The Israel-Hamas conflict remained the dominant theme in global macro. No major surprises from the IMF meetings in Marrakesh, where countries presented their fiscal and structural reform and several frontier countries worked on debt restructuring negotiations. In Poland, election exit polls suggested the pro-European Union opposition was ahead of the ruling party, but the road ahead is tortuous. Ecuador elected young businessman Daniel Noboa to finish President Lasso’s current term (March 2025). The Argentine Peso depreciated again last week as economic distortions mounted one week before the 22 October presidential elections. China’s economic data was mixed, and India had lower inflation and better activity than expected. Malaysia announced important fiscal consolidation in its 2024 budget.

Global Macro & Geopolitics

Seasonally, October and Q4 are positive periods in our view for risk assets such as equities, with some claiming that the technical backdrop favours equity markets going higher from here. US Federal Reserve (Fed) speakers downplaying the odds of a final hike in 2023 brought yields at the long end of the curve sharply lower, which may explain why stocks were able to reverse a shallow sell-off following the hotter than expected non-farm payrolls report on 06 October, as well as post-Hamas terrorist attacks on Israel over the previous weekend.

The main known risk in the outlook is for the Israel-Hamas conflict to broaden, with Lebanon, Syria or even Iran directly fighting Israel. This scenario would lead to significant energy price volatility at a stage of the economic cycle where monetary policy has tightened significantly, growth has been declining, and inflation remains stubbornly high. In fact, volatility increased last Friday after reports that Israel gave 24 hours for North Gaza inhabitants to move South. Brent crude rose 5.5% and both US Treasury (UST) yields and stocks declined in classic risk-off mode last Friday. It followed a day when UST yields increased due to poor demand of 30-year US government bonds, leading stocks lower. Volatile government bonds and unhinged correlations with risk assets are concerning developments to market participants trying to calibrate their overall portfolio risk. Gold rallied 3.3% last Friday but has sold off 6.48% since the yearly peak in May.

The instability of the political situation in the Middle East is notable. Israel, Egypt and Iran have been struggling to stabilise their societies due to different reasons. Lebanon and Syria remain dysfunctional territories. The Hamas move shows that when regimes face existential treats, they may ignore economic considerations and act on their own strategic, geopolitical, or even selfish interest. In the meantime, the United States still does not have a leader on its own Congress, marking it hard to approve support measures to both Ukraine and Israel. A dysfunctional Washington in itself is bad news for geopolitical stability as it could lead to bolder moves from non-aligned countries.

There was intense diplomatic activity over the weekend, including the first call between Saudi Arabia and Iran. US Secretary of State Antony Blinken is going to Israel for the second time today after meeting Crown Prince Mohammed bin Salman Al Saud in Riyadh, and the Palestinian Authority Mahmoud Abbas in Amman, Jordan. Stops in Bahrain, the United Arab Emirates and Egypt also took place this weekend.1 There are reports that US President Joe Biden is considering visiting Israel, but that seems a risky move at this stage, considering the likelihood of an intense escalation of the conflict in Gaza.

This morning, the Israeli Army said more than 600,000 Gazans moved South and Israeli jet fighters struck Hezbollah infrastructure in Lebanon. The Gaza death toll rose to 2,300 as public opinion quickly turned pro-Palestine in most European countries. Several pro-Palestine protests took place across the world, with violence witnessed in Sweden, France, Italy, and other European Union (EU) countries. In North Africa, Moroccans took to the streets to demand it cut ties with Israel, which were restored in 2020.

On the positive side, Israel’s Energy Minister agreed to turn the water supply in South Gaza back on, while Secretary Blinken is negotiating the opening of the Rafah border between Egypt’s Sinai peninsula and Israel. The Telegraph reported Egypt is considering a deal to host up to 100,000 Palestinians displaced from the Gaza Strip in exchange for US debt relief, albeit the source is not clear.2

Last week the International Monetary Fund (IMF) hosted its semi-annual World Economic Outlook in Marrakech. It forecasts global GDP growth to slow to 3.0% in 2023 and 2.9% in 2024, from 3.5% in 2022, significantly below the 2000-2019 average of 3.8%. Developed Markets (DM) GDP growth will moderate from 2.6% in 2022 to 1.5% in 2023, and 1.4% in 2024, whereas Emerging Markets (EM) have a more resilient growth profile (4.1%, 4.0%, and 4.0%) over the same period. The IMF forecasts global inflation to decline from 8.7% in 2022 to 6.9% in 2023 and 5.8% in 2024.

Geopolitical events dominated discussions in the event. Egypt was reported to negotiate an increase of its existing programme from USD 3bn to more than USD 5bn. Zambia, Ghana and Sri Lanka reported progress in their debt restructuring exercises, with Zambia securing a Memorandum of Understanding with the Official Creditor Committee, which followed a separate agreement with China and Paris Club members last June.3 Türkiye remained a reforming story, even if most acknowledged it has a weak macro foundation in the shape of negative net foreign exchange (FX) reserves and challenging inflation dynamics. Angola clarified its weak FX reserve position was due to the replenishing of escrow accounts that support debt service with China. Angolan authorities are reportedly aiming to set a low oil price in the budget (in the USD 60/barrel area) and use any surplus from the budget to accumulate savings for any eventuality. Kenyan authorities said that FX reserves will be largely unchanged after repaying the USD 2bn on Eurobonds expiring in June 2024. This bond was one of the first issuances from sub-Saharan Africa, and the symbolism of its repayments from reserves (rather than issuing new debt) would be important, in our view.

EM Asia

China: Economic data was mixed last week. The year on year (yoy) rate of consumer price index (CPI) inflation declined by 10 basis points (bps) to 0.0% yoy in September, 20 bps below expectations, while producer price index (PPI) inflation increased by 50bps to -2.5% in September, remaining in deflationary levels and 20bps below consensus. The trade surplus rose to USD 77.7bn in September from USD 68.2bn in August, as exports fell 6.2% yoy in September, up from a decline of 8.8% yoy in August, 180bps above consensus. Total aggregate financing rose to RMB 4.1trn in September from RMB 3.1trn in August, significantly above consensus, led by local government issuance. This morning the People’s Bank of China (PBoC) kept its one-year medium-0term lending facility unchanged at 2.5% but increased its volume to RMB 789bn from RMB 591bn prior and consensus. Last Tuesday, Bloomberg reported China is considering a RMB 1trn (0.8% of GDP) fiscal stimulus focused on infrastructure spending such as water conservancy projects. For comparison, in 2008 China announced a RMB 4trn stimulus package, equivalent to 12.5% of GDP, of which RMB 1.2trn was in central government funding and the remainder in local government and bank loans. This time, local governments will struggle to invest, and banks are healing from the property crisis, so any stimulus is likely to be orders of magnitude smaller (no ‘bazooka’). Nevertheless, a fiscal stimulus announcement would be welcome as it lowers the likelihood of a hard landing amid the economic re-balancing away from levered property development towards more sustainable growth. What China needs are measures and steps to boost private sector confidence, investment, and employment.

In geopolitical news, the Biden administration is expected to announce exports restrictions to artificial intelligence chips this week, while Foreign Minister Wang Yi travels to Washington, potentially to prepare for a possible Biden-Xi meeting.

India: The yoy rate of CPI inflation declined by 180bps to 5.0% yoy in September, 40bps below consensus, mostly due to a moderation in vegetable prices. Core inflation declined by 40bps to 4.5% led by lower healthcare, education and household goods and services. Industrial production increased by a yoy rate of 10.3% in August, from 6.0% in July, 120bps above consensus. A drier than average period in August boosted mining (+12.3% yoy), electricity consumption (+15.3% yoy), and infrastructure goods (+14.9% yoy).

Indonesia: The trade surplus rose to USD 3.4bn in September, significantly above consensus at 2.3bn, mostly due to lower imports. In political news, a decision by the constitutional court allowed individuals aged under 40 to be Vice-President candidates, increasing speculation that President Jokowi’s eldest son Gibran Rakabuming Raka, the Mayor of Jokowi’s hometown Solo, will be on the ticket with Defence Minister Prabowo Subianto. The speculations highlight the tensions between Jokowi and the ruling Indonesian Democratic Party of Struggle (PDI-P) which nominated Ganjar Pranowo for the presidential race taking place on 14 February 2024. Both Prabowo and Ganjar are expected to keep the legacy policy of Jokowi, but the election process and results can have an impact on the country’s future political stability, in our view.

Malaysia: Prime Minister Anwar Ibrahim announced the government’s plans to reduce its budget deficit in 2024 via a series of spending cuts, new taxes, and reduced debt payments. The new budget would lower spending to MYR 393.8bn, from a revised MYR 397.1bn in the current year. This decreases the shortfall to 4.3% from 5.0% this year. In addition to the absence of debt obligations related to the state fund 1MDB, the government will also reduce levels of spending on subsidies and social assistance. This will see a decrease of around MYR 11.5 to a total of MYR 52.8bn, moving towards a more targeted approach for assistance, rather than the current blanket subsidies, which should be positive for productivity and GDP growth. The lower budget deficit will support local yields as gross and net issuance should fall in the remainder of 2023 as the government has raised 87% and 84% of the respective targets according to ANZ Bank. In economic news, industrial production fell 0.3% yoy in August, down from an increase of 0.7% in July, beating a consensus of -2.0% yoy.

South Korea: The unemployment rate increased to 2.6% in September, up from 2.4% in August, in line with consensus.

Taiwan: The trade balance increased in September to USD 10.32bn, from USD 8.59bn in August, beating a consensus figure of USD 8.35bn.

Thailand: Foreign reserves decreased as of 06 October to USD 210.5bn, down from USD 211.8bn as of 29 September.

Latin America

Argentina: Javier Milei’s success at Argentina’s primary PASO elections ahead of the first round of presidential elections on 22 October was a clear shock to political and economic stability across the country. Milei has reinforced his plans to dollarise the Argentine economy and close the central bank stating central banks are distinguishable as “bad ones, like the Federal Reserve”, “very bad ones, like those in Latin America” and “horribly bad like the Central Bank of the Argentine Republic (BCRA)”. Since the PASO, Milei has named Emilio Ocampo, a reputable senior economist who defends dollarisation, as the “last” BCRA Governor. The ‘Milei-effect’ ahead of the election is one factor to describe the large depreciation in the local currency. Since the PASO, the official exchange rate has remained at USD/ARS 350, the parallel rate closed at 963 last Friday, nearing 1k during the week.

However, the main culprit for de-anchoring the ARS and inflation over the past few months has been the exacerbation of the budget deficit by Economic Minister and presidential candidate, Sergio Massa. CPI inflation increased 12.7% month on month (mom) in September, up from 12.4% mom in August, 120bps above consensus. Last week, Barclays revised the primary deficit by 50bps to 2.5% of GDP, with the measures overall costing the economy around 1.0% of GDP.

Against this backdrop, volatility will likely continue to rise ahead of the election as economic decisions continue to surprise the market, and dollarisation becomes increasingly likely. Ocampo claims there is USD 200bn “stashed” in bank safe deposits or “at home under the mattress”. Hypothetically, this represents 50% of Argentina’s GDP (USD 480bn in 2021) and 10% of all USD bills and coins in circulation (USD 2.3trn), according to the US Treasury. However, despite the polarisation of the economic landscape, the three main electoral candidates all agree on monetary policy stabilisation by implementing a large and frontloaded fiscal consolidation to lower Argentina’s risk premium and curb currency outflow.

Juntos por el Cambio candidate Patricia Bullrich announced a deal with her previous adversary within the party, Horatio Lareta, to serve as her Chief of Staff. Political analysts expect to see approximately half of the Cambiemos Party, and even some of the Peronist members, to support Milei if he wins, which should support governability in the short term.

Brazil: The yoy rate of CPI inflation increased by 60bps to 5.2% yoy in September, slightly below consensus.

Chile: Copper exports increased to USD 3.9bn in September, from USD3.7bn in August.

Colombia: Manufacturing production decreased 8.6% yoy in August, down from a decrease of 7.2% yoy in July, below estimates of a decrease of 5.7% yoy. Industrial production decreased 4.6% yoy, down from a decrease of 3.6% yoy in July, below estimates of a decrease of 1.4% yoy. Retail sales decreased 10.0% yoy in August, down from a decrease of 8.2% yoy in July, below estimates of a decrease of 8.0% yoy.

Ecuador: The 35-year-old businessman Daniel Noboa won the runoff to the presidential elections with 52.0% of the votes against 48.0% of Correista candidate Luisa Gonzáles, as suggested by last week’s polls. Noboa has the mandate of completing President’s Lasso’s term through to 24 May 2025 (Noboa cannot be impeached until the end of the term), too short a period of time for any ambitious agendas. It also doesn’t help that Noboa’s party has only around 10% of the seats in parliament, albeit the non-Correista parties now represents more than 50% of the parliament, giving room for some policy implementation. The main challenges are to improve the security situation to allow for a recovery in consumer and business sentiment and an economic rebound. Despite good intentions from former presidents Lenin Moreno and Guillermo Lasso, Ecuador has not fully recovered from a large increase in indebtedness during Rafael Correa’s term, which forced the country to restructure its debt and enter an IMF programme during Covid-19. FX reserves declined to USD 4.6bn in July 2023 from USD 7.0bn in August 2022, albeit still significantly above the USD 0.8bn levels in February 2020. The July 2035 bond traded at USD 36.5c from USD 71c in February 2022 as declining FX reserves represent a big challenge for a fully dollarised economy.

Mexico: The yoy rate of CPI inflation declined by 10bps to 4.5% in September, in line with consensus. Core CPI inflation decline by 30bps to 5.8% yoy, in line with expected. Industrial production (NSA) increased 5.2% yoy in August, up from an increase of 4.8% in July, 70bps above consensus.

Venezuela: Reports suggest the US and Venezuela are close to an agreement that could see limited sanctions relief if President Nicolás Maduro commits to running fairer democratic elections. In return, the US would potentially lift some oil and banking sanctions, such as current penalties on the central bank and the state-owned development bank, potentially recovering c. USD 3.0bn in European accounts.

Central and Eastern Europe

Czechia: Industrial output (NSA) decreased by 1.7% yoy in August, up from the decrease in July of 2.9%. CPI inflation increased by 6.9% yoy in September, down from an increase of 8.5% yoy in August, 60bps below expectations.

Hungary: The trade balance increased to EUR 708m in August, an increase from EUR 559m in July, beating a consensus figure of EUR 400m. CPI inflation increased by 12.2% yoy in September, down from an increase of 16.4% yoy in August, 20bps below expectations.

Poland: The exit polls following Polish general elections estimates the three main opposition parties (Civic Coalition, Third Way, and the Left) won 248 seats combined, 17 above the absolute majority of 231 seats, despite the PiS ruling party receiving c. 40% of the votes. This would be a big surprise, if confirmed, as most polls gave a 5-10% margin to the government, making a pro-EU parliament the base-case in Poland. Turnout was very large at 73%, compared to estimates of 55%-60%, which may explain the surprise. At the time of writing, with 58.4% of the votes counted, the tally suggests the exit polls are broadly correct, giving the opposition most seats in the parliament. The PLN jumped 1.5% this morning as a pro-EU government would lower political risks and facilitate access to large European funds. Poland is eligible for EUR 23.8bn in grants and EUR 11.5bn in loans. A reform of the Supreme Court reform was committed to access the Recovery and Resilience Facility (RRF) funds which has been stuck at the Constitutional Tribunal for months. The government had said it would apply for the first tranche of RRF funds (expected to be around EUR 4bn) once the Supreme Court reform is approved, but the reform remained uncertain before the elections. The new parliament will be formed on 14 November, but President Andrzej Duda from the PiS Party is likely to delay government formation, by nominating his own party to form a government. Eurasia estimates a first vote of confidence by 12 December and a second by 26December, with a potential third attempt to form a government by 23 January. The President also has powers to veto legislative measures, except for the budget, which would complicate any reforms until presidential elections in 2025.

In economic news, CPI inflation increased by 8.2% yoy in September, down from an increase of 10.1% yoy in August. The current account balance decreased to EUR -202m in August, down from EUR -62m in July (which was revised down from EUR +566m), below a consensus figure of EUR +899m.

Romania: Final GDP increased 1.0% in Q2, down from an increase of 2.4% yoy in Q1, 10bps below the consensus. CPI inflation increased 8.83% yoy in September, down from an increase of 9.43% yoy in September, but 13bps above consensus. Industrial output decreased 5.6% yoy in August, down from a revised decrease of 5.2% in July.

Russia: The preliminary current account balance for Q3 increased to USD 16600m from USD 9562m in Q2, beating a consensus of USD 8555m. CPI inflation increased 6.00% yoy in September, up from an increase of 5.15% of August, 10bps above expectations.

Central Asia, Middle East, and Africa:

Egypt: Bloomberg reported that “people familiar with the matter” said Egypt is negotiating an increase with the IMF on its rescue plan to over USD 5bn from USD 3bn pledged last year. Egypt is the IMF’s second-biggest borrower after Argentina and faces financing needs estimated by Morgan Stanley at USD 24bn in the fiscal year through June 2024 — including billions in repayments to the fund. In economic news, urban CPI inflation increased by 38.0% yoy in September, up from an increase of 37.4% yoy in July.

South Africa: Manufacturing production increased (NSA) increased 1.6% in August, down from an increase of 2.2% in July, 70bps below consensus.

Türkiye: Industrial production increased 3.1% yoy in August, below an increase of 7.6% in July, 190bps below consensus. The current account balance improved in August to USD -0.62bn from USD -5.53bn in July, below a consensus of USD -0.55bn.

Developed Markets

United States: House Republicans started their search for a new Speaker, following the removal of Kevin McCarthy prompted by the vote on postponing the government shut down.4 Earlier in the week, Republicans nominated Steve Scalise, Representative for Louisiana, as the new speaker – beating Jim Jordan by a vote of 113-99. Despite this, Scalise withdrew his bid following internal closed-door meetings and Jim Jordan was nominated instead, illustrating the deep-rooted divisions in the Republican Party.

Recent communications from the Fed suggested that the market’s reaction to the ‘higher-for-longer’ sentiment conveyed by many DM central banks (namely the material increase in UST yields), have raised the cost of borrowing to a sufficient degree that it has decreased the need for further rate hikes. JP Morgan highlighted that although there is a lag for higher debt servicing costs to filter through to the debt service ratio (DSR), the recent pace of the increase in cost of borrowing lowers the demand for credit without an additional increase in interest rates by the Federal Open Market Committee (FOMC).

The higher duration nature of US private sector debt when compared to the likes of Australia, Canada, and Norway5 means the recent tightening of financial conditions will take longer to pass through to the financing costs of household debt, but will nevertheless gradually impact household balance sheets over time – something the FOMC is increasingly aware of.

In economic news, headline inflation was slightly above consensus, jobless claims were higher than expected and economic sentiment measured by the University of Michigan deteriorated, while inflation expectations increased on the same survey:

- PPI final demand increased 2.2% yoy in September, up from a revised increase of 2.0%, 60bps above consensus.

- The yoy rate of CPI inflation was unchanged at 3.7% yoy in September, 10bps above consensus, while core CPI inflation declined by 20bps to 4.1% yoy in September, in line with consensus.

- Initial jobless claims were unchanged at 209k on the week ending 7 October, in line with consensus. Continuing claims rose to 1.7m in the previous week, up by 44k in three weeks.

- Preliminary University of Michigan Sentiment for October decreased to 63.0 from 68.1 in September, below a consensus figure of 67.0.

Eurozone: Industrial production decreased 5.1% yoy in August, down from -2.2% in July and 160bps below consensus.

United Kingdom: Industrial production increased 1.3% yoy in August, up from a revised increase of 1.0% yoy in July, but 40bps below consensus. Manufacturing production increased 2.8% yoy in August, down from a revised increase of 3.1% yoy in July, 70bps below consensus.

Japan: The Balance of Payment Current Account Balance fell to JPY 2279.7bn in August, from JPY 2771.7bn in July, below a consensus of JPY 2972bn. PPI inflation increased 2.0% yoy in September, down from an increase of 3.3% yoy in August, 40bps below expectations. Core machine orders fell 7.7% in August, up from a decrease of 13.0% in July, but 100bps below consensus.

The authors thanks the contributions from Alessandra David.

1. See – https://www.state.gov/secretary-blinkens-travel-to-israel-jordan-qatar-saudi-arabia-the-united-arab-emirates-and-egypt/

2. See – https://www.telegraph.co.uk/world-news/2023/10/15/egypt-deal-palestinians-us-debt-relief-israel-gaza-attacks/

3. See – https://www.reuters.com/world/africa/zambia-bilateral-creditors-agreed-debt-rework-memorandum-understanding-finance-2023-10-14/

4. See – https://www.ashmoregroup.com/insights/hamas-strikes-israel

5. See – https://markets.jpmorgan.com/#research.publication_page&publicationId=163433

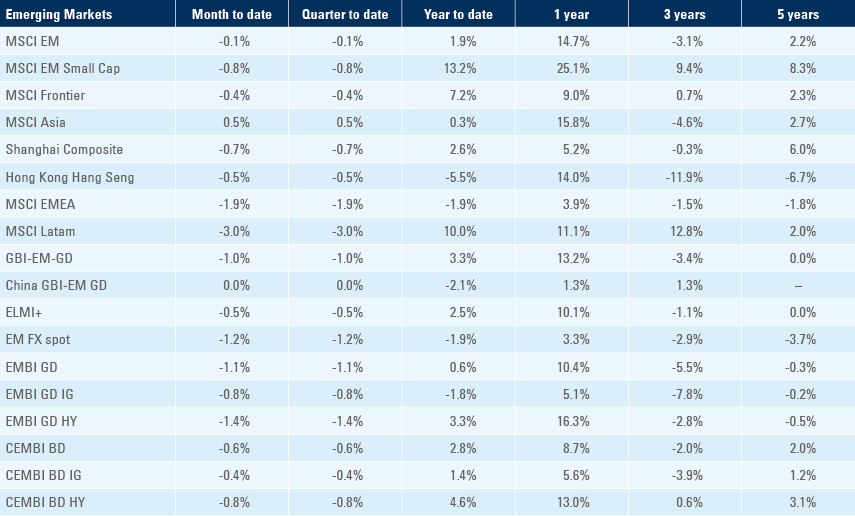

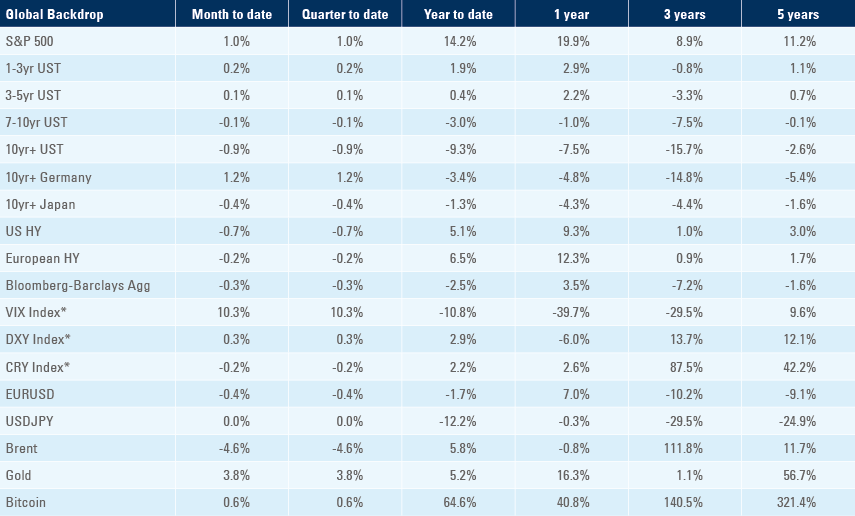

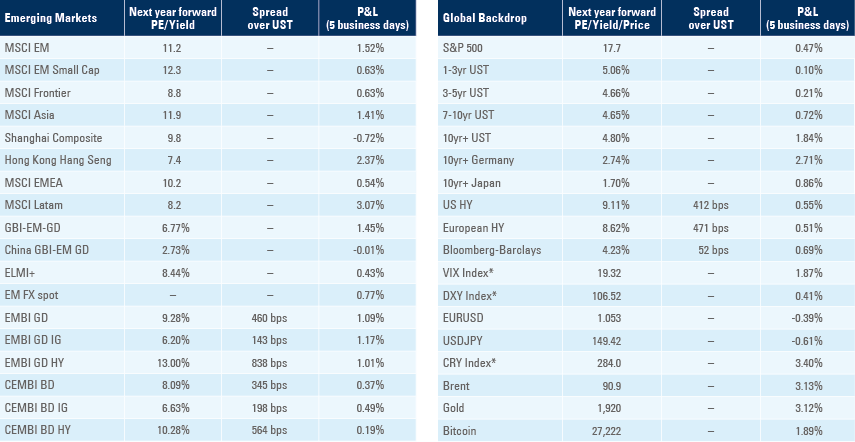

Benchmark performance