G-3 central banks and reaction to earnings to set the tone for the summer

This week’s events will have important developments for asset prices in the remainder of the northern hemisphere summer season, including G-3 central bank decisions, reaction to earnings and whether Ukraine will be allowed to export its grains via the Black Sea. European Flash Purchasing Managers’ Indices (PMIs) were much weaker than expected. China’s politburo published an earlier than expected statement vowing to support the economy. Korea and Taiwan trade data were weak again. Argentina had positive political news, but its economy is in tatters. Declining inflation expectations in Brazil allow for an earlier and more aggressive easing cycle. South Africa’s central bank kept policy rate unchanged (consensus to hike) with two members voting for a cut. Saudi Arabia announced a USD 500m support to Tunisia and the United Arab Emirates (UAE) agreed on USD 50bn investments in Türkiye.

Global Macro - week ahead

A big week ahead for global macro that may set the tone for the summer with the largest central banks in the developed world due to announce policy decision.

- The US Federal Reserve (Fed) meets Wednesday and is widely expected to hike its policy rate by another 25 basis points (bps) to 5.5% and keep future decisions “data dependent”, while the overnight interest rate swaps (OIS) weighted average outcomes implies 33% odds of a final 25bps hike in September. The messaging may have a “dovish” tilt after weaker than expected inflation in June. The Senior Loan Officer Opinion Survey will be released next week, but Fed officials will have access to it before the Wednesday meeting.

- The European Central Bank (ECB) meets on Thursday and is very likely to hike rates by another 25bps to 3.75%. OIS weighted average outcomes implies 62% odds of a 25bps in September and 87% cumulative odds by December, albeit some strategists believe the ECB may end the cycle in July. Europe will have its own bank lending survey released this week and results this week will be closely watched head of the ECB. The very weak flash manufacturing PMI numbers released this morning is leading to expectations of a more dovish tilt to forward looking ECB decision, but ECB Chair Christine Lagarde has kept a firm hawkish bias for a while now.

- The Bank of Japan (BOJ) meets on Friday and albeit several strategists are speculating on yield curve control adjustments, BOJ guidance from last week suggests it still has a dovish bias.

The economic calendar is busy with global flash PMIs today, ECB bank lending survey tomorrow, United States (US) Q2 2023 GDP on Thursday, US core personal consumption expenditures, German and French consumer price index (CPI) (Friday). The flash PMIs released this morning were much weaker than expected, after two months when manufacturing came in better than expected:

- Japan Manufacturing -0.4 to 49.4; Services -0.1 to 53.9

- France Manufacturing -1.5 to 44.5; Services -0.6 to 47.4

- Germany Manuf. -1.8 to 38.8; Services -2.1 to 52.0

- EU Manufacturing -0.7 to 42.7; Services -0.9 to 51.1

- UK Manufacturing -1.5 to 45.0; Services -2.2 to 51.5

Lastly, several companies report earnings are due with 165 S&P 500 and 200 out of 600 Euro Stoxx companies reporting this week. Focus will be on technology companies after Tesla and Netflix reported better than consensus earnings but sold-off due to poor guidance. It will also be interesting to monitor whether large technology companies are following through with artificial intelligence capital investment plans, which have been widely anticipated in the valuations of several stocks.

Geopolitics

Ukraine said that ships heading to Russian ports may be military targets following the collapse of the Black Sea grain deal. Over the weekend, Russia intensified the bombardment of the port city of Odesa and further West, including infrastructure along the Danube River. African countries traveling to St Petersburg will pledge for grains to keep flowing and negotiate a peace or cease fire agreement, but last week, South Africa said Russian President Vladimir Putin won’t attend the BRICS summit in person. Wheat prices rose 16% from the lows on 12 July after the deal allowing for exports of grain was suspended.

Emerging Markets

EM Asia

China: The Citibank Economic Surprise index declined -17 to -88.6, the lowest level since 2015 excluding the pandemic. The Chinese Politburo released the statement of its meeting before expected. The tone of the statement was broadly unchanged compared to April, when it vowed to support China’s economy but had more specific details, including:

- Economy faces new challenges, mainly because of insufficient demand.

- Vows to enliven capital market and boost investors’ confidence.

- Will optimise and adjust property policies at an appropriate time to promote stable and healthy development of the sector.

- Pledged to draft and implement a package of policies to prevent and resolve local government debt risks.

The statement suggests Chinese authorities are aware of the economic challenges and will act to prevent larger systemic risks developing, in our view.

South Korea: The first 20-day trade numbers came in very soft again. Exports declined 15.2% yoy and imports dropped 28% yoy. Chip exports were down 35.4% yoy as exports to China declined 21.2% yoy and exports to the US dropped 7.3% yoy. The trade deficit widened to USD 1.36bn over the period. In other news, the producer price index (PPI) dropped to a yoy rate of deflation of 0.2% in June from +0.5% yoy in May.

Taiwan: Export orders were down by 24.9% yoy in June from -17.6% yoy in May, significantly below consensus at -20.3% yoy. In political news, the Taipei Times reported “The Chinese Nationalist Party (KMT) unanimously passed a resolution nominating New Taipei City Mayor Hou You-yi as the party’s presidential candidate, amid concern that the party might replace him as he continues to lag in the polls.”1 Meanwhile, KMT Chairman Eric Chu said: “more than 60% of Taiwanese support a change of the ruling party”.

Latin America

Argentina: The candidates from the opposition coalition Juntos por Cambio (JxC) received 63% of the votes in the Province of Santa Fe while Union Popular (UP) candidates received only 28% of the votes. No polls had the opposition above 50%. Santa Fe is the third-largest province in Argentina and has been run by the Peronists since the early 1990s. So far, the incumbents had not won a single state where they were not in power, while JxC has had the upper hand in primaries across several provinces controlled by the Peronists. This is interesting to the extent that the national level polls don’t seem to give the opposition a big advantage. Also, the candidates backed by Larreta are getting better results in the regions.

The main problem for JxC is the risk of the economic crisis descending into chaos, which could potentially help to support the far-right candidate Javier Milei. The economic activity index dropped 0.1% mom in May after -1.8% in April, bringing the yoy rate down 110bps to -5.5% (consensus -3.4%). The trade deficit widened to USD 1.7bn in June from USD 1.1bn in May as exports dropped by USD 0.8bn to USD 5.5bn, and imports were down only USD 0.2bn to USD 7.2bn. The budget deficit widened to ARS 611bn in June from ARS 248bn in May, the worst result on record, bringing the primary deficit to 1.1% of GDP in H1 2023, from 0.2% in H1 2022. The spending adjustments in social transfers and were not enough to offset the massive drop in revenues due to the drought. Argentina’s Treasury has continued to rely on central bank financing to fill the 2.9% financing gap from H1 2023.

Brazil: The Focus survey with financial institutions showed consensus expectations for end-2025 CPI inflation down to 3.55%, from 3.8% a month ago, getting closer to the target of 3.0% +/- 1.5%. Alongside softer economic activity (est. -0.1% mom) paves the way for cuts. Markets are pricing in 50bps every meeting from September (August a bit more than 25bps) and 420bps until Jan-2025. Soft activity may bring the Central Bank of Brazil to cut faster.

Colombia: The Minister of Energy Irene Velez resigned from her post, bringing hopes that a more pragmatic person would be given the position. Gustavo Petro pledged to cut fossil fuel production aggressively, a key risk to the country’s external accounts.

Central Asia, Middle East, and Africa

South Africa: The Reserve Bank of South Africa kept policy rates unchanged at 8.25%, surprising 17 out of 27 analysts surveyed by Bloomberg who expected a 25bps increase to 8.5%. In fact, two out of the five members of the committee voted for a 25bps cut last week. The statement had a balanced read on economic activity but had inflation outlook risks biased to the upside counterweighted by persistent “tighter global financial conditions raising the risk profile of economies needing foreign capital”.2 Against that backdrop, CPI inflation rose +0.2% mom (+5.4% yoy) in June from +0.2% mom (+6.3% yoy) in May, broadly in-line with consensus (5.5%). This is the first time the yoy CPI has fallen within target in 14 months, primarily driven by lower food costs. The yoy rate of retail sales improved 0.4% to -1.4%, coming slightly below consensus at -1.1%.

Türkiye: The Central Bank of Türkiye raised its one-week repo rate to 17.5%, below consensus expectations at 18.5%. Of the 23 estimates from economists, only one analyst expected policy rates to increase to 17.0% and four expected 17.5%. The central bank remains worried about a monetary policy shock in an economy that is already slowing down due to the end of the pre-election credit boom. There is also the risk of too much tightening displeasing Erdogan, who was busy last week in a foreign trip to Qatar, Saudi Arabia, and the UAE. Saudi Arabia agreed to buy Turkish drones and the UAE pledged USD 50bn in investments to the country.3

Tunisia: Saudi Arabia granted USD 500m of financial aid to Tunisia comprising USD 400m “soft” (subsidised) loan and a USD 100m donation. The International Monetary Fund (IMF) is yet to approve a USD 1.9bn External Fund Facility (EFF) to support the government’s budget. Fitch Ratings estimates the 2023 external financing shortfall to be USD 5.0bn or 10% of GDP. Fitch, which downgraded Tunisia’s sovereign debt rating to CCC- last month, estimated financing from bilateral and multilateral parties would be equivalent to around 65% of the government’s needs, but it’s unclear whether Fitch factored in the USD 500m aid from Saudi Arabia. The government has been reluctant to adopt the IMF suggested reforms and spending cuts, including food and fuel subsidy cuts, public sector wages, and reform to state owned enterprises. President Kais Saied is trying to balance fiscal improvement with the country’s fragile social and political stability. A compromise is likely to be reached, in our view, to keep supporting the only democracy emerging from the Arab Spring. Saied’s rejection of the removal of food subsidies was met with IMF openness to supply assistance to enable the replacement of broad base subsidies with targeted transfers. Tunisia is also set to receive financing from creditors in Europe, the World Bank and African Development Bank, which have stated their desire to ensure Tunisia avoids default.

Developed Markets

June CPI data (yoy) improved across countries. The Citibank Economic Surprise index declined from very high levels in the US (-12 to +63.1) and recovered from very depressed levels in Europe (+16 to -118).

United States: Retail sales rose by +0.2% mom in June (consensus at 0.5%), after an upwardly-revised 0.5% mom in May. The retail sales figure climbed 0.3% after excluding autos and gasoline and the “control group” measure used to calculate GDP (ex-food services, auto dealers, building materials and gas stations) was better than expected at 0.6% mom (consensus 0.3%). Industrial production dropped 0.5% in June, after -0.2% in May. Manufacturing output declined 0.3% in June, the largest fall in three months. US initial jobless claims declined to 228k, 12k below consensus for the week ending 15 July but continuing claims rose to 1.75m (1.72m consensus) in the prior week). The Philadelphia Fed manufacturing outlook survey rose slightly to -13.5 (consensus was -10.0), but six-month ahead expectations rose to a 12-month high of 29.1.

Eurozone: Spain is heading for a hung parliament after national elections on Sunday. Incumbent Pedro Sánchez Socialist Workers Party (PSOE’s) won 122 votes, less than the centre-right Popular Party’s (PP) 136 seats. Both parties were short of the 176 seats needed to control the Spanish parliament, but Sánchez's coalition can potentially reach 172 seats against the right-wing block’s 170. Polls before the blackout period last week suggested Sanchez would have 180 seats, but the far-right VOX party received fewer votes than expected. At this stage, it feels like a Sánchez controlled hung parliament with fresh elections later in the year.

United Kingdom: CPI inflation rose 0.1% mom in June (7.9% yoy), below consensus at 0.4% mom, declining below 8% for the first time in 12 months. The yield on the two-year Gilts plummeted 22bp following the announcement but retraced most of the sell-off to close the week at 4.96% (down from 5.56% highs on 6 July).

Japan: CPI inflation rose by a yoy rate of 3.3% in June, 10bps above the previous month and consensus, while ex-fresh food and energy CPI declined 10bps to 4.2%, in line with consensus. Japanese imports prices rolled over after hitting the highest level since the early 1970s, leading BoJ officials to believe inflation will decline from here.

The author thanks the contributions from Olivia Shaul and Iylana James.

1. See: https://www.taipeitimes.com/News/taiwan/archives/2023/07/24/2003803658

2. See: https://www.resbank.co.za/content/dam/sarb/publications/statements/monetary-policy-statements/2023/july-/Statement%20of%20the%20Monetary%20Policy%20Committee%20July%202023.pdf

3. See: https://www.ft.com/content/23691b9d-b395-4333-84c0-f09a24e12a27 and https://www.middleeasteye.net/news/turkey-uae-agree-50bn-worth-agreements-during-erdogans-visit

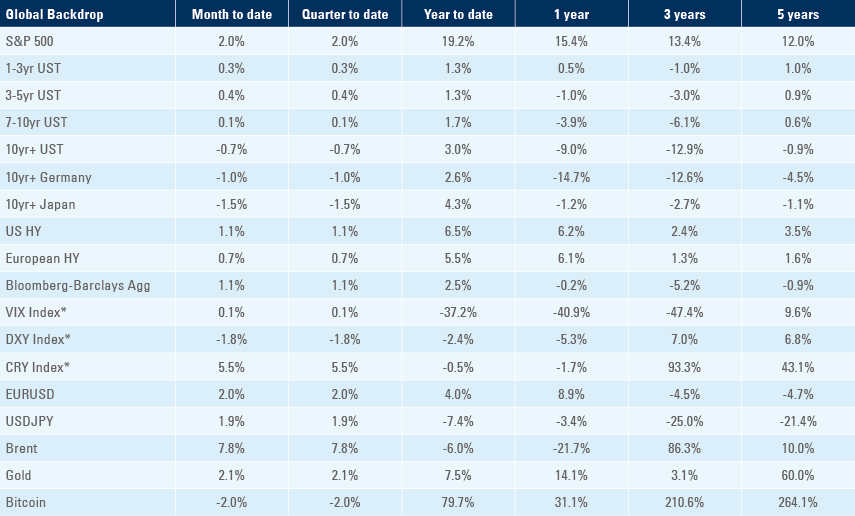

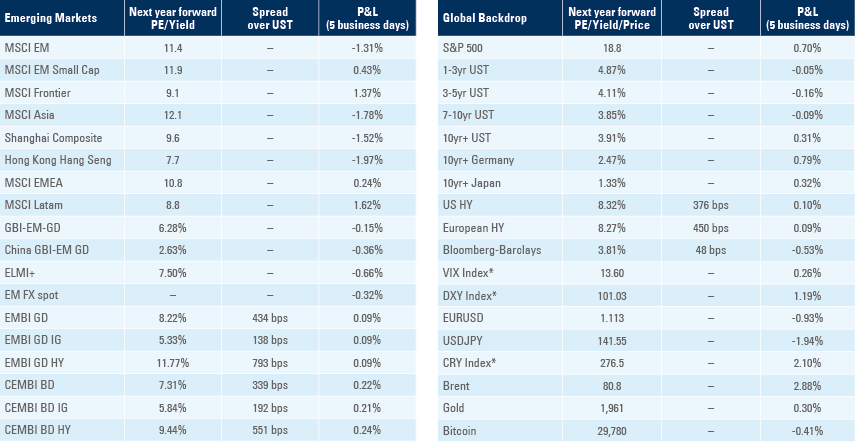

Benchmark performance