- Upwards GDP revisions in US lead markets to reprice ‘bullish scenario’ of rate cuts and soft-landing.

- Strikes in Israel after nationwide protests against Netanyahu’s handling of hostage negotiations.

- China considers a plan to allow homeowners to refinance up to USD 5.4trn in mortgages.

- Credit rating agencies upgrades in Pakistan, Montenegro and Uganda.

- Lula appoints Brazil’s new central bank Governor.

- Judicial reform approved by a Congress Committee in Mexico.

- South African Rand hits 13-month high.

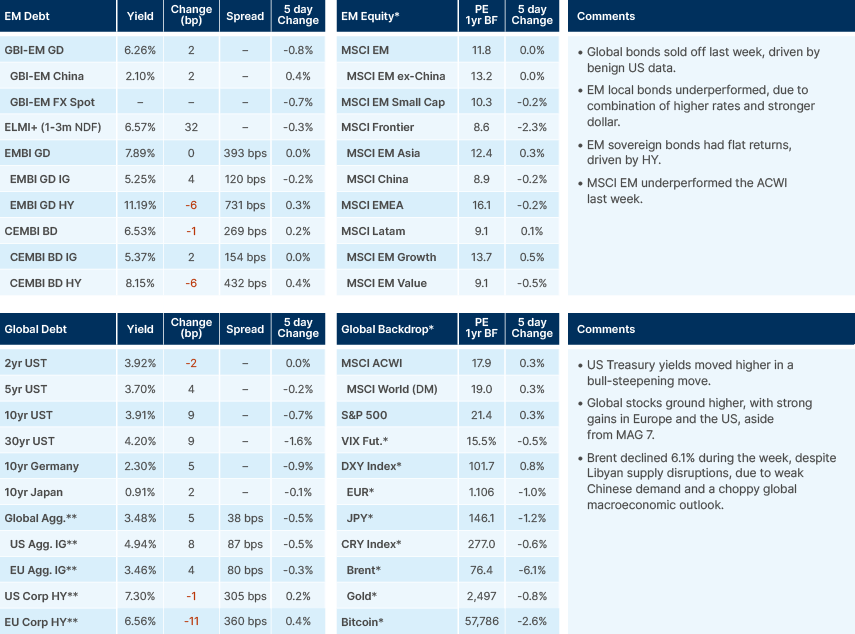

Last week performance and comments

Global Macro

After more benign US data releases, markets moved to price the bull ‘soft landing’ case of rate cuts, but no recession. The US second-quarter gross domestic product (GDP) growth rate was revised upward to 3% annualised, from the previously estimated 2.8%, indicating stronger-than-expected economic performance. On a year-over-year (yoy) basis, GDP is up 3.1%, a very healthy number. Core Personal Consumption Expenditures (PCE) inflation for the same quarter was also revised in the right direction, from 2.9% to 2.8%, suggesting a slight easing of inflationary pressures. On the labour market front, weekly jobless claims were lower than expected, pointing to a resilient employment situation. However, a note of caution was raised by Bank of America Merrill Lynch (BAML), which highlighted that private sector jobs now constitute less than 40% of total hiring—a threshold that has preceded recessions in the last six instances.

The positive economic data led to increased optimism about the direction of the US economy, driving the equal-weighted S&P 500 to new highs. However, AI-related stocks, particularly those following NVIDIA’s earnings results, underperformed, which kept the market-cap-weighted S&P 500 index relatively flat. In the bond market, the favourable data reduced expectations for a 50 basis points (bps) rate cut by the US Federal Reserve (Fed) in September, with the probability dropping from 36% to 32%. This shift in expectations also resulted in a selloff in 10-year US Treasury bonds, pushing yields from 3.8% to 3.9% over the course of the week.

In Europe, stock markets reached new highs on Thursday after Germany’s preliminary August consumer price inflation (CPI) came in 20bp lower than expected, at 2% on the EU harmonised level, marking the lowest level since March 2021 and raising expectations that the European Central Bank (ECB) may continue cutting rates in coming meetings. This outlook was further supported by Friday’s Eurozone inflation release for August, which showed a significant decline to 2.2% yoy, down from 2.6% in July.

Commodities

Oil prices are experiencing significant intraday swings, with disruptions in Libyan oil supply and softer demand, particularly from China, are contributing to the heightened volatility in the market. Brent futures have reflected this instability, with an average daily trading range of USD 2.29 in August, marking the widest range since January. Additionally, the 30-day historical volatility in oil prices has reached its highest level so far this year, as traders brace for continued volatility towards the end of the year. This expectation is fuelled by a choppy macroeconomic outlook and the anticipation that OPEC+ will gradually increase supply by scaling back its current supply curbs.

Geopolitics

China/US

US President Joe Biden’s National Security Advisor, Jake Sullivan, began his first one-on-one talks with Chinese President Xi Jinping. Both sides are seeking to stabilise relations ahead of the US Presidential election in November, as Beijing prepares for a turbulent period in US politics, with both Vice-President Kamala Harris and former President Donald Trump likely to maintain a ‘tough on China’ stance, adding to the complexity of the bilateral relationship.

Israel

The head of Israel’s biggest labour union called a one-day general strike on Monday, as protests continue over what is seen as the government’s failure to secure the release of Hamas hostages. This comes after six hostages were found dead in an underground tunnel in Rafah on Saturday, leading to tens of thousands of people protesting across Israel on Sunday.

Emerging Markets

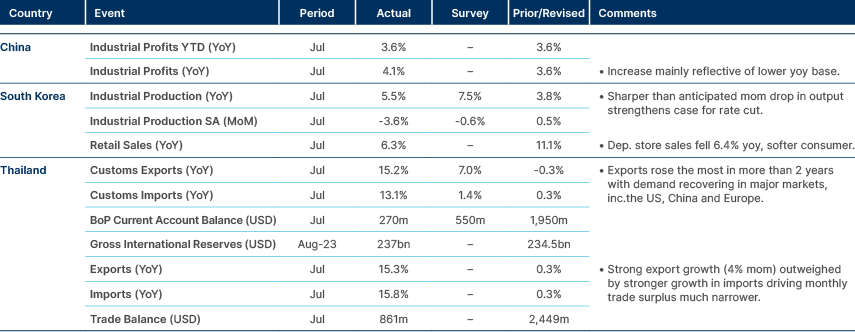

Asia

Weaker output in South Korea, but stronger in Thailand.

China

China is considering a plan that would allow homeowners to refinance up to USD 5.4trn in mortgages. This initiative could enable homeowners to renegotiate terms with their current lenders before January, a time when mortgage rates are typically repriced by banks. If implemented, this would mark the first time since the Global Financial Crisis that refinancing mortgages with a different bank might be permitted. The plan is aimed at reducing mortgage costs, building on a previous push from the People’s Bank of China last year, which encouraged a rate cut on outstanding first-home mortgages.

This move comes in response to China's housing-led economic slowdown, which has led to a decline in consumer demand growth, as highlighted by recent disappointing earnings reports from consumer companies like Alibaba. While the plan is likely to be positive for consumers by lowering mortgage rates, it could also lead to reduced profitability for state-run Chinese banks due to net interest margin (NIM) compression.

Pakistan

Ratings agency Moody's has upgraded Pakistan's credit rating to Caa2 and changed the outlook to positive, citing improvements in the country's macroeconomic conditions and liquidity. A key factor contributing to this improved outlook is the increased certainty surrounding Pakistan's external financing, particularly following the staff-level agreement with the International Monetary Fund (IMF) for a 37-month Extended Fund Facility totalling USD 7bn. Moody's expects the IMF board to approve this agreement in the coming weeks.

Although Pakistan's foreign exchange (FX) reserves have nearly doubled since June 2023, Moody's cautions that the reserves are still insufficient to fully meet the country's external financing requirements. As a result, Pakistan remains dependent on timely financial assistance from official partners to meet its external debt obligations.

Latin America

Brazil CPI moderating, Mexico trade deficit narrower.

Brazil

President Luiz Inácio Lula da Silva appointed Gabriel Galípolo to head the country’s central bank Banco Central do Brasil (BCB), after sharply criticising the current Governor over high interest rates. If confirmed by the Senate, Galípolo will take over the position at the start of 2025. The BCB cut interest rates to an all-time low of 2% during the pandemic, but later aggressively raised rates into the double digits. Despite a series of rate cuts in 2023 and 2024, the benchmark rate remains at 10.5%. Investors are keenly watching for signs of whether Galípolo will adopt a more dovish approach or continue the hawkish stance of his predecessor.

The country is also facing a drought expected to increase electricity bills starting in September, according to O Globo newspaper. Brazil has a monthly three-flag system that raises electricity costs when there is a rising demand for thermal plants during peak hours, which will come with lower electricity generation from hydropower.

Mexico

The Morena Party and its allies have approved a Judicial Reform in the Constitutional Points Committee of the Chamber of Deputies. The reform includes the controversial introduction of “faceless judges”, intended to protect the identities of judges handling organised crime cases. Despite extensive debates and over 250 proposed amendments from the opposition, Morena rejected most changes, maintaining the core aspects of the reform, including the popular election of judges, magistrates, and ministers. Critics argue these elections could undermine judicial independence by prioritising popularity over technical qualifications. The reform still needs approval from the full Chamber of Deputies before becoming law, and debates will begin on Tuesday.

The peso weakened by 3.5% during the week up to Thursday before paring back some of the losses, as investors began factoring in the risks posed by this judicial reform to the country’s stability. Various business leaders and notable voices, including the US Ambassador to Mexico, have warned of the potential negative consequences of the reform, which could impact foreign investments and possibly lead to a downgrade from credit rating agencies due to a perceived weakening of the democratic constitutional framework. Claudia Sheinbaum, a key figure in Mexico's ruling coalition, stated that they fell just one senator short of securing a supermajority in the Senate on Wednesday after two opposition senators defected.

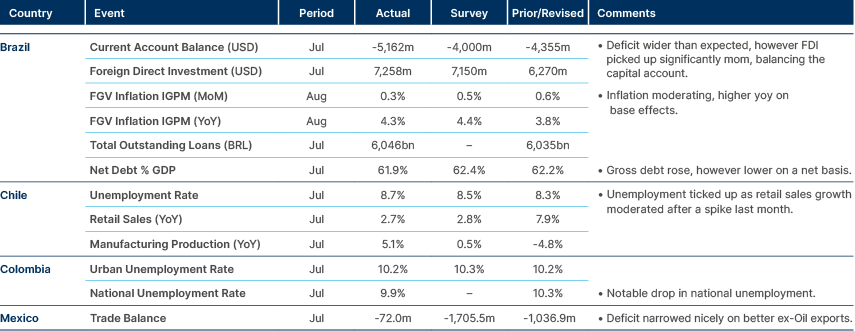

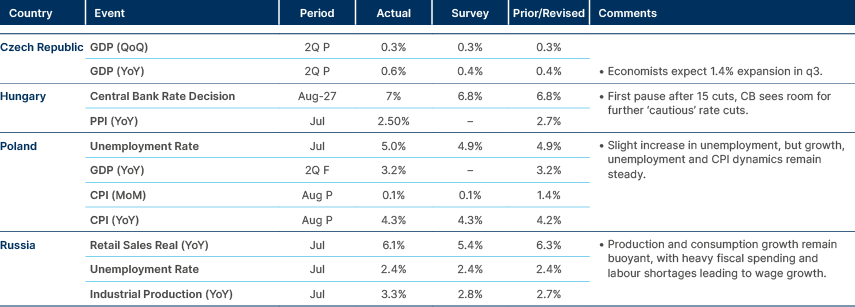

Central and Eastern Europe

Pause in cuts in Hungary.

Montenegro

S&P upgraded Montenegro to “B” +, citing its “strong nominal GDP growth and improved budgetary performance helped reduce net general government debt from a peak of 78% of GDP in 2020 to a projected 53% of GDP in 2024, which is also below the pre-pandemic level.”

Serbia

Moody's said it had raised Serbia's outlook to positive from stable on prospects of a further sustained economic and fiscal improvement, while affirming the government's long-term issuer and senior unsecured debt ratings at “Ba2.”

Central Asia, Middle East, and Africa

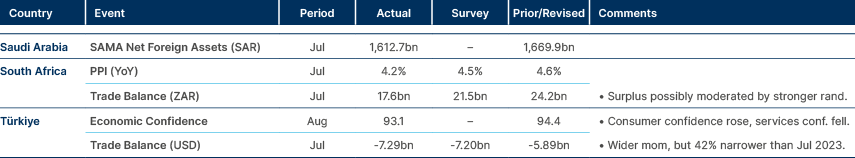

South Africa steady, Turkey trade deficit much improved yoy.

South Africa

The South African Rand reached a 13-month high on Friday as investors grew increasingly optimistic about the country’s economic outlook and with anticipated rate cuts in the US putting downward pressure on the dollar. Expectations of easing by the Fed are driving investors to seek higher-yielding assets, such as South African Rand-denominated bonds, which have experienced net inflows of USD 930m over the past five days, according to Bloomberg.

The recent end to load-shedding in South Africa has significantly improved the country’s growth outlook, while the ongoing disinflation reflects the cumulative impact of earlier monetary tightening. When these factors are combined with the favourable expectations surrounding Fed easing, the conditions appear to be set for a sustained rally in the Rand.

Uganda

Fitch downgraded Uganda to “B”, reflecting “heightened fiscal risk and external liquidity pressures given the relaxation of fiscal consolidation plans, high fiscal financing needs, renewed deterioration in government interest costs/revenue, reduced access to concessional financing, high domestic borrowing costs and a decline in foreign exchange reserves.”

Developed Markets

Benign US and Eurozone data, higher inflation in Japan

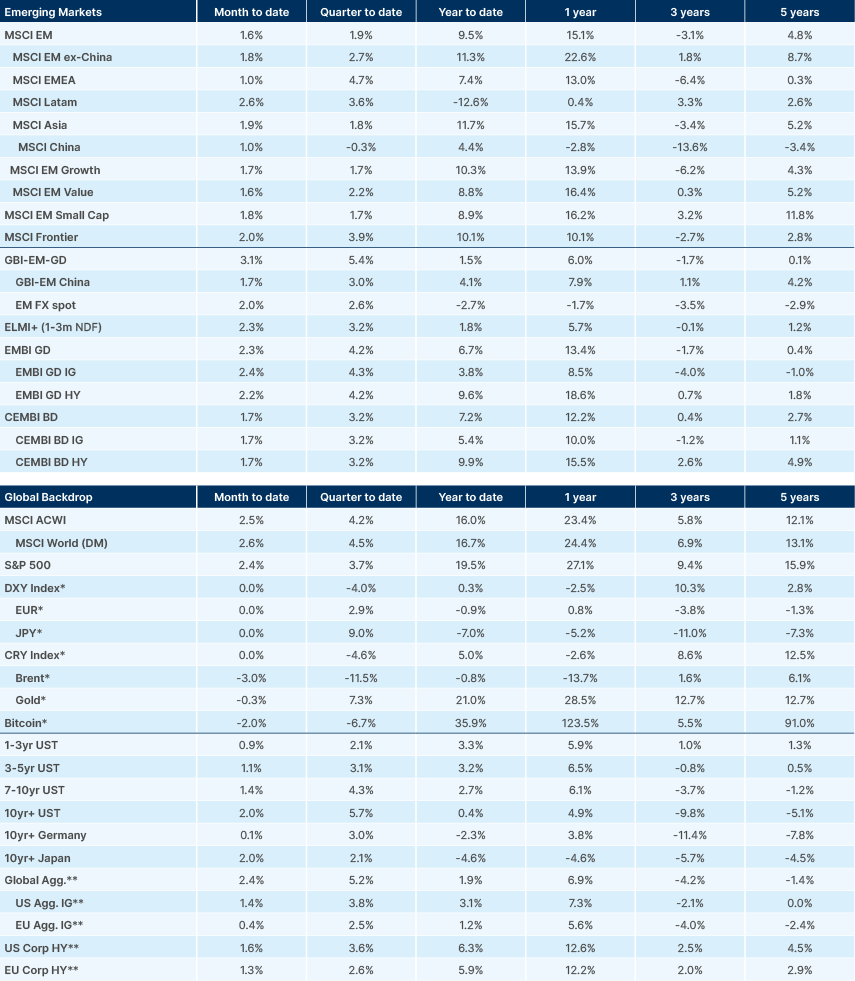

Benchmark performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.