President Milei sworn in and launches Argentina’s great economic experiment

Fossil fuel industry showdown at COP28. China’s imports slow down. Argentina cheers as new President Milei promises belt-tightening. Suriname concludes its protracted debt restructuring deal. Venezuela’s Maduro turns the heat on Guyana likely to bolster his political appeal; The US employment report paints a resilient picture and prices out rate cuts previously priced into the yield curve as soon as spring 2024.

Global Macro

COP28

The President of this year’s Conference of the Parties (COP28), Sultan Al-Jaber, is also the CEO of Abu Dhabi National Oil Company. This was an initial point of contention, but the conference’s agenda was clearly focused on the phasing down (rather than out) of fossil fuels. Al-Jaber sparked controversy when he said there was “no science… no scenario out there, that says the phase-out of fossil fuels… is going to achieve 1.5°C”, in response to questions from former United Nations (UN) special envoy for climate change Mary Robinson. The issue underpinning his statements is the broader resistance to moving away from fossil fuel dependence, where a lack of decisive action delays abatement efforts and incentives to scale-up carbon neutral alternatives.

In other COP28 news, the loss and damage fund was launched with a total of USD 700m pledged by 18 countries including: USD 100m from both the United Arab Emirates (UAE) and Germany, USD 108m from Italy and France, USD 17.5m from the United States (US), and USD 75m from the United Kingdom (UK). The loss and damage fund is designed to provide financial assistance for rehabilitation to lower-income nations impacted by climate-related disasters.1 The creation of the fund is in response to the 2022 UN report which estimated that USD 100-580bn is needed annually to cover the cost of damages from environmental disasters, which appear to be borne disproportionately by low income countries. Thus, although the initial pledges are a step in the right direction for the future of the fund, and for a just transition, the reality is that they remain inadequate in the context of the total amount needed.

Emerging Markets

EM Asia

China: Moody’s kept China’s long-term sovereign rating at ‘A1’ (equivalent to ‘A+’), while downgrading the country’s credit outlook to negative. The lower outlook is due to concerns over China’s debt level, as the malaise in the property sector persists. Moody’s expects the property sector to represent a smaller proportion of the economy than before the onset of the property crisis in 2021. Given the high share of local government revenues attributed to land sales, a smaller property market will potentially require greater financial support from the central government, posing risks inconsistent with the current ‘A1’ rating.2 Moody’s last lowered China’s rating in 2017 over concerns of a rise in debt across the economy impacting state finances. In economic data, the Caixin services purchasing managers’ index (PMI) rose by 1.1 points in November to 51.5, ahead of expectations at 50.5. Exports grew 1.7% yoy in November in RMB terms, up from the 3.1% decline in October, while imports grew by 0.6% yoy, down from the +6.4% yoy in October.

India: The services PMI declined by 1.5 points to 56.9 in November, below consensus at 58.0. The Reserve Bank of India kept the repurchase rate unchanged at 6.5%, in line with expectations.

Indonesia: The consumer confidence index declined by 0.7 to 123.6 in November.

South Korea: The yoy rate of consumer price index (CPI) inflation declined by 50bps to 3.3% yoy in November, 20bps below consensus.

Taiwan: The yoy rate of CPI inflation declined by 20bps to 2.9% in November, 10bps above expectations. The yoy rate of core CPI inflation slowed by 10bps to 2.4% yoy and producer price index (PPI) declined further into deflation, down 30bps to -0.7% yoy in November. Exports rose by a yoy rate of 3.8% in November, up from -4.5% yoy in October, but came in 70bps below expectations. Imports declined 14.8% yoy, 2.5% lower than October, significantly under expectations of a 2.0% yoy decline. Thus, the trade surplus rose by USD 4.0bn to USD 9.8bn in November, above consensus at USD 5.4bn.

Thailand: The yoy rate of CPI inflation declined further into deflation, by 10bps to 0.4% yoy in November, below expectations of -0.3% yoy. Core CPI inflation slowed 10bps to 0.6% yoy, broadly in line with consensus. The consumer confidence rose 0.7 points to 60.9 in November.

Latin America

Argentina: President Javier Milei was sworn in on Sunday in front of a rapturous crowd that cheered as he promised radical government spending cuts. He received unqualified support from former president Macri. Milei also announced the nomination of Santiago Bausili as governor of the central bank. Bausili is a former debt capital markets banker and close associate of finance minister Luis Caputo, and while his appointment should be welcomed by financial markets, he will have the unenviable task of announcing a meaningful devaluation in the peso’s official exchange rate – currency forward markets are already pricing a 45% devaluation. Caputo is expected to announce further details of the government’s fiscal plans during a press conference on Tuesday. Industrial production declined by a yoy rate of 0.8% in October, up from -3.3% yoy in September, better than consensus for -3.0%. Construction activity grew by 3.0% in yoy terms, from -4.5% yoy in September.

Brazil: The current account deficit improved to USD 230m in October from USD 1,400m in September, better than consensus for a USD 830m deficit. Real GDP growth slowed to 2.0% in yoy terms in the third quarter, down from 3.5% yoy growth in Q2 2023, 20bps higher than consensus. On a sequential basis, this represents 0.1% qoq in Q3 after +1.0% qoq in Q2.

Chile: The trade surplus grew by USD 682m to USD 1,288m in November, USD 188m above forecasts.

Colombia: The yoy rate of CPI inflation increased by 10.2% in November, 30bps higher than October and broadly in line with consensus. Core CPI inflation was 10.6% yoy, 10bps higher than the month prior and 20bps higher than expected.

Ecuador: The yoy rate of CPI inflation declined by 40bps to 1.5% in November.

Mexico: Private consumption grew by a yoy rate of 4.5% in September, unchanged from August, and 50bps higher than expectations. Meanwhile, gross fixed investment declined by 1.5% mom in September after rising 2.2% mom in August, leading to a decline in the yoy rate to 21.9%, from 29.2% yoy over the prior period. The yoy rate of CPI inflation rose by 6bps to 4.3% in November, slightly better than consensus as core CPI slowed 20bps to 5.3% yoy.

Suriname: Nearly three years after defaulting on its debt, the Suriname government concluded its debt restructuring by issuing USD 660m in 10-year bonds, with a coupon of 7.95%. The nation also issued an oil-linked note of USD 315m notional – a type of value recovery instrument (VRI) heralded as a future path for commodity-producing nations struggling to pay off debt. The intention is VRI holders will receive 30% of every USD 100m in revenues perceived through the commercial development of a specific oil field until the bondholders are compensated for the 25% haircut in principal outstanding granted as part of the restructuring deal.

Venezuela: Last week, the government of Venezuela held a consultative referendum on Venezuela’s claim over the territory of Essequibo, which has been under the control of neighbouring Guyana since an arbitration decision in Paris dating back to 1899, and the Geneva Treaty of 1966. The disputed area represents two-thirds of Guyana’s territory. 96% of the votes, representing 10.5m Venezuelans, were cast in favour of Venezuela rejecting the Paris arbitration, and in support of the creation of a Venezuelan state in Essequibo. President Nicolás Maduro granted licenses to state-owned oil company Petroleos de Venezula (PDVSA) likely to exploit contested oil and mineral deposits in the territory. The International Court of Justice ordered Venezuela to abstain from any action that could change the status over the disputed territory. A former Venezuelan ambassador in Guyana, Sadio Garavini di Turno, said the situation is “ridiculous” as PDVSA doesn’t have resources to undertake oil exploration and the army has no ability to take over the disputed territory. The former ambassador believes the government’s actions endangers Venezuela’s legitimate concerns over the arbitrary demarcation of the maritime territory around the Amacuro River Delta. The demarcation restricts Venezuela’s access to the Atlantic as well as carving areas rich in oil and gas to Guyana.3 The situation de-escalated over the weekend as the presidents of Venezuela and Guyana agreed to meet next Thursday on the island of St Vincent, at the behest of the Community of Latin American and Caribbean States.

Central and Eastern Europe

Czechia: Industrial output grew by a yoy rate of 8.0% in October, up from a 7.7% yoy decline in September, and ahead of expectations of +5.1% yoy.

Hungary: The yoy rate of CPI inflation declined by 200bps to 7.9% in November, broadly in line with consensus estimates. Industrial production declined by 2.8% in yoy terms in October, up from -5.8% yoy in September. Retail sales also declined by 6.5% yoy in October, 80bps better than in September, broadly in line with consensus.

Poland: The central bank kept the policy rate unchanged at 5.75%, in line with expectations.

Romania: The unemployment rate declined by 10bps to 5.4% in October. PPI inflation declined by a yoy rate of 2.2% in October, from -0.4% yoy in September. Retail sales increased 1.4% yoy in October, from an upward revision of 1.0% yoy growth in September. The yoy rate of real GDP growth increased by 90bps to 1.1% in Q3 2023. In sequential terms, this represents 0.9% qoq in Q3, up from 0.4% qoq in Q2, better than consensus expecting no change.

Russia: President Vladimir Putin met with Crown Prince Mohammed Bin Salman of Saudi Arabia and Sheik Mohammed bin Zayed al-Nahyan in Abu Dhabi last week. The visit marked Putin’s first visit to the Gulf since the onset of the conflict with Ukraine. The meeting took place against the backdrop of the recent OPEC+ announcement to continue and deepen existing production cuts into Q1 2024. Both Saudi Arabia and the UAE have been maintaining relations with Russia since the invasion of Ukraine. In economic news, the services PMI in November declined by 1.4 points to 52.2, slightly lower than expected.

Central Asia, Middle East, and Africa

Egypt: PMI rose by 0.5 points in November to 48.4.

Kenya: The central bank announced the largest rate hike on record, taking the country’s policy rate up by 200bps to 12.5%. The monetary policy committee said the move was motivated by the need to shore up the exchange rate, which depreciated by almost 20% against the USD this year, and to further mitigate the impact of inflation, with the yoy rate of CPI inflation at 6.8% in November, down from the high of 9.6% in October 2022.

Saudi Arabia: The Whole Economy PMI dropped by 0.7 points to 57.0 in November.

South Africa: The Whole Economy PMI increased by 1.1 points in November to 50.0. The yoy rate of real GDP contracted by 0.7% in the third quarter, down from the revised 1.5% yoy growth in Q2 2023, below consensus for a 0.1% contraction. The current account deficit improved to 0.3% of GDP in Q3 2023, up from a downward revised 2.7% in Q2, better than consensus at 1.0% of GDP.

Türkiye: The yoy rate of CPI inflation was virtually unchanged at 62.0% in November. The yoy rate of PPI inflation increased by 290bps to 42.3% yoy in November

Developed Markets

Eurozone: The Eurozone service PMI was revised 0.5 points higher to 48.7 in November. PPI inflation declined by 9.4% in yoy terms in October, up from -12.4% in September, broadly in line with consensus. Retail sales declined by 1.2% yoy in October, a 1.7% improvement from September, close to forecasts.

Japan: The yoy rate of Tokyo CPI inflation declined by 60bps to 2.6% in November, 40bps below consensus. The core CPI declined by 20bps to 3.6% in yoy terms, 10bps lower than expected. The composite PMI was revised lower by 0.4 points in November to 49.6. Real GDP contracted by 0.7% qoq (-2.9% yoy) in Q3, 20bps lower than in Q2 (-2.1% yoy). Private consumption declined by 0.2% qoq in Q3 from flat previously, and business spending declined 0.4% yoy in Q3, 20ps higher than in Q2.

United States: The Job Openings and Labour Turnover Survey showed 8.7k new job openings in October, down from a downward revised 9.4k in September and 9.3k forecasted. The October data marked the lowest advertised job openings since March 2021. Following the data release, yields dropped by 8bps to 4.17% on the day. However, some of the rally unwound following the release of the employment report from the Bureau of Labor Statistics on Friday. While the number of non-farm jobs created over the month was close to expectations at 199k (up from 150k in October), the unemployment rate posted a surprise drop to 3.7% from 3.9%, and the under-employment rate also fell to 7.0% from 7.2%, pointing to a resilient jobs market. Prior to that, initial jobless claims registered 220k in the week, virtually unchanged and in line with expectations, and continuing claims fell by 64k to 1861k.

The ISM services index increased by 0.9 points to 52.7 in November, 0.4 points above expectations. Factory orders declined by 3.6% yoy in October, 60bps lower than expectations. Durable goods orders remained unchanged in October, declining by 5.4% yoy, in line with consensus. Unit labour costs declined by 1.2% in Q3, 40bps lower than in Q2, below expectations of a 0.9% decline.

United Kingdom: Services PMI improved by 0.4 points in November to 50.9, as the composite PMI moved 0.6 points higher to 50.7.

1. See – https://www.bbc.co.uk/news/world-asia-india-67610621

2. See – https://blinks.bloomberg.com/news/stories/S56NAHTP3SHS

3. See – https://www.bbc.com/portuguese/articles/crgpyp1ve01o.amp

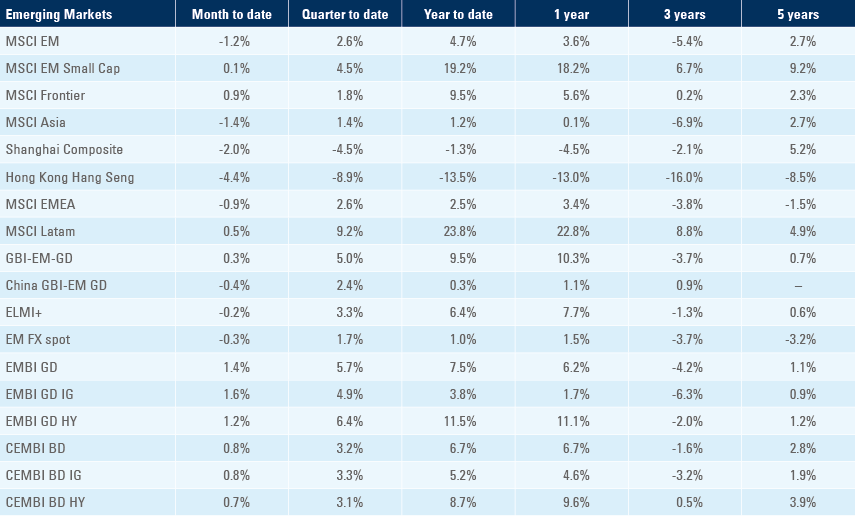

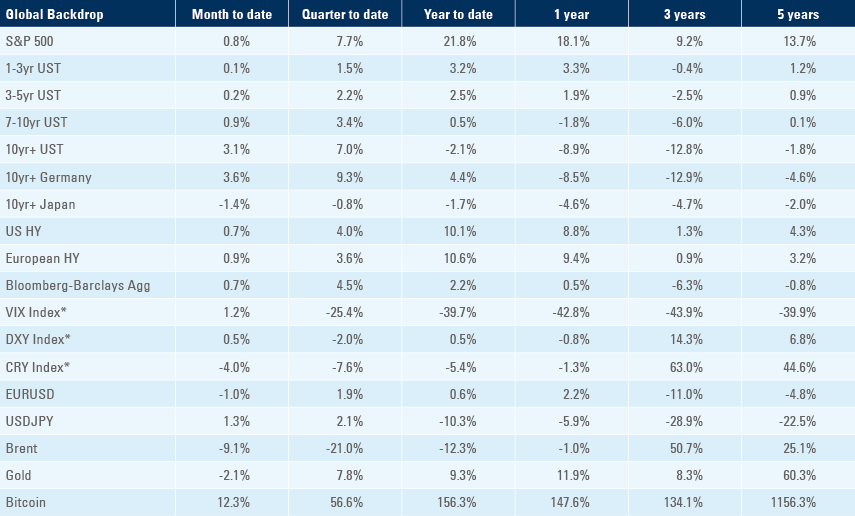

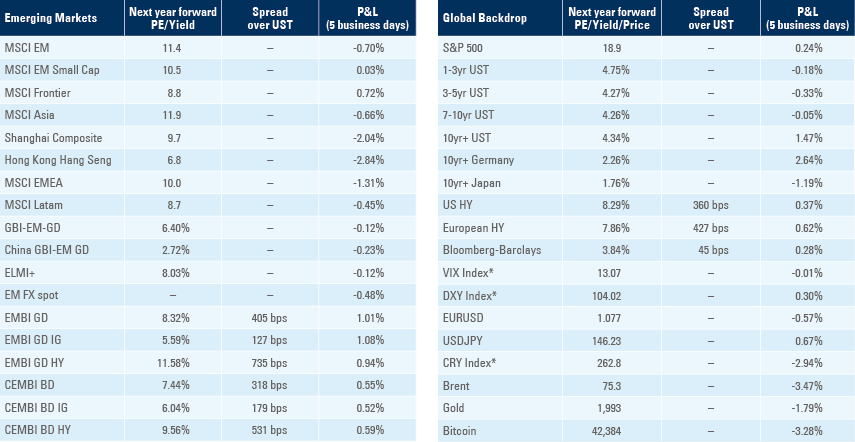

Benchmark performance