NEW SERIES: Live at the Sub-ICs

Insight into areas of research focus at our Equity Sub-Investment Committees (ICs) which are responsible for managing Emerging and Frontier Markets strategies.

The health of developed market (DM) economies is in doubt with bank profitability stresses highlighting the impact of tight financial conditions on the real economy. This is prompting some to question whether enough downside risk is priced in DM equity markets. While Emerging Markets (EM) are not immune to this external backdrop, they are much more advanced in their monetary tightening path and their economies are benefitting from strong domestic growth drivers.

EM stock markets also trade pro-cyclically meaning they have already seen their price multiples derated and their earnings expectations revised to prudent levels, reflecting global concerns.

This dichotomy, with EM and DM currently appearing in ‘different chapters’ of the cycle, is challenging Ashmore’s equity investors to consider whether now is the time to be adding exposure to an industry that is inherently cyclical?

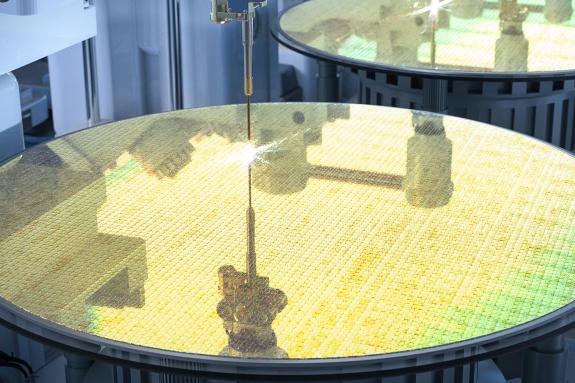

The semiconductor industry stands out to us as a research priority due to the idiosyncratic nature of its many cycle drivers, as well as its role at the centre of a seemingly increasingly multi-polar world. This paper brings readers into the discussion underpinned by a series of questions.

Question 1

Is now too early to add Semiconductors exposure and therefore cyclicity in portfolios?

Yes. The market narrative of ‘policy success’ whereby DM policy makers have instigated a managed deceleration in economic growth, while simultaneously anchoring inflation, and hence leading the next policy move to be towards monetary easing, is premature.

There is a lagged impact of tighter US financial conditions on the economy and the test to come is whether inflation has been sufficiently well anchored to permit policy to be able to respond to future challenges that may lay ahead. While US debt markets’ price and volatility performance have commensurately gyrated, the S&P500 index continues to trade towards cycle highs. We believe, this suggests that DM macroeconomic health remains questionable and DM equity price risk-reward unattractive. EM are tied to global capital flows and trading patterns, and hence are vulnerable too.

Agreed, but…

The seemingly most well-anticipated DM recession in recent times, should it materialise, is well…, anticipated. US monetary tightening is almost certainly now nearing its peak and DM policy has so far proved quick to ringfence contagion risks, in our opinion. Challenges in US regional banks may prove to be a precursor for quicker than otherwise policy easing, both in DM and EM, and self-solving in that bond yields can fall and affordability could improve. On balance, we think these should mitigate significant downside risks.

Meanwhile, and just as importantly, EM are at a different point in the cycle. In a world of growth scarcity, even by conservative standards EM economies are set to grow over 2% faster than DM this year and next according to the World Economic Outlook (April 2023). EM’s largest economy and stock market, China, is doing the opposite of DM and stimulating activity facilitated by low inflationary pressure. Other large EM like Mexico, India, Indonesia, and maybe soon Brazil, are undergoing domestic capital expenditure cycles and the direction of travel is towards policy easing from current high real rates.

Moreover, certain EM industries have already undergone meaningful down cycles and can be ‘First-In-First-Out’. Investor positioning is light and valuations are attractive; the MSCI World (i.e. Developed Markets) trades at a forward price earnings multiple of 16.5x compared to a 20 year median of 15x, while MSCI EM trades around 11.5x, in-line with its 20 year median. The headwind of persistent US dollar strength has also receded, which in our view means that investors should increasingly balance current ‘defensive’ positioning with ‘cyclicality’, albeit selectively.

Question 2

Where could cyclicality be an attractive investment?

We believe the semiconductor industry is one area that stands out due to the idiosyncratic nature of its many cycle drivers.

On the demand side, low-to-mid end consumer electronics has been under pressure since Q1 2022, given discretionary spending was under pressure from higher inflation and then tighter monetary policy. High-end consumer electronics has been more resilient while handset demand in China has been weighed on by the prolonged Covid lockdown. Cloud revenue has slowed, although remains at still high levels. We believe future demand hinges on the magnitude of the US slowdown and companies' preference for cash preservation versus cost savings initiatives, which should become clearer in time.

Meanwhile, on the supply side, the inventory cycle has been undergoing a correction since the third quarter of 2022. The magnitude of which has been exacerbated by previous, disproportionately high ‘just-in-case’ inventory management, given Covid. For example, Memory exited Q2 2022 with c.110 days of inventory compared to a 10-year average of 60 days. Handset inventory days stood at c. 80 days compared to a 10-year average of 40 days.1 Semiconductor companies have since seen their earnings contract, in some cases by over 100%, and stock prices have commensurately suffered.

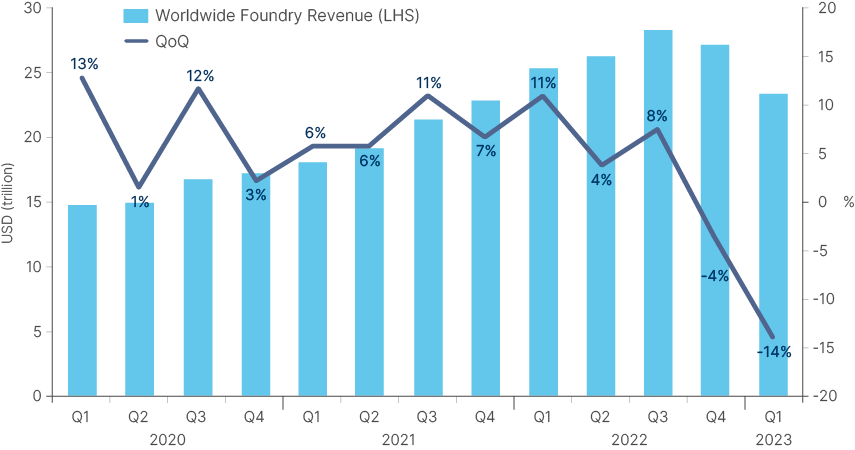

Fig 1. Semiconductor inventory cycle: Major Foundry revenue

Our seasonality and inventory destocking cycle model suggests manufacturing capacity utilisation troughs around mid-year 2023. We monitor carefully for management guidance noting that recent comments have suggested more patience may be required. Once inventory has been sufficiently cut, we have greater visibility on the strength of corporate balance sheets and can wait for top line demand to recover and the earnings trajectory to improve. Stock markets anticipate this cycle in advance and hence stock price performance typically leads ‘fundamentals’.

Company idiosyncratic considerations remain critical though. We expect demand recoveries will differ by product (e.g. smartphones, datacentres and PCs) as well as by business model (e.g. discretionary logic vs. commoditised memory), yet overall the cycle can inflect positively from a low base.

Question 3

How are Semiconductors impacted by geopolitics?

Semiconductors are China’s largest imported good, ahead of food and oil and consequently are of strategic significance. The Chinese government has sought to reduce their dependency by supporting a thriving domestic semiconductor industry which, among other factors, has led the US to seek to contain China’s technology advancement.

The impressive multi-year ‘Taiwanisation’ of Semiconductor production, with its over 90% of global leading-edge chip production, has put Taiwan in the crosshairs of geopolitical tensions, and newspaper headlines; ‘The most dangerous place on Earth’, The Economist in May 2021. Taiwan is home to the world’s largest foundry, TSMC. A company that has successfully embedded itself in the global logic chip supply chain to such an extent that it is likely hard for others to rival, not least given enormous research and development costs. This has seen its business model become more idiosyncratic and hence its earnings typically behave less cyclically than more commoditised semiconductor memory producers. TSMC has been diversifying its leading-edge capacity away from Taiwan by building a manufacturing plant in Arizona, subsidised by the US government. On our current assumptions, by 2026 this 'Fab' may be able to generate 20% of the world’s advanced node production, potentially reducing US reliance on Taiwan.

In October 2022, the US further tightened export controls on advanced semiconductors and semiconductor equipment. In January 2023, Japan and the Netherlands joined meaning that all suppliers of advanced lithography equipment are encompassed. This includes EUV tools used to produce the most advanced logic chips. This meaningfully impedes China’s ability to advance its ‘leading edge’ logic chip capabilities, based on current technology. It also reduces competition for TSMC (Taiwan), Samsung (South Korea) and Intel (US).

On memory chips the picture is more nuanced. China has been increasingly competitive for the most commoditised DRAM and NAND chip production. Consequently, potential impediments to China’s technology advancement may be considered positive for its main peers Samsung (South Korea), SK Hynix (South Korea) and Micron (US). However, in some cases, product centres have been exported to China given lower production costs, which may require supply chains to be redirected with cost implications. Meanwhile, we think export controls will likely also weigh on semiconductor clients, such as global cloud datacentres, who may be impacted by supply chain bottlenecks.

We believe the focus of export controls on ‘leading-edge’ chips should not oversimplify the reality that most of today’s technology is based on ‘legacy’ chips, for example the global banking system, and future technology initiatives, like Artificial Intelligence, require a blend of both leading and legacy chips. Consequently, there are a myriad of both opportunity and risk scenarios for EM companies in our opinion. In the event of a severe downturn in Sino-US relations, the implications could be far more important than Semiconductors alone, or even EM for that matter.

Question 4

How sustainable are Semiconductor structural growth drivers?

The structural drivers for the semiconductor industry look well placed to be sustained. There are several key future chip demand sources meaning the super cycle narrative has some basis. Extrapolating future trends in technology, though, should be treated with care in our view. For example, the importance of AI language models, like ChatGPT, currently dominate market speculation and the newsreels, although it is notable that leader technology companies themselves are so far reticent to project the implications on future earnings in our observation.

There remain several current and future demand drivers for semiconductors. These include:

- Digital transformation; this is underway across multiple industries and includes pre-emptive maintenance and inventory management.

- Cloud migration; the shift from on-premise IT spending migrating to the cloud should see semiconductor demand cyclicality reduce with positive implications for earnings visibility and their multiples alike.

- Internet-of-things; growing semiconductor content in anything from smartphones to cars.

- Increased connectivity; with applications and appliances generating large amounts of data analysed by Artificial Intelligence.

Consequently, the future for semiconductors looks bright and EM dominate supply chains and global technological advancement.

Conclusion

Global economic growth may be challenged for longer, although EM can demonstrate First-In-First-Out 'FIFO' qualities and benefit from a global growth scarcity premium in our opinion. We believe the Semiconductor industry should remain a research priority given the idiosyncratic nature of its business cycle, while geopolitics is likely to remain a periodic trigger for episodes of market volatility, and potentially outsized investment opportunity. Security selection, though, remains critical given the anticipated differential in the speed of recovery in the semiconductor product and applications industries, which we expect will impact at the company level, too.

1. Source: Credit Suisse, December 2022