Attending the International Monetary Fund (IMF) World Economic Outlook Forum is always a delight. Investors spend time probing key developed market (DM) and emerging market (EM) policymakers about their economies and contrasting their views with those of the IMF, ratings agencies, and other investors. Overall, we came back feeling the global macro environment remains favourable towards risk assets, in particular EM and frontier markets (FM), where reform processes continue.

The ‘debasement’ narrative is everywhere but has extended far beyond current global macro reality in our view. While concerns about financial conditions being too loose are valid, US rates have been trading well, and additional credit risks do not really add-up to a full debasement scenario such as we saw in 2020-2021.

The capex cycles in global artificial intelligence (AI) and other manufacturing sectors in North America should keep earnings and global equities supported, while insurance cuts from the Federal Reserve (Fed), due to a soft labour market, are keeping ‘animal spirits’ intact. Concerns about US equity market overexuberance contrast with undemanding valuations across EM equities, local currency markets, and FM debt. EM USD debt has selective pockets of opportunities despite tight credit spreads, in our view.

The offside debasement narrative

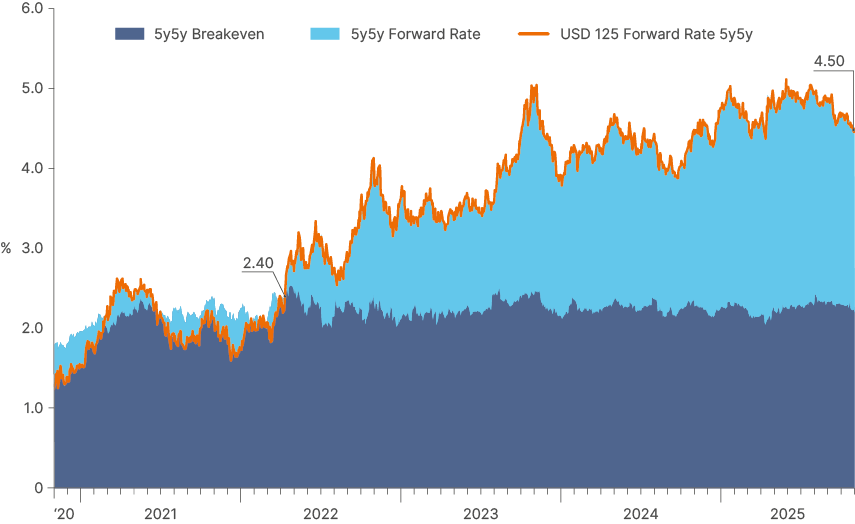

Our sense from the meetings was that most investors remain focused on the ‘debasement’ narrative. This is the idea that DM policymakers will not meaningfully rein-in loose fiscal policy and will keep monetary policy accommodative to contain debt-servicing costs. This would effectively inflate debt away over time, and the value of fiat money along with it. The historical parallel usually cited is the 1940s–1970s, when nominal rates were held below inflation for extended periods. In our view, this narrative is inconsistent with the fact that longer-term inflation expectations have remained broadly stable this year, even in the US where consumer price index (CPI) inflation has risen since April due to tariff effects. The real interest rate on US 5y5y inflation-linked bonds declined from about 2.7% in mid-January to around 2.3% now, with 5y5y inflation breakevens - a gauge for long-term inflation expectations - declining from 2.4% to 2.2%.

In a broad debasement scenario, inflation break evens should be rising as they did during 2020-2022. The fact that they are not likely reflects expectations of rate cuts, and policy measures to support long-dated bonds, such as reduced issuance of longer-dated bonds and the end of the Fed’s quantitative tightening (QT). It was the recent decline in US real yields, not debasement, that underpinned equity and precious metal gains, in our view.

Fig 1: 5y5y US Treasuries, real rates, and inflation break-even

Another factor underpinning declining yields, perhaps not talked about enough, is that US tariff revenues are leading to a modest but notable fiscal consolidation this year. Deficits improved from 7.2% of GDP in January to 5.8% of GDP in September, according to Bloomberg. The fiscal deficit will also be on a declining path across other G7 countries, including the UK, France, Italy, and Japan, according to the IMF. The measures are far from enough, but they are a step away from debasement. That being said, we do not discount the relevance of monetary debasement as both a risk and investment theme and acknowledge that concerns over fiscal sustainability and debasement are leading long-end bond yields higher in several DM countries even as nominal and real yields in the US have fallen.

Private credit

The cracks in the private credit market that are beginning to form reflect the late monetary policy rate cycle. Tariffs and heightened uncertainty around trade policy since this time last year has also increased stress, particularly among smaller companies.

While some high-profile defaults have raised investors’ concern, the risk of serious contagion from private credit to credit spreads more broadly and the banking sector (the primary fear) remains low. US private credit assets are estimated to stand at c. USD 1.4trn according to the Bank for International Settlements (2025), less than 10% of the overall US corporate debt market. The Fed estimates that even a full drawdown of credit lines to private credit vehicles would impact large banks’ capital by only about 2% of CET1.1Exposure is therefore limited, at a time where US banks are generally well capitalised. And if further cracks do appear in credit, and contagion risks rise, this will likely prompt action from the Fed. The markets’ pricing of the ‘Fed put’ partially explains the downside momentum in US Treasury yields in recent weeks.

Lower yields will have a positive impact on fiscal policies, both in the US and elsewhere, as interest payments have been a big factor in the recent DM fiscal malaise.

The capex cycle

The tax incentives for research and development (R&D) and manufacturing investment included in the ‘One Big Beautiful Bill Act’ (OBBBA) suggest the AI-led capex cycle can keep running independent of the ‘normal’ business cycle.

Under the OBBBA, the 100% bonus depreciation for eligible property after 19 January 2025 incentivises firms to accelerate acquisitions and capital commitments. A visible uptick in investment is expected through late 2025 into 2026, implying a deeper capex rollout in 2026–27. The AI capex boom is clearly a structural development of enormous scale. Citi now projects AI infrastructure investment exceeding USD 490bn by 2026 and USD 2.8trn by 2029.2 Investment at these levels will be supportive for equities in the US and beyond, in our view. And with declining oil and rental prices easing inflationary pressures, the probability of a non-recessionary easing cycle amid disinflation has increased. It is therefore hard not to be bullish global equities, despite valuation concerns in the US. Investors looking for attractively valued exposure to AI in EM Asia and diversification in EM ex-China can expect to benefit in our view.

Gold and geopolitics

This would not be a bullish scenario for gold, which traded 30% above its 200-day moving average before the 9% correction last week. It has been at this level (30% above 200-day moving average) for only 1% of its trading days since the 1970s, mostly in 1979-1980, when annualised inflation was close to 20%. Geopolitical tensions are a key factor driving higher demand for gold in portfolios, although current conflicts are de-escalating. The Gaza ceasefire, talks of Hezbollah disarmament, Syria stabilising, and Iran laying low, all point to temperatures in the Middle East cooling further. Talk of a ceasefire in Ukraine has been gaining momentum. Last, the recent purges of the leadership of the People’s Liberation Army in China suggest lower odds of any sudden move in the Taiwan Strait in the foreseeable future.

Conclusion

An environment of low interest rates with neither recession nor surging inflation is positive for EM and FM assets. In FM, reforms across countries such as Nigeria, Egypt, and Ghana are still rolling, supporting further economic growth and macro stabilisation.

In EM, there are positive signs of policy adjustment in Romania and Panama, both countries with significant fiscal imbalances. Investors expect a similar post-election consolidation in Colombia and Brazil.

In terms of local bonds, EM and FM valuations remain attractive, offering 1 year ex-ante real rates of 2.5% and 4.5% respectively. With US rates and the USD on a downwards trend, the potential for carry, duration and FX returns from local bonds will continue to attract investor demand.

Highlights from the meetings

Macro soundbites

- Global GDP growth better than feared. Ongoing resilience in DM and EM despite tariffs.

- US growth supported by capex, which has more legs due to OBBBA incentives.

- The Germany fiscal bazooka is expected to lift GDP growth, but the EU needs to accelerate capital markets, and defence integration to boost productivity.

- China economy has been supported by piecemeal fiscal measures. Housing market malaise remains as houses not marked-to-market.

- EM ex-China credit rating upgrade cycle stalled. Several countries face downgrade risks. More upgrades likely at the low end of ratings, as reform momentum remains.

- Commodities: Oil has further downside, but has a floor of around USD 50 (shale). Gold has more upside on no additional supply and ongoing demand from investors.

DM snippets

- The US economic team presented a somewhat coherent plan, focused on consolidating the fiscal deficit by spurring private sector-led GDP growth and scaling back the size of government.

- Divergence among Fed policymakers may increase towards year-end.

- Bank of Japan still focused on “underlying inflation” (ex-food, and energy). Tariffs a risk. Auto industry initially cut prices to keep market share but now has started to increase.

EM highlights

Argentina’s officials stressed a politics‑first approach. After achieving a budget surplus for two consecutive years, sequencing reforms in tax, labour, and deregulation, the key is to entrench credibility. They cite a foreign direct investment pipeline of c. USD 80bn, predominantly in energy and mining, with a potential USD 48bn external surplus in four years, and measures to repatriate local savings. The FX framework is seen as adequate. The currency depreciated c. 20–25% in real terms with little pass-through as the monetary base sits at roughly half of historical norms. The base case is gradual FX liberalisation and rate normalisation as uncertainty recedes, with politics the main risk to execution.

Egypt continues to pursue reforms and maintain tight monetary policy, positioning itself to begin a gradual easing cycle toward a medium-term neutral rate (r*) target of 3.0-3.5%. Moody’s maintains a ‘Caa1’ positive outlook, as upgrades remain constrained by high interest costs (over 70% of revenue), despite supportive UAE capex inflows and ongoing fiscal discipline. Lower interest rates will be key to bringing the country’s debt/GDP trajectory lower for good.

El Salvador’s economic growth is supported by surging remittances, with a rising share funnelled into investment, alongside structural tax revenue gains. The key overhang is pensions: liabilities are growing and a three‑year grace period expires in March 2027; the IMF discourages a default on pensions, urging sustainable parametric fixes. Authorities are eyeing Eurobond issuance for asset liability management now that spreads have compressed and suggest c. 3% growth is realistic (4% is ambitious) given demographics. Credible pension reform would be the single strongest signal for markets.

Ghana: The IMF Executive Board approved the fourth review in July (c. USD 367m disbursement), and staff reached a staff‑level agreement on the fifth review on 13 October, keeping financing on track. Disinflation has been rapid—headline CPI inflation fell to 9.4% in September 2025 from 23.8% in December 2024—allowing the Bank of Ghana to begin an easing cycle (policy rate now 21.5%). The cedi’s Q2 rally and stronger external inflows have eased FX pressures, though cocoa remains a swing factor; authorities raised the 2025/26 farm‑gate price by ~63% to support farmers. With fiscal consolidation resuming into 2025, there is room to add to local currency duration selectively as inflation converges toward target.

Mexico’s ratings remain anchored at investment grade levels (Fitch is lower at ‘BBB‑’ stable) with tariff risk smaller than feared and USMCA compliance broadly adequate, but fiscal space is narrowing without tax reform. Debt stands at ~55% of GDP and Pemex still weighs on the sovereign profile. The IMF expects modest growth of around 1.7% in 2026, and notes policy has been pragmatic under President Claudia Sheinbaum. Watch for a credible fiscal anchor and a clearer Pemex support path to sustain ratings resilience.

Nigeria is a bright spot within frontier EMs. Growth momentum is improving after structural reforms, including a successful tax overhaul. The naira was undervalued in real terms by end-2024 for the first time in years, suggesting room for sustained currency stabilisation.

Panama is showing early signs of recovery, despite its downgrade to ‘BB+’ stable by Fitch. Challenges remain, including a narrow revenue base, the copper mine disruption, and Panama Canal issues. However, improving congressional cooperation and pension reform progress are helping sentiment. The fiscal deficit is expected to decline from c. 7.5% of GDP in 2024 to c. 4.0% in 2025 and 3.5% in 2026. The suspension of arbitration in the copper mine case reduces contingent liability risks and improves the outlook for a settlement. The finance minister is confident the country can avoid further downgrades to below investment grade by the other two ratings agencies.

Türkiye’s policy anchors are fiscal discipline and formalisation to deliver durable disinflation. Tax revenues to GDP rose to ~18% on compliance gains; the deficit is narrowing to c. 3-3.5% of GDP despite c. 6% of GDP in earthquake outlays, and public debt is low at c. 25% of GDP. Authorities guide to mid‑teens inflation (16% midpoint; 13–19% band) with 20–25% wage increases and temporary energy subsidies to smooth adjustment, while structural work on housing supply, food logistics, education, and rule‑based indexation underpins the path. De‑dollarisation is gradual as formalisation broadens the tax base. Politics remains the biggest risk to Türkiye’s orthodox fiscal and monetary policy, with ongoing attacks by the judiciary on the opposition showcasing the democratic backslide.

Zambia: Post‑restructuring stabilisation is taking hold. The IMF completed its 2025 Article IV consultation and fifth extended credit facility review in August (c. USD 184m), with most programme targets met. Inflation eased to the 12% range in August, as kwacha strengthening allowed the Bank of Zambia to hold its policy rate at 14.5%. Copper output is recovering (government targets ~1Mt in 2025) as KCM/Mopani ramp and new projects advance. Debt management transparency is improving with regular debt bulletins and a dedicated Debt Management Office. We continue to prefer USD bonds while monitoring scope to extend local currency duration as inflation heads toward the 6–8% target in 2026.

Rating Agencies: Net upgrade momentum stalled.

The post-pandemic ratings upgrade cycle has plateaued as the wave of IMF-supported recoveries fades. One year ago, S&P had 17 more positive country outlooks across EM and FM than they did negative. After 17 upgrades in 2024, and 13 upgrades in 2025 so far, this ‘net positive outlook’ number has fallen to just one. Moody’s upgraded 12 sovereigns and downgraded four last year, while Fitch recorded seven net upgrades with six positive and eight negative outlooks. S&P assumes geopolitical risks will not have a systemic impact, but notes a fat tail of potential shocks, while Moody’s claims such risks are already reflected in its ratings framework.

Today’s key fallen angels at risk include Mexico, Romania, Panama, and Colombia.

Fitch is positive on Mexico, citing fiscal consolidation and lower tariff risks, while Moody’s is concerned about the large ongoing assistance to Pemex. Romania announced an ambitious fiscal consolidation plan to address its twin deficit crisis, although a rocky political coalition raises execution risks, although the EU’s condition-contingent support packages should help bolster credit rating stability. Colombia has a split rating with a challenging growth and fiscal story, which led to multiple downgrades by S&P, but Moody’s notes a strong track record of policy-driven consolidation and is waiting for the new government post-elections in Q2 2026. Panama was downgraded to ‘BB+’ by Fitch, but S&P and Moody’s are willing to be more patient, waiting for the full implementation of the government’s corrective measures.

By contrast, Morocco, Oman, and Serbia were noted as rising stars. Morocco holds a stable outlook as debt levels are beginning to inch down from a high base, although World Cup-related protests present a fiscal headwind. Fitch is not looking to upgrade Morocco to investment grade “anytime soon” due to the gradual reduction of the country’s debt level relative to its peer, and the protests presenting fiscal headwinds. Oman holds a positive outlook with Fitch noting debt has fallen significantly under coherent policy making. Serbia faces a medium-term tailwind on exports despite slower growth and protest risks.

Rating agencies remain cautious about Indonesia amid major policy changes and little visibility on their economic impact. Moody’s downgraded Senegal to ‘Caa1’, citing its debt burden and the interruption of its IMF programme.

Investor positioning

- Long gold, long equities. Short dollar positions felt small.

- Debasement trade is the main “offside” consensus, but less clear-cut in USD terms.

- Broad consensus bullish US stock market driven by capex/AI.

- Some investors also adding exposure to China as a “cheap” AI play alongside South Korea and Taiwan, but it remains a less crowded space than the US.

- Significant interest in frontier stories but feels like positioning is lighter than the enthusiasm.

Key risks

- Economists are concerned about AI exuberance. Market participants relaxed.

- Defaults on private credit driving further cyclical slowdown and shallow recession.

- Fed cutting less than expected driven by higher inflation and labour market resilience.

- Trade and US government shutdowns seen as small risks, but mentioned.

1. See “Bank Lending to Private Credit: Size, Characteristics, and Financial Stability Implications”, Federal Reserve, 2025.

2. See https://www.reuters.com/world/china/citigroup-forecasts-big-techs-ai-spending-cross-28-trillion-by-2029-2025-09-30/