China upped the ante on supportive policies to both the real estate sector and stock market, sparking a USD 11.9bn weekly inflow to Chinese equities. GDP growth surprised to the upside in South Korea. Tax collection was better than expected in Brazil. The bickering between Hungary and Europe over aid to Ukraine intensified. Ghana got a boost as new oil refining capacity came online, while Ivory Coast successfully tapped USD Eurobonds. The US economy remained strong in the fourth quarter of 2023, as gross domestic product (GDP) grew faster than expected, giving bragging rights to Joe Biden over his fiscal policy. The European Central Bank (ECB) kept policy rates unchanged, maintaining that while the “disinflation process is at work”, talk of rate cuts remains premature. Brent crude prices rose 6.5% month-to-date to a three-month high of USD 82.4 per barrel as US crude inventories dropped to their lowest since October 2023, and a Russian refinery came under drone attacks.

Global Macro

US Data

The US economy expanded at an annual rate of 3.3% in Q4 2023, down from 4.9% in Q3, but much faster than the 2.0% consensus estimate. This gave bragging rights to Joe Biden, who can point to these figures as a demonstration of his success, as growth stayed resilient and inflation declined amidst a high interest rate environment, albeit Biden’s main issue is about the elevated level of prices. In a speech in Wisconsin on Thursday, Biden said that effective fiscal spending during his tenure on green energy, roads, and other infrastructure was instrumental to this resilience. The “soft landing team” received a further boost from core personal consumption expenditure (PCE) inflation, which declined from 3.2% in November to 2.9% in December and was at 2.0% annualised over Q4 2023. However, higher initial unemployment claims (+25k in January) and consistently weak manufacturing and services purchasing managers’ indices (PMI) data cloud the picture. Revised seasonal consumer price index (CPI) factors for 2023 (due on 9 February), will be closely watched.

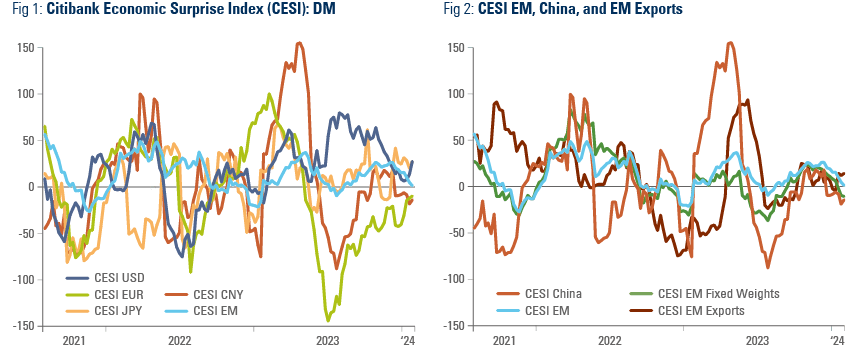

Overall, the Citibank Economic Surprise Index rose another 10 points to +25 last week. The gap between the US and Europe widened again but remains on a narrowing trend as per Fig 1. The EM Surprise Index continues to decline after peaking in Q3 2023, but EM exports have posted positive surprises over the last weeks and are in positive territory, as per Fig. 2.

Christine Lagarde says, “disinflation work is in progress”

The ECB kept its deposit and refinancing policy rates unchanged at 4.0% and 4.50%, respectively, as widely expected. The ECB maintained that this level of borrowing costs will eventually make “a substantial contribution” to lowering consumer prices. President Christine Lagarde said that while the “disinflation process is at work, talks of rate cuts are still premature”. This was after she told Bloomberg in Davos last week that the ECB could start cutting rates in the summer. Lagarde highlighted that a combination of strong wage growth and low productivity is keeping inflation sticky and suggested that for the ECB to turn more dovish, energy prices staying lower will be key. It will continue to monitor the supply chain disruptions in the Red Sea “very carefully”. On the other hand, growth and inflation trends were toned down in the prepared statement, and Lagarde acknowledged that the headline inflation rise in December was smaller than the ECB expected.

Geopolitics

Russia intensified its missile bombardment of Kharkiv and Kyiv this week. Reports surfaced that Vladimir Putin has indirectly signalled to the US that he is open to discussion over peace talks. However, in our view, this is not representative of a significant shift in the dynamics of the war. While never indicating he was willing to stop at the current front lines, Putin has stated numerous times in the past that Russia is open for negotiations on Ukraine. This may be a bluff, or a move to make Russia seem more moderate to the international community. However, it is generally understood that any agreement would be contingent on Ukraine officially relinquishing the Donbas Region and Crimea to Russia. For now, this remains out of the question for Volodymyr Zelenskyy and Ukraine, but their calculus may change depending on the progress on the ground as well as the likelihood it will stop receiving support from the United States (US).

The International Court of Justice (ICJ) ordered Israel to take steps to limit harm to Palestinians in Gaza, in a response to South Africa's request for emergency measures to be applied, while its case, accusing Israel of genocide, is heard. The ICJ rejected Israeli bids to throw out the case.

Brent crude prices rose 6.5% month-to-date to USD 82.4 per barrel, a three-month high, after drone attacks on a Russian refinery and US crude inventories dropped in the week ending 19 January to the lowest since October 2023. The Drewry’s World Container Index rose for the seventh consecutive week to USD 4k/40ft, nearly three times above the November 2023 levels.

Emerging Markets

EM Asia

China: One week after disappointing markets by keeping policy lending rates unchanged, the People’s Bank of China (PBoC) announced a 50bps RRR cut for all banks with RRR above 5.0%, effectively releasing RMB 1trn of liquidity, effective from 5 February. PBoC Governor Pan Gongsheng also announced a 25bps cut in re-lending and re-discounting rates for rural/SME sectors. The one-year and five-year prime rates were left unchanged, at 3.45% and 4.20%, respectively. Chinese authorities are considering a package of measures to stabilise the stock market, with policymakers seeking to mobilise about USD 280bn from offshore Chinse state-owned enterprise (SOE) accounts to buy shares onshore through the Hong Kong exchange link. Beijing has pledged RMB 1trn of direct policy support via pledged supplementary lending (a loan from the policy banks to specific projects) for developers, of which RMB 350bn was disbursed in December. China does not have room to increase supply-side stimulus promoting infrastructure, but it is solely in their hands to backstop the current malaise. In our view, Beijing should focus on delivering targeted resources for developers to finish buildings sold, buy its unfinished projects, promote ‘urban villages’ (shantytown) renovations, and improve policies providing social welfare to motivate the population to reduce its savings rates. The MSCI China Index rebounded more than 5.0% last week as investors digested the large stimulus measures.

India: India's stock market capitalisation briefly overtook that of Hong Kong's last week for the first time, as global capital continued to flow into India and out of China. It is now the fourth-largest stock market in the world. There is room for a tactical outperformance of China, but the structural trend of flows is likely to continue to favour India.

Malaysia: CPI inflation remained at 3.5% yoy in December, as expected, while foreign reserves rose by USD 1.5bn to USD 115bn.

South Korea: Producer price index (PPI) inflation rose 1.2% yoy in December, from 0.6% prior, driven by a 4.9% rise in food prices. Consumer confidence rose from 99.5 in December to 101.6 in January. The yoy rate of real GDP growth rose 2.2% in Q4 2023 (0.6% qoq), slightly above consensus. Higher net exports and government spending compensated for a slight private consumption decrease. This data should give the Bank of Korea some room to keep rates higher for longer and keep inflation on a downward path towards target, while encouraging some further private sector deleverage. While domestic demand remains constrained, exports, driven by higher semiconductor demand, are likely to remain the key growth engine.

Taiwan: The unemployment rate was unchanged at 3.4%. Export orders declined by a yoy rate of 16.0%, from +1.0% yoy prior, led by steep drops in demand from the US (-22%) and Europe (-39%). No economist had predicted a decline of more than 5.0%. This marked a return to pre-pandemic seasonal trends, when data normally slowed towards year-end, with Christmas production orders being filled in the months prior.

Vietnam: CPI inflation rose 3.4% in January, from 3.6% in December (vs. 3.3% est.).

Latin America

Argentina: Argentina's monthly budget deficit for December widened to ARS 2.0trn, from ARS 210bn prior. Economy Activity Index data declined by -0.9% yoy in November, from +0.6% prior. On Wednesday, the Confederación General del Trabajo, the country's largest labour union, called for a general strike, staging a major demonstration in Buenos Aires against the economic austerity measures proposed by President Javier Milei in his Omnibus Bill. Argentina's government responded by announcing it will dock a day's pay from striking public servants. A statement from Patricia Bullrich, Milei's Security Minister and former election rival, said the strikes stemmed from “mafia unionists” and other corrupt actors who are “resisting the change that society chose democratically”. The Omnibus Bill was approved at the committee level and will be debated and voted on in the plenary of the Lower House next week. Negotiations are ongoing, with opposition legislators particularly opposed to the widespread export taxes proposed. The government reportedly agreed on an increase in the capital gains tax that is primarily retained by the provinces to boost the odds of approving the bill.

Brazil: Tax collections increased from BRL 179bn to BRL 231bn, slightly more than expected. On Monday, President Lula's government unveiled plans to invest USD 60bn into Brazil's ageing industries. At an event in Brasilia to market the plan, Lula said “For Brazil to become competitive, it has to finance some of the things it wants to export. The international market is very competitive. It’s a war”. This reindustrialisation plan will likely extend credit and funding to sectors including defence and agribusiness and encourage decarbonisation and modernisation of infrastructure. Market participants get goosebumps hearing about industrial policy designed by the Worker’s Party. The key will be in the implementation. More worrisomely, there were reports of Lula criticising mining company Vale for investing little and there were rumours Lula was willing to install his former finance minister Guido Mantega as CEO. The government has some indirect influence over Vale via the public pension plans minority ownership of the company. In other news, Vale and BHP Group were ordered to pay BRL 47.6bn (UDS 9.7bn) in compensation for damages caused in a 2015 tailings dam disaster in Brazil, a judge ruled.

Mexico: Bi-weekly CPI inflation was unchanged at 0.5% mom (4.9% yoy) in the first fortnight of January, 10bps above consensus. Core inflation met expectations at 0.3% MOM and 4.8% yoy, but some pressures, such as housing, persisted, likely reflecting Mexico's positive output gap (real GDP growing above its potential). The unemployment rate fell 10bps to 2.6% in December, in line with consensus.

Central and Eastern Europe

Poland: The yoy rate of retail sales growth slowed to just 0.5% yoy in December, from 2.6% yoy prior, significantly below 4.6% consensus, as household goods and fuel consumption were weaker. Industrial output decreased 9.8% mom in December, slightly less than expected, following a 0.6% uptick the month prior. The unemployment rate rose 10bps to 5.1%.

Hungary: European officials said that if Hungary's President Viktor Orban chooses to block EUR 50bn of funding to Ukraine in February, Article 7 may be invoked. This would mean stripping Hungary of its voting rights. This came in the same week as the US ambassador to Hungary lamented a delay in ratification over Sweden joining NATO. Türkiye’s parliament approved Sweden's membership last Thursday. The pressure started yielding results as Orban said Hungary was committed to ratifying Sweden’s NATO bid.

Central Asia, Middle East, and Africa

Egypt: The trade deficit narrowed in December, to USD 3.1bn in November from USD 3.2bn in October.

Ghana: A new USD2.0bn oil refinery started operations in Ghana last week. It will produce 50k barrels a day before doubling its capacity by 2025. The refinery was built by the Chinese conglomerate Sentuo Group. Ghana currently produces around 180k barrels of crude oil per day and consumes 88k barrels of refined product daily. Thus, this extra volume is likely to heighten export capacity significantly.

Nigeria: Nigeria sold USD 316m of local currency bonds in the first weeks of 2024, 47% less than last year. According to loading schedules compiled by Bloomberg, Nigeria's oil exports are set to climb by 16% mom in March. Nigeria's oil production is likely set to increase on a sustainable basis, in our view, as it improves ageing infrastructure.

Ivory Coast: Ivory Coast sold the first US dollar bond issue from a sub-Saharan African state in nearly two years. The world's largest cocoa producer sold a USD 1.1bn 2033 sustainable note and USD 1.5bn in a conventional 2037 bond. Both bonds were met with strong demand. The 2033 sustainable note was issued to yield 7.875%, down 50bps from its initial price talk (IPT) and the conventional bond priced 37.5bps lower than IPT at 8.5. On Friday, Ivory Coast halted forward sales of cocoa for the 2024-25 season, amid concerns rise over declining production.

Saudi Arabia: Aramco continued to send oil tankers through the southern Red Sea, stating the associated risks were “manageable”. The Saudis called for restraint in US and UK airstrikes against the Houthis, as they seek to end military involvement in the Yemen civil war. Yemen has been under civil war since 2014 as Houthi rebels fight to take control of the country. A coalition led by Saudi Arabia, the United Arab Emirates and other Arab countries, tried unsuccessfully to restore the full territory to the government.

South Africa: CPI inflation yoy fell to 5.1% in December, 10bp more than expected, and core CPI was unchanged at 4.5% yoy. The SARB kept interest rates at 8.5%, as expected.

Türkiye: The one-week repo rate in Türkiye was hiked from 42.5% to 45%, in line with consensus, thus consolidating real policy rates.

Developed Markets

United States: Real GDP growth rose to an annualised rate of 3.3% in Q4 2024, from 4.9% prior, but still much above consensus at 2.0%. This boosted optimism that the US Federal Reserve (Fed) can deliver a soft economic landing. Initial jobless claims rose by 25k to 214k. Richmond Fed's January manufacturing survey fell to -15, from -11 last month (-8 consensus) with capacity utilisation slowing most markedly, from -8 to -27. Mortgage applications rose 3.7% to their highest level since April, signalling a pickup in housing demand, as borrowing costs on fixed mortgages dropped below 7%. Former president Donald Trump publicly endorsed downgrading China's trade status with the US, a move that would lead to a significant and disruptive increase in the average rate of Chinese import tariffs.

Eurozone: The ECB kept its main refinancing rate unchanged at 4.5%. President Christine Lagarde said the “disinflation process is at work”, while outlining that wage growth and low productivity are keeping inflation sticky. A report by the European Council on Foreign Relations thinktank suggested Eurosceptic parties will be the most successful in nine member countries (Austria, Belgium, Czechia, France, Hungary, Italy, the Netherlands, Poland, and Slovakia) in June’s European Parliament elections.1

Japan: The Bank of Japan (BoJ) maintained negative policy rates, at -0.1%, with the ten-year yield target at 0%. After the decision, the BoJ Governor Kazuo Ueda maintained that any rate increase would be gradual, aiming to keep monetary policy supportive of the economy. January's inflation readings further complicated the picture. Tokyo CPI inflation fell to a yoy rate of 1.6% in January from 2.4% yoy in December, 40bp more than expected. Interest rate futures price in a 70% odds of a rate hike by April. Exports rose 9.8% yoy in December, the fastest for a year, from 0.2% in November. Imports dropped to a yoy rate of 6.8%, more than expected, flipping the trade balance from a JPY 780bn deficit to a JPY 62bn surplus.

United Kingdom: Consumer confidence improved slightly in January, from -22 in December to -19, (vs. -21 est.)

1. See – https://www.eureporter.co/politics/european-parliament-2/2024/01/25/a-sharp-right-turn-a-forecast-for-the-2024-european-parliament-elections/

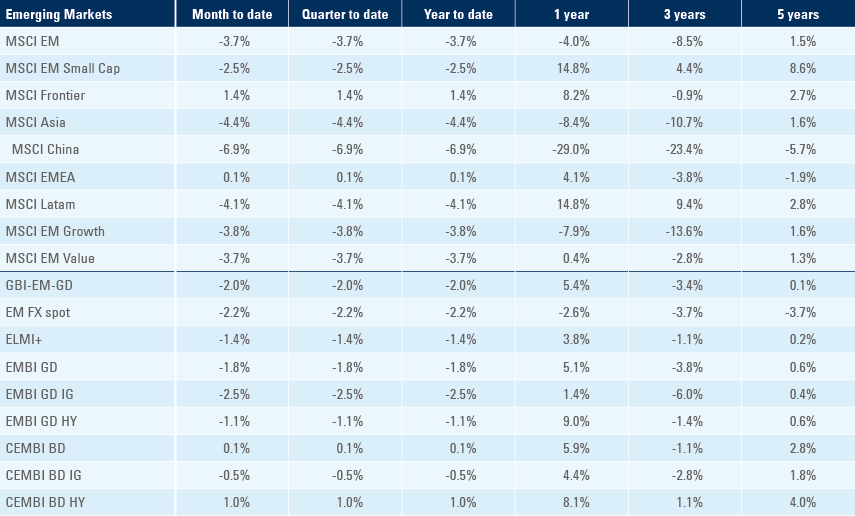

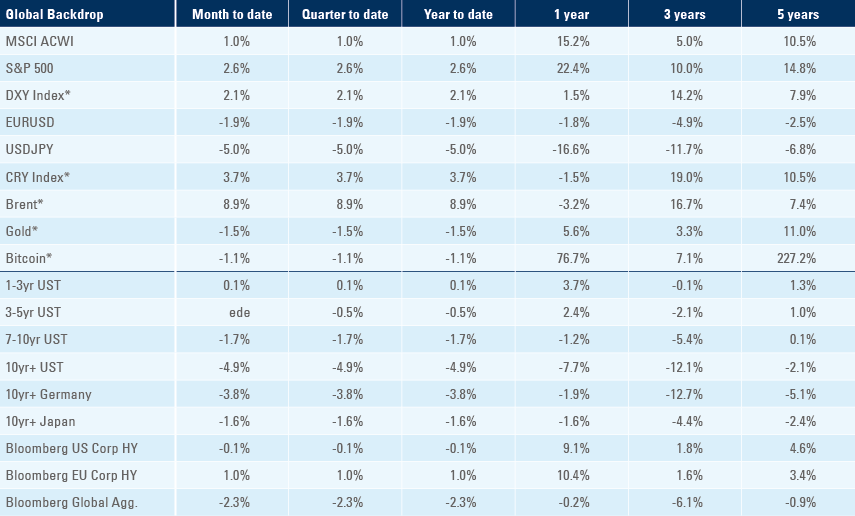

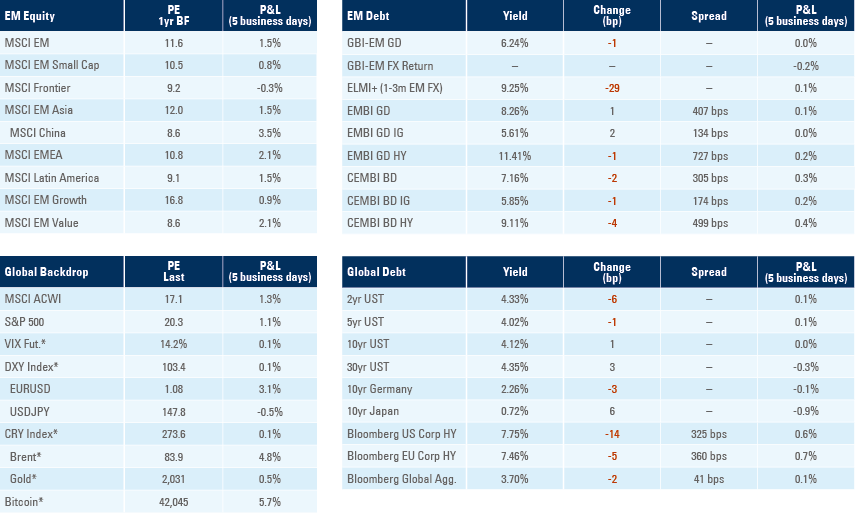

Benchmark performance