonymous EU official. In economic news, the yoy rate of retail sales rose 60bps to 3.0% in September and industrial production increased 110bps to 1.6% yoy over the same period. CPI inflation slowed to 2.0% mom in October from 4.1% in September, lifting the yoy rate by 100bps to 21.1%, 10bps above consensus. The trade deficit narrowed to USD 652m in September from USD 1,580m in August.

South Korea: Banks made efforts to stabilise markets, including buying commercial paper and asset-backed commercial paper after a financial institution did not call its long-dated callable bonds, driving a spike in volatility in Korean credit markets. Korean assets outperformed thanks to higher demand for semiconductor and industrial equities benefiting from the reopening of the Chinese economy. In economic news, the current account moved to a USD 1.6bn surplus in September from USD 3.0bn deficit in August, thanks to the trade account moving to a USD 500m surplus from a USD 4.5bn deficit over the same period. The unemployment rate was unchanged at 2.8% in October.

Snippets

- Argentina: The yoy rate of construction activity moderated to 5.2% in September from 7.3% yoy in August as industrial production slowed to 4.2% yoy from 7.8% over the same period, but wages increased by 6.7% mom in September from 6.5% in August.

- Chile: The trade balance moved to a USD 467m surplus as exports were unchanged at USD 7.6bn and imports dropped by USD 0.9bn to USD 7.1bn. CPI inflation declined to 0.5% mom in October from 0.9% mom in September, bringing the yoy rate down by 90bps to 12.8%, which is 50bps better than consensus.

- Colombia: The consumer confidence index dropped to -19.5 in October from -11.5 in September as manufacturing, industrial production, and retail sales declined to yoy rates of 6.9%, 4.4% and 7.2% respectively, all missing consensus expectations marginally.

- Czechia: The trade deficit narrowed to CZK 13.9bn in September from CZK 29.7bn in August. The consumer price index dropped 1.4% mom in October after +0.8% in September, bringing the yoy rate down 290bps to 15.1%. The surprising drop is related to the Czech national statistical bureau incorporating the household electricity subsidy payment ion the index calculation.

- Egypt: CPI inflation rose 2.6% mom in October after 1.6% in September, bringing the yoy rate of core CPI up 100bps to 19.0%.

- India: The yoy rate of industrial production rose 3.1% in September from -0.7% in August – 110bps above consensus. Wholesale price index (WPI) slowed to a yoy rate of 8.4% in October from 10.7% in September, 10bps below consensus, and CPI inflation declined by 60bps to 6.8% yoy – 10bps above consensus.

- Indonesia: GDP growth slowed to 1.8% qoq in Q3 2022, 10bps above consensus, from 3.7% qoq in Q2 2022, leading to a 30bps increase in the yoy rate to 5.7%.

- Malaysia: The yoy rate of industrial production slowed to 10.8% in September from 13.5% in August, and manufacturing sales declined by 490bps to 19.5% yoy over the same period. GDP growth slowed to 1.9% qoq in Q3 2022 from 3.5% qoq in Q2 2022.

- Peru: The central bank hiked its policy rate to 7.25%, in line with consensus.

- Philippines: GDP growth rose to 2.9% qoq in Q3 2022 from -0.1% qoq in Q2 2022, leading to a 10bps increase in the yoy rate to 7.6%. The unemployment rate declined by 30bps to 5.0% in September.

- Poland: The central bank kept its policy rate unchanged at 6.75%, surprising consensus expectations for a 25bps hike.

- Romania: The central bank hiked its policy rate by 50bps to 6.75%, as consensus was split between 50bps and 75bps hike. CPI inflation was unchanged at 1.3% mom in October, allowing for a 50bps reduction on the yoy rate to 15.3% as wage inflation increased 100bps to 13.8% yoy in September.

- South Africa: Mining production rose 0.1% mom in September from -0.6% in August, slightly better than consensus as manufacturing production jumped 4.9% mom after rising 2.2% mom over the same period, significantly above consensus for unchanged manufacturing.

- Taiwan: The trade surplus narrowed to USD 3.0bn in October from USD 5.0bn in September as imports rose 8.2% yoy (consensus -5.0%) and exports declined 0.5% yoy (consensus -6.0%). The yoy rate of CPI inflation dropped 10bps to 2.7%, as WPI declined 110bps to 11.1%, but core CPI rose 20bps to 3.0%.

- Thailand: The yoy rate of CPI inflation declined 40bps to 6.0, in line with consensus as core CPI rose 10bps to 3.2%. Consumer confidence on the economy by 1.4 points to 40.0 and consumer confidence rose 1.5 to 46.1 in October, both remaining close to the most depressed levels since 1998.

- Turkey: A bomb exploded on a popular street in Istanbul on Sunday, killing six people and wounding dozens. President Recep Tayyip Erdogan said perpetrators of this “treacherous attack” would be punished. The current account deficit widened to USD 3.0bn in September from USD 2.7bn in August (consensus USD2.5bn deficit).

Developed markets

United States: CPI inflation rose 0.4% mom and core CPI inflation increased 0.3% mom in October, both 20bps lower than consensus, to 7.7% and 6.3% yoy respectively from 8.2% and 6.6% yoy in September. Most of the decline in inflation came from manufactured goods as well as healthcare as shelter inflation remained elevated. Core service prices rose by 0.5% mom in October, down from 0.8% mom in September but remained at the highest levels in yoy terms since 1982 at 6.7%.

The lower-than-expected inflation number triggered a powerful unwind of the consensus positions that worked well year-to-date: long US dollar, paying US rates and short stocks, allowing stocks to close positive on the week. Despite below consensus inflation, the Federal Reserve Governor Christopher Waller said “we’ve still got a ways to go” before the US central bank stops raising interest rates, highlighting more rate hikes will take place and rates will “stay high for a while”.

The Republican Party is likely to gain a narrow control of the Lower House of Congress, but the Democratic Party guaranteed control of the Senate by keeping 50 seats even before a run-off in Georgia on 6 December. The results were a disappointment to Republicans that expected a “red wave” and are likely to hit Donald Trump’s candidacy in 2024 in favour of the re-elected Governor of Florida Ron DeSantis. Nevertheless, the Republican majority in the Lower House is likely to be enough to bar any meaningful legislation proposed by the Democratic Party and could lead to faster fiscal consolidation and volatility due to the more challenging situation to increase the debt ceiling.

The University of Michigan sentiment survey declined another 5.2 points to 54.7 in November as both current conditions and expectations declined while long-term inflation expectations increased 10bps to 3.0%.

Europe: Retail sales rose 0.4% mom in September after 0.0% in August, allowing the yoy rate to increase 80bps to -0.6% over the period.

Japan: PPI inflation rose 0.6% mom in October from 1.0% in September, allowing the yoy rate to decline 110bps to 9.1%, 30bps above consensus.

1. See https://en.wikipedia.org/wiki/CoronaVac

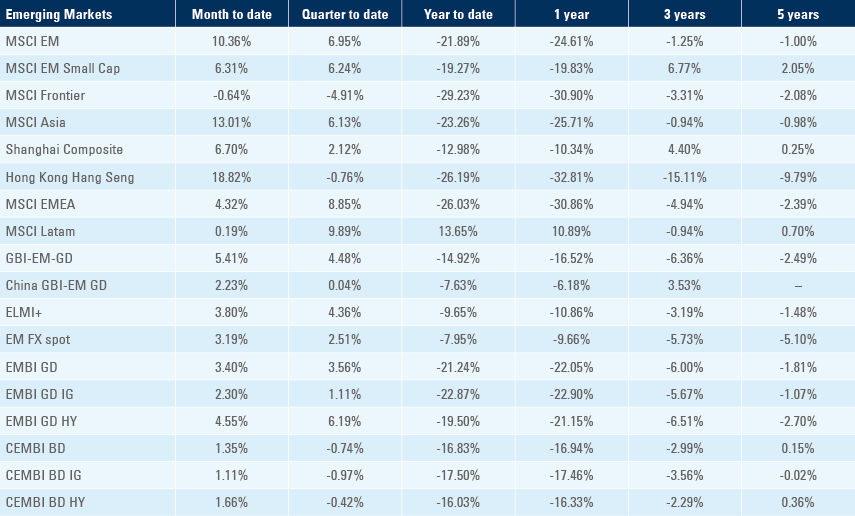

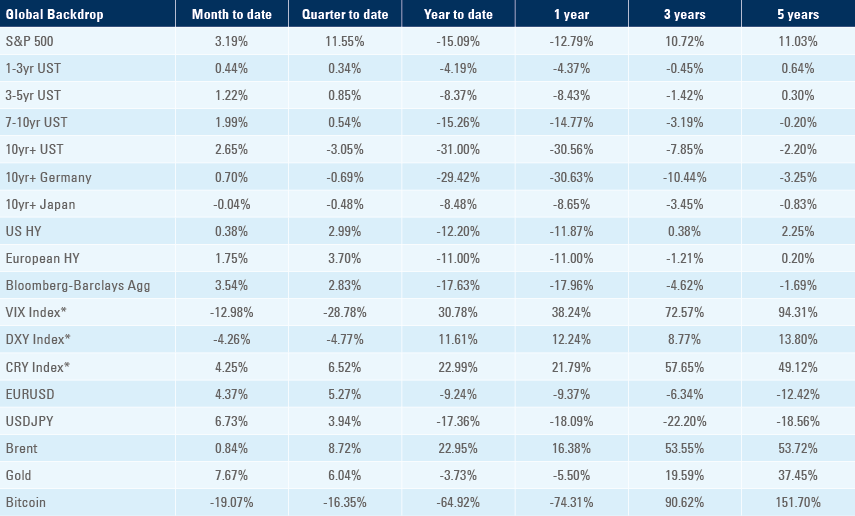

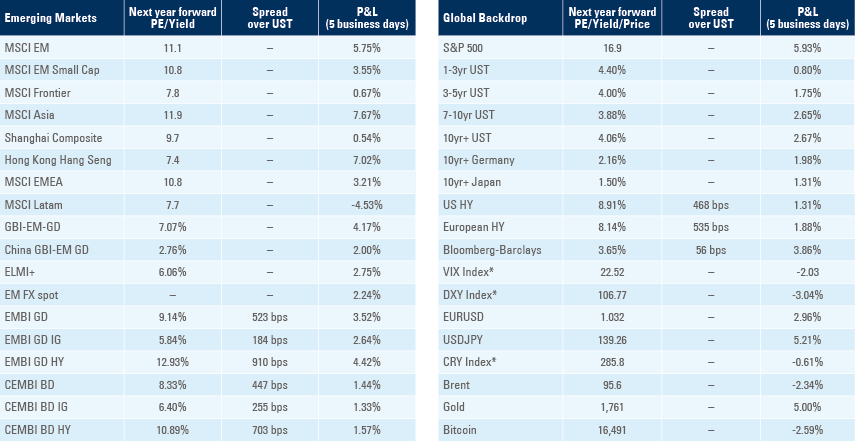

Benchmark performance