The JPY posted high volatility overnight as over-extended short JPY positions remain in place. Bank Indonesia hiked policy rates by 25bps in a surprise move, signalling dissatisfaction with the USD strength derived from JPY weakness. EU-China relations remain tense while Antony Blinken’s visit to China was more cordial than feared. Chinese stocks outperformed again last week despite negative sentiment remaining. Korean economic activity surprised to the upside. Brazil inflation was lower than expected. The IMF granted a new programme to Ecuador. Venezuelan bonds index inclusion starts this week.

Global Macro

The JPY posted an unusually high volatility overnight. After closing last week around 158, the JPY traded at 160.1 before retracing below 155 this morning. Authorities neither confirmed nor denied intervention. A bank holiday in Tokyo suggests thin volumes are partially to blame. Last week, the Bank of Japan kept its policy rate unchanged. Governor Kazuo Ueda struck a relatively dovish tone but warned that the central bank could act if the impact of a weaker yen became “too big to ignore”. Ueda said that “currency rates is not a target of monetary policy to directly control… But currency volatility could be an important factor in impacting the economy and prices. If the impact on underlying inflation becomes too big to ignore, it may be a reason to adjust monetary policy”.1

The JPY was the only G-10 currency trading weaker against the Dollar last week. The acute JPY weakness has been driven by yield differentials as the BOJ is the last central bank to normalise policies, thanks to government subsidies keeping inflation less volatile in recent years. Its fate matters for EM. Last week, Bank Indonesia surprised market participants with a 25bps hike, bringing its policy rate to 6.25% even though core CPI remains around 2.0%. The IDR weakness – primarily driven by the weaker JPY – was the main culprit. Governor Perry Warjiyo said the Middle East conflict and Dollar resurgence demanded an “anticipatory, forward-looking, and pre-emptive” policy response. Other central banks in the region have also been intervening recently to contain currency depreciation.

Geopolitics

Three developments last week indicate relations between the European Union (EU) and China remain tense. Firstly, the staff of a candidate of the far-right Alternative for Germany Party was arrested on suspicions of spying for China.2 Secondly, the EU raided the offices of a Chinese security equipment supplier, Nuctech, through its new anti-foreign subsidy powers. Nuctech has also been added to the US commerce department’s entity list for national security interests, due to the company’s ties with the PRC government. This has fuelled further tensions, with the Chinese Chamber of Commerce stating that the sudden inspection “undermines the business environment for foreign companies within the EU in the disguise of foreign subsidies”.3 Thirdly, investigations into China’s procurement of medical devices have continued, using the EU’s International Procurement Instrument, for the first time. The 2022 legal instrument aims to promote reciprocity in access to procurement markets.4

Meanwhile, talks between US and Chinese officials mark a bettering commitment to ease tensions. US Secretary of State Antony Blinken was in talks with both Chinese President Xi Jinping in Beijing and China’s Foreign Minister Wang Yi last week. Wang expressed how US measures against the Chinese economy is “not fair competition, but containment and it is not removing risks, but creating risk”. However, the overall tone of bi-lateral communication was clear with Wang stating that there is room for China and the US to improve ties.5 Similarly, Blinken stated “we have an obligation for our people - and indeed, an obligation for the world – to manage the relationship between our two countries responsibly”.6

US solar panel makers asked the US government to increase duties of USD 12.5bn on imported panels from Southeast Asia. Cambodia, Malaysia, Thailand, and Vietnam constitute 80% of the US panel imports. US solar makers are seeking to counteract what they call unfair practices of overseas competition, and request for tariffs to be raised between 70.4% to 271.5% later this year.7 US trade protectionism is likely to increase, no matter who wins the Presidential election.

As for the US presidential election race, Biden, and Trump both won their primaries in Pennsylvania (PA). Biden got 491,892 votes (94.4%). Trump got 268,670 votes (79.4%), Nikki Haley, who dropped out of the race, got 70,648 votes (20.6%). This shows that several Republicans are dissatisfied with Trump.8 However this only matters if these “protest votes” came from some five sub-districts in PA as most sub-districts are firmly held by Republicans.9 The state is perhaps the most important swing voting battleground, with 19-electoral votes that can decide the race.

Emerging Markets

EM Asia

China

People’s Bank of China (PBoC) remains relatively tight. The PBoC kept its 1-year and 5-year loan prime rates unchanged at 3.5% and 4.0%, despite fears of deflation. Chinese stocks trading in the Hong Kong stock exchange (H-shares) rose 9% last week as the MSCI China rose 8.2%. H-shares are now up 25% from lows. Last week, the government announced measures to support the acquisition of electric vehicles as well as measures to support the broader industrial and healthcare sectors. Against that background, several currency analysts have recently become worried about a severe RMB devaluation. In our view, this is unlikely to take place for several reasons:

- RMB underweight positions are already very stretched.

- RMB weakness has been largely driven by JPY weakness. The JPY price action overnight suggests that this trend may be close to an end.

- Chinese stocks are breaking out: the Hang Seng Index (H-shares) is up more than 20% from its lows and its 50-day moving average is about to rise above the 200-day.

- Chinese stock market gains held despite US stocks sold-off in three of the four last weeks and now trade below 50-day moving average (maybe breaking down).

- Chinese bonds are the best performing and least volatile among majors over the past five years.

- Yet, the ownership of Chinese bonds by foreign investors is the lowest amongst majors while equity investors remain very underweight in Chinese stocks.

- China’s competitiveness remains solid, as shown by the fact that its trade surplus remains elevated by exports of higher value-add products.

- A weaker RMB does not serve West’s interests. It would add competitiveness to Chinese exports and increase inflationary pressures in the consensus.

- A weaker RMB doesn’t serve China’s interests either. The main issue in China is lack of confidence. A weaker currency would lead to lower purchasing power in China at a time that property markets remain very weak. This would be highly unpopular and unhelpful for the government’s soft-landing objective.

Indonesia

Bank Indonesia hiked its benchmark interest rate to 6.25% on 24 April from 6.0% prior. Governor Perry Warjiyo stated that the conflict in the Middle East and dollar resurgence has required the central bank to have an “anticipatory, forward-looking, and pre-emptive” policy response.

- The trade balance was USD 4.5bn in March vs. USD 1.2bn consensus and USD 0.8bn prior.

- Exports -4.2% yoy in March vs. -10.7% consensus and -9.6% prior.

- Imports -12.8% yoy in March vs. 15.8% prior.

Malaysia

- Foreign reserves USD 113.4bn 15 April vs. USD 113.8bn prior.

- CPI 1.8% yoy in March vs. 2.0% consensus and 1.8% prior.

South Korea

Economic activity surprised to the upside, driven by the strong recovery from both exports and capital investments. The cyclical and structural rebound from the semi-conductor sector was the main driver.

- Real GDP growth: 1.3% qoq in 1Q 2024 vs. 0.6% prior and consensus.

- Real GDP growth: 3.4% yoy in 1Q 2024 vs. 2.5% consensus and 2.2% prior.

- PPI inflation 1.6% yoy in March vs. 1.5% prior.

- Consumer Confidence 100.7 in April vs. 100.7 prior.

- Business Survey Manufacturing 74.0 for May vs. 73.0 prior.

Taiwan

- Unemployment rate 3.4% in March vs. 3.4% consensus and 3.4% prior.

- Export orders 1.2% yoy in March vs. 4.0% consensus and -10.4% prior.

- Industrial production 4.0% yoy in March vs. 7.3% consensus and -1.3% prior.

Thailand

- Trade deficit USD 1.2bn in March vs. USD 1bn surplus est. and -USD 0.6bn prior.

- Imports 5.6% yoy in March vs. 6.0% est. and 3.2% prior.

- Exports -10.9% yoy in March vs. -4.0% est. and 3.6% prior.

Latin America

Argentina

- Economic Activity Index -3.2% yoy in February vs. -6.0% consensus and -4.0% prior.

- Economic Activity Index -0.2% mom in February vs. -0.8% mom prior.

- Budget Balance ARS 625.0bn in March vs. ARS 1232.5bn prior.

- Consumer Confidence Index 37.2 in April vs. 36.7 prior.

Brazil

Consumer price inflation surprised to the downside again, bringing headline levels closer to the 3.25% (+/- 1.5%) centre of the Brazilian Central Bank (BCB) inflation target for 2024. BCB Governor Roberto Campos Neto kept a more cautious tone to cuts, justified by local and external uncertainties. Locally, the main question mark remains the President’s stated preference of not achieving this year’s primary fiscal balance, which could de-anchor inflation expectations. External pressures have increased on higher commodity prices, the lower odds of the US Federal Reserve cutting policy boosting the Dollar and geopolitical uncertainties.

- Tax collections BRL 190.6bn in March vs. BRL 190.9bn consensus and BRL 186.5bn prior.

- IBGE Inflation IPCA-15 0.2% mom in April vs. 0.3% est. and 0.4% prior.

- IBGE Inflation IPCA-15 3.8% yoy in April vs. 3.9% est. and 4.1% prior.

Colombia

The Constitutional Court decided to discuss the fiscal impact of last year’s ruling overturning a ban for mining companies from deducting royalty payments from the corporate tax. The government estimates that the court decision will cost USD 1.7 bn this year.10 Hence, a revision to the ruling may lead to larger than expected tax revenues.

Ecuador

The IMF reached a staff-level agreement with Ecuador on a new 48-month extended fund facility arrangement that will “support Ecuador as it continues to make progress to help strengthen fiscal sustainability, safeguard macroeconomic stability, and foster strong and inclusive growth”.11 The agreement will allow for a later repayment of the IMF than at today’s schedule, significantly lowering the burden to the country in 2025 and 2026.

Mexico

- Economic Activity IGAE 4.4% yoy in February vs. 2.7% consensus and 1.9% prior.

- Unemployment Rate NSA 2.3% (all-time lows) in March vs. 2.5% est. & prior.

- Trade surplus USD 2.0bn in March vs. USD 0.5bn est. and USD 0.6bn deficit prior.

Peru

- S&P downgraded the country’s sovereign rating by one notch to `BBB-` due to a deterioration of the country’s fiscal accounts.

Venezuela

Venezuelan and Petroleos de Venezuela (PDVSA) bonds will be re-weighted into the JP Morgan Emerging Markets Bond Indices (EMBI) group in three stages starting at the end of April. On Wednesday, Venezuela will account for an estimated 0.45% weight on the most followed EMBI Global Diversified (EMBI GD) index and 0.26% weight in the EMBI Global (EMBI G). The bond with the largest weight is the PDVSA 20 with an estimated 0.07% in EMBI GD and 0.04% in the EMBI G. The index inclusion will be done in three months. At the end of the inclusion, Venezuelan weights will be closer to 1.0% - the actual weight will depend on the price change over the next weeks.

This month, the weights of Colombia and El Salvador will also increase by 0.09% and 0.06% respectively on new issuances. The weights of Vietnam (-15bps), Malaysia and Turkey (-7bps each) decline the most.

In other news, Brazil’s President Luiz Lula da Silva welcomed Venezuela’s opposition’s decision to “launching a single candidate” and that “there will be elections”. The coalition uniformly backed Edmundo Gonzalez as its candidate. Edmundo Gonzalez stated that he seeks a “normal transition” of power if he wins this year’s election.

Central and Eastern Europe

Hungary

- National Bank of Hungary kept policy rate at 7.8%, in line with consensus.

Poland

After soft economic data released last week, Finance Minister Andrzej Domanski stated that “based on growing investments in the second half of this year, we see scope for the economy to grow 3.7% in 2025”. Domanski also announced that Poland is likely to issue a small amount of Green Bonds in the fourth quarter.12

- Average gross wages: 12.0% yoy in March vs. 12.2% consensus and 12.9% prior.

- Employment -0.2% yoy vs. -0.2% consensus and -0.2% prior.

- Sold industrial output +3.6% mom (-6.0% yoy) in March vs. 7.3% mom consensus and 0.7% (3.3% yoy) prior.

- PPI -9.6% yoy in March vs. -9.5% consensus and -10.0% prior.

- Retail Sales 6.0% yoy in March vs. 7.5% consensus and 6.7% prior.

Russia

- Policy rate unchanged at 16.0%, in line with consensus. Economy remains very strong:

- Retail Sales Real 11.1% yoy in March vs. 8.6% est. and 12.3% prior.

- Unemployment Rate 2.7% in March vs. 2.8% est. and 2.8% prior.

- Real Wages 10.8% yoy in February vs. 8.0% est. and 8.5% prior.

- Industrial Production 4.0% yoy in March vs. 4.0% est. and 8.5% prior.

Central Asia, Middle East, and Africa

South Africa

- PPI 4.6% yoy in March vs. 4.5% consensus and 4.5% prior.

Turkey

- Real sector confidence rose to 106.1 in April vs. 104.4 prior.

- Capacity utilisation: 76.7% in April vs. 76.3% prior.

- One-Week Repo Rate: 50.0%. Unchanged and in line with consensus.

Developed Markets

Eurozone

- Consumer Confidence -14.7 in April vs. -14.5 consensus and -14.9 prior.

Japan

- Tokyo CPI 1.8% yoy in April vs. 2.5% est. and 2.6% prior.

- Tokyo CPI Ex-Fresh Food 1.6% yoy in April vs. 2.2% est. and 2.4% prior.

- Education subsidies were part of the reason, but price increases declined across all components.

- The end of energy subsidies from end of May, will likely add 1.3% to inflation over the summer.

- BOJ Target Rate (Upper Bound) 0.1% on 26 April vs. 0.1% est. and 0.1% prior.

United States

- GDP Annualised 1.6% qoq in 1Q vs. 2.5% est. and 3.4% prior.

- Personal Consumption 2.5% in 1Q vs. 3.0% est. and 3.3% prior.

- Core PCE Price Index 3.7% in 1Q vs. 3.4% est. and 2.0% prior.

- Wholesale Inventories -0.4% mom in March vs. 0.3% est. 0.4% prior.

- Durable Goods Orders 2.6% in March vs. 2.5% est. and 1.3% prior.

- Business equipment demand slowed in March.

- Claims 207k in week ended 20 April vs. 215k est. and 212k prior.

- Continuing Claims 1,781k in week ended 13 April vs. 1,814k est. and 1,796k prior.

- Personal Income 0.5% in March (in line) vs. 0.3% prior.

- Personal Spending 0.8% In March vs. 0.6% est. (unch.)

United Kingdom

Bank of England Chief Economist, Huw Pill, stated that “we still have a reasonable way to go before I am convinced that the persistent momentum in underlying inflation has stabilised at rates consistent with achievement of the 2 per cent inflation target on a sustainable basis”.13

1. See – https://www.ft.com/content/30c39c56-3aee-4120-9490-5ce09c187322

2. See – https://www.ft.com/content/aae50967-e728-4c72-ab52-0ed7ef68cd30

3. See – https://www.ft.com/content/4aa9b10f-93bf-4af3-b5e0-e2865ad78af7

4. See – https://blinks.bloomberg.com/news/stories/SCFYLCT0AFB4

5. See – https://blinks.bloomberg.com/news/stories/SCJJQKT1UM0W

6. See – https://blinks.bloomberg.com/news/stories/SCJIE7T0G1KW

7. See – https://blinks.bloomberg.com/news/stories/SBMQJIT0AFB4

8. See – https://www.theguardian.com/us-news/2024/apr/23/pennsylvania-primary-races-battleground-state

9. See – https://public.tableau.com/shared/WY2J68FT7?:display_count=n&:origin=viz_share_link

10. See – https://blinks.bloomberg.com/news/stories/SCIC6KT0AFB4

11. See – https://www.imf.org/en/News/Articles/2024/04/25/pr-24127-ecuador-new-48-month-eff-arrangement

12. See – https://blinks.bloomberg.com/news/stories/SCFVJUT0G1KW

13. See – https://www.ft.com/content/068301b0-9f35-4dda-8d25-21482983bfcd

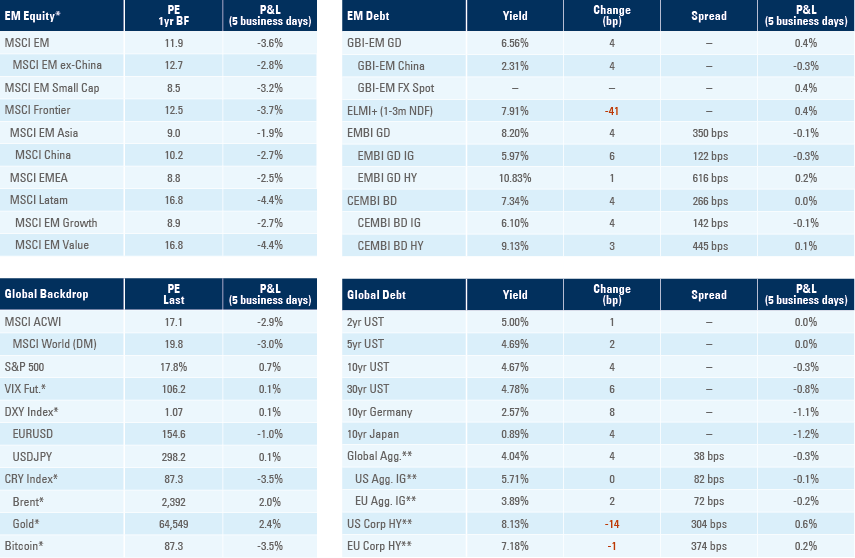

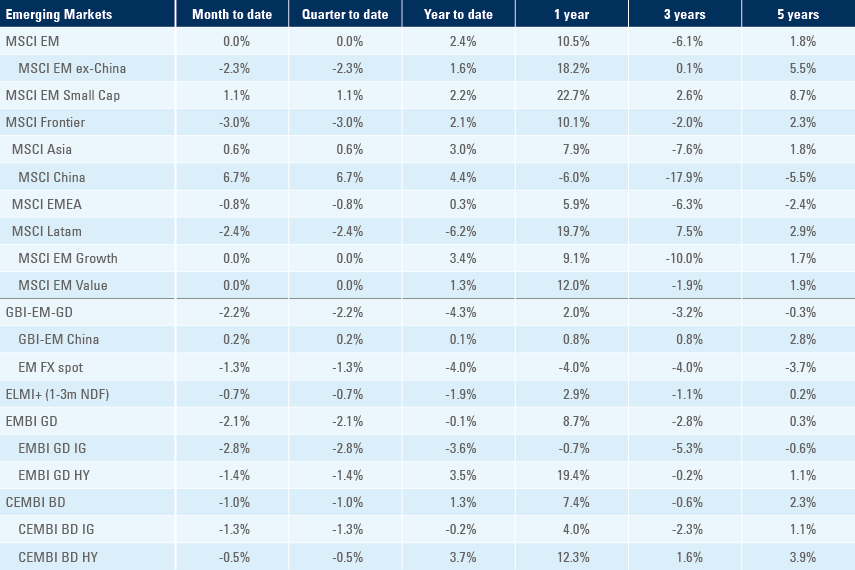

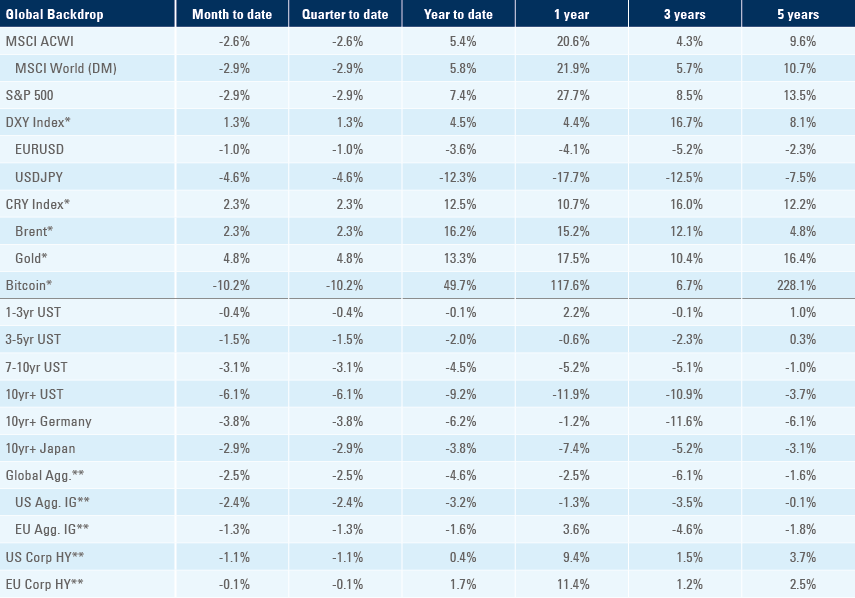

Benchmark performance

*Price only. Does not include carry. **Global Indices from Bloomberg.

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI, total returns.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.