The December meeting of the US Federal Open Market Committee (FOMC) proved a pivotal moment for markets. Whilst the target policy rate was unchanged, the median forecast for the Fed funds rate at end-2024 fell from 5.1% in September to 4.6%, triggering a rally. Meanwhile, at its final meeting of the year, the European Central Bank (ECB) kept deposit rates at 4.0%, in line with expectations. As of Friday, 50bps of cuts are priced in for Q1 2024, although ECB President Christine Lagarde’s rhetoric remained hawkish. European Union (EU) leaders agreed to commence talks over Ukraine and Moldova’s accession, albeit with Hungary’s Viktor Orbán in strong opposition. At COP28, a major deal was signed by 200 countries calling for a transition away from fossil fuels. However, critics have characterised the language in the agreement as vague, lamenting a lack of science-based targets. Argentina’s Economic Minister, Luis ‘Toto’ Caputo released a video offering a first look at the economic “shock-therapy” promised by Javier Milei. The plan includes a front-loaded programme of fiscal savings, amounting to 3% of GDP, as well as an immediate 54% devaluation of the Peso.

Global Macro

FOMC decision

The last FOMC meeting of the year, which was widely expected to be uneventful, was a watershed moment for markets. Although the Committee did not change the target policy rate (5.25 to 5.5%), Federal Reserve (Fed) officials delivered several surprises in the Committee’s statement and in the Summary of Economic Projections (SEP). The statement qualified the probability of “any” additional policy tightening by introducing the word “any”, thereby suggesting a more balanced stance. In the SEP, the median forecast for the Fed funds rate at end-2024, fell to 4.6% from 5.1% at the September update. The press conference was similarly dovish, notably with comments from Chairman Powell suggesting the Committee had started discussing the appropriate conditions to cut rates. Powell also brushed off suggestions that the market was pricing too many cuts and unwittingly easing financial conditions prematurely.

This triggered a quick in the number of rate cuts priced in the Overnight Index Swap curve next year to six cuts from 4.4 cuts. For reference, the median SEP projection represents just three rate cuts next year. The probability of a first rate cut taking place at the March 2024 FOMC meeting nearly doubled to 76% right after the December FOMC meeting.

COP28

After two weeks of Conference of the Parties (COP28) negotiations, close to 200 countries signed a deal calling for the transition away from fossil fuels. Overall, the deal is notable for the call for nations to transition away from fossil fuels to align with the Paris Agreement and towards net zero targets by 2050. However, the agreement does not explicitly reference or commit to either the phasing down or the phasing out of fossil fuels, but instead signatories committed to transitioning away from fossil fuels in a “just, orderly and equitable manner” and to ‘accelerate’ actions.1 Critics of the agreement have also flagged the loose rhetoric of the agreement that, much like preceding agreements, does not bind signatories towards science-based targets or action. Furthermore, there was little reference to climate adaptation and finance – despite the acknowledgement of trillions of dollars required to scale-up investments in these areas. On the other hand, the deal should be recognised as an accomplishment in its own right for reinforcing the 1.5°C warming goal while also implying that when new commitments are scheduled in 2025, there will be heightened stringency and policy commitment.

Geopolitics

EU member states agreed to commence talks on EU accession with Ukraine and Moldova. The Prime Minister of Hungary, Viktor Orbán, did not veto this decision, but expressed his strong disagreement with the decision and blocked a proposal for EUR 50bn in additional funding to Ukraine from the EU over the next four years. Orbán’s political director said Hungary would only consent to using the EU budget to continue supporting Ukraine if Hungary’s EU funding was unfrozen. Some of Hungary’s demands were satisfied last week when the European Commission announced that, following a review of Hungary’s progress against the EU Charter of Fundamental Rights, t may start claiming reimbursements of up to around EUR 10.2bn. EUR 21bn in EU funds remain blocked.2 Since the announcement, EU leaders have been working to circumvent Orbán’s veto and push through the support package for Ukraine – an effort that has become much more pressing following the repeated failure of the US Congress to approve USD 60bn in aid proposed by the White House.

Emerging Markets

EM Asia

China: In the property sector, residential property sales in year-over-year (yoy) terms declined by 4.3% year-to-date, from the 3.7% yoy decline registered in October. Chinese authorities announced on Tuesday that they would be relaxing homebuying curbs in Beijing and Shanghai by reducing the down payment ratio for second homes to 40-50%, down from 60-80% previously. The down payment for first-time homes was also lowered to 30% from 35-40% previously. Beijing also reportedly tightened the definition of a ‘luxury’ residence, to allow more residences to qualify for lower mortgage thresholds. While this should make it easier for people to get onto the property ladder, for these measures to be more effective, sentiment about the weak economic backdrop needs to improve.

The People’s Bank of China (PBoC) maintained its one-year medium term lending facility (MLF) at 2.5%, and its five-year MLF at 4.2%. Through the MLF, the PBoC injected CNY 800bn, marking the largest monthly amount thus far, ahead of expectations of CNY 325bn.

Data was mixed during the week. Retail sales grew by 10.1% yoy, up from 7.6% in October, but below economist expectations of 12.5% yoy growth. While industrial production grew by 6.6% yoy, up from 4.6% yoy growth in September, 90bps above expectations. Aggregate financing for November registered CNY 2,450bn, CNY 600bn higher than October, slightly below expectations of CNY 2,600bn. New loans increased to CNY 1,100bn, CNY 350bn higher than October, below expectations of CNY 1,300bn. The surveyed jobless rate remained unchanged at 5%.

India: Industrial production grew by 11.7% yoy in October, from an upwardly revised 6.2% in September, 1.2% higher than consensus estimates. The yoy rate of consumer price index (CPI) inflation grew by 5.6% in November, up from 4.9% in October, 23bps below expectations. The trade deficit shrank in November by USD 10,870m to USD 20,590m, USD 3,910m below estimates. Exports declined by 2.8% yoy in November, down from 6.2% yoy growth in October, while imports shrank by 4.3%, from 12.3% yoy growth in September.

Indonesia: The trade balance surplus shrank by USD 1060m in November to USD 2,400m, USD 560m lower than expected. Exports declined by 8.6% yoy, up from a 10.4% yoy decline in October, while imports grew ahead of expectations by 3.3% yoy, from a 2.4% yoy decline in the month prior.

Malaysia: Industrial production grew by 2.7% yoy in October, from a 50bp decline in September, 30ps ahead of economist estimates. Manufacturing sales value declined by 1.4% yoy in October, 100bps higher than the downwardly revised September print of -2.4% yoy.

South Korea: Unemployment reached 2.8% in November, up from 2.5% in October, 20bps above expectations.

Latin America

Argentina: On Tuesday, Economy Minister Luis ‘Toto’ Caputo released a recorded video in which he provided a first-look at the sort of economic “shock-therapy” promised by President Javier Milei. The first pillar of the economic plan is a front-loaded programme of fiscal savings, with a budgeted cut in real expenditures cuts of c. 2.9% GDP. This is notably driven by immediate cuts in energy and transportation subsidies, as well as an immediate stop on public works tenders and public servants’ hires. The second pillar of the plan was an immediate devaluation of the official exchange rate of 54% to 800 pesos per US dollar, from 391 at the time of the announcement. The devaluation, which is greater than generally expected, also came in with a crawling peg of 2% per month in the short term. Despite pledges to eliminate import duties, fiscal expediency required the government to announce a temporary increase in import duties (PAIS) to 17.5%. As expected, the programme was welcomed by the International Monetary Fund (IMF), Argentina’s largest creditor, which published the following statement: “IMF staff welcome the measures announced […]. These bold initial actions aim to significantly improve public finances in a manner that protects the most vulnerable in society and strengthen the foreign exchange regime. Their decisive implementation will help stabilize the economy and set the basis for more sustainable and private-sector led growth”.

The cuts in subsidies and the re-alignment of the exchange rate will have important short-term inflation implications, before the spending cuts kick in. Already, inflation has been rising and CPI inflation rose to 12.8% in November, from 8.3% in October. In yoy terms, November CPI inflation jumped to 161%, from 143% yoy in October. Monthly inflation could double in the coming quarter.

Brazil: The yoy rate of CPI inflation grew by 4.7% in November, 14bps lower than in October, broadly in line with forecasts. The Central Bank of Brazil cut the Selic rate by 50bps to 11.75%, in line with expectations. Retail sales grew by 0.2% yoy in October, down from 3.3% yoy growth in September, 1.8% yoy growth anticipated.

Colombia: Manufacturing production declined by 5.9% yoy in October, up from -6.9% yoy in September, 20bps lower than expectations. Industrial production declined by 2.2% yoy, a 70bp improvement from September, 20 bps higher than expected. Retail sales declined by 11% yoy in October, down from 9.3% yoy decline in September, an improvement to an 8% yoy decline was forecast.

Mexico: Manufacturing production grew by 1.1% yoy in October, 20bps higher than the month prior, and 10bps higher than expected. Industrial production grew by 5.5% yoy in October, from 4.0% yoy growth observed in September, 4.1% yoy growth was estimated by economists. The Banxico left the policy rate unchanged at 11.25%, in line with expectations.

Peru: The central bank cut the policy rate by 25bps to 6.75%, in line with economist estimates. Economic activity declined by 0.8% yoy in October, 50bps higher than September, slightly below expectations of -0.9% yoy.

Central and Eastern Europe

Czechia: The yoy growth in CPI inflation was 7.3% in November, down from 8.5% yoy growth in October, broadly in line with estimates. In month-over-month terms (mom), this represented a 0.1% growth, in line with October, a 0.1% mom decline was forecasted.

Poland: The current account surplus widened by EUR 1,600m in October to EUR 2,040m, above expectations of EUR 1,800m while the trade surplus widened by EUR 520m to EUR 1,320m. The yoy rate of CPI inflation grew by 6.6% in November, 10bps higher than October.

Romania: The trade deficit declined in October by EUR 645m to a deficit of EUR 2,800m. The yoy rate of CPI inflation grew by 6.7% in November, 135bps lower than October, 48bps lower than forecasted. Industrial output in October declined by 4.9% yoy, 60bps lower than September. Industrial sales grew by 1.3% yoy in October, down from 2.5% yoy growth in September.

Russia: The trade surplus registered USD 9.4bn in October, USD 6.3bn lower than September. Exports declined from a total value of USD 40.4bn in September to USD 33bn in October, while imports declined more moderately in the month by USD 1.3bn to USD 23.5bn. GDP in Q3 2023 grew by 5.5% in yoy terms, unchanged from Q2. The central bank hiked the policy rate by 100bps, taking the rate to 16%, in line with economist estimates.

Central Asia, Middle East, and Africa

Nigeria: The yoy rate of CPI inflation was 28.2% in November, 90bps higher than in October and 30bps above expectations of 27.9% yoy growth.

Saudi Arabia: The yoy rate of CPI inflation was 1.7% in November, 10bps higher than October.

South Africa: In data, mining production grew by 3.9% yoy in October, from the 1.9% yoy decline in September, ahead of consensus expectations of 1.2% yoy growth. Gold production grew by 2.2% yoy, from a 0.2% yoy decline in September, while platinum production grew by 16.9% yoy in October, up from 3.8% yoy growth in September. Manufacturing production in October grew by 2.1% yoy, from a 4.1% yoy decline in September. The yoy rate of CPI inflation slowed to 5.5% in November from 5.9% yoy in October, 10bps higher than expected. This reflected a 10bp mom decline, from a 90bp mom growth in October, 10bps higher than expected. Retail sales declined by 2.5% yoy in October, from the 1.0% growth in September, expected to remain broadly unchanged in October. The yoy rate of producer price index (PPI) inflation grew by 4.6% in November, down from 5.8% yoy growth in October, and 50bps lower than consensus forecasts. In employment, non-farm payrolls in Q3 2023 grew by 2.6% yoy, 90bps higher than in Q2.

Türkiye: The current account surplus declined in October to USD 190m from USD 1,910m, USD 320m lower than expected. The unemployment rate declined by 50ps to 8.5%. Industrial production grew by 1.1% in yoy terms, down from a revised 4.1% yoy growth in September. In mom terms, this represented a 40bp decline in October, from the 10bp decline in September.

UAE: The S&P Global Dubai Purchasing Managers’ Index (PMI) declined 0.6 points in November to 56.8. Dubai CPI inflation grew by 3.3% yoy in November, from 4.3% yoy in October.

Developed Markets

Eurozone: Industrial production declined by 6.6% yoy in October, 20bps lower than in September, and lower than the 4.6% yoy decline forecasted by economists. Labour costs continue to rise, growing by 5.3% yoy in 3Q 2023, up from 4.5% yoy growth in 2Q. The ECB left the deposit rate unchanged at the final meeting of the year at 4.0%, in line with expectations. As of Friday, 50bps of cuts by the end of Q1 2024 are priced in. Despite this, ECB Chair Christine Lagarde maintained a hawkish stance, saying “rate cuts were not discussed” and reiterating that rates would remain at “sufficiently restrictive levels for as long as necessary”. In other news, the ECB announced it would commence the tapering down of reinvestments under the Pandemic Emergency Purchase Programme (PEPP) from H2 2024 onwards, for reinvestments to fall by EUR 7.5bn a month before ceasing all together by the end of 2024.

Composite PMI remained in contractionary territory, declining by 0.6 points to 47.6 in December. The manufacturing PMI was unchanged at 44.2, while the services PMI declined by 0.6 points to 48.1. In trade data, the trade surplus grew by EUR 1.7bn to EUR 10.9bn in October, EUR 0.9bn higher than economist estimates.

Japan: The yoy rate of PPI inflation in Japan grew by 30bps in November, down from the upwardly revised 0.9% yoy growth in October, and 20bpps ahead of consensus estimates. In mom terms, this represented 0.2% growth, 50bps higher than in October, in line with consensus estimates. Industrial production grew by 1.1% yoy in October, from 0.9% yoy in September. Manufacturing PMI declined in December by 0.5 points to 47.7, while services PMI improved by 1.2 points to 52.0, taking the composite PMI into expansionary territory at 50.4.

United States: US headline CPI inflation continued to fall in November, down to 3.1% yoy from 3.2% in October, in line with expectations. The mom headline print was 0.1% in November from 0.0% the previous month. Core CPI inflation was unchanged at 4.0% yoy, but the mom print was also up one tenth to 0.3% in November from 0.2% the previous month. The yoy growth in PPI inflation was 0.9% in November, 0.3% lower than October, and core PPI inflation rose by 2% yoy, also 0.3% than the previous month. Retail sales rose by 0.3% on a mom basis in October vs. a 0.1% decline expected.

In employment data, initial jobless claims registered 202k in the week, down from a revised 221k in the week prior, and 18k below expectations, while continuing claims rose by 20k to 1,876k.

United Kingdom: In the housing market, Rightmove reported that the average house price declined by 1.1% yoy in December, 20bps higher than November, reflecting a 1.9% mom decline, against the -1.7% mom change in November. In employment data, the claimant count remained unchanged at 4% in November. The jobless claims change was 16k in November, up from a downwardly revised 8.9k in October. The rate of GDP growth in October declined by 0.3% mom, 50bps lower than the month prior and 20bps lower than expected. Industrial production grew by 0.4% yoy in November, 110bps lower than October and 70bps below consensus forecasts, while construction output grew by 1.1% yoy, from 2.8% yoy in September, 1.4% yoy growth forecasted. The trade deficit widened in October by GBP 2,900m to a GBP 4,480m deficit for October, GBP 2,330m lower below economist forecasts. At its final meeting of 2023, the Bank of England left its policy rate unchanged at 5.25%, as anticipated.

In PMI data, the composite PMI grew by 1.0 point to 51.7, services PMI grew by 1.8 points to 52.7 while manufacturing PMI declined by 0.8 points to 46.4.

1. See – https://www.theguardian.com/environment/2023/dec/13/cop28-landmark-deal-agreed-to-transition-away-from-fossil-fuels

2. See – https://www.ft.com/content/da1f9924-be28-4ad5-a028-56d05735380d

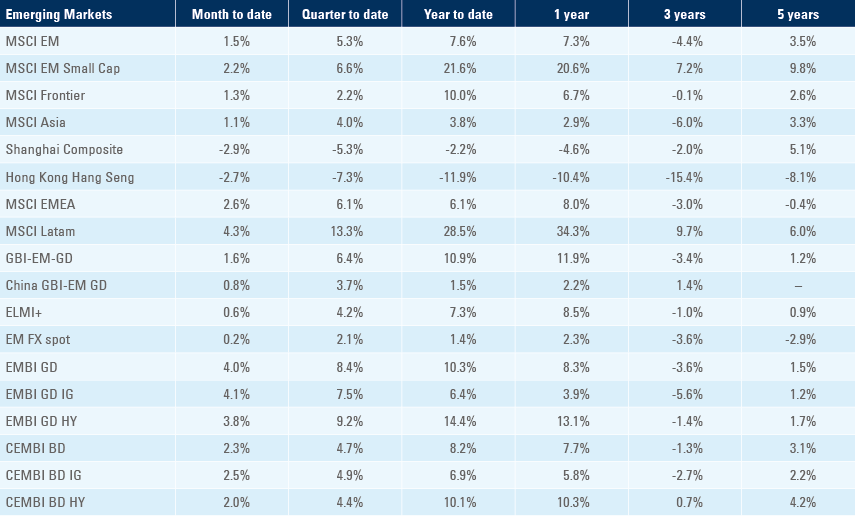

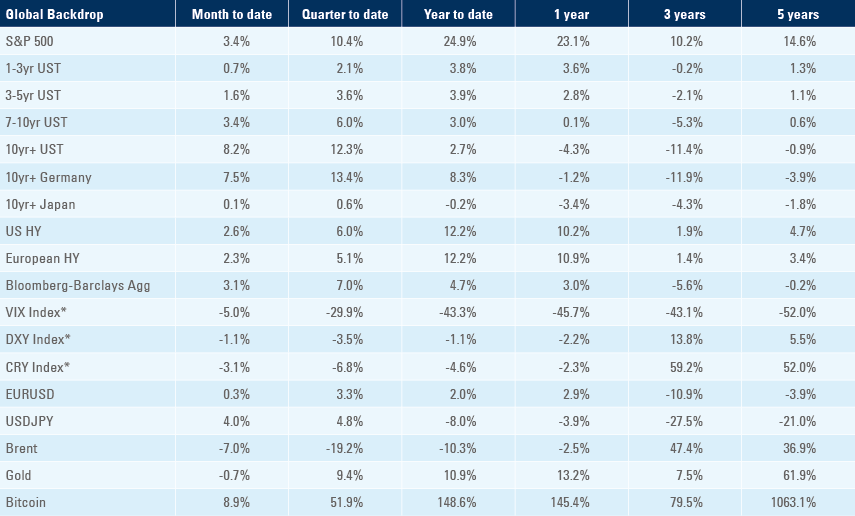

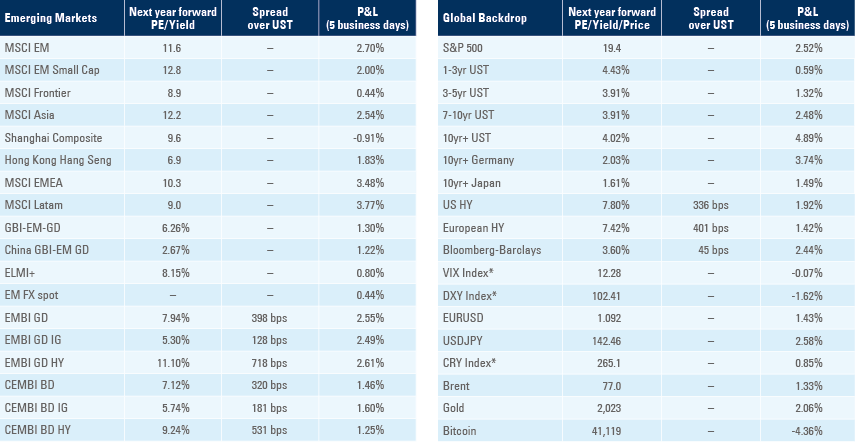

Benchmark performance