An encouraging start to 2023, as the re-opening of China’s economy goes ahead. A new year, a rebirth of EM primary market issuance. The storming of the Federal District by supporters of ex-president Bolsonaro in Brazil echoes the similar event on 6 Jan 2021 in the US. Strong rally in global interest rates markets, with the 10-year US Treasury yield moving 30 basis points (bps) lower. A choppy week for equities ended on a strong note. Commodities were generally weaker, with the Bloomberg Commodity Index off -4.2% as oil prices were down -8.1% (WTI). The USD sold off and EM foreign exchange (FX) outperformed. In equity markets, cyclical sectors outperformed, and growth underperformed value by -3.5%, among the largest gaps between the two sectors over the past 12 months.

Week ahead

The focus will be the release of US consumer price index (CPI) inflation data on Thursday, where consensus is at 6.5% yoy, down from 7.1% in December. The result will be a good indicator of the US Federal Reserve (Fed) next move at the 1 February Federal Open Market Committee (FOMC) meeting . as it will likely decide to implement either 25bps or 50bps in hikes. In LatAm, Peru’s Monetary Policy Committee also meets on Thursday, with expectations of a continuation of the 25bps pace in rate hikes. In the Central Europe, Middle East and Africa (CEEMEA) region, both the Czech Republic and Hungary will release inflation data, with questions over whether these countries will repeat the inflation miss in neighbouring Poland.

Emerging Markets

EM Purchasing Managers’ Indices (PMI) manufacturing data released last week confirmed EM’s out-performance over developed markets. While some Gulf Cooperation Council (GCC) countries saw a modest pullback in PMIs (Saudi Arabia from 58.5 to 56.9, the United Arab Emirates from 54.4 to 54.2), they largely remained in expansionary territory. Elsewhere, South Africa saw an increase from 52.6 to 53.1, while India’s PMI jumped from 55.7 to 57.8.

After a year of extremely low new debt issuance out of EM (less than half the amount issued in 2021), the new year kicked off with USD 29bn in new EM issues, the largest weekly amount since early January 2022. All of the new issuance was in the investment grade sector, with Mexico reprising its role for the third consecutive year as the first EM sovereign issuer. Three-quarters of the issuance came from sovereign issuers. Investor cash levels are high, and the dearth of new issuance in Q4 2022 has given investors a keen interest in new paper, as index-level yields remain attractive and issuers are offering new-issue concessions to encourage participation. The late-week rally in US Treasuries could open the door for further issuance in the week ahead.

Brazil

In events echoing the US Capitol building attack on January 6, 2021, thousands of supporters of former president Jair Bolsonaro stormed Brazil’s Congress and presidential offices in the Federal capital Brasilia, to protest what they falsely believe was a stolen election. The insurrection caps months of attempts by Bolsonaro to call into question the integrity of the Brazilian electoral system. Security forces regained control of the Federal District in the evening and arrested 300 protestors. President Lula, who was in Sao Paolo at the time of the insurrection, was able to return to Brasilia and vowed to punish the perpetrators. The events highlighted clear security lapses, and the Brazilian Supreme Court has already ruled to remove the Governor of the Federal District, Ibaneis Rocha, from office.

Before the storming of the Federal District, the BRL had depreciated by 3.6% during President Lula’s first two days in office. Adding to concerns about the new administration’s commitment to fiscal responsibility, Finance Minister Fernando Haddad advocated for a “feasible target” for fiscal accounts that would not be either unachievable or unambitious. He said he will address a new fiscal anchor along with a tax reform proposal in Q2 2023. President Lula met for the first time with all 37 of his newly-appointed ministers of state, to present his vision for his new administration. Brazil’s trade balance saw a record surplus of USD 62.3bn in 2022, with elevated commodity prices impacting both exports (up 19.3%) and imports (up 24.3%). On the inflation front, the General Price Index (IGP-DI) increased 0.31% month-on-month in December, up from a -0.18% month-on-month decrease in November. Industrial production for November grew 0.9% year-on-year, slightly above market forecasts. For the first 11 months of the year, industrial production remained 0.6% below the level of the prior year.

China

The global mood appeared somewhat brighter on hopes of a rebound in the Chinese economy. Most reports indicate that major Chinese cities have passed their Covid peak. China also appears to be softening its rhetoric concerning other key countries. Notably, China is resuming its coal trade with Australia after a three-year halt, triggered initially in 2018 by Australia’s ban on Huawei Technologies’ participation in Australia’s 5G broadband network. The Chinese government maintained its aggressive pace of policy announcements, including further support for the property sector, reduced scrutiny of the tech sector, and further steps towards reopening.

Having rolled out a wide-ranging rescue plan for its ailing property sector in November, the Chinese government followed up with several new measures to further ease borrowing restrictions for property developers, extending reduced mortgage rates to encourage home purchases and additional measures to alleviate debt pressures. These proactive steps are part of China’s focus on reigniting growth momentum as it continues to emerge from its ‘zero-Covid’ period. The extent of the challenge is evident as new home sales continued their 15-month fall in December, down 30.8% year-on-year and following a 25.5% year-on-year fall in November.

World Health Organization (WHO) officials cast doubt on China’s Covid-related reporting. WHO officials noted that data from China showed no new variants, and also said the data under-represents the number of deaths occurring after the sudden end of the zero-Covid policy. Several countries have imposed restrictions on travellers from China. While China has thus far rejected offers by Western governments to share vaccines, recent reports indicate it has entered talks with Pfizer to license a generic version of the antiviral Paxlovid drug. The hope is to have an agreement before the Lunar New Year on 22 January, when millions of Chinese will travel to their ancestral towns and villages, potentially bringing the virus to areas with much less advance medical services.

Mexico

Minutes from the most recent Banxico meeting were less hawkish, reflecting the view that an improvement in the inflation outlook was sufficient to justify a moderation in the pace of rate hikes. Most analysts expect a further 25bps hike at the central bank’s February meeting. Separately, Mexico’s Supreme Court elected the first woman to serve as president of the Court. Norma Piña has shown an independent streak, often voting against President Andrés Manuel López Obrador’s (AMLO) policies during the most recent stint of her 30-year judicial career. The Finance Ministry said Mexico’s state-owned oil company Pemex will cover its own financial needs in 2023, including the payment of its debts, but AMLO said the following day that the government would be there to assist if it doesn’t have the case to do so. AMLO will join US President Biden and Canadian Prime Minister Trudeau in a “Three Amigos” United States-Mexico-Canada (USMCA) summit meeting after a bilateral session with Biden that will touch on ‘nearshoring’ – bringing new investment to Mexico for closer export to the US. American tourists are also nearshoring, with a significant uptick in inbound tourism at Mexico’s resort destinations.

Venezuela

For the first time in seven years, representatives of both Venezuela and Colombia celebrated the re-opening of the Tienditas Bridge between the two countries, a further step towards normalisation of relations. The bridge will permit transportation of goods and passengers across the border in a boost to bilateral trade. The Venezuelan opposition dissolved Juan Guaido’s interim government, leaving many to question the future course of the Maduro administration. The US announced that it still does not accept Maduro as the legitimate President of Venezuela. Ever hopeful, Maduro said that he is ready to resume normal relations with the US.

Snippets

- Argentina: Argentina’s reserves, which increased sufficiently to meet the International Monetary Fund (IMF)’s reserve accumulation target, will see a USD 1bn drop when the government pays the coupons of its USD bonds.

- Bolivia: Public violence broke out following the arrest of Luis Camacho, the Governor of the Province of Santa Cruz, Bolivia’s commercial centre, on charges of terrorism for his alleged involvement in the protests that led to the removal of President Evo Morales in 2019.

- Chile: December headline inflation confirmed the declining trend, up 0.3% mom and 12.8% yoy. November inflation had been at 1.0% mom and 13.3% yoy. The government announced a new USD 2bn support package for lower-income Chileans, with most of the cost already embedded in the 2022 budget, mitigating any potential inflationary impact.

- Colombia: The government announced a 400 peso increase in the price of gasoline, a move welcomed by the market as it lowers the fiscal impact of subsidies. Diesel prices were also increased, but at a much small level, as diesel is more politically sensitive due to the importance of the transportation sector. Inflation in 2022 reached 13.2%, the highest level experienced since the start of the 2000s.

- Dominican Republic: Based on preliminary data, the government ended 2022 with a deficit of 3% of gross domestic product (GDP), beating its budgeted level of 3.6%. The central bank reported record-high FX reserves of USD 14.4bn. Congress still needs to approve the borrowing law to permit new financing.

- Egypt: The central bank changed its intervention philosophy, allowing the currency to move higher in intra-day steps, rather than in a larger one-step depreciation, confirming the move to a more flexible exchange rate regime. The announcement followed two earlier devaluations that were instrumental in the approval of a USD 3bn 46-month Extended Fund Facility with the IMF, and is a positive sign of engagement with the multilateral that should enable the continued flow of financial support from Egypt’s allies in the Gulf.

- Ghana: Reports indicate Ghana may be seeking debt relief through the G20 Common Framework, which would be a surprise given Ghana’s debt is heavily skewed to domestic markets and multilaterals. The Common Framework has not been a very successful procedure for resolving earlier sovereign defaults, as it likely draws out the resolution timeline.

- Kenya: President William Ruto stated that Kenya will not default on its debt and intends to increase tax collection in the next two years. He added that Kenya will turn from public debt markets to multilateral financing at cheaper rates.

- Panama: President Cortizo announced that a “final contract” had been presented to First Quantum, the mining company involved in a dispute over payments from the Cobre Panama mine to the government. Panama had demanded a minimum payment of USD 375m from First Quantum. Talks remain at a stalemate, but production at the mine continues despite a government order to cease commercial operations.

- Peru: Demonstrations against the new Boluarte government resumed, with protestors demanding the resignation of Boluarte and the release from prison of her predecessor Castillo. The second required vote on moving elections forward to April 2024 will occur when Congress reconvenes in February.

- Poland: December CPI fell to 16.6% yoy, below consensus expectations, largely reflecting a fall in the energy component. The data is likely to reinforce Poland’s central bank’s ‘wait-and-see’ attitude for future interest rate adjustments.

- South Africa: Manufacturing PMI data for December showed an increase to 53.1 from 52.6 in November, but the forward outlook remains challenging due to recurring power outages.

- Ukraine: The Ukraine government denounced the “propaganda gesture” by Russia’s Vladimir Putin to call a 36-hour ceasefire for the Orthodox Christmas. The ceasefire came shortly after more than 100 Russian troops were killed in a strike by Ukrainian forces, reportedly facilitated by Russian soldiers’ use of cell phones that were tracked. Putin rejected a broader ceasefire call from Turkish President Erdogan, calling on Ukraine to recognise the “new territorial realities.” The US, Germany and France have announced the transfer of armoured vehicles to Ukraine, an upgrade in weaponry that had been requested by President Zelenskiy.

Developed Markets

United States

Encouraging US jobs data, but weak survey data. December US manufacturing PMI fell 1.5 points to 46.2, the largest contraction in activity since May 2020, and December ISM services dropped a substantial 6.9 points in December to 49.6. The US labour market again demonstrated its strength as the Bureau of Labour Statistics reported there were 10.5m job openings at the end of November, a figure little changed from October. The Job Opening and Labour Turnover Survey (JOLTS) reported there were 1.7 open jobs for every unemployed worker.US nonfarm payrolls added 223,000 positions in December and the unemployment rate fell to 3.5%, both better than prior estimates of 200,000 positions and a 3.7% unemployment rate. Average hourly earnings were up just 0.3% for the month and 4.6% yoy. The December results gave hope that the upward trend in inflation may finally be reversing. FOMC minutes were seen as hawkish, with several officials emphasising that the decision to pull back to a 50bps hike from the earlier 75bps pace “was not an indication of any weakening of the Committee’s resolve to achieve its price-stability target”. The Atlanta Fed President Raphael Bostic said the December job report, which showed a slowdown in wage growth and better-than-forecast employment growth, did little to alter his outlook on the economy and confirmed his view that interest rates will continue to rise to a level above 5%, where he expects it to stay for an extended period. Bostic expects a further rate increase of either 25bps or 50bps at the Fed’s next meeting on 1 February, adding he does not expect a recession in the aftermath of the Fed’s actions, but if one were to occur it would be “short and shallow.”

Those who thought that the new Republican majority in the US House of Representatives would commence its business quietly were sorely mistaken as a group of 20 conservative members forced 15 rounds of voting for a new Speaker of the House. The role is of extreme importance as the Speaker is second in line to the Presidency after the Vice President. The holdout members, all part of the conservative Freedom Caucus, forced the presumptive Speaker Kevin McCarthy to agree to several significant conditions that would give the conservative wing of the GOP (‘Grand Old Party’) more control over the actions in the House, and confirm the challenge the next Speaker will have in marshalling support for legislation in the next two-year session. Why is this relevant for investors outside of the US? One of the key concessions was a commitment to tie raising the nation’s debt ceiling (a routine practice) to spending cuts, which could become an issue when the increase is necessary to avoid a default on US debt, as Senate Democrats and the White House are unlikely to agree to spending cuts. This was the first time the election as Speaker was not settled in the first round of voting since 1923. The ‘civil war’ within the Republican Party pushed balloting longer than at any time since before the actual US Civil War in the mid-1860s.

Europe

Consumer prices rose by 9.2% yoy in December, below the 9.5% consensus expectation and down from the 10.1% pace reported in November. However, core inflation accelerated to a record 5.2%, above the 5.0% expectation. The return to single-digit inflation is the first since August 2022, raising hopes that the recent spike in prices has passed. Europe continues to benefit from sustained mild weather, which has reduced the demand for natural gas and other energy sources. Energy prices in the Eurozone increased at an annual rate of 25.7% in December, a drop from the reported 41.5% level earlier in the quarter. Despite the respite, the ECB has already indicated it will hike rates further at its February meeting. Meanwhile, the European Commission released its monthly economic sentiment index for December, showing an increase to 95.8 from 94.0 in November, the first increase since the rapid fall in sentiment following the Russian invasion of Ukraine.

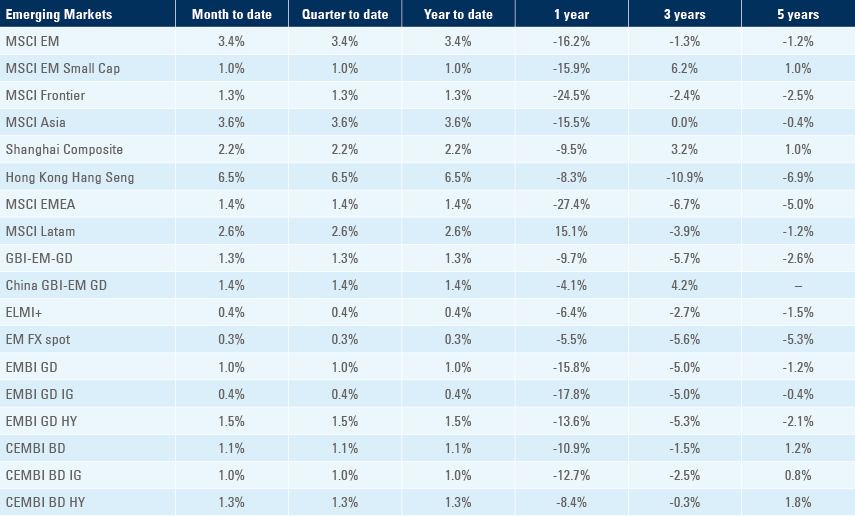

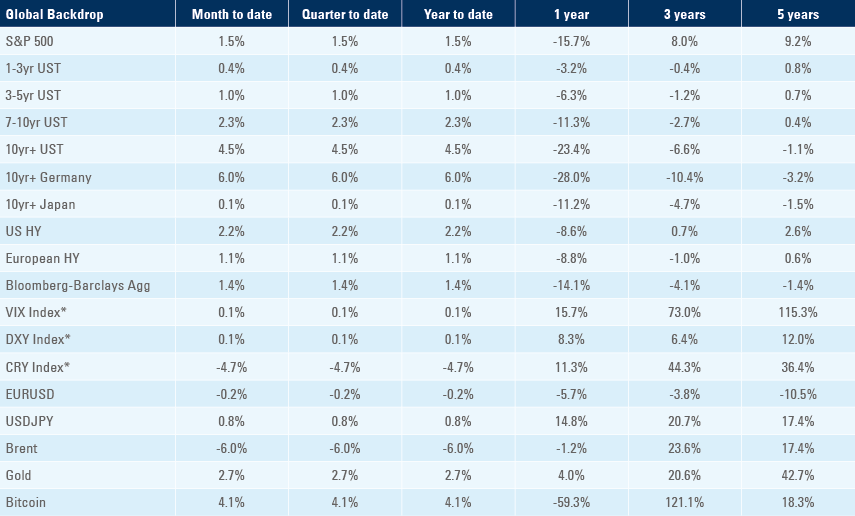

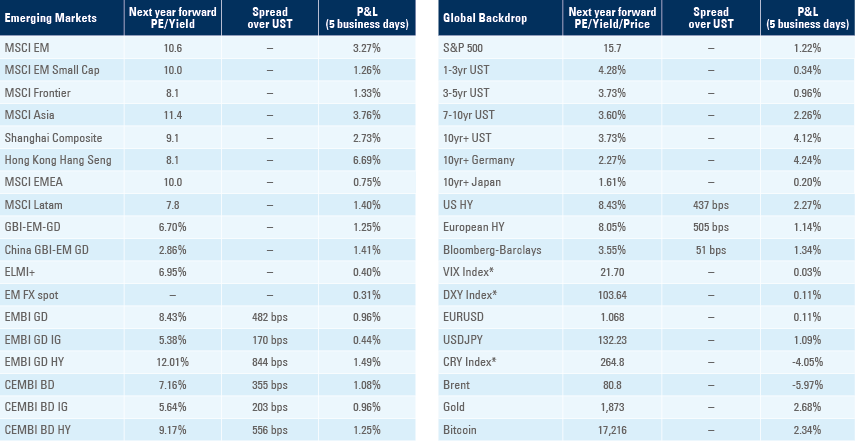

Benchmark performance