The great rates divergence: US rates steepen as Brazil starts its easing cycle

The United States (US) yield curve bear-steepened after the government’s credit rating was downgraded which – alongside higher supply of US Treasuries – led to higher market volatility. The correlation between yields of 10-year yields and US stocks hit an all-time low (-0.77), suggesting markets remain exposed to negative price action in rates during the summer. Leading indicators delivered a mixed performance in July. China reported better services sector activity. A fresh attempt of forming a government in Thailand. Brazil cut policy rates by 50 basis points (bps) and signalled moves of similar magnitude in future meetings. In Colombia, the son of President Gustavo Petro confessed to raising illegal money for his father’s campaign. Ex-Prime Minister Imran Khan was arrested in Pakistan. Nigeria’s protests were cut short after President Bola Tinubu agreed to negotiate with unions.

Global Macro

Ratings agency Fitch downgraded the US Government’s credit rating from `AAA` to `AA+`. The downgrade came on the heels of the US Treasury announcement of USD 1trn of auctions in Q3 2023, the largest for the period. Japanese bond sales accelerated before the yield curve control adjustment last week, which drove 10-year government bonds to 0.65%. The move in JPY (weaker) and rates suggests Japanese investors are unwinding the hedge in their foreign bond exposure and selling unhedged bond exposures.

The US Treasury yield curve bear steepened last week and 30-year mortgage rates moved to the highest level since Q4 2000, even though the softer than expected payroll report1 last Friday brought yields below its highs. The month-to-date (MTD) moves:

- 2-year: -6bps to 4.82% (high at 4.92%)

- 5-year: +5bp to 4.18% (high at 4.35%)

- 10-year: +11bp to 4.07% (high at 4.2%)

- 30-year: +21bp to 4.22% (high at 4.32%)

One of the Fed’s favourite gauges of inflation expectations, the 5-year/5-year break-even inflation rate, rose to 2.49% at the end of last week, up from 2.2% at the end of June. The US labour market is softening, but too slowly for the Fed to claim victory. Non-farm payrolls had negative revisions every single month year-to-date (YTD) (-245k total) but the six-month moving average declined to only 223k, significantly above the 107k average since 2003.

Headline inflation may also be at a turning point as gasoline prices are up +23.5% YTD and now flat in year-on-year (yoy) terms in the US. Oil prices rose again last week after Saudi Arabia announced another 1m barrel voluntary cut extended to September, while US strategic oil reserves hit the lowest level since 1985.

Credit spreads remained resilient last week, but high yield (HY) credit default swaps (CDS) moved away from its lows. The US CDX HY index rose 27bps last week at 435 (12-month low/high 408-627) while the US CDX IG (investment grade) index slowed at 68 (12-month low/high 63-112).

Stocks declined, but US equities are still close to all-time highs. The S&P500 correlation to 10-year government bond yields plunged to -0.77, the lowest level since August 2008 while several positioning indicators moved to overbought territory. Emerging Market (EM) equities sold-off in line with US stocks MTD, but inflows to EM equities have accelerated in recent weeks. China’s policy stance is improving with the government announcing measures to address local government debt issues. Floods in North China are likely to impact short-term activity but is unclear if it will lead to any significant long-term implications. The earnings from the large Chinese technology companies may hold the key for a potential re-rating, particularly after reports of a diplomatic rapprochement following the replacement of China’s top diplomat.2

The big rates divergence is reflected in last week’s monetary policy decisions. The Bank of England (BOE) hiked its policy rate by 25bps, with some members of the BoE’s Monetary Policy Committee (MPC) voting for 50bps. Meanwhile, Australia paused its hike cycle and Brazil started its easing cycle, cutting policy rates by 50bps. The Central Bank of Brazil had a larger challenge (higher inflation structurally) but benefited from moving much earlier (started hiking in Q1 2021), anchoring the BRL and inflation expectations, thus bringing inflation down several months ahead of the UK and Australia, as demonstrated in Fig 1:

Fig. 1: CPI inflation in Brazil, UK, and Australia

EM local currency bonds had a poor start to the month due to position unwinding with the ZAR, COP, BRL, KRW, and CLP declining more than 2.0% against the USD for August so far. The US yield curve bear steepening is undoubtedly negative for both EM currency and rates, but rates may remain better-supported by the upcoming easing cycle across several EM countries, whereas EM currencies are more vulnerable to a short-term rise in the USD, a move that is unlikely to prove sustainable, in our view.

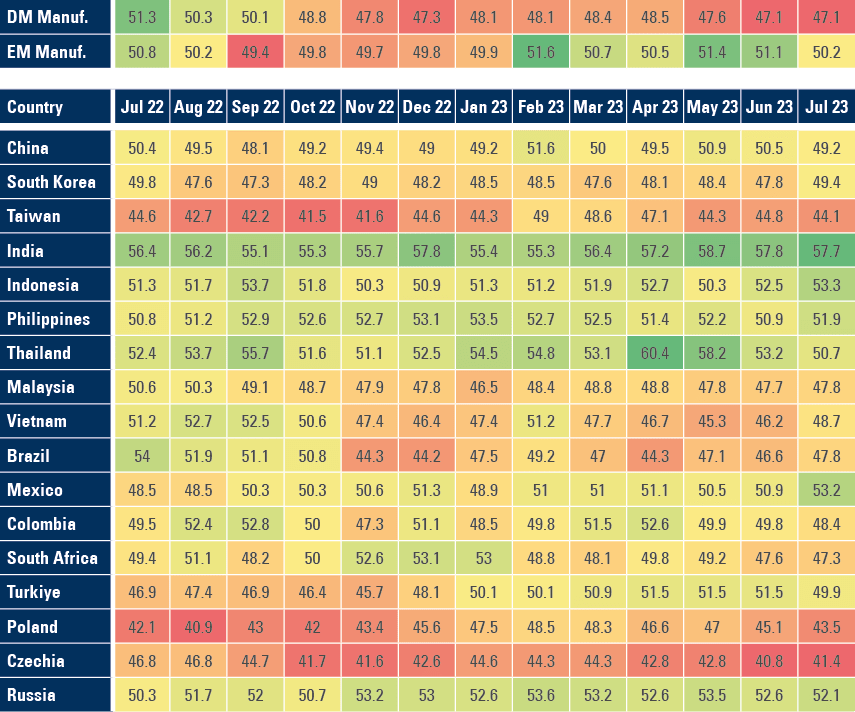

Last week’s leading indicators painted a mixed picture. The EM Manufacturing Purchasing Manager’s Index (PMI) dropped, led by China and Eastern Europe. However, PMIs recovered across several key EM countries, including South Korea, Indonesia, Philippines, Vietnam, Brazil, and Mexico while India remained super strong. By contrast, Developed Market (DM) manufacturing PMIs were unchanged at 47.1, as per Fig. 2:

Fig 2: S&P Global Manufacturing PMIs

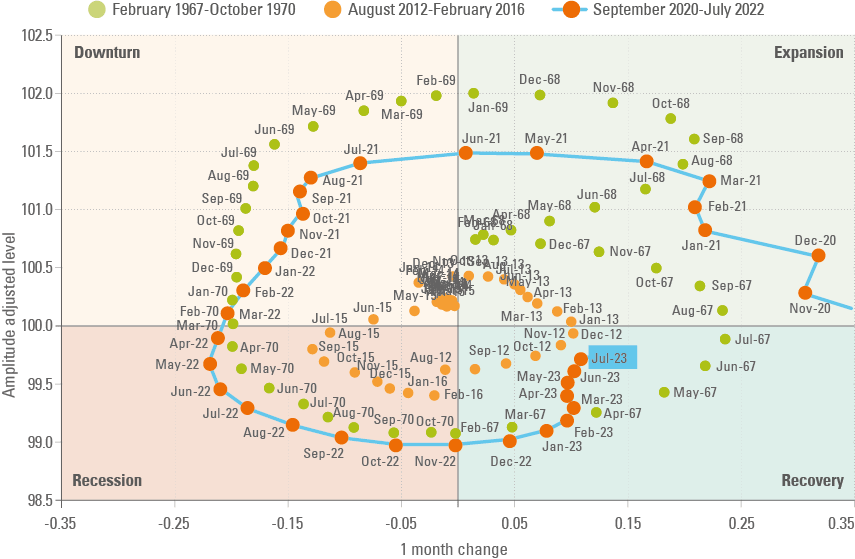

The OECD G-20 Leading Indicator improved marginally in July. It remains in recovery territory, still below 100, but recovering. The comparison between the current cycle and previous cycles presents a case for higher (rates) for longer, anchored by both structural and cyclical factors. Fig 3 shows the current cycle resembles the 1960s more than post 2008 Global Financial Crisis period. Until May, leading indicators were pointing towards recession but moved to point towards expansion over the last two months.

Fig 3: OECD G-20 leading indicator

Emerging Markets

Asia

China: The official manufacturing PMI rose +0.3 to 49.3 (consensus 48.9) and non-manufacturing PMI fell 1.7 to 51.5 (consensus 53.0). The Caixin manufacturing declined 1.3 to 49.2 (consensus 50.1), but the services PMI rose 0.2 to 54.1 (consensus 52.4). Floodwaters from Typhoon Doksuri deluged farms and cities in Northeast China last weekend, as its disaster relief systems struggled to contain the aftermath of one of the strongest storms in years, and also adding food security risks, as export bans push up global prices. In other news, the China Securities Journal reported China’s government will speed up its roll-out of a plan to resolve local government debt risks, with measures including debt swap, extension, and restructuring.

Philippines: The yoy rate of CPI inflation declined by 70bps to 4.7% in July, 20bps better than consensus. Central Bank Governor Eli Remolona vowed to exercise caution against “too much” monetary tightening to avoid “crimping growth”.

India: Services sector PMI surged to 62.3 in July from 58.5 in June. Monsoon rainfalls brought water levels at 40 reservoirs in southern regions 26% below 2022 levels, a notable improvement from the previous week, when water levels were 37% below a year ago.

Indonesia: Real GDP growth expanded by 3.9% quarter-on-quarter in Q2 2023 after contracting 0.9% in Q1 2023, as the yoy rate increased 20bps to 5.2% (consensus 5.0%), driven by a broad-based improvement in domestic demand. Higher growth makes it more likely that revenues will keep surprising to the upside and the fiscal dynamics will improve faster than expected, in our view. The yoy rate of CPI inflation declined 40bps to 3.1% in July, in line with consensus.

South Korea: Exports declined by a yoy rate of 16.5% in July (-15.0% consensus) from -6.0% yoy in June as the trade surplus improved to USD 1.6bn from USD 1.1bn over the same period, albeit coming in USD 1.0bn below consensus. The yoy rate of CPI inflation declined by 40bps to 2.3%, in July, 10bps below consensus, while CPI ex-food and energy dropped by 20bps to 3.3% yoy.

Thailand: The Pheu Thai Party linked to former premier Thaksin Shinawatra said it will seek to form a new government with the Bhumjaithai Party. Prospects of a Pheu Thai-led alliance, even without the progressive Move Forward Party, was positive for Thai equities due to its proposed policies such as cash handouts and a minimum wage increase. In economic news, the yoy rate of CPI inflation rose to 0.4% in July from 0.2% in June, 30bps below consensus, with core inflation unchanged at 0.9%. Despite soft inflation, the Bank of Thailand hiked its policy rate by 25bps to 2.25%, in line with consensus, pre-empting stronger economic activity ahead led by tourism rebound and a potential reduction of political uncertainties. The current account balance moved to a USD 1.4bn surplus in June from a USD 2.8bn deficit in May, slightly better than consensus.

Latin America

Argentina: Argentina paid over half of its USD 2.7bn debt due this week to the International Monetary Fund (IMF) by tapping its currency swap line with the People’s Bank of China (PBoC), alongside using a bridge loan from the Development Bank of Latin America (known as CAF).

Brazil: The central bank cut its policy rate by 50bps to 13.25%, with four Committee members voting for a smaller 25bps cut and five members (including Governor Roberto Campos Neto) voting for a 50bps cut. The Committee statement said it “Unanimously foresees a move of the same magnitude in the next meetings” and that the “total easing will depend on the data/cycle”. The inflation scenario shows CPI inflation at 3.4% at the end of 2024 and 3.0% in 2025 (target 3.0% +/- 1.5%). In economic news, the services sector PMI declined by 3.1 points to 50.2 in July, and the trade surplus slowed to USD 9.0bn in July from USD 10.6bn in June, but USD 1.0bn above consensus. Vehicle sales rose by 36k to 225.6k in July

Chile: The yoy rate of economic activity dropped 1.0% in June from -2.0% yoy in May and better than the -1.4% yoy consensus. Copper production rebounded to 457.9k long tons in June from 413k in May, getting production closer to the average of the last ten years (480k long tons).

Colombia: President Gustavo Petro’s eldest son Nicolas was imprisoned in a money laundering inquiry which, in our view, is likely to be damaging for his father. Initially, President Petro tried to dissociate himself from his son, claiming he had nothing to do with the accusations and “wishing luck” to him. However, last week Nicolas admitted receiving illicit money from a former senator convicted of drug trafficking that went into his father's 2022 presidential campaign, but said his father was unaware of the illegal funding.

Mexico: The yoy rate of real GDP growth was unchanged at 3.7% in Q2 2023, significantly higher than 3.3% consensus. Vehicle production declined by 37k to 294k in July, as exports slowed by 10k to 276k over the same period.

Peru: The yoy rate of CPI inflation declined by 60bps to 5.9% in the city of Lima in July, 10bps above consensus.

Central and Eastern Europe

Czechia: The Czech National Bank kept its policy rate unchanged at 7.0%, in line with consensus. The yoy rate of real GDP contracted 0.6% in Q2 2023 after -0.5% yoy in Q1 2023

Poland: The yoy rate of CPI inflation declined 70bps to 10.8% in July, 20bps more than consensus.

Central Asia, Middle East, and Africa

Pakistan: Former president Imran Khan was arrested again last week after a court sentenced him to three years in prison for illegally selling state gifts, potentially barring Khan from contesting an upcoming general election. The parliamentary term ends this week, but parliament may be dissolved on 9 August according to Prime Minister Shehbaz Sharif. Pakistan’s Law Minister said the next general election will be based on a new census that showed the population increased by 16% over the past six years, indicating the vote could be pushed back by months as the Electoral Commission revises its lists and constituencies, potentially postponing the vote beyond 15 February 2024.3

Nigeria: Two large unions mobilised nationwide protests which were set to last seven days but have been suspended since Thursday morning, following President Bola Tinubu’s meeting with union leaders. The government pledged to review the minimum wage to support citizens with the rising cost of living as CPI inflation rose by a yoy rate of 22.8% as of June. Tinubu has heard the request of the Nigeria Labour Congress to provide monthly NGN 30k (c. USD 38) direct payments to 12 million of the poorest Nigerians for a six-month period, a suggested increase from the government’s plans of giving NGN 8k. Any direct transfer costs are likely to be ‘peanuts’ compared with the savings from ending subsidies, in our view. The World Bank estimates that removal of fuel subsidies will result in NGN 21trn savings over the next two years. Removal of the subsidy has also unlocked room for better budget allocation, as previously the fuel subsidy costs were 32.4% of total government revenues.

Saudi Arabia: Riyadh announced on Thursday it will extend a unilateral cutback of 1 million barrels a day into September.

South Africa: The Nuclear Energy Corporation announced on Tuesday that it had signed a memorandum of understanding (MoU) with Russia's TVEL Fuel Company, a subsidiary of state-owned Rosatom nuclear group. The MoU covers cooperation in the production of nuclear fuel and related components. In other news, the trade balance moved to a ZAR 3.5bn deficit in June from a ZAR 9.6bn surplus in May, disappointing consensus for a ZAR 5.0bn surplus.

Turkey: The yoy rate of CPI inflation surged by 9.6% to 47.8% in July, 100bps more than consensus. Producer price inflation (PPI) rose 8.2% mom in July from 6.5% mom in June, and the yoy rate increased by 4.1% to 44.5%

Developed Markets

United States: The US government’s credit rating was downgraded over concerns for the country’s finances and its debt burden. Fitch cut its rating from the top level of AAA to AA+. The ISM services PMI report showed a decline from 53.9 to 52.7, below consensus at 53.1, while the ISM manufacturing PMI survey rose by 0.4 to 46.4 (consensus 46.9). The Chicago PMI declined 1.2 points to 52.7 in July, below consensus at 53.1. The US unemployment rate fell to 3.5% in July, down from 3.6% in June. Non-farm payrolls increased 187k, slightly below consensus at 200k, but had negative revisions in every single month in 2023, adding up to 245k fewer jobs than originally reported. US average hourly earnings rose 0.4% mom and 4.4% yoy, unchanged from June, but 20bps above consensus. The JOLTS report (Job Openings and Labor Turnover Survey) showed job openings declined to 9.58m in June from 9.62m in May (revised from 9.82m).

Eurozone: CPI inflation declined by 0.1% mom in July, in line with consensus and 5.3% yoy from 5.5% in June. Core CPI was unchanged at 5.5% (consensus 5.4%).

United Kingdom: The Bank of England raised its policy rate by 25bps to 5.25% in three-way 2-6-1 split. The overnight index swap (OIS) implied year-end terminal rate declined to 5.69% last week from 6.35% in July, implying two more hikes instead of five. Governor Andrew Bailey said inflation was starting to decline, but it was too early to talk about the timing of easing. Last week, British Airways workers received a 13.1% pay rise over an 18-month period and a one-off £1k payment, according to Unite Union. The annual pay increase adds to 9.9%, assuming an average wage at British Airways of £38,646.4

Australia: The Reserve Bank of Australia kept rates unchanged at 4.1% (consensus +25bps). CPI inflation peaked at 7.8% and declined to 6.0% before the decision. RBA sees CPI converging to the top end of the 2-3% target in Q4 2025. The door is open for a final hike should inflation not decline below 5% soon.

The author thanks the contributions from Olivia Shaul and Iylana James.

1. See: A report from the US Department of Labor

2. See: https://www.ft.com/content/524fdff1-a3f1-406f-9bcf-f3af606df52e

3. See: https://www.reuters.com/world/asia-pacific/pakistans-general-elections-under-new-census-indicates-delay-2023-08-05/

4. See: https://www.payscale.com/research/UK/Employer=British_Airways/Salary

Benchmark performance