- Jackson Hole pivot from Powell leaves 50bps September cut on the table.

- Brent crude rises back above USD80 on heightened geopolitical risk and Libyan supply constraints.

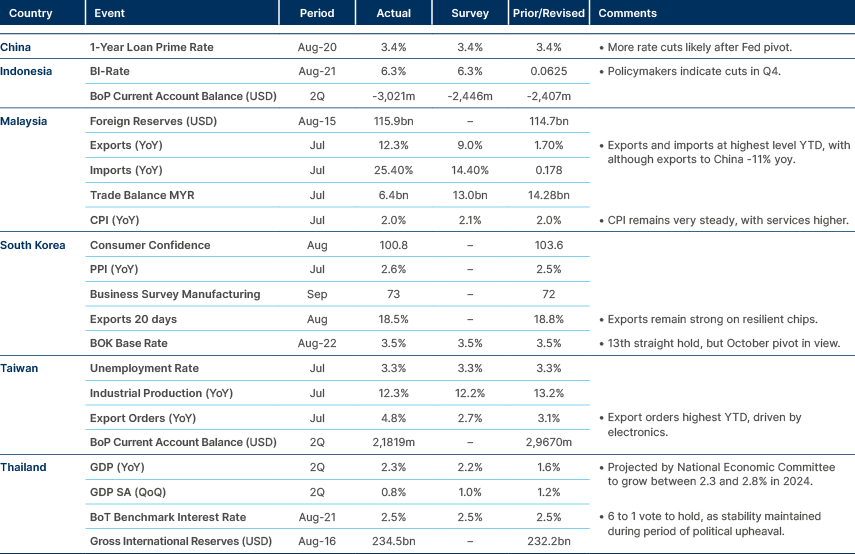

- China and Indonesia hold policy rates, cuts more likely after Fed pivot and US election.

- Details of tax reforms emerging in Colombia.

- Strikes in Mexico, in protest against judicial reform.

- Export growth remains strong across Southeast Asia, despite weaker Chinese demand.

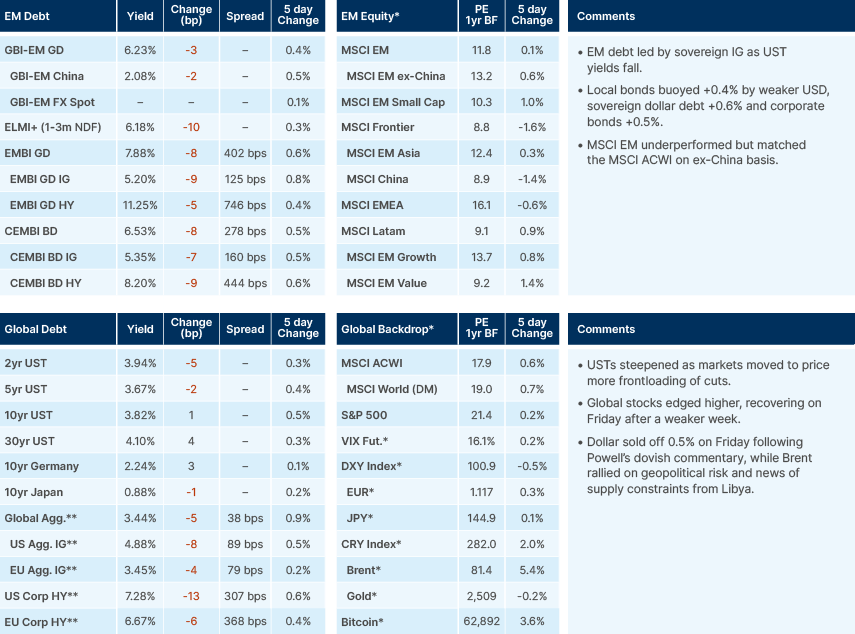

Last week performance and comments

Global Macro

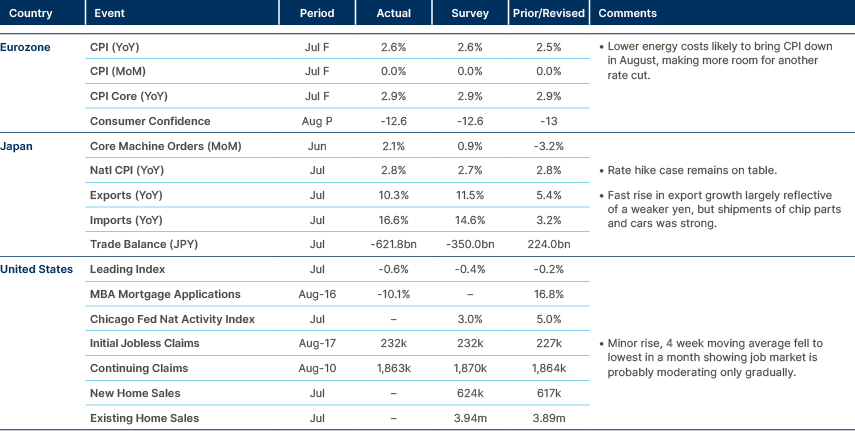

Stocks extended their gains, and bond yields fell after US Federal Reserve (Fed) Chair Jerome Powell used his Jackson Hole Symposium speech to state “the time has come” for the central bank to start cutting interest rates. Without providing specific details on the pace of rate cuts, Powell noted the “balance of risk” had shifted from inflation concerns to a weaker jobs market, emphasising that the Fed no longer seeks further cooling in the labour market. In emphasising this shift back towards a dual mandate, Powell left the possibility of a 50 basis points (bps) cut on the table, should job numbers deteriorate further. In response, the S&P 500 rose by 1%, the 10-year US Treasury yield dropped by 5bps to 3.8%, and the dollar fell by 0.6%. The market is now pricing in a 37% probability of a 50bps cut in September and cuts totalling 100bps by the end of the year.

The decline in bond yields may be leading to further strength in equity markets, however it aligns with weakening macroeconomic data, including the Bureau of Labor Statistics now revising down nearly a million jobs—818,000 lost last week and another 107,000 over the past 12 months. Under the headline numbers, certain data points are indicating a macro environment that is softer than the equity market is pricing. Employment in white-collar sectors is nearly flat year-over-year, and retail sales growth is now in fact flat year-to-date, in real terms. Additionally, 11% of credit cards are now delinquent for 90+ days, a level historically associated with an economy already in recession.

Commodities

Brent crude oil prices have surged nearly 7% from their lows last week, reaching above USD 80 per barrel. This increase is primarily driven by heightened geopolitical risks following Israeli airstrikes on Hezbollah targets over the weekend. Additionally, Libya's eastern government has announced a halt to all oil exports under a force majeure, due to an ongoing dispute with Tripoli over control of oil revenues. Although the eastern government in Benghazi lacks international legitimacy, most of Libya's oilfields are controlled by eastern military leader Khalifa Haftar. Libya currently exports approximately 1.2m barrels per day, with over 1m barrels exported to global markets.

Geopolitics

Israel deployed around 100 aircraft strikes on southern Lebanon, targeting Hezbollah's rocket launchers at 40 different sites. In response, Hezbollah retaliated with over 300 rockets, marking the largest exchange of fire since their conflict in 2006. Israel continued its strikes to neutralise further threats from Hezbollah.

The U.S. is “closely monitoring” the situation, and has deployed additional warships and fighter jets to the region as a deterrent, while supporting ongoing diplomatic efforts in peace talks. However, there has been no sign of progress on key issues in the ceasefire negotiations in Egypt, particularly regarding Israel's insistence on retaining control of the Philadelphi Corridor, which lies on the border between Gaza and Egypt.

Leading Indicators

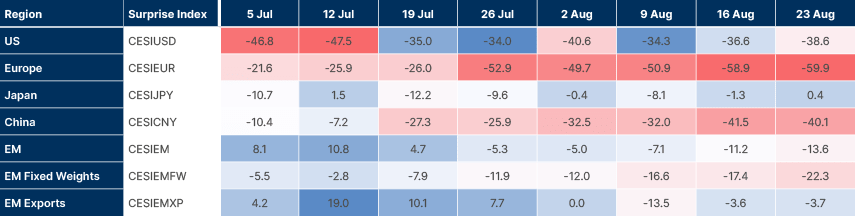

Fig 1: Citi Surprise Index: Negative surprises deepen in US, Europe and China, more stable in EM and Japan

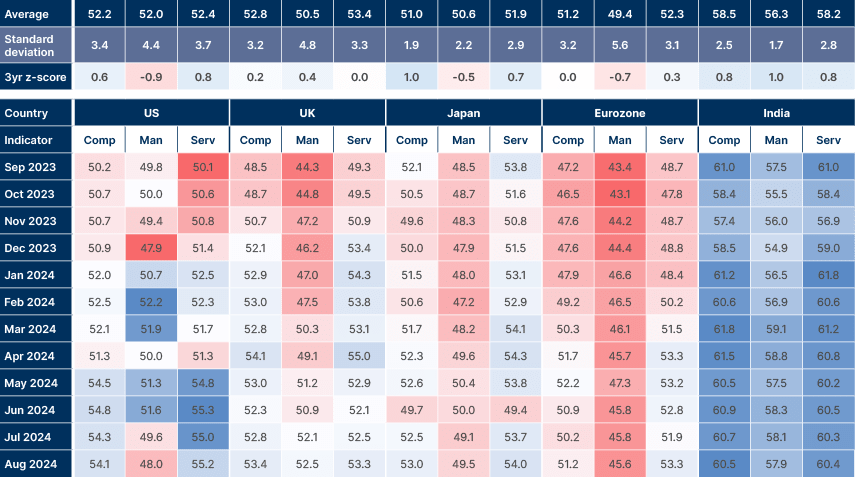

Fig 2: PMI’s: Comp PMIs higher across DM, led by services. Manufacturing indicators still contractionary

Emerging Markets

Asia

China and Indonesia hold rates, exports strong across Southeast Asia.

Indonesia

Central Bank Governor Perry Warjiyo has indicated that he expects the Fed to implement two 25 bps rate cuts this year, starting in September. He emphasised the importance of geopolitical dynamics, particularly the upcoming US election, as a significant risk to monitor. This outlook suggests Indonesia's own monetary policy easing could be postponed until November, after the US election.

Meanwhile, Indonesian lawmakers have abandoned plans to revise regional election laws following widespread national protests. The proposed amendments would have allowed President Joko Widodo’s youngest son to participate in a gubernatorial race. Additionally, the changes included the reinstatement of nomination thresholds, which could have given an advantage to allies of both the outgoing President and President-elect Prabowo Subianto in key elections in Central Java and Jakarta. The nationwide protests, fuelled by concerns over the potential undermining of democratic processes, have led to financial market instability, with the Indonesian Rupiah down 5% month-to-date.

Thailand

Prime Minister Paetongtarn Shinawatra is reportedly planning to abandon the flagship digital wallet programme and instead implement a direct cash handout to low-income individuals, according to a report by Thansettakij. The new plan would provide THB 10,000 (USD 291) to 14m welfare card holders, costing the government THB 140bn (USD 4.1bn), with THB 122bn of this amount recently approved by parliament. The original digital wallet programme was expected to grant THB 10,000 to nearly 50m citizens. Given the fiscal policy uncertainty, the Bank of Thailand’s decision to hold its policy rate steady is considered a prudent move.

Latin America

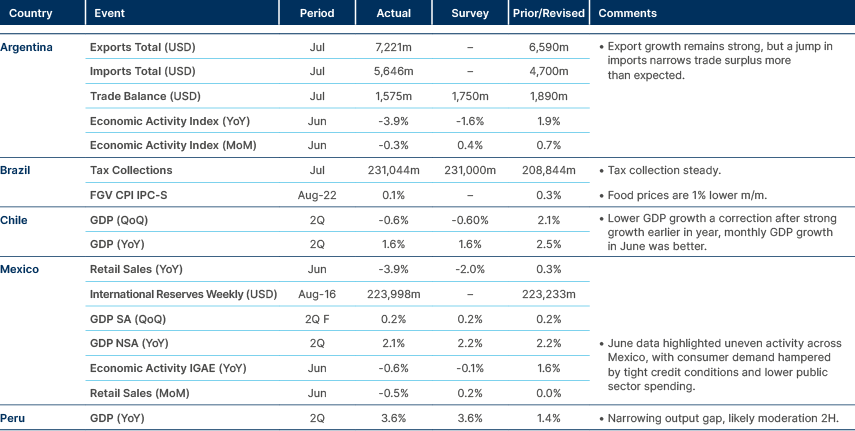

Argentina export strong, economic activity looking weaker in Mexico.

Argentina

Exports have seen significant growth, with fuel and energy exports rising by 42%, agricultural manufacturing increasing by 29%, and primary products up by 20%. Petroleum exports have been particularly strong, with a 65% increase in 2024 year-to-date compared with the same period in 2023. On the other hand, imports have declined, with fuel imports down by 34%, capital goods by 24%, and intermediate goods by 17%.

Brazil

The Chairman of Brazil's Central Bank, Roberto Campos Neto, reiterated its Monetary Policy Committee will not provide any guidance ahead of the next monetary policy meeting. The approach remains data-dependent, with decisions being made based on the latest economic indicators.

Colombia

Details of a new tax reform proposal are beginning to emerge in Colombia, with reports indicating that the Ministry of Finance is drafting a bill to be presented to Congress later this month or in early September. The preliminary version of the bill suggests a gradual decrease in the corporate tax rate from 35% to 30%, with a reduction of 1 percentage point per year, in line with President Gustavo Petro's previous comments. To increase revenues, the bill proposes raising the highest marginal tax rate from 39% to 41% and increasing the capital gains tax rate from 15% to 20%. The reform aims to raise COP 12trn to finance the 2025 budget currently under discussion in Congress. Additionally, the Finance Minister Ricardo Bonilla announced that Colombia will end a subsidy on diesel prices due to fiscal challenges, with diesel prices set to rise in three increments of COP 2,000 (USD 0.50) by the end of next year. The total increase is expected to save the government COP 12trn (USD 3bn) and likely impact inflation by 1.4%.

Dominican Republic

President Luis Abinader of the Dominican Republic introduced a Constitutional reform bill to Congress earlier this week. The bill aims to limit presidential re-election to two terms, reduce the number of congressional deputies from 190 to 137, align general and local election cycles starting in 2032, and ensure the independence of the Attorney General’s Office. This move aligns with the government's ongoing commitment to strengthening democratic institutions, and the approval of the bill would be very positive for the country's long-term stability. Given this is Abinader’s final term, and thanks to his strong governance, the reform is expected to progress smoothly, with additional labour and fiscal reforms anticipated in the coming months.

Mexico

An indefinite national strike is set to begin this Wednesday, involving over 1,400 federal judges and magistrates, including Supreme Court ministers, and more than 55,000 workers from the Federal Judicial Power (PJF). The strike is in protest against the judicial reform, particularly the proposal to elect judges by popular vote. Strikers are also demanding the protection of their labour rights, including pensions and trusts, and assurances that these funds will not be diverted to finance elections, as suggested by President Andrés Manuel López Obrador (AMLO).

The scale of the strike increases the likelihood that AMLO’s judicial reform could be watered down. However, the demands of the PJF workers are broad and do not focus on specific labour disputes or violations of benefits, meaning they do not directly oppose the judicial reform bill itself. Furthermore, both AMLO and the House leader of the Morena Party have already addressed the concerns of judicial workers, assuring the reform will not affect their labour rights, pensions, or trusts, and that pension funds will not be used to finance the election of judges. Despite these assertions, the US Ambassador to Mexico said last week that the proposed judiciary reforms “is a major risk to the functioning of Mexico’s democracy”, a comment branded as “disrespectful” by AMLO.

Venezuela

Venezuela’s highest court has upheld the re-election of Nicolás Maduro as President, following accusations of widespread voter fraud in July's poll.

Central and Eastern Europe

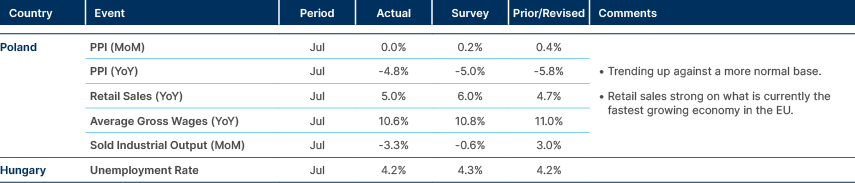

Poland activity strong, job market steady in Hungary.

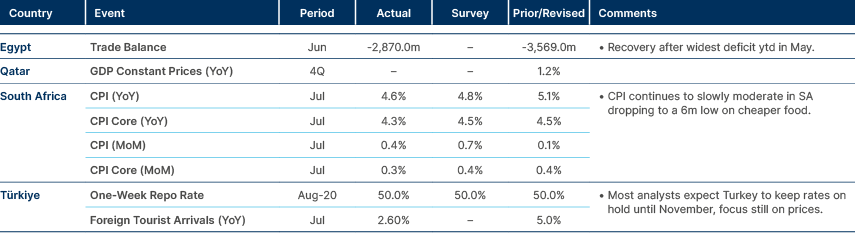

Central Asia, Middle East, and Africa

CPI moderating in South Africa, Türkiye keeps rates steady.

United Arab Emirates

Non-oil foreign trade hit a record of USD 381bn in H1 of the year, up 25% since the same period last year. Non-oil exports made up 18.4% of total trade, versus 16.4% last year. The expansion was supported by trade agreements with fast-growing economies including Indonesia, Cambodia and Georgia.

Developed Markets

Weak yen boosts exports numbers in Japan, US job market gradually moderating.

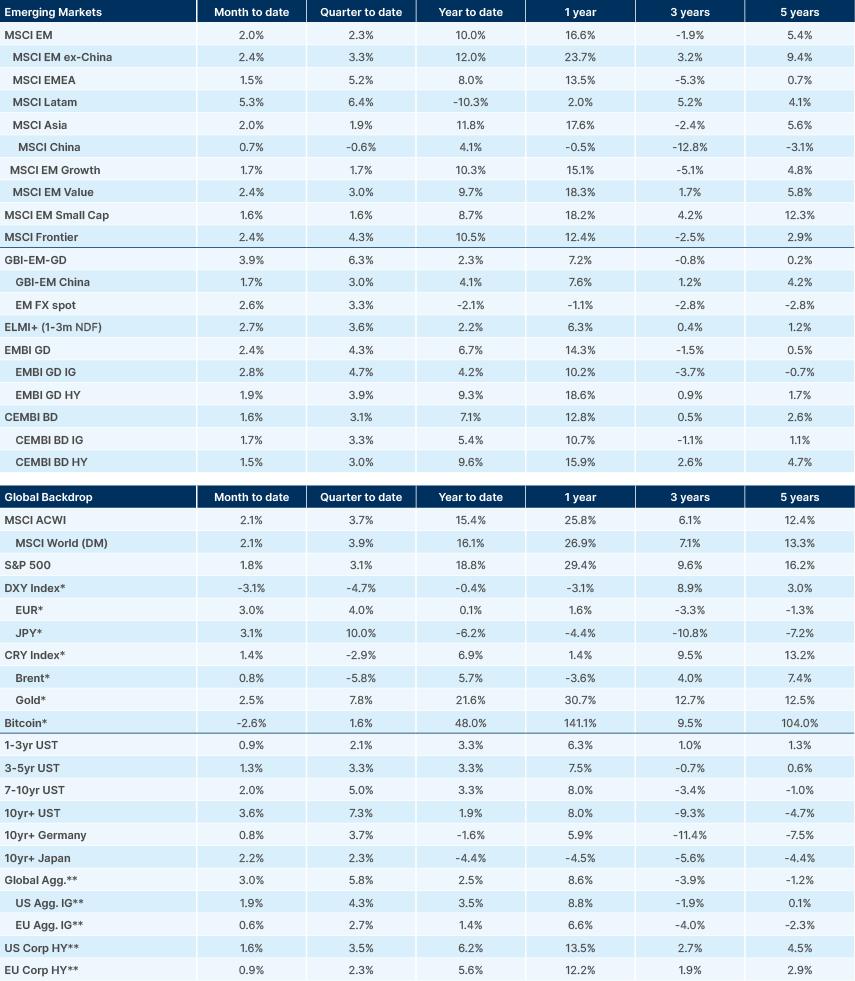

Benchmark performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.