Not so Bueno in Buenos Aires: Outsider Milei on top in Argentinian primaries

Argentinian presidential primary election provides shock defeat of the traditional parties; China’s credit data for July disappoints after a strong June; Gabon issues a blue bond; Commodity prices give everyone a bit of a scare; Ecuador bonds shrug off a tragic death.

Top EM Stories

Argentina: Argentinians cast their votes on Sunday 13 August for a presidential primary election called PASO (Primarias Abiertas Simultáneas y Obligatorias) designed to reduce the number of candidates in the general election next October. With 77% of the votes counted, the PASO has delivered a shock to the political system, with a stunning defeat of the traditional centre-right opposition parties at the hands of political outsider Javier Milei, who topped the field with 31% of voting intentions, more than 10% over median poll estimates. Conversely, the opposition coalition Juntos por el Cambio (JxC), which was hoping to gather 34% of the votes (split between their two competing, and sometimes feuding candidates) came up short with only 27% of combined votes, barely ahead of beleaguered Economy Minister Sergio Massa representing the Peronist vote under the banner of the Union por la Patria, at 26%. The result is a clear rejection of Argentina’s traditional parties, punishing both centre-right and centre-left parties that have failed to stabilise inflation and have weakened the value of the Argentinian Peso (ARS) by 95% against the US dollar in the last decade. Javier Milei has embraced a mix of libertarian ideology and right-wing populist rhetoric.

China: Total social financing plunged to RMB 528bn in July from RMB 4,224bn in June as new bank lending declined to RMB 346bn from RMB 3,050bn over the same period. The series are quite volatile and the weak July contrasts with a strong June report, but these were nevertheless the lowest monthly readings since 2016 and 2009, respectively. M2 growth continued to slow to 10.7% year-on-year (yoy) in July, from 11.3% yoy in June. All credit metrics were significantly below consensus. Households are feeling blue, and household sector lending contracted for the fourth consecutive month. Home sales in China’s 30 major cities declined 26.7% yoy in volume in July, and real estate debt and equity came under pressure after Country Garden, China’s largest private developer, failed to pay two coupons totalling USD 22.5m on US dollar obligations due 6 August.

Low activity is having an impact on prices and China went into deflation. Consumer Price Index (CPI) inflation fell to -0.3% yoy terms in July, down from 0.0% in June, but the yoy rate of Price Producer Index (PPI) deflation increased to -4.4% from -5.4% over the same period. The external sector is not helping much either: the current account surplus declined to USD 65.3bn in Q2 2023 (or 1.5% of GDP) from USD81.5bn in Q1 2023 (or 2.0% of GDP), which was below its Q2 2022 level of USD73.8bn. Foreign direct investment (FDI) plunged to USD 4.9bn in Q2 2023 from USD 20.5bn in the previous quarter, a new historical low. The trade surplus increased to USD 80.6bn in July from USD 70.6bn in June (USD 10.6bn above consensus) as imports declined faster than expected.

The US White House unveiled an Executive Order designed to limit investments by US private equity and venture capital firms into the Chinese technology sector to prevent the transfer of American know-how in three specific, sensitive sectors: quantum computing, semiconductors, and artificial intelligence (AI). The restrictions had been expected for some time and were viewed as less stringent than anticipated. For instance, portfolio investments are allowed and the investment prohibition on AI is for military end users only. The rules are undergoing consultation and will not come into force until next year.

Gabon: Gabon’s ‘debt for nature’ swap completed last week with the issuance of USD 500m in ‘blue’ bonds last Monday. The bonds, which benefit from risk insurance provided by the International Development Finance Corporation (DFC), were issued at a 6.1% yield, or 200 basis points (bps) over US Treasuries. This interest rate is cheaper than the coupon of the bonds being partially bought back in the swap, which pay coupons of between 6.625% and 7%.

Malaysia: Local elections in six Malaysian states, held over the weekend, have been viewed as a referendum on Prime Minister Anwar Ibrahim. In the end, the elections results were inconclusive, with three states going to the governing coalition, and three states won by the opposition. Anwar remains fragile but the main opposition party Perikatan Nasional (NP), which is backed by a conservative Islamist party, failed to gain enough ground to challenge Anwar at the federal level. The government is likely to keep pursuing its fiscal consolidation agenda, but does not have enough political capital to re-introduce goods and services taxes. In economic news, Malaysia’s foreign exchange (FX) reserves rose by USD 1.1bn to USD 112.9bn in July, the second consecutive monthly increase. Manufacturing sales value declined by a yoy rate of 4.0% in June after rising 3.3% yoy in May and industrial production dropped 2.2% yoy after increasing by 4.8% yoy in May.

Commodities

Commodity prices, a major tailwind for the drop in year-on-year inflation over the last nine months, are rearing their heads up again. Stronger demand is translating into higher oil prices: Brent and West Texas Intermediate (WTI) oil prices just clocked their seventh consecutive week of increase, with Brent trading up to USD 87 per barrel, 10% above the 2023 average. In its monthly bulletin released last week, OPEC projected demand to remain strong and to rise by 2.4m barrels per day (bpd) in 2023 to an average of 102m bpd, unchanged from last month’s estimate. US crude oil inventories have been quite volatile, with a huge drop in July followed by a recovery in August, but it is notable that the US Strategic Petroleum Reserve (SPR) has stopped being a moderating factor on oil prices: the SPR has stopped supplying the market for the past four weeks, which has coincided with the rally in the oil price.

European gas prices have also escalated in recent weeks, notably in rection to fears of industrial action at major liquefied natural gas (LNG) facilities in Australia – a key source of gas for major Asian markets. The Rotterdam gas future’s first contract is back up to EUR 40 per Megawatt hour (MWh), its highest level since June. The series is admittedly volatile, but Europe will have to compete with Asia for shipments again next winter.

Finally, rice prices have been soaring to their highest levels in almost 15 years in Asia on mounting concerns over global supplies after India decided to ban the exportation of a large portion of its rice production, and poor weather conditions threatened rice crops in Asia (too dry in Thailand, too wet in China). Thai white rice 5 percent broken, an Asian benchmark, jumped to USD 648 a tonne, the most expensive since October 2008 and 50% up over a year ago, according to the Thai Rice Exporters Association.

Emerging Markets

EM Asia

India: The Reserve Bank of India (RBI) surprised market participants by keeping its repo rate unchanged at 6.5%, in a unanimous vote. The RBI lifted its FY24 inflation projection by 30bps to 5.4% yoy, with an initial uptick to 6.2% yoy expected by year-end. Nevertheless, RBI Governor Shaktikanta Das explained that the Monetary Policy Committee is comfortable looking through a temporary jump in food price inflation.

Indonesia: There is mounting speculation that Gibran Rakabuming Raka, the Mayor of the city of Solo and the son of President Joko Widodo (Jokowi) could be the running mate for Prabowo Subianto, the current Minister of Defence and a member of the Gerindra Party. The rumour is driven by a Constitutional Court hearing on the reduction of the age requirement for vice-presidential candidates from 40 to 35 years (Gibran’s age). Gibran could help Prabowo benefit from Jokowi’s popularity.

Pakistan: The country is gearing up for general elections in November. In preparation, Prime Minister (PM) Shehbaz Sharif dissolved the National Assembly. Sharif is stepping down from his post and a caretaker PM was appointed by the country’s political parties: Anwaar-ul-haq Kakar, the Senator from Balochistan who is believed to be close to the army, was chosen and will be the new caretaker PM of Pakistan until the election.

Philippines: Real GDP contracted 0.9% quarter-on-quarter (qoq) in Q2 2023 (consensus +0.6%) after 1.0% qoq in Q1 2023, bringing the yoy rate down to 4.3% from 6.4% over the same period. A tighter fiscal stance explains the bulk of the slowdown as government consumption declined by 7.1% in yoy terms. The trade deficit declined to USD 3.9bn in June from USD 4.5bn in May. The unemployment rate rose 20bps to 4.5% in June.

South Korea: The current account surplus rose to USD 5.9bn in June from USD 1.9bn in May as the trade surplus increased by USD 2.1bn to USD 4.0bn over the same period. The unemployment rate increased by 20bps to 2.8%.

Taiwan: The trade surplus rose to USD 8.5bn in July from USD 6.0bn in June as exports declined by a yoy rate of 10.4%, significantly better than the -23.4% drop recorded in June, and imports improved to -20.9% yoy from -29.9% yoy over the same period. CPI inflation rose by 10bps to 1.9% yoy, and core inflation was up 10bps as well to 2.7% yoy, in line with consensus. PPI recovered somewhat to -3.2% yoy in July from -4.8% yoy in June.

Vietnam: The equity market is one of the better performing in the region year-to-date, supported by interest rate cuts by the State Bank of Vietnam and early signs of an economic recovery. Last week, Vingroup (VIC) was the highlight rising 5% to an 11-month high after the Ministry of Transport proposed supportive policies to promote the adoption of electric vehicles.

Latin America

Brazil: CPI inflation rose 0.1% mom in July after declining 0.1% in June and the yoy rate rose 80bps to 4.0%, in line with consensus. Vehicle sales rose to 226k in July from 189k in June. Vehicle sales are now back in line with the average of the previous 10 years, indicating stronger demand for durable goods. The higher demand for autos is meaningful and the July data suggests economic activity is still surprising to the upside in H2 2023. Retail sales were flat in June, but the broad measure including auto and civil construction rose 1.2% mom (consensus -0.2%) or 8.3% in yoy terms. Autos, supermarket sales, apparel and furniture explain the stronger data.

Chile: CPI inflation rose to 6.5% yoy in July from 7.6% in June, 10bps above consensus. Nominal wages increased by 20bps to 10.3% yoy in June. President Gabriel Boric adjusted the tax bill voted down in May, and now plans to submit separate bills to maximise chances of approval. The adjusted bills include measures to increase tax compliance, which Boric hopes can generate 1.5% of GDP in revenues. This is ambitious, but is much lower than the USD 8.0bn (c. 2.7% of GDP) that the government estimated was necessary to guarantee universal pensions and to finance public spending. The trade surplus narrowed to USD 0.8bn in July from 1.6bn in June as exports declined USD 0.4bn to USD 7.4bn and imports rose USD 0.2bn to USD 6.6bn over the period.

Colombia: CPI inflation rose to 0.5% mom in July from 0.3% in June as the yoy rate declined by 30bps to 11.8% in July, 20bps above consensus.

Ecuador: Presidential candidate Fernando Villavicencio was murdered in Quito last week. This was a terrible act of political violence which also changes the political calculations somewhat. Villavicencio was an anti-corruption and anti-crime campaigner and one of five candidates in a position to reach the second round of the presidential election. Before the assassination, the Correísta candidate Luisa González was leading the polls with c. 30% of voter intentions, and centrist former vice-president Otto Sonnenholzner was in second place. Villavicencio was virtually tied with leftist indigenous candidate Yaku Pérez, and security hardliner Jan Topić with around 9-13% each. Following his assassination, there is now a greater chance that either the market-friendly Sonnenholzner or the populist security hardliner Topić will be able to seriously challenge Mrs González . This is why Ecuador’s sovereign bonds rallied last week.

Mexico: The yoy rate of CPI inflation declined to 4.8%, from 5.1% in June. The Bank of Mexico (Banxico) kept its policy rate steady at 11.25%, considering the resistance of core inflation which slowed marginally to 6.6% from 6.9%. There was no discussion of the timing of possible rate cuts as Banxico is likely to wait for core inflation to converge to the 3.0% (+/- 1.0%) target and for the US Federal Reserve to cut policy rates. Industrial production rose 0.6% mom in June after 0.9% mom in May and the yoy rate declined 20bps to 3.7%.

Peru: The central bank kept its policy rate unchanged at 7.75%, in line with consensus.

Venezuela: The opposition-led National Assembly is finalising an agreement with international creditors to extend a legal deadline on USD 60bn of defaulted bonds to the end of 2028. This follows a similar move by President Maduro a few months ago – only this one is officially recognised by the US administration, which does not recognise Maduro. This is a technicality designed to avoid creditors suing Venezuela in US courts before their claims lapse, potentially burying it in legal action.

Central and Eastern Europe

Czechia: CPI inflation rose to 0.5% mom in July from 0.3% in June, partly due higher fuel prices, but the yoy rate slowed to 8.8% from 9.7% in June, in line with consensus and the lowest level seen in 19 months. The yoy rate of industrial output rose to 0.9% in June from -1.6% in June, significantly above consensus at -0.8%.

Hungary: CPI inflation was unchanged at 0.3% mom in July, but base effects brought the yoy rate down by 250bps to 17.6%, declining below 20% for the first time in 11 months. The trade surplus increased to EUR 1.5bn in June from EUR 1.1bn in May.

Romania: CPI inflation declined to 0.2% mom in July from 0.4% mom in June and the yoy rate declined by 80bps to 9.4%, 30bps below consensus and down from 16.8% at the peak in November. The central bank kept its policy rate unchanged at 7.0% as inflation, albeit declining fast, remains too elevated.

Central Asia, Middle East, and Africa

Egypt: CPI inflation slowed to 1.9% mom in July from 2.1% mom in June, but the yoy rate rose by 80bps to 36.5% due to base effects and core CPI slowed by 30bps to 40.7%. The parallel EGP has been converting to the official rate, moving to 41.0 at the end of the last week from 46.7 in early June, but still remains significantly above the official rate at 30.9, suggesting FX backlogs still have not cleared.

South Africa: FX reserves increased by USD 0.7bn to USD 62.2bn in July, in gross terms and USD 55.6bn in net terms. Mining production increased 1.1% in yoy terms in June after contracting 0.7% yoy in May, while manufacturing production rose 1.2% mom in June after contracting 1.3% in May, bringing the yoy rate up 310bps to 5.5%, 250bps above the consensus.

Turkey: The current account moved to a USD 0.7bn surplus in June from a USD 7.8bn deficit in May, slightly above consensus. Industrial production rose 1.6% mom in June from 1.4% mom in May, as the yoy rate rose 40bps to 0.6%, significantly above the consensus at -3.0% yoy.

Developed Markets

United States: CPI inflation rose 0.2% month-on-month (mom) in July (headline and core) and the yoy rate of headline inflation rose 20bps to 3.2% yoy while core CPI declined 10bps to 4.7% yoy over the same period, all broadly in line with consensus. PPI inflation came in a bit higher than consensus at 0.3% mom and 0.8% yoy and PPI ex-food and energy rose 0.3% mom and 2.4% yoy. The University of Michigan Consumer Sentiment Index declined only marginally to 71.2, while the one-year and 5-10-year inflation expectations declined 10bps to 3.3% and 2.9%, respectively. Consumer credit increased to USD 17.9bn in June from USD 9.5bn in May, in line with the average of the last three and six months.

Moody's downgraded the credit rating of 10 US banks last week, put another six on review for possible downgrade, and lowered the outlook for another 11 institutions from stable to negative.

The US administration reached a deal with Iran over the mutual exchange of prisoners, including five Americans held by Iran. The deal also covers the release of USD 6bn in Iranian assets, which would be made available for humanitarian purposes. The White House stressed the deal is not part of the negotiations on Iran’s nuclear capabilities.

Japan: PPI inflation rose 0.1% mom in July after declining 0.1% in June, and the yoy rate declined by 70bps to 3.6%, 10bps above consensus.

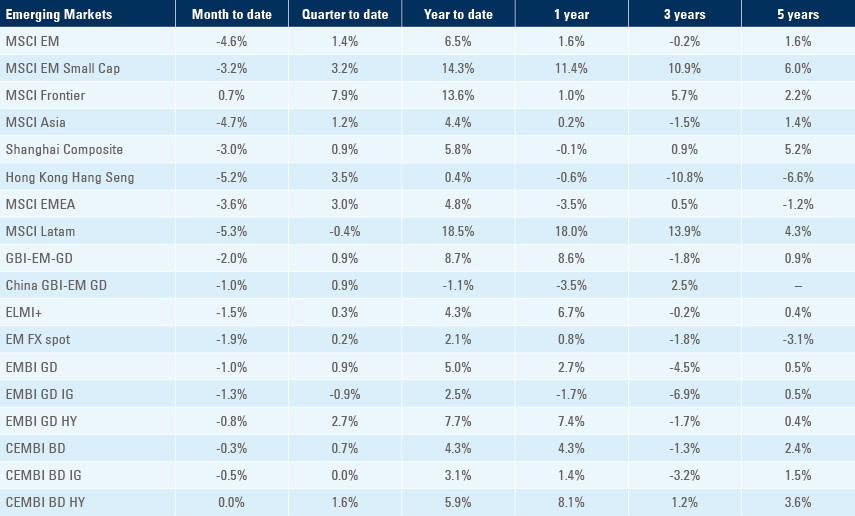

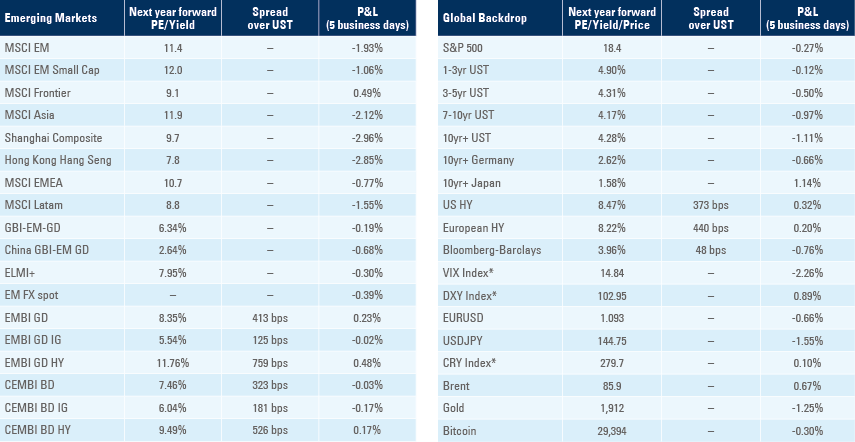

Benchmark performance