US stocks ‘liberated’ from 2024 returns; EM outperformance persists.

- As “Liberation Day” shocked global markets, EM assets outperformed.

- NASDAQ now in technical bear market, down 23% from its February peak.

- US effective tariff rate now at an estimated 22.5%, the highest since 1909.

- China retaliated with a 34% tariff on US goods.

- Oil prices fell as much as 15% to approximately USD 60 per barrel after major OPEC+ supply hikes.

- Domestically-driven economies, such as India, are less affected by tariffs.

- South Korea’s Constitutional Court unanimously impeached President Yoon.

- Intel and TSMC reached a preliminary deal to form a joint venture.

- Colombia’s central bank held its policy rate at 9.5%.

- Dominican Republic President Abinader believes it can achieve investment grade status by 2028.

- South Africa's coalition government under severe stress after a fallout over the 2025 budget.

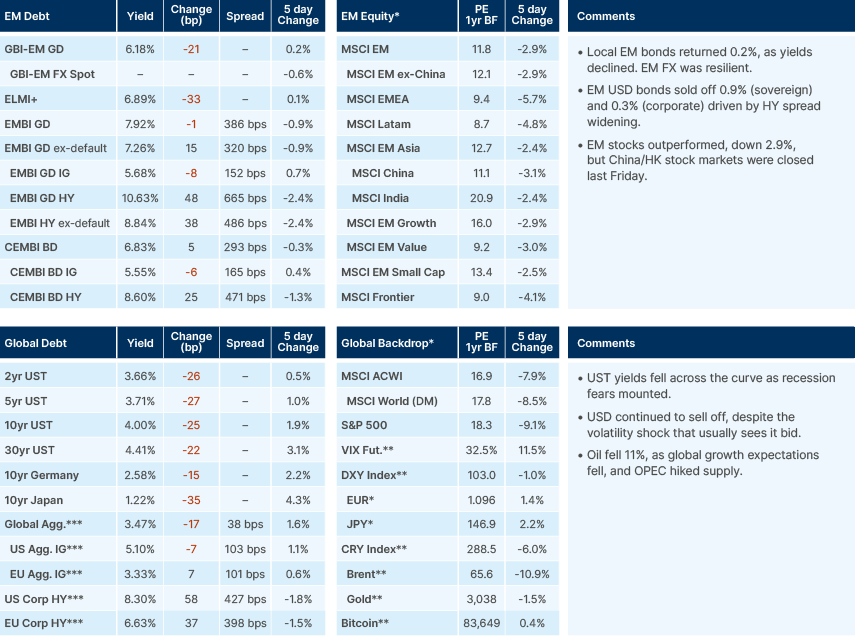

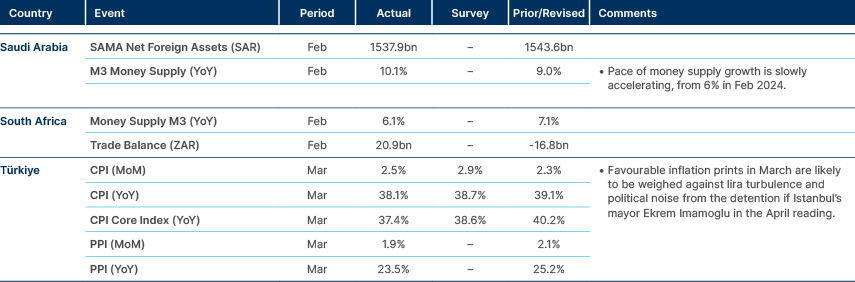

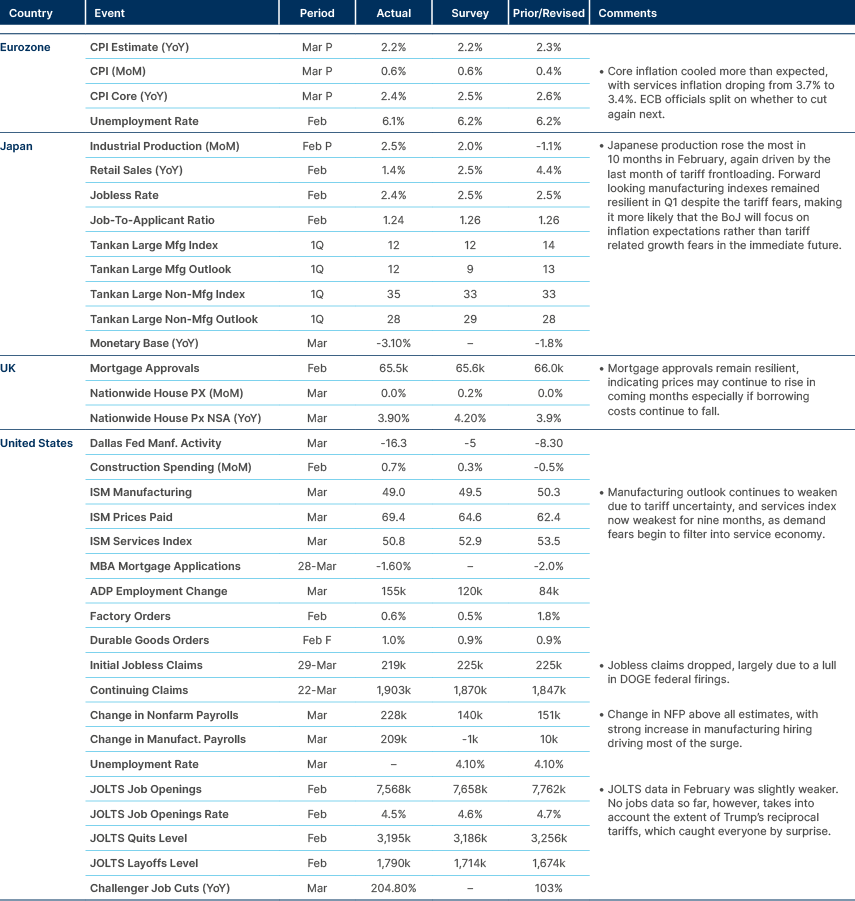

Last week performance and comments

Global Macro

“Liberation Day” tariffs were far higher than expected and led to the largest sell-off in US equities since the onset of COVID in March 2020. President Donald Trump announced a baseline 10% tariff increase for all countries, effective from 5 April and then “reciprocal” tariffs based on bilateral trade deficits. These will come in on 9 April. The incredibly blunt method of calculating the reciprocal tariffs blindsided the market, especially after such a long spell of consideration by Trump’s economic aides. For each country:

- (Exports to US – imports from US) / imports from US.

The actual formula, published by the White House, included an estimation for price elasticity of demand, and for the pass-through of tariff hikes to import prices. However, these were set at 4 and 0.25, so cancelled each other out in the formula. Most economists agree that this is not appropriate, as in reality, most of the tariff hike is passed through to imports, certainly not only a quarter. Foreigners will not absorb 75% of the tariff, it will be passed onto American importers, and consumers.

The unreasonable approach to calculating tariffs undermined the little market hope that the current administration would manage its trade policies sensibly. Canada and Mexico so far have been excluded from any broader reciprocity tariffs, and instead had minor tariffs on specific goods added for bargaining to combat illicit drugs. Tariffs on China are additional to existing tariffs, taking its rate up to above 60%, a level that will drive severe disruption across supply chains and cause massive cost increases for Americans. The Budget Lab at Yale (a non-partisan research centre) found tariffs boosted the US’s effective rate another 11.5% to 22.5%, the highest since 1909. Other economists saw it closer to 24%, depending on economic scenarios around import levels.

Trump issued these tariffs by Executive Order, based on the Economic Emergency Act of 1977.It is important to remember that Congress can challenge this. A simple majority in the House and 60/100 in the Senate, given the filibuster, is enough to rule against the tariffs. After that, Trump can veto it. Then, if two-thirds of both the Lower and Upper Houses of Congress rule against the veto, the tariffs would get cancelled. This remains a possibility, considering the severe disruption to markets and the economy.

The economic impact of these tariffs, if they stay in place, will be very significant. Economists are unanimously revising US (and global) gross domestic product (GDP) forecasts down for 2025, and consumer price index (CPI) inflation forecasts up. The NASDAQ has moved into bear market territory having dropped more than 20% from its previous high. Credit spreads are widening, but not yet in panic mode and rates have moved lower, but are not pricing a recession yet, with the US 10-year trading at around 4%.

While markets will hope for either a White House or Fed ‘put,’ against sliding asset prices, betting on this is dangerous. Trump, between rounds of golf last weekend, doubled-down on his commitment to tariffs, and his tolerance for stock market pain. It is key to monitor whether the White House will take offers from countries like Vietnam, which proposed to slash tariffs and buy more items from the US, to avoid large reciprocal tariffs.

The economic team is keen to find a negotiated solution. Treasury Secretary Scott Bessent told Fox News: “my advice to every country right now is, do not retaliate, sit back, take it in, let’s see how it goes…If you retaliate, there will be escalation. If you don’t retaliate, this is the high-water mark. We’ve got a ceiling, now let’s see if there is a different floor…NASDAQ peaked on DeepSeek day, that is a MAG 7 problem, not a MAGA problem…”

As for the Fed, in a speech last Friday, Chair Jerome Powell emphasised that tariffs at these levels may cause more “persistent” inflation, and that he was in no hurry to cut rates. This may well change if the sell-off continues unabated. The Fed would be particularly sensitive if there are signs that the credit market or US Treasury market are ‘broken’ and would intervene.

Perhaps the most notable part of the market reaction so far has been the price action of the Dollar in conjunction with a major risk-off move. The ‘Dollar Smile’ theory suggests the Dollar will sell off when the US economy is expanding at a relatively slower pace than others, but rally both when the US economy is outperforming (right smile) or in a serious risk-off move due to a ‘flight to safety’ (left smile). However, on Thursday, the Dollar was down across the board, including against high-yielding emerging market (EM) currencies. US tariffs aim for lower trade deficits, which should have led to a stronger Dollar, but the severe break in confidence from asset allocators in US assets was the most important factor in the initial price action. But then on Friday, as China upped the ante with a major retaliation of 34% tariffs against the US, the Dollar rallied again. So, the question of whether the Dollar smile is broken for good, or the threshold for it to kick in just has not been reached yet, will probably be answered in the coming weeks.

We remind readers that the structural macro shifts away from a stronger Dollar – China/European fiscal expansion, end of US exceptionalism and Japan’s reflation – remain in place, irrespective of the probability of a US recession rising. It is also notable that in the downturn in equities so far, EM stocks have traded at a very low beta to the US.

Geopolitics

Retaliation

China retaliated on Friday with an extra 34% tariff on US goods. This is big. The US exports over USD 150bn in goods to China per year (third-biggest export partner) and one million US jobs are supported by exports to China. Its main exports are agriculture, semiconductors oil and gas and pharmaceuticals.

Messaging from the European Union (EU) so far is that although the EU has a goods trade surplus with the US, it has a large services deficit and will target online services if it chooses to retaliate. The retaliation measures of the US’ largest trading partners away from USMCA explains why the Dollar is weaker. If large countries were to retaliate at the same time, the impact on the Dollar is much more ambiguous.

Commodities

West Texas Intermediate (WTI) crude oil prices experienced a significant decline, dropping as much as 15% to approximately USD 60 per barrel. This came after OPEC+ announced plans to increase oil supply by 411,000 barrels per day in May, a quantity three times greater than the market had anticipated. The move is widely perceived as a deliberate strategy by OPEC+ to push oil prices lower, placing pressure on member countries such as Iraq and Kazakhstan, which have recently exceeded their production quotas. Saudi Energy Minister Prince Abdulaziz bin Salman described the announced increase in production as merely an "aperitif," implying that further actions could follow if member nations do not adhere strictly to agreed-upon output controls.

Emerging Markets

Asia

India: India was hit with a 25% tariff by Trump. However, the first order impact is expected to be relatively contained. 50% of Indian GDP is domestic, and the country’s exports to the US equal only c. 2% GDP. These are mainly spices, electronics, jewellery and pharmaceutical products (which remain exempt from tariffs for now). A second-order impact that may prove more serious would be lower US investment in India in a recession scenario. US outsourcing of services to India, such as IT and call-centres, is now a large economy, valued in the hundreds of billions of dollars.

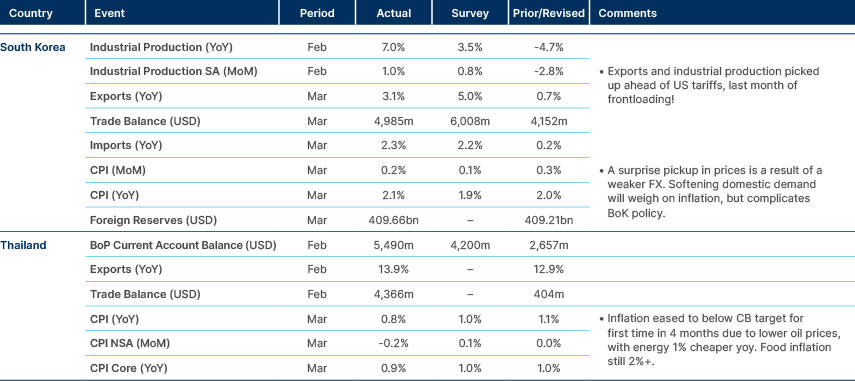

South Korea: The South Korean Constitutional Court unanimously impeached President Yoon Suk Yeol, citing his 3 December 2024 martial law declaration as a violation of democratic principles. The ruling, mirroring the 2017 impeachment of Park Geun-hye, condemned Yoon's actions, stating he wrongly excluded the National Assembly and misused martial law powers.

The Court specifically cited the deployment of troops, tracking of political leaders, and unwarranted inspections. Snap elections are mandated within 60 days, with acting President Han Duck-soo in charge for now. While concerns exist about potential unrest from Yoon's supporters, the unanimous ruling, including a vote from Yoon's own appointee, is expected to mitigate tensions.

Taiwan: Intel and TSMC reached a preliminary deal to form a joint venture (JV) to operate Intel’s chipmaking facilities, with TSMC taking a 20% stake in the new company. The JV would include some of Intel’s existing foundries. Instead of funding its stake in the JV with capital, TSMC would share some intellectual property, divulging chipmaking methods, and training Intel personnel to carry them out.

Vietnam: Despite low Vietnamese tariffs rates, Trump’s 46% “reciprocal” tariff on Vietnamese imports is among the highest of all countries, due to a USD 123.5bn trade deficit. In response, Vietnam's leader To Lam contacted Trump, offering to drop all tariffs on US goods and requesting a delay for negotiations. Vietnam also intends to increase US goods purchases and diversify its markets. The news caused Vietnam's stock market to plummet and its currency to surge, with concerns also raised by US companies reliant on Vietnamese production.

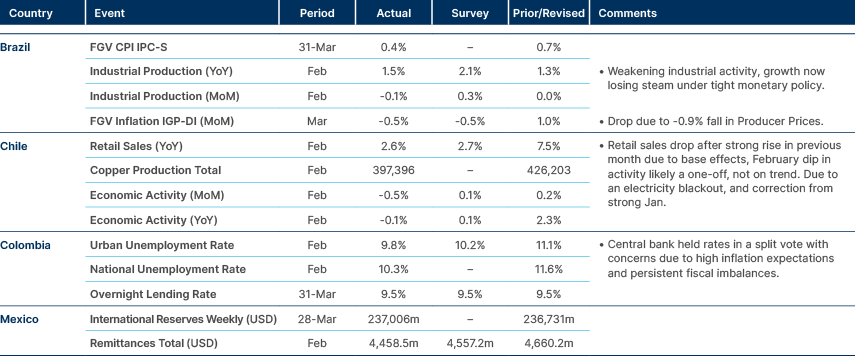

Latin America

Colombia: Banco de la República held the policy rate at 9.5% and guided for future rate cuts if inflation keeps declining. President Gustavo Petro criticised the decision, suggesting it is politically motivated to undermine the government. Bancolombia reported a 2.7% annual growth in productive activity for Q1 2025.

The government exceeded its tax collection target for March 2025 by over COP 300bn, with potential plans for a new financing law and spending adjustments. The new credit chief, Javier Cuellar, announced changes to Colombia's debt strategy, focusing on shorter duration local peso bonds to attract foreign investors.

Dominican Republic: President Luis Abinader believes the Dominican Republic can achieve investment grade (IG) status by 2028, citing its economic model and comparable interest rates to IG countries. Despite delaying fiscal reform, the country is pursuing effective growth strategies and considering labour reforms to attract investment and diversify the economy.

Mexico: President Claudia Sheinbaum took a celebratory approach to Mexico’s avoidance of further “reciprocal” tariffs on 2 April, despite major tariffs already being in place on Mexican autos, steel, aluminium and non-USMCA goods. Sheinbaum seems unwilling to respond to US tariffs and is avoiding confrontation for now.

Peru: Lima CPI inflation rose 0.8% in March. Core inflation remains contained. The government launched a deregulation package with more than 400 measures to reduce bureaucratic barriers, boost investments and increase economic competitiveness.

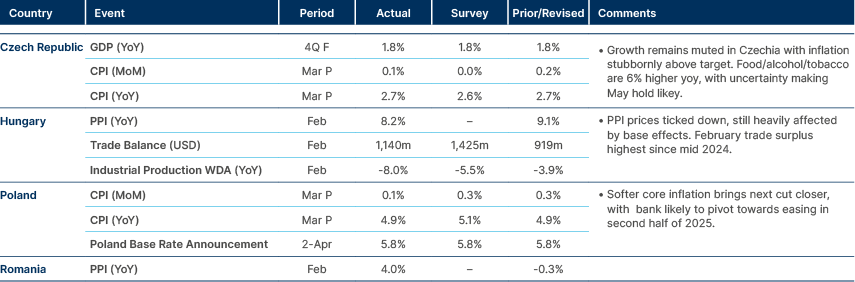

Central and Eastern Europe

Poland: Monetary Policy Council member Cezary Kochalski said the Council might reduce rates at its next policy sitting on 6-7 May and that he might back a 50 basis points (bps) cut, according to an interview for Bloomberg.

Central Asia, Middle East, and Africa

Egypt: Last Tuesday, the European Parliament approved a EUR 4bn tranche for Egypt, following a EUR 1bn tranche that was disbursed in January 2025. The vote passed with broad support, garnering 452 members in favour, 182 against, and 40 abstentions. The two tranches form the EUR 5bn package of concessional loans that aim to provide macro-financial assistance and budget support.

South Africa: South Africa's Government of National Unity (GNU) is hanging by a thread after the 2025 budget was narrowly passed by the ANC with the help of small minority parties, without support of its largest coalition partner, the DA. The EFF and MK parties voted with the DA against the budget. The budget introduces a phased value-added tax (VAT) increase of 0.5 percentage points in both 2025/26 and 2026/27, aiming to raise the rate to 16% by 2026 to address a ZAR 60bn fiscal shortfall.

To mitigate the impact on lower-income households, the government proposes additional VAT zero-rating on essential food items and maintains the current fuel levy. The DA opposed the VAT hike, arguing it would disproportionately affect the poor, and advocated for spending cuts and alternative revenue measures. However, its concerns were ultimately ignored. In response, the DA filed a court challenge, alleging procedural flaws in the budget's adoption. Leaders of the DA told the Financial Times that they feared the coalition was “done and dusted”.

Developed Markets

United States: The Challenger Jobs survey showed US employers announced 275,240 job cuts in March 2025, marking a 204.8% increase from March 2024. This was the highest monthly total since May 2020. The surge was primarily driven by planned federal government job reductions under the Department of Government Efficiency (‘DOGE’). Without this factor, March would have been a relatively quiet month for layoffs.

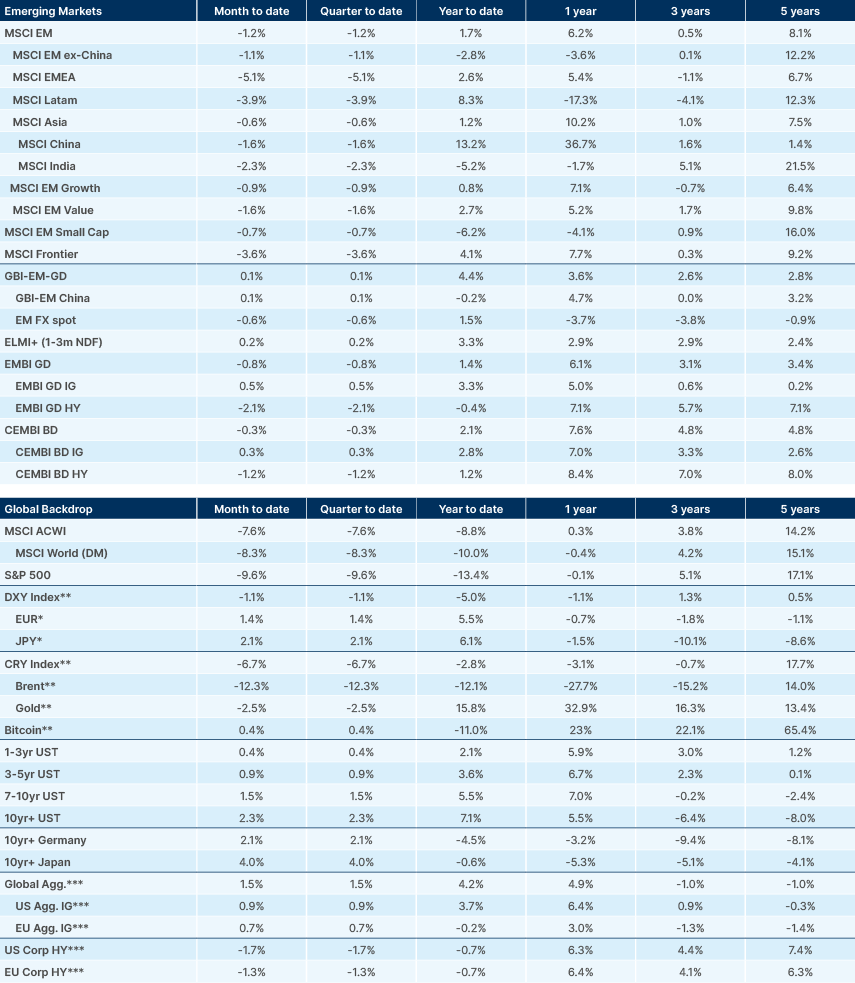

Benchmark Performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.