- Europe and Japan had ‘trade deals’ announced with 15% unilateral tariffs

- China reportedly negotiating a 90-days postponement of the 12 August deadline

- Still no deals announced by India, South Korea, Thailand, but signal is positive

- The IMF staff agreed on the first review of its programme to Argentina

- Brazil had lower than expected foreign direct investment and higher current acc. Deficit

- Mexico supporting Pemex with USD 7-10bn in innovative structure echoing Brady bonds

- Poland reshuffled the cabinet ahead of a tight schedule to implement structural reforms

- Türkiye upgraded to ‘Ba3’ by Moody’s

- Nigeria and Zambia make further progress on their new debt structure and strategy.

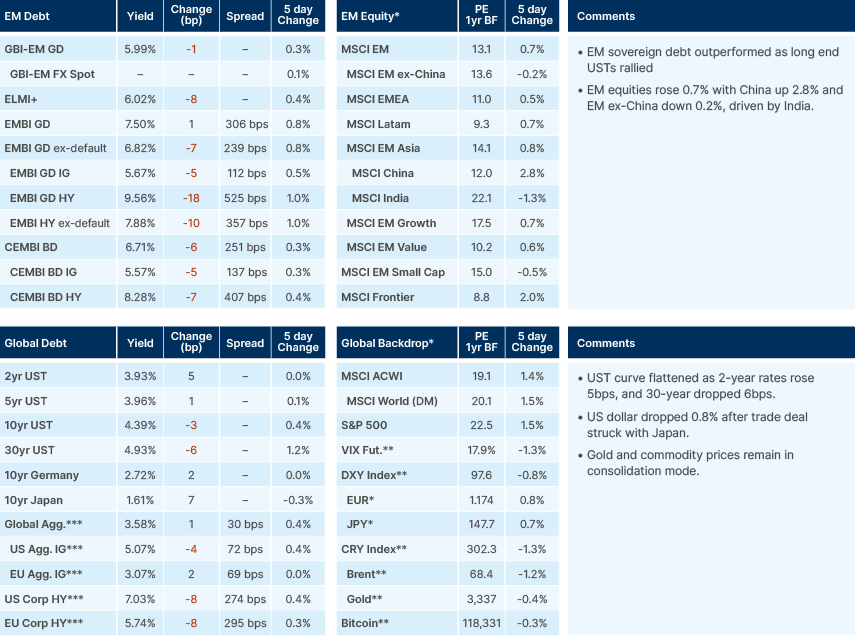

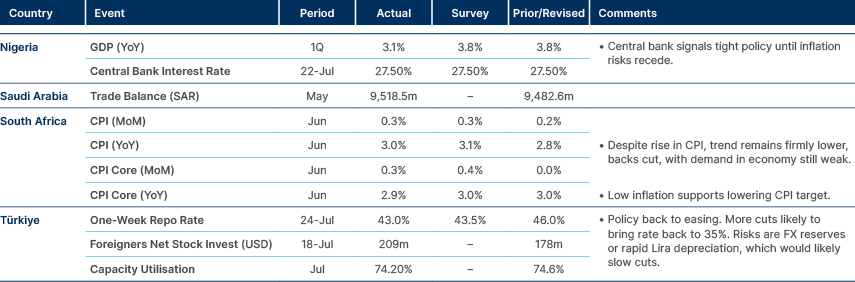

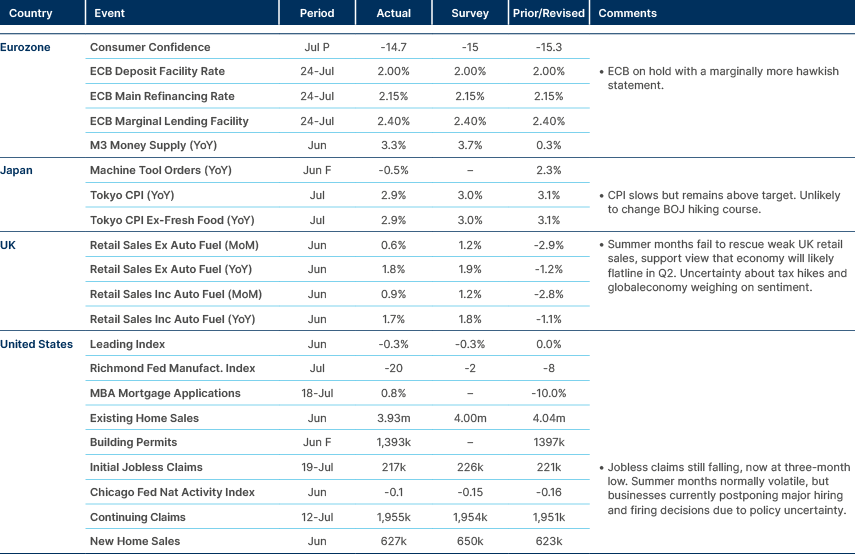

Last week performance and comments

Global Macro

Economic data was marginally softer last week in the US, but jobless claims improved. Data remained firm in Europe, Japan and EM ex-China, supporting Dollar weakness. The odds of US President Donald Trump firing Federal Reserve (Fed) Chair Jerome Powell dropped further after Trump’s awkward, but somewhat friendly, visit to the Fed’s Eccles Building headquarters. There appeared to be no sellers of risk assets as retail and systematic strategies kept buying equities, forcing underweight active investors to capitulate, keeping credit spreads tight. The European Central Bank (ECB) was marginally more hawkish, not signalling a rate cut in September, but this may change depending on the economic performance post-tariffs.

The US announced very asymmetric ‘trade deals’ with Japan and Europe. In both cases, the US will levy 15% tariffs across imports, including autos. Japan pledged to invest USD 550bn in the US, somehow forfeiting 90% of the profits. European Commission President Ursula don der Leyen pledged to invest USD 600bn in unspecified ways, beyond current investment levels and the purchase of USD 750bn worth of US energy. There are already discrepancies between the interpretation of the US-EU deal on both sides, particularly in the pharmaceutical sector, suggesting this story may not go away.

Some sectors, like autos and consumer discretionary, were pricing a very uncertain scenario, which turns out to be quite bad, but better-than-feared initially. Investors don’t see a return to April 2025 levels of uncertainty. The analogy of markets cheering 15% tariffs symptomatic of ‘Stockholm syndrome’ is uncanny. Will markets fully look through the softness of economic activity and companies results in Europe and Japan, as well as the softer activity and higher inflation in the US? It is also worth remembering that bullies rarely leave the bullied alone after easily taking their lunch. The trade deal with Japan may also have an impact on local politics (covered in Developed Markets)

US Treasury Secretary Scott Bessent will meet with his Chinese counterpart in Stockholm (no pun intended). The Chinese media is mulling a 90-day postponement of the 12 August deadline for a deal. That follows good signalling from both sides, with the US agreeing to sell high-end semiconductors and China increasing the flow of rare earths exports. It is noteworthy that China, so far, has been the only major country that managed to extract meaningful concessions from the US and an improved relationship.

This is an important week for global macro with the Fed decision overshadowed by the US Treasury quarterly refunding announcement (QRA) this Wednesday. The Fed is unlikely to change its policy rates, but may have two members (Bowman and Waller) rare dissents. These Republican-appointed likely dissenters have been pointing at a soft private sector labour market to suggest activity is more fragile than seen at the surface. Soft data is needed to convince others on the Board. Hence the importance of this week’s labour market data, including JOLTS1 Tuesday, ADP2 and initial jobless claims Thursday, and non-farm payrolls on Friday. We are also at peak earnings season. In the US, most companies have beaten downwardly revised estimates. Capex spending is up by 19% yoy, but only 2% yoy after excluding the technology sector and the Magnificent 7. The proportion of CEOs expecting higher capex over the coming six months has dropped to 28%, the lowest level since the pandemic. The market is betting that trade deals will boost sentiment and capex intentions.

A good scenario for asset prices and the economy would be lower than expected pass-through from tradable goods to non-tradeable services amidst a recovery on sentiment and investment on cyclical industries in the US. This may not be too farfetched considering most manufacturing companies from Europe and Japan will work hard to retain their market share in the US, which is the only market that has been totally insulated from Chinese manufacturers in sectors like autos.

Geopolitics

French President Emmanuel Macron signalled France will formally recognise the State of Palestine at the next UN General Assembly in September. Macron cited France’s historic commitment to a just and lasting peace in the Middle East and urged an end to the humanitarian crisis in Gaza. Pressure is building for British Prime Minister Kier Starmer to take the same steps, as the grass roots of his Labour Party has been protesting in favour of Palestine for a while.

In other news, Thai F-16 jets struck Cambodian military sites amid renewed clashes that left between 12 and people dead, including Thai and Cambodian civilians. This is the worst conflict between both nations in 14 years, with violence erupting across six locations. Each country reports close to 100k displaced. A prolonged stalemate could disrupt trade and reginal movement. Nevertheless, a de-escalation mediated by the US, China, and ASEAN countries is the most likely scenario.

Emerging Markets

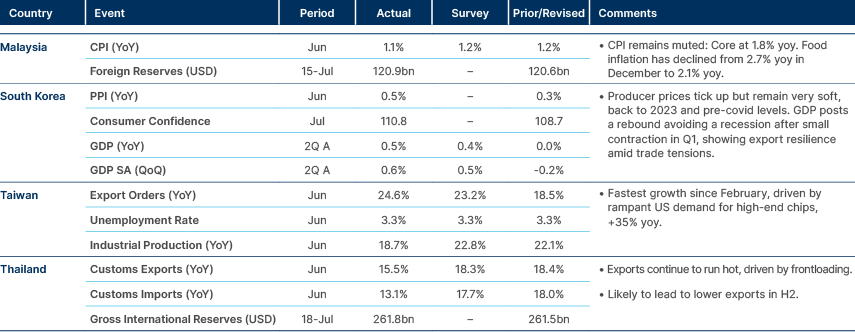

Asia

Inflation remains soft across the region, supporting further easing.

China: An FT article based on dozens of sales contracts, company filings and interviews with people that had direct knowledge of the deals suggested Nvidia’s B200 had become the most sought-after — and widely available — chip in a rampant Chinese black market for American semiconductors. The piece highlighted “at least USD 1bn” worth of Nvidia’s advanced artificial intelligence (AI) processors were shipped to China in the three months after Donald Trump tightened chip export controls, exposing the limits of Washington’s efforts to restrain Beijing’s high-tech ambitions. These challenges, alongside the importance of rare earths for US manufacturing may explain the backpedalling of the US tough stance on China.

Korea: Average daily exports increased by 4.1% yoy, led by semis (+24%) and ships (+190%) in the first 20 days of July. Exports to Taiwan, EU, Vietnam, China, rose by 38.3%, 9.6%, 7.6%, and 4.2%. Exports to the US were unchanged.

India: India and the UK signed a comprehensive Free Trade Agreement during Prime Minister Narendra Modi’s visit, following more than three years of negotiations. The deal is expected to boost annual bilateral trade by USD 34bn. Nearly all Indian exports to the UK will be duty-free, with major tariff cuts on key UK exports to India.

Indonesia: Parliament approved the 2026 macroeconomic framework with minimal changes to current projections. The government expects GDP growth to reach 5.2%-5.8%, as inflation remains contained at a 1.5%-3.5% range and the unemployment rate oscillates between 4.4%-5.0%. The fiscal deficit is expected to be around 2.5% of GDP with government revenue estimates between 11.7%-12.3% of GDP and spending from 14.2% to 14.8% of GDP.

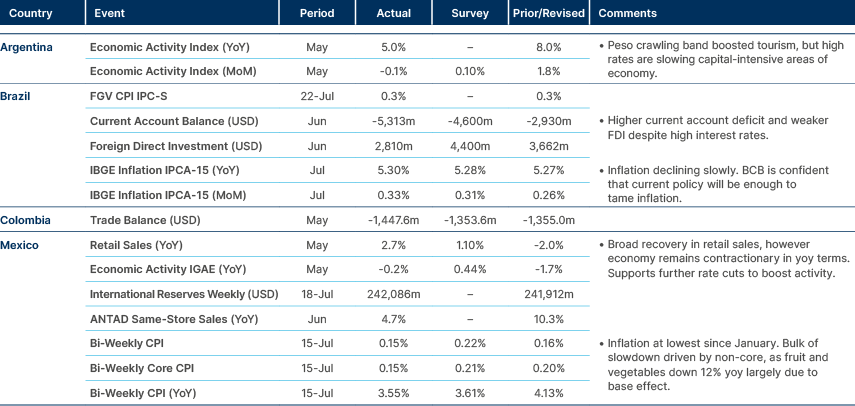

Latin America

Softer external accounts in Brazil amid trade dispute warrants attention.

Argentina: Central Bank of Argentina (BCRA) Governor Santiago Bausili admitted that eliminating the overnight instrument in mid-July led to unexpected liquidity issues, leaving about ARS 5trn unabsorbed. The intention was to push banks’ precautionary funds into longer T-bills (1-3 months), reduce overnight market dependence, and widen the spread between overnight and 30-day rates. However, banks avoided T-bills due to the absence of a liquidity backstop, volatility, regulatory exposure limits, and risk constraints. When the overnight instrument expired, banks were left with excess cash, causing overnight rates to fall sharply and weakening the Peso. The Treasury responded with an emergency auction, as the BCRA intervened to set a rates floor. Overnight and one-month rates are now higher, and the ARS has depreciated. Without reforms, such as opening a liquidity window and easing T-bill limits, Argentina risks prolonged high interest rates or further currency weakness. In other news, the IMF announced a staff-level agreement on the Extended Fund Facility (EFF) first review, unlocking a USD 2bn disbursement upon board approval. On the political front, President Javier Milei “permanently” slashed export duties over the weekend. Poultry and beef taxes will be cut from 6.75% to 5.0%, corn from 12% to 9.5%, and soybeans from 33% to 26%. This could support further Dollar conversion from agriculture producers, supporting liquidity and the ARS.

Brazil: President Lula criticised Trump for refusing to negotiate over the proposed tariff hike on Brazilian exports from 10% to 50% starting 1 August. Lula defended Brazil’s sovereignty and condemned the political pressure from Trump’s letter. Brazil’s WTO representative Philip Gough warned the use of tariffs for political leverage threatens global stability and is a “dangerous shortcut to war”, calling unilateral measures a violation of WTO principles. While the country is right about its grievances, the confrontational stance is unlikely to yield results in the short term. A behind-the-scenes grand political bargain about the fate of former-president Jair Bolsonaro ahead of 2026 elections is the most likely path for de-escalation. Brazilian corporates with a US presence and regional leaders in Brazil will also be important. Supreme Court Justice Alexandre de Moraes warned Bolsonaro over non-compliance with court-imposed restrictions but chose not to order his arrest. He noted Bolsonaro’s son Eduardo’s social media activity breached the ban but called it an “isolated incident”.

Colombia: President Gustavo Petro accused Colombia’s Constitutional Court of deliberately stalling his pension reform, calling the move a “coup” against legislation passed twice by Congress. Despite legal uncertainty, the government will begin partial implementation by expanding a key pension bonus in 2024 and funding it in the 2026 budget. Petro’s decision to bypass the Court underscores his willingness to trade institutional stability for political gain, raising concerns over Colombia’s institutional stability.

Chile: Two pollsters showed a similar picture on December’s presidential race: Cadem showed Communist Party candidate Jeannette Jara and far-right candidate Jose Kast tied with 27%, with centre-right candidate Evelyn Matthei at 14%. Criteria had Jara at 30%, Kast 29%, and Matthei at 26%. In the runoff, Kas would easily defeat Jara with 47% vs. 34% votes, according to Criteria. President Gabriel Boric hosted a pro-democracy summit with leaders from Brazil, Colombia, Spain, and Uruguay, calling for stronger multilateralism and UN reform to counter extremism. The meeting avoided direct mention of US tariffs, but drew criticism from Chile’s right, who argue Boric is aligning with controversial leftist leaders and risking tensions with the US. Some linked Washington’s copper tariff announcements to the summit’s timing. Boric plans a second meeting in September in New York with additional global leaders.

Mexico: Mexico is creating a special purpose vehicle (SPV) called Eagle Capital to issue USD 7-10bn in the Eurobond market today. The SPV will buy US Treasuries with the proceeds and lend it to Pemex, who will repo the US treasuries to buy back their own Eurobonds. If the SPV fails to repay the debt effective 4-year maturity, Mexico will either repay it or issue 5-year bonds to repay it. Therefore, for all intents and purposes, including ratings and index inclusion, this is a new sovereign bond under Mexican ticker with same rating. The difference is that this debt is not officially a liability on the sovereign balance sheet. This is a transaction that is likely to be replicated in the future to lower Pemex indebtedness. Investors have recourse to US Treasuries – echoing former Brady bonds structure. The oil and gas national company is also announcing results today. Focus will be less on the actual operational results and more on the business strategy for the next 5-years, including liability management exercised. We believe this will allow rating agencies to upgrade Pemex into the ‘BB’ territory again.

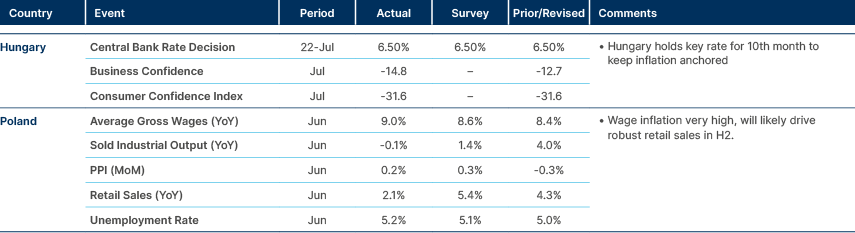

Central and Eastern Europe

Poland: President Andrzej Duda swore-in Prime Minister Donald Tusk’s reshuffled government, which now includes Super-Ministries for Finance and Energy, aiming for greater efficiency. Political conflict is likely to intensify, in our view, after PIS’s President-elect Karol Nawrocki takes office in August. The ruling coalition had delayed legislation ahead of the election but must now act quickly before opposition pressure mounts. Nawrocki’s assertiveness may ironically help the government by allowing it to frame him as overstepping constitutional limits. Although the far-right currently holds momentum, the government, backed by 11.6m voters, hopes to rebuild support before the next general election is due by the Autumn of 2027.

Central Asia, Middle East, and Africa

Türkiye cuts policy rates by 300bps.

Angola: President João Lourenço hinted at preparing a successor who could “do better” than him, signalling no intention to betray the country’s constitutional limit by seeking a third term. He is reportedly grooming trusted figures within the MPLA to ensure party dominance while maintaining stability. This planned transition aims to preserve political continuity, while Lourenço retains influence through party leadership and succession planning for the end of his mandate in September 2027.

Nigeria: The Senate approved President Bola Tinubu’s 2025–2026 borrowing plan, which includes USD 21bn, EUR 4bn, JPY 15bn in loans, and a EUR 65m grant to finance infrastructure, power, transport, health, education, water, and agriculture projects. The plan focuses on concessional loans (no Eurobonds) with low interest rates and NGN 758bn domestic bond issuance to clear pension arrears. A USD 2bn FX programme will raise funds domestically from the private sector and diaspora. Nigeria’s total debt could rise by about 5-7% of GDP, and external debt (ED) by around 8-10% of GDP.

Saudi Arabia: Fitch affirmed ‘A+’ rating with stable outlook, highlighting the Kingdom’s solid financial position.

South Africa: The government signed a condition precedent document with the US Trade Representative ahead of the 1 August deadline, aiming to delay or ease proposed 30% US tariffs. The agreement signals South Africa’s intent to work toward a broader trade deal that may well function as a framework the US hopes to replicate across the African continent. South Africa is seeking to exempt key exports like cars, steel, aluminium and agriculture. However, Democratic Alliance leader John Steenhuisen revealed that a proposal submitted on 20 May was rejected by the US as “lacking ambition”. After political disputes over VAT hikes and corruption scandals delayed the 2025 budget, the Treasury will overhaul the budget process for 2026 to improve policy coordination.

Türkiye: Moody’s upgraded the sovereign rating to ‘Ba3’, bringing it to the same level as S&P and Fitch.

Zambia: The 2025 Debt Sustainability Analysis (DSA) shows higher external debt ratios after reclassifying certain domestic securities as non-resident holdings, without new borrowing. Key 2025 ratios now include ED to GDP at 46.4%, ED to exports at 99.8%, and debt service to revenue at 14.7% (up from 12.7%). Total public debt is USD 25.3bn, or 88% of GDP. High indebtedness remains overshadowed by a fast improvement in the policy direction and fiscal results.

In other news, Zambia and Brazil signed a ‘Memorandum of Understanding’ to collaborate on agriculture, livestock, and biofuels, covering seed production, fisheries, crop development, infrastructure, and trade promotion. It includes joint research, training, and support for Zambia’s Lobito Railway Corridor master plan to boost productivity and exports. The deal leverages Brazil’s successful agro-industrial model to diversify Zambia’s economy beyond mining, strengthen food security, and attract private investment. By developing export-oriented value chains and biofuel capacity, it could generate regional spillovers, particularly benefiting Angola through trade and technology transfer.

Developed Markets

Softer data, but US labour market not cracking.

Japan: Prime Minister Shigeru Ishiba initially indicated he may resign this summer after his Liberal Democratic Party (LDP) lost the majority in the Upper House. Nevertheless, he pledged to remain in power in a key LDP meeting held today to consider the party leadership. The LDP faces the risk of non-confidence votes in the five sessions held from 1 August. Despite fears of additional fiscal stimulus, we believe the JPY yield curve is already excessively steep compared to Europe and we believe any stimulus is unlikely to be excessive. This suggests a stronger JPY will be the anchor of further dollar weakness in H2 2025

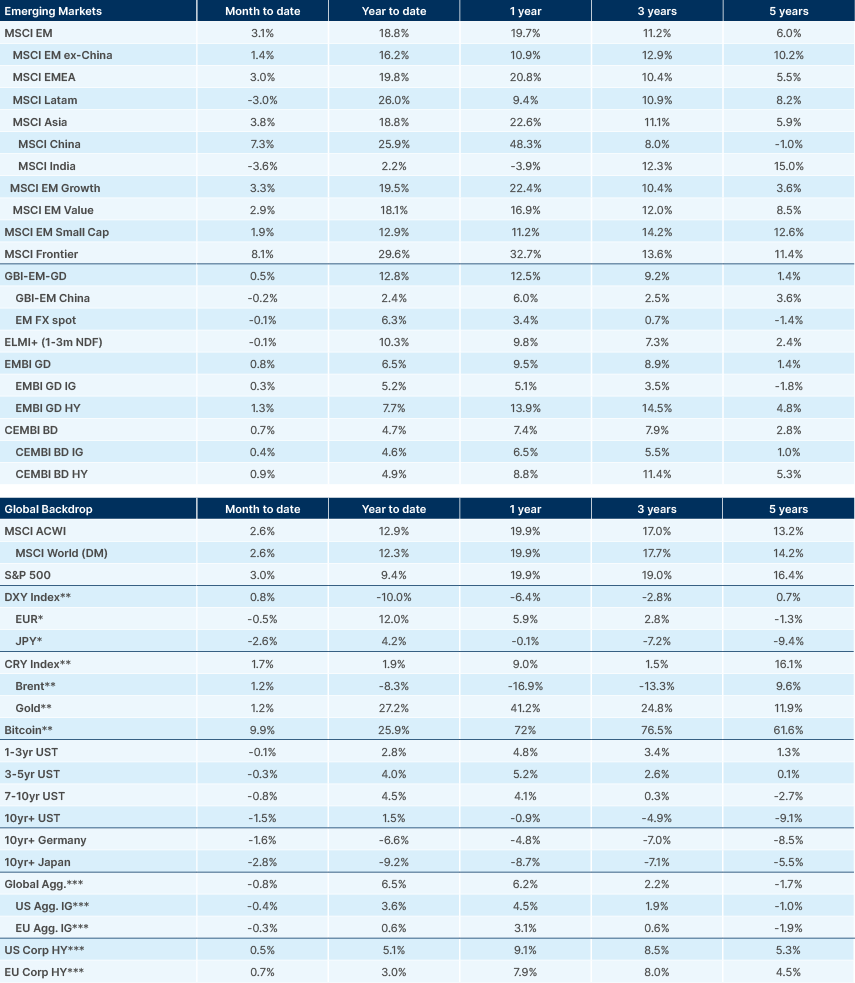

Benchmark Performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.

1. The Job Openings and Labor Turnover Survey

2. Automatic Data Processing private payrolls