Meetings and public statements suggest an attempt to build multilateral support for a ceasefire in Ukraine. China’s Xi Jinping wrote an article in support of boosting income for his country’s low and middle classes as well as supporting its real estate market. Political noise was subdued in Brazil after the Central Bank of Brazil’s Governor struck a conciliary tone. Colombian economic data came in lower than expected. The Ecuadorian government suffered a significant defeat in a referendum and local elections. India’s inflation surprised to the upside. Bank Indonesia kept its policy rate unchanged at 5.75% and Philippines hiked its policy rate by 50 basis points (bps) to 6.5%. Pakistan’s sovereign credit rating was downgraded to CCC- by Fitch.

Geopolitics

The United States (US) Secretary of State Anthony Blinken reported China was considering providing lethal weaponry to Russia after meeting his Chinese counterpart Wang Yi. They met on the side-lines of the Munich security conference, which did not defuse any US/China tensions, from balloons to Ukraine and Taiwan. In parallel, China said it would release a new peace proposal for Ukraine in the coming days. Russian President Putin will meet with China’s Wang this week in Moscow. China will also hold security talks with Japan, the first in four years. This week, US President Joe Biden is in Ukraine to meet with its President Volodymyr Zelensky

French President Emmanuel Macron said he wants “Russia to be defeated in Ukraine”, as Ukraine should be able to “defend its position” but added Russia should “not be crushed” (i.e., Russia should not be attacked on its own soil). The events, including Macron’s comments, suggests an attempt to reach a ceasefire is in the works, this time perhaps involving China. However, Zelensky ruled out immediate talks with his counterpart, saying there is “no trust” between the parties.

In other news, Iran is looking for up to USD 40bn in energy investment from China, according to Iranian Deputy Oil Minister Ahmad Asadzadeh, who added that Tehran, Beijing, and Moscow will work together to “ease payments”. Iran and Russia have both been sanctioned by the US, which is restricting access to their foreign exchange (FX) reserves and to the USD payment system.

The US announced it will be selling a further 26 million barrels (mb) of strategic oil reserves, or 7% of remaining reserves at 371mb (down from 727mb at the peak in March 2010), bringing US reserves to the lowest level since 1983. The sale was necessary to comply with a law enacted in 2015 which mandated periodical sales of reserves until 2027. If the law is not repealed, the US will be required to sell another 140m or 38% of its current reserves.1 Confusingly, the US has been saying it wants to replenish its strategic oil reserves should oil trade at around USD 70 per barrel, which is likely to provide a floor to the market in the short to medium term. The US could already be purchasing oil at these levels as 12-month forward West Texas Intermediate (WTI) has been trading between USD 70 -–80 per barrel for five months now. China could have a higher level of energy reserves than the US today. With the US self-sufficient, it explains China’s push to settle oil and gas with Saudi and the Gulf countries in RMB. In other energy market news, OPEC raised its 2023 global oil demand forecast by 2.3m barrels of oil per day to 100m barrels per day.

Emerging Markets

China: President Xi Jinping wrote an article for the Qiushi Journal – a flagship magazine of the Communist Party of China – where he cited insufficient demand as the main problem in China's economy. The solution, according to Xi, is to boost low and middle class incomes to stimulate consumption and restore confidence in real estate to support “legitimate demand”, highlighting that the sector is important for economic growth, jobs, fiscal income, and financial stability. In other news, China’s National Bureau of Statistics (NBS) reported 36 out of 70 cities saw primary housing prices rising in January, with prices rising in Tier 1 cities but declining in Tier 2 and 3 cities. In economic news, the People’s Bank of China (PBoC) kept its one-year medium-term lending rate unchanged at 2.75% as the lending volume on the facility declined to RMB 499bn in the week to 15 February, from RMB 779bn in the previous month remaining in the upper band of the seasonal range for the period. The PBoC vowed to boost private sector lending in 2023 by expanding financial support tools for private companies, and improving policy tools for inclusive finance, green development, and tech innovation. The PBoC also said it will closely monitor marginal changes in the property market and differentiate property support under “one city, one policy” and carry out its 16-point policy package announced last year, as well as the healthy development of platform companies.

Brazil: The Governor of the Central Bank of Brazil (BCB), Roberto Campos Neto, gave a series of interviews to the press, striking a conciliatory tone with the government. Campos Neto said the BCB wants to work with the government on inflation expectations concerns, but said he is not willing to change the inflation target and reaffirmed BCB autonomy. Campos said there is an open dialogue with Finance Minister Fernando Haddad and Planning Minister Tebet, and said he is open to a Congress Hearing. President Lula also seemed to lower the rhetoric attacking rate levels in an event held by his party. In other news, Volkswagen Brazil reported it will temporarily close three out of its four factories and give collective holidays for two weeks due to a lack of components.

Colombia: Economic data surprised to the downside. Consumer confidence declined another 6.3 points to -28.6 in January (consensus -19.8). The year-on-year (yoy) rate of retail sales contracted 1.8% in December, down 350bps from November, while manufacturing production dropped by 400bps to +0.5% yoy and industrial production declined 180bps to +0.7% yoy over the same period. Real gross domestic product (GDP) growth rose 0.7% quarter-on-quarter (qoq) in Q4 2022 from 0.5% qoq in Q3 2022 (revised from +1.6% qoq), bringing the yoy rate down by 490bps to 2.9%. Meanwhile, the 2022 full calendar year growth declined to 7.5%, down from 11.0% in 2021. Hence, despite the negative surprises to GDP growth in H2 2022, the Colombian economy was still one of the best performers in the world in 2021-22. GDP growth is expected to slow down to 1.2% in 2023.

Ecuador: Ecuadorians went to the polls two weeks ago to vote in an eight question referendum called by President Guillermo Lasso. Lasso lost on all eight referendum questions, including those considered an easy victory, such as whether drug dealers should be extradited (polls showed strong support for yes, but no won in the end). Some fake ballots were found in Guayaquil, which may have influenced the result. The party of former president Rafael Correa (dubbed ‘Correistas’) demanded Lasso’s resignation and early elections, but so far, they do not have support from other parties which would prefer to keep their seats until the scheduled election in 2025. Lasso reshuffled his cabinet and appointed a member of the centre-right Social Christian Party (PSC), which has a good relationship with the Correistas. The next key test for Lasso comes in March, when indigenous groups will evaluate whether Lasso fulfilled his side of the bargain on several agreements.

India: The yoy rate of CPI inflation rose 80bps to 6.5% in January, 50bps above consensus, led by higher food inflation. Meanwhile, wholesale prices declined by 20bps to 4.7%, 20bps above consensus. Higher inflation may mean the Reserve Bank of India hikes its policy rate by another 25bps to 6.75%, to anchor inflation expectations. The trade deficit narrowed to USD 17.7bn in January from USD 23.8bn in December, significantly better than consensus.

Indonesia: Bank Indonesia kept its policy rate unchanged at 5.75%, signalling the end of its hiking cycle as widely expected, as it expects CPI inflation to return to the (3.0% +/-1%) target by the end of 2023. The trade surplus was virtually unchanged at USD 3.9bn in January as the yoy rate of export growth rose to 16.4% (from 6.6% yoy in December), while imports increased by 1.3% yoy (from -7.0%).

Pakistan: The ratings agency Fitch downgraded Pakistan’s credit rating from CCC+ to CCC-, one notch below S&P and Moody’s after FX reserves dropped to critically low levels (around USD 3bn) amid a delay to the bailout from the International Monetary Fund (IMF). Parliament is looking to approve a bill seeking to raise PKR 170bn in taxes by raising general sales tax by 1% and increasing revenue from luxury goods, an important step to revive its USD 6.5bn programme with the IMF. Kristalina Georgieva said Pakistan must increase tax for the richer portion of the population to avoid a default.

Philippines: The Central Bank of Philippines rose its deposit and lending policy rates by 50bps to 5.5% to 6.0% respectively, in line with consensus. Overseas cash remittances rose to USD 3.16bn in December from USD 2.64bn in November, a new monthly record and accumulating USD 32.5bn in 2022, approximately 8% of GDP.

Snippets

- Argentina: CPI inflation rose 6.0% mom in January after 5.3% mom in December, bringing the yoy rate up 380bps to 99.0%.

- Hungary: Real GDP growth declined by 0.4% qoq in Q4 2022 after dropping 0.7% in Q3 2022 (revised from -0.4% qoq).

- Lebanon: The World Bank froze a USD 300m loan. The loan was approved in 2021 and was to be used for gas imports from Egypt, as well as electricity imports from Jordan. The multilateral lending agency cited Lebanon’s failure to follow through on promises made to implement electricity reforms, as rampant corruption and gross mismanagement are still leading to widespread blackouts.

- Peru: The unemployment rate in the city of Lima rose by 90bps to 8.0% in January, and the yoy rate of economic activity index declined by 80bps to 0.9% in December.

- Poland: The current account deficit widened to USD 2.5bn in December, after a small USD 0.3bn surplus in November, as the trade deficit increased to USD 2.7bn (from 1.0bn) over the same period. Real GDP contracted 2.4% qoq in Q4 2022 after expanding 1.0% in Q3 2022, bringing the yoy rate down by 160bps to 2.0% over the same period. CPI inflation rose 2.4% mom in January after 0.1% mom in December as the yoy rate rose 60bps to 17.2%.

- Romania: CPI inflation rose 0.3% mom in January after 0.4% mom in December, as the yoy rate declined by 130bps to 15.1%. Wage inflation declined 20bps to a yoy rate of 13.4% and real GDP growth expanded 1.1% qoq in Q4 2023 after 1.2% qoq in Q3 2023, bringing the yoy rate up 80bps to 4.6% over the same period.

- South Africa: CPI inflation dropped 0.1% mom in January after expanding by 0.4% mom in December, and the yoy rate declined 30bps to 6.9%, in line with consensus. Core CPI inflation was unchanged at 0.2% mom and 4.9% yoy in December. Consumer confidence rose 2.0 points to 112.9 in January, the highest level since 2018. Retail sales contracted 0.6% mom In December after rising 1.0% mom in November.

- South Korea: The unemployment rate dropped to 2.9% in January from 3.1% in December (revised from 3.3%), some 40bps below consensus.

- Thailand: Real GDP contracted 1.5% qoq in Q4 2022 after expanding 1.1% qoq in Q3 2022, bringing the annual GDP growth rate to 2.6% yoy in 2022, 100bps above 2021, but 60bps below consensus.

- Türkiye: The current account deficit widened to USD 5.9bn in December from USD 4.1bn in November, USD 0.5bn above consensus. A large part of the deficit is still funded by errors and omissions.

- Uruguay: The central bank kept its policy rate unchanged at 11.5%, in line with consensus, as expectations have started to converge to the target.

Developed Markets

United States: CPI inflation rose 0.5% mom and ex-food and energy rose 0.4% mom in January, both in line with consensus, bringing the yoy rates down by 10bps to 6.4% and 5.6% respectively. Real average hourly earnings declined 1.8% in yoy terms in January from -1.6% yoy in December. The Empire Manufacturing Survey rose 27.1 points to -5.8 in February, 12 points above consensus. Retail sales rose 3.0% mom in January, 100bps above consensus and retail sales ex-auto and gas rose 2.6% mom (170bps above consensus), all confirming economic activity improved at the beginning of the year. Industrial production was unchanged in January after declining 1.0% mom in December. PPI inflation rose by 0.7% mom in January, 30bps above consensus, after -0.2% mom in December (revised from -0.5%). PPI ex-food and energy rose 0.5% mom, 20bps above consensus and the previous month. The yoy rate of PPI inflation declined 50bps to 6.0% (consensus 5.4%) and core PPI dropped 40bps to 5.4% (consensus 4.90%). February regional surveys were mixed with the Philadelphia Federal Reserve (Fed) business outlook down to -24.3 from -8.9 (consensus -7.5) and the NY Fed service business survey rising to -12.8 from -21.4 (consensus -17.0)

Richmond Fed President Thomas Barkin said the central bank may need to raise interest rates to a higher level than previously anticipated should inflation keep running too fast for comfort, and other Fed presidents (Dallas’s Lorrie Logan and Philadelphia’s Patrick Harker) had similar messages. New York’s John Williams also struck a hawkish tone at the Bankers Association meeting in New York in a speech titled “Our work is not yet done”, highlighting that non-energy services sector (excluding housing) inflation needed to decline from “Elevated average of 3.0% to 3.75% over the most recent six months”.2

In other news, World Bank President David Malpass is stepping down at the end of June, one year before the official end of his term and five months after he was attacked on social media over his remarks on climate change. The Congressional Budget Office (CBO) estimates the US could become unable to pay its bills on time between July and September. Next week, we’ll have the minutes of the Federal Open Market Committee meeting, which may shed some light into the planned pace of tightening before labour market and inflation surprised to the upside.

United Kingdom: January payrolls rose 102k, significantly above the c. 33k average since 2014 and the six-month and 12-month moving average, both at 66k. The Bank of England should bring its own neutral policy rates higher than the Fed, given the current labour scarcity. Labour scarcity (particularly blue collar) is a problem everywhere, but particularly bad in the UK due to Brexit having significantly reduced the inflow of European immigrants. A YouGov poll suggested some Brexit voters now regret their choice, particularly the younger voters.3 Nicola Sturgeon stepped down from the leadership of the Scottish Independence Party, citing fatigue after eight years in the job. Opinion polls suggested a lower likelihood of Scotland voting for independence should another referendum take place.

Japan: Japanese Parliamentary hearings for the nominated Bank of Japan board members will start on 24 February.

Australia: The unemployment rate rose 20bps to 3.7% as payrolls declined by 11.5k (consensus +20k), as a total of 43.3k full time jobs were lost and +31.8k part time jobs were created.

1. See https://www.energy.gov/ceser/articles/doe-issues-notice-congressionally-mandated-sale-purchase-crude-oil-strategic

2. See https://www.bis.org/review/r230215b.htm

3. See https://yougov.co.uk/topics/politics/articles-reports/2023/02/03/which-leave-voters-have-turned-against-brexit

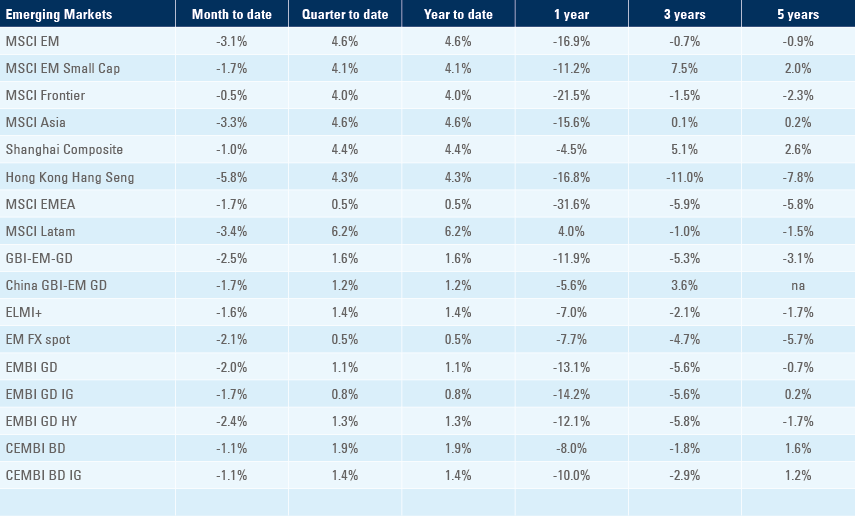

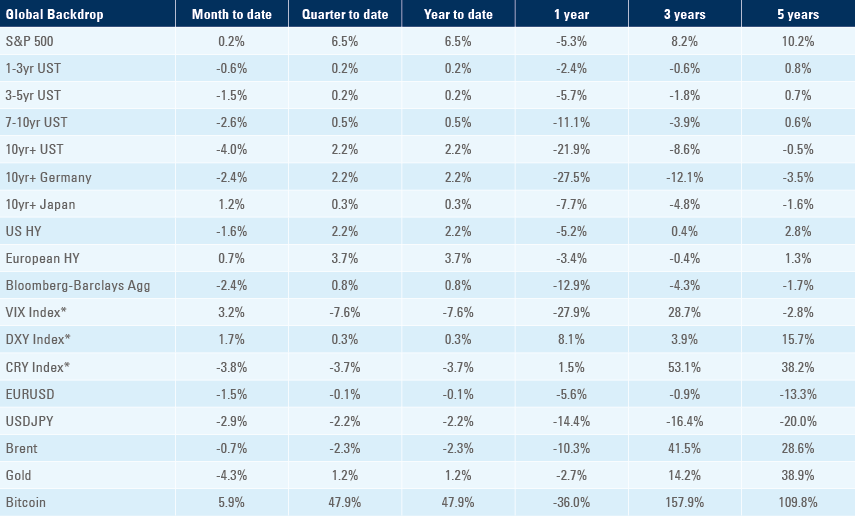

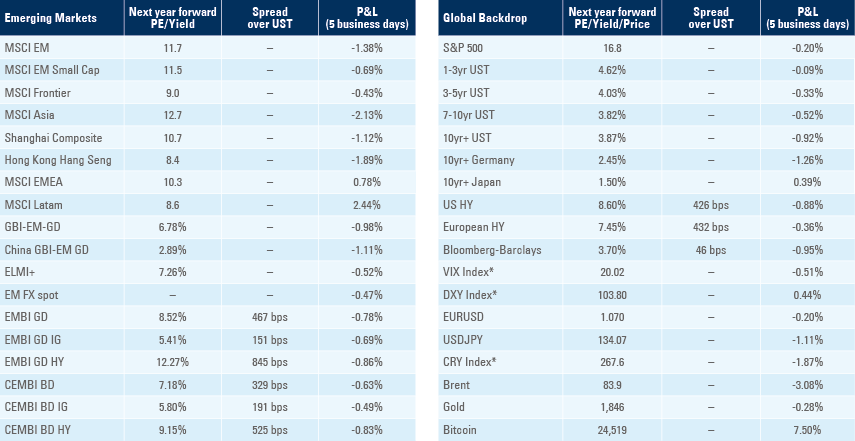

Benchmark performance