This week will set the tone for risk assets for the remainder of Q1. In Emerging Markets (EM), Colombia and South Africa hiked rates by 25 and 75 bps respectively, both below consensus. China mobility indicators recovered sharply during the Chinese New Year. Argentina vowed to boost trade with Brazil as it proceeds to buy back its own debt. Nigeria was downgraded to below B-, highlighting the importance of elections in February.

Global Macro & Geopolitics

After a very strong performance in January, the next week looks likely to set the tone for risk assets for the rest of Q1 2023, with central bank policy announcements, plus earnings cycle and economic data that could lead to an extension of the relief rally which started in October. In our view, this week could prove a turning point, bringing the current relief rally to an end.

This week brings meetings from the US Federal Reserve (Fed) on Wednesday, and the European Central Bank (ECB) and Bank of England (BOE) on Thursday. The yield curve is consistent with the Fed hiking its policy rate by 25bps over the next two meetings for a terminal rate of 5.0%, the ECB to hike by 50bps this week and another 75-100bps thereafter, bringing the terminal rate to 3.25%-3.50% and the BOE to hike by 50bps this Thursday and two 25bps increases over the next two meetings, bringing its policy rate to 4.5%. The Fed is the most important of the three, but the fact that ECB and the BOE terminal rates are catching up with the Fed explains why the US Dollar has been on the backfoot after completing the bull trap round trip we’ve expected since last May.1 Even though the USD is oversold, we do not believe the greenback will print new highs this cycle, particularly considering how imbalanced the US external accounts remain.

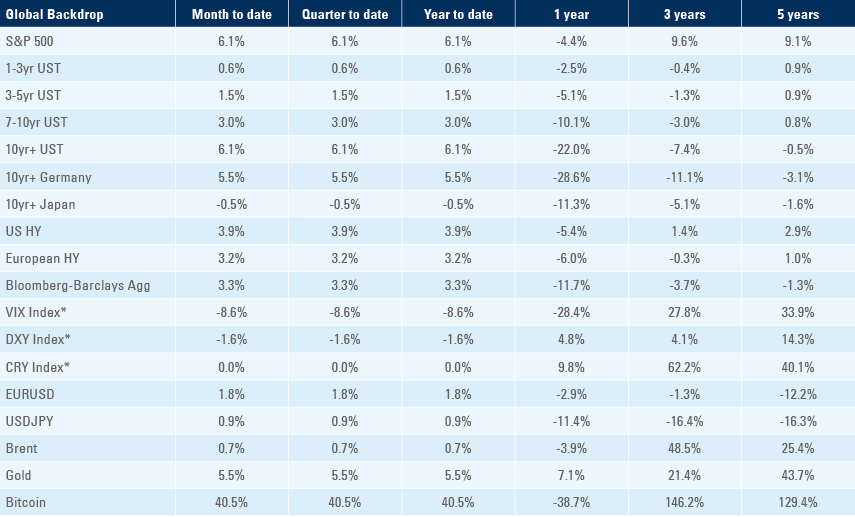

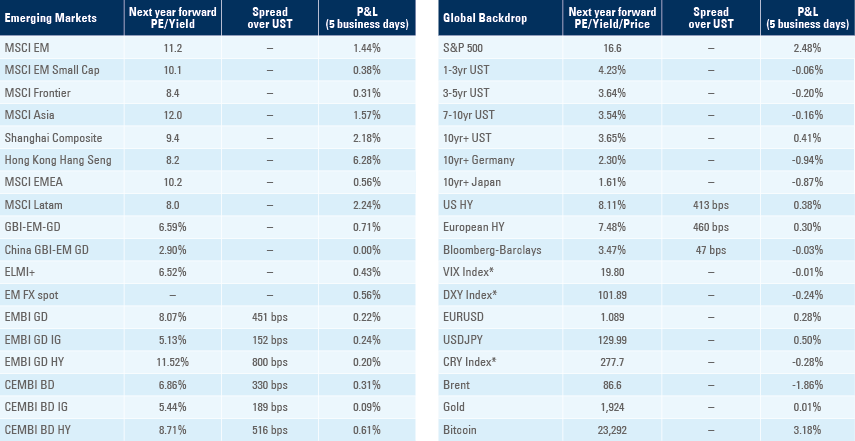

These central banks meet against a backdrop where financial conditions have eased significantly. In equities, the S&P500 closed last week at 4,070, up 13.8% from its lowest levels on 12 October 2022, while MSCI Emerging Markets is up 24.7% to 1,051 from its lows on 24 October. The Euro Stoxx 50 rebounded 27.4% from its lows on 29 September. Further, global bond yields rallied significantly with the 10-year US Treasury at 3.5%, down 75bps from its highs on 24 October, 10-year German Bunds trade at 2.25%, down 32bps from its highs on 30 December, and yields on the JP Morgan Emerging Market Bond Index are at 8.07%, down 208bps from its highest level on 21 October. Technically, equity markets have moved from very oversold levels. Several markets are moving to overbought levels with retail driving very large price appreciation in certain corners of the market, such as meme stocks and non-profitable companies.

China reopening its economy earlier than expected was the main factor contributing to the massive rebound since October, alongside a lower yield on government bonds. Whereas we believe the China reopening is far from fully priced, Chinese stocks have moved to very overbought territory and are susceptible to a short-term correction, which could come in sympathy with lower prices from Developed Market (DM) stocks.

On the fundamentals side, inflation has been declining sharply, led by lower energy prices, particularly natural gas as several leading economic indicators continue to suggest significant disinflation ahead. Energy and food prices are close to flat in year-over-year (yoy) terms, but down 42% from the highs after the Russian invasion of Ukraine. Industrial commodities are up 30% from their October lows, driven by China reopening, and precious metals are up 20% since November, driven by hopes of an end to monetary policy tightening.

Completing the disinflation picture, the yoy rate of M2 growth has collapsed to -1.3% in January from +27% in February 2021 and +12% in December 2021, the first time the monetary aggregate has declined in nominal terms since the inception of the data on Bloomberg, dating back to 1960. A paper by the Bank of International Settlement suggests money growth does drive inflation in high inflationary regimes, thus corroborating our view of disinflation ahead.2 Further, existing home sales are down 34% yoy from +45% in May 2021, the largest drop since the inception of the series, compared with a 31% yoy drop in 2007 and 26% yoy drop in 2009.

Some investors think a combination of significant disinflation and the approaching end of the monetary policy tightening cycle should augur well for the riskier spectrum of assets, such as equities and high yield bonds. However, market prices still seem very far from pricing in the likely incoming economic recession which comes alongside sharp disinflation periods. European stocks are at the same levels as before the Ukraine invasion (only 5.5% below all-time highs) while US stocks are pricing in a significant earnings per share increase for 2023, despite what appears to be continuous poor guidance and also layoffs from large companies.

On the data front, the non-farm payrolls report last Friday is dominating the agenda, but the ISM manufacturing and services reports will be closely monitored. In Europe, January consumer price index (CPI) inflation as well as Q4 GDP growth and the S&P Markit Purchasing Managers’ Indices (PMIs) will be released next week.

In geopolitics, Europe has allowed for German Leopard tanks to be sent to Ukraine, while Russia is readying hundreds of thousands of troops to be sent there, suggesting an intense escalation is likely as the winter thaws. Japan and the Netherlands agreed on imposing restrictions to exports of semiconductors (and machines to manufacture them) to China, a step that facilitates the implementation of the US restrictions, closing the circle on the chip war front. Over the weekend, Iran reported that one of its ammunition storages was attacked in a drone strike, with The Wall Street Journal claiming the strike was carried out by Israel. The Iranian Defence Ministry said it shot down one of the three drones during the attack, with the other two causing minor damage when exploding into the ceiling of a structure inside the depot facility.

We contend that, the most toxic combination for markets would be hawkish forward guidance alongside strong economic data and poor earnings guidance. Whereas, the most bullish combination would be central banks clearly signalling the end of the cycle and soft economic data, but resilient earnings guidance buoyed by a softer-than-expected recession and cost savings from layoffs. In our view, the combination of very easy financial conditions and still robust labour market indicators would suggest central banks will keep a hawkish tone. The data is, as always, a crapshoot, but recent leading indicator surveys suggest activity sentiment could surprise to the upside even if inflation keeps rolling over and big picture indicators (housing, monetary aggregate) remain at very negative levels.

Emerging Markets

Colombia: The central bank hiked its policy rate by 75bps to 12.75%, 25bps below consensus with two directors voting for a 25bps hike. It signalled it will be in data-dependent mode. Colombia issued USD 1.8bn in 2034 bonds at 7.6% with the proceeds destined to repurchase bonds due in 2024. In other news, Energy Minister Irene Vélez said hydrocarbon reserves will be increased to support the energy transition, a change in rhetoric compared with her speech in Davos.

South Africa: The South Africa Reserve Bank hiked its policy rate by 25bps to 7.25%, with two out of three members of the board voting for a 50bps hike (which was the consensus for the meeting). Governor Lesetja Kganyago signalled further hikes are likely when he said rate hikes will end when a “sustained reduction of the inflation rate towards the target” is clear, which should happen by the middle of the year. Producer price index (PPI) inflation dropped to 0.0% month-on-month (mom) in December from +0.5% mom in November, bringing the yoy rate down 150bps to 13.5%, or 40bps below consensus.

China: Mobility indicators rebounded to the highest levels since the beginning of the Covid-19 pandemic during the Chinese New Year, albeit they have not yet reached pre-pandemic levels.

Argentina: Brazilian President Lula visited Buenos Aires and clarified there is no intention of implementing a common currency between the two countries, but to foster trade. Brazilian banks will be encouraged to finance Brazilian exports to Argentina, backed by hard products like commodities, and the State-owned bank BNDES will finance the second phase of the pipeline connecting the shale oil and gas fields in Vaca Muerta. Argentina has been implementing its programme to buy back Eurobonds with an important impact in market prices, but also having a strong impact on debt reduction. The economic activity index declined 0.7% mom in November after contracting 0.5% in October, as the yoy rate slowed 190bps to 2.6% yoy in November, 80bps lower than consensus. Supermarket sales rose to 2.5% yoy from -1.6% yoy in October.

Brazil: CPI inflation was unchanged at 0.5% mom in January, as the yoy rate was unchanged at 5.9%. December tax collection increased to BRL 210bn in December from BRL 172bn in November, in line with consensus. The Federal government debt rose 6.8% yoy in December to BRL 6.0tn, approximately 80% of gross domestic product (GDP). Gross external debt (public and private) declined 2.1% yoy to USD 318.5bn, while foreign exchange reserves declined 10.4% yoy to USD 324.7bn over the same period. The current account deficit widened to USD 10.9bn in December from USD 0.6bn in November, much wider than consensus, leading to a cumulative deficit of USD 55.7bn (2.9% of GDP) in 2022 up from USD 46.4bn (2.8% of GDP) in 2021, as foreign direct investment slowed to USD 5.6bn from USD 8.3bn over the same period.

Nigeria: The central bank hiked its policy rate by 100bps to 17.5%, in line with consensus. Credit rating agency Moody’s downgraded Nigeria’s sovereign rating to Caa1, with a stable outlook, the first agency to assign a below B- rating to Nigeria. Nigeria has very low debt-to-GDP levels, but debt service will add up to c. 50% of the country’s revenues in 2023 due to a combination of high yields on local bonds and low tax revenues owing to several governance issues. This situation makes Nigeria’s elections in February all the more important. The right policy mix (floating NGN, ending costly subsidies on fuel, and boosting the strength of institutions including tax authorities) has the potential of unleashing significant upside on asset prices, but no policy changes would be worrying for debt sustainability.

Mexico: CPI inflation rose 0.5% mom in the first 15 days of January, leaving the yoy rate unchanged at 7.9% for headline inflation and 8.5% for core CPI. Economic activity declined 0.5% in November and the unemployment rate was unchanged at 2.8%. Trade data moved to a USD 984m surplus in December from a 96m deficit in November.

Philippines: The trade deficit widened to USD 4.6bn in December from USD 3.7bn in November as imports declined USD 0.6bn to USD 10.3bn. Exports were down by USD 1.4bn to USD 5.7bn. GDP growth rose 2.4% quarter-on-quarter (qoq) in Q4 2022 from 3.3% qoq in Q3 2022, taking the 2022 rate of growth to 7.6%, up from the 5.7% achieved in 2021.

South Korea: Consumer confidence increased 0.5 points to 90.7 in January, around one standard deviation from its average trend line over the last 15 years. GDP growth rose by 1.4% yoy in Q4 2022 from 3.1% yoy Q3 2022.

Snippets

- Chile: The central bank kept its policy rate unchanged at 11.25%, in line with expectations. PPI inflation dropped 6.6% mom in December as the yoy rate plunged 1,050 basis points to 3.0% in 2022, from 31.5% in 2021.

- Hungary: The central bank kept its policy rate unchanged at 13.0%, in line with consensus. Average gross wages slowed 160bps to 16.8%, and the unemployment rate rose 10bps to 3.9%. Ratings agency Fitch downgraded Hungary’s sovereign debt to BBB- with a stable outlook due to challenging macroeconomic and environment following the Russian invasion of Ukraine.

- Pakistan: An International Monetary Fund (IMF) mission arrives in Islamabad on Tuesday and will stay in the country until 9February. Pakistan’s Prime Minister said he is confident a deal with the IMF is forthcoming.

- Russia: PPI inflation dropped 3.3% in yoy terms in December, accelerating the yoy deflation from -1.9% in November. Gold and foreign exchange reserves rose by USD 2.6bn to USD 594.6bn.

- Thailand: The Bank of Thailand hiked its policy rate by 25bps to 1.5%, in line with consensus.

- Tunisia: Moody’s downgraded Tunisia’s sovereign rating to Caa2 (two levels below B- levels) but kept a negative outlook on its rating. The IMF has a staff-level agreement for a USD 1.9bn funded facility, but less than USD 0.5bn are likely to be disbursed this year against roughly USD 8bn of funding needs according to the government, making Tunisia a likely candidate for default in the short term.

Developed Markets

United States: Economic data was overall better than expected. The preview for the S&P Global manufacturing PMI rose 0.6 to 46.8, while services increased 1.9 to 46.6 in January, both above consensus at 46.0 and 45.0 respectively. Initial jobless claims dropped to 186k in the week ending 21 January, from 192k in the previous week, significantly below consensus at 205k. GDP growth rose 2.9% in annualised qoq terms in Q4 2022, down from 3.2% annualised qoq in Q3 2022, which was 30bps above consensus. The core PCE index in the GDP survey declined by 80bps to 3.9% in Q4 2022, but the December core Personal Consumption Expenditures (PCE) deflator slowed by 30bps to 4.4% yoy, in line with consensus. The one-year inflation expectation in the University of Michigan survey dropped 10bps to 3.9%, while the five-to-ten-year survey also declined by 10bps to 2.9%. University of Michigan consumer expectations increased by 0.7 to 62.7, and current conditions dropped 0.2 to 68.4, both indicators remaining at very depressed levels. Durable goods orders rose 5.6% mom in December from -1.7% mom in November. Personal spending dropped 0.2% mom in December after declining 0.1% mom in November, suggesting further economic softness ahead.

Canada: The Bank of Canada hiked its policy rate by 25bps to 4.5%, in line with consensus, but signalled it will pause hikes to access their impact in the economy.

Europe: The Eurozone manufacturing PMI rose 1.0 to 48.8 in January and service PMI increased 0.9 to 50.7 over the same period.

Japan: The yoy rate of CPI inflation rose by 50bps to 4.4% in January in the city of Tokyo and 40bps to 4.3% yoy ex-food.

Australia: PPI inflation dropped to 0.7% qoq in Q4 2022, bringing the yoy rate to 5.8%. However, CPI inflation rose 1.9% qoq over the same period, lifting the yoy rate up 90bps to 8.4% in December, 70bps above consensus.

1. See ‘The USD bull trap and EM USD debt’, The Emerging View, 29 April 2022.

2. See https://www.bis.org/publ/bisbull67.htm

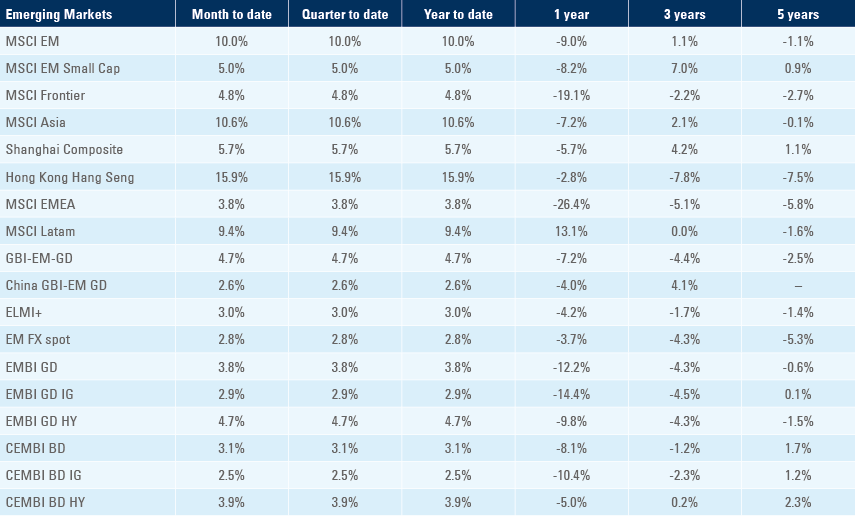

Benchmark performance