The coup in Gabon is idiosyncratic, but previous coups in Africa reveal broader geopolitical dynamics at play

The military seized power in Gabon, Central Africa. Emerging Market (EM) Purchasing Manager Indices (PMIs) rebounded, while Developed Markets (DM) PMIs deteriorated. Oil prices kept rising towards USD 90 per barrel following tighter inventories. China announced several measures to shore up activity in the real estate sector. India’s economic activity remained strong. Brazil’s GDP surprised to the upside, but its fiscal deficit was wider than expected. Mexico announced a small intervention on the Peso. Turkey’s economic activity and inflation were higher than consensus.

Geopolitics

A military coup seized power in Gabon on Wednesday, following the results of the presidential election. President Ali Bongo won the vote by 65%, but senior military officials said there was a lack of transparency and alleged rigging of the elections. The military dissatisfaction and suspicion are shared by the population in Gabon. After all, President Ali Bongo has held power since 2009, while his father’s tenure lasted 41 years previously. The coup adds to the unrest brewing across the continent. However, the situation in Gabon differs from the instability in the Sahel region, which is largely influenced by extremist groups. The coup in Gabon is symptomatic of the dissatisfaction from the population with the Bongo family which have been in power for nearly five decades. The military tried a coup in 2019 but failed.1

The pattern of coups in the Sahel has three traces in common, in our view. The first is the general sense that the current regimes have failed to deliver any social improvement to the broader population, as is the case of Gabon. The second is the influence of Russia. Despite being a small trading partner, Russia punches above its weight in terms of influence in Africa. It sells weapons to many countries and supports different political actors that end up stabilising or destabilising existing regimes. The third is the fact that Africa is a key player, in terms of natural resources availability, particularly metals relevant for the energy transition. The CEO of Sibanye Stillwater, Neal Froneman noted that his company has "been involved in a number of assessments in Africa, and it is very clear to us that Africa is emerging as a key player in the energy transition. And in fact, there's a bit of tug of war going on between the East and the West, and certainly I want to make it clear, we're a Western facing company and we look forward to bringing some of these resources to account for the West, and this will be an interesting landscape that is going to evolve".

In other news, for the first time since taking power in 2012 as the President of the People’s Republic of China, Xi Jinping will not be attending the G20 meeting to be held in India this week. China’s Foreign Ministry announced that Premier Li Qiang will be leading the Chinese delegation instead. This comes as a shift from recent positioning from Beijing having established themselves as a diplomatic power uniquely positioned to utilise its influence on the world stage. Earlier this year, China held talks with both Russia and Ukraine, brokered a deal between Saudi Arabia and Iran in March, and most recently expanded the BRICS group of nations in their August Summit. These in our view demonstrate the role China can play in international affairs; a nation with the influence and ability to structure global narratives.

Global Macro

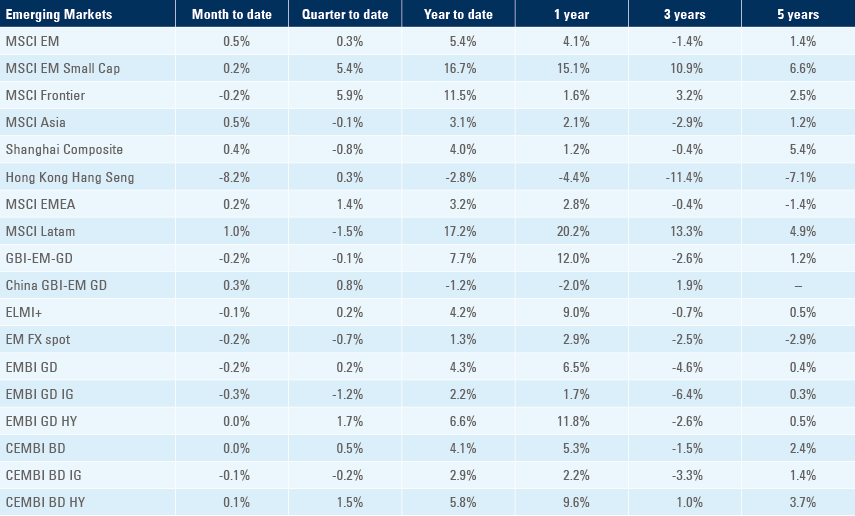

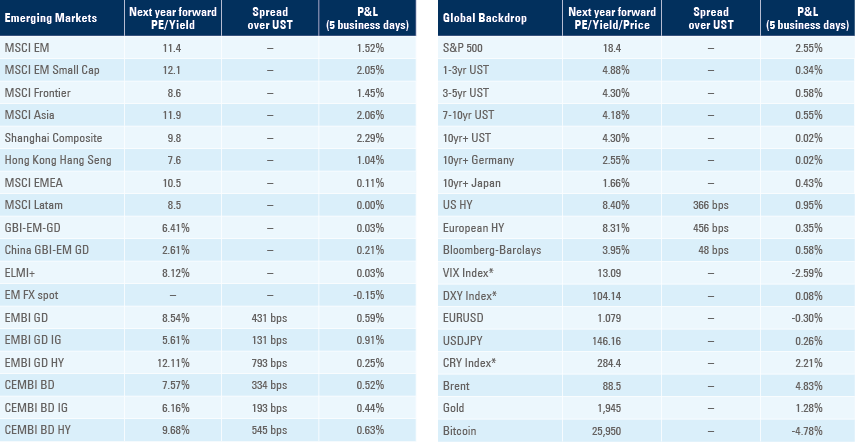

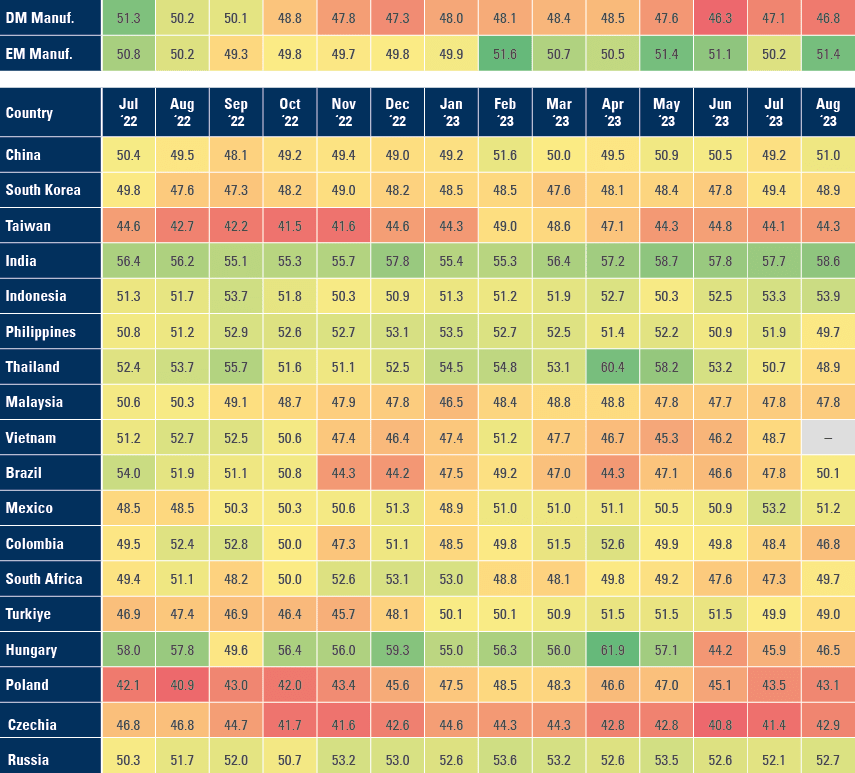

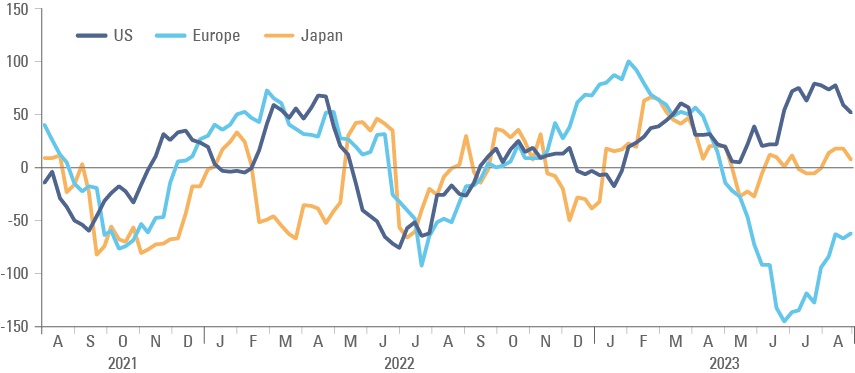

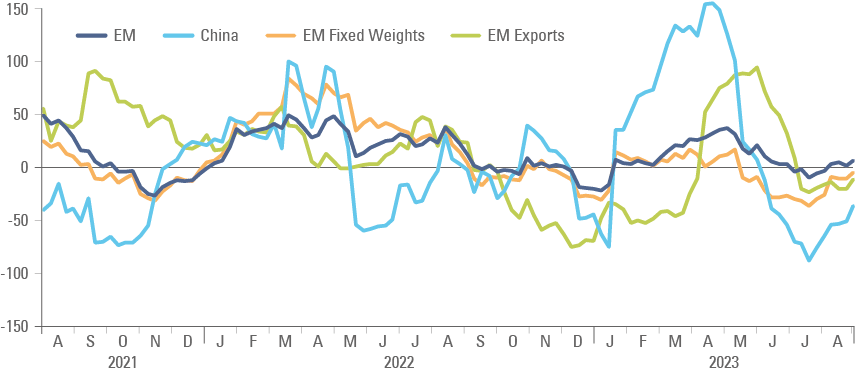

Global PMIs have been a tale of two halves; EM leading indicators have recovered while DM has softened. China manufacturing PMIs increased by 0.80points(pts) to 51.0pts in August, with India and Indonesia as well as Brazil and Mexico all seeing increases over the month as highlighted by Fig. 1. This comes as the Citi Surprise Index fell for the US over the week by 7.5pts to 52.1pts (Fig. 2), whereas EM and China specific measures both rose by 4.5pts and 14.7pts respectively (Fig. 3).

Fig 1: Manufacturing PMI’s: EM vs DM and EM breakdown

Fig 2: Citibank Economic Surprise Index: DM

Fig 3: Citibank Economic Surprise Index: EM

Commodities

Oil inventories declined by 10.6m barrels last week, according to the US Energy Information Administration (EIA). Gasoline inventories were broadly unchanged but remained at the bottom of the last five-year range. A decline in refine capacity as more investment is funnelled to renewable energy is keeping the spread between crude and refined products above average. Chinese gasoline stocks declined by 2.7% to 12.7m tons in the week to 31 August, hitting the lowest levels since 2019 according to OilChem, mostly due to lower inventories from small private refineries (Teapots).

Emerging Markets

EM Asia

China: The People’s Bank of China (PBoC) announced several nation-wide measures aimed at supporting the property sector for the first time since 2021. These included: a cut to down payments for first-time purchases to 20% and second homes to 30%, representing a large reduction from 30-35% and 70-80% respectively in Tier 1 cities; a lowering of interest rates for first-home buyers’ current mortgages, subject to negotiation with banks; as well as a broadening of the definition of first-home mortgages, allowing preferential loans for first-home purchases regardless of credit record subject to local government judgement. It will be important to monitor whether the policies will be fully adopted at the local level. On Friday, Shanghai and Beijing eased their mortgage rules.

In other news, China’s composite PMI increased 0.2pts to 51.3pts, led by the manufacturing PMI which rose 1.8pts to 51.0pts in August while the non-manufacturing PMI declined 0.5pts to 51.0pts over the same period.

India: The year on year (yoy) rate of real GDP growth accelerated to 7.8% in Q2 2023 from 6.1% yoy in Q1 2023, in line with consensus as private domestic demand surged to 13.7% yoy, leading the demand side and services and real estate services growing at double-digit pace on the supply side. Government consumption was weak, but public investment grew 8.0% yoy as its share in GDP terms was steady at elevated 34% of GDP. The fiscal deficit narrowed to INR 154bn in July from INR 241bn in June. Subsidies on gas prices are expected to soften inflation pressures, which alongside other measures will result on a c. 30 basis points (bps) impact on Consumer Price Index (CPI) inflation, in our view. The manufacturing PMI rose by 0.9pts to 58.6pts, remaining at very bullish levels.

Indonesia: The manufacturing PMI rose 0.6pts to 53.9pts in August. CPI inflation was unchanged in August after rising 0.2% month on month (mom) in July and the yoy rate increased by 20bps to 3.3%, but core CPI declined 20bps to 2.2% over the same period.

Philippines: The manufacturing PMI declined 2.2pts to 49.7pts in August.

South Korea: The manufacturing PMI declined 0.5pts to 48.9pts in August. The yoy rate of industrial production contracted 8.0% in July, down from -5.9% yoy in June. The trade surplus narrowed to USD 0.9bn in August from USD 1.7bn in July, significantly better than consensus for a USD 0.6bn deficit as imports contracted faster than exports.

Taiwan: The manufacturing PMI increased 0.2pts to 44.3pts in August, remaining at very weak levels.

Thailand: The current account moved to a USD 0.5bn deficit in July after a USD 1.5bn surplus in June as the trade surplus shrank to USD 0.4bn from USD 2.0bn over the same period. Exports declined by USD 2.6bn to USD 22.0bn and imports were USD 1.0bn lower to USD 21.7bn. The manufacturing PMI declined by 1.8pts to 48.9pts, coincidently the same level of the business sentiment index.

Vietnam: The yoy rate of CPI inflation rose to 3.0% in July, from 2.5% in June, 50bps above consensus. The trade balance widened to USD 3.8bn in August from USD 2.1bn in July, USD 1bn above expectations. The yoy rate of retail sales rose by 50bps to 7.6% and industrial production declined 110bps to 2.6% yoy in August.

Latin America

Argentina: Presidential candidate, Patricia Bullrich announced Carlos Melconian as her Economy Chief. Carlos Melconian pledged to “disentangle a spider web” of taxes and currency controls, regain competitiveness in international trade, provide predictability and bring informal workers to the formal sector by lowering business costs.

Brazil: Real GDP growth declined to 0.9% quarter on quarter (qoq) in Q2 2023 from 1.8% qoq in Q1 2023, 60bps above consensus as the yoy rate declined only 60bps to 3.4% over the same period, 70bps above consensus. The manufacturing PMI rose 2.3pts to 50.1pts. Economic activity is anchored by positive wealth effects (strong performance from commodity exports) and higher fiscal deficit compared to 2022. The fiscal deficit improved marginally to BRL 82bn (or BRL 36bn before interest) in July from BRL 90bn (BRL 49bn primary) in June as the net debt to GDP ratio increased 50bps to 59.6%. Producer price index (PPI) posted a 0.1% mom deflation in August after -0.7% mom in July as the yoy rate of deflation moderated to 7.2% from -7.7% over the same period. A total of 143k formal jobs were created in July, marginally below the 157k in June as the unemployment rate declined 10bps to 7.9%, in line with consensus. The trade surplus declined to USD 9.8bn in August from USD 8.9bn in July.

Chile: Copper production declined to 434k in July from 458k in June as Codelco reported a large cost increase, at results was presented last week. The yoy rate of retail sales contraction moderated to 10.1% in July from -13.0% in June, slightly below consensus, and the unemployment rate rose to 8.8% in July from 8.5% in June, 10bps above consensus.

Colombia: The urban unemployment rate surged 100bps to 9.8% (consensus 9.5%) in July and the national unemployment rate rose 30bps to 9.6% over the same period.

Ecuador: The first round of elections, overseas votes was annulled after hacker attacks prevented most overseas Ecuadorians from voting. As a result, the inauguration of the new National Assembly, as well as the new president, will be delayed. The second round of presidential elections will take place on the 15 October between centrist businessman Daniel Noboa and Correista Luisa Gonzales. The winner will lead the country for 18 months, the remaining term of the current President Guillermo Lasso, who resigned and dissolved the parliament a few months ago. Violence remains a presence at the presidential election. Last week, two car explosions targeted prisons as inmates at six penitentiaries held 57 guards and officers hostage, likely as a response to government security operations.

Mexico: The Foreign Exchange Commission composed by three members from the Treasury (including the finance minister) and three from the Bank of Mexico (Banxico) (the governor and two board members), announced that Banxico will start unwinding its USD 7.5bn of its non-deliverable forward (NDF) book in September, rolling only 50% of the hedges. The decision was probably related to concerns about excessive long MXN position ahead of a potential easing cycle from the central bank. A key question is whether the central bank will start to accumulate foreign exchange (FX) reserves. In the short term, buying USD will have a negative impact on the MXN, but in the medium term, accumulating FX reserves, if accompanied by sound fiscal policies, could drive the sovereign risk premium lower, making the intervention a catalyst for more investments in Mexico and thus leading to a stronger currency. Seasonally adjusted GDP grew 0.8% in Q2 23 compared to 0.7% in Q1 23, 20bps below consensus as the yoy rate of GDP growth declined 20bps to 4.1% (10bps below consensus). The unemployment rate rose by 50bps to 3.1% in July, 20bps above consensus. The Manufacturing PMI declined 2.0 points to 51.2 in August.

Peru: CPI inflation in the city of Lima was unchanged at 0.4% mom in August, but the yoy rate declined by 40bps to 5.6% due to base effects – 15bps above consensus.

Venezuela: Refinitiv reported oil companies ENI and Repsol are looking to upgrade their oil-for-debt swap with Venezuela’s oil company PDVSA after US approval.

Central and Eastern Europe: The manufacturing PMI remained at depressed levels across the region.

Czech: Real GDP growth was unchanged at 0.1% in qoq terms in Q2 2023 but contracted by -0.4% yoy up from -0.6% in the previous quarter, 20bps above consensus. The manufacturing PMI improved 1.5 pts but remained at very depressed 42.9pts.

Hungary: The Central Bank of Hungary held monetary policy rate at 13.0%, in line with consensus. PPI inflation rose to 0.9% mom in July after -1.3% mom in June, but the yoy rate declined another 440bps to 1.3% over the same period. The manufacturing PMI increased by 0.6pts to 46.5pts.

Poland: Real GDP contracted by 2.2% qoq in Q2 2023, less than the first estimate at -3.7% qoq, as the yoy rate was revised lower to -0.6%. The manufacturing PMI declined 0.4pts to 43.1pts. CPI inflation was unchanged in August after declining 0.2% mom in July as the yoy rate declined 70bps to 10.1%.

Central Asia, Middle East, and Africa

Egypt: The privatisation programme is moving forward as Egypt will be offering stakes of power plants and other state owned enterprises (SOEs) from October 2023 until June 2024.

South Africa: PPI inflation rose 0.2% mom in July, 30bps below consensus, after dropping 0.3% mom in June as the yoy rate declined, another 210bps to 2.7% over the same period. The trade balance moved to a ZAR 16.0bn surplus in July from ZAR 4.7bn deficit in June. The Absa manufacturing PMI increased 2.4pts to 49.7pts, notably above consensus.

Turkey: Real GDP growth rose by 3.5% qoq in Q2 2023 as the yoy rate declined by only 10bps to 3.8% (consensus 3.1% yoy). Trade deficit widened to USD -12.2bn in July from USD -5.bn the previous month, below consensus by USD 0.2bn. The manufacturing PMI declined 0.9pts to 49.0pts in August. CPI inflation rose by 9.1% mom in August after 9.5% in July as the yoy rate rose by 11.1% to 58.9% over the same period. Core CPI inflation rose by 8.8% to 64.9% and PPI inflation increased by 4.9% to 49.4% in August. The move highlights the challenges faced by the new economy team headed by Mehmet Simsek.

South Africa: The fiscal deficit widened the ZAR 143.8bn in July from a surplus to ZAR 36.7bn in June, but the trade balance moved to a ZAR 16.0bn surplus from a ZAR 4.7bn deficit over the same period. The Absa manufacturing PMI rose 2.4pts- to 49.7pts in August, almost two points higher than consensus.

Developed Markets

United States: Annualised Q2 2023 GDP growth was revised down by 30bps to 2.1% from the first reading and core personal consumption expenditures (PCE) was revised 10bps lower to 3.7%. The downward revision to GDP reflected less inventory and non-residential fixed investment as consumption expanded by 1.7%. The yoy rate of the PCE deflator rose by 30bps in July to 3.3% and the core PCE deflator rose 10bps to 4.2% yoy, both in line with consensus.

Confidence surveys were slightly better than consensus but remained at low levels. The ISM Manufacturing rose 1.2pts to 47.6pts as prices paid jumped 5.8pts to 48.4pts and employment increased 4.1pts to 48.5pts, albeit new orders were down 0.5pts to 46.8pts. Some analysts were quick to point out that the new order/inventory ratio increasing was a sign the US economy is not going into a recession, but the data is inconclusive in that regard. In almost all recessions, the ratio of new orders/inventories rebounded above zero and then cratered again: 1948, 1953, 1957, 1960, 1973, 1979, 1989, and 2007. Interestingly, in 2001, the ratio went up throughout the recession. The S&P Manufacturing PMI rose 0.9pts to 47.9pts and the Chicago PMI rose six points to 48.7pts, but the Conference Board Consumer Confidence survey declined 10 points to 106.1pts in August.

Labour market surveys softened further last week. A total of 8.8m jobs were opened in July, down from 9.2m in June according to the Job Openings and Labour Turnover Survey (JOLTS), below consensus at 9.5m. Job openings are down 27% from the March 2022, compared with declines of 38% during the pandemic, 55% in the 2008 crisis and 43% in the dotcom crisis. The quit rate dropped 10bps to 2.3%, the lowest level since January 2021. Below the radar was the report from the Challenger, Gray and Christmas, Inc. showing 75.1k jobs were cut in August, accumulating a total of 557k year-to-date. This is the largest since 2020 and third largest since 2009. The report showed a total of 25 of the 30 industries have seen an increase in layoffs this year, the exceptions being Automotive, Government, Entertainment/Leisure, Industrial Goods, and Utilities.2 Finally, non-farm payrolls rose by 187k (consensus 170k), but the previous two months data was revised lower by 134k jobs, taking the cumulative revisions year-to-date to -355k. The six-month moving average of non-farm payrolls have declined below 200k (from 613k in August 2021 and 387k in August 2022) for the first time since the pandemic.

Eurozone: CPI inflation rose to 0.6% mom in August, 20bps above consensus, after -0.1% mom in July, as the yoy rate was unchanged at 5.3%, the same level as core CPI inflation, which declined from 5.5% in July. There is significant inflation divergence within the Eurozone with Spanish CPI rising 30bps to 2.6% yoy, France up 50bps to 4.8% yoy and Germany down 10bps to 6.1%. European Central Bank Board Member, Isabel Schnabel acknowledged growth prospects for the Euro area are more dire than officials predicted in June, while underlying inflation remains “stubbornly high.” Isabel Schnabel added that, while further rate hikes could be warranted, “should our assessment of the transmission of monetary policy suggest that the pace of disinflation is proceeding as desired, we may afford to wait until our next meeting”. The Eurozone manufacturing PMI was revised 0.2pts lower to 43.5pts in August. In Sweden, the state-owned lender SBAB said around 65% of contracts for planned new dwellings were cancelled in the past six months by buyers choosing to pay a cancellation fee rather than follow through home purchases in a slumping market. Housing in Sweden plunged 57% in H1 2023 versus H1 2022, according to official preliminary data.

Japan: The jobless rate rose to 2.7% in July from 2.5% in June, 20bps above expectations. The Prime Minister said the government will extend gasoline subsidies until year-end, reducing prices to JPY 175 per litre in October. Subsidies were introduced in January 2022 and were due to end in September 2023.

United Kingdom: The British Retail Consortium said shop price inflation fell sharply again to a yoy rate of 6.9% in August from 7.6% yoy in July as food prices led the decline, particularly meat, potatoes, and cooking oils. House prices declined by a yoy rate of 5.3% in August, the sharpest in 13 years, according to Nationwide. The UK economy is more dependent on housing than the average DM economy. The manufacturing PMI was revised 0.5pts higher to 43.0pts, not changing the big picture at all.

The author thanks Joshua Martin for his contribution.

1. https://en.wikipedia.org/wiki/2019_Gabonese_coup_attempt

2. See: https://www.challengergray.com/blog/job-cut-announcements-jump-in-august-2023-ytd-up-210/

Benchmark performance