Global equity markets attempt to rise after consumer price index (CPI) inflation was lower than expected across the world, with US equities rallying sharply after its CPI release last Tuesday. However, stocks sold off after the “one-two hawk strike” by the US Federal Reserve (Fed) and European Central Bank (ECB), as both central banks signalled a higher terminal rate for longer than priced in by the United States (US) and European rate markets. Risk assets will likely remain under pressure after the “Fed pivot” narrative and thesis were proven incorrect, particularly with liquidity deteriorating over the next two weeks. The Fed should eventually pivot to ease monetary policy after an economic recession leads to higher unemployment, a condition that has not yet been satisfied. Leading indicators continued to soften across developed markets (DM). Latin American central banks are close to the end of their hiking cycle as Argentina takes initial steps to rebalance its economy. Chinese data was weaker than expected due to further pandemic mobility restrictions. Ghana reached a deal with the International Monetary Fund (IMF). The Philippines hiked its policy rate to 5.0% and the South African parliament rejected a motion to initiate impeachment proceedings against President Ramaphosa.

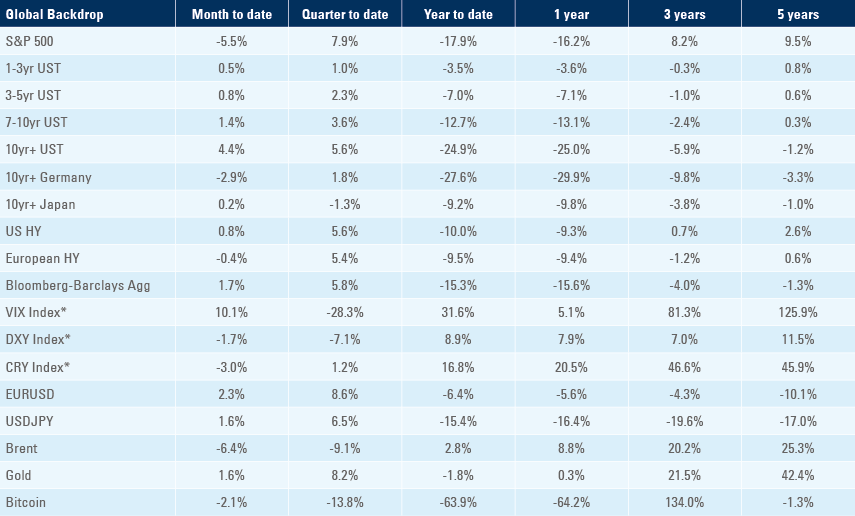

Flash PMIs

December’s flash PMIs showed better economic activity in Europe, but a further deterioration in the UK and US. New orders improved +4.6 points in Germany to 42.9, and +2.9 points in France to 45.1 but dropped another 2.0 points in the UK to 39.9 and 2.1 points in the US to 43.1. Output was also mixed with a similar profile but remained below 50 across all four countries. Employment remained resilient in Germany, but declined sharply in France, and more mildly in the UK and US, as per Figure 1.

Fig 1: Flash PMIs: selected DM countries

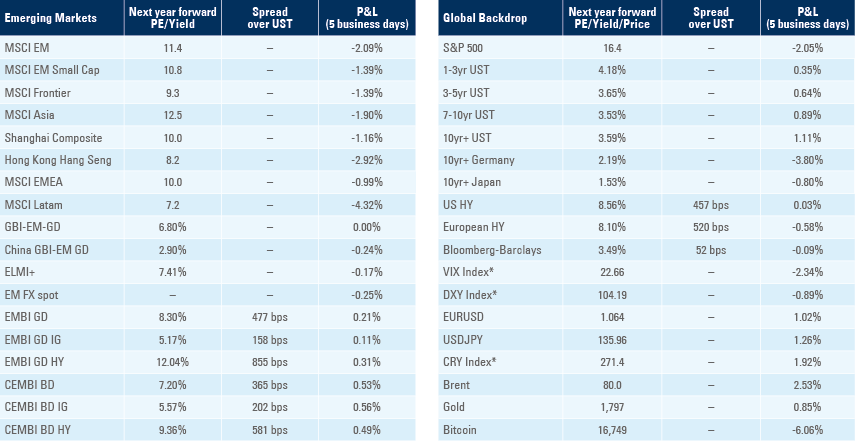

US services sector PMI dropped 1.8 to 44.5, with most of the decline concentrated in input prices, dropping 7.8 points to 58.3 as new and outstanding business remained below 50, contrasting with elevated levels of business expectations (above 60) as per Fig. 2.

Fig: 2: Flash US Services PMI

Emerging markets

Argentina: Real GDP growth accelerated to 1.7% qoq in Q3 2022 from 1.0% qoq in Q2 2022 and the yoy slowed to 5.9% from 7.1% over the same period due to base effects. CPI inflation declined to 4.9% mom in November from 6.3% in October, 1.0% lower than consensus and surprising on the lower side for the third consecutive month after a peak of 7.4% mom in July, even though the yoy rate rose by 440 basis points (bps) to 92.4%. Economic growth is likely to slow down in 2023, in our view, as Finance Minister Sergio Massa increases taxes across the utility sector and works to lower subsidies despite presidential elections. However, fiscal consolidation should also bring inflation down, providing more certainty to investors at a time when progress in critical pipeline infrastructure for Argentina’s large shale basin Vaca Muerta is gathering pace. Last week, Argentina announced USD 1.2bn in financing from the Brazilian National Development Bank (BNDES) and the Latin American Development Bank (CAF), for the completion of the first phase of the natural gas pipeline connecting Tratayen (Vaca Muerta) with the Province of Buenos Aires in June 2023. The company in charge of the project estimates the first stage will save USD 1.5bn annually in energy imports and a second stage connecting Buenos Aires with Santa Fe would save another USD 1.2bn per year.

Brazil: Brazilian assets underperformed for another week with stocks, local rates and the BRL underperforming, after President-elect Lula appointed Aloizio Mercadante, another former Worker’s Party member, as president of BNDES. The formalisation of the appointment depends on overturning the legislation introduced by former President Michel Temer, which prevents bringing political appointments to state-owned enterprises. The law could be overturned by Provisional Measure (president decree) and confirmed by Congress in up to 120 days. If confirmed, it would be the second institutional breakdown demanded by Lula (the first being the expenditure ceiling) before taking office.

China: Economic data for November was weaker than expected, reflecting the impact of surging Covid-19 cases and further mobility restrictions. The yoy rate of industrial production declined to 2.2% in November from 5.0% in October, retail sales contracted 5.9% yoy from -0.5% yoy, and fixed asset investment slowed to 5.3% yoy from 5.8% yoy over the same period. The property investment contraction worsened to -9.8% yoy in November from -8.8% in October, with the property sales slump unchanged at -28.4% yoy. Covid-19 outbreaks in several large Chinese cities are causing medicine shortages and led to some cities moving teaching classes online. Officially, there were only 2,028 new locally reported cases on Saturday, but China has recently stopped recording asymptomatic cases.

Chile: The leaders of the Senate, Álvaro Elizalde, and of the Lower House, Vlado Mirosevic, reached an agreement for a new constitutional reform project named “Agreement for Chile”. The project was signed by 14 political parties and proposes the creation of two constitutional bodies. The first body will have 24 members elected by Congress and the second will have 50 members elected by popular vote. Congress plans to have a new constitution in place before the end of 2023.

Colombia: Economic activity continued to slow in October, with the yoy rate of retail sales growth declining to 1.9% in October from 7.2% in September, while manufacturing production decelerated by 160bps to 5.3% yoy over the same period. The central bank hiked its policy rate by 100bps to 12.0%, in line with consensus as Governor Villar reiterated that the monetary policy tightening cycle is close to an end, but not yet over. Finance Minister Ocampo lowered 2023 gross domestic product (GDP) growth expectations by 50bps to 1.3%, as the government expects lower inflation in the beginning of 2023 concurrent with the end of the monetary policy tightening cycle.

Ghana: The IMF reached a staff-level agreement on a new USD 3bn programme aimed at restoring “macroeconomic stability and debt sustainability while laying the foundation for stronger and more inclusive growth”. Last week, Ghana unveiled terms for a local debt restructuring, which entails a net present value of close to 40% of the face value across local debt. However, this has been initially rejected by local investors. Ghana is likely to start discussions to restructure its Eurobonds and other foreign liabilities before year-end.

Mexico: The central bank hiked its policy rate by 50bps to 10.5%, in line with consensus, raising rates by 650bps overall since June 2021. Policymakers see average headline inflation declining from 8.1% in 4Q 2022 to 4.2% in 4Q 2023 and 3.0% in 4Q 2024 and signalled the end of the tightening cycle at its next meeting in February, even if that would imply decoupling from US monetary policy.

Philippines: The Bangko Sentral ng Pilipinas (BSP) hiked its deposit and borrowing policy rates by 50bps to 5.0 and 5.5% respectively, taking the total hiking cycle to 350bps. It also increased its 2023 inflation estimate by 20bps to 4.5%, 50bps above the ceiling of its 2%-4% target range. The trade deficit narrowed by USD 1.5bn to USD 3.3bn in October, as imports declined by USD 1bn to USD 11bn, and exports rose by USD 0.5bn to USD 7.7bn. Overseas remittances rose by USD 0.1bn to USD 2.9bn in October, marking a new record for the month.

South Africa: Parliament voted against the impeachment probe on President Cyril Ramaphosa after the Africa National Congress (ANC) party closed ranks to support the president. In economic news, CPI inflation slowed to 0.3% mom in November from 0.4% in October and the yoy rate slowed by 20bps to 7.4% as producer price inflation (PPI) dropped 100ps to 15.0% yoy. Core CPI was unchanged at 5.0% yoy.

Snippets

- Czechia: PPI inflation declined 1.0% mom in November after rising 0.6% in October, allowing for a 280bps decline in the yoy rate to 21.3%.

- India: The yoy rate of wholesale price inflation plunged 250bps to 5.9% in November, significantly lower than consensus. The trade deficit narrowed to USD 23.9bn in November from USD 26.9bn in October as the yoy rate of exports increased 0.6% from -16.6% yoy. Meanwhile, imports were unchanged at 5.4% yoy over the same period.

- Indonesia: The trade surplus narrowed to USD 5.2bn in November from USD 5.6bn in October, significantly better than consensus at USD 4.3bn. The yoy rate of exports growth slowed to 5.6% from 11.9%, but imports contracted by 1.9% in November after rising 17.4% yoy in October.

- Nigeria: CPI inflation rose 40bps to a yoy rate of 21.5% in November, 20bps above consensus.

- Peru: Ratings agency S&P kept Peru's long-term foreign currency debt rating at BBB, the second-lowest investment grade score. However, S&P’s outlook was changed from stable to negative due to the current political crisis. The unemployment rate rose by 40bps to 7.6% in the city of Lima.

- Poland: The current account deficit narrowed to EUR 0.5bn in October from EUR 1.6bn in September, despite the trade deficit widening by EUR 0.2bn to EUR 2.3bn over the same period. CPI inflation was unchanged at 0.7% mom and 17.5% yoy, while core CPI slowed to 0.7% mom and 11.4% yoy.

- Romania: CPI inflation was unchanged at 1.3% mom in November, lifting the yoy rate up by 150bps to 16.8%. The yoy rate of wage inflation slowed 70bps to 13.1%. Industrial output growth slowed to 0.7% yoy in October from 1.6% yoy in September.

- Saudi Arabia: The yoy rate of CPI inflation declined 10bps to 2.9% in November.

- Taiwan: The central bank hiked its policy rate by 12.5bps to 1.75%, in line with consensus.

- Turkey: Industrial production rose 2.4% in October after declining 1.6% in September, bringing the yoy rate up 200bps to 2.5%.

- Vietnam: Domestic vehicle sales declined by 0.4k to 31.2k in November, in line with the average of the last 12 months.

Developed markets

United States: The Federal Open Market Committee (FOMC) hiked the Fed Funds policy rate by 50bps to 4.5%, in line with consensus. However, the dot-plot chart signalled almost all policy makers see the terminal rate rising to 5.1% at the end of 2023 (from 4.6% in September), in sharp contrast with current market pricing of the terminal rate at around 4.85% in May 2023 and 4.35% in December 2023. The FOMC’s statement still said it expected “ongoing increases” in the Fed Funds rate, implying at least another two hikes in 2023. FOMC members also expect unemployment to increase from 3.7% in 2022 to 4.6% in 2023 and 2024 (revised from 3.8% and 4.4% respectively). Core CPI inflation was revised to 4.8% (+30bps) in 2022, 3.5% (+40bps) in 2023 and 2.5% (+20bps) in 2024.

In economic news, CPI inflation slowed to 0.1% mom in November from 0.4% in October, 20bps below consensus, bringing the yoy rate down 60bps to 7.1%. Core CPI declined 30bps to 6.0%, also 10bps below consensus. The Empire Manufacturing survey in New York dropped 15.7 points to -11.2 in December and the Philadelphia Fed Business outlook improved marginally to -13.8, still in depressed territory. Small business optimism increased 0.6 points to 91.9, ahead of consensus at 90.5, but remains one standard deviation below the median trend line since 1983. Coincident indicators were soft as retail sales dropped 0.6% mom in November after rising 1.3% in October, and industrial production dropped 0.2% mom after -0.1% over the same period. Importantly, initial jobless claims declined 20k to 211k in the week of 10 December, moving in the opposite direction for what would be required for the Fed to stop its hiking cycle, while continuing claims were unchanged at 1.67m in the previous week.

Europe: The ECB hiked its policy rates by 50bps, taking the deposit rate to 2.0% and the refinancing rate to 2.5%, accumulating 250bps of hikes in one semester. It also announced it will start shrinking its Asset Purchase Programme portfolio in March 2023 by no longer reinvesting EUR 15bn per month (roughly half the size of maturities) and signalled another 50bps hike in the first meeting of the year in February. Its hawkish stance continued as it increased its 2022, 2023 and 2024 inflation forecasts to 8.4%, 6.3% and 3.4%, from 8.1%, 5.5% and 2.3% respectively while GDP growth is likely to slow from 3.4% in 2022 to 0.5% in 2023 (previous forecasts were 3.1% to 0.9% respectively).

In economic news, the seasonally adjusted trade deficit narrowed to EUR 28.3bn in October from EUR 36.4bn in September. The yoy rate of CPI inflation in November was revised 10bps higher to 10.1%, but core CPI remained at 5.0%. The German ZEW survey with bankers showed the economic climate was improving, albeit still at very depressed levels, with the index rising 3.1 points to -61.4 and economic expectations climbing 13.4 points to -23.3. The EU ZEW survey of expectations bounced 15 points to -23.6.

United Kingdom: The Bank of England hiked its policy rate by 50bps to 3.5%, in line with consensus. Most Monetary Policy Committee members signalled further hikes are likely with one dissenting in favour of a 75bps hike. Nevertheless, two out of nine members voted to keep policy rate unchanged, signalling concern that the overall level of policy rate may already be too elevated.

In economic news, CPI inflation rose 0.4% mom in November, significantly lower than 2.0% mom in October as the yoy rate declined 30bps to 10.7% and core CPI declined 20bps to 6.3%. Jobless claims surged to 30.5k in November from -6.4k in October, a significant level that has been surpassed for several months only in five previous recessions in 1975, 1980, 1990, 2008 and 2020. That said, the UK labour market remains tight as the unemployment rate increased by only 10bps to 3.7%, while the yoy rate of average weekly earnings rose by 10bps to 6.1%.

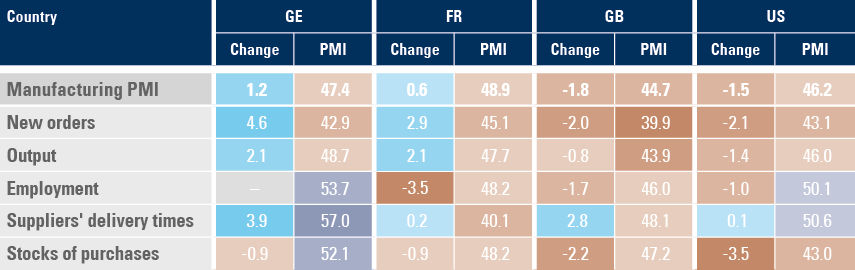

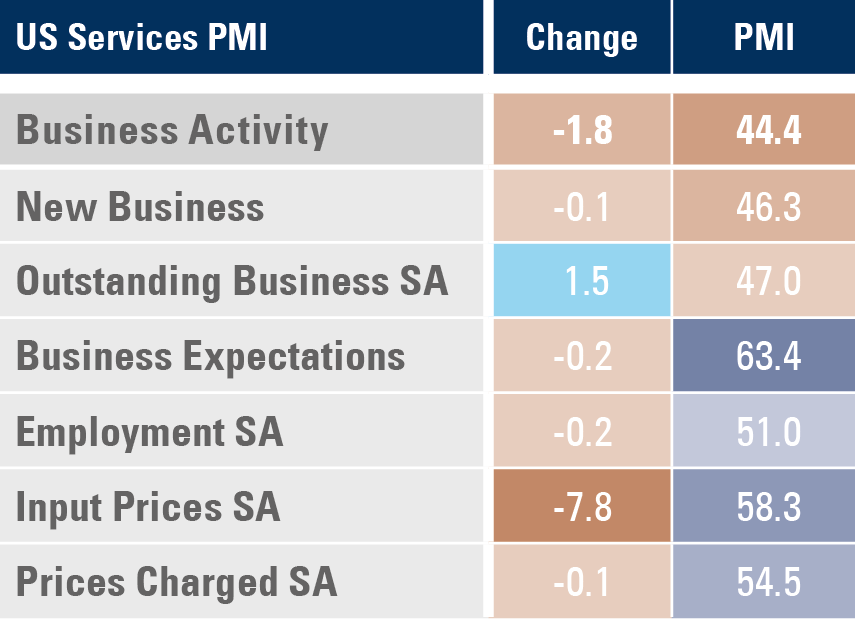

Benchmark performance