A solid November so far for market returns, but the path for an ongoing year-end large rally is narrowing. The respite in geopolitical tensions may also be short-lived. Israel agreed to a four-day cease fire in Gaza until Monday, but its Defence Minister said the conflict is likely to extend for at least another two months. The United Nations Climate Change Conference COP28 takes place in Dubai. China is reportedly considering unprecedented support for the real estate industry. Sri Lanka agreed on a restructuring with China on separate terms than with the International Monetary Fund (IMF). Taiwan’s opposition parties failed to agree on a common candidate for presidential elections in January, increasing the odds of the incumbent Democratic Progressive Party (DPP) remaining in power. Argentina’s president-elect Javier Milei announced Luis Caputo – an orthodox economist – for his transition team. Caputo said dollarisation is a medium-term goal and the government will seek a primary surplus in 2024. The South Africa Reserve Bank kept is policy rate at 8.25%, and Türkiye hiked rates 500 basis points (bps) to 40.0%. In Europe, the far-right party led by Geert Wilders gained most seats in the Dutch Parliament.

Global Macro

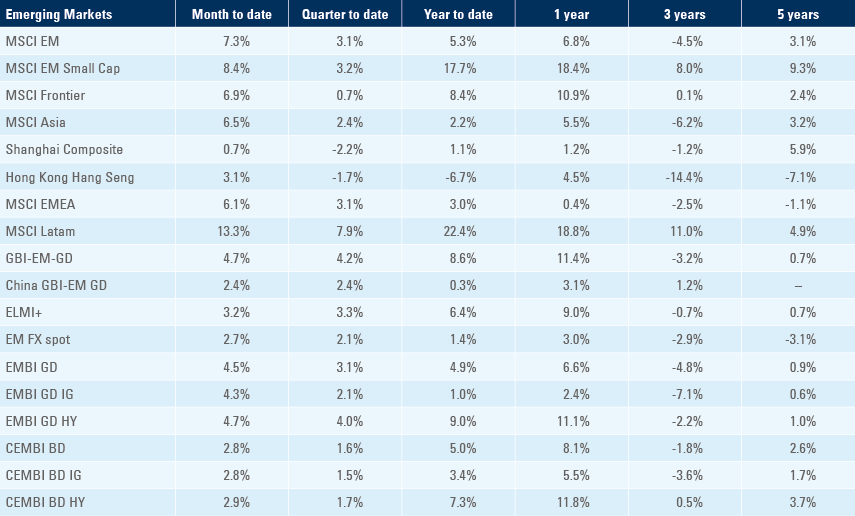

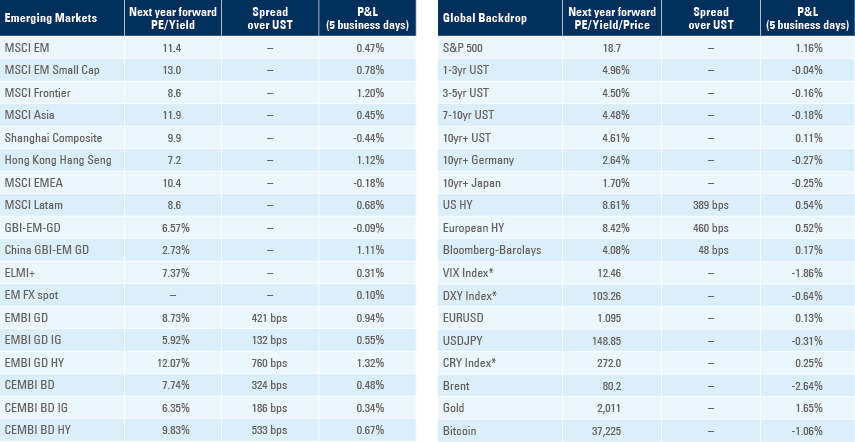

November is shaping up to be a solid month to investors across the board. The MSCI All Countries World Index (ACWI) was up 8.9% until last Friday. Emerging Market (EM) local bonds rose 4.7% as EM currencies rose 2.7% on the back of a 3.1% decline on the DXY Dollar Index. EM Dollar-denominated debt also did well, with sovereigns up 4.5% (high yield 4.7%) and corporate debt up 2.8% month-to-date. The main catalyst for the rally was weaker inflation and activity data in the US leading the market to price the end of the Federal Reserve (Fed) hiking cycle and starting to price in rate cuts for 2024. The yields on 10-year and 30-year US Treasuries declined by 44 and 48bps to 4.49% and 4.62%, respectively.

Nevertheless, the rally has been stalling last week with US Treasury yields up around 5bps, MSCI ACWI up 1.0%, local currency bonds unchanged and EM sovereign and corporate debt up 0.9% and 0.5%, respectively. With the implied overnight interest swap (OIS) already pricing close to 100bps of cuts by January 2025, the continuation of the year-end rally is subject to a narrow path. Weaker economic activity and much lower inflation without a significant credit event that bring forward a soft-landing easing cycle is what is demanded in our view. Last week, Mastercard reported Black Friday sales were +2.5% in yoy terms, thus, negative in real-terms.

Another reason for the rally was the squaring of crowded positions post-summer price action. In short, macro investors were paying interest rates and short stocks. The path of least resistance in December points to consolidation. Asset prices volatility has been supressed vis-à-vis summer levels and investors’ positions are likely to be more moderate after the strong moves in November.

Geopolitics

On Friday, Israel and Hamas reached a deal for the release of 50 civilians taken hostage in Gaza over a four-day period, in exchange for the 150 Palestinians detained in Israel. The temporary ceasefire commenced on Thursday. At the time of writing, Qatar is trying to broker a deal to extend the ceasefire if Hamas would secure the release of additional woman and children held by other groups. It is unlikely that this temporary ceasefire will mark the end to the conflict as Israel said it intends to resume the attacks. The Israeli Defence Minister Yoav Gallant said that phase 2 of the Gaza operation may last around two months, suggesting the invasion may last until end of January or early February. If this timeline is confirmed, the humanitarian cost is likely to lead to further significant strain between Israel and its Western partners as well as Israel and the Arab World, in our view. The internal political dynamics in Israel also matter, in our view, as the end of the conflict in Gaza represents a political threat to Israeli Prime Minister Benjamin Netanyahu.

The leaders of several Arab nations travelled to Beijing to discuss the situation in Gaza. China is the largest trading counterpart across the Middle East and has been establishing strategic partnerships across industries. Beijing has been critical of the Israeli invasion of Gaza. This week, COP28 will be hosted by Dubai and there is a risk that the regional geopolitical matters overshadow the pressing climate issues.

US Politics and climate change

On Sunday, the White House announced that President Joe Biden will not attend the COP28 forum and will send his climate envoy, John Kerr, instead. Carla Sands, an advisor to former President Donald Trump, said that if elected for a second term, Trump would seek to overhaul Joe Biden’s Inflation Reduction Act (IRA). When it comes to climate and industrial policy, the 2024 Presidential Election contest will see a polarisation between Biden’s aim to stimulate the industrial heartlands of the US by providing green energy subsidies on the one hand and Trump’s intention to ‘gut’ the IRA, reverse curbs on fossil fuel production, and withdraw from the Paris Agreement (again), on the other. There is a lot at stake next year with the outcome of the US election critically significant for US fiscal and foreign policy. The US is a key player within the Paris Accord, accounting for the second largest emitter of greenhouse gases globally.1 , 2

Emerging Markets

EM Asia

China: Bloomberg reported China is weighting “unprecedented” support for construction companies to ensure sold but unfinished homes are completed. “Policymakers are finalizing a draft list of 50 developers eligible for financial support that includes Country Garden Holdings Co. and Sino-Ocean Group, indicating a pivot by Beijing to help some of the most distressed builders”.3 Nomura’s Ting Lu estimates that the total funding gap to complete the remaining housing units would be around RMB 3.2trn (USD 446bn). A large support for construction companies and encouraging mergers and acquisitions is the only way to stabilise the property market, in our view, and the news is therefore encouraging for sentiment.

On the other hand, the shadow banking giant Zhongzhi Enterprise Group Co is facing a criminal probe after revealing a USD 36.4bn shortfall on its balance sheet. The company’s property sector exposure is only 7.4% according to data from the China Trustee Association. The largest exposures are in securities (30%), industrials and commerce (26%) and financial institutions (14%), with infrastructure assets accounting for 10% of the total. Chinese social media estimates the liquidation value of its assets could be even lower, potentially leading to more than USD 50bn losses to investors.

The negative sentiment is reflected in investor flows. Foreign investors redeemed 77% of the RMB 235bn invested in Chinese stocks at the beginning of the year. Following a squaring of positions in global equities throughout November, Beijing maybe trying to motivate its own short-covering. The Beijing stock exchange is now reportedly requiring investors holding a stake of 5% or more in locally listed companies to make a public filing in order to sell their shares.

However, another potentially encouraging development takes place this week, with Xi Jinping visiting technology companies in Shanghai for three days, marking the first post-Covid presidential visit to China’s commercial hub since a two-month covid lockdown in late 2022 In other news, global payments in CNY declined by 0.1% to 3.6% in October, according to Swift. In economic news, the yoy rate of industrial profits slowed to 2.7% in October from 11.9% yoy in September. In seasonally-adjusted terms, industrial and manufactured profits are year-to-date just slightly above average. Most of the decline was concentrated in consumer goods, including computer (-18.2% yoy) and clothing (-7.7% yoy), while electricity and heavy industry profits increased.

Indonesia: The current account deficit narrowed to USD 900m in Q3 2023 from USD 2,200bn in Q2 2022, USD 900m lower than consensus. After the surprise off-cycle policy rate last month, the Bank of Indonesia left the policy rate unchanged at 6.0%, in line with 25 out of 31 economists surveyed by Bloomberg. Governor Perry Warjiyo said “This decision remains consistent with the policy of stabilising the rupiah exchange rate from the impact of high global uncertainty, and as a pre-emptive and forward-looking step to mitigate the impact on imported inflation”.

Malaysia: The trade surplus softened to MYR 12.9bn in October from MYR 24.5bn in September, below expectations MYR 21.7bn. Exports increased sequentially by 1.6% mom, mostly led by an increase in petroleum product exports, partially offset by a continued decline in exports of electronics. In yoy terms, exports declined by 4.4% in October, up from -13.7% yoy in September, while imports declined by 0.2% yoy from -11.1% yoy prior and below consensus at -9.3% yoy. The yoy rate of consumer price index (CPI) inflation rose 1.8% in October, 10bps lower than September and consensus.

Philippines: The government sold PHP 15bn of 6.5% bonds maturing in 2024 in the form of tokenized treasury bonds (TTBs). The offering was 3x oversubscribed at PHP 31.4bn. The offering is an important milestone in the government’s digitalisation and diversification strategy. Tokenisation of the asset class appears advantageous for investors, as it can help increase the efficiency and liquidity of the asset market through improved price discovery.

Sri Lanka: After defaulting on its foreign debt in 2022, and entering into an agreement with the IMF, Sri Lankan President, Ranil Wickremesinghe, recently announced that China had agreed to restructure its debts with the country on its “own terms”, separate to the IMF process.4 Sri Lanka currently has USD 46.9bn of foreign debt outstanding, with just over half owed to China. The IMF is set to conduct a review of Sri Lanka’s debt as part of its current Extended Fund Facility programme, as soon as 6 December, provided Sri Lanka obtains financing assurances from its official creditors.5

South Korea: The trade data for November showed further signs of improvement as exports increased by a yoy rate of 2.2% and imports declined by 6.2% yoy in the first 20 days of November. Key to the recovery has been the bottoming of prices for semiconductors as chip sales rose by 2.4% yoy. Producer price index (PPI) inflation increased by 0.8% yoy in October, 60bps lower than September.

Taiwan: The two opposition parties, the Kuomintang (KMT) and the Taiwan People’s Party (TPP), surprised the nation when they announced the formation of a coalition to compete against the incumbent DPP. However, both parties failed to agree on their nominee for their joint ticket ahead of the deadline on 24 November, and will therefore each have their own candidate in the 2024 elections. Hou Yu-ih was nominated to represent the KMT and Ko Wen-je will represent the TPP. Failure to form a unified opposition to rival the DPP, to be led by William Lai, means the DPP is likely to remain in power.

In economic news, export orders declined by a yoy rate of 4.6% in October, up from -15.6% yoy decline in September, and 300bps above consensus. The current account surplus increased to USD 2.7bn in Q3 2023, up from USD 2.2bn in Q2 2023. Unemployment remained largely unchanged at 3.4% in October. Industrial production improved to a yoy rate of -2.3% yoy in October, from -6.7% yoy in the month prior, significantly above consensus. The electronics sector led the recovery with increased demand for advanced computing power. The sequential improvements continue to point towards a bottoming out of global manufacturing as Taiwanese and Korean exports are important links to the advanced manufacturing sector and thus often leads the global manufacturing purchasing managers’ indices (PMIs).

Thailand: GDP in the third quarter grew 1.5% yoy, down from 1.8% in the second quarter, 70bps lower than expected. The decline was mostly attributed to lower government spending during delays to form the new government after the elections.

Latin America

Argentina: On Tuesday, president-elect Javier Milei met with current President Alberto Fernandez to begin the transition process. Milei appointed Luis (Toto) Caputo – the former Central Bank Governor in the Mauricio Macri administration – to lead his economic transition team, likely placing him as Minister of Finance. On Friday, various local media outlets reported Emilio Ocampo will not be appointed as the new Central Bank Governor Caputo said dollarisation will be a medium-term goal and added that the government will seek to generate a fiscal surplus in 2024. The other focus will be dealing with the monetary policy instruments with less than 1-year duration that accumulate ARS 24trn (or c. 10% of GDP). Reaching out to Macri’s team and dealing with the immediate problems of rolling the debt while the fiscal adjustment takes place should indeed be the priority in our view. In our opinion, no monetary stabilisation programme (including dollarisation, the most radical of all) will work without a front-loaded fiscal shock therapy. In economic data, the budget deficit shrank from ARS -380bn to ARS -330bn in October. The economic activity index shrank by 0.7% yoy in September, 80bps lower than in the month prior, as forecasted.

Brazil: Consumer confidence declined by 0.2 points in November to 93.0.

Chile: The current account deficit increased to USD 4.5bn in Q3 2023, from USD 2.8bn in the second quarter. The yoy rate of real GDP growth rose by 0.6% in Q3 2023, up from -1.1% yoy in Q2 2023; 40bps higher than consensus estimates. PPI inflation rose by 1.0% mom basis, 90bps lower than in September, but PPI now accumulates 17.3% deflation in yoy terms, 80bps lower than in September. PPI would have to decline another 11% to bring the index back to the 2017-2020 trend line prior to the Covid-19 shock.

Mexico: Economic activity grew by 3.3% on a yoy basis in September, 40bps lower than August, but and 30bps above consensus. Real GDP was revised by 10bps to 3.3% in Q3 2023, as the economy grew by 1.1% qoq, 20bps higher than in Q2 2023, and 30bps higher than expected.

Central and Eastern Europe

Czechia: Consumer confidence declined 2 points to 90.7 in November while business confidence improved by 0.7 points to 93.5.

Hungary: The Central Bank of Hungary cut the key rate by 75bps to 11.5%, an increase in the cuts after a 50bp cut in the month prior. The unemployment rate in October was 4.1%, 20bps higher than September and 20 bps higher than consensus expectations.

Poland: PPI inflation declined by 4.1% in October from -2.7% yoy in September; 50bps lower than expectations and the fourth consecutive month in deflation. Sold industrial output grew by 1.6% yoy in October, 10bps lower than forecasted, but an improvement from the 3.3% yoy decline in September. Consumer confidence in October improved 2.8 points to -15.1. Real retail sales increased 2.8% yoy in October, up from -0.3% yoy in September and 110bps above consensus. The unemployment rate was unchanged at 5.0% in October, in line with expectations.

Central Asia, Middle East, and Africa

Dubai: CPI inflation rose by 4.3% yoy in October, from 3.8% yoy in September.

Egypt: The trade deficit declined to USD 3.1bn in September from USD 3.9bn in August.

Nigeria: The yoy rate of real GDP growth was unchanged at 2.5% in 3Q 2023, 30bps below consensus.

Oman: CPI inflation declined by 100bps to a yoy rate of 0.3% yoy in October.

South Africa: The Reserve Bank of South Africa (SARB) kept the policy rate unchanged at 8.25%, in line with expectations. The statement highlights that energy shortages are likely to improve, but the operations of ports and rails became a serious constraint. The weak Rand and elevated inflation pressures keep the SARB in high alert. Another issue is the elevated cost of borrowing, just above 11% due to low tax revenue, higher employee compensation and ongoing financing needs of state-owned companies keeping funding costs elevated. The yoy rate of CPI inflation rose by 50bps to 5.9% in October, 30bps higher than consensus. In sequential terms, CPI inflation increased 0.4% mom in October, after 0.2% in September. Core CPI inflation declined by 10bps to 4.4% yoy, 20bps higher than expected.

Türkiye: Consumer confidence grew by 0.9 points to 75.5 in November. The central bank raised the benchmark rate by 500bps to 40% on Thursday, 18 out of 25 surveyed economists predicted 37.5%. In its statement, the central bank said it intended to slowdown the pace of monetary tightening as current levels are likely to lead to moderation in activity and inflation. Foreign tourist arrivals for October rose by 3.8% yoy, down from 5.7% yoy in the month prior.

Developed Markets

Eurozone: Consumer confidence showed continued pessimism but with a 0.9-point improvement in November to -16.9, no change was expected.

Japan: The yoy rate of CPI inflation grew by 3.3% in October, 30bps higher than September and 10bps lower than consensus expectations. Japan composite PMI declined by 0.5 points in November to 50.0, manufacturing PMI declined by 0.6 points to 48.1, and services PMI increased 0.1 points to 51.7 in the month.

Netherlands: In politics, the party of far-right leader, Geert Wilders, gained the most seats (37 out of the 150) in the Dutch Parliament. Wilders is seen by many as one of the most far-right politicians in Europe, advocating for anti-immigration policies and stating he will work to curb the “asylum tsunami”, and help the “Dutch get their country back”.6 However, Wilders’ party will struggle to amass the 76-seat majority required to form a government. The liberal centre-right former incumbent VVD party (24 seats), announced on Friday it would not join a government with him.

United Kingdom: The composite PMI rose 1.4 points to 50.1 as the services PMI grew 1 point to 50.5 and the Manufacturing PMI was up 1.9 to 46.7, slightly higher than expected.

United States: In data, the US Leading Index for October shrank to -0.8%, 10bps lower than in September and consensus. Existing home sales dropped 4.1% mom to 3.8m in October, after declining 2.2% in September. Initial jobless claims declined to 209k, down from 233k in the week prior and 18k below expectations; and continuing claims dropped to 1840k, 22k lower than the week prior and 35k lower than forecast. US durable goods orders in October declined by 5.4% yoy, following a revised 4% yoy increase in September. The decline was mostly led by continued weakness in aircraft bookings and business equipment weakness. University of Michigan sentiment indicators, across the board, all indicated strengthening of both current conditions and expectations.

1. See – https://econpapers.repec.org/article/tprglenvp/v_3a16_3ay_3a2016_3ai_3a3_3ap_3a1-11.htm

2. See – https://edgar.jrc.ec.europa.eu/report_2023

3. See – https://blinks.bloomberg.com/news/stories/S4JY63DWLU68

4. See – https://colombogazette.com/2023/11/23/china-asked-to-share-copies-of-letter-on-sri-lanka-debt-restructuring

5. See – https://www.dailynews.lk/2023/11/23/admin-catagories/breaking-news/250827/imf-hails-sri-lanka-china-debt-accord

6. See – https://www.ft.com/content/312e43f2-a8be-445d-9d46-88d2ddf174a7

Benchmark performance