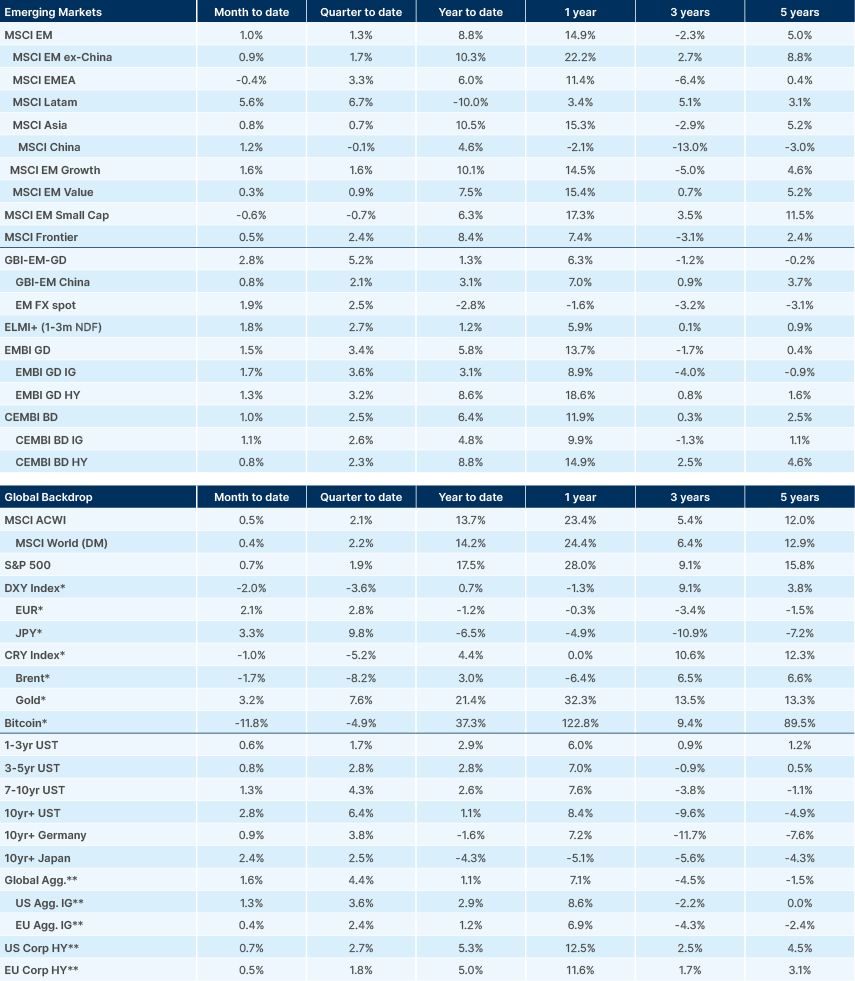

- Very strong week for global equities, spurred by benign US retail sales and jobs data.

- MSCI ACWI is now just 1.7% away from July record high.

- Jokowi’s last budget kept an austere framework in Indonesia.

- The Thai parliament quickly appointed Paetongtarn Shinawatra as Prime Minister after Srettha Thavisin was found guilty on an ethics violation case.

- The Philippines Central Bank cut policy rate by 25bps.

- Argentina’s inflation declined to the lowest level since Q2-2022, and Türkiye’s inflation expectations dropped further.

- Jackson Hole Economic symposium likely to mark switch in Fed’s focus to both sides of its “dual mandate.”

- Hamas ceasefire talks in Doha signalling little progress, so far.

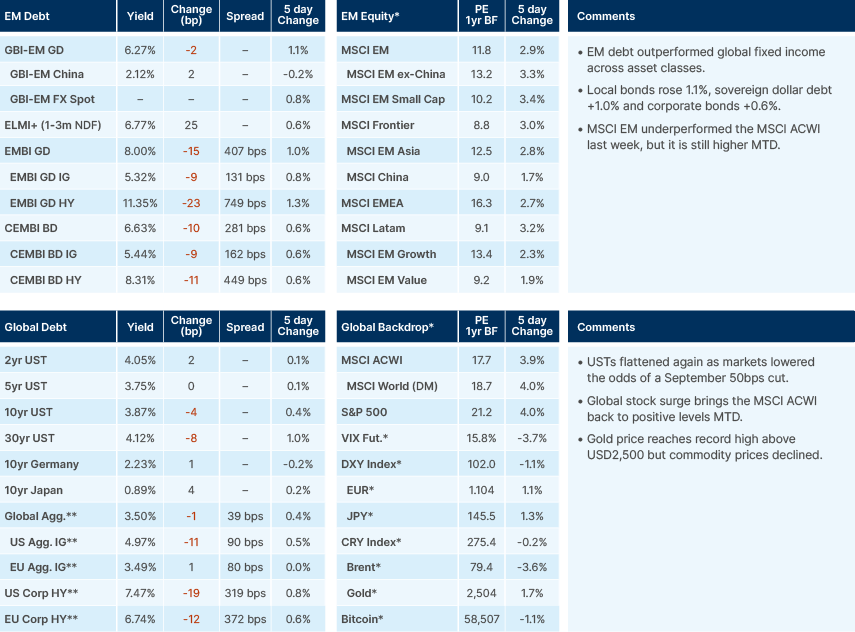

Last week performance and comments

Global Macro

Global equities had their best week of the year, as investors brushed off recent concerns about a potential US recession. The MSCI All Countries World Index (ACWI), which tracks global developed market and Emerging Market (EM) stocks, had its strongest week since early November 2023, rising 3.8%. These movements followed a 1.6% gain in Wall Street's S&P 500 on Thursday, spurred by strong retail sales data that reassured investors about the US economy's resilience.

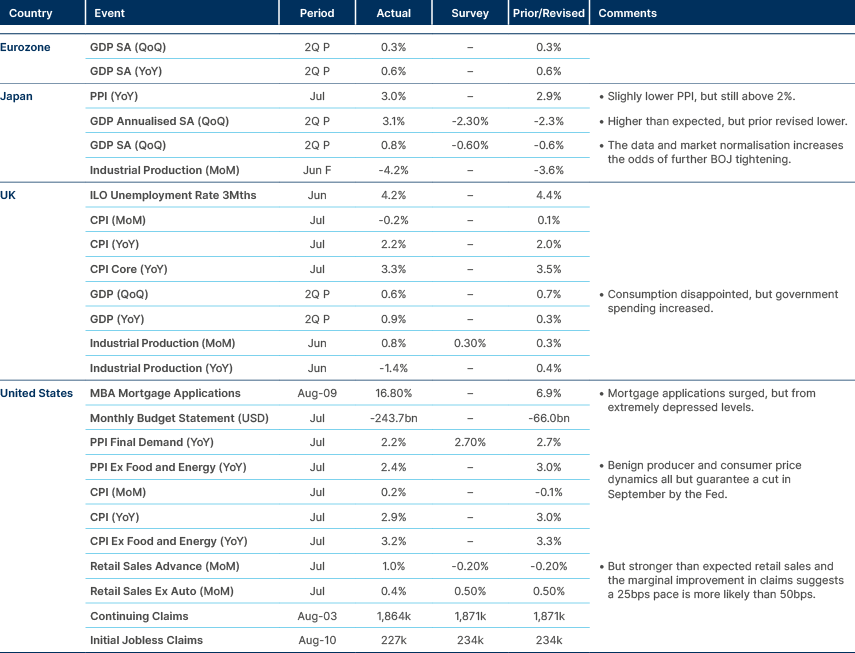

Fed Funds futures now price 117 basis points (bps) of cuts (c. 29bps per meeting) over the next six months, down from 157bps (39bps per meeting) last week. This suggests rates are still pricing a negative picture for growth as the markets only priced this much easing ahead in 2000 and 2008, when the Federal Open Market Committee cut the effective Fed Funds rate by 475bps and 500bps during each cycle, to 1.75% and 0.15%, respectively.

This week is light in terms of economic data. The focus will be on the Democratic convention in Chicago and on the Jackson Hole Symposium. On the first, Kamala Harris’s main challenge is to maintain the unity within the Democratic Party that Joe Biden achieved by steering policy to the left. Last week, Harris pledged to implement price controls, a policy that has failed many times in history across countries.

In Jackson Hole, the cyclical and structural factors suggest the Federal Reserve (Fed) will signal another meaningful calibration of its policies. After moving to average inflation targeting (FAIT) in 2020 and the belated hawkish stance in 2022, the Fed will shift the focus to the growth side of its dual mandate. Cyclically, the softening of the labour market and inflation data over the last two weeks gives a green light for focusing on growth risks.

However, the fact that risks are more symmetrical does not mean that they have declined. In fact, it is the other way round. On one hand, the Fed cannot afford to get into a recession right after the cost-of-living crisis that kept Biden’s popularity on the ropes. On the other hand, the ongoing populist policies alongside the risk of more supply shocks means that monetary policy easing may be followed by higher inflation once again.

Geopolitics

Israel/Hamas ceasefire talks

International mediators, including the US, Egypt, and Qatar, held talks in Doha to broker a ceasefire in Gaza and secure the release of Israeli hostages held by Hamas. The US is actively pushing for a resolution that would reduce regional tensions, provide humanitarian relief to Palestinians, ensure Israel's security, and prevent a wider conflict. However, several key obstacles remain.

Israeli Prime Minister Benjamin Netanyahu is steadfast on several points: he refuses to withdraw Israeli forces from the Gaza-Egypt border, known as the Philadelphi corridor, and opposes the unvetted return of displaced Palestinians to northern Gaza. Netanyahu has also so far rejected any permanent ceasefire, only considering a six-week truce. He insists that these are longstanding conditions, blaming Hamas for the current deadlock.

Hamas, on the other hand, demands a comprehensive ceasefire, the complete withdrawal of Israeli forces from Gaza, the return of displaced Palestinians, and the reconstruction of Gaza. Despite some progress in narrowing gaps, these unresolved issues, particularly Netanyahu’s security demands and Hamas’s insistence on a full ceasefire and withdrawal, remain significant hurdles to reaching an agreement. The situation is further complicated by recent assassinations of militant leaders, increasing fears of regional escalation, while the humanitarian crisis in Gaza continues to worsen.

Russia/Ukraine

Ukraine's rapid offensive into several Russian border regions aims to pressure Moscow into engaging in “fair” negotiations over the war in Ukraine, according to an aide to President Volodymyr Zelenskyy. Ukrainian presidential adviser Mykhailo Podolyak stated on the Telegram messaging app: "We must deliver significant tactical defeats to Russia. In the Kursk region, it's evident how military force is being strategically employed to compel the Russian Federation to participate in a fair negotiation process."

Emerging Markets

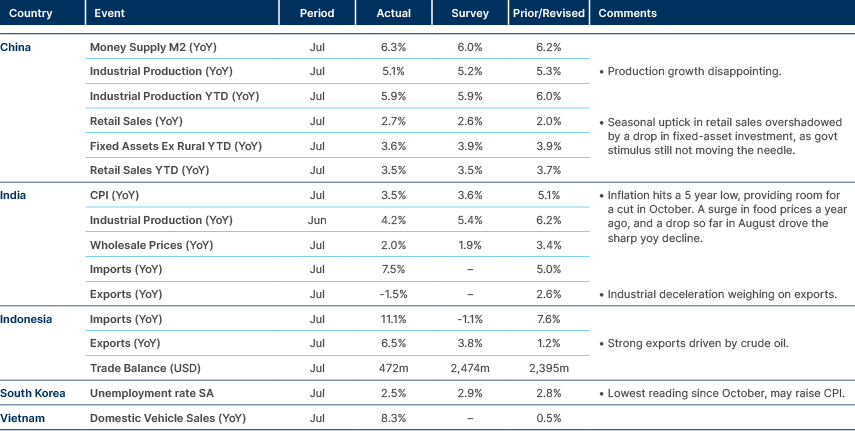

Asia

Anaemic activity in China remains. Low inflation in India and strong external accounts in Indo.

China: July economic data showed continued softness, with Morgan Stanley projecting nominal GDP growth at a subdued 4% year-on-year for the third quarter of 2024. While infrastructure capital expenditures have improved, this has been offset by weakness in consumer spending during July.

Indonesia: President Joko Widodo, commonly known as Jokowi, used his tenth and final budget to solidify his legacy and gain the support of his successor, Prabowo Subianto. Prabowo will inherit a solid financial position with some room for additional spending. Jokowi has set a target deficit of 2.5% of GDP for the 2025 budget, which is lower than this year's projected deficit of 2.7% and significantly below the 3% legal limit. The budget marks a shift in focus from infrastructure spending, which had driven much of Jokowi's economic growth strategy, to prioritising education and nutrition, in line with Prabowo's policy goals. The government set a conservative target for revenue growth of 6.9%, below nominal GDP growth, to cover for higher social benefits, including the free lunch programme for students (0.3% of GDP for the first year). The tax on sugar is a constructive way of increasing taxes indirectly, whilst the energy subsidy increase due to higher consumption is a negative aspect. Overall, debt issuance levels are likely to remain low, which is positive for bonds.

Thailand: The Constitutional Court found Prime Minister Srettha Thavisin guilty of an ethics violation, leading to his dismissal and the dissolution of his government. Just days later, Paetongtarn Shinawatra, the youngest daughter of former Prime Minister Thaksin Shinawatra, won a parliamentary vote to become Thailand's next leader. At 37 years old, she is the youngest person ever to hold the position. Her appointment maintains a delicate coalition between the Shinawatra-controlled Pheu Thai Party and various royalist, conservative, and military-aligned parties that partnered after last year's election. Disruption will likely be limited. However, for a material increase in investor confidence, her government will have to be clear on plans to tackle high household debt, improve export competitiveness. and address issues related to an aging population. One key issue investors will be monitoring is the potential reduction of some of the planned digital-wallet handout programme scheme, which would help trim future government borrowing requirements. The government is also expected to implement measures to improve stock price stability in early September.1

Philippines: The central bank cut its deposit and lending policy rates by 25 bps, bringing them to 5.75% and 6.0% respectively, aligning with the predictions of 13 out of 23 analysts surveyed by Bloomberg. This move follows a series of rate hikes totalling 450 basis points between 2022 and 2023. The central bank now forecasts inflation at 3.4% in 2024, down from the peak of 4.7% in October 2023 when the bank last raised rates between meetings. Inflation is expected to further soften to 3.1% by 2025. The expectation of future US rate cuts and a stronger Japanese yen, which would probably strengthen the Philippine peso, were key factors in the central bank's decision. A stronger currency tends to stabilise inflation and inflation expectations.

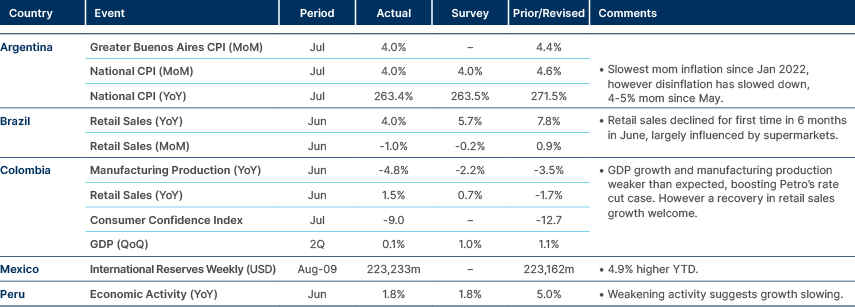

Latin America

Best performing region in equity space QTD +6.7%, still worst YTD -10%

Argentina: The consumer price index (CPI) of inflation fell to 4% month-on-month, an annualised rate of 60% year-on-year, marking the lowest level of the year. This rate is four times lower than the inflation rate over the previous 12 months. Core inflation also slowed to 3.8% month-on-month.

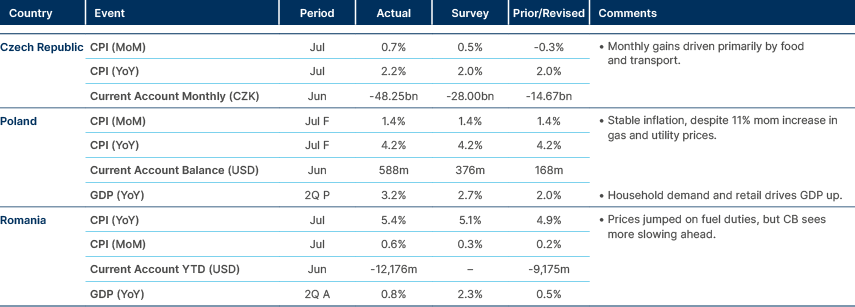

Central and Eastern Europe

Labour market remains soft in South Africa. Inflation higher in Czech and Romania. Stronger GDP in Poland, weaker in Romania.

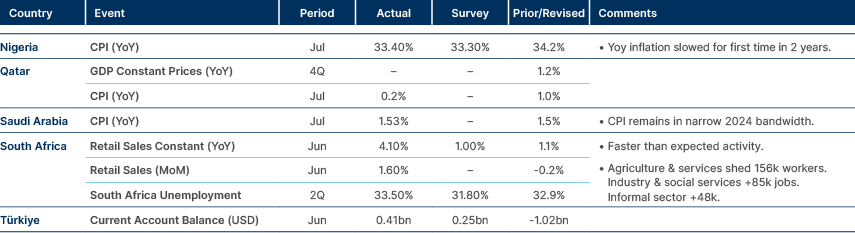

Türkiye: Inflation expectations for the next 12 months declined by 130bps to 28.7% year-on-year, down from a peak of 45.3% in October 2023. Although this represents progress, it is still insufficient for the Central Bank of Türkiye to meet its 2025 inflation target of 14%. Inflation expectations are likely to approach this target once the current CPI rate decreases to around 1.0% month-on-month (12.7% year-on-year).

Central Asia, Middle East, and Africa

Labour market remains soft in SOAF.

Developed Markets

Stronger economic activity in the US. CPI lower in both US and UK.

Japan: Prime Minister Fumio Kishida announced his resignation, with the Liberal Democratic Party (LDP) set to appoint a new caretaker Prime Minister to lead it into the upcoming election, which must be announced before an unspecified deadline. It is highly likely that the political dispute within the LDP influenced the Bank of Japan's (BOJ) recent shift towards a more hawkish stance. The current monetary policy has led to a persistent depreciation of the Japanese yen, eroding the purchasing power of the population. The primary challenge for the next government and the BOJ will be to reverse the ultra-easy monetary policy in a way that maintains higher levels of wages and inflation. The unwinding of energy subsidies, which were introduced during the COVID-19 pandemic, will be one of the first major challenges. Meanwhile, GDP data shows that consumption and business spending have risen, although previous figures were revised lower.

Benchmark performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.

1. See – https://www.bangkokpost.com/business/investment/2848563/investors-await-clarity-on-cabinet-digital-wallet