- US Q1 earnings impressive and Q2 expectations reduced in line with seasonal trends.

- US ‘soft-data’ continues to roll over, stagflation remains a concern.

- Taiwan’s dollar posted its largest daily rally since the 1980s on Friday.

- Oil prices fell and price expectations turned more negative after Saudi Arabia announced supply hikes.

- Korea’s acting President, Han Duck Soo, resigned to enter the election race.

- More local currency bond issuance in Argentina to dampen liquidity.

- Brazil’s congressional procedure over Lula’s tax reform to begin.

- Colombia unexpectedly cuts rates.

- George Simion, leader of far-right Alliance for the Union of Romanians, won the first round of the presidential election, but fell short of a majority. The runoff vote is scheduled for 18 May.

- Fredrich Merz achieved a majority vote in parliament to officially become German chancellor at the second time of asking, after a surprising failed attempt in the morning.

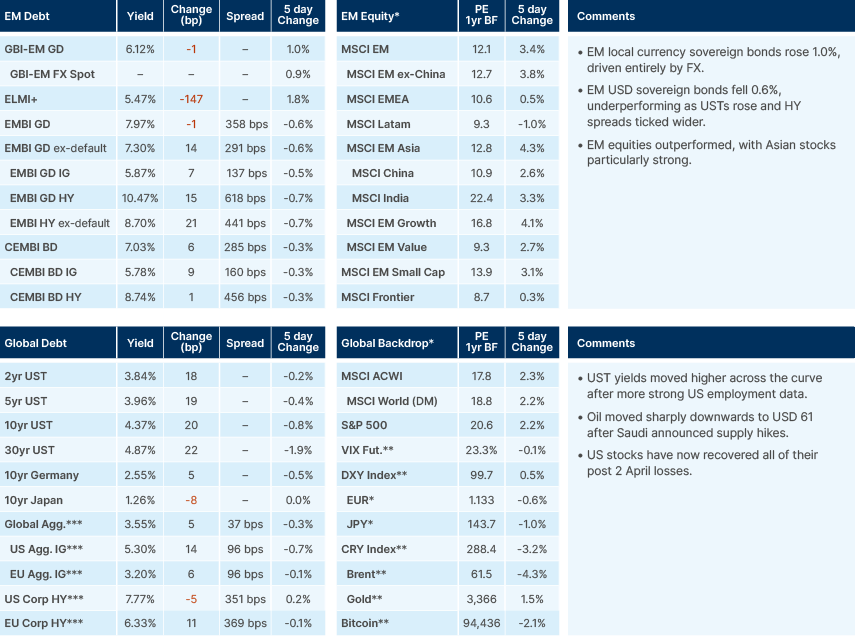

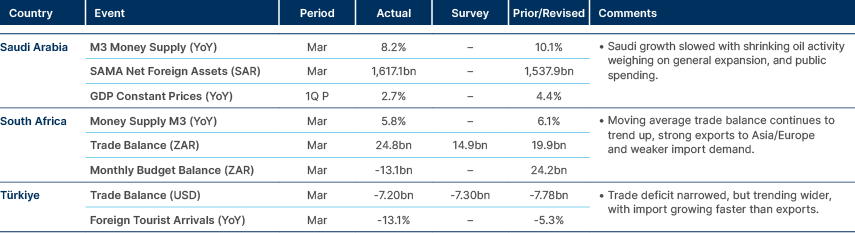

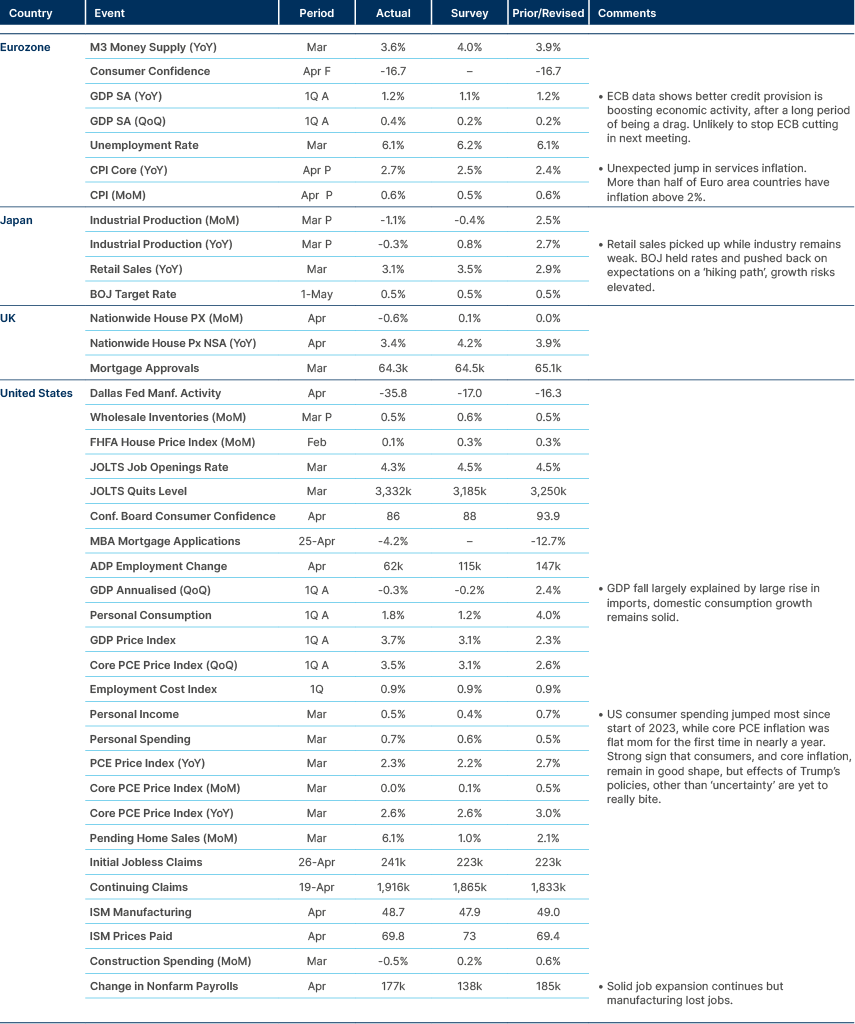

Last week performance and comments

Global macro

As US Q1 earnings continue to impress, especially Google and Meta, the S&P 500 has now recovered its post “Liberation Day” losses. Despite all the tariff noise, current indications from companies are that artificial intelligence (AI) demand and capex will sustain momentum. Earnings are currently very much in line with seasonal trends. 76% of companies reported positive earnings-per-share (EPS) growth, in line with history. Negative revisions to Q2 EPS estimations were down 2.4% on average, only slightly higher than the -1.8% historical average. Revisions to full-year 2025 earnings in the first four months of this year have been -3.1%, exactly in line with the average of the last five years. Part of this ‘normality,’ however, may be explained by it being impossible to factor in the tariff-related impact on earnings, when no one knows what the tariffs will be.

While it may still be too early to see tariff-related impact in the ‘hard’ data, the ‘soft’ data has been rolling over now for a while in the US. In April, the ISM Manufacturing Production Index fell to 48.7, the lowest since 2020. The ISM Services Prices Index rose from 61 to 65, indicating expectations of inflation rising with import tariffs among service providers. This sets the stage for a stagflationary environment, should reality catch up with expectations. Indeed, recessions are normally triggered when the gap between the present economic situation and the negative expectation of future conditions peaks and then converges. The current gap between the Consumer Board Consumer Confidence ‘Present Situation’ and ‘Expectations’ survey is very large versus the historical average, and consistent with the beginning of a recession. However, this gap has remained unusually elevated since recession expectations began to rise in 2022.

The Taiwanese dollar (TWD) rose 7.3% against the US dollar on Friday and Monday morning, a move of extraordinary magnitude in such a short timeframe. The surge wasn’t driven by central bank intervention, but by a combination of demand for Taiwanese assets, speculation that the authorities would allow the TWD to strengthen as part of a trade deal with the US, and Taiwanese life insurance companies rushing to hedge some of their very large exposures to US Treasury bonds. These companies hold USD 1.7trn in foreign assets, much of which in US bonds. The rally snapped by Tuesday this week and the Taiwanese Central Bank confirmed some intervention on Monday, with the USDTWD at 30 appearing to be a cap, for now, to discourage excessive speculation.

Attention now shifts to other Asian currencies, including the Chinese yuan, with similar dynamics of a large US trade surplus and foreign investment position in US assets. Speculation may have played a role in the TWD’s rally, but repatriation flows from the US and hedging overexposure to the USD are powerful forces in FX markets when the world’s exposure to US assets is this big. US investment liabilities with the RoW reached USD61tn at the end of 2024, with a Net International Investment Liability of USD26tn.

Commodities

The oil curve last week entered into a very unusual ‘smile’ position, with backwardation in the front nine months of the curve giving way to contango further out, as long-term bearish supply/demand expectations met with short-term low inventories and persistent demand. The curve is now nearly flat for the first nine months, but this dynamic is still unusual given contango from 12 months onwards and suggests the short end may have further to fall before traders begin to arbitrage. Oil fell 8% last week and is down 20% since 1 April.

On average, oil prices have fallen 30% in the 12 months after a US recession. A similar drop from here would take oil to the low USD 40s…unless already in a recession. Part of the story behind the price drop so far has been falling demand expectations, but the bigger story is on the supply side. Last week, Saudi Arabia indicated it would raise production into falling prices, something it hasn’t done for over a decade. A 411k barrel-per-day is scheduled for June, and indications are that this could increase further. For various reasons, Saudi Arabia seems to be abandoning the high price strategy that has kept the oil curve in nearly constant backwardation since 2015. Ostensibly, this is to discipline OPEC ‘cheaters,’ like Kazakhstan, that have not been adhering to their output targets. However, this move could also be the beginning of a price war with less competitive producers, such as US shale producers. It could also be interpreted as an olive branch to Donald Trump, who is very vocal of his desire for lower oil prices, but perhaps not at the expense of US shale profitability.

Geopolitics

Israel/Gaza

Israeli Prime Minister Benjamin Netanyahu says the Israeli Defence Forces (IDF) will seize all of Gaza and stay indefinitely, not conduct temporary raids. The plan involves pushing civilians south and restricting aid to prevent Hamas access, though no new supplies will enter yet. Aid would be distributed via Israeli-run hubs, which the United Nations (UN) and countries including the UK condemn as violating humanitarian principles. The UN Office for the Coordination of Humanitarian Affairs (OCHA) calls Gaza’s situation “absolutely desperate.” Over a year into the war, Netanyahu has not destroyed Hamas nor freed all hostages. The new operation won’t begin until after Trump’s visit, giving Hamas time to offer further concessions.

Emerging Markets

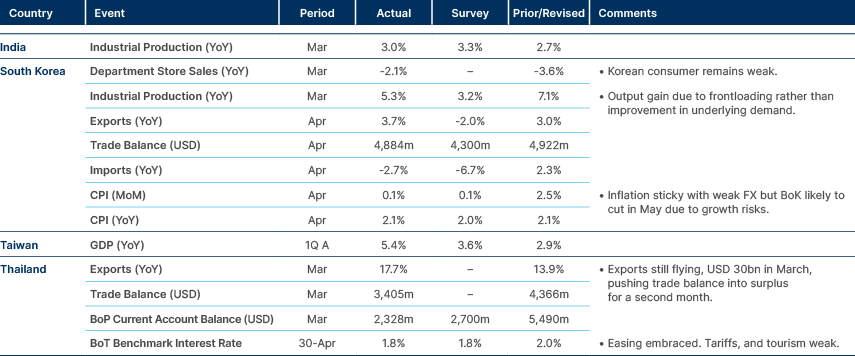

Asia

Korea: Acting President and former Prime Minister Han Duck-soo resigned and announced his official presidential bid. Lee Ju Ho has now taken on the role of Acting President. Han has promised to focus on the economy, but his key pledge is constitutional reform. He plans to draft an amendment in his first year, finalise it in the second, and hold joint legislative and presidential elections in the third. This would shift the current electoral calendar—parliamentary elections are due in 2028 and the presidential term ends in 2030—aiming to improve political efficiency. He also emphasised the need to address trade pressures and strengthen national unit.

Opinion polls show opposition Democratic Party candidate Lee Jae-myung as the front-runner in the election by a wide margin, but a Supreme Court last week overturned a decision that cleared Jae-myung of election law violation. Lee is embroiled in several criminal trials, but if this decision is finalised it would bar him from running in elections for at least five years. The Supreme Court said Lee violated election law by publicly stating false facts and ruled to send the case back to the appeals court. It is unclear, however, whether the lower court would be able to revisit the ruling in time of the election in June.

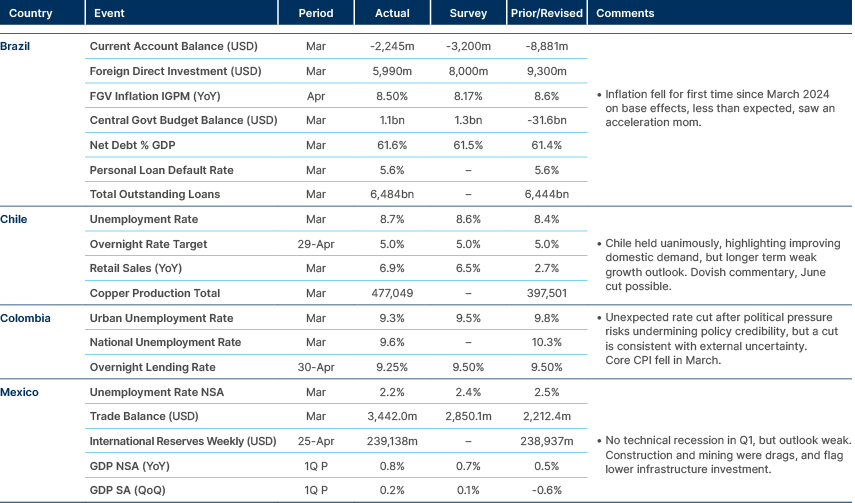

Latam

Argentina: Argentina’s central bank (BCRA) approved the issuance of the Bopreal Series 4 to "orderly channel" the stock of unpaid dividends prior to December 2024 and the stock of unpaid debt prior to 12 December 2023 through FX markets. This complements the recent lifting of FX controls on flows. This Series 4 Bopreal is up to USD 3bn in size, in successive issuances. It pays 3% interest rate (bi-annual) and amortises in October 2028. It is to be subscribed in ARS, which will help keep monetary policy tight and inflation lower. Auction dates are to be announced soon (first auction expected by mid-May).

Brazil: The Lower House will set the special commission next Tuesday (6 May) to discuss the Income Tax Reform Bill, the first stage in congressional procedures. The proposal includes income tax exemption for those who earn up to BRL 5k per month, which will be compensated by higher income tax for those who earn BRL 50k or above per month. Focus will be on whether there is any dilution to the compensatory measures.

Chile: Moody’s maintained Chile's sovereign rating at A2 with a stable outlook. The rating agency stressed the country’s institutional strength, while at the same time adding that Chile’s fiscal strength reflects a relatively low yet increasing debt burden. Further progress is needed. In this regard, April's tax season will be a very important barometer to assess whether the government is meeting its revenue forecast.

Colombia: Colombia’s central bank (BanRep) unexpectedly cut rates by 25 basis points (bps) on Wednesday, the first move since December 2024, citing easing inflation (5.3% in February to 5.1% in March) and strong Q1 growth. Chair Leonardo Villar emphasised that market-based inflation expectations are also declining, and the decision was aligned with BanRep’s cautious stance. It revised its 2025 GDP forecast down from 2.8% to 2.6%, and sees 3% growth in 2026, reflecting a weaker global outlook. Finance Minister Germán Ávila supported the cut but had hoped for a larger one. Meanwhile, President Gustavo Petro criticised BanRep just hours before the decision, accusing it of limiting fiscal flexibility and acting politically.

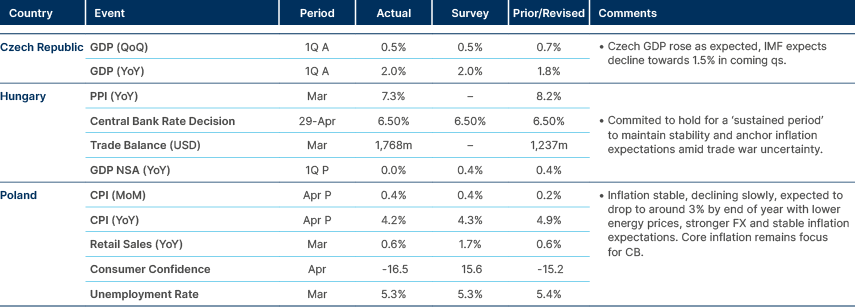

Central and Eastern Europe

Romania: Romania held the first round of its rerun presidential election over the weekend. As expected, George Simion, leader of the far-right Alliance for the Union of Romanians (AUR), won the first round but fell short of a majority. He received 41% of the vote, significantly above pre-election polls that had him near 30%. Simion will face Nicușor Dan, the independent and pro-European mayor of Bucharest, in the 18 May runoff.

Dan secured second place, unexpectedly outperforming the Social Democratic candidate, Călin Antonescu, who was pushed into third. The margin between Simion and the rest was larger than anticipated, with Simion nearly doubling Dan’s vote total. The result triggered political fallout. Prime Minister Marcel Ciolacu announced his resignation, and his centre-left Social Democrats (PSD) Party has withdrawn from the governing coalition. The current alliance, which also includes the centre-right National Liberal Party (PNL), the Democratic Alliance of Hungarians in Romania (UDMR), and minority representatives, has lost its majority. Romania is now under a caretaker government. Interim President Ilie Bolojan is expected to name a temporary Prime Minister on Tuesday. PSD has stated it will not endorse either candidate in the runoff, where Simion is now favourite.

The Q1 2025 budget deficit reached RON 43.7bn (2.28% of GDP), 22% better year-on-year, but still below the 3% target. March alone posted a record RON 13.4bn gap. The shortfall was narrower than expected due to weak capital spending and underused European Union funds. Revenues rose 6.9% but missed targets by 10.5%, with gains in income tax offset by weak VAT. Spending rose 10.1%, driven by wages, pensions, and energy aid. Interest costs surged 63.9%. Personnel spending increased despite wage freeze promises. The government must implement further measures post-election to meet its 7% deficit goal.

Central Asia, Middle East, and Africa

Zambia: International Monetary Fund (IMF) Deputy Managing Director Nigel Clarke commended Zambia's economic reforms and debt management, urging stronger domestic revenue efforts during talks with Finance Minister Situmbeko Musokotwane in Washington DC. Clarke plans to visit Zambia next week. Musokotwane reaffirmed Zambia's commitment to home-grown reforms, fiscal discipline, and investor confidence, stressing continued focus on stabilisation, productivity, and revenue post-debt restructuring. Zambia was cited as a model for fiscal governance. Zambian sovereign bonds have performed well against the index in the last month, and are again trading where they were pre “Liberation Day” announcements.

Developed markets

Germany: Friedrich Merz and his government officially took power in Germany today, achieving a parliamentary majority of 325 votes (600 members) at the second time of asking. He only managed 310 votes a morning voting round, causing some temporary blushes and volatility in German assets. No chancellor has ever failed to have his election confirmed by parliament in the first round. This suggests he may not have as much political capital within the parties backing his coalition as he might have hoped. The ballot was secret, so it will remain unknown which parliament members didn’t vote for him initially.

The major fiscal reform for defence and infrastructure spending has already been passed into law in the Bundestag. Further fiscal reform from here, could require support from the Green and Left parties to reach supermajorities in parliament, but spending laws are usually popular, so this should be achievable. Structural reforms, such as benefit cuts, are often less popular, so these may be difficult for Merz to pass without full support of his coalition.

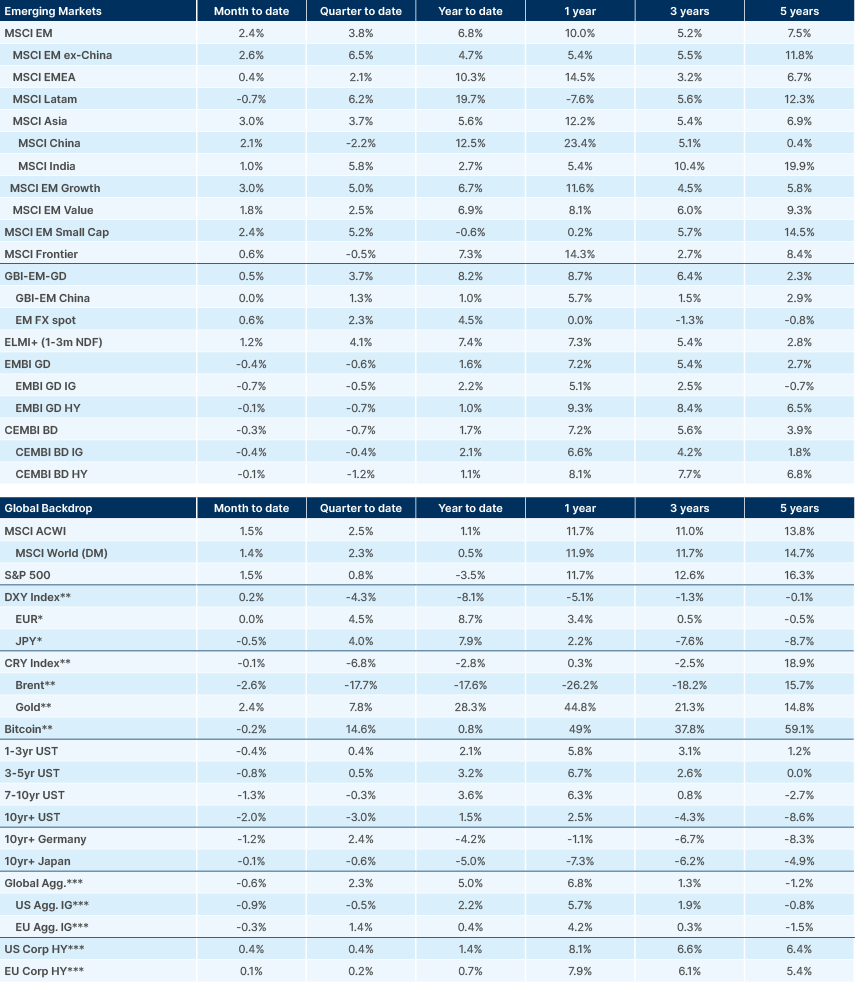

Benchmark Performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.