Chinese stocks’ outperformance extended in 2023, allowing for another relief rally into Developed Markets (DM) stocks. Argentina announced a bond buyback. Political noise remained loud in Brazil. China said Covid-19 infections may be peaking, and despite the challenging situation, economic data came in better than expected. Ecuador registered a solid improvement on its fiscal accounts. Bank Indonesia hiked its policy rate by 25 basis points (bps) to 5.75%, but Bank Negara Malaysia kept its policy rate unchanged at 2.75%. The Russian Central Bank announced it will provide RMB swap lines to boost foreign exchange liquidity. Kazakhstan tightened immigration rules for members of the Eurasian Economic Union. Morocco showcased its economic success in Davos. South Korean exports remained soft.

Emerging Markets

Some investors have challenged Ashmore’s 2023 outlook thesis – which suggested DM risk assets would remain choppy at the beginning of the year – as both equities and bonds started the year with strong performance. The thesis remains intact, in our view. The key fundamental discrepancy between our expectation and the events, so far, has been a faster and more intense reopening of the Chinese economy, something we expected to happen only towards the end of the winter in the Northern hemisphere. This has accelerated the geographical two-halves concept with China (and Emerging Markets (EM) broadly) outperforming DM. As anticipated, the reopening process in China was a political decision (not healthcare-related), and was announced alongside policies to boost gross domestic product (GDP) growth, including:

- Policymakers signalling easy monetary and fiscal policy;

- Less interventionist policy on technology companies; and

- Progress in the reprofiling of debts from real estate companies.

The reopening of the Chinese economy was announced when China’s stocks were at extremely oversold levels. This allowed for a very sharp rebound in asset prices, with the Hang Seng China Enterprises mega-cap index in Hong Kong recovering more than 50% from its 31 October low. The recovery is likely to have more legs, in our view, as surveys suggest foreign investors’ exposure is moving to neutral, hedge funds are long but have room to increase, and retail investors were not involved in the rebound at all.

The rebound of the Chinese economy, alongside a much less severe winter allowing for a sharp decline in natural gas prices, drove a sharp recovery in European stocks. Several European companies are very dependent on China, including the top European car manufacturers and industrial producers, as well as luxury goods. US stocks have also rebounded, despite its lower interdependencies with the Chinese economy.

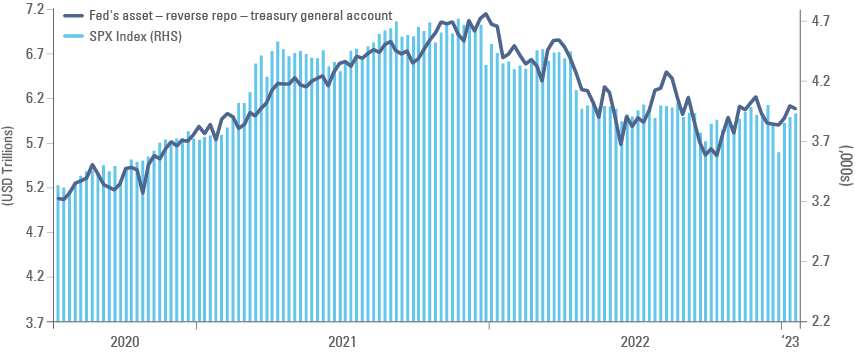

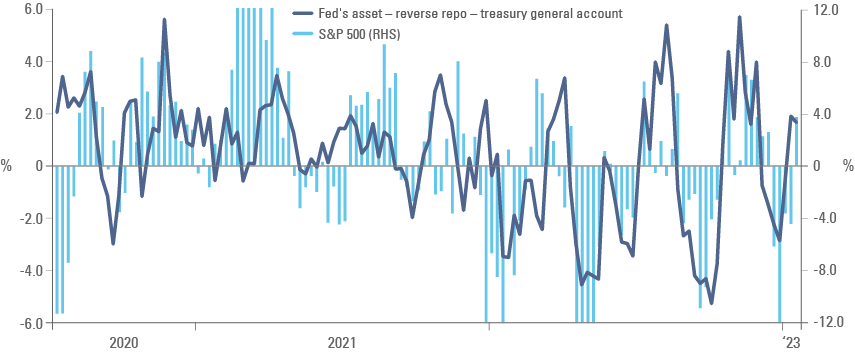

The rebound on DM stocks is likely to be just another bear market relief rally, in our view. Europe is still in a very complicated position in terms of energy policy, a process likely to last for many years. US stocks started the year in extreme oversold territory, and have benefited from an increase in liquidity due to a reduction on the Treasury General Account (TGA) and a large reduction on the Reverse Repo (RR) facility.

In the outlook report, we have highlighted that temporary expansions in liquidity conditions have led to a temporary relief rally in US stocks since the beginning of the bear market in Q4 2021. This is a process that should be monitored. The US Treasury has been reducing the TGA since mid-2022, compensating for the strong reduction in liquidity from the US Federal Reserve's (Fed’s) security sales (quantitative tightening). Should the US Treasury keep drawing down the TGA due to the current debt ceiling debacle, Figures 1 and 2 would suggest the relief rallies may have more legs.

Figure 1: Fed assets minus selected liabilities (TGA & RR) vs. S&P500

Figure 2: Four-week change in S&P500 vs Fed’s assets minus selected liabilities (TGA & RR)

Argentina: Finance Minister Sergio Massa said Argentina will buy back up to USD 1bn in Eurobonds maturing in 2029 and 2030 to improve the debt profile of the country. It was not clear whether that amount is notional or face value. The prices on the 2030 bonds rose from USD 27c to USD 35c year-to-date and jumped four points following the announcement. At current market prices, the country could reduce USD 1bn of outstanding debt with USD 350m or spend USD 1bn to reduce its outstanding debt by USD 2.85bn. While the debt reduction is a relatively small amount compared to more than USD 100bn in Eurobonds outstanding, allocating foreign exchange (FX) reserves to debt repurchase makes economic sense as it provides a steep return to reserve assets while lowering the country’s risk premium. In economic news, the trade surplus narrowed by USD 0.2bn to USD 1.1bn in December as imports declined by USD 0.75bn to USD 5.0bn and exports slowed by USD 1.0bn to USD 6.1bn.

Brazil: The political noise remained elevated last week when President Lula called central bank independence “silliness” in a television interview. The context of his comments was again in defence of his own record, saying former central bank chief Henrique Meirelles achieved low inflation and high and inclusive economic growth without formal independence. However, the remarks resonated badly in local press. Central Bank Governor Roberto Campos Neto is unlikely to abandon his mandate before the end of his term in December 2024, reducing the risk of any government action hurting the institution’s independency in pursuing its inflation target and currency stability goals. In economic news, the unemployment rate dropped by 20bps to 8.1% in November, in line with consensus.

China: Speaking at the World Economic Forum in Davos, Vice Premier Liu He admitted that the peak of Covid-19 infections and return to economic normalisation came earlier than expected. He also said the number of “stalled" property projects across China added up to more than 2,600, impacting around 1.9m people. This was the first time China has released such estimates.

In economic news, the yoy rate of retail sales improved to -1.8% in December from -5.9% in November, significantly above consensus at -9.0%. Industrial production slowed to 1.3% yoy from 2.2% yoy over the same period, also above consensus at 0.1%. Real GDP growth was stable at 3.0% yoy in Q4 2022 (0.0% qoq) bringing 2022 calendar year GDP growth to 2.9%, significantly better than consensus at 1.6%.

Ecuador: The general budget declined to 1.7% of GDP in 2022 from 4.0% in 2021, consistent with a central government fiscal surplus of 0.6% of GDP. The fiscal consolidation means the ratio of debt to GDP is likely to decline below 55% in 2023, a target that was originally set only for 2025. Furthermore, FX reserves rose to USD 8.5bn at the end of 2022, a historic high.

Indonesia: Bank Indonesia hiked its policy rate by 25bps to 5.75%, in line with consensus. Gross external debt (private and public) dropped by USD 23.1bn until last November to USD 392.6bn, a rate of decline of 7.6% yoy, mostly due to lower public sector external debt. The trade surplus declined to USD 2.9bn in December from USD 5.2bn in November, slightly below consensus as imports declined by a yoy rate of 6.6% and exports rose 6.6% yoy.

Kazakhstan: The government tightened restrictions for citizens of other Eurasian Economic Union (EAEU) countries to stay in the country without a visa for a maximum of 90 days every three months. This means immigrants have to leave for at least 90 days after reaching the visa-free limit. Previously, individuals from the EAEU, including Russia, could stay in the country indefinitely. The new regulations could make Kazakhstan a less attractive permanent destination in the event that Russia announces another mobilisation.

Malaysia: Bank Negara Malaysia (BNM) kept its policy rate unchanged at 2.75%, while consensus expectations were for a 25bps hike. The yoy rate of consumer price index (CPI) inflation declined by 20bps to 3.8% in December, 10bps below consensus. BNM is one of the most conservative central banks in the world and has a reputation for controlling inflation with much lower volatility on its policy rates. The trade surplus increased to MYR 27.8bn in December from MYR 21.2bn in November.

Mexico: Retail sales dropped 0.2% mom in November after expanding 0.7% in October, bringing the yoy rate down by 140bps to 2.4% over the same period, slightly better than consensus.

Morocco: At Davos, Ali Sedikki, the General Secretary of the Moroccan Agency of Development, made the case in an interview that Morocco will be focusing on new technology, including artificial intelligence. Morocco has become a leader in the automotive and aerospace industries, thanks to the robustness of its infrastructure and an abundance of well-trained engineers , helping it to become a technology powerhouse in North Africa.1

Russia: On 19 January, the Bank of Russia started providing RMB overnight swaps, selling RMB for RUB. Swap lines are common instruments to provide FX liquidity in periods of heightened volatility, and the possibility of offering RMB without passing by the EUR or USD highlights the progress made in reducing Russia’s dependency on the US and European currencies. The CBR swap rates were overnight SHIBOR -250bps for CNY and key rate +100bps for the RUB swap rate. The trade surplus surged to USD 282bn in 2022 and the current account surplus rose 180% to 227bn, although the surplus narrowed towards the end of the year owing to lower exports and higher imports.

South Africa: The yoy rate of CPI and core CPI inflation declined 10bps to 7.3% and 4.9% respectively, both slightly below consensus. Mining output declined 9.0% yoy in November, slightly better than October’s -11.0% yoy, due to energy restrictions and supply chain disruptions. Retail sales rose 1.1% mom in November from 0.3% in October, slightly above consensus.

South Korea: Exports declined by a yoy rate of 9.8% in the first 20 days of January (after adjusting for business days), as chip exports dropped 24.3% yoy and imports rose 1.9% yoy over the same period. The trade deficit widened to USD 6.4bn in the first 20 days. From a destination perspective, exports to China dropped 26.6% yoy but exports to the US rose 16.1% yoy. In our view, the reopening of the Chinese economy should boost Korean exports over the next few quarters, while exports to the US will slow down on the back of slower economic performance.

Turkey: Leader of Nationalist Movement Party (MHP) Devlet Bahceli called on all parliamentary parties to reach a consensus to bring elections forward to May from the original date of 18 June. News channel Haberturk reported a proposal, supported by the ruling AK Party. President Erdogan suggested the election would be set for 14 May, but the ruling coalition needs votes from the opposition parties to confirm the election date. The Central Bank of Turkey kept its one-week policy rate unchanged at 9.0%, in line with consensus.

Snippets

- Bulgaria: The Finance Minister issued EUR 1.5bn in 10-year Eurobonds at 4.78% yield-to-maturity last week with most of the proceeds destined to repay a EUR 1.15bn Eurobond expiring in March.

- Colombia: Retail sales (excluding fuel and vehicles) declined 1.8% mom in November after a 0.9% mom drop last October, bringing the yoy rate down 20bps to 1.7%, a large drop from the 8.2% yoy peak in August. The yoy industrial production rate declined 80bps to 2.5% in November and the trade deficit narrowed to USD 1.1bn in November from USD 1.5bn in October, broadly in line with consensus.

- Czechia: Producer price index (PPI) inflation declined 1.1% mom in December after a 1.0% mom drop in November, meaning the yoy rate fell 50bps to 20.8% over the same period.

- India: Wholesale prices declined 90bps to 4.95% in December, 55bps below consensus. The trade deficit was unchanged at 23.8bn in December, in line with consensus.

- Nigeria: The yoy rate of CPI inflation rose 30bps to 21.8%.

- Peru: The unemployment rate in the city of Lima declined to 7.1% in December from 7.6% in November. The economic activity proxy rose declined 30bps to 1.7% yoy in November, 60bps below consensus.

- Philippines: The balance of payments moved to a USD 612m surplus in December after a USD 756m deficit in November.

- Poland: The yoy rate of CPI inflation rose 10bps to 11.5% in December.

- Saudi Arabia: The yoy rate of CPI inflation rose 40bps to 3.3% in December.

- Taiwan: Real GDP declined by 0.9% in yoy terms in Q4 2022 after rising 4.0% yoy in Q3 2022, bringing the 2022 growth rate down to 2.4%. The unemployment rate was unchanged at 3.6%.

Geopolitics

Ukrainian Prime Minister Denys Shmyhal said Russia hit nine thermal electric facilities during a recent missile attack. The US and its allies did not reach a decision to send German tanks to Ukraine as Russian military has deployed air defence equipment around Moscow to deter drone attacks which have hit the country last week.

The European Commission issued a EUR 3bn tranche of the EUR 18bn Macro-financial Assistance package for Ukraine, in the form of a 35-year loan with a 10-year grace period. This is aimed at helping the Ukrainian government to pay salaries, pensions and social assistance. It reported receiving over EUR 113bn in international assistance since 24 February 2022, including financial, humanitarian and military, with EUR 52bn contributed by the European Union (EU) and EUR 48bn by the US.2

The Iranian Navy is planning to expand the scope of its operations, including sending warships through the Panama Canal for the first time. No timeline was given in remarks by a senior Iranian military officer at a naval ceremony, but the US is likely taking the issue seriously.

Developed Markets

United States: Economic data surprised to the downside, but hard labour market data is not cracking, despite widening anecdotal evidence of layoffs increasing. The Empire Manufacturing Index plunged to -32.9 in January from -11.2 in December, levels only seen before in Q1 2020 and Q1 2009. Retail sales dropped 1.1% mom in December after declining 1.0% in November and industrial production declined 0.7% mom from -0.6% mom over the same period. PPI inflation dropped 0.5% mom in December but rose 0.1% mom (excluding food and energy), bringing the yoy rate of PPI inflation to 6.2% (down 110bps) and 5.5% yoy ex-food and energy (down 70bps) in December. Housing starts and building permits dropped 1.4% and 1.6% mom to 1.38k and 1.33k respectively in December. Existing home sales declined 1.5% mom to 4.02m in December, the lowest level since 2010. Despite significant anecdotal evidence of companies laying off employees (Google, Microsoft, Amazon, Sales Force, Vimeo, Coinbase, Goldman Sachs, etc), initial jobless claims dropped by 15k to 190k on the week of the 14 January, and continuing claims rose only 17k to 1.647k in the previous week.

Europe: CPI inflation declined 0.4% mom in December, bringing 2022 calendar year CPI inflation to 9.2% and core CPI to 5.2%. The EU ZEW survey of economic expectations jumped to 16.7 in January from -23.6 in December, mostly due to a sharp drop in natural gas prices allowing for a stronger performance of EU stocks and the EUR. Lower energy prices allowed the trade balance to move to a EUR 13.6bn surplus in November from a EUR 0.5bn deficit in October.

Japan: The Bank of Japan (BOJ) surprised markets by keeping the cap on 10-year bond yields at 0.5%, against a consensus for an increase on the cap to 1.0%. The BOJ decision led to a precipitous drop in US Treasury yields, with 10-year yields dropping 16bps to 3.37%. The JPY initially sold-off above 130 but recovered all its losses. The market anticipates a strong likelihood the BOJ will move to a more hawkish stance after Governor Haruhiro Kuroda retires on 8 April, as a dysfunctional market for Japanese government bonds and higher interest rates across the rest of the world makes the policy increasingly untenable. Furthermore, CPI inflation rose another 20bps to 4.0% and PPI inflation rose another 90bps to 10.2% in December, making it difficult to justify the BOJ’s ultra-easy monetary policy stance.

1. See https://www.euronews.com/next/2023/01/21/how-morocco-hopes-to-become-a-new-hub-for-emerging-technologies-under-new-investment-model

2. See https://www.kmu.gov.ua/en/news/minreintehratsii-mizhnarodna-dopomoha-ukraini-perevyshchyla-113-mlrd-ievro

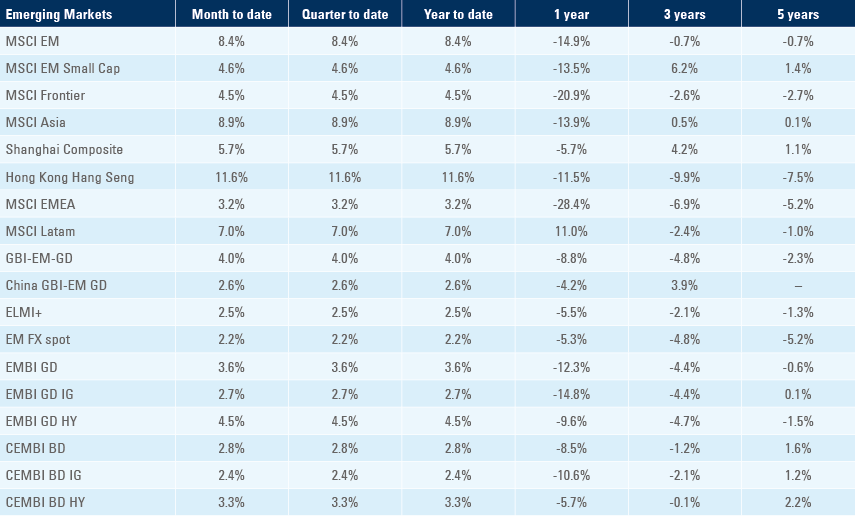

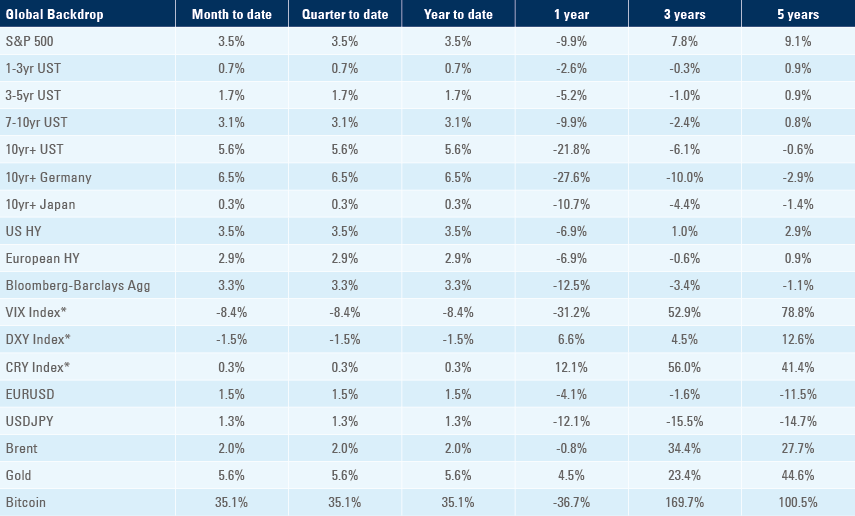

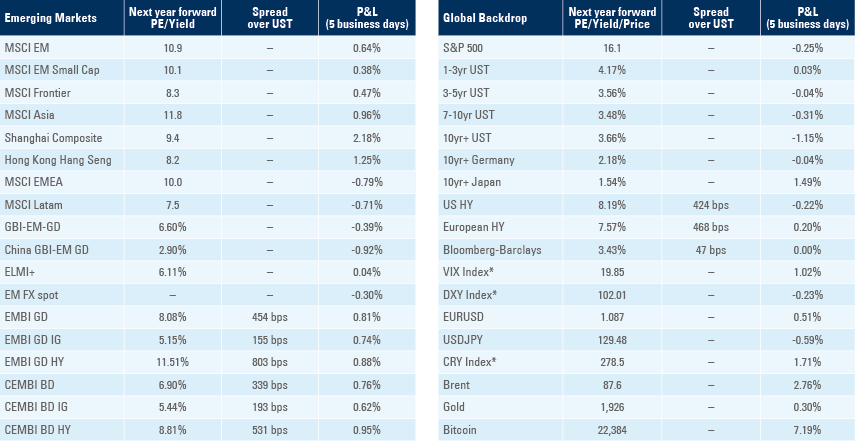

Benchmark performance