Strong US economic data could postpone the start of the interest rate cutting cycle

Unexpectedly strong US manufacturing activity returned to expansionary territory after 16 negative months. Chinese President Xi Jinping met with a group of US business leaders concerned about the Chinese economy. Erdogan’s party suffered a major defeat in Türkiye’s municipal elections. Nigeria aggressively hiked interest rates for the second consecutive month to combat inflation. Panama’s debt was downgraded to high yield status by Fitch. S&P revised its outlook for Morocco to positive, affirming its BB+ rating. Russia has ordered further oil output cuts in Q2 to reach the OPEC+ goal of 9m barrels per day. Gold prices hit a record high following the release of US factory data as the market rethinks the timing of rate cuts by the US Federal Reserve (Fed).

Global Macro

Apple, Google and Meta are being investigated by the European Union (EU) under its new digital law. This came after the US Department of Justice sued Apple for monopolising smartphone markets.1 The European Commission has focused on Apple and Google app stores, perceiving Apple as making it difficult for users to select an alternative browser to Safari, and Google as limiting search engine results to prefer its own services. Meta is under investigation for its plan to collect monthly fees for ad-free versions of Facebook and Instagram so users’ personal data cannot be used to customise online ads. The EU and the US are adopting the Chinese model, evidenced by the massive fine of Alibaba in 2019 for abuse of its dominant market position.2

The Congressional Budget Office head said the US faced an “unprecedented” fiscal burden path and warned of a “Liz Truss-style” market shock if left unaddressed.3 The independent fiscal watchdog stated that a crisis of the kind that led to a run on the pound and the collapse of the Truss government in 2022 could be in the offing without serious policy action as the US Federal debt reaches USD 26.2tn, or 97% of GDP. The current situation is the legacy of the 2017 Trump tax cuts and the sizeable stimulus spending during the Covid-19 pandemic. Trump has indicated he would renew the tax cuts which are set to expire in 2025 should he win the November presidential election. The Committee for a Responsible Federal Budget indicated that renewing the tax cuts would add an additional USD 5 trillion to the Federal debt between 2026 and 2035.

Geopolitics

Russia escalated its attacks on energy infrastructure in Ukraine as Ukrainian President Volodymyr Zelenskyy says Vladimir Putin will push war onto NATO soil “very quickly” unless he is stopped in Ukraine. A Russian missile violated Polish air space, leading to the scrambling of Polish and Allied aircraft.

Egypt reported the resumption of Gaza ceasefire negotiations in Cairo, but it remains unclear whether Hamas will participate. Protests broke out against Israeli Prime Minister Benjamin Netanyahu in Tel Aviv and other cities.

Emerging Markets

Asia

China: The People’s Bank of China (PBoC) Governor Pan Gongsheng said China's property market volatility has a limited impact on the country's financial system, and some "positive signals" have emerged in the market.4 The Province of Shenzhen saw sales volumes up for six consecutive weeks after streamlined secondary housing sales. President Xi Jinping met with a group of US business leaders concerned about the Chinese economy and stated, “China’s reform will not stop and its opening up will not stop.” He also promised “major measures to comprehensively deepen reforms.” At the same time, US Treasury Secretary Janet Yellen criticised China’s use of subsidies to support its preferred industries including electric car, battery, and solar panel producers, threatening retaliatory trade actions if China does not reduce subsidies.

Malaysia: Bank Negara Malaysia (BNM) confirmed its 2024 GDP growth forecast of 4-5% based on sustained improvement in exports and tourism.

Philippines: President Ferdinand Marcos Jr said the country will undertake proportionate and reasonable countermeasures against “illegal, coercive, aggressive and dangerous attacks” by China’s military in the South China Sea.

Sri Lanka: The Central Bank of Sri Lanka surprised the market with a 50bps cut, moving the corridor to 8.5%-9.5%, with inflation hovering around the 5% mark.

Thailand: Tourist arrivals rose to 3.4m in February (93% of pre-Covid levels), from 3.1m (82% of pre-Covid) in January. Tourism was boosted by the Lunar New Year holiday as daily arrivals fell from 112k in February to 96k in March. The trade deficit narrowed to USD 554m in February from USD 2.758bn in January, in line with consensus. Car sales remained soft at 52.8k in February, down from 54.6k in January.

Vietnam: Following Q4’s strong GDP print of 6.7% yoy expansion, growth fell back to 5.7% yoy in Q1 2024 with a slowdown in the agricultural, manufacturing and services sectors. FTSE Russell announced it will retain Vietnam’s status as a frontier market and needs to see more improvements in access to the local equity market and settlement issues.

Latin America

Argentina: The monthly economic activity index declined 4.3% yoy in January, an improvement over the 4.5% yoy contraction in December and ahead of survey expectations. The index was boosted by the agricultural sector but saw a decline in manufacturing.

Brazil: Consumer price index (CPI) inflation slowed to 0.4% in mom terms in the first 15 days of March from 0.8% in February, and the yoy rate slowed to 4.2% from 4.5%, in line with consensus. The central government posted a BRL 58.4bn primary fiscal deficit in February, in line with consensus estimates. The February figure puts the 12-month deficit figure at 2.3% of GDP, increasing from 2.1% of GDP in the prior month, as primary spending increased by 17.2% yoy, while net revenues increased at a slower 9.5% yoy pace. The Central Bank of Brazil (BCB) released its Q1 2024 inflation report with a new 2026 year-end inflation forecast at 3.2%, which means BCB inflation forecasts for all horizons (2024 – 2026) remain above the 3.0% mid-point target, at 3.5%, 3.2% and 3.2% for 2024, 2025 and 2026, respectively. The BCB is forecasting the Selic rate at 9.0%, 8.5% and 8.5% for the comparable year-ends. The BCB also revised higher its 2024 GDP growth forecast to 1.9% from the 1.7% level contained in its Q4 2023 inflation report. The government is facing a 15 April deadline to submit its 2025 Budget Proposal to Congress.

Chile: Signs of recovery continued with the release of February data. Manufacturing production increased 8.8% yoy after a 6.5% yoy increase in January, while industrial production was up 7.9% yoy after a 3.6% yoy increase in January. Retail sales increased 3.9% yoy following a 2.2% yoy increase in January. Confirmation of the ongoing recovery was confirmed in the release of the February Economic Activity Index, which reported activity up by 0.8% mom and up 4.5% yoy.

Dominican Republic: The central bank held the policy rate steady for the fourth consecutive month at 7.0%. The accompanying communique highlighted the expectation that global interest rates will remain higher for longer. February headline inflation was reported at 3.3% yoy, while core inflation declined to 4.0%, leading the central bank to reiterate that both headline and core are expected to remain within the 4% +/-1% target through the end of 2024.

Panama: Fitch lowered its BBB- rating with a negative outlook to BB+ with a stable outlook. With one high yield (HY) rating, attention has shifted to Moody’s to see when it will lower its Baa3 rating to HY. Fitch highlighted "fiscal and governance challenges," as well as the lingering impact of the closure of the Cobre Panamá mine. A second HY rating would trigger forced selling from investment grade-dedicated funds.

Venezuela: The opposition coalition was blocked in its attempt to register its preferred replacement candidate, 80-year-old university professor Corina Yoris, by the mandated deadline. However, the National Electoral Council announced that former ambassador Edmundo Gonzalez Urruti, candidate of the Democratic Unitary Platform (PUD), was named as a provisional candidate “given the clear impossibility of registering the chosen candidate so far.” Another opposition candidate, Manuel Rosales of the Un Nuevo Tiempo Party, was also able to register to “open a space for Venezuelans to vote.” The decision to block Yoris from registration was widely criticised by the UN, the US and other countries in the region.

Central and Eastern Europe

Bosnia and Herzegovina: The European Council voted to open accession negotiations for EU membership.

Hungary: The National Bank of Hungary cut its policy rate by 75bps to 8.25%, in line with consensus. It lowered both inflation and GDP targets for 2024, inflation lower by 0.5% to 3.5-5% and GDP lower by 0.5% to 2.0-3.0%.

Poland: Moody’s affirmed Poland’s A2 long-term senior unsecured rating, which is supported by “very strong economic and fiscal strength…and strong institutions including improving strength of civil society and the judiciary.”

Russia: The government ordered companies to cut their oil output in Q2 in order to meet a production target of 9m barrels per day, in line with OPEC+ pledges.

Middle East and Africa

Morocco: Ratings agency S&P raised its outlook to positive from stable and affirmed its BB+ rating. It expects GDP growth to accelerate with a 3.6% average expansion in 2024-2027 and expects the budget deficit to fall to 3% of GDP by 2027.

Nigeria: The central bank hiked its policy rate by 200bps to 24.75%, 75bps above consensus, to address soaring inflation and support the naira (NGN). The move follows an aggressive 400bps hike in February. The uptick in inflation has been driven by an end to fuel subsidies and two devaluations of the currency.

Senegal: Opposition leader Bassirou Diomaye Faye was declared winner of the presidential race and received congratulations from incumbent President Macky Sall, raising expectations of a peaceful transition of power.

South Africa: The electoral court rejected the African National Congress (ANC) bid to remove former President Jacob Zuma from the presidential election ballot. The ANC expelled Zuma after he was accused of corruption. Zuma’s new party is set to gain significant votes from the ANC in its Kwa-Zulu Natal home state, threatening to bring his former party out of government for the first time since 1994. The central bank held the repo rate steady at 8.25% and noted that while growth risks are balanced, inflation risks remain to the upside, and a return to the 4.5% midpoint target is unlikely before the end of 2025.

Tunisia: Ratings agency Moody's changed the outlook on its Caa2 rating for Tunisia's sovereign debt to stable from negative as a "material reduction of the current account deficit […] supported the resilience of reserves" and resilient support from the country’s international partners.

Türkiye: President Erdogan’s AK Party suffered a major defeat in municipal elections, with opposition leader (and Istanbul Mayor) Ekrem Imamoglu’s CHP winning big in major cities across the country. The opposition maintained its gains from the 2019 elections and won 35 cities (2019: 21 cities) while the AKP/MHP alliance won 32 cities (2019: 50 cities).

Zambia: After signing a restructuring agreement with China, the Zambian government announced it had reached an agreement on a debt restructuring with the bondholder committee that will see external debt repayments resume later this year. The terms of the restructuring are deemed compatible with the Official Creditor Committee’s assessment of comparability of treatment.

Developed Markets

United States: President Joe Biden signed into law a USD 1.2trn government spending package. He called for a national security supplement which included funding for Ukraine. The bill passed Congress with 185 Democrats and 101 Republicans voting for it. Georgian Republican Marjorie Taylor Greene filed a motion to vacate the Republican House Speaker, but Democrats said they would support him.

A cargo ship crashed into, and caused the collapse of, the Francis Scott Key Bridge in Baltimore, diverting shipping at one of the busiest ports on the US East Coast and creating delays and elevated costs in a disruption to global supply chains.

In economic data news, durable goods orders rose by 1.4% mom in February (+0.5% ex-transportation) after declining 6.9% in January (-0.3% ex-transportation). Capital goods orders rose 0.7% mom from -0.4% mom over the same period. The S&P Case-Shiller house prices rose by a yoy rate of 6.6% in the largest 20 cities of the US and by 6.0% across the country in January, in line with consensus, but above the prior month at 6.2% and 5.6%, respectively. Consumer confidence was unchanged at 104.7 (107 est.).

The Commerce Department reported personal consumption expenditures (PCE) inflation up 2.5% yoy in February, marginally higher than the 2.4% print in January and in line with expectations. The Fed officially targets PCE as it looks to achieve its 2% annual inflation objective, indicating that while inflation continues to cool, it has further to go to meet the target. ISM manufacturing activity rose 2.5 points in March to 50.3 after 16 months of declining activity, reflecting a sharp rebound in production and stronger demand. The ISM data provides further confirmation that the US economy grew at a healthy pace in the first quarter of 2024, but raised concerns that the Fed may opt to wait until after June to commence its rate cutting cycle.

Last week was a good week for Donald Trump as a New York appeals court lowered the amount of a bond he would be required to post from USD 454m to USD 175m, after Trump was unable to find any insurance company that would underwrite a bond for the higher amount with real estate as collateral. Trump received the good news while he was in court for a separate criminal case concerning the falsification of business records to hide a hush-money payment to a porn star before the 2016 election. Separately, Trump’s Truth Social media platform went public; Trump owns approximately 60% of the company, which now trades on the Nasdaq stock exchange.

Japan: As the Yen hit a 34-year low, Japan’s Ministry of Finance hinted that the Bank of Japan would intervene to support the currency. Vice Minister Masato Kanda said, “the recent weakening of the Yen cannot be said to be in line with fundamentals” and “we will take appropriate action against excessive moves without ruling out any options.”

UK: The Office for National Statistics confirmed the UK entered a shallow recession in 2023, with Q3 GDP falling by -0.1% and Q4 GDP falling by -0.3%, in line with preliminary estimates. More recent data, notably a monthly GDP increase of 0.2% in January, indicates a stronger start to 2024, but the 2023 outcome poses a challenge for Prime Minister Rishi Sunak in advance of elections expected later in 2024.

1. See – https://www.justice.gov/opa/pr/justice-department-sues-apple-monopolizing-smartphone-markets

2. See – https://www.reuters.com/business/retail-consumer/china-regulators-fine-alibaba-275-bln-anti-monopoly-violations-2021-04-10/

3. See – https://www.ft.com/content/c43cf841-174a-457f-92de-be2c44dbb440

4. See – https://www.globaltimes.cn/page/202403/1309505.shtml

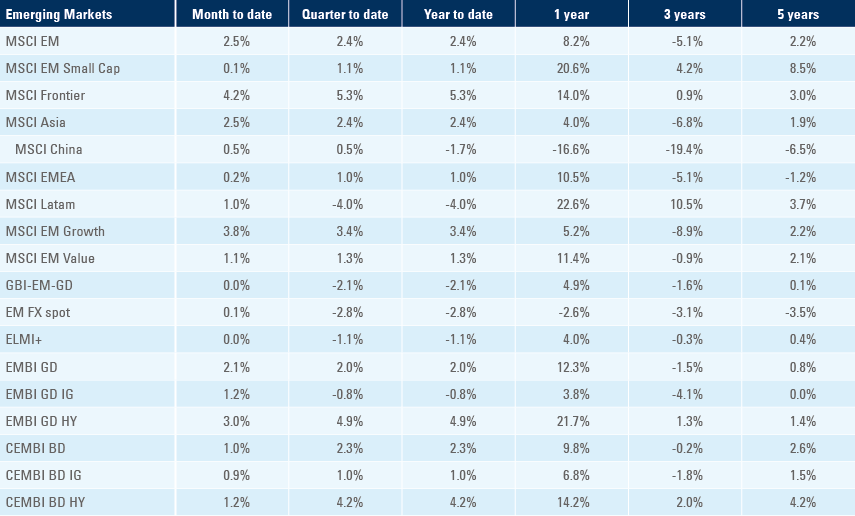

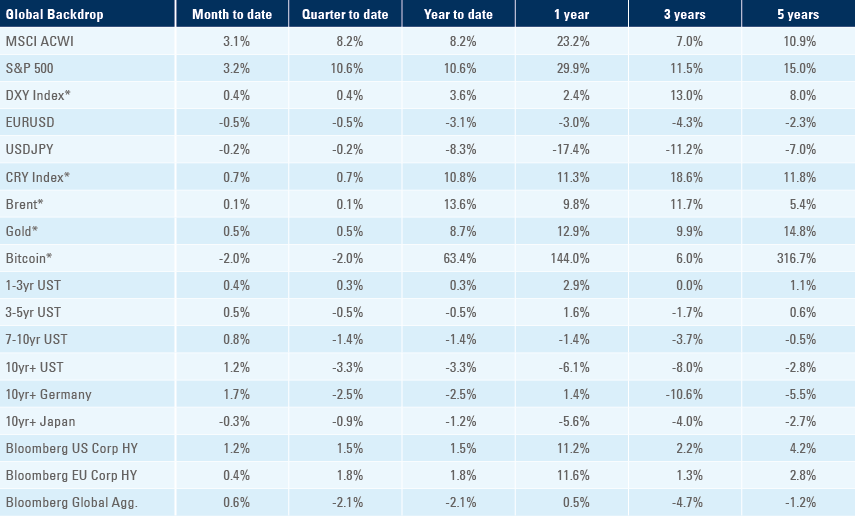

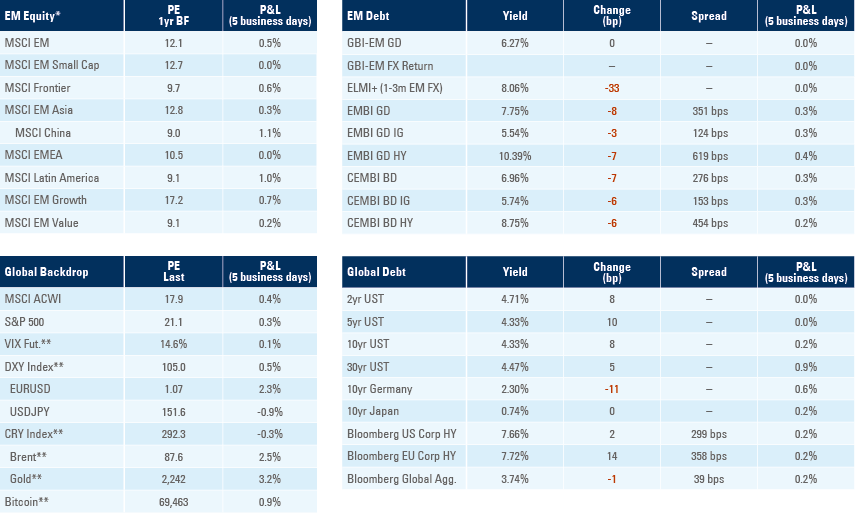

Benchmark performance