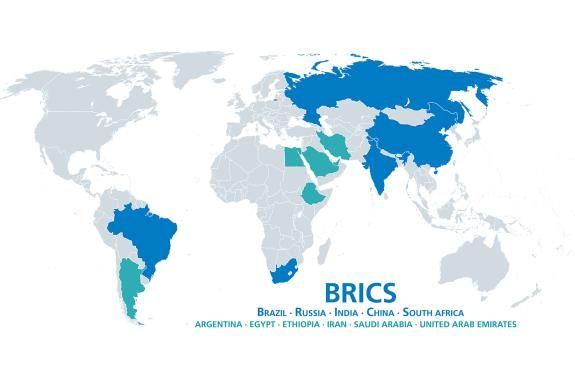

The BRICS group of countries (Brazil, Russia, India, China and South Africa) announced the inclusion of several other countries. China announced further measures to boost growth (and stock prices). Thailand Parliament elected a new government, led by the second largest party in parliament. Argentina’s first polls following the PASO had libertarian Javier Milei ahead. Colombian President Petro’s disapproval rating reached new high. Türkiye’s central bank hiked its policy rate by 750bps to 25.0%.

Geopolitics

During the 15th annual BRICS summit, hosted in Johannesburg, South Africa, the group announced expansion to include Argentina, Egypt, Ethiopia, Iran, Saudi Arabia, and the United Arab Emirates (UAE). Indonesia opted out of the inclusion candidacy using the Chairmanship of the ASEAN1 forum as justification. India tried to avoid the inclusion of countries subjected to sanctions. The inclusion of the Gulf countries is an attempt to grow the influence of the bloc as it pushes to establish its role in global affairs, away from a US-centric status quo, into a multipolar world where China plays a significant role in global trade and the Gulf countries as key providers of energy. The expanded BRICS countries account for 42% of global oil supply, 72% of rare earths, 75% of manganese, and 28% of the world's nickel.2

Russian News Agency Tass reported the group has discussed a common unit of account alternative to the US dollar. Not a single currency like the Euro, but a vehicle to trade settlements as trade relations develop amongst the BRICS and currently national currencies are being used in transactions.3 For now, the focus of the group is to develop settlement in national currencies, something already taking place on a bilateral basis across several counties in the group.4 Russia was represented by Foreign Minister Sergey Lavrov as Vladimir Putin was barred from travel by the summit host.

Yevgeny Prigozhin, leader of the Wagner mercenary group, died alongside nine other individuals – including the group’s founder – in a plane crash last week. The incident was hardly surprising given the number of high-profile enemies accumulated by Prigozhin, particularly from the Russian Army, and is unlikely to be a catalyst for any changes in the conflict in Ukraine.

Emerging Markets

EM Asia

China: The People’s Bank of China (PBoC) kept the five-year loan prime rate (LPR) at 4.2%, while the market expected a 15 basis points (bps) cut. However, the PBoC did cut the one-year LPR by 10bps, slightly less than 15bps consensus. Over the weekend, the authorities halved the stamp duty levied on stock trading from 0.1% to 0.05%, the first cut since 2008, to boost confidence in the stock market. The Hang Seng index rose 3.8% and the Shanghai Stock Exchange Index rose 2.6% following the news. Bloomberg reported today that Chinese banks are weighing further deposit and mortgage rate cuts to boost growth while Hong Kong set up a taskforce to boost stock market liquidity.

Indonesia: Bank Indonesia kept its policy rate unchanged at 5.75%, in line with consensus. The current account moved to a USD 1.9bn deficit in Q2 2023 from a surplus of USD 3.0bn in Q1 2023, significantly below consensus.

Malaysia: The yoy rate of consumer price index (CPI) inflation declined 40bps to 2.0%, 10bps below consensus.

South Korea: The Bank of Korea kept its policy rate unchanged at 3.5%, in line with consensus.

Taiwan: Export orders declined 12.0% yoy in July, up from -24.9% the previous month, 350bps above expectations. The current account surplus widened to USD 22.4bn in Q2, from USD 19bn in Q1. The unemployment rate declined marginally to 3.43% in July from 3.45% in June, 7bps below consensus.

Thailand: As anticipated last week, the Thai Parliament elected Pheu Thai’s (PT) Srettha Thavisin as Prime Minister. PT is the second-largest party in Parliament. Srettha commanded the support of 482 votes with 330 votes coming from Members of Parliament and 152 from Senators, placing him comfortably above the required 374. This came after the first vote on appointing a new PM on 13 July, where the Move Forward Party, led by Pita Limjaroenrat, fell 51 votes short of the threshold, despite winning the most seats in the general election (151 seats to PT’s 141). Protests on the streets have been moderate, so far, as PT received the second-largest number of votes. In economic news, real GDP grew 1.8% yoy in Q2, down from 2.7% in Q1, 120bps below expectations.

Latin America

Argentina: A poll by local pollster Opinaia showed the Avanza Liberdad candidate Javier Milei leading vote intentions with 35%, followed by the incumbent Frente de Todos Sergio Massa with 25% and Juntos por el Cambio Patricia Bullrich trailing with 23%.5 Bloomberg reported that Milei’s advisors will travel to New York in September to meet with investors. The article mentions Dario Epstein, congressional candidate Diana Mondino, and Senate candidate Juan Napoli as part of the delegation. Milei has also toned down the principles of his radicle libertarian ideas in recent speeches aimed at market participants. Argentina’s trade deficit narrowed to USD 650m in July from USD 1.833m in June as imports declined and exports advanced.

Brazil: The current account deficit increased to USD 3.6bn in July from USD 1.3bn in June, but foreign direct investment increased to USD 4.2bn from USD 1.9bn over the same period. CPI inflation rose by 0.3% mom in the first fortnight of August from -0.1% mom in the same period in July as the yoy rate of inflation rose by 100bps to 4.2% (10bps above consensus) partially due to base effects.

Colombia: President Gustavo Petro disapproval rating reached 62% in August while his approval rating declined 3% to 32%, according to the latest ‘Opinometer’ survey conducted by pollster Datexco, with 700 participants. The changes are within the 3.7% margin of error. Social demonstrations took place (but no social unrest) after recent gasoline price hikes, and the implementation of better prices to taxi drivers has been challenging. Gasoline prices will keep increasing, according to the government.

Mexico: The current account moved to a USD 6.3bn surplus in Q2 2023 from a record USD 20.3bn deficit in Q1 2023. CPI inflation rose to 0.3% in the first 15 days of August from 0.2% in the same period of July as the yoy rate declined by 10bps to 4.7%, in line with consensus. Core CPI inflation rose 0.2% mom (from 0.1%) over the same period as the yoy rate declined 30bps to 6.2%, slightly below consensus.

Central and Eastern Europe

Hungary: The unemployment rate increased by 10bps to 3.9%.

Poland: The yoy rate of producer price index (PPI) inflation declined to -1.7% yoy in July from +0.5% in June, 70bps below expectations. The employment rate declined to 0.1% in July down from 0.2% the previous month, in line with expectations. Sold industrial output declined -8.5% mom in July, down from 1.2% growth in June, 200bps below expectations.

Central Asia, Middle East, and Africa

Czechia: The consumer and business confidence survey improved to 0.8 from -1.4 in August as business confidence recovered, but consumer confidence remained depressed.

Egypt: The trade deficit narrowed to EGP 2.3bn in July from EGP 3.7bn in June.

South Africa: The yoy rate of CPI Inflation declined 70bps to 4.7% yoy in July, 20bps below expectations.

Türkiye: The Central Bank of Türkiye hiked its policy rate by 750bps to 25.0%, a much more hawkish decision than anticipated by consensus, which had the policy rate moving to 20.0% (highest 20.5%).

Developed Markets

United States: US Federal Reserve (Fed) Chair Jerome Powell struck a balanced tone at the Jackson Hole symposium last week, reiterating that inflation remains too high, that the Fed was prepared to “raise rates further if appropriate” and that rates will remain at a restrictive level until inflation is moving sustainably down toward the objective. He also reiterated the 2.0% inflation target will not change. On the more dovish side, Powell acknowledged that inflation moved lower and pointed out there was significant uncertainties regarding policy lags saying there could be “significant drag on the pipeline” from those.

The first Republican presidential debate took place on 24 August, with the notable exception of former President Donald Trump, who instead opted for an interview with Tucker Carlson. Despite his lack of physical presence, President Trump was a clear focal point of discussions in the debate, given his continued dominance in polling for the Republican nomination.

In economic news, the flash (preliminary) manufacturing purchasing managers’ index (PMI) dropped 2.0 points to 47.0 in August, also 2.0 points below consensus. Services PMI dropped 1.3 points to 51.0 over the same period, 1.2 points below consensus. Home sales declined 2.2% mom in July, up from -3.3% in June but 200bps below consensus. Durable goods orders declined 5.2% mom in July (consensus -4.0%) after rising 4.4% mom in June. The University of Michigan Consumer Sentiment Survey declined to 69.5 in August from 71.2 in July, but reported one year and 5-10 years ahead inflation expectations rising by 20bps to 3.5% and 10bps to 3.0%, respectively.

Eurozone: The flash manufacturing PMI for August was 43.7, 1.0 point above expectations, up from 42.7 the period prior. Services PMI across the same period was 48.3, 2.2 points below expectations, down from 51.5. The German IFO Business Climate index declined 1.7 points to 85.7, 1.1 points below consensus. German PPI dropped 1.1% mom in July after -0.3% mom in June, taking the yoy rate to a 6.0% deflation. Producer prices have declined 14.8% from the peak in September 2022, but would have to decline by another 23% to revert to the pre-2021 trendline.

United Kingdom: The flash manufacturing PMI for August dropped 2.8 points to 42.5 and the services PMI dropped 2.2 points to 48.7 over the same period, both significantly below consensus.

Japan: The yoy rate of CPI inflation declined 30bps to 2.9% (consensus 3.0%) but core CPI ex-fresh food and energy was unchanged at 4.0%, in line with consensus.

The author thanks the contributions from Joshua Martin and Iylana James.

1. Brunei, Cambodia, Timor-Leste, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand and Vietnam.

2. See: https://www.csis.org/analysis/six-new-brics-implications-energy-trade

3. See: https://tass.com/world/1663619

4. See: https://www.ledgerinsights.com/brics-digital-currency-local-currency/

5. See: https://oglobo.globo.com/mundo/noticia/2023/08/29/pesquisas-indicam-que-argentina-tera-segundo-turno-entre-massa-e-milei.ghtml

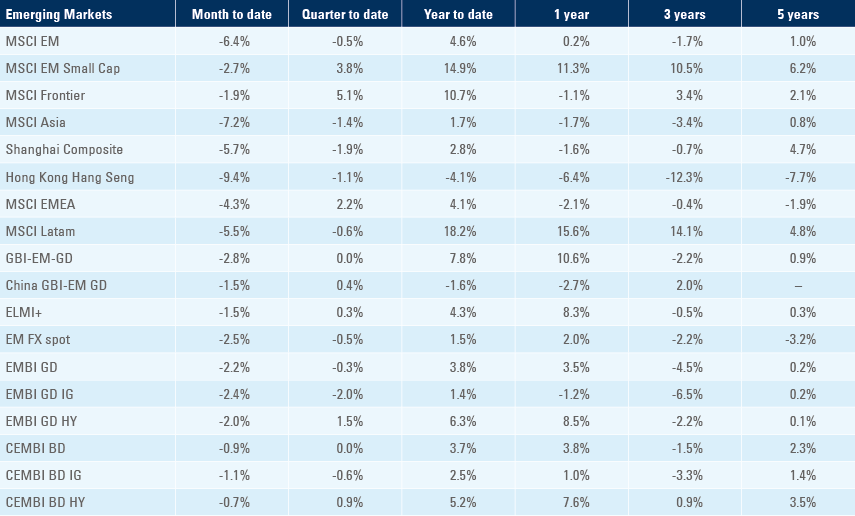

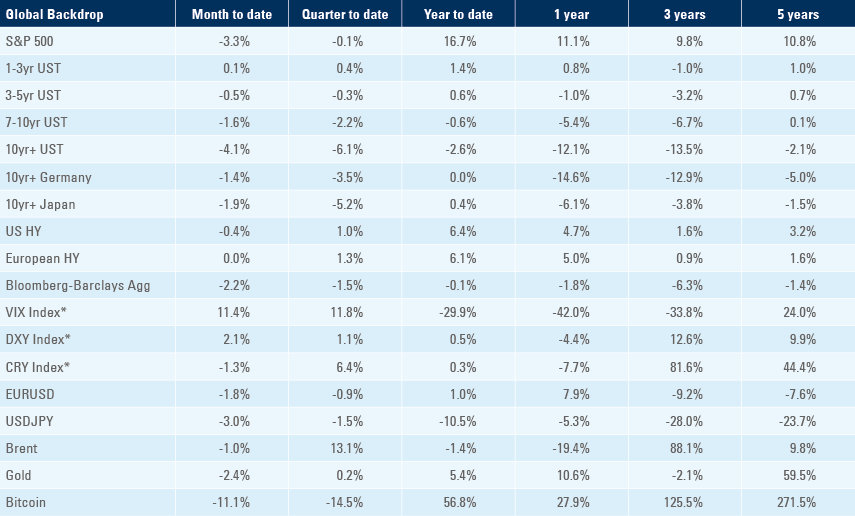

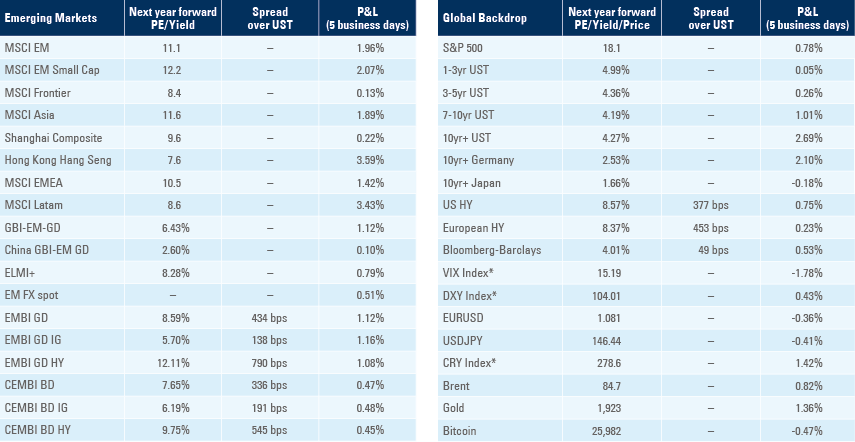

Benchmark performance