Two articles from renowned economists highlighted Emerging Market (EM) policy superiority which has allowed EM local currency bonds to outperform Developed Market (DM) bonds over the last years. Indeed, inflation remained on a declining trend in most countries last week. Corroborating the importance of high-quality EM policy, Türkiye’s external accounts improved by more than expected in September as monetary policy reforms since the election started to pay off. New issuance increased significantly over the last weeks as issuers took advantage of marginally lower yields on US Treasuries. The RMB adoption for trade settlement increased to new highs. The JPY weakened to the lowest level in 33 years as carry traders ignore bigger fundamental questions, for now.

Global Macro

EM Policy Stability

Two articles published in November highlighted the much better post-pandemic monetary policy response from Emerging Market (EM) central banks. Elina Ribakova from the Peterson Institute for International Economics wrote a long form paper highlighting EM central banks have outperformed DM peers in “addressing rising post-COVID inflationary pressures in a timely manner and, related, avoiding banking sector stress during the monetary policy tightening cycle”.1 Harvard Professor Kenneth Rogoff also wrote a piece titled “The Stunning Resilience of Emerging Markets” (EM) for Project Syndicate.2 At an International Monetary Fund (IMF) event that included US Federal Reserve (Fed) Chair Jerome Powell, Rogoff further reminded investors that there has been no major EM debt crisis despite the pandemic, attributing this to three factors:

- Better macroeconomic policy management under the “Washington Consensus” (prudent fiscal policies, inflation target regimes and floating currencies)

- Good regulations protecting the banking sector from exogenous shocks

- EM central bank skills

Issuance

In the first 10 days of November, seven EM sovereign issuers placed USD 13bn of Eurobonds, taking the gross issuance to a monthly rate of USD 67bn. The largest deals were Türkiye and Colombia with USD 2.5bn each, followed by Bulgaria (EUR 2.3bn), Indonesia (USD 2.0bn), Costa Rica (USD 1.5bn), Israel (USD 0.8bn + EUR 0.5bn), Uruguay (USD 0.7bn), and Egypt with a JPY 75bn (c. USD 500m) Samurai bond guaranteed by a Japanese bank.

EM issuers were rushing to take advantage of the lower yield on US Treasuries and better sentiment to lock-in in their financing before the year-end lull that starts. Despite the flurry of EM new issuance activity in November, indicating optimism of a turning point, in the latest BAML survey, 52% of investors remain underweight EM fixed income, with only 10% overweight EM.

Geopolitics

The White House reported that Israel agreed to a “tactical” four-hour humanitarian pause each day and other “limited” pauses to allow people to escape the conflict in Gaza, while maintaining there will be no ceasefire until the hostages have been released. Palestinian officials reported the death toll from the conflict had risen to 10,800 people thus far. Israel separately reported that 37 of its soldiers had died since the onset of the ground invasion.

Over the weekend, President Netanyahu reiterated that Israel’s aim is to retain “overall security control” over Gaza, opposing the notion that a Palestinian authority-led government would have control over the territory.

Emerging Markets

EM Asia

China: The latest publication from the People’s Bank of China (PBoC) demonstrated that as of Q3 2023, the RMB had overtaken the USD as the most used currency in China’s cross-border payments within China. Furthermore, the RMB also surpassed the Euro as the second most used currency in global trade. The rise in RMB debt financing, under the so-called ‘Panda bonds’, were cited as one of the key drivers behind the rise in importance and flows of the RMB.3 This shows the increasing role of the RMB in international capital markets, despite the concerns over the economy and the poor performance of Chinese stocks.

In economic news, the trade surplus narrowed to USD 56.5bn in October from USD 78bn in September, USD 15bn below consensus. Imports rose 3.0% yoy in October, up from -6.3% yoy decline in September, and consensus at -5.0%. Exports dropped by a yoy rate of 6.4% in October, 10bps lower than September, (consensus -3.5%). Commodity exports strengthened led by iron ore, coal, crude oil, and copper, while the exports of consumer goods such as laptops, clothing, and furniture, remain in a deep contraction. The silver lining was the robust exports of mobile phones and cars, growing at 21.8% yoy and 45.0% yoy, respectively. The yoy rate of consumer price index (CPI) inflation dropped by 20bps to -0.2% yoy in October, 10bps below consensus. Producer price index (PPI) posted a 2.6% deflation in yoy terms in October, 10bps lower than in September. China aggregate financing registered CNY 1,850bn in October, down from the CNY 4,120bn in September, and below consensus expectations of CNY 1,950bn. New loans in October also shrank in the month, registering CNY 740bn, down from CNY 2,300bn in the month prior, slightly ahead of expectations of CNY 655bn.

India: The yoy rate of industrial production rose by 5.8% in September, from 10.3% in August, below consensus expectations at 7.0% yoy.

Indonesia: The yoy rate of GDP growth slowed to 4.9% in Q3 2023 from 5.2% in Q2 2023. Sequentially, GDP growth slowed to 1.6% qoq in Q3 2023 from 3.9% in the previous quarter.

Malaysia: Industrial production declined by a yoy rate of 0.5% in September, 20bps lower than August, and 40bps lower than the forecasted improvement to 0.1%.

Philippines: The yoy rate of CPI inflation decelerated in October to 4.9%, 120bps below September, and 70bps lower than consensus forecasts. Despite the decline, inflation remained above the 2%-4% corridor target for 19 consecutive months, explain the 25bp off-cycle hike to 6.5% last month.

South Korea: The current account surplus improved to USD5.4bn in September, from USD5.0bn in August. The goods surplus rose to USD7.4bn in September from USD5.2bn in August, as exports improved above expectations, compensating the larger services deficit in September.

Taiwan: CPI inflation rose by 3.1% in yoy terms in October, 0.1% September, and 0.3% above consensus estimates. PPI inflation declined 0.2% in yoy terms in October, down from +0.2% yoy in September. The trade surplus shrank to USD5.8bn in October from USD10.3bn in September, significantly below consensus. Exports declined 4.5% yoy in October, down from the 3.5% yoy growth observed in September, and imports declined by 12.3% in yoy terms in October.

Thailand: Inflation remains very subdued in Thailand as CPI declined to -0.3% yoy in October, from +0.3% yoy in September, while core CPI inflation rose marginally to 0.7% yoy in October. Consumer confidence improved by 150bps to 60.2 in October.

Latin America

Argentina: The elimination of Juntos por el Cambio, the nation’s more market-friendly party, leaves a political landscape polarised between Sergio Massa, the current Economy Minister under the Peronist government, against the right-wing radical, Javier Milei. With the runoff rapidly approaching on 19 November, neither candidate offers the market much comfort. On the one hand, Finance Minister Sergio Massa supported the private sector, in particular the energy industry, but returned to populist spending financed by the central bank to win the election. On the other hand, Javier Milei, known for his radical ideas, including the dollarisation of the economy, but has offered little in the way of explaining how he intends to meet these bold objectives. Despite the polarisation of views, all presidential candidates have campaigned for fiscal consolidation, which is likely encouraging for markets for a more optimistic outlook into 2024. Following intense droughts throughout 2023, agricultural production should begin to pick up; additionally, as shale gas production increases, these tailwinds should complement the fiscal consolidation under either candidate, hopefully offering some respite to the external accounts. Last Friday, a poll by Atlas Intel showed Javier Milei had 49% of vote intentions compared to 45% for Sergio Massa. Atlas Intel was one of the few pollsters to predict Massa ahead in the first round of presidential elections. Furthermore, the average of polls published since early November shows a small margin in favour of Milei, ahead of the presidential run-off next Sunday.

Brazil: The yoy rate of CPI inflation declined by 40bps to 4.8% yoy in October, 5bps below consensus estimates. The current account deficit widened in September to USD1.4bn from USD 0.7bn in August, broadly in line with consensus. Foreign direct investment declined to USD 3.8bn in September from USD 4.3bn in the month prior. The S&P Global Services PMI increased by 1.3 points to 51.0 in October. Personal loan default rate decreased by 10bps for September to 6.0%. The ratio net debt-to-GDP rose by 10bps to 60.0%, above consensus at 59.8%. Retail sales rose by 3.3% yoy in September, up from a revised 2.4% in August and 80bps ahead of consensus forecasts.

Chile: The trade surplus was broadly unchanged at USD 1.0bn in October. Nominal wages rose by 8.9% yoy in September, 90bps above than August as CPI slowed by 10bps to 5.0% yoy in October.

Colombia: CPI inflation grew by 10.5% yoy in October, down from 11.0% yoy growth in August, and 10bps below consensus estimates. JP Morgan reported CPI inflation runs at 8.3% yoy in seasonally adjusted terms (last three months, annualised), and ex-food & regulated CPI momentum eased to 6.5% yoy, still above the central bank’s target.

Mexico: The yoy rate of CPI inflation rose by 4.3% in October, 20bps below September (in line with consensus). The central bank kept its policy rate unchanged at 11.25%, also in line with consensus. Manufacturing production grew by 0.8% yoy in September, a 140bp improvement from August and significantly ahead of expectations of -1.7%. Industrial production shrank by 80bps to 3.9% yoy growth in September from the month prior, 40bps below consensus.

Peru: The central bank cut the reference rate by 25bps to 7.0%, in line with consensus.

Central and Eastern Europe

Czechia: The unemployment rate was broadly unchanged in October at 3.5%. CPI inflation rose by 8.5% yoy in October, from 6.9% yoy in September. Industrial output declined by 7.8% yoy in September, after -1.7% yoy in August and -5.4% yoy consensus. Retail sales ex-auto declined by 4.0% yoy in September, 120bps lower than August and 30bps below expectations.

Hungary: The yoy rate of CPI inflation slowed to 9.9% yoy in October from the 12.2% yoy in September, 50bps below consensus. Industrial production rose by 1.2% mom in September, after declining 2.4% mom in August, bringing the yoy rate up 30bps to -5.8% in September, 60bps above consensus. Retail sales shrank by 7.3% yoy in September, 20bps below consensus and the prior month. The trade surplus doubled to USD 1.3bn in September.

Poland: The central bank left the policy rate unchanged at 5.75% at the November meeting, while the median estimate was a 25bp cut to 5.5%.

Romania: CPI inflation slowed to 0.6% mom and 8.1% yoy in October, from 0.8% mom and 8.8% in September, broadly in line with consensus. The yoy rate of retail sales slowed 40bps to 0.7% yoy in September. The central bank kept the policy rate unchanged at 7.0%. The trade deficit shrank in September to EUR 2.2bn from EUR 2.6bn in August.

Russia: The yoy rate of CPI inflation rose by 6.7% in October, up from 6.0% in the month prior, and ahead of consensus expectations.

Türkiye: The current account moved to a USD 1.9bn surplus in September, USD 0.5bn ahead of consensus, from a USD 0.4bn deficit in August. The increase in surplus is also notable in seasonally adjusted terms as the average current account for September over the last 10 years stands at -USD 0.5bn deficit (low/high -4.0bn to +3.1bn). A decline in gold imports and higher tourism spending are the main culprits. Lower gold imports are likely a sign that the tight monetary policy implemented by the central bank is working. Furthermore, foreign exchange reserves increased by USD 7.7bn in September. The unemployment rate decreased by 10bps in September to 9.1%. Industrial production grew by 4.0% yoy in September, 90bps higher than August and 120bps ahead of consensus.

Central Asia, Middle East, and Africa

South Africa: Mining production declined by 1.9% yoy in September, 10bps better than August, and 60bps ahead of consensus. Gold production declined 0.1% yoy in September, down from +0.5% yoy in August. Platinum production rose to 3.8% yoy in September, 80bps higher than the month prior. Manufacturing production declined by 4.3% yoy in September, down from a revised growth of 1.5% in September, and lower than estimates of a 2.5% yoy decline for the month.

UAE: The Whole Economy PMI increased to 57.4 in October, from 56.1 in September.

Developed Markets

Australia: The Royal Bank of Australia (RBA) hiked the policy rate 25bps on Tuesday taking the key rate to 4.35% in line with expectations. The RBA also raised its inflation forecast to 3.5% by the end of 2024. The move comes after inflation rose 40bps in September to 5.6% in September. Despite the cash rate now elevated at its highest levels since 2012, the RBA revised its unemployment rate forecast down by 25bps to 4.25% for the end of 2024 signalling strength in the overall economy despite the tighter financial conditions imposed thus far.

United States: Initial jobless claims in the week rose by 217k in the week ending 4 November, down from 220k prior, but continuing claims rose by 1,834k in the previous week, up from 1,812k and 14k above consensus. Economic sentiment by the University of Michigan deteriorated from 63.8 in October to 60.4 in November, below a consensus figure of 63.7. Inflation expectations rose by 0.2% for both 1-year and 5-10 years horizons to 4.4% and 3.2% respectively.

United Kingdom: Yields on the two-year gilt was unchanged over the week at 4.67%, after reaching 4.6% during the week, the lowest level since June, following dovish comments from the Bank of England’s (BoE) senior economist, Huw Pill, implying that the BoE would consider rate cuts as early as mid-2025. The move marks a pivot in discussions regarding interest rates concerning spiralling inflation and follows softer data out of the UK and Eurozone in the prior week. As of Friday, the market had priced that the policy rate would decline to 4.8% by September 2024, from 5.25% today. Manufacturing production was unchanged in October, in line with expectations, growing at 3% yoy. Industrial production grew by 1.5% yoy in September, unchanged from August, against expectations of 1.1% yoy growth.

Eurozone: Retail sales shrank by 2.9% yoy in September, 80bps lower than August, and 20bps ahead of consensus forecast of 3.1% yoy decline.

Japan: In economic news, PPI inflation slowed to 0.8% yoy in October, from 2.2% yoy in the prior month. This marked the tenth straight month of disinflation and the first time in two-and-a-half years where PPI came in below 1.0%. Household spending continued to decline, with a 2.8% decline observed in September, broadly in line with expectations, 30bps lower than in August. The current account surplus rose to JPY 2.7trn in September, up from JPY 2.1trn in August, below estimates of JPY 3.0trm.

The JPY weakened to 151.8 this morning in London, very close to its 151.95 in October 2022. A disconnect between yield differentials and the JPY has been building as the correlations between the two declined to close to zero over 30-days. Currency traders remain keen on capturing the juicy c. 6.0% carry implied on one to three-months USD/JPY non-deliverable forwards (c. 4.3% on EUR/JPY). Traders with a ‘short JPY’ position seem to be ignoring the possibility of a more intense economic slowdown that would lead G-10 ex-Japan yields lower. Fundamentally, Japan has the second-largest net international asset-to-GDP ratio in G-10 at 75%, just behind Switzerland’s 99%, at the end of 2022. It is the repatriating flows to Japan and Switzerland that explains the JPY and CHF strength during volatility (risk-off) spikes. In contrast, the US has the highest net international liability-to-GDP amongst major economies at -64% at the end of 2022. This liability increased from 39% in five years and is mostly explained by ‘hot money’ portfolio inflow to US stocks, leaving the USD exposed to large outflows of capital from its capital markets.

1. See – https://www.piie.com/publications/working-papers/central-banks-and-policy-communication-how-emerging-markets-have

2. See - https://www.project-syndicate.org/commentary/macroeconomic-orthodoxy-saved-emerging-markets-from-debt-crisis-by-kenneth-rogoff-2023-10

3. See – Asia Macro Weekly, 10 November 2023, ANZ Bank.

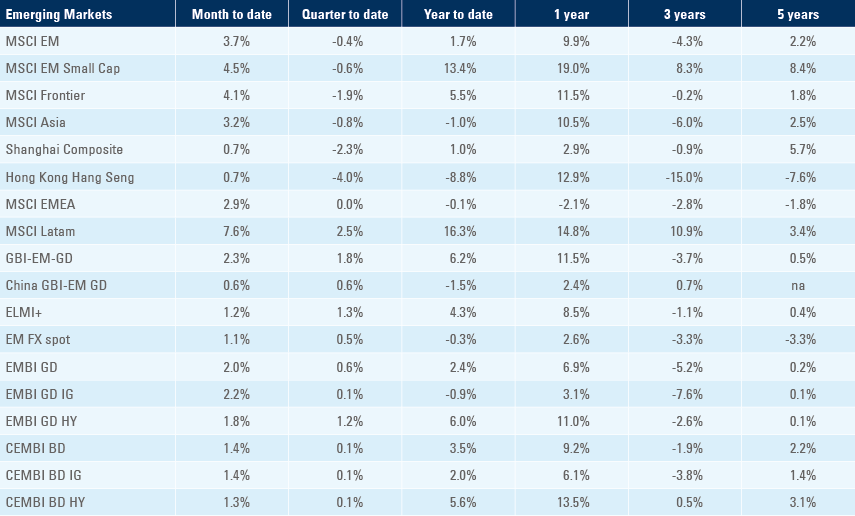

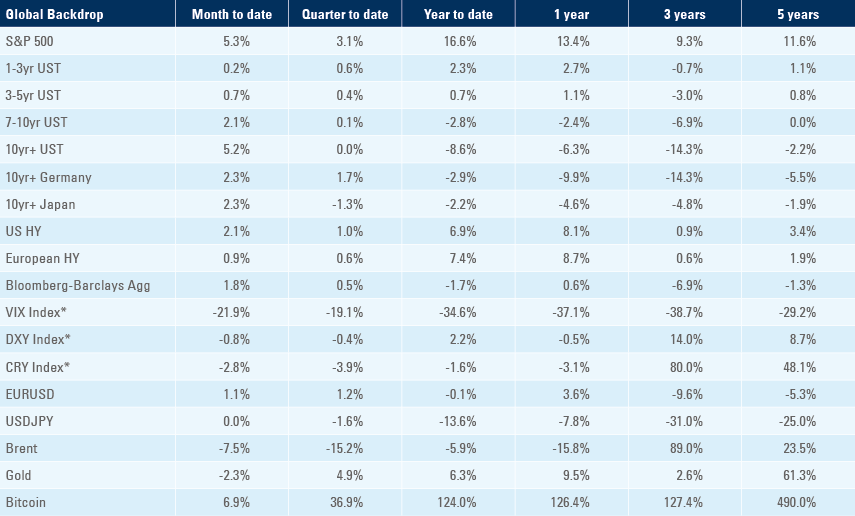

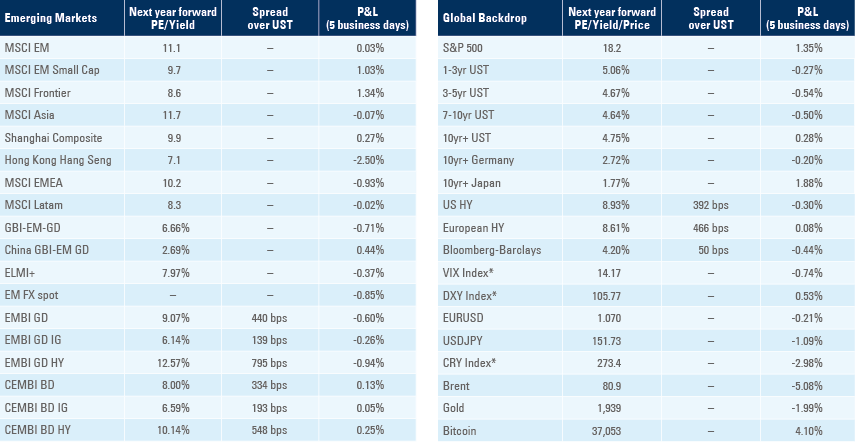

Benchmark performance