Economic reforms in Frontier countries continue & better sentiment in Chinese stocks.

Chinese stocks were lifted by hopes of improved regulatory environment for tech stocks, but economic data remained subdued. Indonesia’s pollsters showed the reformist candidates leading voting intentions for the 2024 General Election. Korea’s import and export prices dropped further. Brazil’s Finance Minister highlighted future reform plans. In Frontier Markets, Egypt announced important privatisations. Protesters took to the streets in Kenya against tax increases, but fiscal consolidation is likely to remain in place, in our view. Nigeria announced a digital tax identification (ID) initiative to impact the informal economy. In geopolitics, the renewal of the grain export agreement from Ukraine has so far not yet been agreed, with important ramifications for Türkiye, Egypt, and other African countries. In global macro, the United States (US) fiscal deficit kept deteriorating at a worrisome pace.

Geopolitics

This morning, Russia announced it would not renew the agreement allowing grain to be exported from Ukrainian ports. The flow of grains has been subdued, but is due to pick up as the harvest season begins. There is a significant risk for Egypt, Türkiye, and other African countries should grain stop flowing from Ukraine via the Black Sea. However, Russia’s ability to enforce a blockade has arguably diminished after Ukraine’s strikes on the Russian naval in the Black Sea, as well as the Kerch bridge connecting Russia to Crimea.

Türkiye's President Recep Tayyip Erdogan agreed to support Sweden’s bid to join the North Atlantic Treaty Organisation (NATO), a breakthrough for the group. Türkiye also secured the transfer of F-16 fighter jets from the US as a quid-pro-quo, as Erdogan moved back towards the US after purchasing S-400 anti-air strikes systems from Russia a few years ago. Overall, this signals Erdogan recognises Russia as a long-term threat to the balance of power in Central Asia and Europe.

Emerging Markets

China: The Hang Seng Index rose 5.7% last week after financial technology companies Ant Group and Tencent were fined by RMB 7.1bn, signalling the end of two years of probes in the sector. The People’s Bank of China (PBoC) said fines were imposed on Ant Group and its subsidiaries in response to violations of laws and regulations in areas including financial consumer protection, payment and settlement business, and anti-money laundering obligations. Ant Group released a company statement saying it had “completed the rectification” required by regulators, removing a key overhang on its subsidiary Ali Baba.

In other news, China’s housing regulator held a symposium with private sector companies seeking suggestions on expanding the scope of bond financing tools for the sector. The PBoC signalled further “targeted” support for the property market as the head of the monetary policy department Zou Lan said real estate policies will be “tailored” to cities, suggesting no widespread stimulus.

In economic news, aggregate financing rose to RMB 4.22trn in June from RMB 1.55trn in May, above consensus at RMB 3.1trn as new loans increased to RMB 3.05trn from RMB 1.36trn over the same period, also meaningfully above consensus at RMB 2.32trn and a new record for the month. The main driver for the expansion was a rebound on consumption credit and mortgages by households.

This morning, economic numbers were slightly softer than expected, driven by poor household sentiment. The yoy rate of real GDP growth increased to 6.3% in Q2 2023 from 4.5% in Q1 2023, but below consensus at 7.1%. Retail sales plunged to 3.1% yoy in June from 12.7% in May (consensus 3.3%) and fixed asset investments rose to 3.1% yoy from 1.6% over the same period. Property investment remained soft at -10.2% yoy. Industrial production was a bright spot, rising 4.4% yoy (consensus 2.5%). Mechanical machinery surged 15.7% yoy in H1 led by solar cell production (+54.5% yoy in H1), auto industry +13.1% (of which electric vehicles +35% yoy in H1). The poor sentiment in the household sector is palpable. Youth unemployment rose to 21.3% in June and household deposits grew by c. 18% yoy in H1 2023. The outstanding deposits are equivalent to more than 30 months of retail sales, according to ANZ. Fixed asset investment accelerated to 6.4% yoy in June from 4.9% in May as more infrastructure projects were executed.

The trade surplus increased to USD 70.6bn in June from USD 65.8bn in May (consensus USD 74.9bn) exports declined by a yoy rate of 12.4% (-10.0% consensus and -7.5% prior) and imports were down by 6.8% yoy (-4.1% consensus and -4.5% prior).

India: The yoy rate of consumer price index (CPI) inflation rose by 50bps to 4.8% in June, above consensus at 4.6%. Food prices rose more than expected, perhaps due to worse rainfall during the monsoon season so far. Nevertheless, core-core CPI inflation softened to 0.2% month-on-month (mom) in June from 0.4% on average over the last three months, as the yoy rate declined by 40bps to 5.4%. Furthermore, the yoy rate for the wholesale price index dropped 80bps to 4.1% deflation, suggesting the market will not worry too much about slightly higher CPI inflation. Industrial production rose 70bps yoy to 5.2% in June and the trade deficit narrowed to USD 20.1bn in June from USD 22.1bn in May, as both exports and imports declined by yoy rates of 22.0% and 17.5%, respectively.

Indonesia: A pre-election poll by Publik Nasional showed current Defence Minister Prabowo Subianto with 42.3% of support, followed by Central Java Governor Ganjar Pranowo at 37.4%, and former Jakarta governor Anies Baswedan at 17.0%, while Poligov poll by shows Prabowo slightly ahead of Ganjar (33.0% to 32.4%), with Anies trailing at just 16.6%. President Joko Widodo “Jokowi” suggested an alliance between Ganjar and Prabowo where the first would be the presidential candidate and the latter run for Vice-President. The General Elections are scheduled for February 2024. Ganjar is the most market-friendly of the candidates, expected to keep Jokowi’s reforms in place. Prabowo lost the two previous elections to Jokowi before becoming his political ally, a shrewd move from Jokowi that afforded him more sway in Parliament. He is also expected to be supportive of Jokowi’s economic agenda. Prabowo’s numbers rose due to speculation of Jokowi supporting his campaign, but this may prove temporary if Jokowi supports Ganjar in the end. Anies was part of the first term of the Jokowi administration and initially supportive of pro-market reforms, but has since broken with the President and took a populist stance after patchy implementation of policies in the government. In other news, Bank Indonesia determined that 30% of all export earnings must be kept onshore for three months. The regulation is intended to keep USD liquidity plentiful in the local banking system, even though local banks are offering a lower USD deposit rate than offshore banks. It could also lead to higher foreign exchange (FX) reserves held by Bank Indonesia. In economic news, Indonesia’s retail sales survey rose 8.0% yoy in June from revised 4.5% yoy contraction in May driven by a rebound in demand for food, beverages, and tobacco as well as fuel. In economic news, the trade surplus surged to USD 3.5bn in June from USD 0.4bn in May.

Malaysia: Bank Negara Malaysia (BNM) signalled its willing to intervene in the MYR as the currency traded above the USDMYR 4.5 psychological level. The Ringgit weakness is mostly related to the Chinese Renminbi weakness since 2021, in our view.1 The yoy rate of industrial production rose to +4.7% in May from -2.0% in April and manufactured sales rose to +3.3% yoy from -2.0% yoy over the same period. The dip in April was related to the earlier Eid al-Fitr holidays in 2023.

The government is seeking to revive the 218-mile Kuala Lumpur-Singapore high-speed rail link project halted in 2021 following changes in government. The state-owned entity company is inviting both domestic and foreign companies to submit proposals for the project, estimated to cost MYR 100bn. Prime Minister Anwar Ibrahim said he is open to restarting the project if it is done without public funding. The project aims to cut the travel time between Kuala-Lumpur and Singapore down to roughly 90 minutes, from 240 minutes on an equivalent car journey today.

Pakistan: The Executive Board of the International Monetary Fund (IMF) approved a nine-month stand-by arrangement for Pakistan for USD 3bn to support the authorities’ economic stabilisation programme. The approval allows for an immediate disbursement of USD 1.2bn.

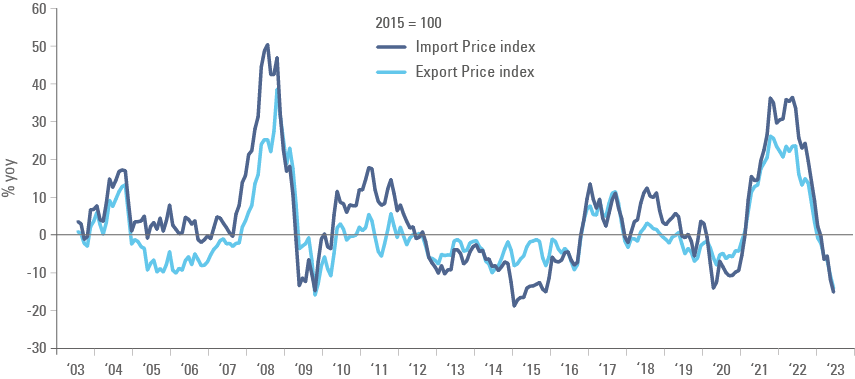

South Korea: Bank of Korea kept its policy rate unchanged at 3.5%, in line with consensus, but all board members (all aside from the Governor) are still open to a terminal policy rate of 3.75% and no discussion to reduce its policy rate. Export and import prices declined by 14.7% yoy and 15.7% yoy respectively in June as per Fig. 1, the fastest pace of decline since 2009. The evolution of trade prices in Korea suggests the global economy is far from the 2010-2019 ‘goldilocks’ period, even though it may feel like it is judging by price action over the last week, with both global bonds and stocks rallying. The roller-coaster inflation cycle is quite disruptive.

Fig. 1: South Korea import and export prices

Thailand: In the first vote in Parliament for Prime Minister on 13 July, Pita Limjaroenrat, the leader of the Move Forward Party, received 324 votes in his favour, 182 votes against and 199 abstentions, leaving him 51 votes short of his target. Parliament President Wan Muhamad Noor Matha scheduled the second and third rounds of voting for 19 July. In economic news, consumer confidence rose by 1.0 point to 56.7 in June.

Latin America

Argentina: CPI inflation declined to 6.0% mom in June from 7.8% in May (7.0% consensus) but the yoy rate rose by 140bps to 115.6% due to base effects.

Brazil: Finance Minister Fernando Haddad said the government will present an investment plan in July and an environmental plan in August. Haddad also said income tax reform will be incorporated into the budget bill, which must be sent to Congress by the end of August. The government aims to have a net zero primary deficit in the 2024 budget, which will require higher tax revenues. Most likely Haddad will target close-ended funds, which have zero income tax today and mushroomed as vehicles for wealthy financial services individuals. In economic news, CPI inflation declined by 0.1% mom in June, led by lower energy and commodity prices, after rising 0.2% mom in May, taking the yoy rate down to 3.2%, in line with the inflation target for 2023 of 3.25% +/- 1.5% for the first time since September 2020. Core CPI inflation dropped 70bps to 6.0% and the seasonally-adjusted core CPI declined by 80bps to 4.5% yoy over the same period. Retail sales dropped 1.0% mom in May after -0.1% in April as the yoy rate declined 150bps to -1.0% over the same period.

Colombia: Retail sales declined by a yoy rate of 5.1% in May, better than -6.9% yoy in April and -5.7% consensus.

Peru: The central bank kept its policy rate unchanged at 7.75%, in line with consensus.

Central and Eastern Europe

Czechia: CPI inflation was unchanged at 0.3% mom in June as the yoy rate declined by 140bps to 9.7%, in line with consensus.

Poland: The current account surplus increased to EUR 1.4bn in May from EUR 0.5bn in April as the trade surplus rose to EUR 1.1bn from EUR 0.3bn over the same period.

Romania: CPI inflation rose 0.4% mom in June after 0.6% in May and the yoy rate declined by 30bps to 10.3% while wage inflation rose by 70bps to 15.7% in May.

Central Asia, Middle East, and Africa

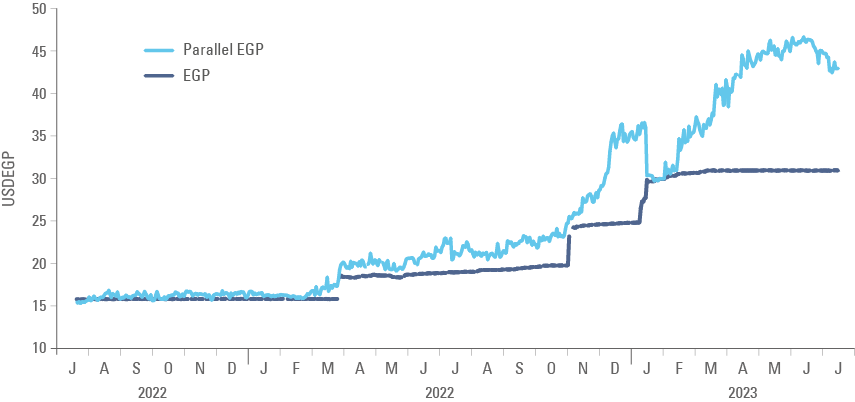

Egypt: The government announced USD 1.9bn of privatisations comprising USD 1.65bn in foreign currency and USD 0.25bn in EGP. The sales are 37% of the Hotel Holding Company for USD 0.7bn and 25%-30% petrochemical companies Ethydyco, Elab and EDC worth USD 0.8bn, both for United Arab Emirates (UAE) investors. We believe, the announcement is an encouraging step to improving foreign currency scarcity. Moreover, the near-term divestment pipeline suggests proceeds close to USD 4.0bn, not far from the IMF target for the 2024 fiscal year of USD 4.6bn. Nevertheless, the deals are not finalised, and the proceeds may take a few weeks or months to be disbursed. As a result, the gap between the official and parallel EGP barely closed, reflecting the timing uncertainty and the fact that larger privatisations are needed to balance the FX market.

Fig. 2: Egyptian Pound official vs. parallel rate

Kenya: The government is looking to consolidate its fiscal deficit from 5.8% of GDP in the fiscal year from July 2023 to July 2024 (FY24) to 4.4% of GDP. The budget for FY24 includes a nominal increase to KES 3.8trn (from KES 3.3trn in the previous year) but represents a cut to 22.1%, (from 23.3% of GDP). Furthermore, President William Ruto is looking to raise revenues. The 2023 Finance Bill, signed last month, detailed a host of tax reforms including a doubling of value added tax (VAT) on fuel, widening corporate tax to include informal businesses and several enforcement measures such as investing in tax automation. The leader of the opposition, Raila Odinga, mobilised protests, while a group of petitioners including Senator Okiya Omtatah challenged the tax increases in the High Court. The High Court ruled to bar the implementation of the bill on Monday, which was due to come into effect on July 1. Odinga said Ruto’s government has ‘betrayed the people’, for failing to address the higher cost of living. However, it is unlikely the protests will be sustained or widespread and the tax measures are likely to be implemented, in our view. The country faces a USD 2.0bn Eurobond repayment in June 2024 and will have to find alternative sources of financing given market rates remains prohibitive as ten-year bonds are yielding 10.8%. Local investors have large ownership of this bond, making a default even less likely. Narrowing the fiscal deficit would also help to stabilise inflation, which would be positive for macro stability.

Nigeria: Nigeria took steps towards increasing its meagre government revenues. The Federal Inland Revenue Service (FIRS) launched its VAT direct initiative to record businesses in the informal sector for tax purposes. Nigeria’s informal economy, which has largely gone untaxed in the past, is estimated to make up 57.7% of the country’s GDP in 2023. The FIRS is planning to issue a digital tax ID, simplifying tax collection and remittance for users. Small companies generating under NGN 25m are exempt from VAT but tracking company turnover allows for the FIRS to curb illegal taxation. Several other EM countries have implemented successful digital payment and tax ID systems, such as Brazil’s Pix and India’s UPI. In our view, not only will it help to stimulate the economy through increase government tax revenues, but it also opens the opportunity to incentivise further digitalisation of payments to improve the efficiency and transparency of the economy’s transactions. In parallel, President Bola Tinubu delayed implementation of tax increase until September on account of concerns over higher costs imposed by higher fuel prices and a weaker Naira. Last Thursday, Tinubu asked the Senate to approve a USD 800m loan from the World Bank to support spending on essentials in poor households. The Federal Government of Nigeria plans to utilise digital transfers made directly to current accounts and mobile wallets as part of the National Social Safety Net Programme. The payments will provide more targeted subsidies than oil prices and help to support families in need as well as the economy.

South Africa: Mining production declined 3.8% mom in May after rising 1.5% mom in April, bringing the yoy rate down to -0.8% from +3.2% over the same period.

Türkiye: The current account deficit rose to USD 7.9bn in May after USD 5.4bn in April, reaching a cumulative USD 60.0bn (6.1% of GDP) deficit over a 12-month period – the largest since June 2012. Higher demand for gold and energy as well as a contraction of the goods (non-oil and gold) surplus were the main contributors to the significant widening of the deficit, primarily driven by the large pre-election credit expansion that distorted the economy. More orthodox monetary (weaker FX, higher rates, and no targeted credit) and fiscal policies will lead to a sharp decline in oil and gold deficits in the coming months, in our view. Home sales declined to 83.6k in June from 113.3k in May, and a 44.4% drop in yoy terms, reflecting tighter monetary conditions. Nevertheless, inflation expectations for the next 12 months rose to 33.2% in July from 30.7% in June, after the central bank hiked rates by less than expected. In other news, industrial production rose 1.1% mom in May after declining 0.9% mom in June as the yoy rate increased by 100bps to -0.2% over the same period. This week, President Erdogan will travel to Saudi Arabia, Qatar, and the Gulf Countries with inbound investments to Türkiye top of the agenda.

Developed Markets

United States: Inflation surprised to the downside. On a yoy basis, CPI inflation declined by 100bps to 3.0%, the lowest level since March 2021, whereas core CPI was down 50bps to 4.8% yoy, the lowest level since November 2021. The yoy rate of producer price index (PPI) inflation dropped by 80bps to only 0.1% in June and core PPI dropped 20bps to 2.6%. The decrease in core inflation (headline inflation ex-food and energy), was mainly driven by a 0.5% mom drop in used car prices while energy prices rose, led by gasoline and electricity.

It is important to note that the sharp decrease in headline CPI inflation yoy is largely explained by base effects in energy prices. This latest figure for June 2023 reflects changes from June 2022, a particularly inflationary period given Russia’s invasion of Ukraine kick-started a rapid run-up in energy prices due to fears over energy security. The US Federal Reserve (Fed) is still expected to raise rates by 25bps at its meeting later this month, but the case for the end of the cycle strengthened after the strong decline in inflation.

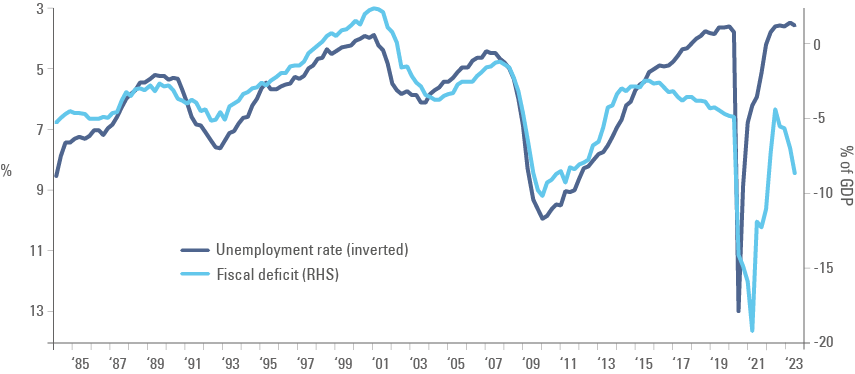

The fiscal deficit rose to USD 228bn in June from USD 89bn in May, a cumulative deficit of USD 2,25trn over the last 12-months or 8.6% of GDP. The US is running a ludicrous deficit for the current stage of the cycle as per Fig. 3. No wonder the Fed had to hike interest rates by such a large extent and cannot crack the service sector. In fact, the gap between the fiscal accounts and unemployment rate opened when Trump came to power in 2016.

Fig. 3: US Fiscal balance (% of GDP) vs. unemployment rate (inverted)

In other news, initial jobless claims declined to 237k on the week of 8 July from 249k on the previous week, while continuing claims rose 11k to 1,729 on the week of 1 July.

Eurozone: German bankers are getting bearish again as the ZEW expectation survey dropped to -14.7 in July from -8.5 in June and -10.6 consensus. The Eurozone industrial production rose 0.2% mom in seasonally-adjusted terms in May after 1.0% mom in April, as the yoy rate plunged to -2.2% from +0.2% over the same period, below consensus at -1.2%.

Japan: Machinery orders declined by 7.6% mom in June after rising 5.5% mom in May as the yoy rate dropped to -8.7% from -5.9% over the same period. Since 1990, there have only been three times when machinery orders hit this low level without a recession: Jun-07, May-14 and May-16. Machine orders hit double-digit negative growth in the previous six recessions: Mar-91 to Oct 93; Jun-97 to Jan-99, Mar-08 to Mar-09; Apr-12 to Nov-12 and Nov-18 to Jun-20.

Canada: The Bank of Canada hiked its policy rate by 25bps to 5.0%, in line with consensus, due to strong consumption and elevated core inflation, keeping the door open for further increases in the policy rate.

New Zealand: The Reserve Bank of New Zealand kept its policy rate unchanged at 5.5%, in line with consensus as the economy likely entered a recession around Q1 2023 and disinflation takes place.

Commodities: Crude and gasoline inventories built up against expectations of a decline. Interestingly, oil prices did not sell-off following the higher inventories, perhaps an indication of light technical positioning on oil future contracts.

The author thanks the contributions from Olivia Shaul and Iylana James.

1. See: ‘A trip to Kuala Lumpur and Bangkok highlights nuances in local investor perspectives’, Market Commentary, 14 July 2023.

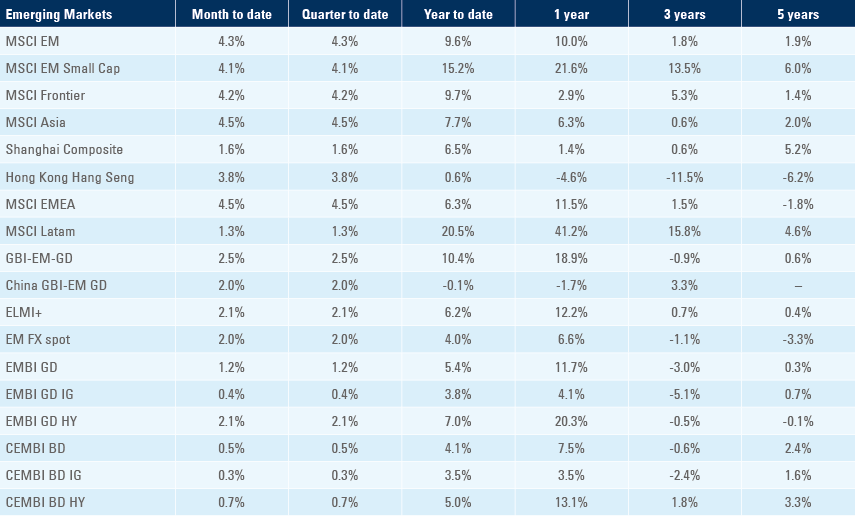

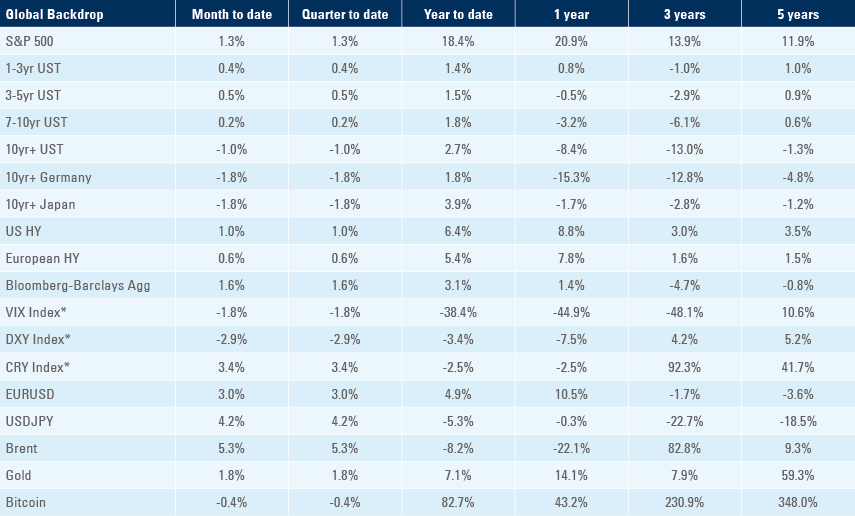

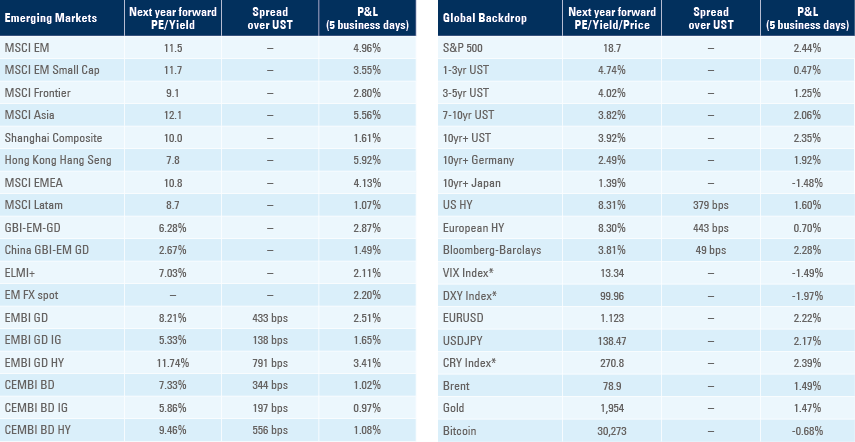

Benchmark performance