- EM outperformance to regain momentum after Moody’s downgrades US credit rating.

- US Republican budget bill cleared the Budget Committee on Sunday, after failing on Friday.

- Soft activity data from China reported this morning.

- Indian inflation slowed for third straight month.

- Milei’s party wins elections in Buenos Aires.

- Good political news in Ecuador. Gustavo Petro’s agenda challenged again in Colombia.

- Pro-market independent wins in Romania.

- Polish election first round tighter than market expected.

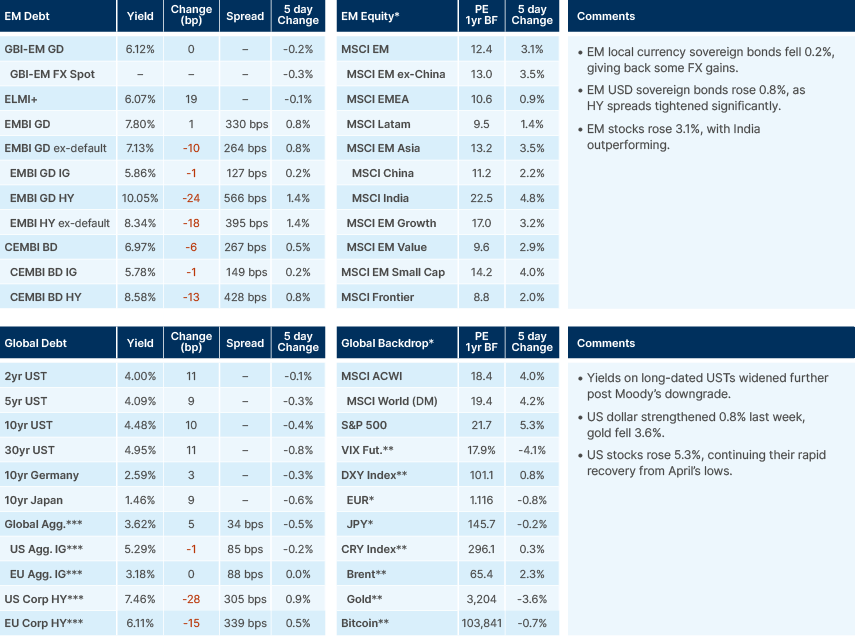

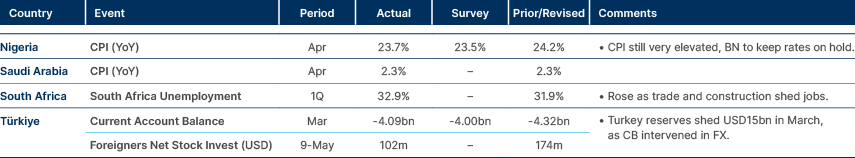

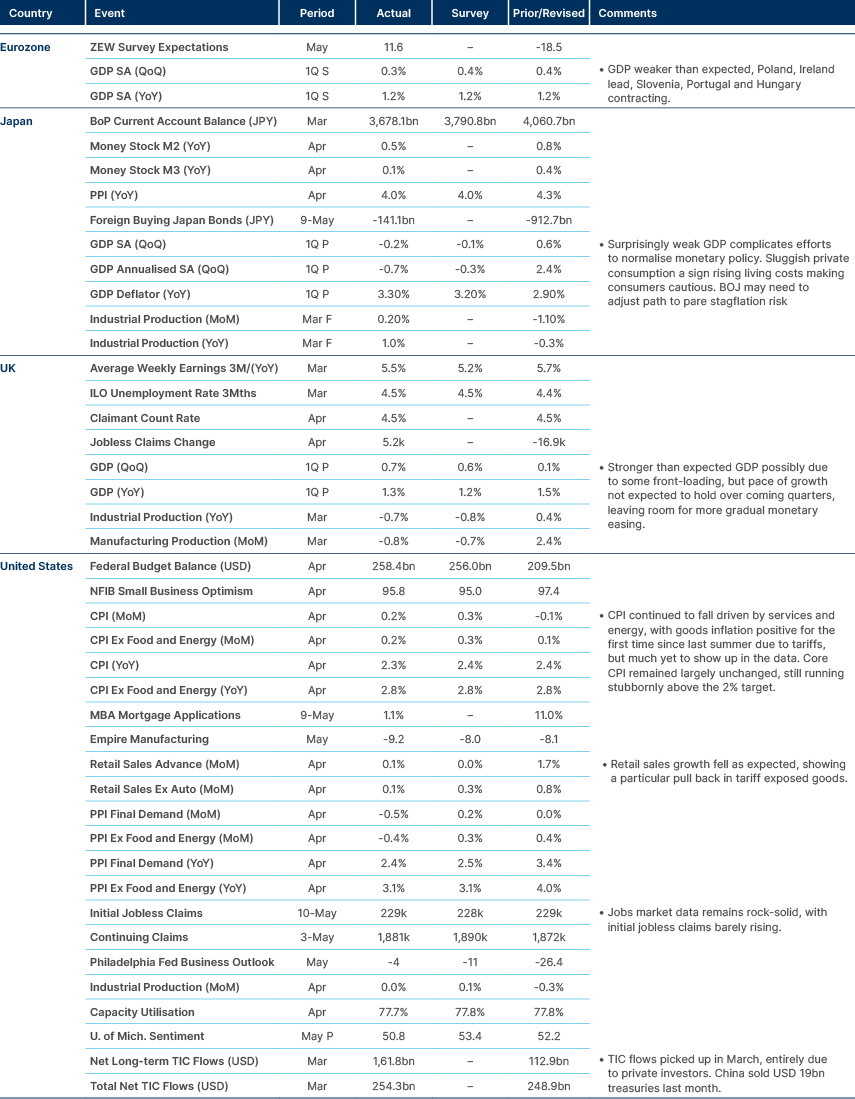

Last week performance and comments

Global Macro

The 30-year US Treasury (UST) rate rose above 5.0% this morning, for the first time since December 2023, up from a post ‘Liberation Day’ low of 4.4%. Notably, 40bp of this increase is due to real yields. This can be measured using the 30-year Treasury Inflation Protected Security (TIPS), which rose from 2.25% to 2.65% in the same period.

April consumer price index (CPI) inflation surprised to the downside, with the last three-month annualised core inflation running at 2.1%, and just 1.2% in headline terms. Declines in the service sectors and lower transport costs, helped by falling oil prices, offset rising goods prices, particularly for appliances. However, investors appear to expect prices to rise again due to the still-significant increase in average tariff rates, now effectively around 15%. This is yet to truly show up in the hard data.

Long-term real bond yields partially reflect growth expectations. Recession risk declining as the US walked back their most egregious 2 April tariffs, certainly helped bond yields higher. But much of the rise in long-term real yields is likely due to deteriorating confidence in the long-term fiscal position of the US. It won’t lead to meaningful forced selling of USTs, but Moody’s credit rating downgrade over the weekend was a significant symbolic move; it was the last of the three major rating agencies to hold an AAA rating on the US.

The United States’ unsustainable fiscal metrics are plain to see. Annual net interest payments have now overtaken defence spending, which ‘Ferguson’s Law’ states is often an indicator for the decline for a great power. The Treasury will have to refinance USD 10trn of debt per year in coming years, which asks a lot of external creditors.

Now, Trump’s “Big, Beautiful Budget Bill” is very much in the spotlight. On Friday, five hawkish Republicans on the House Ways and Means and Budget Committees voted down the ‘Grand Old Party’ (GOP) bill, enough to prevent it from passing. They reversed course in a rare Sunday-night session after House Speaker Mike Johnson pledged still-deeper offsets – chiefly sharper Medicaid cuts – to win their support. The package now heading to the House floor includes making the 2017 tax cuts permanent, and USD 1.2tn of new tax cuts (over 10 years), including on tips and overtime, and a higher State and Local Tax (SALT) cap. Larger defence and border outlays are also on the table. This is all offset by around USD 1.5tn in planned nominal savings, and the promise of significant tariff revenues on top.

This budget points to a fiscal consolidation in 2025 of around 1% of GDP, according to Deutsche Bank calculations, a major shift when considering US government spending grew by USD 750bn in 2024. What happens to the deficit in outer years will hinge on future budgets. The UST reaction suggests the market is not giving the new administration the benefit of the doubt and wants to see a clear path towards a multi-year consolidation. From here, we see that Washington faces two paths:

- Stealth fiscal consolidation. Trimming the primary deficit 0.5% to 1.0% of GDP each year for three to four years. This politically challenging path could cool US stocks earnings growth but restore macro stability.

- Maintaining wide deficits and resorting to financial repression or capital controls to maintain stability. This would be an attempt at extending US equity outperformance via monetary debasement. However, it would likely have a severe negative macro impact, including higher inflation. Any attempts to artificially cap long end yields could also be disastrous for the dollar.

In our view, US Treasury Secretary Scott Bessent will try to intervene and improve the long-term budget numbers. But it will be a long summer of budget discussions and number crunching.

Mar-A-Lago Accord Vibes

This week, the G-7 finance ministers and central bankers meet in Canada to discuss global policy. Last week, the Japanese Finance Minister Katsunobu Kato said he would seek an opportunity to discuss currency matters with Scott Bessent. This followed reports that the US administration discussed currency levels with its Korean counterpart. In the meantime, European Central Bank (ECB) Chair Christine Lagarde said: “Europe is rightly perceived as a stable economic and political area, with a sound currency and an independent central bank”. Lagarde’s commentary has reinforced the notion that the ECB won’t push back against euro appreciation, and may even welcome it. The large increase in infrastructure and defence spending and EUR strength will keep supporting a strategic reframing of EUR assets’ role in global portfolios.

Why does it matter to EM?

EM ex-China stocks are up 20% over the last month, and look set to break their 10-year trading range. As we have repeatedly highlighted, a breakout in emerging market (EM) equities is not only cyclically due, but supported by three structural policy shifts:

- The US fiscal impulse turning negative.

- Europe’s defence and infrastructure-driven fiscal stimulus.

- China’s fiscal and monetary easing.

These policy shifts are likely to provide the catalyst for a shift in the macroeconomic backdrop to a weaker USD environment. This is already the path of least resistance given the overvalued US dollar, currently trading two standard deviations above its 50-year average.

A weaker USD supports EM assets directly, in local currency terms, and boosts populations’ purchasing power. It also supports capital flows into EM countries, lowering financing costs and promoting longer-term infrastructure investment. These factors make a powerful cocktail when combined with very cheap equity valuations across most of EM.

Emerging Markets

Asia

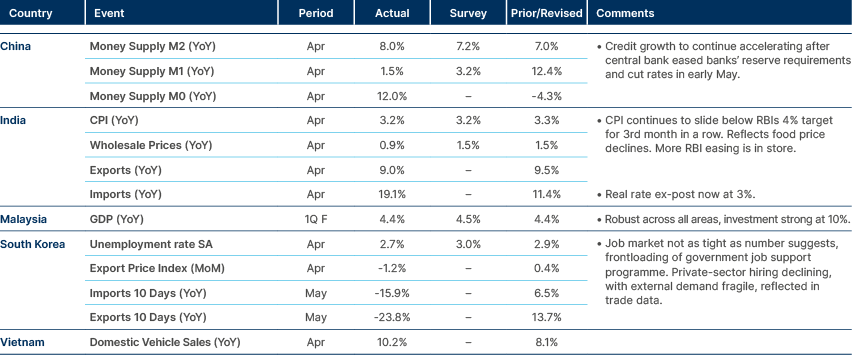

China’s economic data disappointed this morning. Indian inflation slowed down further.

China: April’s activity prints confirmed a soft patch: industrial production grew 6.1% yoy (down from 7.7 % in March), retail sales slipped to 5.1% (from 5.9%) and fixed asset investment eased to 3.6% (from 4.3 %). Measured against the smoother first-quarter averages of 6.5%, 4.6% and 4.2%, respectively, industry and capex have lost momentum while consumption is only edging higher, reinforcing the case for selective stimulus.

Indonesia: Household demand is regaining traction. Bank Indonesia’s survey showed retail sales rising 5.5% year-on-year (yoy) in March, the fastest pace since late 2023.

Malaysia: Festive spending lifted retail turnover 4.9% yoy in March, while wholesale trade recorded its strongest expansion since July 2023. Policymakers expect resilient household consumption to keep the retail sector on a solid footing through mid-year.

Pakistan: External liabilities ticked lower for a second straight quarter. Total foreign debt fell USD 0.6bn quarter-on-quarter to USD 130.3bn at the end of March, a marginal but welcome relief ahead of the next International Monetary Fund (IMF) review.

Thailand: Public confidence is fragile. In a new poll, 76% of respondents said they lack faith in the government’s handling of the US-China trade fallout, while only 24% endorsed current economic policies, and 92% of respondents felt insecure about the overall outlook.

Latin America

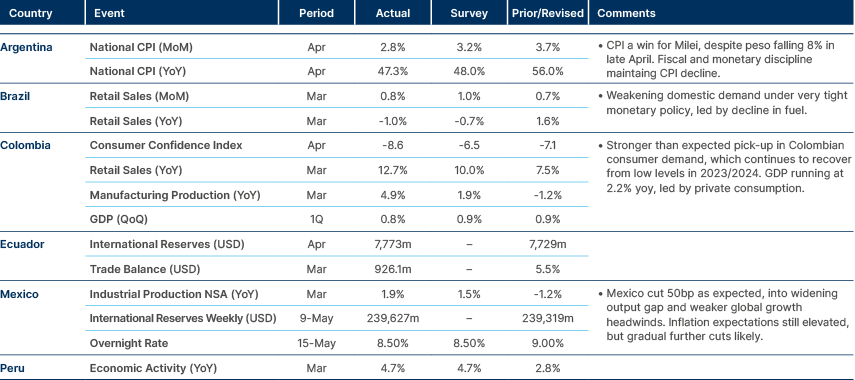

Argentina’s inflation softened. Big win by Javier Milei in Argentina.

Argentina: President Javier Milei’s La Libertad Avanza (LLA) party converted the Buenos Aires City mid-term into a referendum on his economic programme, taking more than 30% of the vote and relegating Kirchnerism (27%) and former president Mauricio Macri’s PRO (16%) parties to second and third place on a low 53% turnout. The upset confirms LLA’s urban advance—also visible in Salta and Chubut—and deepens the Milei-versus-Kirchnerism polarisation that is squeezing out traditional third forces. Talks on an LLA–PRO pact for September’s Buenos Aires Province vote are intensifying. Registering such an alliance in July would likely steady the peso and improve the odds of a market-friendly outcome in both the provincial contest and October’s national mid-terms. The political tail-wind was echoed by Fitch’s upgrade of Argentina’s sovereign rating to CCC +, a small but telling vote of investor confidence.

Colombia: The Senate rejected the government’s plan to put labour reform to a popular referendum, defeating the motion 49–47 amid accusations from Interior Minister Armando Benedetti that Senate President Efraín Cepeda closed the register just as the “yes” camp was gaining ground. President Gustavo Petro branded the result fraudulent, called for mass mobilisation, and secured an appeal that revives the reform at the third-debate stage, though it must now navigate a different constitutional committee.

Ecuador: Pachakutik Party Deputy José Luis Nango pledged support to President Daniel Noboa and signalled that more party members may follow, bringing the ruling National Democratic Action (and) bloc close to the 77 seats required for an outright majority in the National Assembly.

Mexico: Industry groups reported that 92% of auto part exports already meet United States–Mexico–Canada Agreement (USMCA) content rules, with the remaining gaps concentrated in highly-specialised components. Compliance is expected to rise further from April. Bank of America’s Carlos Capistrán warned that a proposed 5% US excise tax on outward remittances, effective after 31 December 2025 and exempting US citizens, would trim Mexico’s inflows by up to 0.2 % of GDP, nudging its current account deficit from 0.3% to 0.5%, and would hit Central American economies even harder.

Peru: President Dina Boluarte reshuffled her cabinet over security concerns, appointing Raúl Reyes as Finance Minister. Reyes cautioned that new US tariffs could shave 0.5% off 2025 growth, though he still projects a robust 3.5%. Deputy Minister Denisse Miralles noted that 90% of tariff sub-segments are affected, while Trade Minister Desilú León is accelerating support for exporters and has touted the new Chancay Port as a springboard to Asian markets.

Central and Eastern Europe

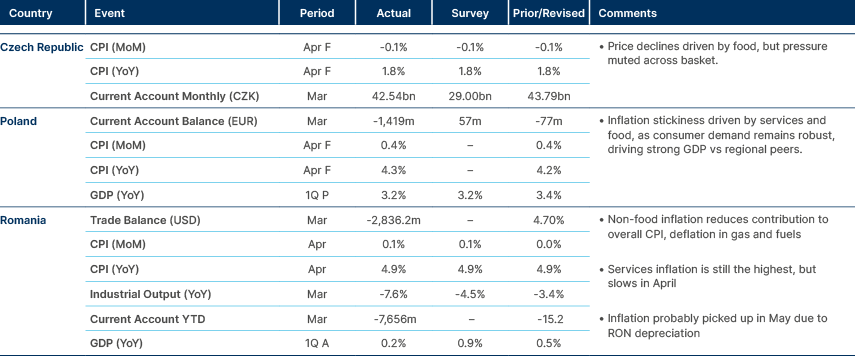

Excellent political outcome in Romania. Mixed in Poland.

Poland: Warsaw mayor Rafał Trzaskowski, a close ally of Prime Minister Donald Tusk, heads into the final campaign week as the favourite despite slipping poll numbers. A runoff with Law and Justice’s Tobiasz Nawrocki remains the likely scenario.

Romania: Centrist independent Nicuşor Dan won the Bucharest mayoral runoff with 54% of the vote, defeating far-right challenger George Simion and capping a cycle of moderate gains across the region. Dan is a mathematician and considered a technocrat, qualities that could help the country tackle its challenging budget deficit. His victory has reduced multiple layers of risks in the near-term, including the risk of a coalition breakdown and another snap election, as well as lowering the uncertainty around the timeline and the implementation of fiscal consolidation.

Central Asia, Middle East, and Africa

Türkiye’s FX reserves drop.

Egypt: Official remittances more than doubled year-on-year to USD 3.0bn in February, lifting the 12-month total to nearly USD 30 bn. The recent exchange-rate reform has eliminated the parallel market and encouraged transfers through formal channels.

South Africa: President Cyril Ramaphosa is preparing for a high-profile meeting with President Trump, an overture aimed at repairing bilateral relations after several years of diplomatic friction.

Developed Markets

Inflation softer than estimated in the US. GDP stronger in UK, weaker in Japan.

Portugal: Prime Minister Luis Montenegro’s ruling centre-right coalition won a snap election with nearly 33% of the vote, and increased its seats in parliament to at least 89, short of the 116 seats required for a majority. With four seats assigned for Portuguese diaspora unannounced, the far-right Chega Party rose to 58 seats (23% of the vote), the same number as the Socialist Party. Portugal’s election results mirror those in Romania and Poland, where the populist right parties emerged stronger this weekend, despite victories for traditional centrist parties.

Japan: Japanese Finance Minister Katsunobu Kato will seek an opportunity to discuss currency matters with US Treasury Secretary Scott Bessent if the timing works out when the two are in Canada for a G7 meeting. He refrained from commenting further on potential bilateral talks, noting that no specifics have been set, and reiterated Japan won’t use the topic of UST sales as leverage in its trade talks with the US. He declined to comment on recent currency moves.

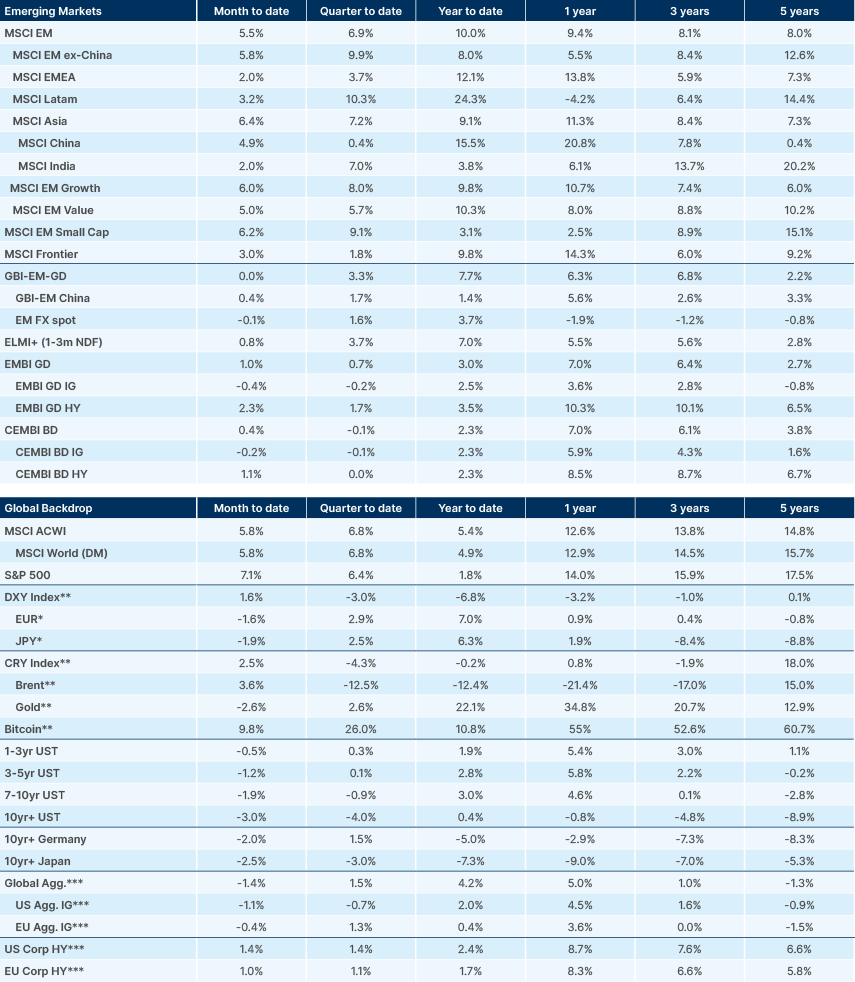

Benchmark Performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.