Lo que sea necesario: Bessent’s ‘whatever it takes’ moment for Argentina

- The German fiscal expansion is accelerating.

- US government risks shutdown this week over Senate funding disagreements.

- US Federal Reserve remains in “data dependent” mode.

- Gold hits record high, now more than 20% above its 200-day moving average.

- Costa Rica, Jamaica, and Morocco were upgraded, the latter to investment grade.

- Fitch revised Thailand’s outlook to negative from stable while affirming its ‘BBB+’ rating.

- Vietnam’s balance of payments swung to a USD 1.5bn surplus in Q2 2025

- US Treasury Secretary Bessent announced a USD 20bn currency swap line with Argentina.

- Saudi Arabia set to allow foreigners to own a majority stake in local companies.

- Nigeria’s benchmark interest rate cut by 50bps to 27%, the first cut for five years.

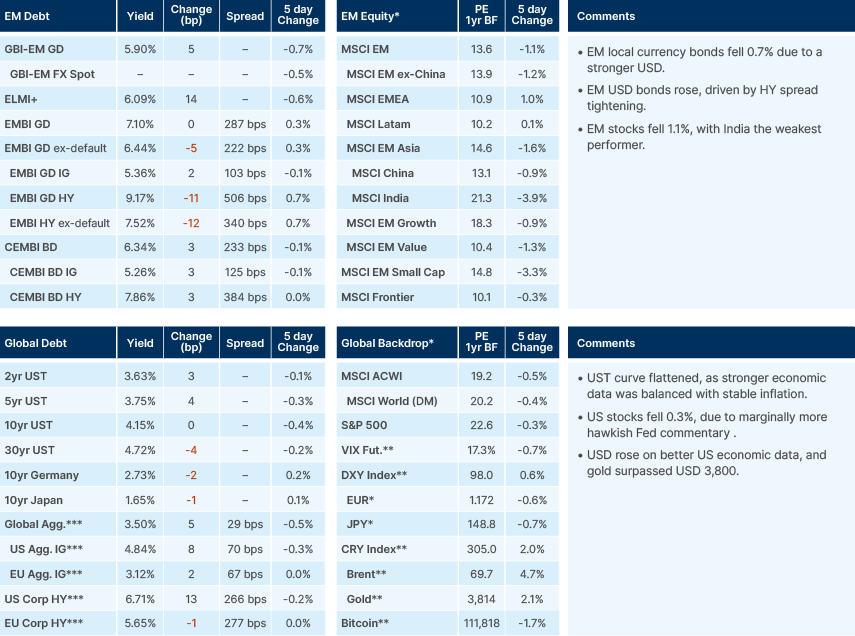

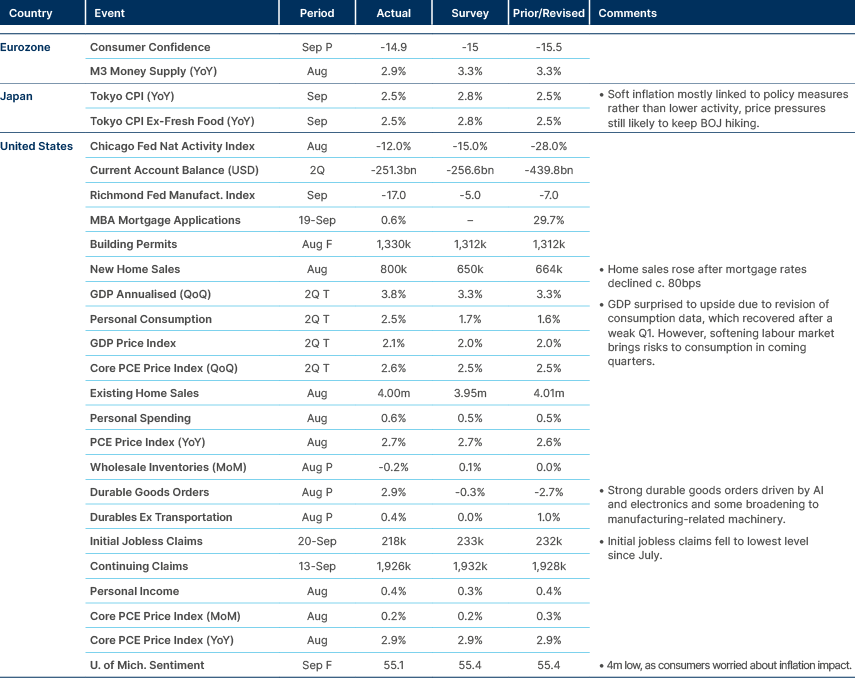

Last week performance and comments

Global Macro

The German fiscal ‘bazooka’ is about to be fired. The government’s draft budget for 2025 was voted through in the Bundestag two weeks ago, meaning spending is set to ramp up significantly. The planned budget deficit for 2025 is EUR 143bn, against a current running deficit of just EUR 50bn as of September.

In parallel, Chancellor Friedrich Merz’s 2026 draft budget was presented in parliament last week. It still requires Bundestag approval. However, in its current form, EUR 127bn has been set aside next year for new investments in infrastructure. Transportation investment is the biggest line item. Around half of this investment will be funded by ‘special borrowing.’ Defence spending is set to rise to EUR 83bn in 2026, with EUR 26bn to be funded by ‘special borrowing.’ EUR10bn has been set aside for the Climate and Transformation Fund. Largely because of this extra spending, consensus estimates are for German GDP growth to pick up from 0.3% in 2025 to 1.0% in 2026.

Various members of the US Federal Reserve (Fed) gave their views on the US economy last week, with the tone from Chair Jerome Powell and others slightly more hawkish than expected. Powell reiterated the Fed is in “data dependent” mode, and that it will move slowly on further cuts. Others commented on the balanced risk outlook, with Kansas Chair Jeffrey Schmid commenting that the labour market “remains largely in balance”. Last week’s US data came in stronger than expected, leading US Treasury yields to bear flatten as the front end of the curve sold off.

A key focus this week is the risk of a US government shutdown due to funding issues. Investors seem to be relaxed about this risk, likely assuming a shutdown would probably be short-lived. A Senate vote is expected on a House bill that would keep the government funded until late November. Currently, the Senate Democrats have blocked the bill, seeking greater healthcare funding.

If the US government does shut down this week, it is possible the Bureau of Labor Statistics (BLS) will be unable to publish non-farm payrolls data on Friday. Bloomberg reported that the BLS filed a contingency report in March that noted in the event of a shutdown all its operations would cease. In the 34-day 2018/19 shutdown, the BLS was able to publish data because Congress had provided special funding ahead of time. In October 2013, there was no such funding, and the BLS ceased operations along with other departments

Gold hit a fresh record high in nominal and real terms above USD 3,800. It is currently trading 20% above its 200-day moving average (MA). It has been there only 2.1% of the time from 1981 and 3.8% from 1971. If it rises to USD 4,000 in the coming days, gold would likely be 25% over its 200-day MA, where it has spent only 0.7% of the time since 1981. Gold and US stocks making record highs at the same time is unusual, however, the drivers of gold in this rally are multi-fold, with prices currently being driven by central banks increasing reserves, traders hedging US ‘fiscal dominance’, geopolitical risks, and more recently retail investors speculating on prices via ETF purchases.

Geopolitics

Another massive Russian air attack took place in Ukraine with some 593 drones and 50 missiles launched. Denmark banned civilian drones for a week after drones were seen flying over military bases housing strategic US assets like F-15s. A conference in Copenhagen to discuss a European anti-drone barrier is taking place this week after Russia reportedly invaded airspace in Poland and Finland.

Hungarian Prime Minister Viktor Orban and Slovak counterpart Robert Fico expressed defiance over pressure to quit Russian oil during a joint appearance on the border of the two countries on Sunday.

“No one should tell us where to get our gas and oil,” Fico told a small crowd in Esztergom, Hungary. “According to international law, it is a sovereign country that decides on its own energy mix.”

Fico backed Orban’s view, calling the EU ambition to cut off Russian energy a “political and ideological decision” that won’t just hit Slovakia and Hungary hardest, but will damage all of Europe.

Emerging Markets

Asia

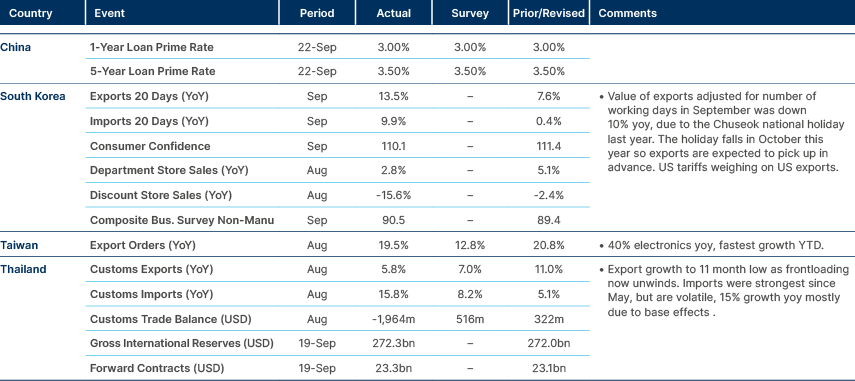

Taiwan’s export orders solid in August, Korea’s first 20 days of September soft, but holiday distorts picture.

India: The government approved INR 949.1bn worth of infrastructure projects, with a strong emphasis on shipping reforms, underscoring India’s intent to scale up shipbuilding and logistics capacity.

The OECD upgraded India’s growth forecast to 6.7%, from 6.3% in June. It cited resilient domestic demand and recent goods and services tax (GST) reforms as key drivers.

Indonesia: Indonesia’s parliament approved the 2026 budget bill without amendments, securing the passage of Finance Minister Purbiya Sadewa’s revised plan following the recent cabinet reshuffle. The budget foresees a 2.7% of GDP fiscal deficit, within, but close to, the 3.0% mandatory cap.

South Korea: The Trump administration is weighing a new plan to force chip companies to manufacture the same number of semiconductors in the US as their clients import from overseas.1 Companies that don’t follow the ratio would face as much as 100% tariffs. US companies would be responsible for tracking the origin of the semiconductors used in their products. The news hit Korea and Taiwan manufacturers on Friday. Prime Minister Kim Min-Seok committed to raising defence spending to 3.5% of GDP.

Thailand: Fitch revised Thailand’s outlook to negative from stable while affirming its ‘BBB+’ rating, reflecting political uncertainty, growth headwinds, and rising fiscal risks with government debt at 59.4% of GDP. GDP growth is projected at 2.2% in 2025 and 1.9% in 2026, with Fitch expecting another 25 basis points (bps) rate this year and one 25bps cut in 2026.

Vietnam: Vietnam’s balance of payments swung to a USD 1.5bn surplus in Q2 2025 after five quarters of deficits, driven by a strong current account surplus of USD 8.7bn on robust trade (USD 9.9bn surplus) and transfer inflows. The financial account stayed in deficit (-USD 4.8bn) due to heavy outflows in “other investment,” despite strong FDI inflows (USD 5.3bn) and easing portfolio pressures; FX reserves fell USD 1.5bn on central bank intervention.

Latin America

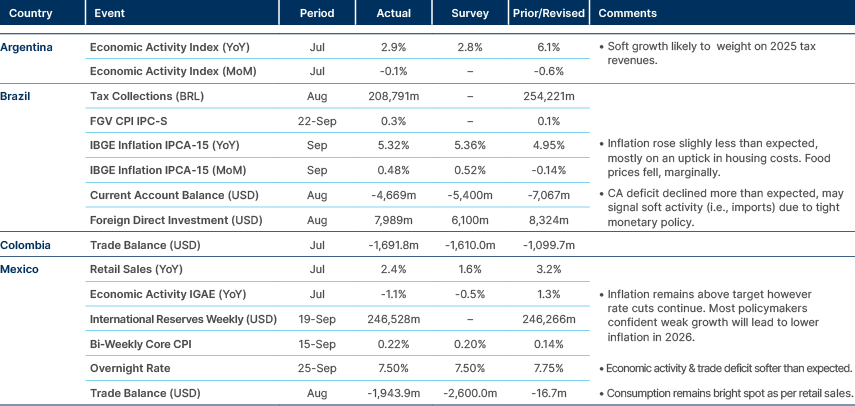

Mexico cut rates. Inflation rose less than est. in Brazil.

Argentina: US Treasury Secretary Scott Bessent announced a USD 20bn currency swap line with Argentina, as well as intentions to directly support with external debt repayments after the mid-term elections. Bessent committed to purchasing the country’s bonds, in both primary and secondary markets, and to mobilising the US Treasury’s Exchange Stabilisation Fund to prop up the Peso if necessary. Bessent also indicated that the US private sector would invest billions directly into Argentina, conditionally on President Javier Milei doing well enough in the October mid-terms.

This type of support by the US has very little historical precedent, and is unquestionably linked to supporting Milei directly, with Argentina a ‘key systemic ally’ in South America. The financial support also came with a direct political endorsement from President Trump. As the story developed last week, Argentinian assets stabilised. The USD 2035 bonds are now trading close to levels before the Buenos Aires province election, where Milei lost to the opposition coalition by a bigger margin than expected, spooking investors. The World Bank and Inter-American Development bank also committed to accelerate investment of around USD 4bn each.

After Bessent’s “whatever it takes” announcement, Argentina’s central bank slashed the one-day Peso repo rate from 35% to 25%. The Argentine government also announced the next USD 7bn of exports converted to Argentinian pesos (ARS) would be exempt from export taxes. On Thursday, the FX volume added up to USD 0.9bn. The central bank accumulated USD 2bn of FX reserves last week, on the back of the anticipation of agricultural flows, as the currency strengthened c. 10% and moved away from the ceiling of the FX band.

Brazil: The current account deficit rose to 3.5% of GDP in July 2025, from 1.1% in February 2024. Foreign direct investment (FDI) slowed to 3.2% of GDP. Resilient domestic demand for imports is driving the external accounts deterioration.

Governor Tarcísio de Freitas of São Paulo met with former president Jair Bolsonaro, following a local newspaper report claiming Bolsonaro had endorsed Tarcísio as a potential presidential candidate. One of Bolsonaro’s sons dismissed the report but has publicly backed Tarcísio himself. All else constant, we believe it is likely that Tarcisio will not confirm his candidacy at least until December this year, but most analysts believe Bolsonaro and the centrists political parties will back his candidacy. Meanwhile, President Lula is expected to hold a formal meeting with President Trump, following a brief exchange at the UN General Assembly, although no date has been confirmed.

The Lower House is set to discuss two key fiscal bills this week. On Tuesday, it will consider the provisional measure aimed at offsetting the recent tax on financial operations (IOF) tax reduction. On Wednesday, attention will turn to the bill proposing changes to income tax exemptions.

Costa Rica: Moody’s upgraded the sovereign credit rating to ‘Ba3’ from ‘Ba2’, but revised the outlook from positive to stable. The upgrade reflects stronger fiscal and debt metrics as growth and interest costs improve debt affordability. Meanwhile, the National Assembly failed to secure the votes needed to strip President Rodrigo Chaves of immunity from prosecution in an extortion case.

Jamaica: The ratings agency S&P upgraded the sovereign rating to ‘BB’ from ‘BB-‘. The rating reflects S&P’s assessment of Jamaica’s strengthening institutional and policy frameworks, supported by consensus across both political parties and various economic sectors on macroeconomic policies focused on debt reduction.

Central and Eastern Europe

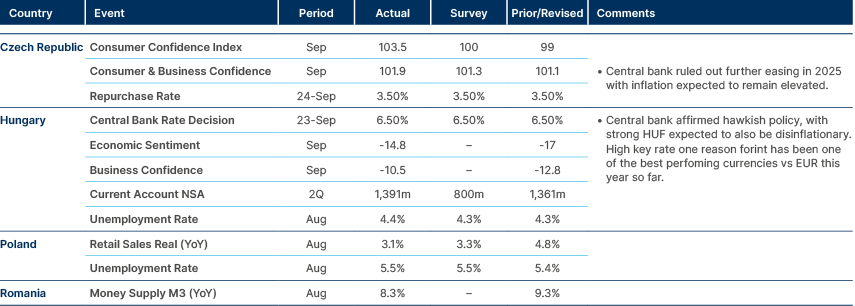

Hawkish holds in Czech and Hungary.

Czechia: The Czech National Bank (CNB) unanimously kept its policy rate at 3.50%, maintaining its hawkish stance with inflation risks broadly unchanged. CNB Governor Aleš Michl noted that a stronger CZK reduced the need for further tightening. Interest rates are now expected to remain unchanged through to at least March 2026.

Romania: Romania’s Constitutional Court postponed its ruling on four of the five notifications to the government reform package until 8 October. Meanwhile, the European Commission approved Romania’s revised 2025 budget deficit target of 8.4% of GDP (vs 7.0% prior), mainly due to rising interest costs. The deficit is projected to fall to 6.0% in 2026 as reforms take effect.

Ukraine: President Trump shifted his tone on Ukraine, calling Russia a “paper tiger” in economic trouble and suggesting Ukraine could retake all its territory with EU support. However, Trump still opposes additional US funding or new sanctions, leaving Europe to bear most of the burden.

Central Asia, Middle East, and Africa

Nigeria cuts policy rate for first time in five years.

Egypt: Egypt’s government is considering gas market liberalisation that would allow large industries to contract directly with suppliers. The move could reduce subsidies, ease fiscal pressures, and build a more competitive market. Meanwhile, remittances jumped 27% yoy to an all-time high of USD 3.8bn in July. Today the country announced it will be issuing USD 1.5bn in Sukuk Eurobonds for 3- and 7-years. Its majority is likely to be subscribed by locals, in our view.

Morocco: The ratings agency S&P upgraded the sovereign rating to investment grade at ‘BBB-‘, one notch above both Fitch which holds a ‘BB+’ with a positive outlook and Moody’s at ‘Ba1’. The outlook was kept unchanged, reflecting “strong structural reform momentum supporting economic growth, diversification, and budgetary consolidation against low GDP per capita, still high unemployment, vulnerability to climate-related events, and global geopolitical tension”. In our view it is a matter of time for the country to receive a second upgrade, which will allow it to re-join the main IG indices.

In other news, Bank Al-Maghrib held its policy rate at 2.25%, citing global and domestic uncertainty. Inflation is projected to remain subdued, at 1% in 2025 and 1.9% in 2026, with GDP growth at 4.6% in 2025 before moderating, while the fiscal deficit is forecast to remain above target at 3.9% of GDP.

Saudi Arabia: The capital market authority said it is considering allowing foreign investors to own a majority stake in local companies by easing rules that cap foreign ownership of listed companies at 49%. Even though the news was not confirmed by an official source, the Tadawul index surge 14.5% following the announcement, positing its largest one-day gain since 2020.

Nigeria: The Central Bank of Nigeria cut the benchmark interest rate by 50bps to 27%, the first cut in five years, citing signs of disinflation. Consumer price index (CPI) inflation slowed to 20.1% yoy in August, the lowest since July 2022. In addition to the rate cut, the monetary policy committee reduced the cash reserve ratio for commercial banks to 45%, adjusted the policy corridor to +250/-250bps, and kept the liquidity ratio unchanged at 30%. GDP growth accelerated to 4.2% in Q2, above market expectations of 3.6%.

Türkiye: President Recep Erdogan secured a high-profile meeting with President Trump, reinforcing “business as usual” ties despite domestic pressures. The meeting included cabinet members such as Finance Minister Mehmet Simsek, Scott Bessent and other senior figures from both sides.Türkiye presented circa USD 50bn in deals (aviation, liquified natural gas, nuclear) while pushing for relief on CAATSA2 sanctions, re-entry to the F-35 programme, and progress on defence cooperation.Erdogan balanced US concerns over Russian energy reliance with diversification steps, while aligning with Washington on Syria and managing tensions over Gaza/Israel.

Developed Markets

US labour market, durable goods, and housing data rebounds.

Spain: Fitch and Moody’s upgraded Spain to ‘A’ and ‘A3’, their highest levels since 2012. Both ratings agencies cited strong economic growth. S&P had already upgraded Spain to ‘A+’ on 12 September.

United Kingdom: Gilts led the sell off after Greater Manchester mayor Andy Burnham said in an interview: “We’ve got to get beyond this thing of being in hock to the bond market.” In a separate interview, Burnham called for £40bn of additional borrowing to fund council house construction. While Burnham is not an MP, he is considered a potential challenger to Prime Minister Keir Starmer.

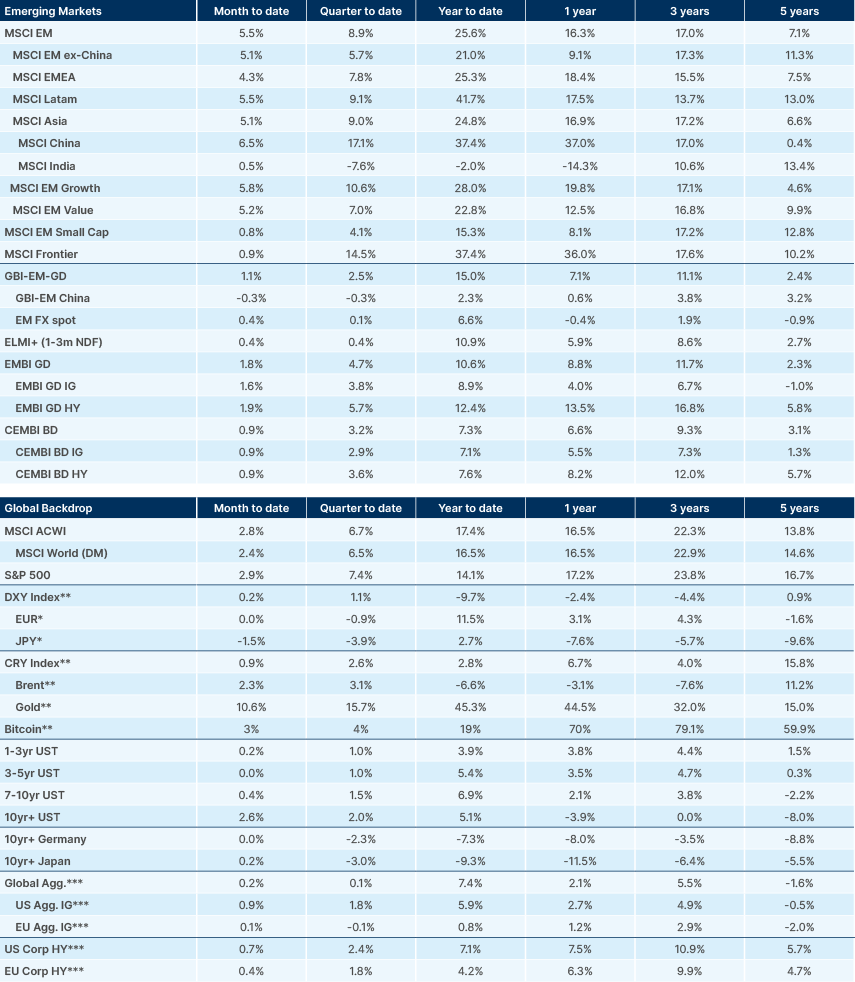

Benchmark Performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.

1. See {NSN T36MIXPV4WE9 }

2. Countering America’s Adversaries Through Sanctions Act.