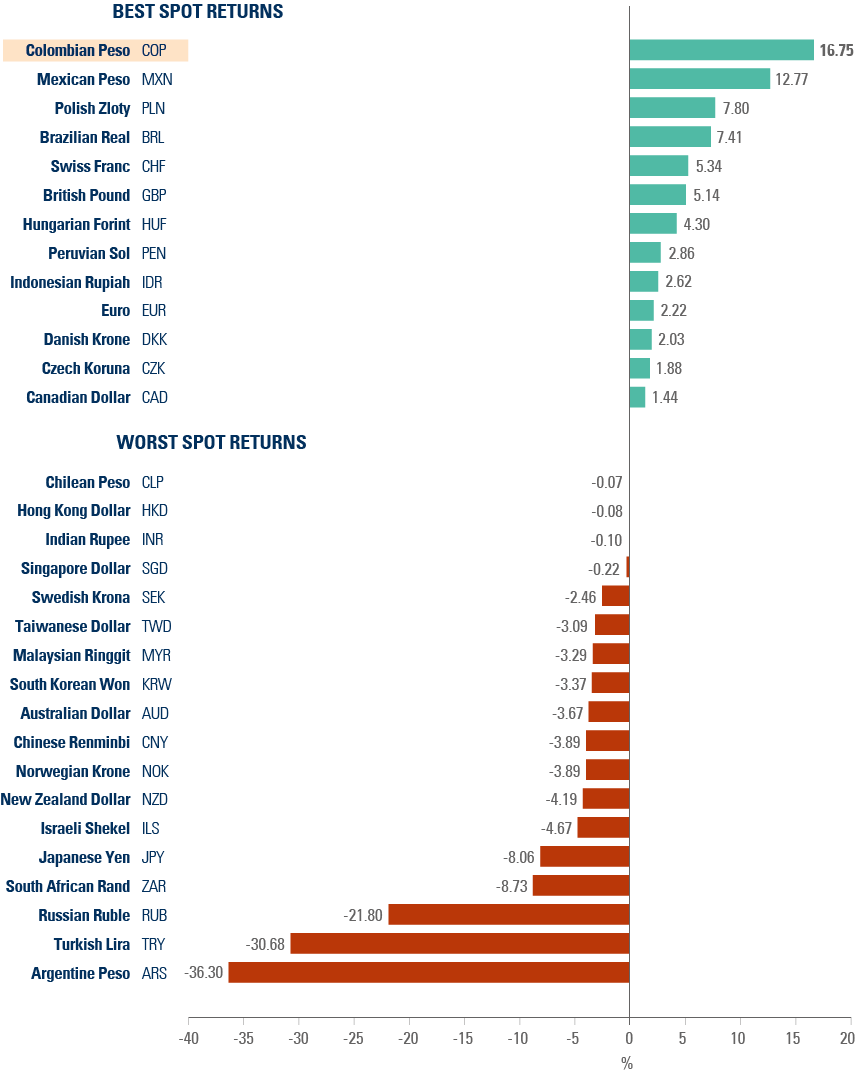

What is the best performing currency in 2023 so far? Against all odds and biases, the Colombian Peso (COP), which is up 16.8% against the USD year-to-date and 22.8% including the ‘carry’, or the interest rate differential earned by carrying long positions in COP vs short in USD. This brief note explains the reason for the COP outperformance and the outlook for the currency.

Fig 1: Major currency performance vs. US Dollar: Year to date (%)

1 | Debunking myths: Is politics the sole driver of currency performance?

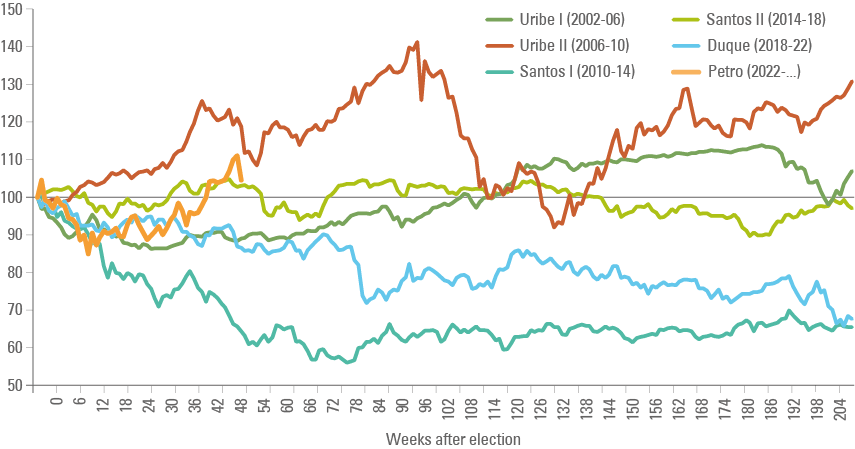

The first interesting element of the COP’s performance is that it has been brought to a positive level since the inauguration of President Gustavo Petro, which took place on 7 August 2022. The key argument behind the COP weakness, political risk, can be easily challenged when comparing currency performance in different presidential terms. Since Petro moved to Casa de Nariño, the COP has had a very similar performance to when former president Juan Manuel Santos came to power in 2010, and has beaten the performance of the currency during Álvaro Uribe’s first term and, more recently, that of Iván Duque as per Fig. 2:

Fig 2: USDCOP performance from date of inauguration of each president since 2002

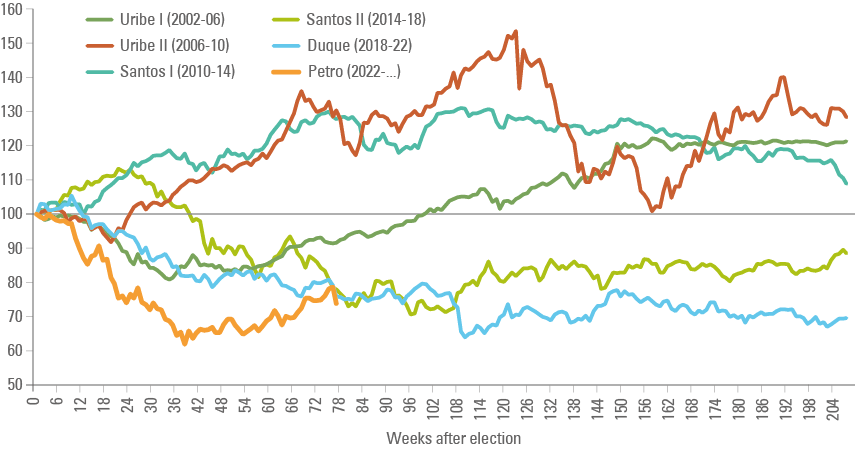

A sceptic could point out that political risks are anticipated by the market and that COP performance is contingent on the broad Emerging Market (EM) asset class returns. Therefore, the better exercise would be to compare COP performance versus EM foreign exchange (FX) performance (instead of vs. USD) and starting six months before inauguration, the period during which the market prices a new president (or continuation of an incumbent). The back-test shows that the COP has indeed underperformed due to political risks triggered by the fear of Gustavo Petro coming to power, as per in Fig. 3. Nevertheless, the trajectory of the COP more recently has a similar (but more pronounced) ‘swoosh’ shape than Uribe’s performance. Will the Peso keep recovering as it did under the first administration of Uribe? Most market participants prefer centre or centre-right politicians with a pro-market stance, but does it mean that leftist presidents will lead to asset prices underperformance?

Fig 3: COP vs EMFX performance from 6-months before inauguration of each president since 2002

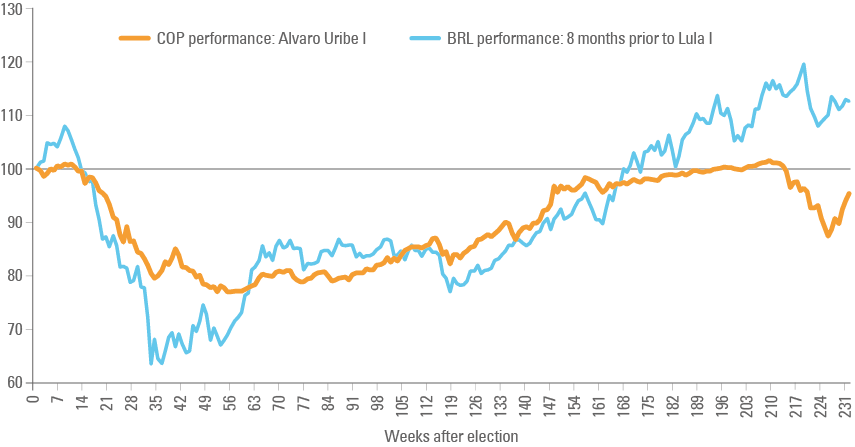

Fig. 4 compares the performance of the COP versus the Brazilian Real (BRL) from February 2002 (i.e., six months before Uribe came to power) to August 2006 at the end of Uribe’s mandate. Over the period, it was clear that Luis Inácio Lula da Silva, then a much-feared leftist candidate, would win the upcoming elections in October 2002. Despite the clear market bias in favour of Uribe and against Lula, the BRL ended the period outperforming the COP by a large margin. We attribute the performance to the surprise factor. Once most market participants expect an event to take place, in this case, a significant deterioration in policy, if that event does not happen, it can lead to a large positioning adjustment contrary to the common perception.

Fig 4: COP vs BRL Feb-2002 to Aug-2006

In our view, it is reasonable to expect the COP will follow the J-curve shape like Uribe’s first mandate, perhaps with even an more pronounced price increase from here. The COP’s continuous outperformance is contingent on two factors: (i) Petro moderating his stance and watering down his populist agenda, and (ii) the US Dollar continuing to depreciate.

2 | Capital flow reversal after political moderation: by hook or by crook

It is no secret that presidents are powerful. However, it is also no secret that, by design, economists are severely constrained in the ability to change their institutional systems. The ‘checks and balances’ in systems makes implementing populist measures much more challenging than feared. Peruvians will be familiar with the gap between a dysfunctional political environment concomitant with orthodox economic policies. In Chile, local investors sold local assets and bought overseas assets at a record pace due to fears of a more structural change in economic policies as Gabriel Boric looked to fulfil his pledge to deliver a new, more progressive constitution, only to find out that neither Chile’s Congress nor its people supported the first proposed constitution, leading to the drafting of a more conservative document. The end of large outflows led to a strong reversal of Chilean Peso (CLP) depreciation last year.

A similar story is playing out in Colombia, in our view. Flows from compensation accounts had a strong reversal, registering a USD 15.8bn outflow in the first half of 2023 after outflows of USD 19.8bn in H1 2022 and USD 18.9bn in H2 2022. Compensation accounts are used by local corporations as an instrument to keep Dollars abroad for trade and financial transactions. Furthermore, foreign direct investment started to increase again, resulting in an exchange surplus (current account balance flows rather than accrual) of USD 0.6bn in H1 2023, up from a USD 1.4bn deficit in H2 2022. Just like in Chile, Colombians ‘shot first and asked questions later’, and the massive outflows in the run-up to Petro’s election are hard to match, explaining the sharp reversal of COP performance year-to-date.

Interestingly, Petro is now reaching out to investors, touting a more pragmatist agenda.1 His economic team, initially led by José Antonio Ocampo and now by Ricardo Bonilla, is committed to consolidation of the country’s fiscal deficit, despite Petro’s leftist agenda. Last month’s announcement of the resignation of Energy Minister Irene Velez lowered the risk of an ill-advised sharp cut in fossil fuel energy production, which would have had a severe impact on Colombia’s external accounts.

Petro’s approval rating has been in decline since he came to power, so his political capital is undermined by his low popularity. The recent event where his elderly son Nicolas Petro were imprisoned for in a money laundering inquiry is very likely to be negative to the president, in our view. Initially, Gustavo Petro tried to disassociate himself from the issue, claiming he had nothing to do with the accusations and “wishing luck” to his son. However, last night Nicolas admitted receiving illicit money from a former senator convicted of drug trafficking, that went into his father's 2022 presidential campaign.

It should not be surprising that ultra-conservative Colombians are fighting against a leftist populist agenda. Even though we believe Petro will keep pursuing a progressive economic agenda that conflicts with orthodox policies, in the end, a pragmatic compromise is likely to be reached, by hook or by crook.

3 | Dollar exceptionalism is over

In our view, the US Dollar peaked last year and has already entered a medium-term period of decline. We made the case against the Dollar clearly in a recent Ashmore publication.2 This session offers a summary of the main points.

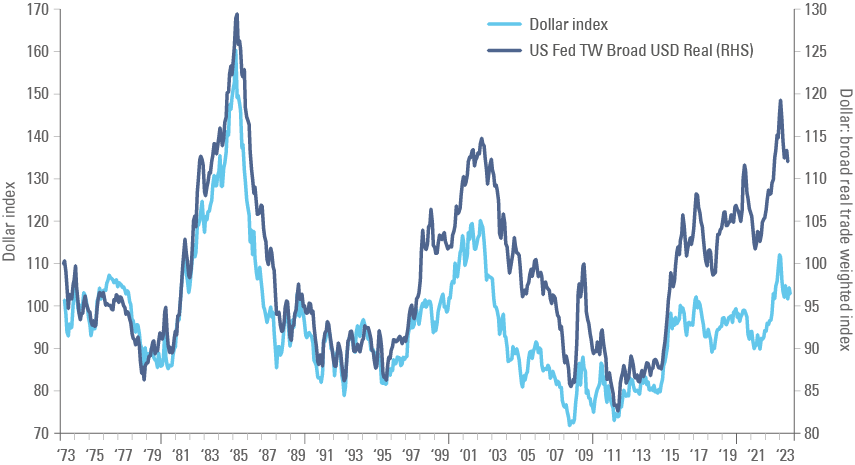

The US Dollar real effective exchange rate (REER), a gauge for long-term valuations, has peaked only 10% below the 1985 Plaza Accord levels, as per Fig 5. The ‘peak Dollar’ thesis is backed both by cyclical and long-term fundamentals.

Fig 5: USD index (DXY) vs. broad trade weighted USD in real terms: 1973 to 2023

On the cyclical side it appears likely that the European Central Bank (ECB), the Bank of England (BOE) and the Bank of Japan (BOJ) will remain more hawkish than the US Federal Reserve (Fed) over the coming quarters. In case central banks need to ease monetary policy, Japanese policymakers have their hands virtually tied, and with European inflation running at more elevated levels, the ECB is likely to lag on easing. Lower inflation since Q3 2022 has coincided with a strong sell-off of the US Dollar Index, from 114 levels to around 100 today, as investors have started to anticipate the end of the hiking cycle, likely at the end of this month.

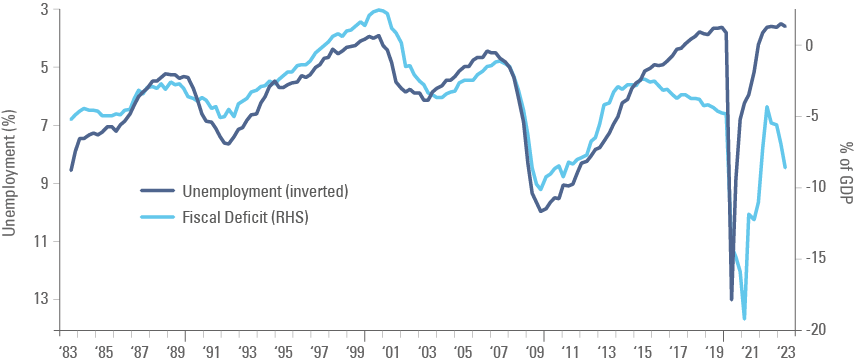

On the structural side, the US has been running larger (and in our view, unsustainable) fiscal deficits which have kept its external deficits elevated, leading to the accumulation of large net international investment liabilities in relation to the rest of the world.3 As a result of its large fiscal deficit, which reached 8.6% of GDP in June as per Fig. 6, the US economy is extremely imbalanced and dependent on risk-on capital flows to its equity market to sustain its large external deficits. It was precisely this large fiscal expansion that kept US capital markets buoyed, also in what we see as an unsustainable fashion, bringing US equity valuations to the highest levels since the 2001 ‘dot-com’ bubble peak at the end of 2021.

Fig 6: US Fiscal balance (% of GDP) vs. unemployment rate (inverted)

Last, it is hard to believe the US will be able to maintain its ultra-loose fiscal policy and ultra-tight monetary policy for too long as the interest costs will increase in a non-linear fashion. Eventually either the US will have to consolidate its fiscal deficits, the Fed will have to ease ultra-tight monetary policy, or both. The only scenario in which the USD could try to hit all-time highs would be tight monetary and fiscal policies, which would most likely lead to a very strong recession, considering the stage of the cycle we are in.

4| Colombian Peso valuations:

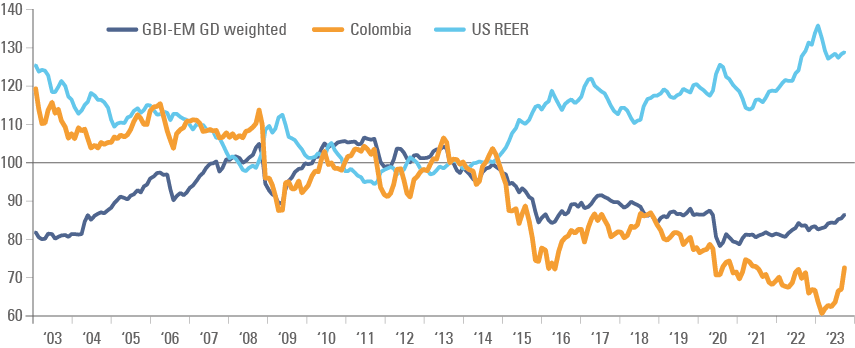

EMs are in a particularly good spot to benefit from the incoming diversification of assets and flows away from the US that will drive EM currencies stronger, in our view. In that context, we’d expect EM flows to most benefit countries with undervalued currencies with high carry. Despite the recent appreciation, the COP is still one the weakest currencies across large EM countries on a REER basis. Fig. 7 shows a normalised (at 100) USD REER, COP REER, and the weighted average of the EM currencies in the EM GBI-EM GD (largest local currency bond index).

Fig. 7: USD, COP and EMFX REER. Normalised at 100 in June-2013

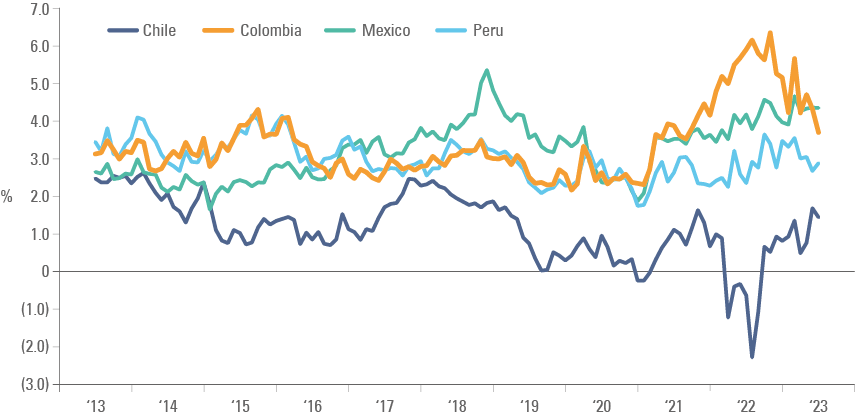

Colombia also has one of Latin America’s highest interest rates, after adjusting for inflation expectations in the region as per Fig. 8. Moreover, the recent decline in volatility has brought the carry-to-volatility ratio to the top of the region as well, meaning investors have a high risk-adjusted return when investing in the COP, as per Fig. 9.

Fig. 8: Ex-ante real interest rates (GBI vs 12m CPI est.) Latin America

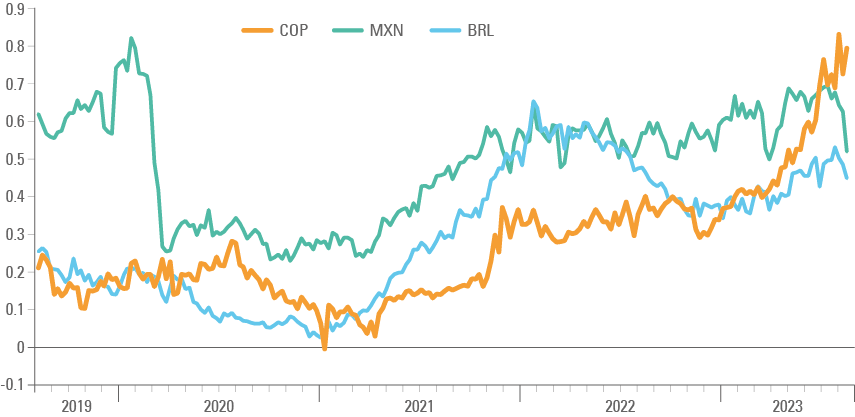

Fig. 9: Carry-to-volatility ratio: COP, MXN and BRL

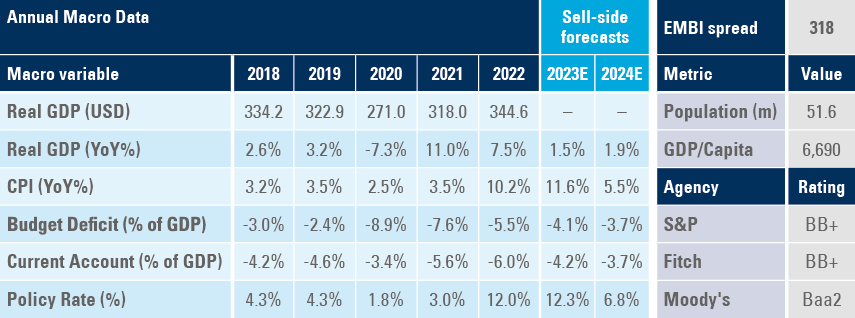

5 | Macro Fundamentals

On the fundamental side, Colombia is one of the fastest-growing economies in Latin America. Fig. 10 shows its economy expanded by 9.6% in 2021 and 7.8% in 2022, compared with Brazil’s more modest growth of 4.7% and 3.0% and Mexico’s 5.3% and 3.0% over the same periods. Economists expect gross domestic product (GDP) growth to decline to a modest 1.5% and 2.0% in 2023 and 2024, leaving plenty of room for upside surprises, which are likely, in our view.

Colombia’s debt burden is relatively small, particularly in the private sector. Its debt/GDP ratio is 29% in the household sector, 33% for corporations and 58% for the government, leaving the country with a below-the-EM average at 46%, 103% and 62%, respectively.

After another round of tax reforms, economists estimate the 2023 budget deficit is likely to decline to 3.9% of GDP this year and 3.6% in 2024, a steep fiscal consolidation from the 7.6% deficit in 2021 and 5.5% last year. A lower fiscal deficit is likely to bring down the current account deficit, which is expected to drop to 4.1% of GDP in 2023 and 3.6% in 2024, down from 5.6% in 2021 and 6.0% last year.

Overall, the key to elevating GDP growth to higher levels on a sustainable basis is to increase the country’s savings rates, which would allow for higher investment in infrastructure without the need to import savings from abroad, which translates in a higher current account deficit. The fiscal consolidation implemented by the government is a key step towards this direction.

Fig. 10: Key macroeconomic data points

Summary and Conclusion

In a surprising reverse of fortunes, the Colombian Peso is the strongest-performing currency in EM in 2023. The sharp decline in Petro’s approval ratings, and his inability to drive the economic agenda to the left, led to a sharp reversal in capital flows as Colombians sent less money abroad and foreign direct investment increased again. Looking forward, the currency can keep appreciating, particularly if Petro’s leftist agenda is blocked by the country’s institutions and globally the Dollar keeps selling off. The COP is the cheapest currency in EM, except for the Turkish Lira, when measured in REER terms. The elevated levels of yields on local bonds and falling inflation are driving the returns from local bonds higher, keeping the currency strong. Over the long term, Colombia’s favourable macro fundamentals are likely to keep the COP’s recovery intact, in our view.

1. See: https://www.ft.com/content/fe2113c1-a128-49a4-b4fc-8282e66aee67

2. See: 'The case for local currency bonds “Si, se puede!”’, The Emerging View, 28 July 2023.

3. See: 'Economic reforms in Frontier countries continue & better sentiment in Chinese stocks’, Weekly Research, 17 July 2023 and https://www.bea.gov/data/intl-trade-investment/international-investment-position