General Prabowo Subianto won the Indonesian presidential election in the first round. Domestic travel and tourism spending hit records during the Chinese New Year. China has been exporting deflation to the world, regardless of the state of the local economy. India’s inflation surprised to the downside again. Hundreds of thousands took to the streets in Mexico to protest the constitutional changes proposed by President Andreś Manuel Lopez Obrador (AMLO). Consumer confidence improved in Colombia as purchasing power improved. In Africa, Ghana’s Finance Minister was replaced, Kenya’s Eurobond provided short-term relief, and political volatility increased in Senegal. Economic data surprised to the upside in Europe. The United States (US) Congress continued negotiating aid to Ukraine, Israel, and border security.

Global Macro

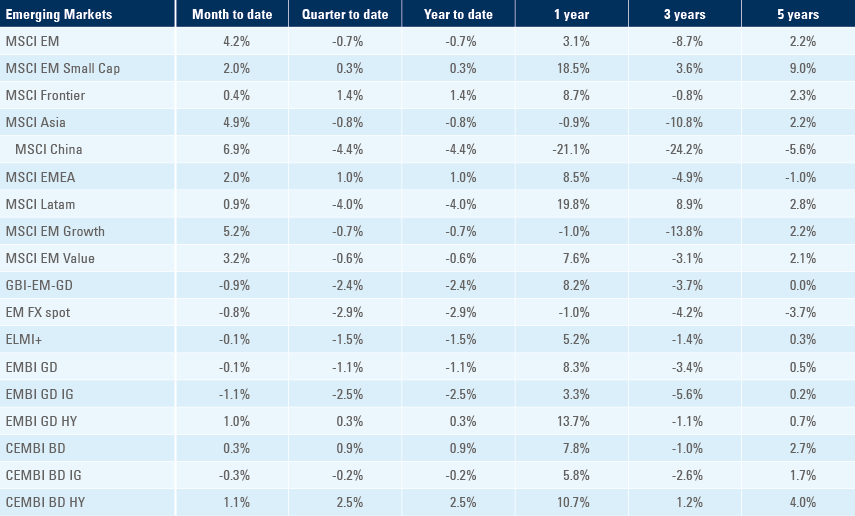

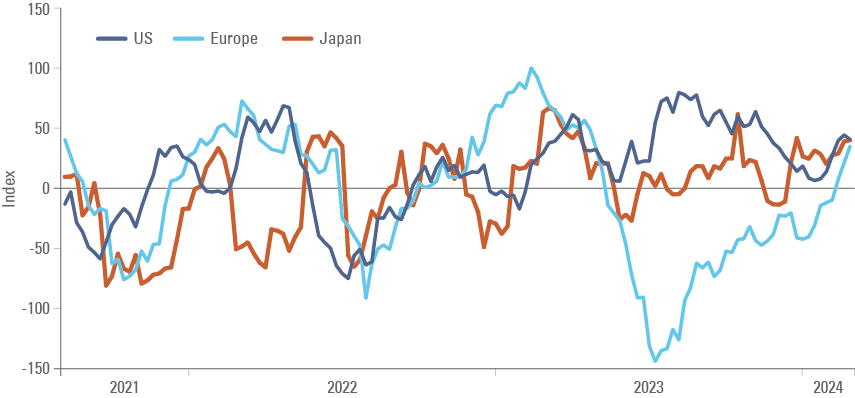

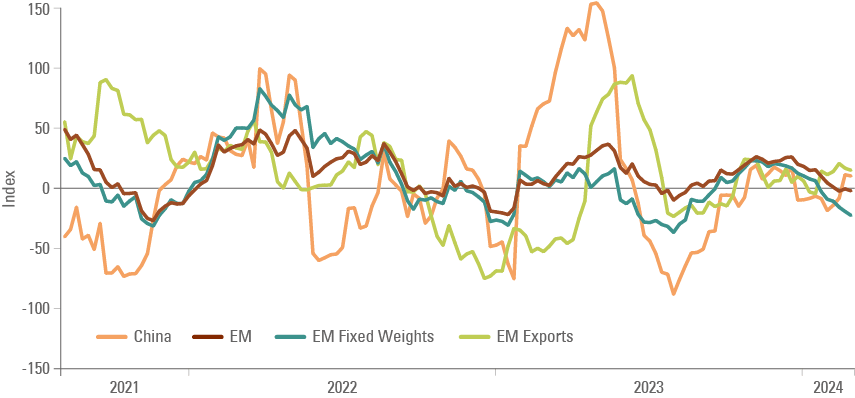

Despite all the negative sentiment on Europe and the negative gross domestic product (GDP) growth numbers from last week, European data has surprised to the upside year-to-date. The European Citibank Surprise Index (CESI) was up to 34.7 on 16 February from 20.9 and -41 at the end of December. The US Surprise Index declined four points to 40.4 and Japan rose one point to 39.8. The Emerging Market (EM) surprise index declined to -2.1 as China softened one point to 10.3 and EM exports softened to +15.1, as per Fig. 2.

Fig 1: Citi Surprise DM

Fig. 2: Citi Surprise Index EM

The numbers may be a preamble for the data from Q2 2024 onwards. After all, strong US economic momentum has been supported by massive fiscal expenditures, which are at risk again as the government runs out of funding on 8 March. At the same time, the likely increase in European defence spending and low natural gas prices may provide support in the period ahead. Europe would massively benefit from a possible, but hard to predict, ceasefire and reconstruction of Ukraine over the next quarters. This week, the flash manufacturing purchasing managers indices (PMIs) will shed some light on whether the Red Sea situation is impacting the cyclical recovery in the manufacturing sector.

Geopolitics

On Tuesday morning, the US Senate passed a USD 95bn foreign aid package providing USD 60bn to the Ukraine military and USD 14bn to Israel, while providing USD 9bn in humanitarian support to Ukraine and Gaza. What proportion of this would go to Gaza is not disclosed. The bill also strips funding to the United Nations Relief and Works Agency (UNRWA) in Gaza, after Israel’s allegations that some of its workers were involved in the 7 October attacks. In response, the UNRWA “fired nine employees due to the seriousness of the allegations and is currently investigating the matter”.1

In parallel, a bipartisan group from the Lower House of Congress passed a USD 66bn national security package including USD 48bn aid to Ukraine, USD 10bn for Israel, and USD 5bn for Indo-Pacific allies, including Taiwan, but without humanitarian support for Gaza. The proposed package also has provisions to control immigration, including a Trump-era provision to return illegal immigrants to Mexico while they await their court hearings.2 The Republican Senator Lindsey Graham supported the Lower House bill.3

Foreign aid and border support are likely to play a key part of negotiations to continue to fund the US government, as the current appropriations for the 2024 fiscal year expire on 8 March.4

In Ukraine, the Russian military took over the city of Avdiivka, a small city in the frontline in the Donetsk region. Several press outlets reported that Ukrainian ground forces are outmanned and outgunned, and highlighted the urgent need for more support. President Biden blamed the fall of Avdiivka on (US) lawmakers’ failure to approve aid.

In Russia, the opposition leader Alexey Navalny died in jail. Navalny’s last appearance showed a thin semblance resulting from torture and solitary confinement periods. As of Sunday evening, 366 people were imprisoned for protesting Navalny’s death, as several spontaneously built shrines with flowers in front of Navalny’s pictures.

In the Middle East, Israel said it would launch a ground offensive in Rafah unless hostages are released by the Ramadan fasting month, starting in March.

Emerging Markets

EM Asia

China: Total domestic trips for the Chinese New Year holiday, which started on 10 February, rose 34.3% to 474m (+19% vs. 2019), while tourism receipts surged 47.3% to RMB 632.6bn c. USD 89bn (+7.7% vs 2019), according to data published on Sunday by the Ministry of Culture and Tourism. Last week, the People’s Bank of China (PBoC) published the monetary policy report for Q4 2023 and credit data for January, showing a better-than-expected increase in household and corporate loans.

In other news, there is much ado about consumer price index (CPI) deflation and the usual, but in our view, highly misleading, comparison to Japan. Deflation so far is mostly related to lower food prices, in particular pork prices. Nevertheless, Chinese export prices are down 10% in yoy terms, so there is some evidence that China is exporting manufactured goods deflation to the rest of the world. Indeed, recent research trips have highlighted a glut of manufacturing of renewable energy items, from electric vehicles to solar panels and wind turbines. This is reflected by a continuous decline in yoy terms of import prices from Brazil, South Korea, and Taiwan – some of the largest importers from China. We believe, China exporting manufacturing deflation bodes well for a decline in inflation – and interest rates – across these countries, as well as Australia.

India: Industrial production rose by 3.8% in yoy terms in December from 2.4% yoy in November, 130 basis points (bps) above consensus. The yoy rate of CPI inflation declined by 60bps to 5.1% in January, 10bps above consensus, but core CPI declined by 30bps to 3.5%. Furthermore, wholesale prices softened to a yoy rate of 0.3% in January from 0.7% in December, adding more potential downside pressures for consumer goods in the months ahead. Sustained core disinflation is likely to lead to lower headline inflation, opening the door for the Reserve Bank of India to cut policy rates, most likely in H2 2024, in our view.

Indonesia: Indonesian Defence Minister Prabowo Subianto declared a first-round victory in the presidential election, after unofficial vote counts gave him a significant lead over his rivals. ‘Quick counts’ of samples of voting ballots nationwide showed Prabowo had won a comfortable 58% majority. The result was broadly in line with consensus As Prabowo’s victory can be somewhat attributed to the support of President Joko Widodo (Jokowi), whose very high popularity effectively gave him the power to ‘elect’ a successor. The Western press had a negative bias post-election, considering Prabowo’s record as General and his more populist inclination. The key question for markets is whether Prabowo will stick to a conservative fiscal policy, respecting the maximum 3.0% fiscal deficit rule, and maintain Jokowi’s progressive policies that brought a lot of investments to the country, keeping GDP growth elevated. Jokowi’s son Gibran Rakabuming Raka will be Prabowo’s vice-president and several of Jokowi’s ministers who have been campaigning for Prabowo are likely to take roles in the new government – a sign of continuity. In our view, risks may increase in the second half of the mandate, ahead of an eventual succession election. In other news, exports declined by a yoy rate of 8.1% in January, more steeply than the 3.2% expected, from -5.9% in December.

Malaysia: GDP rose 3.0% yoy in Q4 2024, down from 3.4% in Q3 and 40bps lower than expected.

Pakistan: The country’s parliament nominated Shehbaz Sharif as the new Prime Minister.

Latin America

Argentina: The Treasury reached an ARS 2trn primary surplus in January, the first monthly surplus excluding interest payments since 2011, a sign that the country is moving forward with its aggressive fiscal consolidation despite political challenges. Argentinian Eurobonds rallied last week after reports that Milei was considering breaking down the omnibus bill into several “digestible” bits and deepen its alliance with Macri’s Juntos por Cambio, a pragmatic turn. CPI inflation increased to 254% yoy in January, from 211% in December, slightly less than expected. In mom terms, CPI inflation fell from 25.5% to 20.6%.

Brazil: The equity index provider MSCI approved Brazilian foreign-listed companies to be part of its index from the August 2024 rebalance. This is relevant for fintech stocks such as Nubank, XP and Stone.

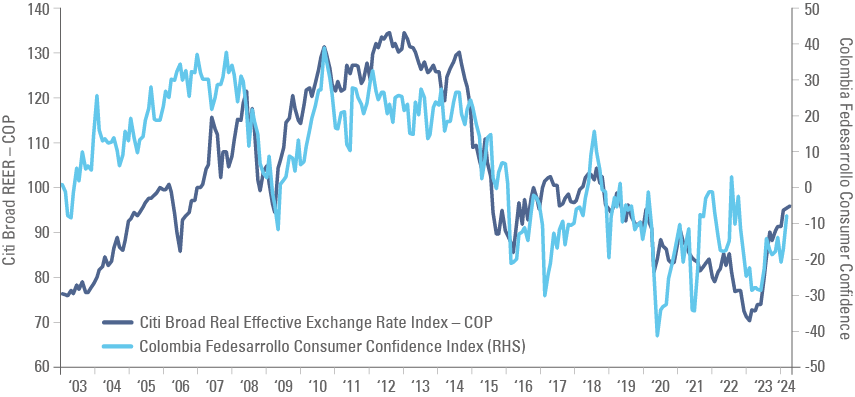

Colombia: Consumer confidence improved by 10 points to -7.9 in January, a step increase from the lows of -28.8 in April 2023. Consumer confidence has not been above zero for more than four months since 2015. Most of the negative sentiment may be attributed to the decline in purchasing power from a lower peso as per Fig. 3. Retail sales declined 4.7% in December, from -3.4% in November, below consensus at -2.3%.

Fig. 3: COP Broad REER (Citibank) vs. Consumer Confidence

Mexico: Hundreds of thousands of protestors took to the streets across Mexico in a “march for democracy” against a radical constitutional reform proposed early in the month by President AMLO, which includes plans for a directly elected supreme court and a smaller legislature. ALMO’s party does not have the votes to approve the reform, which means he hopes his Morena Party will gain seats in the upcoming general election to implement his vision via his successor Claudia Sheinbaum.

Central and Eastern Europe

Czechia: The current account surplus slowed to CZK 13.2bn in December from CZK 43.5bn in November, ahead of consensus for a CZK 3.2bn surplus. The yoy rates of import and export prices declined by 6.2% and 2.4%, respectively in December from -5.7% and -2.1% prior. CPI inflation was softer than expected at 2.3% yoy, 60bps lower than consensus, and 1.5% mom, 15bps lower than consensus.

Hungary: Real GDP was unchanged in both qoq and yoy terms in Q4 2023, below consensus for 0.3% qoq and 0.6% yoy and down from 0.8% qoq and 0.5% yoy in Q3 2023, respectively.

Poland: Real GDP was unchanged in qoq terms and rose 1.0% in yoy terms in 2024, from 0.5% in Q3 2023, 10bps below consensus. The trade balance moved to a EUR 556m deficit in December after a EUR 226m surplus in November, as the current account moved to a balanced position in December after a EUR 1.2bn surplus in the previous month, both broadly in line with consensus. CPI inflation yoy was 3.9% in January, slowing 20bps more than expected from December’s 6.2%.

Romania: The central bank kept its policy rate at 7.0%, in line with consensus. CPI inflation rose to 1.1% mom in January, 20bps above consensus, from 0.3% mom in December, taking the yoy rate up by 90bps to 7.4%. Industrial output rose 0.3% mom as the yoy rate of contraction improved by 180bps to -2.3%.

Central Asia, Middle East, and Africa

Ghana: The yoy rate of CPI inflation rose by 30bps to 23.5% in January, above consensus at 22.8%. President Nana Akufo-Addo reshuffled his cabinet, replacing long-standing Finance Minister Ken Ofori-Atta with Mohammed Amin Adam. While Ofori-Atta is a soft-spoken, conciliatory figure and well-known by market participants, he was unsuccessful in implementing a fiscal consolidation and borrowed excessively from foreign investors both in Eurobonds and local bond markets, forcing Ghana to restructure its debt post-Covid-19 shock. Ofori-Atta was responsible for the debt restructuring in recent years. Adam has a solid background and previously served as Deputy Minister of Energy before his appointment as Minister of state at the Finance Ministry. He holds a PhD in petroleum economics from the Centre for Energy, Petroleum & Mineral Law and Policy at the University of Dundee in the UK and an MPhil (Economics) and a BA in Economics from the University of Cape-Coast.5

Kenya: The country placed a USD 1.5bn 7-year (6-year weighted average life) bond at 10.375% yield (630bps z-spread) using most of the proceeds to buy back its USD 2.0bn April 2024 maturity. While the transaction lowers the short-term liquidity risks, the re-rating of Kenya’s sovereign bonds will remain contingent on fiscal improvement. Kenya has done little in terms of fiscal consolidation since having most of its debt wiped out by the heavily indebted poor countries (HIPCs) framework mostly completed in 2006. The Kenya 2024 bond was issued in 2014 at 6.875% (418bps z-spread) for a 10-year bond – one of the first African countries to access the market post-HIPCs. The sharp increase in spread over US swaps reflects both the higher yield environment, but also the deterioration of Kenyan credit metrics.

Saudi Arabia: CPI inflation rose 1.6% yoy in January, from 1.5% in December.

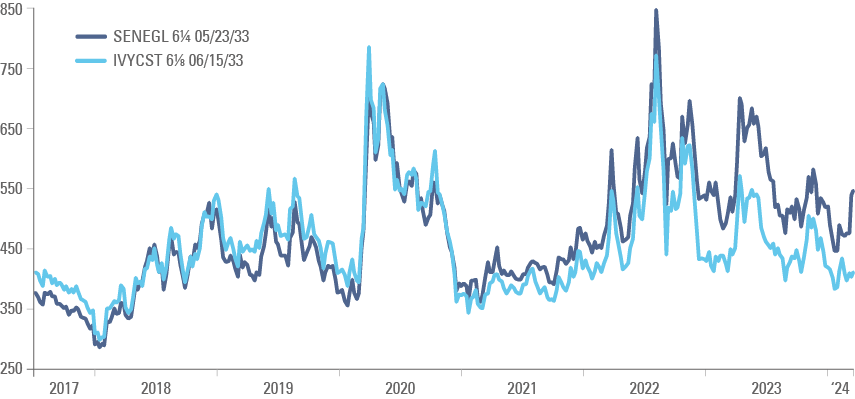

Senegal: President Macky Sall backtracked his initial intention of postponing the presidential elections from 25 February to 15 December. The Constitutional Court said it was illegal, bringing several international agencies to criticise the intention. People took to the streets to protest the government’s intention. Senegal has one of the most stable democracies in Africa with a long tradition of peaceful elections, but the country’s Eurobonds have been lagging other African countries due to increased political risk as per Fig. 4:

Fig 4: Z-spread Senegal 2033 vs. Ivory Coast 2033

South Africa: Mining production rose by a yoy rate of 0.6% in December, down from 6.9% in November and significantly below consensus at 4.9%. A poll showed the party supported by former President Jacob Zuma gaining close to a quarter of votes in its native Kwa Zulu Natal (KZN) region – the largest in the country, which in itself could bring the African National Congress (ANC) vote below the 45% threshold to maintain control of the parliament. President Cyril Ramaphosa will announce the general election date later this month, which must be within 90 days of the end of his mandate in mid May. It is set to be the most consequential election since the end of apartheid that brought Nelson Mandela to power in 1994 – a 30-year period when the ANC were the undisputed hegemon within the country.

Retail sales rose 2.7% yoy in December from 1.1% yoy in November (revised from 0.4%), significantly better than consensus at 0.1% yoy.

Turkey: The current account deficit narrowed to EUR 2.1bn in December from EUR 2.8bn in November, significantly better than consensus at EUR 3.3bn as orthodox policies remain supportive of a strong macro adjustment.

Developed Markets

United States: CPI inflation surprised to the upside on Tuesday, rising 0.3% mom in January (0.2% consensus and prior) and 3.1% in yoy terms (2.9% consensus and 3.4% prior), as core CPI rose to 0.4% mom (0.3% consensus and prior) and was unchanged at 3.9% yoy (3.7% est.). Used car prices declined 3.4%, the largest decline since the 1960s, but service costs increased, particularly owner’s equivalent rent (the largest single CPI component) rising 56bps (44bps prior months), notably above tenant’s rents, which slowed to 36bps in January from 39bps prior. Core services ex-rents rose by 85bps in January — its fastest increase in almost two years — as transportation services rose 97bps and personal services increased 95bps. This may reflect some seasonal effects, which may wane later in the year, but it is an alarming pace of increase nonetheless, in our view. Producer price index (PPI) inflation also surprised to the upside on Friday, rising 0.3% mom (consensus 0.1%) after -0.2% in December and 0.9% in yoy terms. Core PPI rose 0.5% mom and 2.0% in yoy terms, 40bps more than consensus. The result will likely bring January core personal consumption expenditures (PCE) to 0.3%-0.4% mom, bringing the three, six and 12-month annualised core PCE above the Fed’s 2.0% inflation target. Initial jobless claims fell from 220k to 212k. No change was expected, but continuing claims rose from 1865k to 1895k, 95k more than expected. Housing data was weak, with housing starts declining to 1.33m in January from 1.56m in December (revised up by 100k). The Fed manufacturing and business outlook surveys from New York and Philadelphia increased more than expected in February.

Europe: Eurozone real GDP was unchanged in Q4 2023 in qoq terms and up 0.1% in yoy terms, in line with consensus. Nevertheless, Eurozone industrial production was better at 2.6% mom in December (0.4% prior and -0.2% est), taking the yoy rate to +1.2% (-0.4% est). Retail sales also outperformed consensus, rising 1.4% mom and 2.7% yoy (-0.1% est) in December. The German Zew expectations survey with bankers rose 4.7 points to 19.9 in February, while current situation declined another 4.5 points to -81.7. We tend to give more weight to the IFO survey when it comes to economic developments.

United Kingdom: CPI inflation declined 0.6% in mom terms in January after rising 0.4% mom in December as the yoy rate of headline and core CPI were unchanged at 4.0% and 5.1% respectively, both 10bps below consensus. PPI output prices dropped 0.2% mom from -0.5% in December, as the yoy rate moved to a 0.6% deflation from 0.0% over the same period, but input prices are declining faster -3.3% yoy from -2.1% yoy over the same period. The three, six, and nine-month annualised CPI rates are all below the inflation target at -1.6%, 0.8% and 1.1%, respectively. The unemployment rate declined to 3.8% in December as payrolled employees increased by 48k in January (consensus -18k) from 31k in December (revised from -24k). The weekly earnings ex-bonus growth declined by 50bps to 6.2%, 20bps above consensus. Preliminary GDP data for 4Q 2023 shows a 0.2% contraction yoy. Consensus estimates were for 0.1% growth, following 0.2% growth yoy in the previous quarter. In qoq terms, GDP declined 0.3%, 20bps more than expected.

1. See – https://www.israeltoday.co.il/read/us-envoy-unrwa-funding-freeze-is-permanent, https://news.un.org/en/story/2024/02/1146597, and https://www.aljazeera.com/news/2024/2/17/which-countries-are-still-funding-unrwa

2. See – https://www.congress.gov/118/bills/hr7372/BILLS-118hr7372ih.pdf

3. See – https://www.axios.com/2024/02/18/lindsey-graham-house-foreign-aid-bill

4. See – https://www.whitehouse.gov/briefing-room/legislation/2024/01/19/press-release-bill-signed-h-r-2872

5. See – https://www.myjoyonline.com/dr-amin-adam-takes-over-from-ofori-atta-as-new-finance-minister

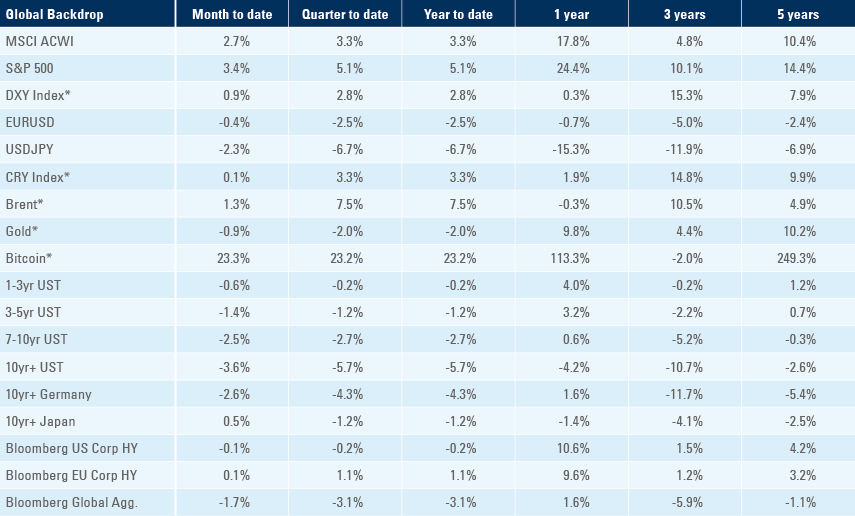

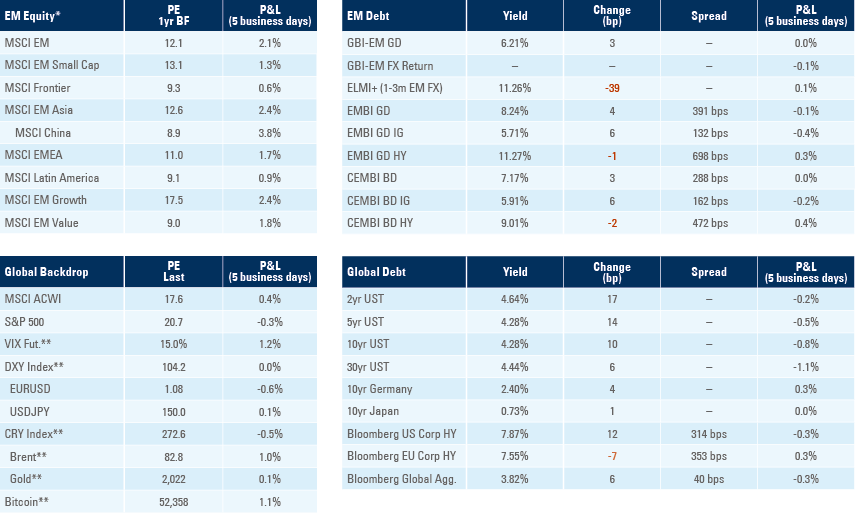

Benchmark performance