EM central banks poised to cut rates as the opportunity in EM equities became even more attractive.

A review of H1 2023 performance and some forward-looking views of broad global macroeconomic trends. China became the largest exporter of vehicles in the world. The IMF granted a USD 3bn loan to Pakistan. Korea and Taiwan manufacturing are in recovery mode. Brazil kept its inflation target and former President Jair Bolsonaro was deemed ineligible to run for office until 2030. Poland central bank signalled rate cuts are likely in H2 2023.

Global Macro

Equities and high yield credit posted a strong performance in the month of June. The US economy outperformed the rest of the world in recent months, which alongside the strong performance of technology stocks led US stock markets to outperform.

The economic divergence was the strongest over the past six weeks: The Citibank Economic Surprise index (CESI) rose from 5.5 on 19 May to 54.4 on 30 June as the European CESI declined from -27.5 to -144.9 over the same period. The EM CESI declined marginally from 17.3 to 2.7 (but China plunged from +24.1 to -54.7), while the CESI Japan rose from -26.8 to +1.4 over the same period.

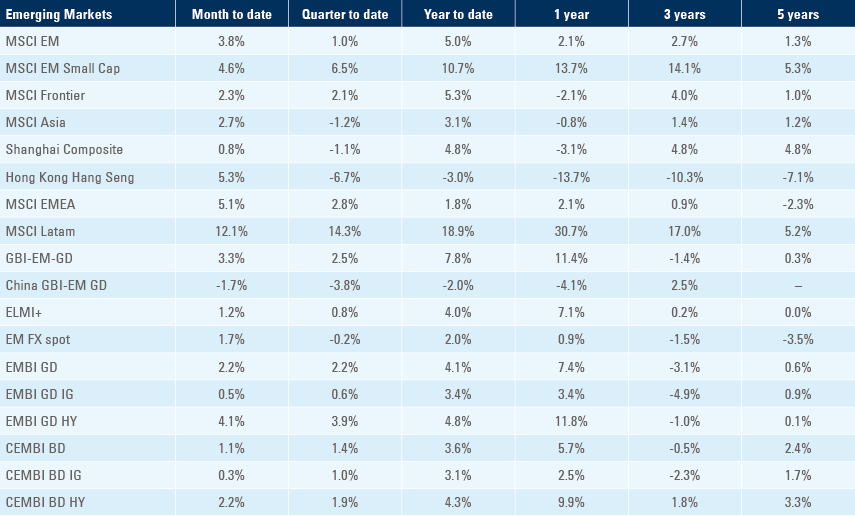

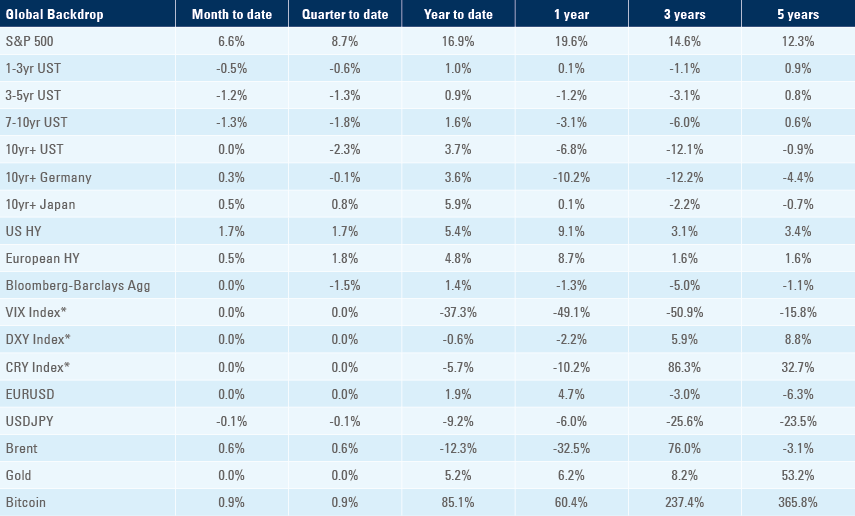

The VIX Index, which measures the implied volatility on US stocks, fell to 13% at the end of June from 22% at the start of the year and a 30% peak in March when the Silicon Valley Bank collapsed. The S&P500 rose 16.9% year-to-date (ytd) and 6.6% in June with most gains concentrated in seven mega-cap companies, but some cyclical sectors like autos and homebuilders rose sharply as well. The Nasdaq rose 39.4% ytd and 21.2% in June. The MSCI EM underperformed, rising 5.0% ytd and 3.8% in June, as Latin American stocks outperformed, rising 18.9%, and Chinese stocks underperformed, declining 5.4% over the period.

The US Treasury curve bear flattened as 12-month rates rose 71bps ytd to 5.4%; 2yr +47bps to 4.90%; 5yr +15bps to 4.16%; 10yr -4bps to 3.84%; and 30yr -11bps to 3.86%. The yield curve inversion, measured by the difference between 10- and 2-year swaps, increased to -1.1%, the most inverted since 1979. The yield curve has now been inverted for a whole year as stronger than expected economic growth keeps the largest central banks in the world in a hawkish stance.

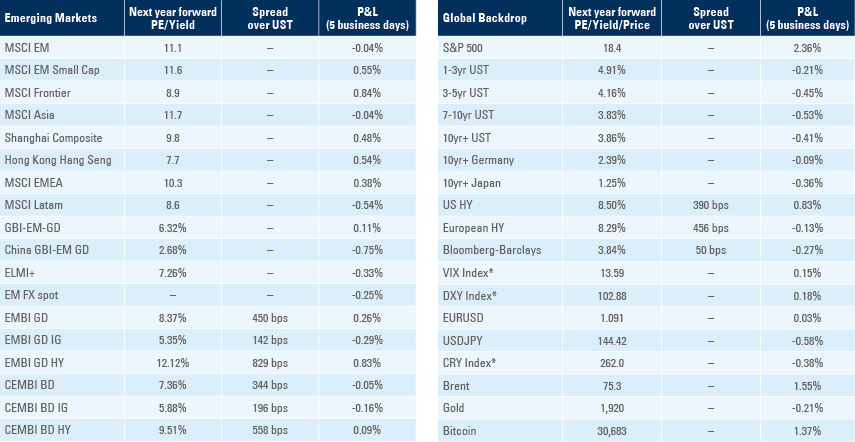

Emerging Market bonds performed well. The Sovereign debt benchmark (EMBI GD) rose 4.1% ytd with investment grade up 3.1% and high yield up 4.3% (of which +4.1% in June). Corporate debt (CEMBI GD) rose 3.6% (IG 3.1% and HY 4.3%). Local currency bonds rose 7.8%, led by EM rates as EM currencies rose by 2.0% ytd (+1.7% in June) with the yield on local bonds declining to 6.32% at the end of June (from 6.85% in December 2022 and 7.31% in September 2022).

The strong backward looking backdrop contrasts with the challenges ahead for DM economies. Data shows that the savings rate accumulated during the pandemic has now been fully spent in the United States with savings rates below pre-pandemic levels. The US consumer is likely to suffer further squeezes in Q3 2023. Last week the Supreme Court ruled Biden’s decision to forgive USD 10k of student debt for as much as 46m Americans earning up to USD 120k per year unconstitutional. A total of 26m individuals had already applied for the debt forbearance and will be caught by surprise with the extra spending. Furthermore, the amnesty on interest and principal repayment on student loans which started in Q2 2020 will end soon, with interest accruing again from 1 September and repayments to resume in October. Liquidity will also tighten in Q3 2023 with quantitative tightening accelerating in Europe and the large issuance of US Treasury bonds to replenish the Treasury General Account leading to tighter liquidity conditions.

Despite the challenging forward-looking backdrop, the governors of the largest central banks in the world kept a “hawkish tune” in the annual European Central Bank forum in Sintra (Portugal). The exception was Governor Kazuo Ueda, who was quite humorous while keeping the Bank of Japan’s long-standing dovish stance. The longer interest rates remain elevated, the more problems will accumulate in sectors experiencing a challenged fundamental and financial leverage backdrop, including global office real estate, residential real estate in places like Scandinavia, Europe, Australia, Canada, and others, as well as private equity and private credit instruments that have yet to be re-priced for a higher interest rate environment.

Investors with an eye for the long term will see that the monetary policy stance is drastically different in EM countries. The breadth and depth of disinflation has been more pronounced across most EM countries, thanks to the more active stance to deal with the inflationary pressures early in 2021. As a result, Vietnam and China are already cutting their policy rates and several countries including Hungary, Chile, Brazil, Colombia, Czechia, Mexico, Peru, Poland, Indonesia, and India are candidates to cut policy rates in H2 2023, in our view. This means that EM local bonds can keep on outperforming USD-denominated debt, particularly if the US economy moves into a recession in H2 2023. The odds of the US going into a hard recession increase the longer central banks keep policy rates at current elevated levels and the more they talk down the potential for rate cuts in the near future.

Ashmore’s 2023 outlook had a stylised scenario where a recession would happen around mid-2023, and whereas the manufacturing sector did performed broadly in line with our view, the run-down of savings accumulated during the pandemic, expansionary fiscal policies in the US, including the Cost of Living Adjustment (COLA) that granted an 8.7% increase in social security benefits in January alongside the Chips Act and the Inflation Reduction Act, compensated for the negative manufacturing environment. We still advocate for a careful asset allocation with an overweight in quality bonds (primarily IG). EM local bonds may keep outperforming USD-denominated debt as the Dollar has barely started to sell-off and EM rates will outperform as discussed.

In equity markets, it is remarkable that US stocks’ outperformance is all based on multiple expansion. The S&P500 EPS declined by 5.8% ytd while the price-to-earnings ratio rose from 18x to 21.3x. These levels are far from pricing both a soft and hard recession scenario, in our view, considering the fact that the S&P500 has traded at 16x earnings at some point during or slightly after the last four recessions since 1990 and that EPS declined by 47%, 70% and 32% over the last three recessions in 2001, 2008 and 2020 respectively. In contrast, EM stocks’ EPS declined by only 3% ytd, but the MSCI EM p/e increased only from 12.5x to 12.9x over the same period. In other words, the H1 2023 outperformance was not based on fundamentals, but by a widening of the premium between US and EM stocks. Therefore, we believe long-term investors have an opportunity to increase their allocation to EM stocks and to fund it by reducing their US stocks allocation.

Emerging Markets

EM Asia

June S&P Global Manufacturing PMI highlights:

- Thailand -5.0 to 53.2

- S. Korea -0.6 to 47.8

- Taiwan +0.5 to 44.8

- Vietnam +0.9 to 46.2

- China -0.4 to 50.5 (consensus 50)

- Indonesia +2.2 to 52.5

China: China exported 1.07m vehicles in Q1 2023, overtaking the long-time leader Japan to become the largest car exporter in the world, in part because of a sales jump to customers in Russia, according to consultancy AlixPartners. Industrial profits improved to -12.6% yoy in May from -18.2% in April. The NPS manufacturing PMI improved 0.2 points to 49.0 in June and the non-manufacturing PMI declined by 1.3 points to 53.2 over the same period, both in line with consensus.

Pakistan: The IMF reached a staff level agreement for a USD 3bn Stand-By Agreement programme with Pakistan after the country met several pre-conditions to tighten fiscal policy.

India: The fiscal deficit narrowed to INR 77bn in May from INR 136bn in April, the best result for the month in 10 years (with the exception of 2021). The output for the eight key infrastructure industries rose by 4.3% yoy in May (unchanged) with cement rising 15.5% yoy, steel +9.2% yoy, and coal +7.2% yoy while crude oil declined 1.9% yoy and natural gas and electricity output were both down 0.3%.

South Korea: Retail sales rose to 5.7% yoy in May from 4.0% yoy in April and department store sales declined by 0.2% yoy from +2.5% yoy over the same period. Seasonally adjusted industrial production rose 3.2% mom in May (consensus -0.9%) from -0.6% mom in April. The trade balance moved to a USD 1.1bn surplus in June from a USD 2.1bn deficit in May as exports declined by a yoy rate of 6.0% (consensus -3.6%) and imports dropped 11.7% yoy (consensus -10.1%).

Taiwan: The yoy rate of industrial production improved to -15.7% in May (consensus -20.3%) from -22.6% in April. The unemployment rate declined 10bps to 3.5% in May.

Thailand: The trade deficit widened to USD 1.9bn in May (USD 0.4bn consensus) from USD 1.5bn in April as exports declined by a yoy rate of 4.6% (-8.0% consensus) and imports declined by 3.4% yoy (consensus -10.0%). The wider trade deficit led to current account deficit of USD 2.8bn in May after USD 0.6bn deficit in April.

Latin America

Argentina: Bloomberg reported that Argentina will repay the next International Monetary Fund (IMF) obligations by tapping the RMB swap with the People’s Bank of China (PBoC). If confirmed, it would be the first time that a country taps its RMB swap lines to repay the IMF. In economic news, the current account moved to a USD 5.6bn deficit in Q1 2023 (USD 4.4bn consensus) after a USD 1.7bn surplus in the previous quarter as the severe drought led to a much weaker performance in agriculture exports.

Brazil: The National Monetary Council (CMN) decided to keep the 2025 inflation target unchanged at 3.0% with a +/- 1.5% interval band but opted to extend the time horizon from a calendar year to a 24-month rolling period. Central Bank Governor Roberto Campos Neto highlighted this is a positive evolution of the inflation target regime system and will allow the institution to target inflation at a more relevant time-horizon for its monetary tools. In other news, Bolsonaro was found guilty of power abuse and casting unfounded doubts on the country’s electronic voting system. The decision forbids him from running for any public office until 2030. There are several potential candidates to “inherit” Bolsonaro’s votes over the next electoral cycle, including the Governors of the States of Sao Paulo and Minas Gerais, Tarcisio de Freitas and Romeu Zema, respectively, as well as Congress leaders Rodrigo Pacheco and Arthur Lyra, all market-friendly leaders that are likely to be less controversial than Bolsonaro. In economic news, CPI inflation declined to 3.4% yoy (in line with consensus) in the first 15 days of June from 4.1% yoy prior. PPI dropped 1.9% mom in June after declining 1.8% in May, bringing the yoy rate to -6.9% from -4.5% over the same period. The current account moved to a USD 0.65bn surplus (consensus USD 1.65bn) in May from a USD 1.25bn deficit in April (revised from USD 1.68bn deficit). Formal jobs creation (CAGED) dropped to 155k in May from 180k in April, slightly below consensus at 190k. The national unemployment rate declined 20bps to 8.3%.

Chile: The unemployment rate declined 20bps to 8.5% (consensus 8.8%). The yoy rate of retail sales declined 10.5% in May, in line with consensus and prior. Industrial production declined by a yoy rate of 4.5% in May from -2.0% in April and -2.2% consensus.

Colombia: President Gustavo Petro’s approval rating declined to 33% in June from 35% in April and his disapproval rating dropped 4% to 61%, according to a poll by Invamer posted on 28 June. The decline in approval rate was broadly in line with the previous trend despite an alleged illegal campaign funding debacle that erupted earlier in June. The central bank kept its policy rate unchanged at 13.25%, in line with consensus.

Mexico: The trade deficit narrowed to USD 0.1bn in May from USD 1.5bn in April (consensus USD -1.1bn). Exports rose to USD 52.9bn (from USD 46.2bn prior). Imports increased to USD 52.8bn (USD 47.7bn prior). The IGAE economic activity proxy rose 0.8% mom in April after declining 0.2% mom in March as the yoy rate rose 2.5% (consensus 2.3%). The unemployment rate rose 10bps to 2.9%, slightly above consensus.

Peru: CPI declined by 0.15% mom in June in the city of Lima after rising 0.3% mom in May, taking the yoy rate down by 190bps to 6.5%, (consensus 6.9%).

Central Asia, Middle East, and Africa

South Africa: PPI inflation rose 0.6% mom in May after 0.0% in April, as the yoy rate declined another 130bps to 7.3% (consensus 7.5%). The trade surplus rose to ZAR 10.2bn in May from ZAR 4.0bn in April, slightly less than seasonality for the period. The fiscal deficit narrowed to ZAR 16.4bn in May (consensus ZAR 18.7bn) from ZAR 67.5bn in April, improving faster than suggested by seasonal patterns. The Manufacturing PMI dropped 1.6 points to 47.6 in June.

Central and Eastern Europe: June S&P Global Manufacturing PMI highlights:

- Czechia - 2.0 to 40.8

- Hungary -12.9 to 44.2

- Poland -1.9 to 45.1

Hungary: The current account deficit narrowed to USD 0.6bn in Q1 2023 from USD 4.8bn in Q4 2022 (revised from USD 4.3bn), in line with consensus, but also the best result since March 2021. PPI posted a 1.6% mom deflation in May after dropping 2.0% in April bringing the yoy rate down by 470bps to 11.2%.

Poland: National Bank of Poland Governor Adam Glapinski said the monetary council could cut policy rates when inflation returns to single digit levels. CPI inflation slowed to 11.5% yoy in June from 13.0% in May (consensus 11.8%), the lowest level since March 2022. In political news, the vote intention for opposition party Civil Coalition increased to 32% last week from 27% in late April as the incumbent Law and Justice coalition declined by 2% to 35%. However, the newly formed “Third Way” coalition between conservative, Christian democratic and moderate liberal politicians declined to 10% from 14%.1

Romania: The unemployment rate declined 10bps to 5.5% in May.

Developed Markets

United States: Economic data was stronger than expected last week, led by better labour and housing markets performance:

- Durable goods +1.7% mom in May (-0.8% est.) and +0.6% mom ex-transportation (0% est.)

- New home sales 763k (675k est. and 680k prior)

- Conference Board Consumer Confidence at 109.7 (103.9 est. and 102.5 prior)

- Q1 2023 GDP growth rose to 2.0% annualised qoq rate from 1.3% in Q4 2022.

- Personal Consumption rose by an annualised qoq rate of 4.2% in Q1 2023 (from 3.8% prior)

- Core PCE inflation declined to 4.9% annualised qoq rate in Q1 2023 (5.0% prior and consensus)

- Core PCE deflator declined to a yoy rate of 4.6% in May (4.7% prior and consensus)

- Initial jobless claims declined to 239k in the week of 24 June (265k prior and consensus)

- Continuing claims declined to 1.74m in the week of 17 June (1.76m prior and consensus)

- The Chicago PMI survey rose by one point to 41.5 (consensus 43.8)

- The University of Michigan Sentiment survey rose 0.5 points to 64.4 (consensus 63.9)

- Inflation expectations were unchanged at 3.3% for the next 12 months and 3.0% for 5-10 years.

Eurozone: Economic data was weaker than expected again, bringing the Citibank Surprise Index to -144.9, the lowest level since Q1 2020.

- The Germany IFO business climate indicator declined to 88.5 (vs. 90.7 consensus), the lowest level since November 2022. The expectations component dropped to 83.6 from 88.3 in May, the largest one-month decline in 11 months, and further adds to the picture that last month’s decline wasn’t just a blip.

- The Eurozone unemployment rate was unchanged at 6.5% in May.

- The Eurozone CPI inflation rose 0.3% mom in June after 0.0% in May bringing the yoy rate down 60bps to 5.5% while core CPI rose 10bps to 5.4%, both 10bps below consensus. Inflation was higher than expected in Germany at 0.3% mom and 6.4% yoy, but slightly lower than expected in France.

- The Italian producer price index of inflation declined by -3.1% mom in May, the fifth consecutive monthly decline, as the yoy rate plunged to -6.8%, the lowest level since May 2020, down from 52.9% in September 2022.

- The very elevated inflation over 2021 and 2022 means the PPI would have to decline by another 20.5% to return to its pre-pandemic trend.

Japan: The yoy rate of CPI inflation declined 10bps to 3.1% in June in Tokyo (consensus 3.4%) and core CPI ex-fresh food and energy declined 10bps to 3.8% yoy (consensus 4.0%)

Australia: The yoy rate of CPI inflation dropped 120bps to 5.6%, 50bps below consensus.

1. See: https://www.politico.eu/europe-poll-of-polls/poland/

Benchmark performance