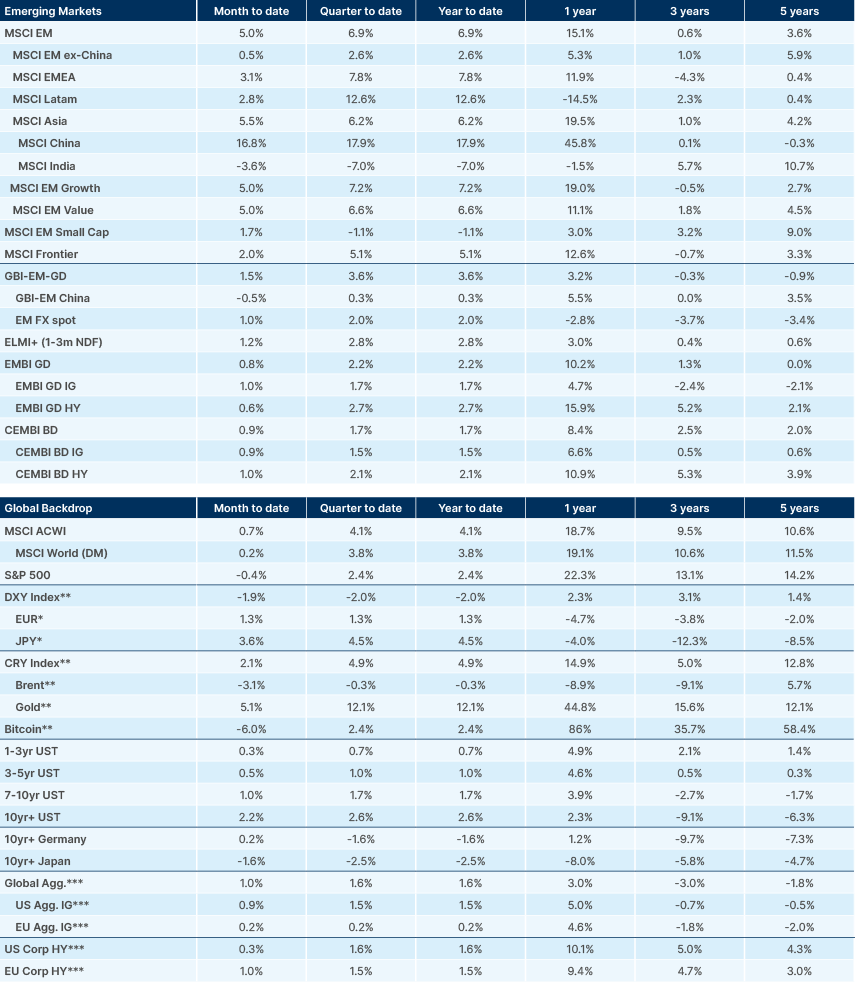

- EM stocks outperformed, led by China, but EM ex-China also outperformed.

- Centre-right and centre-left parties in Germany to form coalition but won’t reach 2/3 majority required for constitutional changes.

- Qatar and Kuwait to be removed from EMBI GD between March and April this year, with LATAM gaining most weight.

- Zelenskyy said he would be happy to leave his post, for peace or a pathway to NATO.

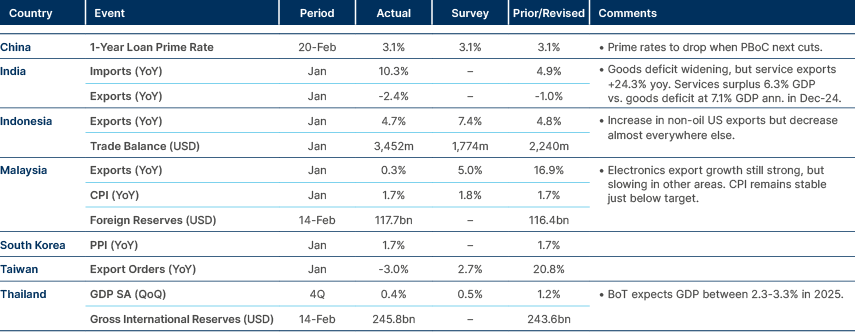

- Export orders down to negative levels in Korea and Taiwan suggests a cyclical downturn

- Argentina executive pushed for further deregulation as government strikes victory on senate.

- Jair Bolsonaro was formally accused by Brazil’s Attorney General’s Office of attempting a coup.

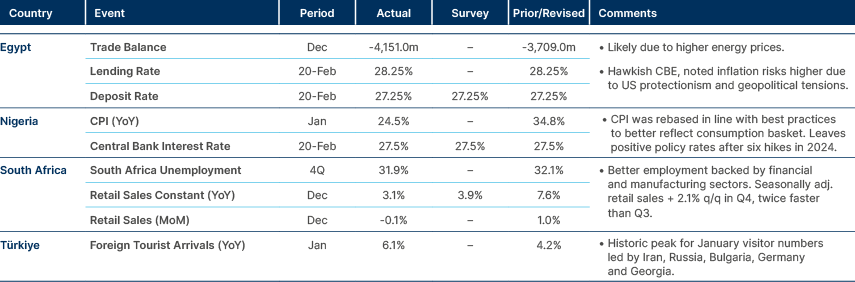

- Nigerian inflation revised downwards.

- Moody’s affirmed Egypt’s Caa1 ratings.

- South Africa postponed its budget announcement due to disagreements within its coalition.

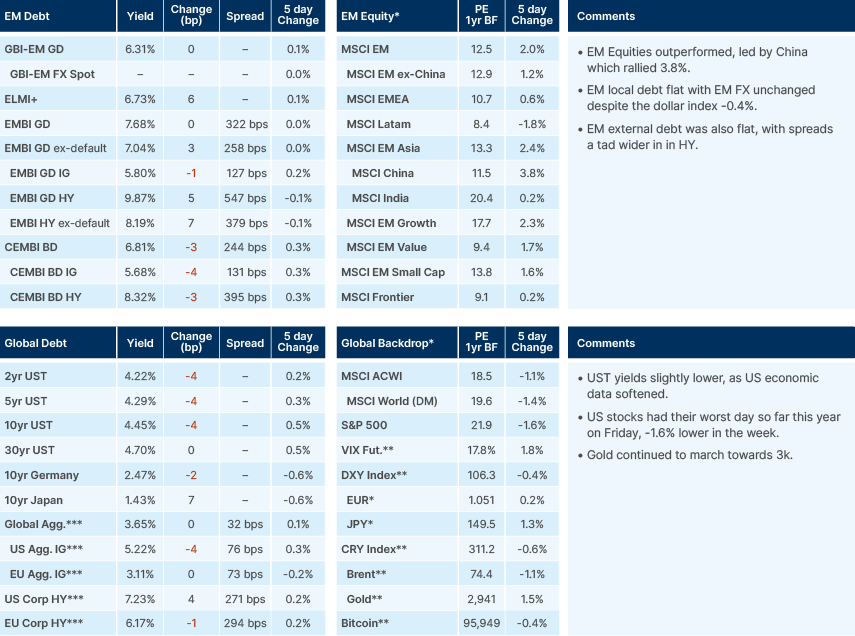

Last week performance and comments

Global Macro

The rally on Chinese stocks remains unabated with the MSCI China up 16.8% month-to-date, led by companies that are unveiling large artificial intelligence investments and solutions post Deep Seek. The Chinese outperformance allowed the MSCI EM to rise 5% month-to-date, a strong outperformance over MSCI ACWI (+0.7%) and the S&P500 (-0.4%). Interestingly, there was plenty of divergence within EM stocks, with companies benefiting from the AI transformation and delivering positive earnings (Ali Baba, Mercado Libre) outperforming, while companies delivering poor results (Nu Bank, Globant) underperformed. Despite the rally, Chinese stocks remain broadly undervalued, in our opinion, at less than 11x earnings. The stocks related to AI still trade at a fraction of the multiple of its US competitors and the domestic-oriented stocks are still far from pricing any significant recovery given the lack of fiscal stimulus, providing ample room for further upside.

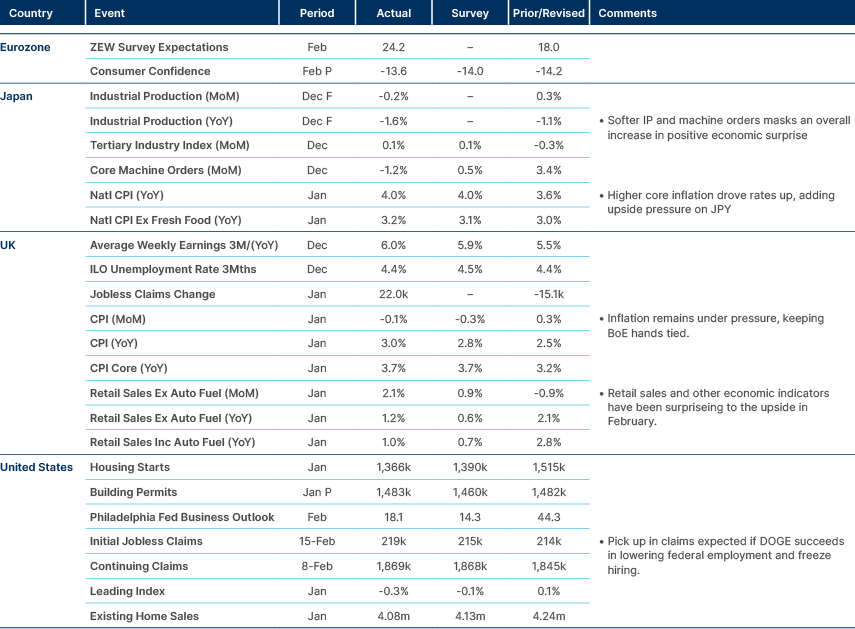

After elections on Sunday, the centre-right CDU/CSU (28.5%) and centre-left SPD (16.4%) are projected to have enough seats to form a grand coalition. The new coalition led by Friedrich Merz as chancellor, is expected to bring more stability than the outgoing government. However, the combined vote share of the two parties is at a historic low, reflecting a decline in support for traditional parties.

The far-right AfD secured 20.8%, while the Greens received 11.6% and the leftist Linke 8.8%. The far-left BSW (4.97%) and liberal FDP (4.3%) fell short of the 5% threshold needed to enter parliament. CDU/CSU, SPD, and the Greens together are just under the two-thirds majority required to make constitutional changes, which will likely limit their ability to pass major reforms. Voter turnout was 82.5%, the highest since at least 1990.

On the monetary policy front, Fed governor Christopher Waller stated that Trump’s tariffs would only have a "modest" and "non-persistent" effect on prices, suggesting they shouldn’t significantly influence the Fed's decision-making. He emphasized that, while current data does not support a policy rate cut, inflation might decline over the coming quarters, as companies often raise prices early in the year. He also stressed that decisions should be based on economic data rather than waiting for clarity on administration policies, cautioning that waiting too long to make decisions could lead to policy paralysis.

On EM index matters, Qatar and Kuwait will be removed from the EMBI GD in equal notional amounts over a six-month period beginning at the March 31st 2025, month-end rebalance and concluding at the August 29th, 2025 month-end rebalance. New issues from these markets will not be eligible for inclusion in the EMBI indices.

- Latin America will gain the most weight as a result, (c. 130bps), followed by Eastern Europe (c. 70bps) over the next 6-months.

- Gaining more than 10bps each: Saudi, Türkiye, Indonesia, China, Hungary, Bahrain, Brazil, Chile, Oman, Philippines and Poland.

- Gaining 9-10bps each: Colombia, Dom Rep, Egypt, Malaysia, Nigeria, Romania, SOAF, Uruguay, Argie, Panama, Peru.

- The IG share of the index to drop from 48% to 46%.

- The EMBI IG index drops from 22 to 20 countries. But Paraguay and Oman should join the index soon. They already hold IG ratings by one agency each.

Geopolitics

Ukraine

Trump called Zelensky a dictator and reiterated his call for wartime elections in Ukraine. Trump expressed discontent with Zelensky's refusal to sign an agreement granting the US effective control over half of Ukraine’s mineral reserves as payment for past and future aid. Elon Musk also suggested that Zelensky cannot claim to represent the Ukrainian people unless he restores press freedom and stops cancelling elections. Republicans have continually referred to the US wartime elections during World War II as a historical reference for their suitability, despite the clear difference that America hadn’t been invaded. However, Zelensky said he's "ready" to "give up" his post in exchange for peace and Kyiv being put on a pathway to becoming a member of NATO. This morning, Zelensky also said Ukraine was ready for an “all for all” prisoner swap with Russia.

Emerging Markets

Asia

Korean and Taiwan export orders soft, suggests cyclical slowdown in electronic goods.

South Korea: The Planning and Finance Committee approved tax amendments under the K-Chips Act, increasing semiconductor investment tax credits to 20% for large firms and 30% for SMEs. Research and development (R&D) tax credits were also expanded, boosting Samsung’s refunds from KRW 200bn to KRW 4tn, with the deadline extended to 2031. However, lawmakers remain divided on exempting semiconductor R&D staff from the 52-hour workweek. The ruling PPP supports it so that Korea can stay competitive with Taiwan, while the opposition DP questions its necessity. Unlike Japan and the US, South Korea has yet to introduce direct subsidies, raising concerns about its chip industry’s global standing.

Vietnam: A recent survey by the American Chamber of Commerce in Vietnam (AmCham) reveals that a significant majority of U.S. manufacturers operating in Vietnam are concerned about the potential impact of new U.S. tariff policies.

Rising tariff costs could disrupt supply chains and reduce competitiveness. Over 85% of respondents foresee a decline in trade volumes and strained long-term business relationships, with 94% predicting negative economic consequences. Employment is also at risk, with 46% of participants alluding to workforce reductions. Despite these challenges, 94% of companies, including 98% of manufacturers, still view Vietnam favourably due to its growing infrastructure, skilled labour, and strategic location.

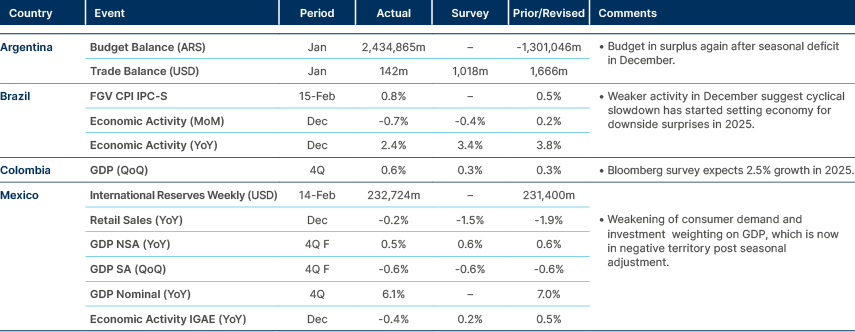

Latin America

Economic activity softening in Brazil and Mexico.

Argentina: The government recorded a primary surplus of 0.3% of GDP in January, maintaining last year’s level despite a 2.1% yoy decline in revenues, largely due to a sharp drop in export tax collection. On the expenditure side, spending rose 13.5% yoy, though from a low base.

Consensus suggests the government will continue achieving a fiscal surplus, supported by a strengthening economy. Additionally, authorities introduced Deregulation 2.0, a decree aimed at eliminating unnecessary laws and streamlining regulations. Public offices within the national administration have 30 days to identify laws for potential repeal, with approximately 4,600 active laws and 4,200 decrees currently in place.

Last week, the Argentinian Senate approved in a 43-20 score the suspension of the obligatory primary elections (PASO) before the mid-term elections in October. It highlights the ability of Milei to approve reforms despite the crypto scandal noise and is positive intuitionally as it eliminates an ambiguous universal ballot, saving costs and postponing the pre-election political paralysis.

In other news, the Central Bank changed the regulation on foreign currency lending, allowing banks to borrow externally (Eurobond or interbank) to lend Dollars to locals. The current yield on the Eurobond of large banks below 7% suggest the offshore market is well open for activity, which is likely to increase the availability of dollars, allowing the central bank to accumulate foreign exchange reserves.

Brazil: Economic activity fell 0.7% m/m in December, a sharper decline than expected, after a 0.2% rise in November. Industrial output, services, and retail all weakened, likely reflecting the impact of monetary tightening. The data leaves a poor carry for 2025.

2024 growth reached 3.8%, exceeding forecasts. The Central Bank expects inflation to ease but awaits further data. Official 2024 GDP figures will be released in March. Bolsonaro was formally accused by the Attorney General’s Office (PGR) of attempting a coup, marking his first criminal charge before the Supreme Federal Court (STF). He faces five charges, including armed criminal organization and violent abolition of democratic rule, carrying sentences of 4–12 years.

The indictment threatens his bid to overturn ineligibility for the 2026 election, accelerating the search for a right-wing successor, with SP Governor Tarcísio de Freitas as the frontrunner. Bolsonaro is expected to claim political persecution, while Congress may push for amnesty for January 8 riot convicts, though passage remains uncertain

Chile: Chile Vamos (ChV) nominee Evelyn Matthei and Republican Party (RN) candidate José Kast sparred over fiscal policy. Matthei proposed a USD 3bn budget cut this year and an additional USD 6bn if elected, citing excessive debt. Kast, trailing in polls, accused her of inaction, claiming RN pushed for USD 5bn in cuts and opposed the budget while ChV helped pass it. Matthei’s team dismissed Kast’s attack, urging him to focus on solutions. ChV is likely to avoid further conflict, needing RN’s support in a potential runoff.

The clash over who implements the larger fiscal cuts is a good preamble to the incoming political cycle in Latin America. The revolution in the Argentinian economy driven by the bold fiscal consolidation and state leaning down by Javier Milei as well as the recent efforts by the US government will resonate in Latin America where the strong dollar has been leading to weaker purchasing power whilst leftist governments led to a strong slowdown on investments vis-à-vis their potential.

Colombia: GDP grew 2.3% y/y in Q4 2024, driven by trade, transport, and services, bringing full-year growth to 1.7%. Investment saw double-digit gains, particularly in infrastructure and machinery. To address fiscal needs, the government raised taxes on fossil fuel production and online gambling, expecting to generate COP 3tn (USD 721 million), with plans to make these measures permanent through tax reform.

President Gustavo Petro's administration is again pushing to ban fracking, requesting a fast-track process in Congress after the bill failed four times. The proposal, previously approved in the Senate, seeks to prohibit fracking and unconventional hydrocarbon extraction, aligning with Colombia’s climate goals. Despite advancing to a third debate last session, the bill’s prospects remain weak due to Petro’s lack of a congressional majority, recent cabinet changes, and the failure of his tax reform. However, with the 2026 elections approaching, Petro is prioritizing this key campaign pledge despite legislative hurdles.

Dominican Republic: President Luis Abinader stated that the Dominican Republic is on track to begin oil exploration in Guyana’s Berbice offshore block. This follows a 2023 cooperation agreement between the two nations for oil exploration, refinery construction, and a petrochemical plant. The refinery decision is expected in the coming months, and a fertilizer plant feasibility study has been completed to strengthen food security. These developments aim to boost energy security and economic growth for both countries.

Mexico: The Monetary Policy Council (MPC) discussed the new phase in inflation control, noting ongoing disinflation and changed inflationary risks. The board sees conditions for further easing and is considering a 50bps cut, though it will maintain restrictive policy. One member supported the cut, citing significant disinflation, while others acknowledged inflation’s progress but noted the risks and economic slowdown. Some members, like Deputy Governor Jonathan Heath, called for caution, questioning core inflation trends. Overall, the board seems aligned on continuing the disinflation effort, but concerns remain over core inflation's resistance to the 3% target.

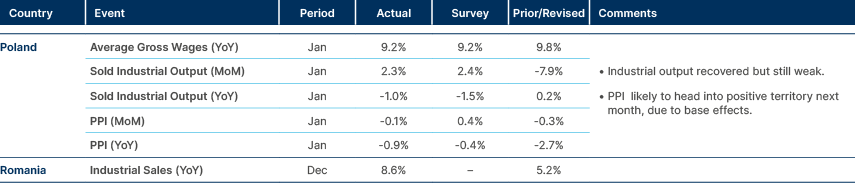

Central and Eastern Europe

Czechia: Alena Schillerova, vice president of the ANO party, stated that while defence spending could rise, 5% of GDP is unrealistic, though 3% is acceptable to meet NATO commitments. This echoes ANO leader Andrej Babis's earlier remarks, ruling out 5%. The party has been notably silent on Ukraine and European security issues, avoiding aligning with Russia’s rhetoric, likely due to political risks ahead of the 2025 elections. ANO’s focus has shifted to domestic matters, such as opposing a bill to increase retirement fund contributions and criticizing the EU Green Deal. The party appears uncertain on how to respond to recent European event.

Central Asia, Middle East, and Africa

Egypt: Moody’s affirmed Egypt’s Caa1 ratings, maintaining a positive outlook, reflecting improved debt service prospects and stronger FX buffers following March 2024 currency reform. The outlook is based on improving borrowing costs and fiscal consolidation efforts. However, Egypt's credit rating is constrained by high debt, affordability issues, and large financing needs. Moody’s projects external debt payments to peak at USD 33bn (9.5% of GDP) in FY 2025, along with an estimated current account deficit of USD 18.5bn (5.3% of GDP).

In other news, Saudi Acwa Power plans to invest USD 2.3bn in a 2GW wind farm in South Hurghada, advancing Egypt’s renewable energy goals. Meanwhile, Egypt, Cyprus, and Italy’s Eni signed a deal to export gas from Cyprus’ Cronos field to Europe via Egypt’s LNG infrastructure, supporting efforts to establish an Eastern Mediterranean gas hub.

Morocco: Morocco is preparing to issue euro-denominated bonds, preferring Euros over Dollars due to strong EU trade ties, according to Finance Minister Nadia Fettah Alaoui. The government aims to proceed after January market volatility subsides. Morocco previously sold USD 2.5bn in Eurobonds in Q1 2023, bolstering investor confidence. The treasury plans to raise MAD 60bn in external borrowing in 2024, with a third possibly coming from foreign issuances.

Nigeria: A rebased Consumer Price Index (CPI) showed inflation down to 24.5% in January from 34.8% in December, reflecting an updated consumption basket and methodology. Food inflation fell to 26.1% from 39.8%, and core inflation to 22.6% from 29.3%. This adjustment improves measurement accuracy but does not indicate an actual decline in prices. The MPC kept Nigeria’s benchmark interest rate at 27.5%, marking a pause after six rate hikes in 2024. Real interest rates have turned positive following CPI rebasing, supporting foreign FX inflows.

In other news, the government filed a lawsuit against Binance for USD 81.5bn, seeking back taxes and damages for allegedly contributing to the naira's devaluation. The lawsuit includes claims for USD 2bn in unpaid taxes from 2022 and 2023.

Saudi Arabia: Hosting the US-Russia summit in Riyadh highlighted the enlarged Saudi Arabia's geopolitical influence. The kingdom’s ties with both the US and Russia position it as a neutral venue for major negotiations. Successfully hosting the summit or mediating a peace agreement elevated Saudi Arabia's global standing, enhancing its role in international peace and security. Saudi nurtures a good relationship with its largest buyer of petroleum – China – and has re-stablished diplomatic relations with Iran. This marks a significant shift from the country's more regional focus within the last years. Saudi Arabia has recently played a key role in facilitating prisoner swaps between Russia, Ukraine, and the US.

South Africa: The Treasury introduced an early retirement package for civil servants aged 55–60, offering up to two weeks’ pay per year worked, with ZAR 11bn allocated to cut public sector costs. The government is also negotiating a revised 5.5% wage increase for 2025/26, up from the initially proposed 5.0%. South Africa's government and public sector unions reached a wage agreement that will increase civil servants' wages by 5.5% in 2025/26, with inflation-linked hikes for the following two years, capped at 6% and 4%, respectively. The deal will cost an additional ZAR 7.3bn in 2025/26 and is partially financed by a proposed VAT hike, which has been delayed due to disagreements within the government. The 2025 budget, originally scheduled for presentation, was postponed, with opposition over the VAT increase and other fiscal measures. The ruling majority ANC party has been pushing for an increase in taxes to drive fiscal consolidation, but the coalition DA party opposes any tax hikes. The delay highlights rifts within the coalition government, but further discussions are expected. The budget dispute is not enough to derail the government of national unity, in our view, and instead is likely to lead to better policies than under a single party system.

Developed Markets

Inflation upside surprises in Japan and UK.

Benchmark Performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.