- Hawkish holds/cuts in EM contrasted with dovish holds/cuts in DM.

- US economic growth softened in recent weeks, while EM growth remained resilient.

- The US is considering quadrupling tariffs on Chinese renewable technology imports.

- China’s Xi visited Europe last week.

- Putin reshuffled his cabinet and will visit China this week.

- Israel deepens its offence in Rafah.

- China’s lending data softened, but ongoing reforms underpin the recent improvement in sentiment.

- Taiwan’s TMSC Q1 results outperformed estimates.

- Brazil cut 25bps, but four dissents led to fears of increased political interference in monetary policy.

- Petro’s political capital was further undermined by Colombian corruption scandals.

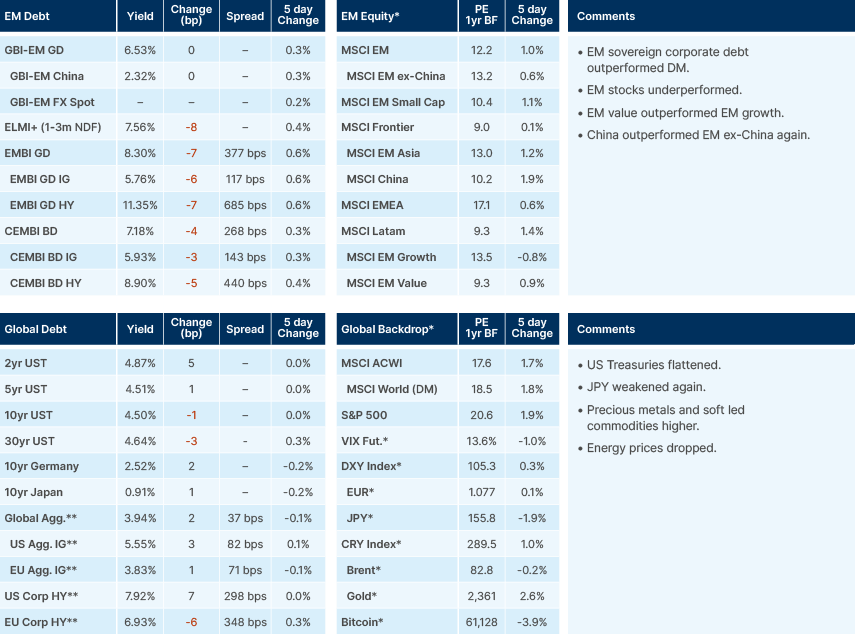

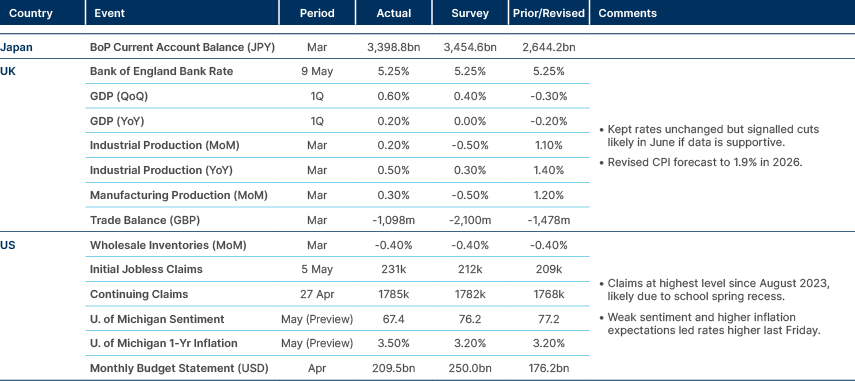

Last week performance and comments

Global Macro

Monetary Policy

The Riksbank of Sweden cut its policy rate by a quarter point to 3.75%, in line with consensus. The Riksbank’s focus on domestic economy fundamentals, rather than being concerned about the weakening of the Krona due to its move before both the European Central Bank (ECB) and US Federal Reserve (Fed), is the right approach, in our view.1 Inflation has rapidly declined in Sweden, moving from 10.2% in December 2022 to 2.2% in March 2024, while the unemployment rate has risen from a low of 6.3% in July 2023 to 9.3% in March 2024. Sweden has one of the highest levels of private sector debt to GDP in the G10 group of countries, a factor that accelerates the transmission channel of monetary policy.2 The same is true for Australia, Canada, and other Scandinavian countries, plus several European countries such as France. The Bank of England (BoE) kept its policy rate unchanged, but two Monetary Policy Committee members voted for a 25bps cut. Governor Bailey said cuts can be larger than currently expected by market participants. The Reserve Bank of Australia also kept rates unchanged with a dovish bias.

In Emerging Markets (EM), Brazil cut by 25bps to 10.5%, in line with consensus, but all four board members appointed by Lula voted for a 50bps cut, increasing fears of political interference in the autonomous institution. Governor Netto’s term expires at the end of the year. Mexico kept its policy rate at 11.0%, as expected, due to higher inflationary pressures ahead, but signalled cuts are likely over the next meetings. Peru cut its policy rate by 25bps to 5.75% – a total of 200bps this cycle – and kept a dovish stance.

Leading Indicators

The US Citibank Surprise Index declined by four points to -18 last week, dropping from close to +40 in April 2024 and +80 in August 2023. The decline contrasts with an improvement of economic surprise in the rest of the world, particularly in EM, where the surprise index improved from close to zero in February to +40 at the end of April, before moderating to +26.5 last week.

Softer economic activity alongside lower energy prices suggests Powell’s unwillingness to hike rates further corroborates our view that rates have more upside than downside in the short term. In our 2024 outlook, we have framed our view of US rates as a “year of tails”, suggesting that the four-cut ‘Goldilocks’ scenario priced at the publication date was the least likely and both tails (significantly more cuts or virtually no cuts) were likely to be tested. As the market moved from pricing a cut per meeting to only one cut in 2024, Ashmore Research's short-term US rates view moved from cautious to positive. EM economic data ‘resilience’ was another key theme explored in the outlook which has been playing out so far in 2024.

Geopolitics

The Wall Street Journal reported the Biden administration is considering increasing tariffs on Chinese electric vehicles (EVs) and solar panels by as much as four times to 100%. The decision may be announced this week. The tariffs are unlikely to be very disruptive, at least initially, as US imports of Chinese EVs and solar panels are not significant. If confirmed, the policy is remarkably similar to Trump’s approach. Biden claims his protectionism is justified on national security grounds (de-risking), albeit the list of sectors under sanction of draconian tariffs is expanding, leading to a more isolated America. Trump has been advocating for a more radical approach, imposing 60%-100% tariffs across the board, which would be effectively decoupling the US from the largest manufacturer in the world. However, as in the first mandate, Trump may be just threatening a massive disruption to global trade to improve his position in negotiations to rebalance global trade.

Nevertheless, both presidents have policies of closing US markets from foreign competition and restricting the access of US intellectual property to non-aligned countries, while subsidising its own industry. These policies aim to re-establish America as a relevant centre for advanced manufacturing. Protecting its own industry while promoting scale is a strategy adopted by the US after independence and was mimicked by Southeast Asian countries during the Cold War. The approach was most successful when national champions were competitive in international markets, ensuring that scale was gained only if the company achieved world-leading technologies and manufacturing processes and costs. This is not what is happening in the US. Ford had 33% of its assets overseas in 2008. Last year, this dropped below 15%. Despite some encouraging signs, it remains to be seen if the semiconductor fabs in the US will be competitive in relation to Taiwan, South Korea, and Malaysia. Closing the US market to cheaply manufactured solar panels and wind turbines is likely to be a costly strategic mistake too, a topic we explored in a recent long-form piece.3 Overall, economic nationalism will ensure ever lower efficiency, in our view.

US tariffs against China are being considered one week after Xi travelled to Europe. Strategically, China’s relationship with Europe becomes more important as the relationship with the US (and Anglo-Saxon countries) deteriorates. Several factors suggest the EU is taking a more pragmatic and flexible approach to China.

- The EU never stopped importing solar panels from China, for example, and its auto industry has been dependent on China.

- Furthermore, Europe is not hastily responding to a surge in Chinese EV exports while its companies lose market share, suggesting a more thoughtful, calibrated approach in the works.

- The fact that several US policies also hurt Europe’s industry is evidence that the EU must find its own path considering its own strategic interests.

- President Macron’s vision of an independent and strong Europe entails stronger links with its Eurasian partners. Europe would struggle to decouple from both Russia and China.

- This is probably the angle Xi was exploring, explaining the fact that his first stop was in France.

At the same time, Xi’s European trip sought to strengthen ties with east European counties, referencing solidarity and cooperation with both Serbia and Hungary. Regarding Serbia, he referred to the 25th anniversary of the bombing of China’s embassy in former Yugoslavia during the Kosovo war. Harping on Serbia’s resentment towards the NATO bombings, he wrote that “the China-Serbia friendship, forged with the blood of our compatriots, will stay in the shared memory of the Chinese and Serbian peoples… We should never forget… NATO flagrantly bombed the Chinese embassy in Yugoslavia, killing three Chinese journalists”.4 Regarding Hungary, Xi stated that the two countries “need to lead regional co-operation,” and emphasised an existing relationship that had “gone through hardships together and defies power politics together amid volatile international relations”.5 China is building the Belgrade-Budapest rail link, as well as other foreign direct investment such as in copper mining in Serbia. The high-speed railway will tighten cooperation trilaterally between Serbia, Hungary and China, furthering perceptions of China as a threat.6

In other news, Israeli troops resumed the invasion of Rafah after the war cabinet unanimously rejected the ceasefire proposal agreed by Hamas. While Israel says 100,000 people fall under its evacuation order, Bloomberg reports that more than 1.4m are sheltering in the area. As a result, aid flows from Egypt have stopped and the US has paused shipments of large bombs to Israel.7

Russian President Putin reshuffled his cabinet, moving former Defence Minister Sergei Shoigu to the National Security Council and replacing him with an economist, Andrey Belousov. Several factors were probably important for this decision. Russia’s failure in Ukraine has exposed the army’s corruption and inefficiency, something publicly denounced by the former (recently assassinated) Wagner Group leader Yevgeny Prigozhin. Second, Belousov is a loyal aide to Putin. Most importantly, it highlights the military-industrial complex will be a priority for Russia. The Ukrainian war has proven to be a drain on resources, therefore managing those resources efficiently, even if targeted by sanctions, has become a priority for Russia’s long-term position.

Emerging Markets

EM Asia

Economic Data: The People’s Bank of China (PBoC) pledged measures to boost economic momentum after weak lending data. Exports softened in Taiwan.

China: Soft credit conditions driven by low household borrowing suggest the monetary authority is “pulling a string” as demand remains the main problem rather than cheap credit supply. The PBoC vowed to promote a moderate rise in inflation and improve policy transmission, placing emphasis on the effectiveness of credit. Despite imbalanced growth, several policies announced and implemented over the last months have supported sentiment and point to more sustainable economic growth ahead:

- Beijing moved to reduce overcapacity in some new sectors such as solar panels while deepening its economic cooperation with Eastern Europe on green capacity.

- The programme to support replacement of internal combustion engines with EVs has been supportive of consumption. Infrastructure investments focusing on energy transmission and distribution are consistent with more demand for electricity in the energy mix and a grid more dependent on renewable energy.

- On the housing market, measures to reduce inventories are being implemented. After the Politburo meeting, more cities such as Shenzhen, Hangzhou, and Wuhan, eased their Home Purchase Restrictions further. Some local governments have also started purchasing existing homes to support new home purchases.

- Equity market reforms – including incentives for higher pay-outs, better minority protection and tighter scrutiny of IPOs – alongside higher allocation of public resources to undervalued Chinese stocks are supportive.

Against this backdrop, domestic tourism recovered during the Labour Day holiday (1-5 May), increasing by 7.6% yoy with recovery ratio of 128% of 2019 levels. However, the per-capita tourism spending ratio dropped to 89% of 2019.

Indonesia: Bank of Indonesia Governor, Perry Warjuyo, stated recent data shows “there is no longer a need to increase the BI rate”. The Rupiah has been strengthening past 16,000 after the rate hike in March.8

Taiwan: Taiwan Semiconductor Manufacturing Company (TSMC), the largest foundry with 54% global market share, reported better-than-expected Q1 2024 earnings last week. Revenues increased by 17% yoy, 2% above consensus and net income by 9%, which was 5% above estimates. TSMC’s guidance for Q2 2024 had revenues growing at 34% in yoy terms, 4% above consensus. It will continue to benefit from its hegemonic position in cutting-edge customisable semiconductor facilities due to four mega-trends: migration to public/hybrid cloud services; artificial intelligence (AI) adaptation and generating insights from big data analytics; growing semiconductor content across durable goods (internet of things); and digital transformation of industries.

Thailand: Finance Minister Pichai Chunhavajira urged the Bank of Thailand (BOT) to support government policies, continuing pressure for rate cuts. He said: “It’s our duty and responsibility for me and the BoT to work together to push both engines – monetary and fiscal policies in the same direction…But before that we need to understand each other and realise what are the problems”. This comes after his remarks that the BoT’s autonomy was an “obstacle”.9

Sri Lanka: Plans to hold presidential elections between 17 September to 16 October were announced, with nominees to be specified within this period.

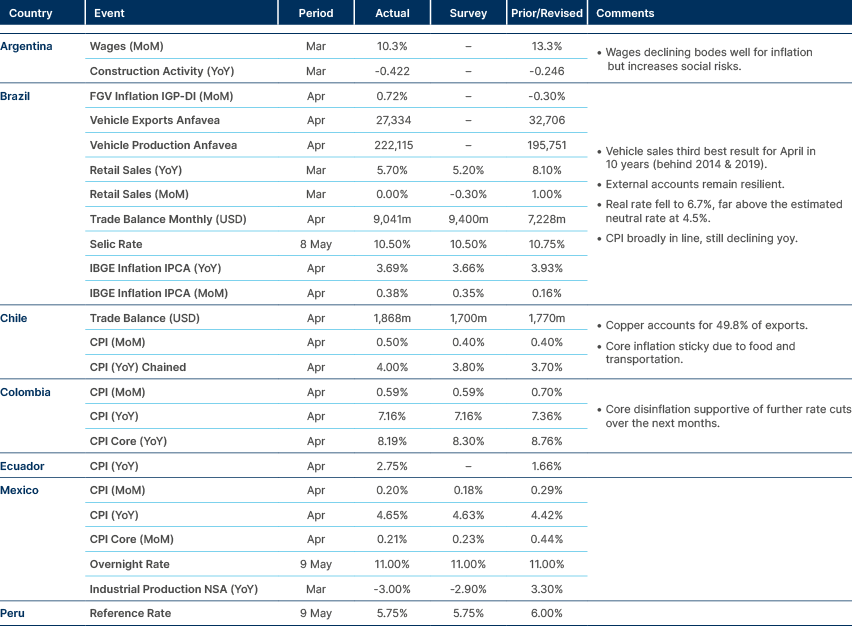

Latin America

Economic Data: Hawkish cut in Brazil, but split decision led to market concerns. Dovish pause in Mexico.

Argentina: The Senate’s Budget Committee began discussing the government’s omnibus bill. There were accusations by the Unión por la Patria Senators that the proposed bill differed from what the deputies approved. Indeed, Presidential Spokesperson Manuel Adorni admitted this and circulated the final text the following day. The chapter most questioned was the RIGI scheme of incentives for major investors.10

Brazil: The Monetary Policy Committee (Copom) statement emphasised “that the extension and adequacy of future changes in the interest rate will be determined by the firm commitment of reaching the inflation target”. Both 2024 and 2025’s inflation forecasts remained above the 3.0% target at 3.8% and 3.3%, respectively.11 Brazilian assets underperformed after four of the nine members from Copom appointed by the current government voted for a larger 50bps cut. Catastrophic floods hit the state of Rio Grande do Sul. This should put upward pressure on soybeans (Rio Grande do Sul is the second largest producer) and rice. The former could have a global impact, but harvests in Argentina and the US are going well, while the latter is mostly relevant to Brazil. The impact on national consumer price inflation (CPI) is estimated at only 10bps. However, the central government will have to provide support to the region.12

Colombia: President Gustavo Petro tried to distance himself from a bribery scandal involving members of Congress. He stated Colombia’s institutions suffer from “structural corruption” and that “our job and our duty is to fight against it”. This may lead to difficulties in the pension reform to pass through Congress.13 The government also announced it will pay household energy debt owed to private companies, instead of increasing household energy prices. The fiscal costs of this decision were not mentioned.14 Monetary policy minutes released indicate that Board members who voted for a 50bps reduction saw it appropriate to maintain pace and warned against the expected widening of the fiscal deficit.

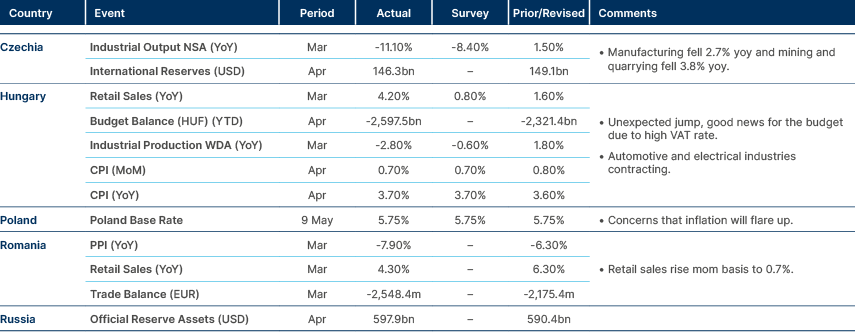

Central and Eastern Europe

Economic Data: Industrial production lagging retail sales recovery.

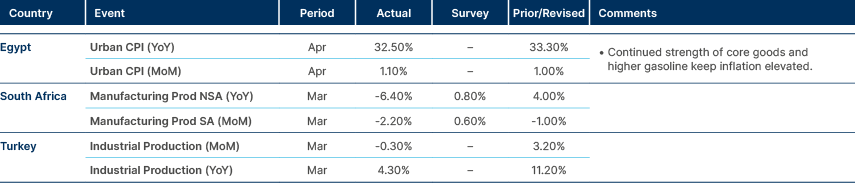

Central Asia, Middle East, and Africa

Economic Data: Egypt’s elevated inflation is led mostly by energy subsidy cuts and hides positive dynamics (food disinflation), suggesting inflation decline will accelerate over the next months.

Jordan: Moody’s upgraded local currency credit rating to ‘Baa3’ from ‘B1’, with outlook remaining ‘Stable’.

Saudi Arabia: Aramco kept its USD 31bn dividend pay-out, supporting the government’s budget. Bloomberg Economics forecasts the government needs oil at around USD 108 a barrel to balance the budget.15

Developed Markets

Economic Data: US data softened as inflation expectations increased.

Japan: Regarding JPY intervention suspicions last week, US Treasury Secretary Janet Yellen called for caution on currency intervention. She said the US expects “Interventions to be rare and consultations to take place”. In response, Japan’s currency official, Masato Kanda, stated, “If the market is functioning properly, of course there’s no need for the government to intervene”, but “there are times when the government need to take appropriate action”. Bank of Japan Governor Kazuo Ueda said that “Abrupt and one-sided weak yen moves raises uncertainties and are negative for Japan’s economy and undesirable as, for example, they make it hard for companies to formulate their business plans”.16 Finance Minister Shunichi Suzuki also stated “While the weak yen has plusses and minuses, right now I have strong concerns about the minus side with the upward pressure on import prices”.

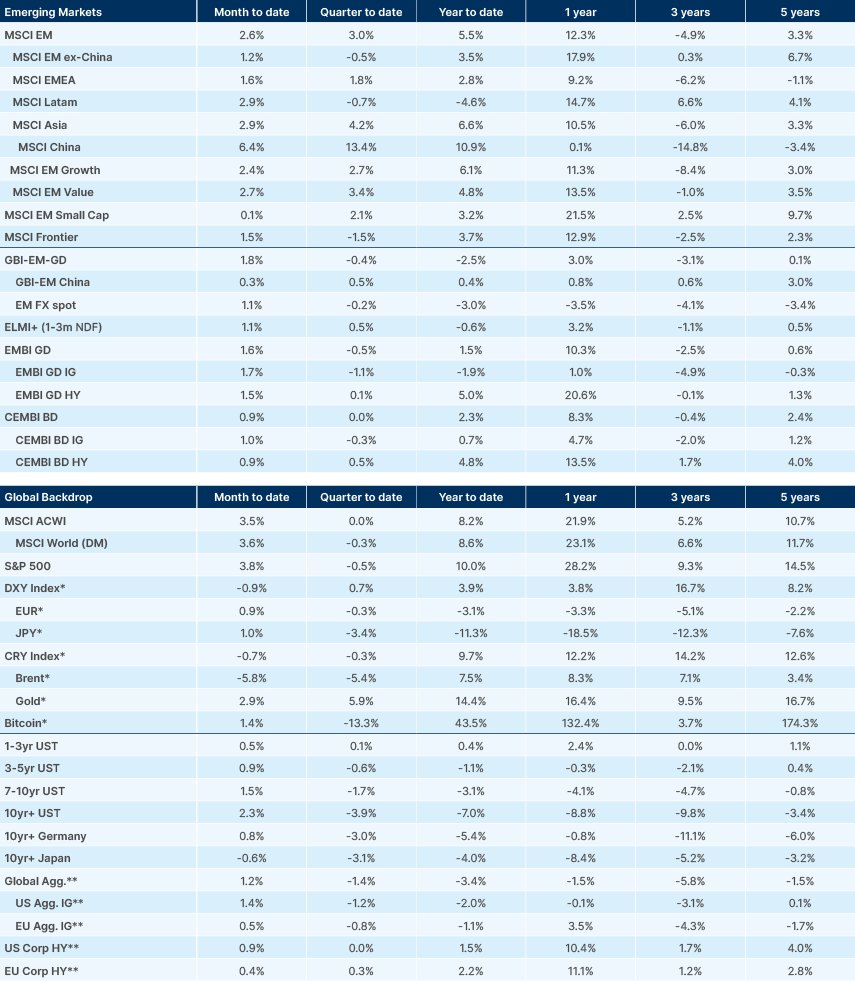

Benchmark performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.

1. See – https://blinks.bloomberg.com/news/stories/SD5P6CDWLU68

2. See – https://blinks.bloomberg.com/news/stories/SD5P6CDWLU68

3. See – The Emerging View, 'An EM ex-China manufacturing renaissance', 27 Feb 2024

4. See – https://www.ft.com/content/ca536cdb-8847-4c2e-9eca-1621e48a04dc

5. See – https://www.ft.com/content/ae84ebee-f51c-4d58-b488-e77a0313b5a2

6. See – https://adamtooze.substack.com/p/copper-railways-china-uae-ai-and

7. See – https://blinks.bloomberg.com/news/stories/SD3ZX9DWRGG0

8. See – https://blinks.bloomberg.com/news/stories/SD5SBHT1UM0W

9. See – https://blinks.bloomberg.com/news/stories/SD3UTMT0AFB4

10. See – https://www.batimes.com.ar/news/argentina/government-gears-up-for-omnibus-senate-showdown.phtml

11. See – https://blinks.bloomberg.com/news/stories/SD6SUKDWLU68

12. See – https://blinks.bloomberg.com/news/stories/SD5VSUDWLU68

13. See – https://blinks.bloomberg.com/news/stories/SD54Z3T0G1KW

14. See – https://blinks.bloomberg.com/news/stories/SD5871T0G1KW

15. See – https://blinks.bloomberg.com/news/stories/SD44D5DWRGG0

16. See – https://blinks.bloomberg.com/news/stories/SD5U8JT0AFB4