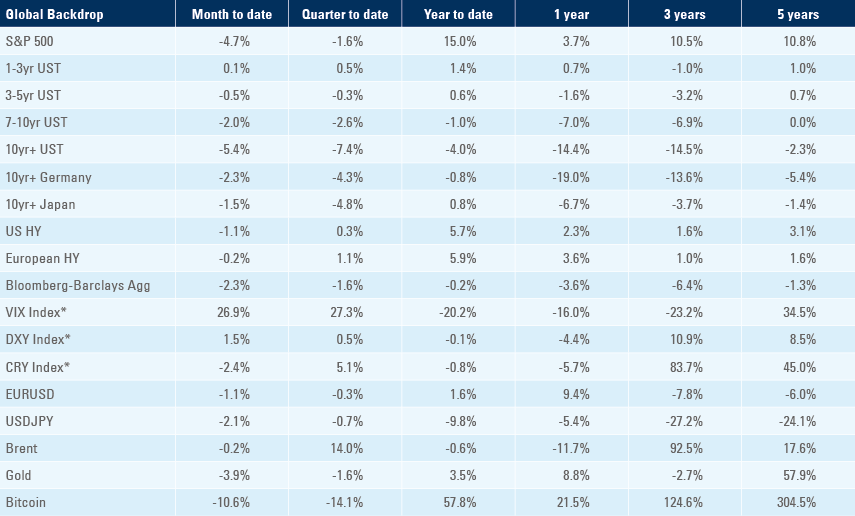

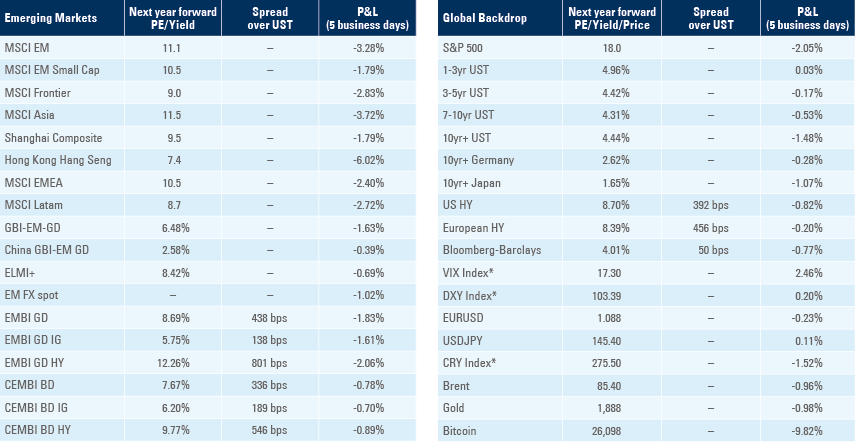

The US and Chinese economic surprise indices push markets into peak US optimism and peak China pessimism. US Treasury yields continue to rise, driven by real rates, under the twin effects of strong data and large Treasury issuance. China’s economic data comes below expectations, pushing the People’s Bank of China (PBoC) to cut some policy rates and to intervene to defend the yuan (CNY). Argentina’s Javier Milei pledges of fiscal rectitude are welcome for markets, but do little to stabilise the Argentinian peso (ARS). In Ecuador, the election will go to a second round, pitting Luisa González’s brand of Correismo against the younger fiscally conservative Daniel Noboa.

Global Macro

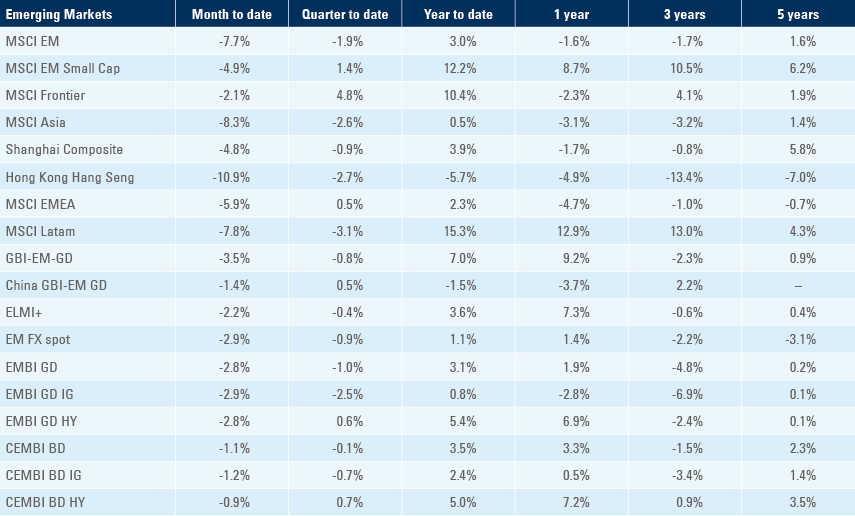

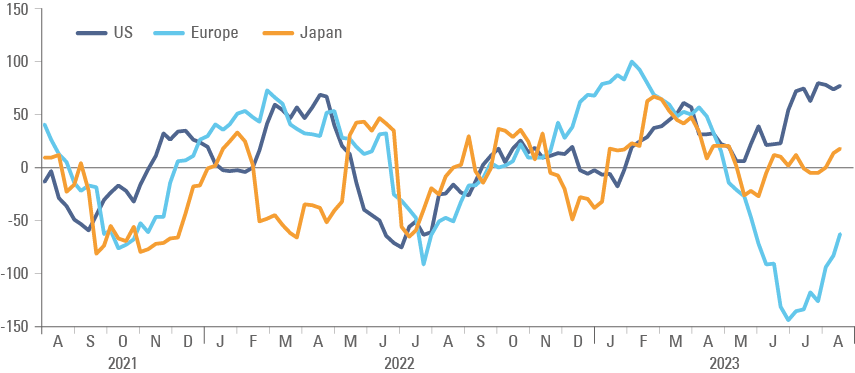

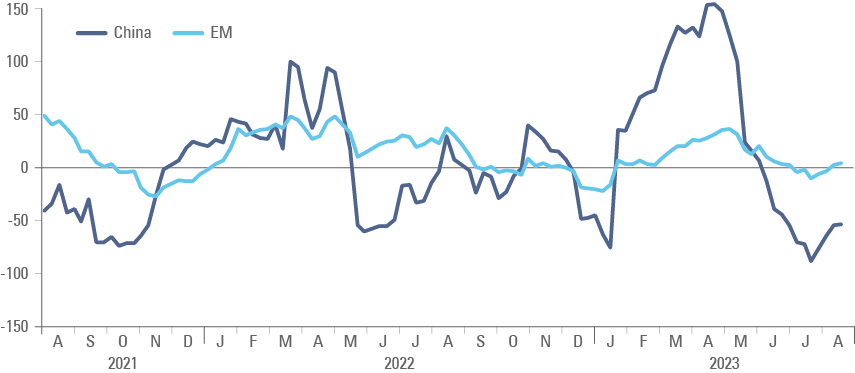

The Citi Economic Surprise indices offer an insight into the recent economic data and the impact on market psychology: the US, Japan, and Emerging Markets (EM) indices are in positive territory, which indicates data has come in above expectations (at 78.9, 18.2, and 3.3, respectively), while Europe and China are near multi-year lows (-64.9 and -54, respectively).

Fig 1: Citi Surprise Index for US, Europe, and Japan

Fig 2: Citi Surprise Index for China and EM

The string of positive surprises in the US economic data is encapsulated by the rise in the Federal Reserve Bank of Atlanta’s GDPNow real-time forecast model for Q3, which rose to the unexpected level of 5.8% (seasonally-adjusted annual rate). The drawback of this sudden surge, however, has been the corresponding increase in US interest rates, driven by real rates. US 10-year real rates, measured by the Treasury Inflation-Protected Securities (TIPS) market, were up 17 basis points (bps) over the previous week and 40bps up since the start of the month. They are within a few bps of 200bps, at their highest level since 2009. This has been taking the wind out of the sails of US equities in recent weeks, with the S&P 500 index clocking its third week of negative returns for the first time since March this year.

China: Concerns about the economy escalated following the news that leading Chinese trust company Zhongrong International Trust Co, had missed payments on high-yielding wealth management products. There are an estimated CNY 15trn in ‘Trusts’ assets under management (AUM) in China, of which Zhonrong is estimated to manage 3% or USD 60bn. The incident will dent sentiment and wealth manager appetite for trusts, but it does not amount to a systemic shock.

Within the broad category of trusts, the amount of so-called ‘shadow banking’ invested in non-standard, private instruments has nearly halved to RMB 3trn from the peak in 2020. This has followed tougher regulation and tighter limits on non-standard products that trusts are allowed to offer, first introduced in 2018. The figure is large in absolute terms, but small relative to the nearly RMB 400trn of assets in China’s banking system. Moreover, there have been instances of non-standard trust products failing in the past, and the high-net-worth investors that remain exposed to these products no longer rely on implicit government support and will have understood the risks taken.

After last week’s disappointing credit growth data, economic data continued to come significantly below expectations last week: industrial production rose 3.7% year-on-year (yoy) in July, a decline from 4.4% in June and 60bps below expectations; retail sales rose 2.5% yoy in July, down from 3.1% in June, and 150bps below expectations. These data led to cuts in analysts’ GDP forecast for 2023: Nomura Securities cut its forecasts from 5.1% to 4.6%, and Morgan Stanley from 5.0% to 4.7%.

In response, the PBoC cut the one-year medium-term lending facility (MLF) rate by 15bps to 2.5%. This is coming quite shortly after the 10bps cut announced last June, and the move is both larger, and earlier than expected. The PBoC also injected some liquidity (c. CNY 200) via a seven-day reverse repo operation conducted at the lower rate of 1.8% instead of 1.9%. Over the weekend, the PBoC held meetings with bank officials and urged them to boost lending. This was followed by the announcement that banks are cutting the one-year loan prime rate (LPR) by 10bps to 3.45%. However, the market remains nonplussed as the five-year rate was left unchanged and the real issue resides with low confidence and tepid demand for loans, rather than lending rates per se.

The economic data and monetary policy have put pressure on the renminbi. The currency has weakened by 10c against the US dollar during the week, to an intra-day high of 7.35, but it was held up by massive intervention by the central bank and state banks during the week, which prevented CNY from closing over 7.30, the level reached by USDCNY at its peak last November.

Last week, China Evergrande Group filed for protection from creditors under Chapter 15 of the US bankruptcy code. This step is effectively designed to guarantee that the debt restructuring process agreed with creditors outside the US is binding under US law, closing the door to any potential disputes. This demonstrates that Evergrande remains on track and moving ahead with its debt restructuring process.

Commodities: After a few red-hot weeks for oil prices, West Texas Intermediate (WTI) prices fell 2.3% last week, and gasoline prices retreated 4.32%.

Top EM stories

Argentina: Following Javier Milei’s success in the presidential primary election called PASO (Primarias Abiertas Simultáneas y Obligatorias) last week, his new-found position as a front-runner in next October’s general election has provided a greater platform for his message. In an interview with Bloomberg, Milei highlighted his opposition to relations with China, refusal to work with “socialists” (including Brazilian President Lula), and his radical economic policy such as the dollarising of the economy and closing down the central bank. He also pledged to significantly reduce public spending to tackle large fiscal deficits, which he considers “immoral” and, more prosaically, to “avoid a default”. While the point of principle on deficits will please market participants, the radical plans to scrap the peso have been dismissed as unworkable given Argentina’s low level of reserves, and have generally increased the degree of risk and uncertainty for holders of the local currency.

Pressure on the peso escalated after the election and the central bank (BCRA) devalued it by 18% to a new official exchange rate of 350 ARS per USD. The BCRA pledged to maintain this foreign exchange (FX) rate until the general elections in October, but the peso’s parallel exchange rate weakened further throughout the week. Currency devaluation is expected to add to inflation next month. July’s month-on-month (mom) consumer price index (CPI) inflation rose to 6.3% from 6.0% in June, 80bps below consensus.

Ecuador: Luisa González came out on top after the first round of the presidential election with 33% of the votes after 86% of the ballots were counted. This was below the threshold required to win the election outright in the first round, so the election is going to a run-off in October. González is seen as the heir to left-wing populist ex-president Rafael Correa, and will need to find allies and broaden her appeal to win against her opponent Daniel Noboa next October. Noboa came second with 24% of the votes cast, a strong showing considering the high number of candidates and his relatively young age of 35. Noboa is a fiscally conservative former businessman whose real chances of victory in the second round will be well received by the market. Regardless, the next administration seems condemned to follow through with the closure of an important oil field in Yasuni National Park, which will impact oil production and dollar revenues.

EM Asia

India: July CPI inflation rose 7.4% from 4.9% in June, 100bps above consensus. This was largely driven by a sudden rise in the price of vegetables, creating concerns for August’s print to remain sticky around July’s levels. Industrial production rose 3.7% in June yoy, contracting 0.2% mom.

Indonesia: The government’s proposed budget for 2024 was approved. Expenditure levels represent a deficit of 2.29% of GDP, in line with the previous budget. USD 34bn has been allocated to build a new capital city in East Kalimantan. The ambition is prompted by the current capital Jakarta’s increasing vulnerability to flooding caused by climate change over the next 30 years. The trade surplus narrowed more than expected from USD 3.5bn in June to USD 1.3bn in July, on account of increased imports of oil and gas, while exports decline 18% yoy, 117bps below consensus and 315bps less than the decline in June.

Malaysia: GDP grew 2.9% yoy in Q2, down from 5.6% in Q1, 40bps below expectations. Exports fell -13.1% yoy in July, from -14.1% in June, 2.0% below expectations, while imports fell -15.9% yoy in July, from -18.7% in June, 50bps below expectations.

Philippines: The Bankgo Sentral ng Pilipinas (BSP) held its monetary policy rate unchanged for the third consecutive meeting at 6.25%, in line with expectations. This was the first meeting under new governor Eli Remolona.

Thailand: GDP growth slowed to 0.2% qoq (seasonally adjusted) in Q2 from 1.7% in Q1 as the boost from tourism failed to mitigate weakness elsewhere. In politics, another vote to select the prime minister is expected to take place on 22 August, with the real estate tycoon Srettha Thavisin of the Pheu Thai Party in the running for the top role.

Latin America

Brazil: Economic Activity/GDP declined 5bps in July to 2.1%, 30bps above market expectations.

Chile: GDP fell -1.1% yoy in Q2, down from -0.8% in Q1, 30bps above expectations.

Colombia: Colombia’s trade deficit widened to USD 766m in July from USD 599m in June, USD 60m wider than estimates. Real GDP growth contracted 1.0% in Q2 compared to 1.4% growth in Q1, a 70bps larger contraction than anticipated.

Peru: The unemployment rate declined to 6.3% in July from 6.6% in June, 10bps below expectations. Economic Activity/CB GDP contracted by -0.6% In June yoy, 10bps above expectations, compared to a contraction of 1.3% yoy in June.

Central Europe, Middle East and Africa

Hungary: Hungary continued along a recessionary path, as GDP (non-seasonally adjusted, yoy) declined 2.4% in July, below market expectations of -1.3%. This was driven by the weak contribution of agriculture and services to output.

Nigeria: President Ahmed Bola Tinubu caved into the demands of citizens and labour unions by suspending fuel price hikes. Fuel subsidies were removed in June to make progress towards fiscal consolidation, but inflationary consequences sparked nationwide protests. It is estimated that prices at the pump should have risen to NGN 700 this month, but the Nigerian National Petrol Corporation is holding prices at NGN 617. CPI inflation rose to 24.1% yoy in July from 22.8% in June, 50bps above expectations.

Niger: The military coup in Niger three weeks ago has both political and economic implications: the country is enrolled in an International Monetary Fund (IMF) programme, but financial aid has been suspended and the regional security environment remains very tenuous. The Economic Community of West African States, headed by Nigeria’s Bola Tinubu, has been threatening to intervene militarily unless constitutional order is restored. A diplomatic dialogue is now underway, and Niger’s new leader has tried to win time by pledging that the country would return to democracy within three years.

Poland: CPI inflation declined to 10.8% yoy in July, from 11.5% the previous month due to the fall in seasonal food and energy prices. Annual GDP growth contracted 0.5%, 20bps below expectations, falling further from last month’s level of -0.3%. A referendum is set to be held in October, coinciding with the elections, and will pose four questions – the most significant being whether the sale of state-owned enterprises should be allowed.

Russia: The Russian central bank (RCB) hiked its main policy rate by 350bps, from 8.5% to 12%, in an emergency meeting on Tuesday. This followed the rise of inflationary pressures and rapid FX depreciation (USD/RUB has depreciated 44% since the end of Q2 2022) with the rouble slipping beyond 100 to the USD dollar for the first time since March 2022, before gaining some strength following the hike, finishing the week around 94.

Turkey: The new economic team is trying to unwind some of the unconventional economic policies put in place in recent years. One such policy tool is the TRY-denominated deposit accounts indexed on the FX exchange rate, known as the KKM programme. Following steps taken by finance minister Simsek last week, banks are now discouraged from offering these accounts.

Developed markets

Canada: CPI inflation rose by 50bps to a yoy rate of 3.3% in July, 30bps above consensus.

Eurozone: The Eurozone yoy rate of real GDP growth came in line with expectations at 0.6% in seasonally-adjusted terms for Q2.

Japan: Industrial production rose 2.4% mom in July from 2.0% mom in June. Real GDP growth rose 6.0% in Q2 2023 compared to 2.0% in Q1 2023 in annualised seasonally-adjusted terms, 310bps above consensus. CPI inflation rose 3.3% yoy for July, in line with both expectations and the June release.

United Kingdom: Wage growth rose 7.8% yoy in Q2, the highest level on record since 2001, underscoring the fact that the Bank of England is yet to break the wage-price spiral. However, the unemployment rate increased by 20bps to 4.2% in Q2, as the employment rate decreased, and participation rates stayed broadly flat. The yoy rate of CPI inflation declined by 110bps to 6.8% yoy, 10bps above consensus.

United States: US industrial production rose 1.0% mom in July from -0.5% mom in June, 70bps above consensus, as the yoy rate increased by 20bps to -0.2% over the same period. The July Federal Open Market Committee (FOMC) minutes show a majority of officials remain concerned over upside inflation risks that may warrant further monetary policy tightening. The Leading Index (a collection of forward-looking variables) contracted 0.4% in July compared to -0.7% in June, in line with expectations. Initial jobless claims declined to 239k in the week to 11 July from 248k last week, 1,000 claims below expectations.