DM central banks flip-flop back to a dovish stance while EM kept a hawkish course

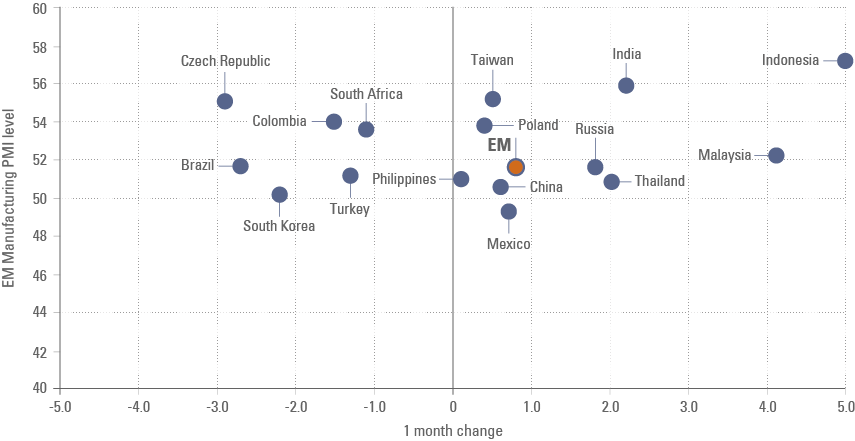

The RBA, Fed and BoE flip-flopped back to a dovish stance while the CNB and NBP hiked policy rates by a larger magnitude than expected. In contrast with DM, EM central banks are ahead of the curve in the task of controlling inflation. The Markit manufacturing PMIs rose across most EM countries and declined in DM as supply chain disruptions are still elevated mostly in DM. Angola fiscal accounts improved faster than expected. China’s trade surplus surprised to the upside as the country looks to expand its free-trade agreements.

Geopolitics

Monetary policy

Another big contrast between hawkish EM and dovish DM central bankers last week as most DM central banks switched back to a dovish stance. The Reserve Bank of Australia kept its policy rate at 0.1%, but officially removed the 0.1% cap on the April 2024 yield, as governor Lowe said it is "plausible that the cash rate may be lifted in 2023”.

The Federal Reserve (Fed) reduced the pace of asset purchases (QE) by USD 15bn per month from mid-November, and will buy USD 70bn of US treasuries and USD 35bn of mortgage-backed securities. The Fed also pre-set another USD 15bn tapering to December. Chairman Jay Powell maintained his “transitory” inflation view and said he was “prepared to adjust the pace of taper as warranted" but not looking to “surprise" markets.

The Bank of England (BoE) voted 7-2 to keep its policy rate at 0.1% and voted 6-3 to keep the pace of QE unchanged, despite the fact that it now sees inflation peaking at 5.0% in April 2022. Governor Andrew Bailey said the decision was “a very close call”, but tried to contain future hike expectations by saying: “I would caution against views on the scale of an increase that would be likely to push inflation below target in the future”. ECB Governor Christine Lagarde said it was “very unlikely” that the ECB would hike its policy rate in 2022, as she remarked, “despite the current inflation surge, the outlook for inflation over the medium term remains subdued”.

In EM in contrast, two central banks in central Europe surprised consensus with a more orthodox approach to rein in inflation expectations. The Czech National Bank (CNB) hiked its policy rate, by 1.25% to 2.75% (0.50% above consensus), for the fourth consecutive month. The CNB revised its 2022 CPI forecasts to 5.6% from 2.8%, signaling sharp rate increases in its last meeting in 2021 and the first meetings in 2022.

The National Bank of Poland (NBP) hiked its policy rate by 75bps to 1.25%, 50bps above consensus. The NBP governor pledged to do “whatever it takes” to rein in inflation as Governor Glapinski sees CPI inflation peaking above 7.0% in January 2022 and revised its full 2022 CPI forecasts to 5.1% - 6.5% from 2.5% - 4.1% yoy.

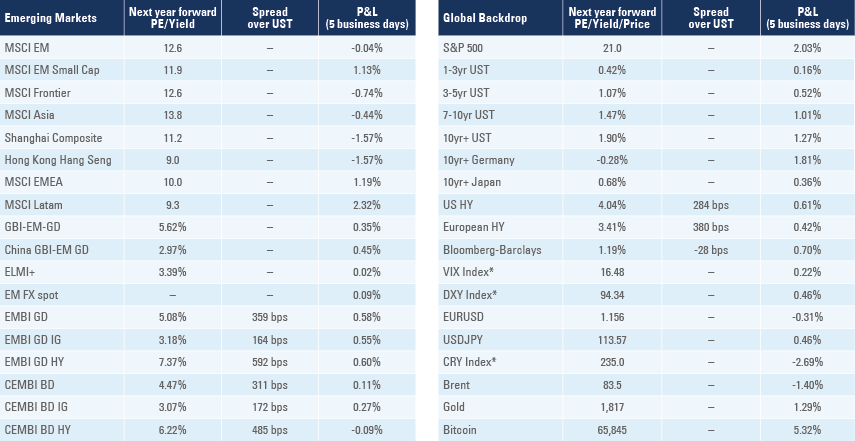

The Brazilian Central bank minutes signaled another 150bps hike in December to 9.25%. The overall yoy rate of GBI-EM GD weighted CPI inflation is now at 5.0% as the impact of higher energy prices and still elevated food prices lead to large one-off effects. However, inflation in EM is truly transitory. EM countries have implemented a much smaller fiscal stimulus and have larger output gaps than DM economies. Furthermore, in contrast with DM, EM central banks are getting ahead of the curve, moving policy rates ahead of inflation expectations for 2022, an important element to stabilise their currencies and attract capital.

Figure 1: GBI-weighted: CPI inflation, 2022 CPI median survey and policy rates1:

Purchasing Managers Index (PMI)

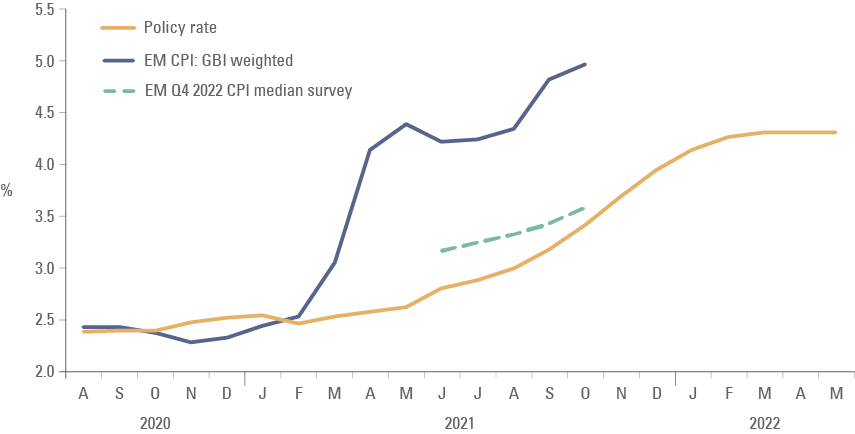

The Markit Global Manufacturing PMI Index rose 0.2 to 54.3 in October as EM increased 0.8 to 51.6 while DM declined 0.5 to 56.6 (Figure 2). EM converged to DM levels across most key sub-indices. Global new orders declined 0.2 to 53.7 with EM rising 0.8 to 52.2 while DM declined 1.4 to 54.5. EM output and employment indices also improved 0.4 to 50.7 and 0.8 to 49.9 respectively. Supply chain disruptions remained evident by another 1.7 points decline in the delivery time global sub-index to 34.8 with EM delivery times lowered 2.2 to 44.6 while DM dropped 1.2 to 24.3 – a new historical low.

Figure 2: Manufacturing PMI:

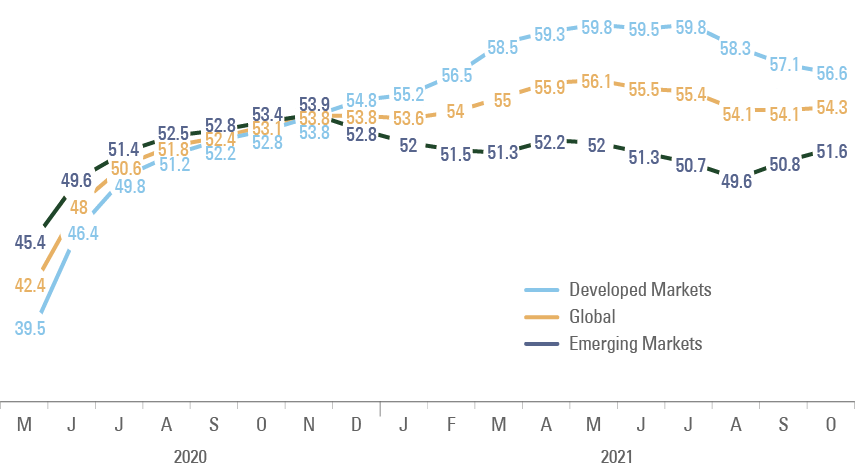

Within EM the manufacturing PMI increased by more than 2 points across five EM countries: Vietnam (+11.9 to 52.1); Thailand (+2.0 to 50.9); India (+2.2 to 55.9); Malaysia (+4.1 to 52.2); and Indonesia (+5.0 to 57.2), as per Figure 32. The EM manufacturing PMI declined by more than 2 points in three EM counties: Czech Republic (-2.9 to 55.1); Brazil (-2.7 to 51.7); and South Korea (-2.2 to 50.2). The manufacturing PMI was above the 50-level across all EM countries, except for Mexico which rose 0.7 in October to 49.3.

Figure 3: EM Manufacturing PMI: October levels and 1 month change

The global services PMI rose 1.8 to 55.6 as EM services PMI rose 0.6 to 54.2 and DM services PMI rose 2.2 to 56.1. Within EM, the services PMI rose 0.3 to 54.9 in Brazil, 0.4 to 53.8 in China, 3.2 to 58.8 in India, but declined 1.8 to 48.8 in Russia.

Emerging Markets

Angola: The Ministry of Finance forecasts the debt-to-GDP ratio will decline to 82.1% by December 2021 from 120.2% in December 2020, an impressive debt consolidation led by a large fiscal surplus, which is likely to reach 7.7% of GDP before interest payments (primary surplus) for an overall surplus of 3.0% of GDP in 2021. The 2022 budget foresees a 5.5% primary surplus and a balanced overall budget, assuming a conservative oil price estimate of USD 59.0 per barrel (from USD 67.5 average in 2021).

China: The trade surplus widened to USD 84.5bn in October from USD 66.8bn in September (consensus USD 64.0) as the yoy rate of export growth moderated 1.0% to 27.1% in October (consensus 22.8%), while import growth rose 3.0% to 20.6% yoy over the same period (consensus 26.2%). A large part of the increase in exports was due to higher goods prices. The volume of imports of commodities softened significantly with oil, iron ore, copper and soybean imports declining at a yoy rate of 11.2%, 14.2%, 33.6% and 41.2% respectively. On the other hand, coal imports jumped 96.2% yoy in October from 76.0% in September as China works to alleviate its energy crisis. Nevertheless, the vast trade surplus is unlikely to be sustainable as exports are likely to soften when the global consumption pattern normalises with higher demand for services. The weak import picture suggests the economy is likely to decelerate further in Q4 2021. China is likely to ease monetary policy at the same time its export growth decelerates, in our view. Last week Premier Li Keqiang called for cuts in taxes and fees to ease pressure on small and medium enterprises (SMEs).

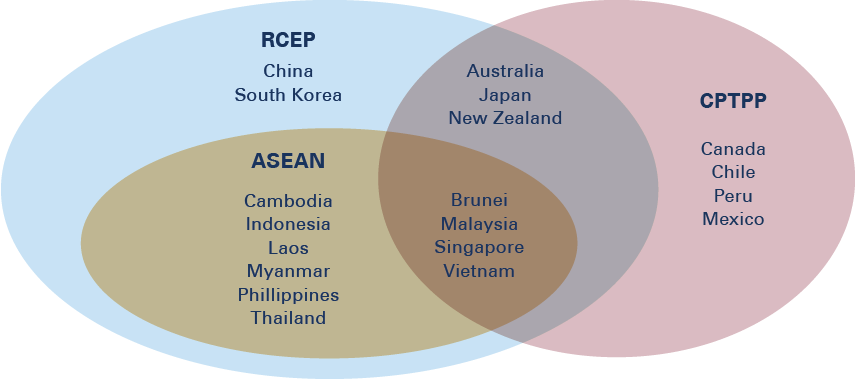

In policy news, the Ministry of Commerce said the Regional Comprehensive Economic Partnership (RCEP) agreement would come into force in January 2022. Unlike the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), which China applied on 16 September, the focus of the RCEP is on tariff reductions with no restrictions to labour, environment or government subsidies. Singapore, Thailand, Vietnam, Australia, China, Japan, New Zealand, Brunei, Cambodia and Laos signed the RCEP, whereas Korea, Indonesia, Malaysia, Myanmar and the Philippines still have to sign. Last week President Xi Jinping said China is open to negotiate industrial subsidies and state-owned enterprises to join the CPTPP:

Figure 4: Trade Agreements across Asia:

Czech Republic: The energy company CEZ announced it would raise electricity prices for households by a third, effective in early 2022, while there was no mention of gas prices. Electricity accounts for around 4.0% of the CPI basket and gas accounts for 2.0%. The outgoing government discussed a potential VAT cut on energy and asked suppliers to cap energy payments on new contracts. A similar hike in gas and electricity prices across all utility companies from January 2022 could lead to a 2.0% increase in CPI inflation.

Ethiopia: Prime Minister Abiy Ahmed declared a state of emergency to contain the advance of the rebel Tigray People’s Liberation Front (TPLF). A social media company deleted a post by PM Ahmed, a Nobel peace prizewinner, where he asks citizens to “organise and march with every weapon and power to prevent and bury the terrorist TPLF”.3

India: The government announced a cut in excise duty on petrol by 5.2% and diesel by 11.5% while some states governed by the BJP Party announced further cuts. The tax cut should have a fiscal impact of approximately 0.5% GDP (and 0.2% for the remainder of FY22) to 6.5% GDP, according to Nomura, as the fiscal deficit remains below the government’s budget. At the same time, the tax cut should lower CPI inflation by 0.14% (direct impact) to 0.30% after accounting for potential indirect impacts.

South Africa: The support for the ruling ANC party softened in local elections with the party’s share of total votes dropping to 46% from 53.9% in 2016. The centre-right DA party’s share declined from 26.9% to 21.8% while the far-left EFF rose to 10.4% from 8.2%. The lion’s share of the ANC and DA lost votes went to other parties, which took 21.7% of the total votes (from 11.0% in 2016). Turnout declined 10.9% to a record-low 47.0%. Low turnout means it is hard to extrapolate the result of local elections to the general election scheduled for 2023.

Turkey: The yoy rate of CPI inflation rose 0.3% to 19.9% in October, 0.4% below consensus, while core CPI declined 0.2% to 16.8%, 1.1% below consensus and PPI inflation rose to 46.3% yoy, 4.9% above consensus. The central bank has cut policy rates pointing to declining core CPI inflation. Two senior government officials said they were preparing fiscal support to low-income households to ease the impact of inflation.

Snippets

Brazil: The yoy of industrial production declined 3.9% in September from 3.2% yoy in August, in line with consensus.

Chile: Economic activity slowed to a yoy rate of 15.6% in September from 19.1% yoy in August, but was 3.3% above consensus and nominal wage inflation slowed 0.7% to 5.7% yoy in September.

Egypt: The Suez Canal Authority (SCA) is looking to raise transit fees by 6.0% in 2022, except for liquefied natural gas tankers and tourist cruise ships.

Indonesia: The yoy rate of GDP growth slowed to 3.5% in Q3 2021 from 7.1% in Q2 2021, 0.4% below consensus as social distancing measures affected the economy one year after the relaxation of the first lockdown in Q2 2020.

Malaysia: Bank Negara Malaysia kept its policy rate unchanged at 1.75%, in line with consensus

Mexico: The ruling Morena party postponed the debate on the electricity constitutional reform to Q2 2022. The reform would give greater power to state-owned company CFE.

Pakistan: The yoy rate of CPI inflation rose 0.2% to 9.2% in October, 0.5% above consensus.

Peru: CPI inflation in Lima rose by 0.6% to 5.8% in yoy terms in October, 0.5% above consensus.

Philippines: The yoy rate of CPI inflation dropped 0.2% to 4.6% in October, 0.3% below consensus. The trade deficit widened USD 0.5bn to USD 4.0bn in September as imports rose 0.7bn to USD 10.7bn and exports went up USD 0.2bn to USD 6.5bn. The unemployment rate rose 0.8% to 8.9%.

Romania: The yoy rate of PPI inflation rose to 19.1% in September from 15.7% yoy in August. The yoy rate of retail sales growth declined 2.9% to 8.4% in September and the unemployment rate dropped 0.2% to 5.0% over the same period

Russia: The yoy rate of CPI inflation rose to 8.1% in October, the highest level since 2016 as food prices increased by 10.1% yoy, while core CPI inflation rose 0.4% to 8.0% yoy.

South Korea: The current account surplus widened to USD 10.1bn in September from USD 7.5bn in August and FX reserves rose to USD 469bn in October from USD 464bn in September.

Taiwan: The yoy rate of CPI inflation was unchanged at 2.6% in October as core CPI dropped 0.3% to 1.4%. Both inflation indices were in line with consensus expectations.

Thailand: The yoy rate of CPI inflation rose 0.7% to 2.4% in October, 0.5% above consensus, mostly led by energy prices as core CPI was unchanged at 0.2% yoy over the same period.

Uruguay: The yoy rate of CPI inflation rose 0.5% to 7.9% in October, above the 7.0% inflation target ceiling. Food and apparel prices were the largest contributors to inflation while services inflation remained subdued.

Global backdrop

Covid-19: The number of covid-19 cases is increasing again, led by a sharp increase in cases in Europe, which increased to 325 cases per million people on 6 November, from 156 in 16 September. Cases per million in the rest of the world remained stable at much lower levels (138 in North America; 41 in South America and 21 in Asia). Romania re-imposed curfews, Poland is debating local lockdowns while Czech policymakers expressed worries about the winter. Several European countries, including Austria, Italy and Greece imposed mobility restrictions to unvaccinated individuals after cases surged to 790 cases per million. UK hospitalisations remain low as cases seem to be peaking, but the number of deaths remains elevated (3.6 per million) in the US, close to 1/3 of peak levels. China maintained its zero tolerance policy as Beijing temporarily closed several schools due to covid-19 infections.

United States (US): Economic data surprised to the upside last week. Non-farm payrolls rose 531k in October from 312k in September (revised from 194k) as private payrolls rose to 604k from 365k over the same period. The unemployment rate declined 0.2% to 4.6% and the underemployment rate declined 0.2% to 8.3% in October, while average hourly earnings was unchanged at 4.9% yoy. Initial jobless claims improved again to 269k in 30 October from 283k in the previous week, reaching similar levels to 2015-16 when the Fed started hiking its policy rates. The fast decline in claims illustrates the current “turbo-charged” economic cycle. It took 7-8 years for claims to decline to these levels after the 2008 economic crisis and only 18 months this time. The ISM manufacturing declined 0.3 to 60.8 in October, slightly above consensus. The trade deficit widened to USD 80.9bn in October, from USD 72.8bn in September, surpassing consensus.

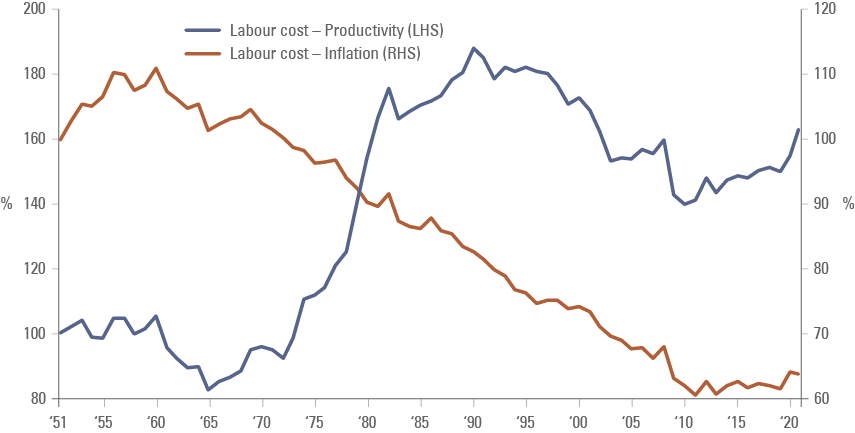

In other economic news, the Bureau of Labour statistics released quarterly data showing labour productivity declined at a 5.0% annualised rate on a qoq basis while unit labour costs rose 8.3%. The sharp rise in labour costs combined with the decline in productivity suggests US companies will have their profit margins squeezed. Indeed, a recurring theme across earnings season was the impact of higher labour costs and supply chain issues on margins. On the other hand, wages rising above inflation would be a welcome development from an inequality perspective. Figure 5 shows labour costs have underperformed inflation from 1969 to 2011 and have since remained relatively stable. It is only more recently that labour prices have started outperforming inflation. However, since 2011 wage inflation has increased at a faster pace than productivity growth. Therefore, if total factor productivity remains depressed, any real increase in wage inflation will cause tighter profit margins.

Figure 5: Labour cost minus productivity & labour cost minus inflation

In policy news, the Lower House of Congress approved a USD 1.2trn infrastructure package (USD 550bn new resources), including USD 110bn in new investment in roads and bridges; USD 73bn for power grid upgrades, USD 66bn for public transportation, USD 65bn for broadband expansion, USD 55bn for clean water and USD 39bn for transit. The Congressional Budget Office estimates the bill will add USD 256bn to the federal budget deficit over the next 10-years.

Japan: The Japanese government is considering a JPY 35trn economic stimulus, including JPY 100k cash handouts to individuals younger than 18 years old, according to Sankei – a newspaper.

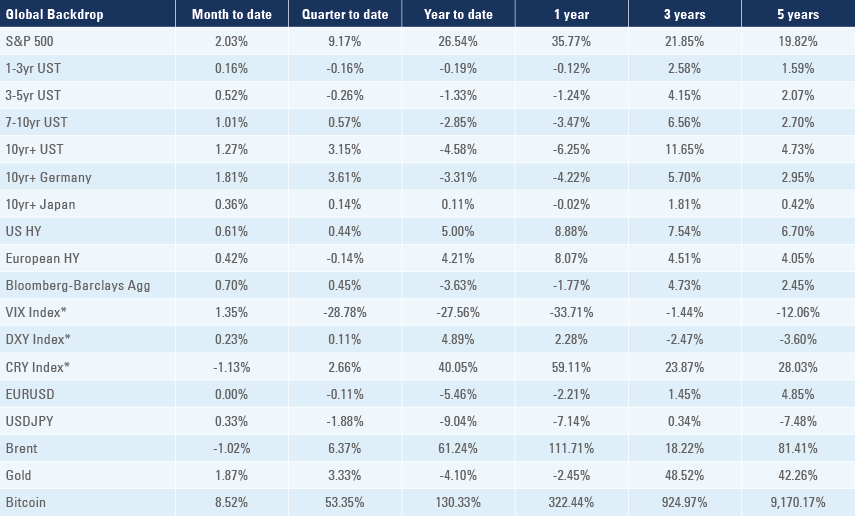

*VIX Index = Chicago Board Options Exchange SPX Volatility Index. *DXY Index = The Dollar Index. *CRY Index = Thomson Reuters / CoreCommodity CRM Commodity Index.

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI, total returns.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.

1. Ashmore’s estimates of EM policy rate path from November 2021

2. Vietnam not included in the chart.

3. See https://www.bbc.co.uk/news/world-africa-59154984