The strong performance of equity markets last week was related to the market interpretation of the main central bank decisions, seeing ‘not hawkish’ as ‘dovish’, and confusion over the actions of the Bank of Japan (BOJ). Chinese stocks outperformed on the expectation of further stimulus. Volkswagen (VW) buying 5% of XPeng and Saudi Arabia buying 10% of Vale’s base metals business highlights that Emerging Markets (EM) hold the most assets and value in the electric vehicle (EV) supply chain, and trade at attractive valuations. The International Monetary Fund (IMF) reached a deal with Argentina. Brazil’s credit rating was upgraded to ‘BB’ by Fitch. Chile slashed its policy rate by 100 basis points (bps). Gabon issued a blue bond as Nigeria investigated its own central bank. Türkiye replaced three members of its monetary policy committee.

Global Macro

The US Federal Reserve (Fed) hiked its policy rate by 25bps to 5.5% and said its next decisions will be data dependent. Chair Jerome Powell tried to strike a balanced approach in his press conference that markets interpreted as ‘not hawkish is bullish’. The overnight index swap (OIS) market is pricing 37% odds of another 25bps hike between September and November. Yields on US Treasury bonds were under pressure during the week due to softer than expected demand on auctions for two, five and seven-year bonds as the US fiscal deficit reached record levels last month.1

The European Central Bank (ECB) raised its policy rates by 25bps, with deposit rates reaching 3.75% (from -0.5%). ECB President Christine Lagarde also struck a balanced tone, leaving the door open for further policy rate increases. OIS is pricing 67% odds of another hike in September and 93% cumulative odds until January 2024.

The biggest surprise was the BOJ decision to widen the band in which ten-year Japanese Government Bonds (JGBs) can oscillate from 0.5% to 1.0%. The BOJ will “nimbly” purchase JGBs between 0.5% to 1.0%, a tool designed to slow the pace of increase in yields.2 The BOJ straitjacket is looser, but policy still does not appear appropriate should inflation prove more resilient. The market reaction was surprisingly muted as the JPY rallied initially but sold-off and is trading today at weaker levels than pre-BOJ meeting, even though ten-year JGBs are 11bps wider at 0.61%.

Japanese investors selling bonds in 2013 and 2022 coincided with a large global rates sell-off. Bloomberg reported “Japanese investors are the biggest holders of Treasuries outside the US. They were also owners of about 10% of Australian debt and Dutch bonds, 8% of New Zealand’s securities and 7% of Brazil’s debt at the end of March.” Japanese investors incur higher hedging costs than the yield on ten-year government bond across all these countries today. In the US, the gap is 170bps, in Netherlands 110bps, in Australia 40bps and in Brazil 160bps. Japanese investors holding these positions are betting on rates moving lower in the future to compensate for the hedging cost, or will have to un-hedge their exposure, betting that the JPY will keep depreciating. The JPY performance so far – and the muted reaction on yields post BOJ – suggests the latter is taking place.

Economic data in the US and China were stronger than expected last week, and the earning per share (EPS) of most companies proved stronger than consensus, albeit after 51% of the companies in the S&P500 reported, EPS is tracking a 7% decline in year-on-year (yoy) terms, which would be the largest since the Covid-19 shock.

Therefore, the tone is set for further solid performance during the summer (at least ahead of Jackson Hole symposium in 24-26 August), despite positioning and sentiment already getting to stretched levels for US stocks. Overall, it remains a positive backdrop for EM equities, local bonds, and high yield. The main risks to monitor are:

- Inflation rising again, driven by higher gasoline/oil prices and food prices (particularly after Russia did not renew the deal allowing grain exports from Ukrainian ports in the Black Sea).

- Higher bond yields on a heavy issuance calendar and poor demand from buy-and-hold managers.

- Strong reversal in flows/positioning amidst poor liquidity in the summer.

There are several key data releases next week, including Purchasing Manager’s Indices (PMIs) across EM and Developed Markets (DM), as well as Institute for Supply Management (ISM) surveys in the US. Also, the Senior Loan Officer Opinion Survey (SLOOS) in the US will gauge credit conditions and the non-farm payrolls release on Friday will also be closely monitored. Another 170 companies in the S&P500 and 87 companies on Euro Stoxx 60 report this week, with Apple and Amazon the main mega-caps to report Thursday, but AMD and Qualcomm’s results will also be important to measure the extent of artificial intelligence (AI) actual investments.

Emerging Markets

EM Asia

China: The Hang Seng Index in Hong Kong (H-shares) rose +3.2% on Tuesday as Chinese real estate equities surged 7.0% after digesting the impact of the measures announced by the Politburo last week.3 H-shares rose 8.6% for the week, and are up another 1.1% at the time of writing as expectations of more stimulus increased following the weaker Chinese PMI. The Manufacturing PMI rose 0.3 points to 49.3 (consensus 48.9), but services declined 1.7 points to 51.5 (consensus 53.0). Stocks from Chinese EV manufacturers surged after the VW announced a strategic 5% investment in XPeng. Chinese manufacturers used the EV transition to leapfrog the traditional auto producers. As a result, German companies have been rapidly losing market share, both in China and abroad, to Chinese EV manufacturers and are under pressure from their shareholders. For example, VW sales are 33% above pre-pandemic levels, but the company’s market capitalisation is below its 2015-2019 average, even though its leverage has declined significantly with its debt/asset ratio dropping from 48% in 2004 and 41% in 2019 to 36% today. The transaction maybe the first of many and highlights the challenges on reducing economic exposure away from China. The other possibility is Chinese EVs to purchase traditional western manufacturers, like Geely acquisition of Volvo.

Indonesia: Bank Indonesia kept its policy rate unchanged at 5.75%, in line with consensus.

Malaysia: The yoy rate of consumer price index (CPI) inflation declined 40bps to 2.4% in July, in line with consensus.

South Korea: The yoy rate of real gross domestic product (GDP) growth was unchanged at 0.9% quarter-on-quarter (qoq) annualised in Q2 2023. Consumer confidence rose 2.5 points to 103.2 in July, the highest level since February 2022, but industrial production declined 1.0%% month-on-month (mom) in June after rising 3.0% mom in May (revised from +3.2%).

Thailand: The trade balance moved to a USD 58m surplus in June from USD 1.85bn deficit in May. Exports declined by a yoy rate of 6.4% from -4.6%, but imports dropped 10.3% yoy from -3.2% over the same period.

Vietnam: CPI inflation rose 10bps to 2.1% in July, 20bps above consensus. Exports declined by a yoy rate of 3.5% (consensus -6.0% yoy) in July and imports declined by 9.9% yoy (consensus -13.1%). The yoy rate of industrial production rose by 90bps to 3.7%, while retail sales rose 60bps to 7.1% yoy.

Latin America

Argentina: The IMF reached a staff-level agreement for the combined fifth and sixth reviews of Argentina’s Extended Fund Facility, opening the door to USD 7.5bn of financing, should the Executive Board approve the deal in the second half of August. The IMF said the targets of the programme were not met due to a combination of the drought and policy slippages and revised the reserve accumulation target until year-end to USD 1bn from USD 8bn previously.4 The deal will permit Argentina country to keep funding for the bare minimum functionality to avoid it potentially crumbling before the presidential election in October.

Brazil: Ratings agency Fitch upgraded Brazil’s foreign currency credit rating by a notch to BB with a stable outlook, citing the approval of structural reforms over the past five years despite “lingering political tensions”. CPI inflation declined 0.1% mom in the first fortnight of July, bringing the yoy rate down 20bps to 3.2%. The deflation was mostly caused by one-off discount in electricity bills and a temporary government programme lowering car prices. More encouragingly, core inflation declined to 0.1% mom over the same period, from 0.3% in the previous month as the yoy rate dropped 70bos to 5.5%, led by lower service prices. Producer price inflation (PPI) posted a 0.7% mom deflation in July after -1.9% in June as the yoy rate of deflation dropped another 80bps to 7.7%. Tax collections rose to BRL 180.5bn in June from BRL 176.8bn in June, slightly above consensus, and the primary deficit improved by a similar amount to BRL 48.9bn but came in higher than consensus at BRL 45.0bn. The current account posted a USD 0.8bn deficit in June after a USD 0.3bn surplus in May, and foreign direct investment declined to USD 1.9bn from USD 5.4bn over the same period. In corporate news, Saudi Arabia announced the purchase of 10% of Vale’s base metals business. Petrobras announced a new dividend policy, lowering the dividend distribution from 60% to 45% of free cash flow, but keeping the door open for buy-backs. The announcement was overall better than expected, compensating for news flow suggesting the government will be increasing its presence in state-owned companies.

Chile: The central bank cut its policy rate by 100bps to 10.25%. Of the 26 analysts surveyed by Bloomberg, only five expected a 50bps cut and 17 expected a 75bps cut with only four forecasters pointing to the 100ps outcome. The central bank said economic activity was behaving as expected, but there were downside risks for inflation, justifying the large cut. Breakeven inflation implied on the difference between nominal and inflation linked bonds already converged to the 3% target over the next 12-24 months. Chile is likely to cut policy rates by at least another 400bps over the next 12 months, in our view, but in this case, the market is already pricing 550bps of cuts over the same period. In economic news, the unemployment rate was unchanged at 8.5% in June, slightly better than consensus.

Mexico: The state-owned oil and gas company Pemex presented results that said the government will continue to support it with MXN 65bn (USD 3.9bn) in further support for the repayment of coupon and interest. The results presentation showed oil production recovered from its lows to stay at the same level as Q1 2018, thanks to the focus on areas with greater productive potential with nearby production infrastructure. In economic news, the unemployment rate dropped by 30bps to 2.7%, significantly below consensus at 3.0% as the economic activity proxy by IGAE increased to a yoy rate of 4.3% in May from 2.7% yoy in April. CPI inflation rose 0.3% mom (4.8% yoy) in the first 15-days of July from +0.2% mom (4.9% yoy) in the previous month as core CPI rose by 0.2% mom (unchanged) and 6.8% yoy (from 6.9%), in line with consensus.

Central and Eastern Europe

Hungary: The National Bank of Hungary cut its one-day deposit rate by 100bps to 15.0% and kept the policy rate unchanged at 13.0%, in line with consensus.

Central Asia, Middle East, and Africa

Gabon: Gabon announced Africa’s first debt-to-nature swap on Tuesday. The transaction includes USD 500m marine conservation-linked blue bonds with an average life of ten years and a 2038 maturity and a partial tender (up to USD 150m) of the USD 700m 2025 and USD 800m 2031 bonds. The blue bond, recently rated Aa2 by Moody’s, will be issued through a Delaware trust named Gabon Blue Bond Master Trust and is secured by the US International Development Finance Corporation. Gabon has presidential elections on 26 August with President Ali Bongo running for a third term.

Ghana: The central bank hiked its policy rate by 50bps to 30.0%, a move not anticipated by analysts.

Nigeria: The Central Bank of Nigeria (CBN) hiked its policy rate by 25bps to 18.75%, below consensus at 19.00% with five out of 11 members voting to keep policy rate unchanged. President Bola Tinubu appointed Jim Obazee as Special Investigator to probe the CBN operations under previous Governor Godwin Emefiele, who remains in jail. Obazee was also tasked to provide a comprehensive report on public wealth currently in the hands of corrupt individuals and establishments (whether private or public). In other news, the current account surplus rose to USD 2.5bn in Q1 2023 from USD 2.3bn in Q4 2022.

Israel: Parliament passed a bill that eliminates the Supreme Court’s authority to review or strike down government decisions based on their “reasonableness”. While the bill does not take away all veto powers from the Supreme Court as proposed by the initial version, it weakens the authority of the institution, which is one of the few checks to potential unreasonable legislation changes by the Israeli Congress ‘Knesset’.

Poland: The unemployment rate dropped by 10bps to 5.0% in June, in line with consensus.

South Africa: PPI posted a 0.3% mom deflation in June (consensus +0.2%) from +0.6% in May, as the yoy rate declined 250bps to 4.8% (100bps below consensus)

Türkiye: The Central Bank of Türkiye (CBT) Governor Hafize Gaye Erkan presented the inflation report, striking a credible tone – albeit more dovish than the market would like. Erkan said inflation is likely to rise to 58% by the end of the year, a sharp contrast with the CBT’s previous 22.3% forecast. Erkan pledged to keep tightening policy to address inflation, but in a more cautious manner than the market initially expected to minimise risks to the banking sector. Rates at deep negative levels are unlikely to anchor the TRY, in our view. However, what we see as more encouraging news, three members of the monetary policy committee were replaced by decree, with key architects of the unorthodox policy framework leaving in favour of more orthodox (and, in our opinion, more credible policymakers). Erkan may be betting she will have more freedom to change policy in a more aggressive manner after local elections in March 2024, but the fact that the political calendar still matters and the risk of another Erdogan ‘U-turn’ speaks volumes. On the other hand, the credit market is betting Türkiye is unlikely to face major financing problems after large investment pledges by the Gulf Countries as the country’s CDS tightened below 400bps levels, likely a result of a “short squeeze”.

Developed Markets

United States

Economic data surprised to the upside again as the Citi Surprise Index rose 16.5 points to 79.6, the highest since February 2021. The yields on US Treasuries rose 16bps month-to-date to 3.99%, mostly due to poor auction results as the Treasury is reaching the upper end of its T-Bill issuance limit.

The annualised qoq (qoq ann.) rate of real GDP growth rose to 2.4% in Q2 2023 from 2.0% in Q1 2023, 60bps above consensus. Personal consumption declined to 1.6% qoq ann. from 4.2% in the previous quarter, but 40bps above consensus and core personal consumption expenditure (PCE) declined 110bps to 3.8% qoq ann. over the same period, 20bps below consensus. Core PCE deflator declined by 50bps to 4.1% in the month of June, 10bps below consensus.

Durable goods orders surged 4.7% mom in June after +2.0% in May, but ex-transportation it declined to +0.6% mom from +0.7% over the same period. On the other hand, new home sales declined to 697k in June after 715k in May (revised from 763k!). Jobless claims declined by 7k to 221k in the week of 22 July (235k consensus) and continuing claims declined by 60k to 1.69m in the prior week.

The manufacturing PMI rose by 2.7 points to 49.0 (46.2 consensus), but the services PMI declined 2.0 points to 52.4 (54.0 consensus), taking the composite PMI down 1.2 points to 52.0 (53.0 consensus).

Consumer confidence rebounded in July with present conditions rising to +1.3 standard deviations above its average (z-score) from +1.0 in March, as expectations improved to -0.3 z-score from -1.1 in March. On a normal economic recovery, expectations rebound early; this time the relationship is upside down. Consumers are spending but a significant part of the population did not believe it could last. Hence, the expectation rebound is notable. The Richmond Manufacturing survey declined one point to -9 (-1.0 z-score) as the gap between consumption and manufacturing widened further:

Eurozone

The German IFO business climate survey came in at 87.3 (down from 88.6 and below consensus at 88.0) with the current assessment declining 2.4 points to 91.3 and expectations down 0.3 to 83.5 (0.1 above consensus). The trend suggests the ‘expectations’ component is heading back to the September 2022 energy crisis levels as ‘current assessment’ is already below those levels. Eurozone consumer confidence was unchanged at -15.1 in July.

The Germany CPI inflation rose by 0.3% mom(unchanged) and 6.2% yoy (from 6.4% prior) in July, in line with consensus. France CPI inflation dropped to 0.0% mom (from +0.2%) and 4.3% yoy (from 4.5%) in July, also in line with consensus. PPI posted a second month of deflation, dropping 1.1% mom in June (-1.4% prior) taking the yoy rate down to 3.0% (from 5.6%).

1. See: 'Economic reforms in Frontier countries continue & better sentiment in Chinese stocks.', Weekly Research, 17 July 2023.

2. See: https://www.boj.or.jp/en/mopo/mpmdeci/mpr_2023/mpr230728d.pdf

3. See: 'G-3 central banks and reaction to earnings to set the tone for the summer', Weekly Research, 24 July 2023.

4. See: https://www.imf.org/en/News/Articles/2023/07/28/pr23281-imf-and-argentina-reach-staff-level-agreement-on-the-fifth-and-sixth-reviews

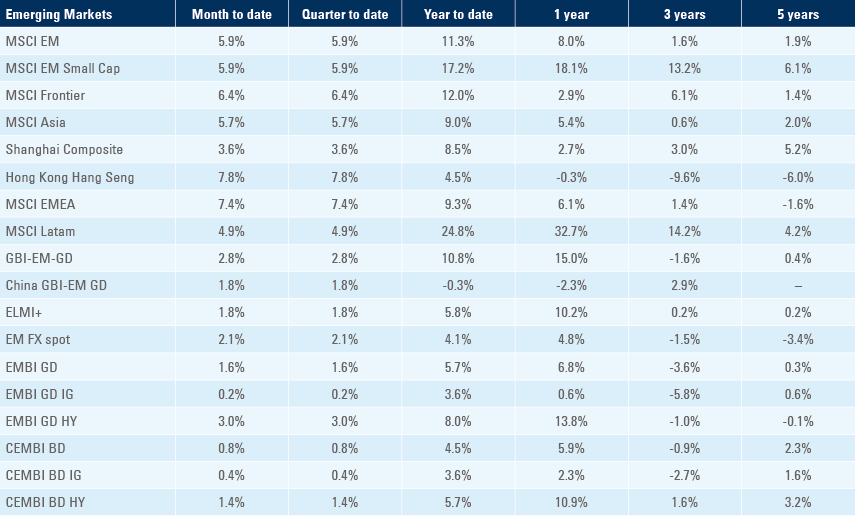

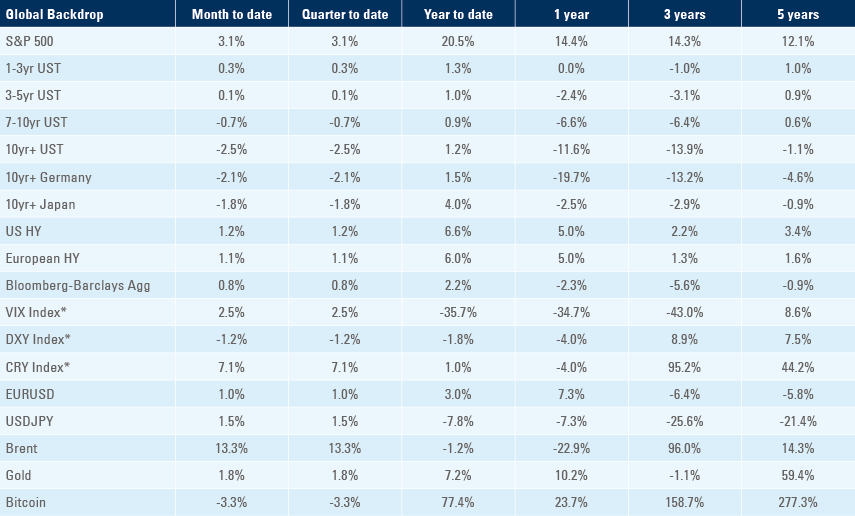

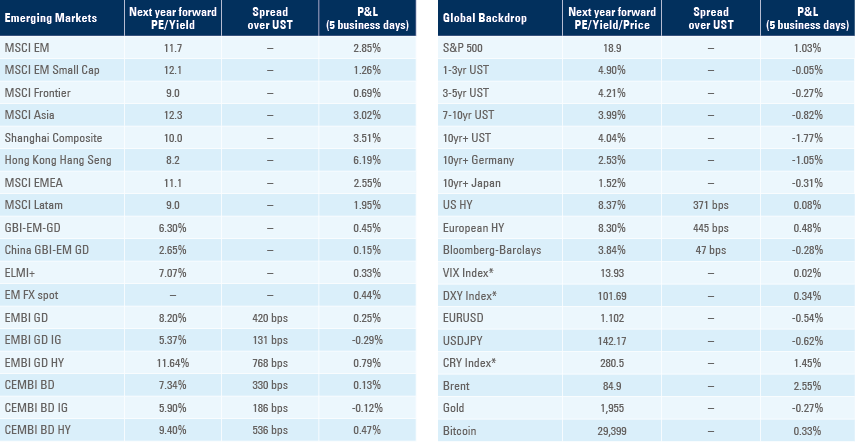

Benchmark performance