Libertarian economist Javier Milei is the new President of Argentina

The war in Gaza is imposing an unbearable cost to both human life and the respective economies. Walmart voiced a cautious outlook on the US consumer. China’s Xi Jinping delivered a hopeful message at the APEC forum in San Francisco. Inflation declined further in India. The two largest opposition parties in Taiwan negotiated an agreement for the elections in January. Last, but not least, libertarian economist Javier Milei won the Argentinian Presidential election run-off by a landslide.

Global Macro

Geopolitics

The Israeli invasion of Gaza since the onset of the war has seen the devastating loss of human life alongside significant costs to both economies. Thus far, Bloomberg estimate Israel has spent around USD 260m (c. 0.05% GDP) per day. This would be equivalent of 1.5% GDP per month or 18.2% of GDP per year. Furthermore, Israel’s initial mobilisation is estimated to have cost c. 1.5% of GDP, bringing total government spend thus far to 3% of GDP. This ‘back-of-the-envelope’ analysis is irrespective of indirect costs, such as disruptions to trade, the highly-skilled labour force mobilised into the military, uncertainties regarding foreign direct investment (FDI) flows and the massive impact on Israel’s international image, particularly within the Arab world.

Micro to Macro

Retailers are starting to caution that the resilience in the US economy thus far may be coming to an end. Walmart said that despite seeing (market) share gain versus other groups, there is still pressure on the consumer, and it is thinking “more cautiously about the consumer versus 90 days ago”. It pointed to a sharper fall in sales during the two last weeks of October,1 with customers increasingly delaying big expenditures or projects, and focusing on smaller expenditures. Walmart also reported that sales between promotional periods were slowing. Despite the strong start to November as part of the expected seasonal holiday shopping increase, October’s drop-off in sales could be emblematic of the cracks starting to form in the US economy as the high interest rate environment weighs on consumers.

Emerging Markets

EM Asia

China: The CEOs of China’s largest companies stood to applaud Xi Jinping at the Asia Pacific Economic Cooperation (APEC) forum in San Francisco last week. Xi delivered a personal, friendly, and touching speech where he reiterated “China is willing to be a partner and friends with the United States” and that China’s “fundamental principles in handling Sino-US relations are mutual respect, peaceful coexistence and win-win cooperation”. The American press is full of bitter articles criticising CEOs of companies for attending the meeting, but the reality is that decoupling the two largest economies in the world is virtually impossible, and its consequences would be destabilising geopolitical terms and devastating economically. Despite some gaffes and the acrimonious tone of the press, the forum brings hope of a truce on the relationship. The tone on the Chinese press (China Daily) was also much more constructive, which is noteworthy. Several of the largest companies in the world listed in the US have a very large share of revenues coming from China. Approximately 19% of Apple’s revenues (USD 72.5bn) comes from China. The share is even larger in other companies, including Tesla, Nvidia and Qualcomm with 21%, 23% and 60%, respectively.2

According to Bloomberg News, the People’s Bank of China (PBoC) is planning to inject RMB 1tn of low-cost financing to increase support to households for home purchases. This is intended to target China’s urban village and affordable housing schemes.3 In other economic news, aggregate financing slowed to RMB 1.85tn in October after RMB 4.13tn in September, marginally below consensus. New loans softened to RMB 738bn in October from RMB 2,310bn in September, slightly ahead of expectations. Despite the decline, aggregate finance was at the highest level for the month of October since 2017. Industrial production grew 4.6% yoy in October, 10bps higher than in September. Retail sales rose by 7.6% yoy in October, ahead of the 5.5% yoy growth in September and 60bps higher than consensus estimates. Residential property sales declined 3.7% yoy in October, from a 3.2% yoy decline in the month prior. FDI declined by 9.4% yoy on the January to October period, down from 8.4% yoy in the month prior.

India: Consumer price index (CPI) inflation declined by 10bps to 4.9% yoy in October, 10bps above consensus. Wholesale prices declined by 0.5% yoy in October, after -0.3% yoy in September, 10bps below consensus. The trade deficit widened to USD 31.5bn in October from USD 19.4bn in September as imports rose by 12.3% in yoy terms in October from a 15.0% you decline in September and exports improved to +6.2% yoy from -2.6% yoy over the same period. Most of the increase in the deficit was driven by higher imports of commodities with oil imports up USD 3.7bn in October, reflecting higher prices and a USD 4.3bn increase in gold and silver import driven by the Diwali Festival, while exports declined by USD 0.9bn.

Indonesia: The trade surplus increased to USD 3.5bn in October, from USD 3.4bn in the month prior, USD 0.5bn above consensus. The larger surplus was driven by a recovery in exports, from a -16.2% yoy in September to -10.4% yoy in October. Imports also declined by a lesser extent, rising to -2.4% yoy in October from -12.5% yoy in September.

Malaysia: GDP in the third quarter grew by 3.3% yoy, unchanged from the second quarter, 10bps higher than expected.

Philippines: The central bank kept its deposit and borrowing policy rates unchanged at 6.0% and 6.5%, respectively, in line with consensus. Overseas workers remittances rose to USD 2.9bn in September from USD 2.8bn in August, in line with consensus.

South Korea: The unemployment rate in October, on a seasonally-adjusted basis, was 2.5%, 10bps lower than September and 20bps below expectations.

Taiwan: The country's two largest opposition parties Kuomintang (KMT) and the Taiwan People's Party announced an alliance ahead of general elections on 30 January 2024. The KMT favours a closer relationship with China and seeks to maintain Taiwan status quo, accepting the 1992 Consensus which define both sides of the Taiwan Strait as “one China”, but maintains its ambiguity to different interpretations.4 Critically, both candidates have emphasised that, if elected, they would resume talks with Beijing, which were notably cut off following the Democratic Progressive Party’s assumption of power in 2016.5

Latin America

Argentina: Opposition candidate Javier Milei won the presidential elections by a landslide. With 99% of the votes counted, Milei received close to 56% of the valid votes against 44% for Finance Minister Sergio Massa. In his victory speech, Milei vowed to take drastic measures from the moment he takes office on December 10th, stating that there is “no room for gradualism”. He also pledged that his government will meet all of its commitments and respect private property.

Milei will likely have to adopt a large front-loaded fiscal consolidation to stop the central bank financing (seigniorage) and start accumulating FX reserves, which ended October at negative levels (-USD 11bn). This absence of FX reserves and other liquid USD assets could leave investors questioning whether Argentina can implement dollarization. If implemented, the official foreign exchange (FX) rate, currently at ARS 350/USD, is likely to converge towards the parallel FX. Looking at the fiscal picture, Argentina’s public debt is close to 85% of GDP, one of the largest among Emerging Markets (EM) countries (although much lower on a net basis), while its private sector debt was around 20% of GDP, the lowest between the largest EM countries. Argentina’s external accounts show a similar story. Contrasting with the negative reserves in the central bank, it has net international investment assets around USD 100bn at the end of 2022. Moreover, Emilio Ocampo estimated in a blog post that as much as USD 200bn in cash is held by Argentinians in bank safes or under the mattress. Thus, if the private sector believes the government will stop spending (and printing) money like ‘a drunken sailor’, and the government does indeed implement a front-loaded fiscal consolidation, then public debt-to-GDP could decline and private investment has the potential to pick up. However, this ‘tough love’ austerity would be very daunting for the poorest in the first few years, but would pay off later as private sector investments boost employment and productivity, in our view.

Reforming social security will also be required to achieve a sustainable fiscal surplus. If successful, there would be a renewed period of investment inflows that may coincide with a cyclical improvement in the balance of payments as soybean exports recover following a disastrous harvest in 2023 and energy exports accelerate. This would allow for the replenishing of FX reserves as higher GDP growth would likely improve the country’s ability to service the debt.

The main challenge, for this agenda/outlook is policy implementation. Milei will have to rely on Juntos por Cambio’s (JxC) Congress base and will therefore have to share power with a more moderate group. The good news is that JxC has also long advocated for a strong front-loaded fiscal adjustment. The bad news is that Milei will face fierce opposition from the Peronist Party from day one. The Peronists retained a significant share of Congress seats and important provinces, including Buenos Aires.6

In economic news, the yoy rate of CPI inflation rose by 143% in October, up from 138% in September, slightly below consensus estimates at 145%. In sequential terms, inflation rose by 8.3% mom in October, down from the 12.7% mom in September, below 9.5% consensus.

Brazil: Economic activity rose by a yoy rate of 0.3% in September, down from 1.2% yoy in August, 50bps below consensus.

Colombia: Retail sales declined by a yoy rate of 9.3% in September, from -10.0% yoy in August, 80bps below consensus at -8.5% yoy. Manufacturing production declined by 6.9% in yoy terms in September, improving from the 8.6% yoy decline in August, ahead consensus at -7.5%. Industrial production declined 2.8% yoy in September, up from the 4.6% decline in August, 90bps higher than estimates. GDP growth declined by 0.3% yoy in the third quarter, down from +0.4% yoy prior and 0.5% yoy growth estimated. Economic activity declined 0.1% yoy in September, from a 0.4% yoy decline in August, consensus forecasted a 0.5% yoy growth. Consumer confidence improved to -14 from -17.9 in October.

Peru: Economic activity continued to contract in September, registering a 1.3% yoy decline, down from a 0.5% decline in August, -0.5% yoy growth was expected. The unemployment rate in the city of Peru declined by 10bps to 6.6%.

Central and Eastern Europe

Czechia: The current account swung to a CZK 33.4bn surplus in September, up from the 26.3bn deficit in August, ahead of expectations of a CZK 15bn deficit. Industrial producer price index (PPI) inflation increased 0.2% yoy in October, 40bps below expectations, and 60bps lower than the month prior.

Hungary: GDP declined by 0.4% yoy in Q3 2023, an improvement from a 2.4% yoy decline in Q2 2023, slightly ahead of expectations of a 0.5% yoy decline in the quarter.

Poland: The yoy rate of real GDP growth rose by 0.4% yoy, in line with expectations, up from the 0.6% yoy decline in Q2 2023. The yoy rate of CPI inflation rose by 6.6% yoy in October, 10bps higher than the month prior.

Romania: CPI inflation rose by 8.1% yoy in October, down from 8.8% yoy in the month prior. The current account swung to a EUR 394m surplus from a EUR 202m deficit in August and ahead of consensus estimates of a EUR 54m deficit in the month. The trade surplus rose to EUR 801m in September, from EUR 340m in August and EUR 550m consensus. The yoy rate of real GDP growth slowed to 0.2% in Q3 2023 from 1.0% yoy in Q2 2023, significantly below consensus at 2.3% yoy. Industrial output declined by 4.2% yoy in September, from -5.2% yoy in August and industrial sales declined yoy 2.0% yoy, down from -1.1% in August.

Russia: The yoy rate of real GDP growth rose by 5.5% in Q3 2023, up from 4.9% yoy growth in Q2 2023 and 40bps higher than consensus estimates.

Türkiye: The current account moved to a USD 1.9bn surplus in September from a USD 0.4bn deficit in August and ahead of expectations for a USD 1.4bn surplus. Home sales declined by a yoy rate of 8.7% in October, up from a decline of 9.5% yoy in September.

Central Asia, Middle East, and Africa

Ethiopia: Reuters reported Ethiopia was in discussions with its official bilateral creditors to suspend interim debt service payments on its 2024 USD 1bn Eurobond. Discussions regarding the restructuring of the bond are likely to begin next year.

Gulf Cooperation Council: The GCC overall has been able to withstand inflationary pressures to lower energy prices. Inflation remained subdued in the region, with the yoy rate of CPI inflation unchanged at 1.6% in Saudi Arabia. In Qatar, CPI inflation rose by 2.5% in yoy terms in October, from 1.8% yoy in September.

Nigeria: The yoy rate of CPI inflation rose by 27.3% in October, 40bps lower than consensus, from the 26.7% yoy growth in September.

South Africa: The unemployment declined by 70bps to 31.9% in Q3 2023, better than consensus for inflation to remain unchanged. Retail sales rose by a yoy rate of 0.9% in September, from a decline of 0.3% in August.

Developed Markets

United States: Economic data continued to soften as the Citibank Economic Surprise Index declined from 51.8 to 34.2 over the month. The regional surveys on aggregate remained mostly at negative levels but improved both relative to the prior month and to expectations. The yoy rate of CPI inflation slowed by 50bps to 3.2% yoy in October, 10bps below consensus. In sequential terms, CPI dropped to 0% mom in October after 0.4% mom in September. Core CPI declined to 0.2% mom from 0.3% mom and the yoy rate softened by 10bps to 4.0%, 10bps below consensus. PPI final demand rose by a yoy rate of 1.3% in October, from 2.2% yoy growth in September, 60bps lower than expected. Retail sales advance in October declined by 0.1% mom, down from +0.9% mom in September and retail sales ex-auto rose 0.1% mom, down from 0.8% mom in August. Initial jobless claims continue to rise, registering 231k for the week, up from the 218k the week prior; 11k higher than consensus and continuing claims rose to 1,865k, 32k higher than the week prior and 22k above than forecasted.

United Kingdom: Former Prime Minister David Cameron was appointed Foreign Secretary. During his tenure as Prime Minister, Cameron’s emphasis on close diplomatic ties with China, even after leaving his post, were notable, including attending a private dinner with Xi Jinping in 2018 regarding investments in a UK-China fund, and Cameron’s more recent involvement included promoting investment in a Chinese-built port in Sri Lanka. While nothing has been explicit, Cameron’s appointment is a likely signal that Britain will endeavour to foster its diplomatic relations with China.

In economic data, CPI inflation grew 4.6% yoy in October, 10bps below consensus and substantially lower than the 6.7% yoy growth in September. CPI core yoy growth declined by 40bps to 5.7% yoy growth and service inflation shrank 30bps to 6.6% yoy growth in the month. The three-month change in weekly earnings grew by 7.9% yoy in September, down from 8.2% yoy growth in August, ahead of expectations of 7.3% yoy. Retail sales declined by 2.4% yoy in October, down from a decline of 1.5% yoy in September, a decline of 1.5% yoy expected.

Eurozone: Real GDP growth was unchanged at a yoy rate of 0.1% yoy in Q3 2023, in line with consensus. Employment rose by 1.4% yoy in Q3 2023, up from 1.3% yoy in Q2 2023. Industrial production declined by 6.9% in yoy terms in September, 60bps lower than consensus and down from -5.1% yoy in August. The yoy rate of CPI inflation declined by 140bps to 2.9% in October, in line with consensus.

1. See – https://www.ft.com/content/210be310-2dff-434c-aed5-91b3c900aedb

2. See – https://www.calcbench.com/blog/post/669837563223326720/sp-500-chinese-revenues

3. See – https://www.reuters.com/markets/asia/china-is-eyeing-137-bln-new-funding-boost-housing-market-bloomberg-news-2023-11-14/#:~:text=(Reuters)%20%2D%20China%20plans%20to,people%20familiar%20with%20the%20matter

4. See – https://en.wikipedia.org/wiki/1992_Consensus

5. See – https://www.ft.com/content/2f4eab5c-455f-4db2-8dbc-a788e745e389

6. See – ‘US temporarily removes sanctions on Venezuela’, Weekly Investor Research, 23 October 2023.

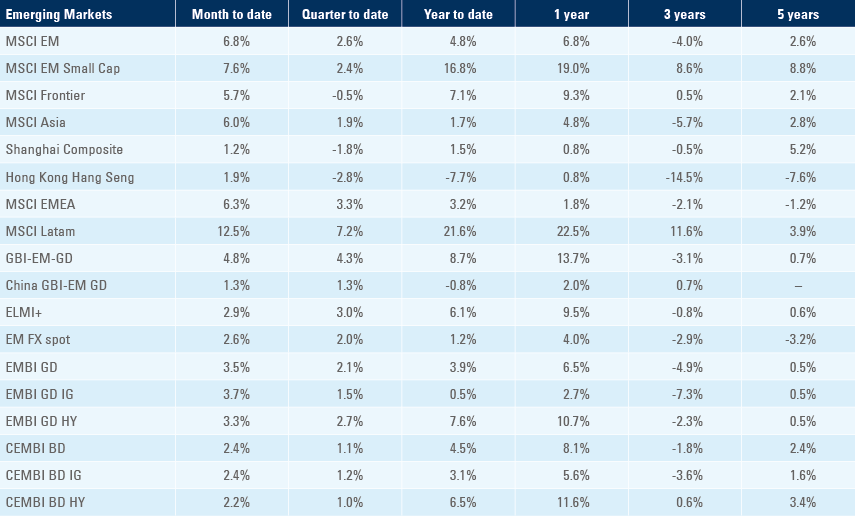

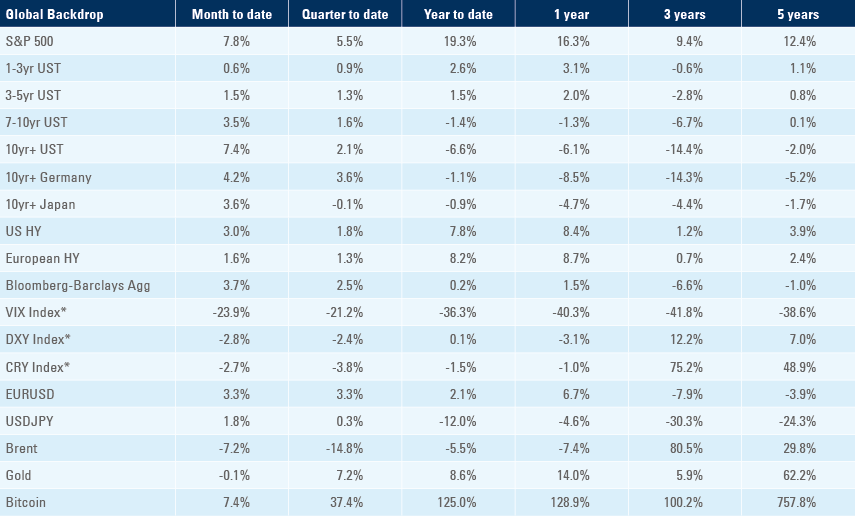

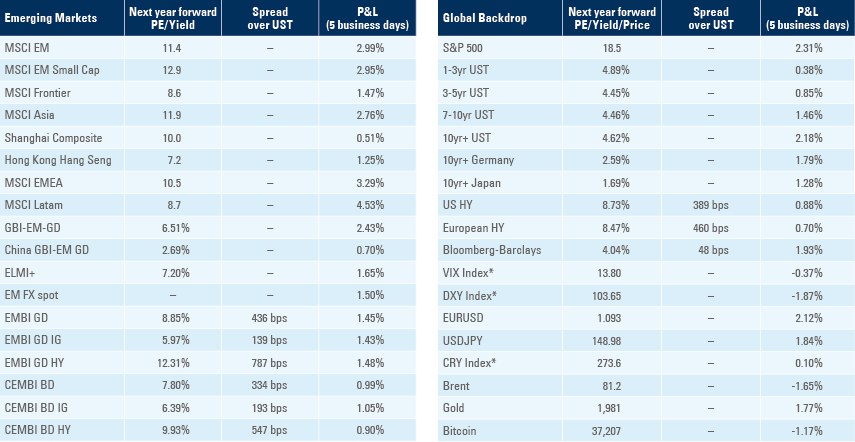

Benchmark performance