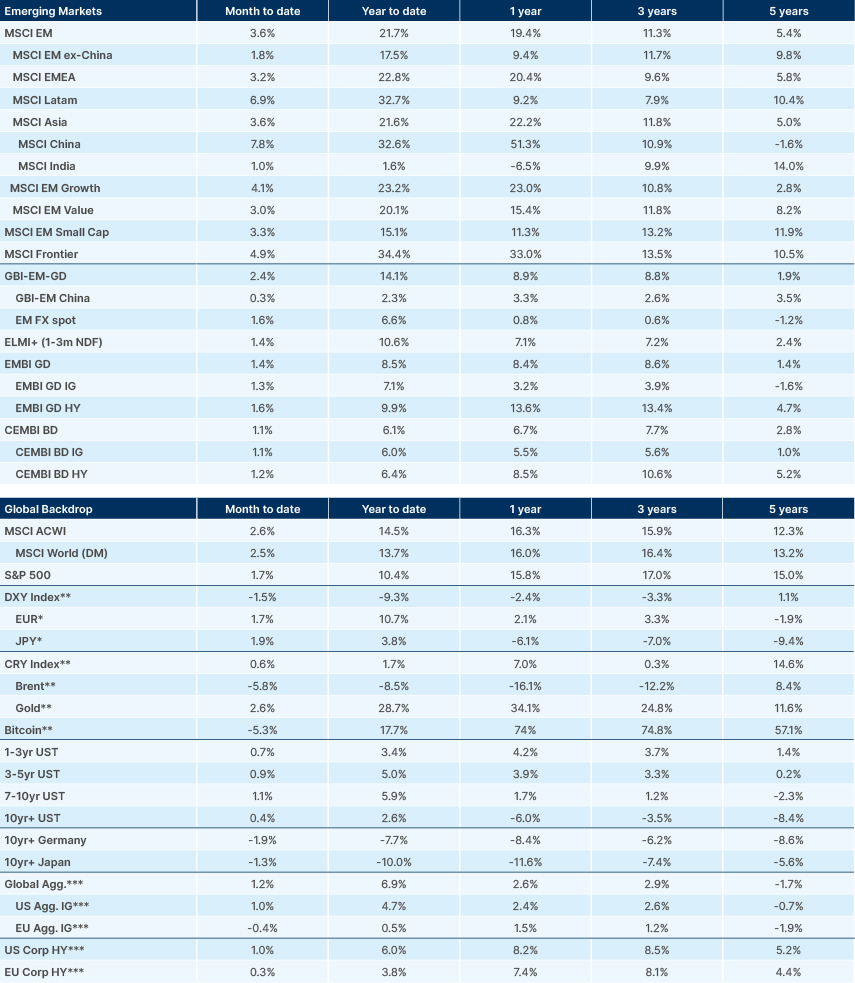

- EM cross-asset outperformance continues through August.

- Strong US data and weaker European PMIs indicative of likely reflation in the US vs deflation in Europe.

- Trump has confirmed he will seek to fire Fed Governor Lisa Cook, escalating his challenge to the central bank’s independence.

- French PM François Bayrou faces 8 September no-confidence vote.

- Markets largely shrugged off geopolitical noise after G7 summit in Washington delivered little concrete progress.

- Global bond funds saw record USD 97bn inflow over the past four weeks.

- Argentina’s dollar bonds and Peso fell after a fresh corruption scandal linked to Javier Milei’s sister.

- Moody’s placed PEMEX on review for an upgrade following President Sheinbaum’s announcement of a USD 12bn pre-capitalised bond issuance plan.

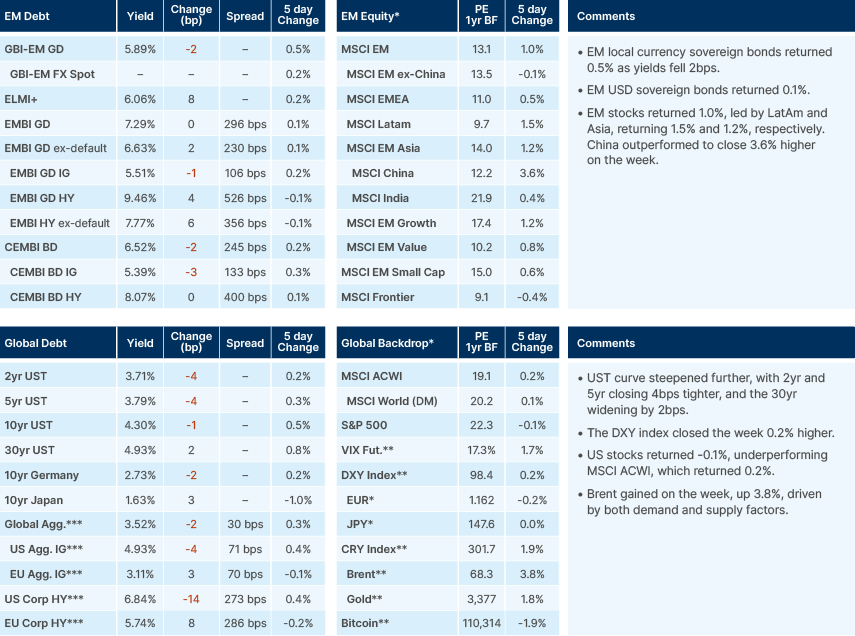

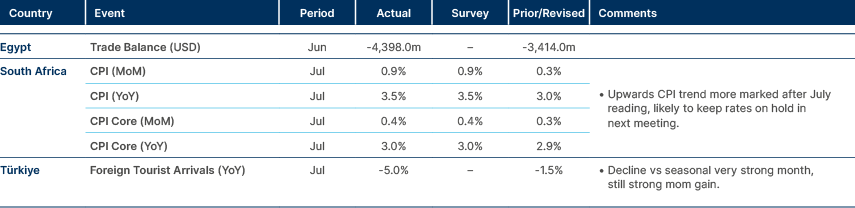

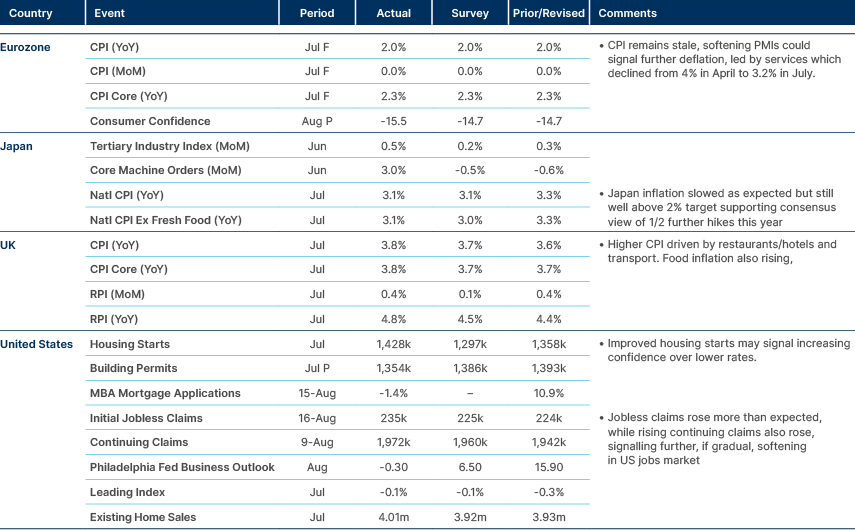

Last week performance and comments

Global Macro

Bank of America reported a record USD 97bn inflow to global bond funds over the past four weeks, with year-to-date (YTD) bonds annualising a record USD 700bn inflow, led by inflows to investment grade (IG) bonds. This is indicative of investors taking risk off the table and positioning in higher quality credits with spreads at the tights, and rate cuts seemingly imminent. Further rate cuts in the US will likely allow many other emerging market (EM) countries to cut rates further this year and probably lead to a further weakening of the dollar. This macro setup can, in our view, extend this year’s cross-asset EM outperformance. August has been another strong month for all EM asset classes, with equities and both local and hard currency bonds extending their YTD outperformance over comparable developed market (DM) assets. We remind investors that while US equity performance has been quite positive since April, in Euro terms, the S&P 500 remains down 3% YTD.

Falling US short-end yields and rising German Bund yields continue to support Euro strength, with the US–Germany yield spread now at its narrowest since late 2021. Persistent executive interference with the Federal Reserve looms as a significant risk to the dollar, even if bond markets seem relatively sanguine so far. In Europe, French politics returned to focus as Prime Minister François Bayrou faces an 8 September confidence vote on a EUR 44bn austerity plan of welfare freezes, tax hikes, and cuts to public holidays. With only a slim centrist minority and entrenched opposition from both extremes, defeat appears likely. A new Prime Minister or even snap elections are now the base case, raising the risk of delayed fiscal consolidation just as the EU presses members to rein-in deficits. This political overhang could keep pressure on French assets and inject fresh volatility into the Euro, particularly if the transition is messy or if widening French German spreads start to test investor confidence in broader Eurozone stability.

Preliminary flash purchasing manager indices (PMIs) for August came in hotter than expected in the US early last week. The manufacturing PMI rose to 53.3 from 49.7 in July. Little change was expected, and this move back into expansionary territory clouds the narrative of tariffs weighing on manufacturers’ outlooks. The services reading remained robust, falling only slightly from 55.7 to 54.7. A rise in the composite output price PMI to 55.4 marks an eight-month high, and in the past has been a reliable leading indicator for hotter core personal consumption expenditure (PCE) readings. As a result, markets lowered the probability of a September Federal Reserve (Fed) rate cut from 82% to 72%, and the 2-year US Treasury (UST) yield rose to 3.8% by Friday.

Although initial jobless claims and continuing claims data rose during the week, indicating further weakening in the jobs market, both indicators remain at relatively low levels. However, in his Friday Jackson Hole address, Fed Chair Jerome Powell took on a decidedly more dovish tone, stating he is now more concerned with the jobs market in the short term. In his view, the likelihood remains that tariff inflation will be a ‘one-off.’ This commentary took markets somewhat by surprise, and 2-year yields fell back below 3.7%, with the probability of a September cut priced in forwards markets rising again to above 80%. US equities also rallied, undoing most of their move lower after a negative report on artificial intelligence (AI) profitability from the Massachusetts Institute of Technology (MIT) spooked investors earlier in the week. OpenAI CEO Sam Altman had also pointed towards over-exuberance. NVIDIA’s earnings on Friday will probably define whether this exuberance continues to grow, or stalls in the short term.

US President Donald Trump’s vow to remove Fed Governor Lisa Cook from office “with immediate effect” is a significant escalation in his attack on Fed independence. Cook responded by saying that the President had “no authority to fire her.” Cook has been accused of lying on her mortgage paperwork for tax reasons. The 30-year UST only moved 5 basis points (bps) on the news, a surprisingly sanguine reaction given the significance of this attempt by Trump to push the Fed further into the MAGA sphere. The independence of the Fed relied upon its members being politically unbiased and leaving whatever bias they do hold at the door. However, with Cook gone, and replaced with a Trump aligned candidate, the Fed Board of seven members including Steven Miran and a new Trump-friendly Fed Chair, would essentially become a majority Republican board. Cook will likely fight Trump in court, a process that may take several months and will likely end up at the Supreme Court. She will be expected to carry out her Fed duties until this litigation concludes. Perhaps the market is pricing in the likelihood she will win, given Trump’s apparent lack of constitutional or legal recourse to fire a Fed member who officially, paper, as of yet, has done nothing wrong. However, the lack of bond market volatility over Trump’s latest attack on the Fed may embolden him to continue to push forward with his reconstruction of the institution, in our opinion.

Geopolitics

Markets largely shrugged off the G7 leaders’ meeting in Washington, which delivered little concrete progress on Ukraine. Headlines reinforced the status quo of continued Western backing but with limited clarity on the conflict’s trajectory. Russia dismissed the talks as a “road to nowhere,” signalling no shift in its stance. The main positive was that Trump reaffirmed US support for a European-led security framework, backing intelligence sharing, air defence, and training, while reiterating there would be no US boots on the ground. Mike Pompeo, the US secretary of state in Trump’s first administration, continued to argue that Ukraine should never be forced to recognise Russia’s territorial claims, warning that doing so would legitimise Moscow’s aggression and deliver a major strategic and propaganda victory for the Kremlin. Pompeo cautioned that any US signal of acceptance would embolden China over Taiwan. He also stressed that any peace agreement must include robust security guarantees, citing the failure of the 1994 Budapest Memorandum, when Western assurances proved hollow after Ukraine surrendered its nuclear arsenal.

Commodities

Oil prices rose last week, supported by geopolitical risks to supply and strong US demand. Ukrainian strikes on Russian energy infrastructure disrupted output, lifting supply risk premiums. US crude inventories fell sharply by 6 million barrels, well above forecasts, while gasoline and jet fuel demand remained strong, signalling resilient consumption. After three weeks of losses, West Texas Intermediate (WTI) oil prices rebounded to around USD 63.7, and Brent Crude moved nearly 4% higher to USD 68.

Emerging Markets

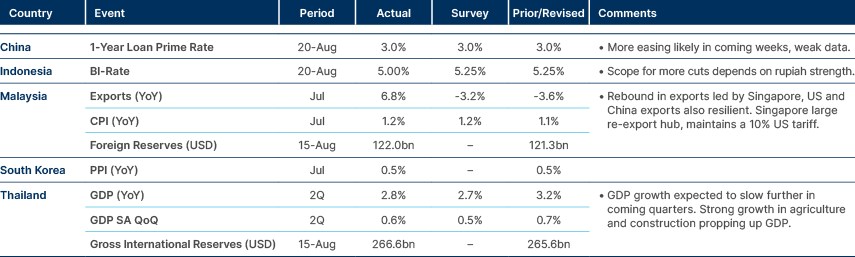

Asia

Indonesia cut again, Malaysian exports resilient

India: Indian refiners are diversifying supplies amid US tariffs and uncertainty over Russian flows, significantly boosting crude imports from Brazil. Indian Oil and Reliance has already taken delivery of Brazilian medium-sweet and heavy-sour grades, while Prime Minister Narendra Modi’s recent Brazil visit laid the groundwork for deeper cooperation in upstream exploration. This highlights a structural shift to reduce exposure to Russian barrels and build Brazil into a reliable long-term supplier.

Indonesia: Crude palm oil production rose 30.7% year-on-year (yoy) in June, lifting output by 24.9% in the first half of 2025. Exports increased 6.5% yoy, with processed palm oil leading the gains. China remains the largest buyer, followed by India, while export values climbed 34.6% to USD 12.8bn on higher volumes and prices. Rising global demand and elevated prices are helping Indonesia offset weaker revenues from other commodities.

South Korea: The government announced a KRW 100trn five-year plan to develop AI, with half the funds sourced from the public sector. The plan will be underpinned by a record KRW 35.6trn research and development budget in 2026. Targets include sovereign AI models and raising potential GDP growth to 3%. Exports in the first 20 days of August rose 7.6% year-on-year, led by semiconductors (+29.5%), autos and ships, though petroleum and steel shipments fell. Imports were broadly flat (+0.4%), leaving a USD 833m trade surplus. To reinforce resilience, Seoul also unveiled KRW 50trn of low-cost loans and guarantees to support supply chains, and expanded its list of “economic security items” to include batteries, AI components and aerospace.

Malaysia: Investment Minister Tengku Zafrul warned US tariffs could cut between 0.6 and 1.2 percentage points from 2025 GDP growth, bringing forecasts closer to Bank Negara Malaysia’s 4.0-4.8% range. Authorities are pushing exporters to fully utilise Malaysia’s 18 free trade agreements, including new deals with the UAE and the European Free Trade Association, and one pending with South Korea. The push reflects pressure to diversify export markets in the face of tariff-driven headwinds.

Pakistan: The press spotlighted damage from Indus River flooding, which has devastated crops and displaced thousands, with direct losses to economy estimated at PKR 15bn. The auto industry raised concerns about rising imports of used cars, arguing it undermines local production. The International Monetary Fund (IMF) is pressing for stricter oversight of parliamentary development schemes. Despite flooding, markets are resilient with Pakistan’s continued recovery from period of political and economic turmoil, with the Karachi Stock Exchange 100 passing 150,000 points, a YTD gain of more than 30%.

Philippines: Bangko Sentral ng Pilipinas (BSP) reported net income of PHP 40.2bn in the first quarter, more than doubling from a year earlier, mainly due to PHP 24bn in foreign exchange (FX) gains. Interest income rose 12.8% yoy, while expenses fell 3.2%. BSP’s total assets rose 2.8% to PHP 7.79trn, underpinned by foreign reserves at PHP 6.07trn. The figures underline the central bank’s strong balance sheet position.

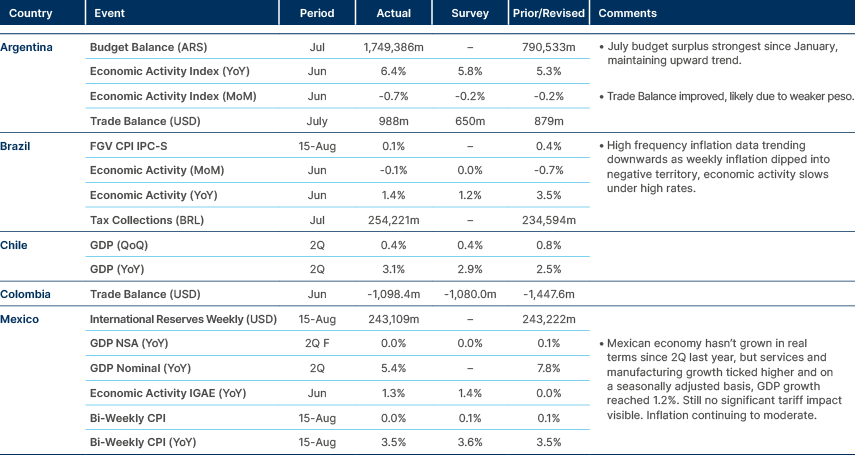

Latin America

Brazilian inflation data trending down.

Argentina: Argentina experienced a volatile week as financial and political pressures converged ahead of the October elections. FX liquidity strains escalated after the central bank (BCRA) introduced new daily reserve requirement rules, sending overnight repo rates swinging between 0% and 148%. The move, aimed at tightening peso defence and supporting the gradual removal of capital controls, caught banks off guard and disrupted short-term funding. The BCRA has paused reserve accumulation to maintain currency stability while tolerating recessionary conditions. Economy Minister Luis Caputo reiterated his commitment to an ultra-tight policy stance, signalling that volatility is a necessary part of the adjustment process. Indeed, while Argentina has underperformed of late, the broader story remains constructive. The removal of most capital controls earlier this year was unlikely to be entirely smooth sailing, and volatility should be seen as part and parcel of this necessary policy transition, in our view, rather than a sign it isn’t working. A corruption scandal broke after leaked audio implicated the Head of the National Disability Agency Diego Spagnuolo, in a kickback scheme tied to medicine purchases, with some leaks referencing Karina Milei, General Secretary of the Presidency and sister of President Javier Milei. The government moved quickly to remove Spagnuolo and framed the episode as a political operation led by Cristina Fernández de Kirchner’s allies. While the scandal has generated headlines and federal raids, its direct impact on the election outlook appears limited, though it risks distracting from the government’s reform agenda in the short term. Economic activity has remained subdued over the past two months, reflecting both tight monetary conditions and weak domestic demand. The University Government Confidence Index fell 13.6% month-on month, marking its lowest level since Milei took office, highlighting some erosion of confidence as the adjustment process weighs on sentiment. However, inflation remains the most important metric for Argentinian consumers and businesses, which has stabilised at below 2% mom since May, a level where it has not been, on a sustained basis, since 2017. This political success is significant and still stands Milei in good stead to perform well in the mid-terms in October, in our view. In Congress, debate over overturning presidential vetoes on pension spending forced the government to agree to a disability pension increase, highlighting the kind of political compromises needed in a currently fragmented legislature.

Brazil: President Lula extended his lead across all 2026 election scenarios as approval ratings improved. This is likely driven by his continued defiant stance towards Trump’s trade policies, as well as moderating inflation. Political tensions escalated after the Supreme Court indicted Jair and Eduardo Bolsonaro for obstruction in the 2022 coup probe. Vice-President Geraldo Alckmin confirmed some relief from tariffs after the US excluded certain aluminium and steel derivatives from the 50% tariff list, worth BRL 2.6bn in exports. Finance Minister Fernando Haddad emphasised that US demands to halt Bolsonaro’s trial were unconstitutional, signalling bilateral trade relations remain at risk.

Colombia: President Gustavo Petro proposed a major tax reform to address the USD 17bn fuel subsidy deficit. The plan would increase taxes on high-income households while cutting corporate rates, a move publicly backed by Ecopetrol. While framed as redistributive, the reform faces significant legislative opposition and market concern, particularly ahead of the 2026 election.

Ecuador: S&P affirmed Ecuador’s rating at ‘B-’, and raised the outlook to stable, citing stronger access to multilateral financing and reform commitment. Fiscal risks remain elevated, but the government is continuing to push Washington for a zero-tariff list covering shrimp, cocoa and bananas after US duties were raised to 15%.

El Salvador: S&P affirmed the sovereign at ‘B-’ with a stable outlook, balancing weak fiscal fundamentals against IMF support and improved security conditions. Growth is projected at 2.5% annually through 2028, underpinned by remittances, though fiscal reform remains critical to sustain stability.

Mexico: Moody’s placed Petróleos Mexicanos (PEMEX) on review for an upgrade following the announcement of President Claudia Sheinbaum’s USD 12bn pre-capitalised bond issuance plan. While short-term liquidity pressure is expected to ease, the agency stressed that long-term sustainability requires structural reform. Market reaction was muted, reflecting scepticism about the pace of deeper restructuring.

Peru: Moody’s cautioned that Peru’s fiscal discipline is being undermined more by political dominance than by fiscal dominance, with the 2025 deficit forecast at 2.6% versus the 2.2% target. Fundamentals remain relatively positive, and low inflation allows scope for rate cuts. However, President Dina Boluarte’s approval rating has collapsed to just 4%, leaving her with record 96% disapproval as she enters her final year in office.

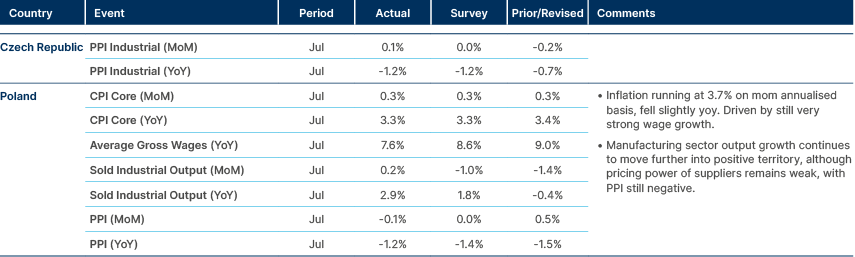

Central and Eastern Europe

Polish CPI stable, PPI remains negative.

Kazakhstan: Kazatomprom’s H1 revenues fell 54% yoy to KZT 263bn as uranium prices weakened, although production rose 13% to 12,242 tonnes. Output guidance for 2025 remains 25,000–26,500 tonnes.

Poland: The Narodowy Bank Polski (NBP) warned it could book losses of up to PLN 30bn in 2025 due to zloty strength. While higher gold prices should offset some of the impact, this follows losses of PLN 13bn in 2024 and PLN 21bn in 2023. The disclosure is likely to draw political criticism but is not expected to change monetary policy direction.

Türkiye: Second-quarter construction permits rose 47.4% year-on-year on base effects, earthquake-related reconstruction and expectations of rate cuts by the Central Bank of the Republic of Türkiye (CBRT). Dwelling approvals surged 90.3%, though average unit size shrank. The rebound signals catch-up demand and continued government support for housing.

Ukraine: Russia struck a US-owned Flex electronics plant in western Ukraine, injuring 23 people. President Volodymyr Zelenskyy argued the attack demonstrates Russian President Vladimir Putin’s lack of interest in peace talks and urged the US to respond. In separate remarks, Zelenskyy estimated it would take Russia four years to seize all of Donetsk, but suggested territorial talks may eventually be considered, while pressing Trump to pressure Hungary on EU accession.

Central Asia, Middle East & Africa

South Africa inflation trending higher.

Egypt: Tourism arrivals increased 23% yoy in the first half of 2025 to 7.8m, pushing average hotel occupancy above 80%. FX inflows from tourism (USD 8bn), remittances and non-oil exports have been helping to offset weaker Suez Canal revenues. The government targets 15–20% growth in arrivals this year and 30 million visitors annually by 2030.

South Africa: Gold Fields, South Africa’s largest gold miner, tripled first-half profits to USD 1.03bn as output rose 24% and gold prices hit record highs. The miner declared a 700c per share interim dividend, lifting its market value to ZAR 486bn. The African National Congress (ANC) collapsed to just 12% support in Johannesburg, with the Democratic Alliance (DA) surging and Helen Zille returning as candidate for Johannesburg mayor in 2026.

Developed Markets

Inflation controlled in EU, sticky in Japan, jobs market weaker in US.

Benchmark Performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.