ESG and Responsible Investing

Ashmore's UK Stewardship Code has been successfully renewed by the FRC

11 February 2025

Our available reports

Select which report you would like to download

.

Responsible Investment and Sustainability in Emerging Markets

Ashmore recognises that being a responsible investor brings with it a duty to act in a manner that benefits wider society. This responsibility is particularly acute in the markets in which Ashmore invests and operates, with the need to balance ESG factors with the financial wellbeing of Emerging Markets sovereigns and corporates.

As an Emerging Markets focused investment manager, Ashmore's success is inextricably linked with the achievement of sustainability goals in the markets in which we operate and invest. We recognise how developing countries are likely to face a disproportionate impact from some of the sustainability challenges facing the world today, particularly the risks associated with climate change.

Yet, Ashmore believes that this is also where the most interesting investment opportunities associated with the attainment of the Paris Agreement and the United Nations Sustainability Development Goals (SDGs) will take place and that, over time, this can be a valuable source of alpha.

Our latest Sustainability Report provide a comprehensive overview of our approach to sustainability across Ashmore’s business activities. The report is intended for all Ashmore stakeholders but will be of particular interest to clients.

Climate change

Climate Change Position Statement

Environmental challenges, and specifically the effects of climate change, can be acutely felt by Emerging Markets countries and companies. Ashmore understands the challenges faced by these markets and the environmental trade-offs that can have a greater impact on emerging nations compared with developed countries, as well as the need for investors from both developed and emerging economies to invest in Emerging Markets to finance sustainable growth.

TCFD Report

Ashmore recognises the responsibilities it has both as a premium-listed company on the London Stock Exchange and as a specialist Emerging Markets investment manager acting as a steward of clients’ capital. A signatory to TCFD since 2019, the Firm explicitly considers climate-related risks and opportunities in its operations and investment processes as recommended by the TCFD framework.

NZAMI

Ashmore recognises the importance for the financial sector to contribute to Climate Action (Sustainable Development Goal 6), and the related net zero transition. To achieve the economic transformation required to deliver ‘net zero by 2050’ financial flows must become aligned with a low-carbon economy and incentivise climate mitigation and adaption. This is particularly the case in Emerging Markets where there is a need to balance the low-carbon transition with improved access to energy and where the need for funding is paramount.

The main framework for asset managers in this regard is the Net Zero Asset Managers Initiative (NZAMI), which Ashmore joined in July 2021 and which is the main mechanism by which Ashmore addresses climate change mitigation.

Integrating ESG considerations

Ashmore has explicitly integrated the analysis of Environmental, Social, and Governance (ESG) factors into its investment processes, which reflects its philosophy that the incorporation of non-financial factors is essential to building a robust understanding and assessment of an issuer, and that over time this will improve investment performance, promote better corporate business models, and help foster more sustainable economic development. As with its credit and financial analysis, Ashmore’s ESG research is primarily proprietary in nature, based on research visits and meetings with issuers, with additional context obtained using third-party data.

Its proprietary scoring approach is applied and implemented consistently across all managed strategies. While governance-related issues have historically dominated non-financial factor assessment in Emerging Markets, climate and social equalities have risen in importance as both a driver of risk as well as opportunity.

Engaging with issuers

Ashmore believes that through strong relationships with sovereign and corporate issuers of debt and equity, the Firm can positively influence outcomes related to ESG risks and an issuer’s management of sustainability concerns. Ashmore sees such active ownership to be an integral part of its fiduciary duty as well as an important tool to enhance and preserve the value of its clients’ investments.

Engagement Report

Our Engagement Report outlines Ashmore’s strategy of direct engagement, collaborative and collective engagement, escalation strategies, and the exercising of voting rights and responsibilities.

As a member of ClimateAction 100+ Ashmore engages collaboratively with three high-emitting companies.

UK Stewardship Code

Ashmore is pleased to announce that it has met the expected standard of reporting and become a signatory to the Financial Reporting Council (FRC’s) UK Stewardship Code. The UK Stewardship Code sets a standard for best practice for asset managers investing on behalf of asset owners.

Ashmore’s stewardship report reinforces its commitment to sustainability and best-in-class stewardship through its rigorous governance framework and investment philosophy.

More about the UK Stewardship Code

As a longstanding investor in Emerging Markets economies, Ashmore recognises the impact it can have on the sustainability of the environment and broader societal outcomes. In Emerging Markets, effective stewardship to promote high governance standards has been proven to add value and contribute to the success of companies and their stakeholders. Active ownership is therefore an important tool to enhance and preserve the value of our clients’ investments.

UN PRI

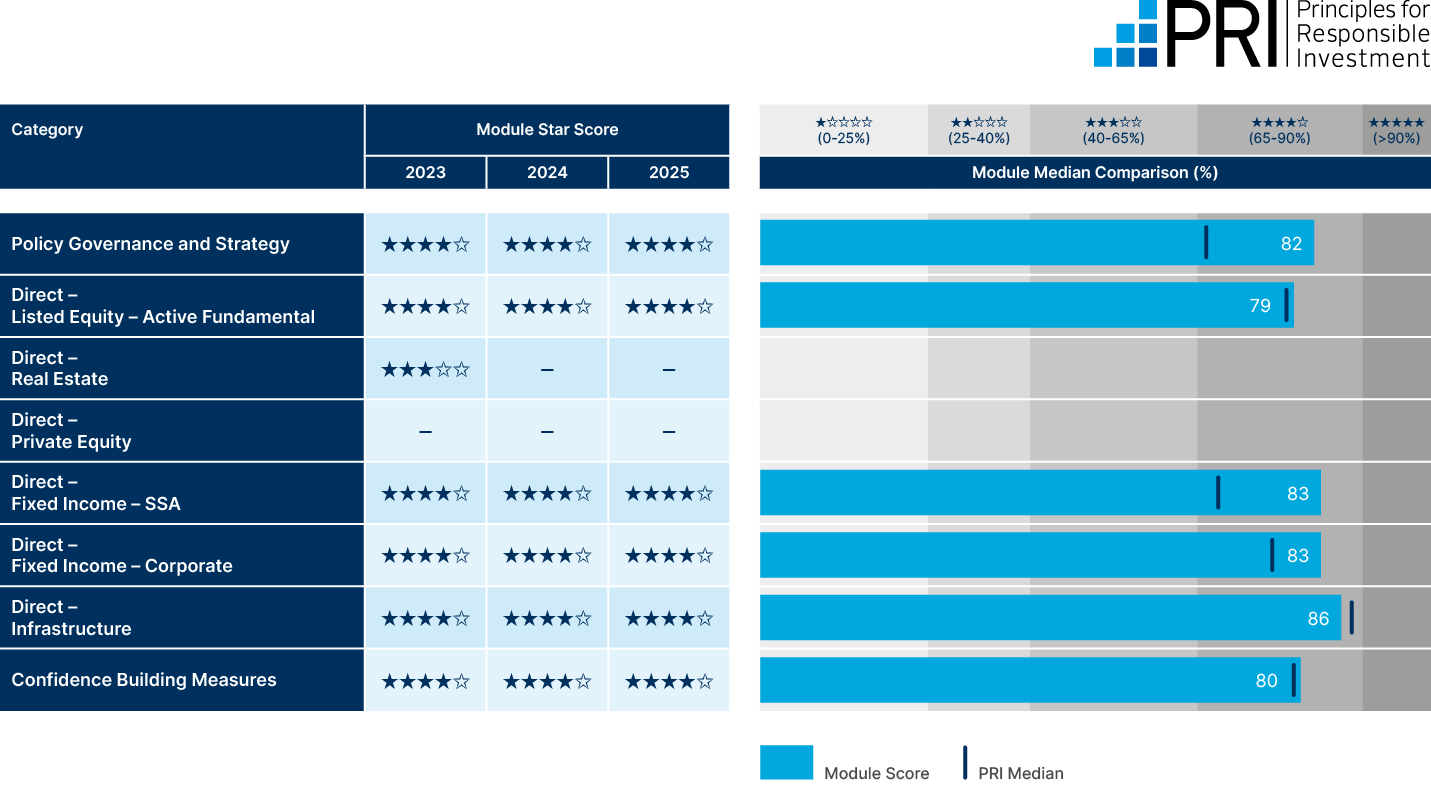

The PRI represents more than 3,000 organisations which collectively manage more than USD 100 trillion and have publicly demonstrated their commitment to responsible investment. Ashmore became a signatory in 2013 and along with other signatories, its responsible investment activities are assessed annually by the PRI. More information on the PRI, its six principles for responsible investment.

The UN PRI is the world’s leading proponent of responsible investment, working to understand the investment implications of ESG factors and to support its international network of investor signatories in incorporating these factors into their investment and ownership decisions.

Dedicated ESG strategies

Ashmore has several dedicated ESG strategies covering external debt, corporate debt, blended debt, and equity.

- Sovereign Debt

This strategy offers investors access to USD-denominated EM sovereign and quasi-sovereign debt securities. It may also include local currency and corporate debt, with all issues meeting a minimum ESG criteria. - Corporate Debt

This strategy invests in EM transferable debt securities and other instruments, with a particular focus on the public sector and private sector corporates that meet specific ESG criteria. - Blended Debt

This strategy invests mainly in transferable debt securities issued by sovereigns, quasi-sovereigns and corporate bonds denominated in both local currencies and hard currencies, with a minimum ESG criteria as set out by the investment manager. - Equity

This strategy invests in equities issued by EM corporates, including voting and non-voting common stock, common stock issued to special shareholder classes, and preferred stock where the issuers satisfy the investment manager's ESG criteria.

Other policies

Exclusion Policy

Ashmore believes that investments which do not meet minimum standards should be excluded from client portfolios. These exclusions are applied at a firmwide and/or fund specific level. Ashmore also restricts investments in companies engaged in the manufacture, distribution and maintenance of controversial weapons. The scope and breadth of these restrictions is outlined in Ashmore's following policy.

Shareholders Rights Directive (SRD II) Engagement Policy

The below statement refers to Ashmore’s Engagement Policy in accordance with SRD II:

Proxy Voting Policy

The below statement refers to Ashmore’s Proxy Voting Policy:

More detailed information related to Ashmore Group’s approach to ESG and Sustainability can be found in our Corporate Responsibility section on our Investor Relations website.

Corporate responsibility

Corporate governance

The Ashmore Foundation

The Ashmore Foundation is committed to making social investments in the Emerging Markets in which Ashmore operates and invests. To date, the Foundation has awarded over USD 6 million in philanthropic donations in over 31 Emerging Markets countries.

Ashmore is mitigating its environmental impact through collaboration with the Ashmore Foundation by supporting projects with defined environmental and social benefits.

We believe that the Ashmore Foundation, with its strong focus on social change, is able to identify and partner the most appropriate initiatives to deliver such objectives.