The G-20 talked up a soft global economic landing, despite many risks. Inflation rebounded in January for the US and surprised to the upside in the Eurozone in February, which led to a re-pricing on the number of policy rate cuts implied in interest rates futures. Global purchasing managers’ indices (PMIs) improved marginally, but with wide dispersion across countries. Emerging Market (EM) stocks performed well in February, led by a rebound in Chinese stocks. EM high yield bond outperformance remained anchored by credits rated single-B and below. Malaysian monetary authorities said the Ringgit is undervalued. Argentina’s Milei proposed a reset of relations with Congress and governors. Hungary cut interest rates to 9.0%. Egypt’s parallel foreign exchange (FX) rate rose sharply over the weekend. Nigeria hiked its policy rate by 400bps.

Global Macro

G-20 Meeting

Leaders at the G-20 meeting in São Paulo failed to achieve a consensus for a closing agreement, but the closing statement suggested the global economy has a growing chance of a soft landing. Risks to the global economic outlook are more balanced, with faster-than-expected disinflation and more growth-friendly fiscal consolidation. The statement suggested among the downside risks to the global economy are wars and escalating conflicts, geoeconomic fragmentation, rising protectionism and trade route disruptions.

Global Rates

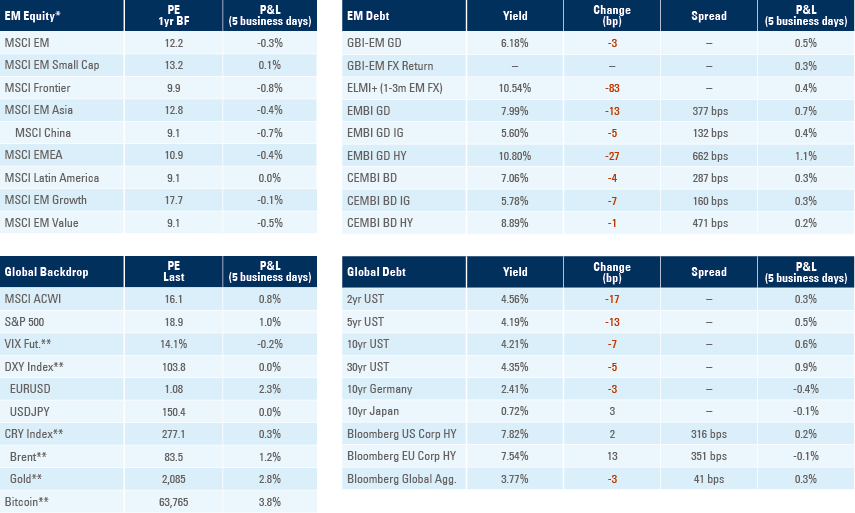

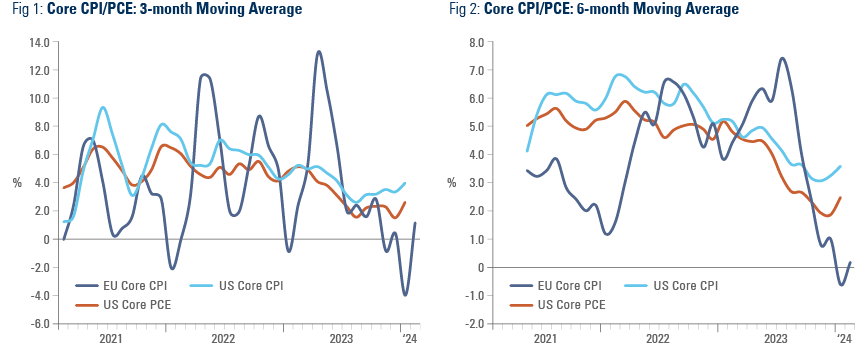

Core personal consumption expenditures (PCE) inflation rose in the United States (US) while consumer price index (CPI) inflation slowed by less than expected in Europe, endorsing the more cautious approach by central banks. In fact, the three- and six-month moving average of core inflation measures in the US has stopped declining and has been increasing in recent months, while European Union (EU) core CPI inflation seemed to inflect higher, as per Figs 1 and 2.

The central banks’ more cautious approach is ‘half-priced.’ Overnight interest rate swap markets are now implying only 3.5 cuts of 25bps by the US Federal Reserve (Fed) and the European Central Bank (ECB) by December, from seven cuts at the lows in rates on 12 January. The bar is high for central banks to hike policy rates, in our view. Even if inflation rises further and remains sticky around the 2.5% to 3.5% area, the long end of the curve would be likely to sell off, doing the tightening work for the Fed as the Fed Funds ex-post real rate would be likely to remain at around 2.0% to 3.0%, the highest level since 2006/07. Hence, in the absence of a major shock, the market pricing no cuts is the key downside risk to consider. That leaves more upside asymmetry for bonds for medium-term investors. Consequently, last week’s softer economic data brought in fresh buyers of bonds.

The problem for the Fed is that the US economy remains resilient to its monetary policy tightening, aided by ample fiscal stimulus and a remarkable stock market boom led by artificial intelligence (AI) stocks. The long end of the curve may need to move back towards 5.0% for credit spreads and stocks to suffer. At the same time, higher for longer interest rates are putting significant pressure on the weak links of the economy, like commercial real estate and leveraged loans. On balance, an overweight position in investment grade (IG) bonds in the front end of the curve (two to seven years) balanced with selective distressed and single-B sovereign debt remains a good position for the current environment.

Global Manufacturing PMI’s

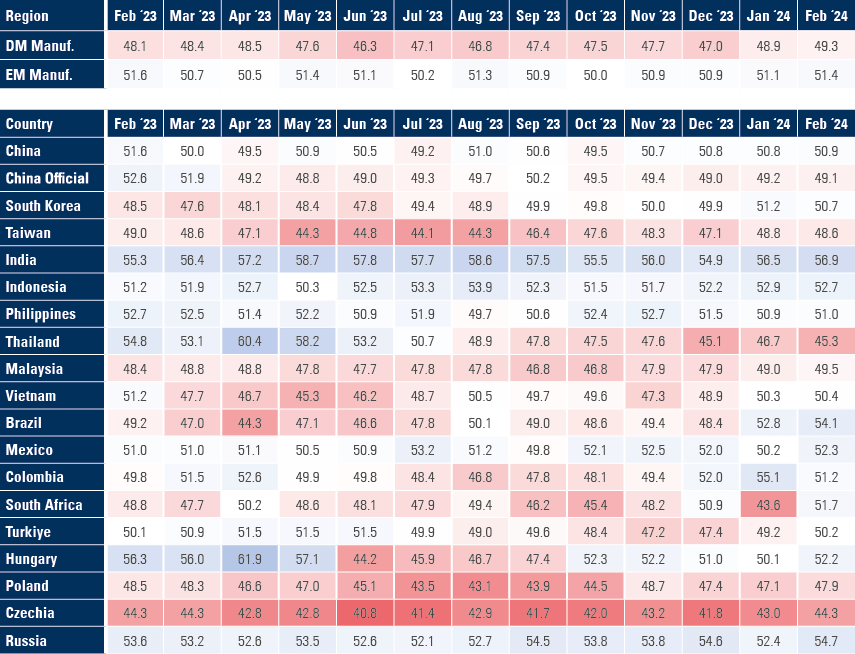

The S&P Global Manufacturing Purchasing Managers’ Index rose by 0.4 points in Developed Markets (DM) to 49.3 and by 0.3 points in EM to 51.4. Within DM, the US PMI rose 1.5 points to 52.2, but the Institute of Supply Management (ISM) survey showed a more negative picture, dropping 1.3 points to 47.8. Germany’s PMI fell by three points to 42.5, while France rose four points to 47.1. Within EM, China increased 0.1 to 50.9, still contrasting with the official NBS PMI, which dropped 0.1 to 49.1. Most Asian readings were soft (except India, Indonesia, Vietnam, and the Philippines), as most Latin American and CEMEA countries outperformed (Brazil up 1.3 to 54.1; Mexico +2.1 to 52.3; Türkiye +1 to 50.2), as per Fig 3:

Fig. 3: Global PMIs

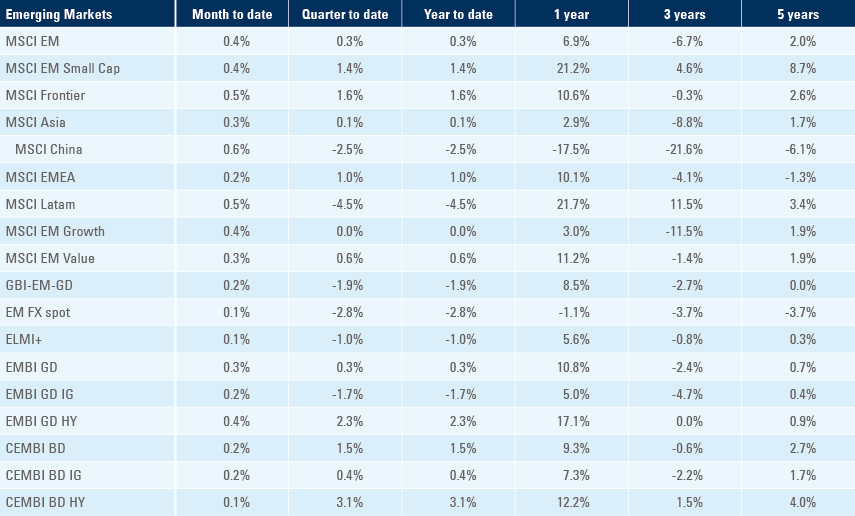

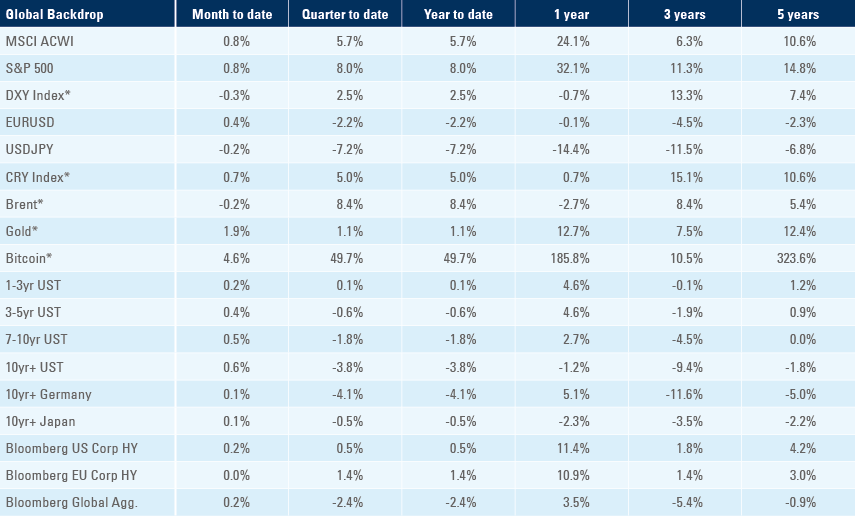

February Performance

Global stocks (MSCI All Countries World Index) rallied 4.3% in February, with the MSCI EM rising 4.8%. The recovery of Chinese stocks, up 8.4%, supported the MSCI EM outperformance despite the underperformance (-0.2%) of Latin American stocks over the period.

The Dollar Index rose 0.9% in February and 2.8% ytd as the EUR dropped 0.5% in January and 2.2% ytd. EM local currency bonds declined 0.6% over the month and 2.1% ytd, fully explained by EM currencies, which declined 0.7% and 2.9%, respectively.

The Bloomberg Barclays Global Aggregate declined 1.3% last month and is down 2.6% ytd, while US high yield rose 0.3% in February and ytd. EM hard currency fixed income outperformed last month. EM sovereign and corporate debt rose 1.0% and 0.7%, as high yield moved up by 2.6% and 1.6%, respectively, while IG declined 0.6% in sovereign and rose 0.1% in corporate benchmarks. In the Sovereign market, single-B bonds rose 3.8% and ‘C’ rated bonds rose 7.2%, lifting ytd total returns to 2.5% and 10.4%, respectively.

While IG credit spreads seem tight at 130bps (sovereign) and 156bps (corporate), the overall yields remain attractive at 5.65% and 5.84%, respectively. EM IG spreads and yields remain significantly above their DM counterparts, with the Bloomberg Global Agg trading at an option-adjusted spread (OAS) of 40bps and yield-to-worst at 3.8%. This spread attracted ‘crossover’ DM investors to buy EM IG bonds, which drove the outperformance of EM despite the large issuance and outflows from retail funds over the first two months of the year.

Commodity prices were slightly higher with Brent futures up 1.7% to USD 83.0 and gold up 0.9% to 2,055.

Emerging Markets

EM Asia

China: Swiss bank UBS estimated that China’s ‘National Team’ of state-owned funds bought RMB 410bn (c. USD 57bn) of shares in the CSI300 and CSI500 benchmarks. Chinese stocks outperformed their EM and DM peers in February as the MSCI China rose 8.4%. Banks approved USD 28bn loans for the property market, with 6k projects included in the ‘white lists’ eligible for funding.

Indonesia: CPI inflation rose 2.8% yoy, down from 2.6% last month (2.6% est.).

Malaysia: The Financial Markets Committee (FMC), comprising representatives from the central bank, financial institutions, corporations, and financial service providers, said the Ringgit is undervalued and “ought to trade higher” in view of the country’s strong fundamentals. Second Finance Minister Amir Hamzah Azizan said the central bank stood ready to restrict any “excessive weakening” of the Malaysian currency.

South Korea: The trade surplus rose to USD 4.3bn in February from USD 0.3bn in January. Exports rose 4.8% (12.5% working-day adjusted), and imports declined 13.1%. Exports of chips increased 66.7% from 2023.

South Korea: The trade surplus widened from USD 328m to USD 4.3bn (+USD 2bn est.). Imports fell 13.1% yoy, from -7.9% in December, (-11.1% est.), while exports rose 4.8% yoy, from +18% last month (+1.4% est.).

Taiwan: Export orders increased 1.9% yoy in January, from -16% in December (vs -3.6% est.) driven by a 28% yoy increase in orders from China.

Thailand: The current account fell into a USD 200m deficit in January, from +USD 2.1bn in December (-USD 422m est.) According to the Bank of Thailand, this was largely due to higher imports of gold. The trade balance fell into a USD 1.1bn deficit. Imports increased 1.5% yoy, -1.7% prior, while exports increased 7.2% (3% prior).

Vietnam: In February, CPI inflation rose 4.0% yoy, from 3.4% prior, as expected. The trade surplus tightened to USD 1.1bn from USD 2.9bn prior, (vs USD 1.5 bn est.), as exports fell 5% yoy (+1.7% est.).

Latin America

Argentina: Speaking at the opening of the legislative year in Congress, President Javier Milei called on governors and political leaders for a “great national agreement”. The foundations of the request are the approval of liberal economic policies and political reforms to reduce the influence of interest groups (such as unions) that have historically opposed those changes. In more substantive terms, the Executive is seeking a preliminary agreement to allow for a new set of legislations increasing its powers, deregulating the economy, increasing incentives for large investments and a new pension indexation regime. Governors have an incentive to embrace the broad pledge to avoid further deterioration of their fiscal position in the near term, since a large part of federal transfers to regions is discretionary, but are still likely to play hardball on the negotiations of the actual bills in Congress.

Brazil: Real gross domestic product (GDP) growth was up 2.1% in yoy terms in Q4 2023, slightly below consensus at 2.2%, and 10bps above Q3 2023. GDP growth closed 2023 at 3.0%, nearly three times the consensus at the beginning of the year, thanks to stellar external accounts led by the agricultural sector. While the agricultural sector’s outperformance is unlikely to be repeated, Brazil’s energy sector expansion, and ongoing improvements in business conditions associated with legacy reforms implemented by former presidents Temer and Bolsonaro, are likely to keep the economy supported. CPI inflation rose 0.8% mom (4.5% yoy) in the first 15 days of February, in line with consensus. Wholesale price inflation measured by the FGV fell 0.5% mom in February (-3.7% yoy) after rising 0.1% in January (-3.3% yoy), in line with expectations.

Chile: Economic activity rose by 2.5% yoy in January, significantly higher than the 0.6% consensus and from -1.0% yoy in December.

Guyana: Exxon Mobil is considering exercising its rights to acquire Hess Corp’s 30% stake in the giant Stabroek offshore oil development in Guyana. The field was discovered in 2015 and developed by Exxon, which controls 45% of the asset, and is estimated to contain 11bn barrels of crude oil with an estimated production of 1.2m barrels of oil a day by 2027. The problem is that the Guyana asset is Hess’s crown jewel, which motivated a USD 53bn offer by Chevron late last year. If Exxon is successful, the acquisition will be challenged.1 The oil field and politics may be behind Venezuela’s referendum and threat to annex the Essequibo region – equivalent to roughly three-quarters of Guyana’s total territory.

Mexico: The trade balance fell into a USD 4.3bn deficit in January, from a USD 4.2bn surplus in December. A narrower deficit of USD 2.4bn was expected. Exports fell from USD 49bn to USD 42bn.

Central and Eastern Europe

Hungary: The central bank cut rates by 100bps to 9.0%, as expected, as inflation continued to slow. Policymakers said that continued cuts would depend on the strength of the forint. Producer price index (PPI) inflation rose 0.3% mom in January (-6.8% yoy) from -0.7% prior (-7.2% yoy).

Poland: GDP rose 1.0% yoy (0.0% qoq) in Q4 2023, unchanged from the previous quarter.

Central Asia, Middle East, and Africa

Egypt: The parallel EGP exchange rate rallied to 41 over the weekend from 49 last week. President Abdel-Fattah El-Sisi said that some of the USD 35bn in investments pledged by the United Arab Emirates were deposited in the central bank, and that additional instalments were expected. The decline in the parallel rate increases the odds of an imminent devaluation of the EGP – perhaps before the beginning of Ramadan on 10 March – since the devaluation would be likely to lead the official currency to stabilise around EGP 40-50, which is much below the parallel FX market of a few weeks ago. A lower official rate could actually increase the purchasing power of some income groups that have been de-facto purchasing imported goods at parallel rates for two years now.

Namibia: Finance Minister Iipumbu Shiimi announced a narrower budget deficit of 3.2% GDP for the 2024/25 fiscal year, a significant improvement from the 5.1% deficit in last year’s Mid-term Budget Review. In addition, the government said it has two-thirds of the resources to repay the USD 750bn Oct 2025 Eurobond in its sinking fund. The sinking fund is a thoughtful and transparent mechanism to service large debt repayments regardless of market access concerns.

Nigeria: Nigeria raised its interest rate to 22.75% from 18.75%, 150bps more than expected. This aggressive hike showed serious intent to stem inflation and support the currency, which has lost around 70% of its value against the dollar since the hiking cycle began in May 2022. Olayemi Cardoso, the Governor of the Central Bank of Nigeria, said its Monetary Policy Committee: “Acknowledged the trade-off between the pursuit of output growth and taming inflation, but was convinced that an enduring output expansion is possible only in an environment of low and stable inflation.”

Türkiye: GDP increased 4.0% yoy (1.0% qoq) in Q4 2023 from 6.1% (0.3% qoq) prior, but 50bps more than expected. This outperformance of expectations, driven by household spending and investment, comes despite the central bank hiking repo rates from 30 to 45% during the period. This bodes well politically for the reforms. However, CPI inflation rose by 4.5% mom in February, above consensus at 3.9%, but below January’s 6.7%. The yoy rate rose by 220bps to 67.1%, 110bps above consensus, as core CPI rose by 240bps to 72,9%. The trade deficit increased to USD -6.2bn in January, as expected (USD 6.1bn prior).

South Africa: The trade balance fell into a ZAR 9.4bn deficit in January, from a ZAR 15.6bn surplus prior (ZAR -5.5bn est.).

Developed Markets

United States: New home sales rose to 661k in January from 651k prior (revised down from 664k, vs 684k est.). Mortgage applications fell 5.6% in February, from a 10.6% decline prior. The PCE price index rose by 0.4% mom in January, or 2.8% rise yoy, in line with consensus. On a three- and six-month annualised basis, core PCE data rose to 2.6% and 2.5% in January, above the Fed's 2% target, having briefly trailed it in the prior month. Core PCE, which strips out food, energy, and housing prices, is the Fed’s preferred gauge of inflation. Personal income rose 1.0% in January, from 0.3% prior, 60bps more than expected. Personal spending growth, on the other hand, fell to 0.2% mom in January from 0.7% prior, in line with consensus, but declining in real terms. Initial jobless claims rose to 215k, from 202k prior (210k est.). The ISM Manufacturing PMI declined by two points to 47.8 as prices paid were 0.5 down at 52.5m. New orders dropped three points to 49.2, and employment declined by one point to 45.9. The Michigan sentiment survey was also soft, down three points to 76.9 as inflation expectations were unchanged at 3.0% for one-year and 2.9% for five-to-ten years.

Japan: Industrial production declined by 7.5% mom in January, close to 6.8% expected, from +1.4% in December. However, inflation surprised to the upside: CPI inflation rose 2.2% yoy, from 2.6% prior, (vs 1.9% est.). Ex fresh food and energy, prices rose 3.5% from 3.7% prior, (3.3% est.). The unemployment rate was flat at 2.4%, as expected. Yields on two-year bonds rose to the highest level since 2011. The overnight indexed swaps imply 35% odds of a 10bps hike in March, cumulative 77% in April, 92% in June and 135% in July.

Europe: Preliminary CPI inflation rose to 0.6% mom in February, in line with consensus, from -0.4% mom in January, as the yoy rate declined by 20bps to 2.6%, coming in 10bps above consensus.

1. See – https://blinks.bloomberg.com/news/stories/S9J81CT0G1KW

Benchmark performance