Switching the focus: diverging policy, with one eye on diplomacy

The US Federal Reserve (Fed) pauses but remains hawkish, and the European Central Bank (ECB) hikes 0.25% and signals more hikes. Conversely in Asia, the Bank of Japan (BOJ) remains dovish despite elevated core consumer price index (CPI) inflation, and China and Vietnam both cut rates. The focus shifts to diplomacy this week: Secretary of State Blinken meets with his counterpart and Xi Jinping in Beijing, and China’s Premier Li Qiang visits Berlin and then Paris for the Summit for a New Global Financing Pact.

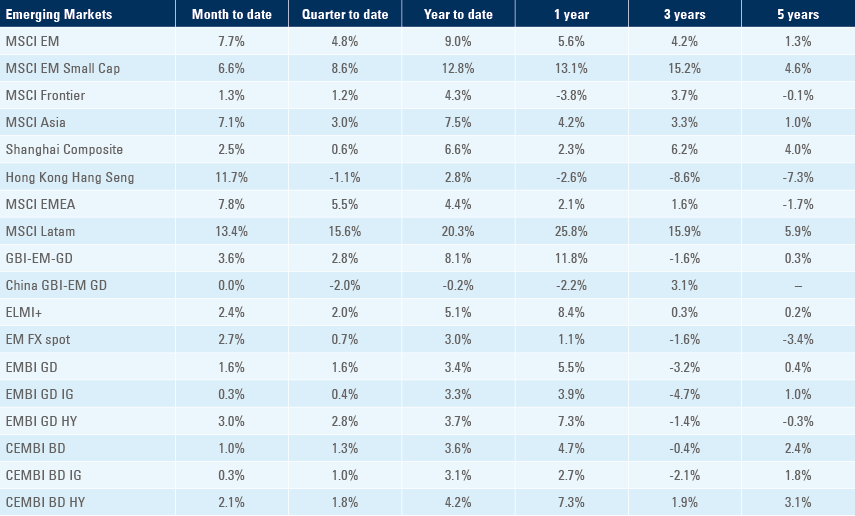

Emerging Markets

EM Asia

China: The People’s Bank of China (PBoC) cut its seven-day reverse repo policy rate by 10 basis points (bps) to 1.9% as credit conditions were tighter than expected and as economic activity softened further in May. Premier Li said more stimulus measures are “a must” to sustain recovery. At the State Council meeting on Friday, no major policy decision was announced, but the countercyclical policies discussed included monetary policy stimulus, expansion in domestic demand (green capital expenditure (capex) and high-speed rail), support for high end manufacturing, and addressing the real estate and local government debt burden. Economic data and credit creation were soft last week. Aggregate financing rose to RMB 1.56trn in May from RMB 1.22trn in April, as new yuan loans rose to RMB 1.36trn from RMB 0.72trn, both below consensus at RMB 1.90trn and RMB 1.55trn, respectively. The year-on-year (yoy) rates of industrial production, retail sales and fixed asset investment dropped to 3.5% (from 5.6%), 12.7% (from 18.4%) and 4.0% (from 4.7%), respectively. The yoy rate of property investment dropped by 100bps to -7.2%, despite residential property sales increasing by 10bps to 11.9% yoy.

India: The yoy rate of CPI inflation dropped by 50bps to 4.25% in May, slightly below consensus at 4.3%, bringing consumer inflation close to the mid-point of the Reserve Bank of India (RBI) 2-6% target range and the lowest reading since April 2021, while wholesale price index (WPI) inflation plunged to -3.5% yoy from -0.9% over the same period, signalling further disinflation for the incoming months. The RBI’s policy rate stands at 6.5%, the real interest rate is one standard deviation above the average real policy rate since 2012, further dampening any potential inflationary pressures. The faster-than-expected decline in CPI inflation means the RBI may be able to cut its policy rate before the year-end. The yoy rate of industrial production rose to 4.2% in April from 1.7% in March, significantly above consensus at 1.4%. The trade deficit widened by USD 22.1bn in May from USD 15.2bn in April, as imports of primary and intermediate goods used to manufacture products for domestic consumption and for export surged, another sign that growth momentum is improving.

Indonesia: The trade surplus narrowed to USD 0.4bn in May from USD 3.9bn in April, as the yoy rate of import growth rebounded to 14.3% from -22.3% while exports recovered to +1.0% yoy from -29.4% yoy. Local automobile sales jumped to 82.1k in May from 58.9k in April, above the average of the past five and ten years for the period where seasonality would suggest a 7k drop in sales.

Vietnam: The State Bank of Vietnam cut its policy rates by 50bps, effective from 19 June, lowering the discount rate to 3.0% and the refinancing rate to 4.5%. The announcement was the third 50bps cut in three months.

Latin America

Argentina: CPI inflation rose 7.8% month-on-month (mom) in May, below April’s 8.4% mom and lower than consensus expectations. Nonetheless, the yoy rate of inflation rose by 640bps to 114.2% over the same period. Food prices explained the bulk of the deceleration, increasing by 5.8% mom from to 9.8% mom on average over the last three months while housing and utilities increased by 11.9% mom, driven by the rise in utility tariffs, hotels and restaurants (9.3% mom) and healthcare (9.0% mom).

Brazil: Economic data was marginally stronger than expected as government transfers, lower inflation and the strong BRL offset the drastic tightening in financial conditions from higher rates. Nevertheless, the detail in the data also shows economic activity decelerating as the elevated 13.75% Selic rate starts to bite. The economic activity index rose 0.6% mom in April after declining 0.1% in March, bringing the yoy rate down to a still robust 3.3% from 5.7% over the same period. Retail sales rose 0.1% mom in April after rising 0.8% in March, bringing the yoy rate down to 0.5% from 3.3% over the same period, while broad retail sales, including autos and construction materials, declined by 1.6% mom (consensus -2.2%) as the yoy rate slowed to 3.1% from 8.8% over the same period.

Central Asia, Middle East, and Africa

Egypt: The yoy rate of CPI inflation rose 170bps to 40.3% in May. In other news, Russia accepted the application for Egypt to join the BRICS group. Six months ago, Egypt – alongside the United Arab Emirates (UAE) and Uruguay – had joined the New Development Bank formed by the BRICS nations. Egypt announced its intention to de-dollarise its commercial transactions with the BRICS, a measure likely to be complicated by the one-sided trade volumes between the country and its trading partners in the block.

Nigeria: President Bola Tinubu announced another key economic reform last week, leading to a sharp increase in business sentiment. After eliminating fuel subsidies in May, this is already alleviating pressure on Nigeria’s fiscal and external accounts due to the collapse of smuggling to neighbouring Cameroon, Niger, and Benin.1 Lower smuggling and the rationalisation of internal consumption will allow for a surplus of oil products to be exported, while the Nigerian state-owned oil company NNPC will stop losing money on subsidies. NNPC claims the Nigerian government owes USD 6bn of losses incurred to maintain the subsidies.2 The risk of social instability remains as the measure is likely to significantly impact transportation costs. After suspending the Central Bank of Nigeria’s former Governor Godwin Emefiele, the central bank announced all foreign exchange (FX) transactions will be unified in an investors and exporters (I&E) window, bringing the Naira to depreciate over 30% to NGN 702 last Thursday. The elimination of oil subsidies and devaluation of the Naira will allow for the improvement of Nigeria’s shortages of goods, external accounts, and investment climate. Further monetary policy tightening is anticipated due to subsequent inflationary pressure of these two policies.

South Africa: The yoy rate of mining production rose 2.3% in April after declining 2.2% in March, 80bps ahead of consensus as gold production rose by 27.4% yoy (from 21.6%) and platinum production declined 4.6% yoy (from -9.0% yoy prior).

Türkiye: The current account deficit widened to USD 5.4bn in April from USD 4.9bn in March (revised from USD 4.5bn). Foreign investors bought USD 262m of stocks and USD 25m of bonds in the week ending 9 June, the largest inflow since December 2022. This week, the Central Bank of Türkiye (CBT) will have its first monetary policy committee under its new governor. Consensus expectations are for a 650bps hike to 15%, but HSBC and Deutsche Bank expect the CBT to hike by 1,150 to 20.0%, which would be the more appropriate decision, in our view.

Central and Eastern Europe

Czechia: CPI inflation rose to 0.3% mom in May after declining 0.2% in April, but the yoy rate dropped 160bps to 11.1% due to base effects after peaking at 18.0% yoy in September 2022. Industrial prices declined 0.8% mom and the yoy rate dropped 280bps to 3.6%, significantly lower than its peak at 28.5% in June 2022. The current account surplus increased to CZK 16.7bn in April from CZK 11.3bn in March.

Poland: The current account surplus declined to EUR 0.4bn in April from EUR 1.6bn in March, as the trade surplus narrowed by EUR 0.4bn to EUR 0.2bn. Core CPI inflation rose 0.4% mom in May, down from 1.2% mom in April, as the yoy rate declined 70bps to 11.5%.

Romania: CPI inflation declined to 0.6% mom in May from 0.7% in April, as the yoy rate dropped by 60bps to 10.6% over the same period and wage inflation moderated 70bps to 15.0% yoy in April. The yoy rate of industrial output dropped by 100bps to -4.6% and industrial sales plunged 650bps to -3.0% yoy in April.

Snippets

- Colombia: Economic activity was softer than expected. The yoy rate of manufacturing and industrial production declined 6.4% and 3.0% respectively in April from -2.0% and -0.4% yoy in March, while retail sales dropped by another 20bps to 6.9% yoy, all below consensus. The consumer confidence survey improved marginally to -22.8 in May from -28.8 in April.

- Peru: The unemployment rate declined by 30bps to 6.8% in the capital city of Lima, close to the 6.5% average between March 2012 and March 2020. The yoy rate of the economic activity index rose 10bps to 0.3% in April.

- Philippines: Overseas cash remittances declined to USD 2.5bn in April from USD 2.7bn in March, a decline that was in line with seasonal standards as remittances remain at the highest level in five-years.

- South Korea: The unemployment rate declined 10bps to 2.5% in May, 20bps below consensus.

- Taiwan: The central bank kept its policy rate unchanged at 1.875%, in line with consensus.

Developed Markets

United States: The Federal Open Market Committee (FOMC) kept its policy rate unchanged at 5.25%, in line with consensus, but struck a more hawkish tone as the median Fed fund rate projection at 5.75%, implying two more hikes by the end of the year. However, it is worth remembering that the Fed’s dot plot chart had Fed fund rates ending 2023 at 1.5% in December 2021. Fed Chair Jerome Powell highlighted during the press conference that July was a “live” meeting, as no decision has been taken ex-ante, a comment that brought rates down and stocks higher. The President of Richmond Fed Tom Barkin emphasised he would prefer to hike a bit too much and risk a more protracted slowdown in activity than hike too little and risk repeating the experience of the 1970s.3 Governor Waller made the case for the slowdown in the pace of hikes in a speech in May, where he highlighted the risk of an excessive tightening on credit conditions, despite the stronger-than-expected economic activity.4 Overall, this sets the FOMC to hike at every other meeting, contingent on incoming economic data and credit conditions.

In economic news, CPI inflation slowed to 0.1% mom in May from 0.4% in April, as the yoy rate dropped 90bps to 4.0% (consensus 4.1%), while core CPI was unchanged at 0.4% mom, bringing the yoy rate down only 20bps to 5.3% (consensus 5.2%). Producer price index (PPI) final demand inflation declined 0.3% mom in May (consensus -0.1% mom), after rising 0.5% in April, taking the yoy rate down 30bps to 2.8%. Initial jobless claims were unchanged at 262k on the week ending 10 June, higher than consensus at 245k, while continuing claims rose by 20k to 1.775m in the previous week. Retail sales rose 0.3% mom in May after 0.4% mom in April, significantly above -0.2% consensus while industrial production dropped 0.2% mom (0.5% mom prior), below consensus for a 0.1% increase over the same period. Economic surveys were mixed as small business optimism increased only 0.4 to 89.4, remaining at the most depressed levels since 2008, while the University of Michigan sentiment survey improved 4.7 points to 63.9, with both current conditions and expectations rising while one-year inflation expectation went down to 3.3% (4.1% est. and 4.2% prior) while five-to-ten year expectations were down 10bps to 3.0% (in line with consensus).

Eurozone: The ECB hiked its deposit, refinancing and lending policy rates by 25bps to 3.5%, 4.0% and 4.25% respectively, in line with consensus, adding to a cumulative 400bps of hikes in less than one year. ECB Governor Christine Lagarde struck a hawkish tone, calling on the ECB to hike policy rates further at the 27 July meeting, unless there is a “material change in the baseline outlook”. Lagarde is focusing on the wage pressure impact on core inflation. The ECB increased its inflation expectations by 10bps to 5.4% in 2023, 3.0% in 2024 and 2.2% in 2025, but increased its estimates of core inflation by 50bps for 2023 and 2024 to 5.1% and 3.0% respectively, and by 10bps to 2.3% in 2025.

The ECB also confirmed it will stop reinvesting proceeds from maturing bonds on its Asset Purchase Programme from July, and sees no need to offer new long-term liquidity injection after the EUR 477bn of targeted longer-term refinancing operations (TLTROs) expires on 18 June. On economic news, the yoy rate of labour cost inflation declined by 60bps to 5.0% in Q1 2023, and the trade balance deteriorated to a EUR 7.1bn deficit in April after a EUR 14.0bn surplus in March (consensus EUR 17.5bn surplus). In other news, the German ZEW survey (conducted with market participants) of expectations improved by 2.2 points to -8.5, although current conditions plunged 22 points to -56.5 due to the poor performance of German industry and manufacturing, highlighting the challenging activity conditions even before the bulk of the ECB tightening impacts the economy.

Japan: The BOJ kept its policy rate and the yield target on ten-year government bonds unchanged at -0.1% and 0.0% (+/- 50bps) respectively. BOJ Governor Kazuo Ueda did not alter the view that the current elevated CPI is cost-push from higher import costs and the weak JPY. The BOJ is still set to carry a 12-18-month review of past loosening monetary policy. While Ueda has suggested that policy could be changed while the review is ongoing he gave no indication on whether inflationary or economic conditions warrants a policy change soon. The consensus expectations for core CPI by the end of the year have risen 10bps to 2.9% over the last two weeks, compared with 2.5% in April 2023, which is already the highest level since 1992.

Geopolitics

US Secretary of State Blinken met with counterpart Foreign Minister Qin Gang for over seven hours in Beijing on Sunday. Both sides said the talks were constructive and that the tone was candid, covering differences from Taiwan to trade. US and Chinese officials both emphasised their desire for stable and predictable relations, and pledged to continue the conversation at meetings in Washington D.C. in the future. Blinken then met with Chinese President Xi Jinping in Beijing on Monday afternoon. Afterwards, Xi said: “The two sides have also made progress and reached agreements on some specific issues. This is very good”.

Chinese officials were clear that Taiwan is the most important issue and presents the greatest risk. More meetings were on the agenda for Monday, including with top foreign affairs official Wang Yi, the head of the Communist Party’s Foreign Affairs Commission, who made the point that: “It is necessary to make a choice between dialog and confrontation, cooperation and conflict”.

Chinese Premier Li Qiang arrived in Berlin on Sunday 18 June, for a very timely China-Germany Economic and Technical Cooperation Forum. These talks coincide with the release of Germany’s first-ever national security strategy last Wednesday, which called China a “systemic rival” that is “Repeatedly acting in contradiction to our interests and values”. Next month, Germany releases its China strategy, which will delve into specific items like outbound investment controls, supply-chain stress testing and Taiwan. At the same time, the European Union will launch its own economic security strategy, which will notably explore how to de-risk its trading ties with China.

Li’s stop in Berlin is the first stage of a six-day trip to Europe, where he will also travel to Paris to attend the Summit for a New Global Financing Pact on Thursday and Friday. The summit will also be attended by US Treasury Secretary Janet Yellen, as well as the newly-appointed World Bank President Ajay Banga. The organisers expect more than 100 heads of states and governments to attend, in the words of the summit’s co-host, the Prime Minister of Barbados Mia Mottley, to: “Build a more responsive, fairer and more inclusive international financial system to fight inequalities, finance the climate transition, and bring us closer to achieving the Sustainable Development Goals”.

1. See: https://dailytrust.com/cameroon-niger-benin-citizens-lament-fuel-subsidy-removal-in-nigeria/

2. See: https://www.aljazeera.com/news/2023/5/31/nigeria-fuel-subsidy-cut-spiralling-costs-all-you-need-to-know

3. See: https://www.richmondfed.org/press_room/speeches/thomas_i_barkin/2023/barkin_speech_20230616

4. See: https://www.federalreserve.gov/newsevents/speech/waller20230524a.htm

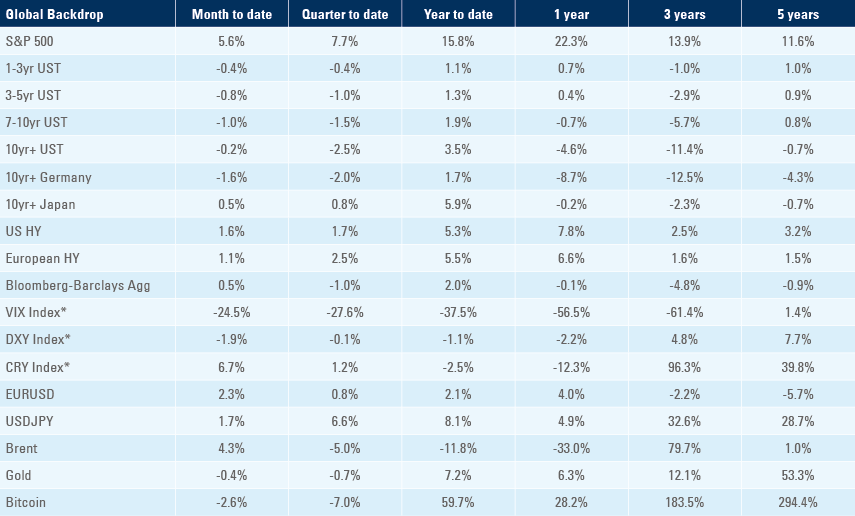

Benchmark performance