China announced fiscal expansion as it seeks to control and re-balance local government debts

The Israeli Defence Forces (IDF) entered Gaza, but the incursion has so far been modest. The contained incursion lowers the risk of the conflict escalating, but the situation remains fluid. Another large merger in the oil and gas sector highlighted some challenges faced in the energy industry. China announced a RMB 1trn fiscal expansion and took measures to control leverage in the local government financing vehicles (LGFV). Indonesian politics brought some volatility to asset prices, but fundamentals remain solid. Philippines hiked its policy rate in an unscheduled meeting. In Argentina, Bullrich announced formal support to Milei. Colombia’s Petro suffered a landslide defeat in municipal elections. As liquidity improved in Venezuelan Eurobonds, JP Morgan might reconsider its re-weighting on its Emerging Market (EM) indices. Nigeria was excluded from the Frontier Market Index by MSCI and is now a ‘stand-alone’ country. Chile and Hungary cut their policy rates as expected.

Global Macro & Geopolitics

Qatar’s Foreign Minister reported progress on talks to release hostages held by Hamas, with four released on 25 October. Doha is working on a deal to release another 50 of the 224 captives. The region has seen heightened efforts of diplomacy as global leaders including President Joe Biden, Prime Ministers Rishi Sunak and Emmanuel Macron among others, have flocked to the region to de-escalate the conflict and diminish the region’s risk of contagion. Earlier in the week, Macron visited Israel where he joined Sunak in defending Israel’s right to defend themselves against Hamas – a second endorsement of Israel’s fight against Hamas. Israel’s credit rating outlook was cut to negative by all three major rating agencies over the risk that the conflict spreading would have a more pronounced impact on Israel’s economy than currently. Israel’s S&P rating is now AA-, under the expectation that the conflict remains concentrated in Gaza and does not endure for more than six months.

Four weeks after the Hamas attacks in Israel, the IDF entered Gaza. The operation is so far shallow (two miles), small and purposefully restrained. The military strategy is “strong, slow, and safe”. Importantly, Hezbollah has refrained from attack in the North, despite its more aggressive stance. The intensity of the conflict in Gaza will be key to the risk of escalation. The next events to monitor are:

- Friday’s speech by Hezbollah leader Hassan Nasrallah.

- Hamas’ reaction to the ground invasion. Some claim that if Hamas puts up stiff resistance to Israel’s ground offensive, Hezbollah has no reason to intervene.1

- But if Hamas faces existential threat, Hezbollah may fear they are next and take a more aggressive stance.

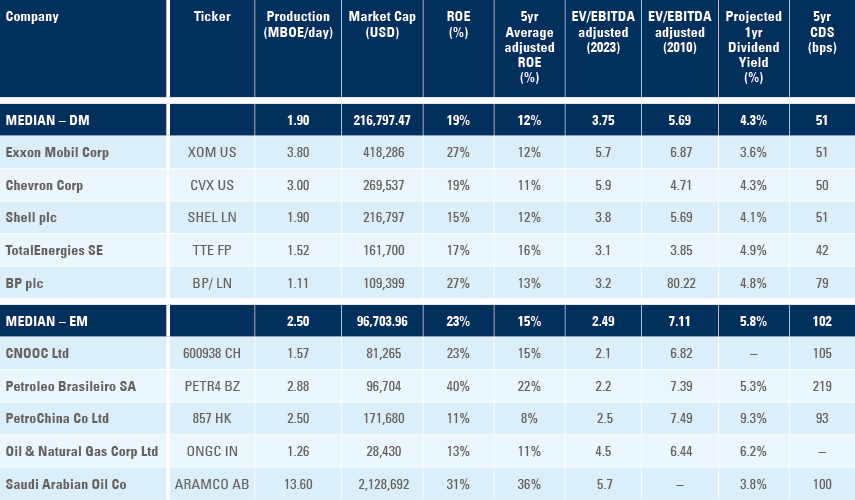

Last Monday, Chevron announced a deal to buy Hess in an all-stock transaction, for USD 53bn at USD 171 per share. The transaction valued the total enterprise value (EV = equity + debt) of Hess at close to 8.5x its estimated EBITDA according to Bloomberg.2 The transaction gives Chevron a strong foothold in Guyana, where oil production has grown exponentially and is expected to reach 480,000 barrels per day (bpd) in 2024, with an expected peak production of 1.5 million bpd by 2033. Chevron’s transaction follows the recent acquisition of Pioneer Natural Resources by Exxon for USD 58bn, close to 6.0x EV/EBITDA. Despite calls of ‘peak oil’ this decade, the recent flurry of M&A activity within the oil and gas industry signals optimism over future growth in the sector beyond 2030. In 2010, EM producers such as Petrobras, PetroChina, and China National Offshore Oil traded around the 7x EV/EBITDA level, and have since derated to 2.5x as shown on Fig. 1. While this might fuel proponents of the peak oil thesis, projected dividend yields remain strong in EM at 5.8% vs a 4.3% in Developed Markets (DM), which remains supportive of future expected earnings potential and signals the growth opportunity in these markets.

Fig 1: Key Valuation Metrics Across EM and DM Oil Majors

Emerging Markets

EM Asia

China: According to state news, the top parliamentary body has approved a USD 137bn fiscal expansion (c. 0.8% GDP) funded by sovereign debt issuance, alongside passing a bill enabling local governments to frontload their 2024 debt issuance. The funds raised from the debt issuance will be used to support the rebuilding of disaster-hit areas and enhance urban infrastructure for natural disaster response. The move is anticipated to increase the 2023 budget deficit from 3% of GDP to 3.8%. At the same time, the Chinese cabinet has also limited the ability of local governments in 12 of the most heavily indebted regions to take on new debt and has tightened surveillance over the type of projects that will be approved by the state council. The order specifies that the debt growth of LGFVs must also remain below that of the average loan growth rate among corporates in that province. The two announcements represent the Catch-22 faced by the Chinese government – on one hand, stimulating the flagging national economy by issuing more debt to fund major infrastructure projects across the country, while on the other trying to contain spiralling debt problems faced at the provincial level.

In politics, Foreign Minister Wang Yi agreed to work towards a Biden-Xi meeting at the Asia Pacific Economic Cooperation (APEC) Summit on 14-16 November, following a healthy exchange with US Secretary of State Antony Blinken. Lan Fo’an has been named China’s new Finance Minister, taking up the mantle of formulating a plan to manage local government debt risks. In the property sector, Country Garden (COGARD) was formally declared in default of its dollar bonds, whereas the company remains current on its onshore debt after agreeing a payment extension on nine bonds totalling RMB 14.7bn of principal.

Indonesia: The Rupiah declined further last week approaching the psychological 16,000 per dollar level not seen since April 2020 despite Bank Indonesia’s surprise rate hike last month. The Rupiah slide is a good opportunity to invest in local assets, in our view, as its mostly related to higher US Treasury yields and increased political uncertainty. The country’s fundamentals remain backed by solid structural and cyclical GDP growth, sound monetary policy, low levels of debt/GDP and fiscal deficits, and good current account and foreign direct investment flows. Importantly, there is no meaningful divergence in terms of policies between the two leading candidates. The political risk is mostly associated with fears of fragmentation after President Joko ‘Jokowi’ Widodo’s decade in power marked by cohesive structural reforms.

Last week, the coalition of parties led by Defence Minister Prabowo Subianto announced Gibran Rakabuming Raka, the son of President Jokowi and the currency mayor of Solo, as his running mate. Jokowi’s current party PDI-P will be represented by Java Governor Ganjar Pranowo. The campaign period runs from 28 November to 10 February 2024, and the election is set for 14 February. The new president will take office on 20 October 2024.

Philippines: After a six-month pause, the central bank hiked its policy rate by 25bps to 6.5%, on an out-of-calendar meeting. The hike was telegraphed by the central Bank Governor last week, as the yoy rate of consumer price index (CPI) inflation rose to 6.1% in September from 4.7% yoy in July. The statement following the meeting underscored concerns of missing the 2-4% inflation target in 2024 under El Niňo risks, food supply constraints, higher energy, and transport costs.

South Korea: The yoy rate of real GDP growth rose to 1.4% in Q3 2023, from 0.9% yoy in Q2 2023, 30bps above consensus. Price producer index (PPI) inflation rose by 30bps to 1.3% yoy in September. Consumer confidence declined slightly in October to 98.1, down from 99.7 in September.

Taiwan: Industrial production declined by a yoy rate of -6.7% in September, up from -10.8% (revised) yoy in August, led by inventory re-stocking and the rebound in the tech sector. The unemployment rate was unchanged at 3.4% yoy in September, in line with consensus.

Thailand: The trade surplus increased to USD 2.1bn in September from USD 0.4bn in August, significantly better than consensus as exports rose by 2.1% yoy in September, marginally below a revised 2.6% yoy in August, but above consensus at -1.8% yoy. Imports were down by -8.3% in yoy terms in September, an increase from -12.8% yoy in August.

Latin America

Argentina: Defeated Juntos por el Cambio presidential candidate Patricia Bullrich announced her tacit support for Javier Milei going into the runoff vote next month, a political manoeuvre backed by Mauricio Macri, but opposed by Horacio Larreta. Milei received only 30% of the total votes, enough to defeat Bullrich with 24% of votes, but far behind Economic Minister Sergio Massa with 37%. Milei's presidential election performance was poorer than in the primaries, suggesting his aggressive speeches may have scared centrist Argentinians away and motivated a higher share of Peronist votes. Thus, Milei is expected to tone down his aggressive stance to be perceived as a more centrist candidate, and Bullrich’s explicit support should boost his competitiveness, in our view. The economic activity index rose 1.3% mom in August after 2.5% in July, as the yoy rate increased by 170bps to 0.3% over the same period, significantly above consensus at -2.2% yoy. The surge is related to the tax cuts and increase in social benefits that supported Massa’s performance. Supermarket and shop centre sales rose by 5.2% yoy and 16.6% yoy respectively.

Brazil: CPI inflation rose by 0.2% mom in the first 15 days of October, down from 0.4% in September and the yoy rate rose marginally to 5.1% (in line with consensus). Tax collections came in line with consensus in September. Last Friday, President Lula said Brazil could take a 0.25%-0.5% primary fiscal deficit in 2023 (the government’s previously stated target is 0%). He would be right if the nominal deficit, including interest, would not be around 7.6% of GDP in 2023 and projected at 6.8% GDP in 2024. Lula also voiced concerns to Brazil GDP growth – citing China’s growth slowdown and rates likely remaining higher for longer as the primary risks. However, derailing fiscal efforts would be catastrophic for political stability in Brazil. For now, the bull case is that the economic team works behind the scenes to pass taxes to at least make the fiscal adjustment path more credible, even if official targets are missed.

Chile: The central bank cut its policy rate by 50bpst to 9.0%, less than consensus for a 75bps cut. PPI inflation increased by 1.9% mom in September, down from 2.2% in August.

Colombia: President Gustavo Petro’s party suffered massive defeats in the municipal elections held last Sunday. In Bogota, Pacto candidate Gustavo Bolivar was defeated in the first round and relegated to a third-place finish with only 20% of Petro’s runoff supporters rallying behind Bolivar, which saw Carlos Galan win by taking 49% of the votes. In Medellin, Frederico Guttierez, a staunch critic of Petro, replaced a Petro ally in a further blow to Petro’s support.

Mexico: Economic activity increased by 3.7% yoy in August, up from 3.2% yoy in July, 30bps ahead of expectations. Bi-weekly CPI increased by 4.3% yoy in the first half of October, down from 4.5% and below consensus at +4.4% yoy.

Panama: President Laurentino Cortizo announced on Sunday that Panama would hold a referendum on 17 December to vote to annul the concession agreement with First Quantum. The contract with First Quantum gives the mining company rights to operate the Cobre Panama open-pit copper mine for 20 years, for an annual payment of USD 375m to the Panama government. The announcement follows recent protests from thousands of locals against the opening of the pit copper mine.

Venezuela: A key market development post sanctions removal will take place when JP Morgan re-introduces Venezuela and state-owned Petróleos de Venezuela (PDVSA) bonds to its Emerging Market Bond Indices (EMBI). When sanctions on secondary market bond trading were introduced, JP Morgan kept the bonds in the benchmark with a 0% weight. The decision was motivated by the fact that US investors could not replicate the benchmark. Furthermore, the absence of US investors and market makers led to a large drop in liquidity post sanctions. There was a marked increase in liquidity post removal of sanctions and most market makers are again actively participating in Venezuelan bond markets. In terms of the impact, Morgan Stanley estimate that the weight of the combined complex would equate to 0.73% of the EMBI Global Diversified, and 0.86% of the EMBI Global; with an USD 1.5bn to USD 2.4bn of purchases in market value (USD 8.6bn to USD 14.1bn notional). The bonds listed in the index have a notional amount of USD 53.2bn and USD 10.2bn of market value, according to bid marks from Bloomberg on 27 October. The ultimate size of Venezuela in the EMBI could be larger as it would depend on the price levels the bonds trade upon re-weighting. On political news, the public prosecutor’s office appointed two officials to investigate the presidential primary elections following the strong victory by Maria Corina Machado in the previous week. This will be the first test to the brokered agreement between the US and Venezuela, where easing economic sanctions were granted under the promise of more free and fair elections. On this topic, it is important to notice that the Office of Foreign Assets Control (OFAC) acknowledged that secondary market sanctions not only did not have the intended effect in local politics, but punished US investors that were forced to sell bonds at artificially low prices and introduced “nefarious players” in the market in the absence of US market makers. The statement raises the bar for reintroduction of sanctions on secondary market trading, even if President Nicolas Maduro does not allow for free and fair elections. However, OFAC still keeps sanctions on the issuance of new bonds, which means a debt restructuring is only possible if evidence of enough progress in rebuilding democratic institution is observed. In other news, Chevron said it is aiming to increase oil production by 15% to 150,000 bpd.

Central and Eastern Europe

Czechia: The consumer confidence index increased to 92.7 in October, from 88.3 in September, with 88.9 expected. The business confidence index reached 92.8 in October up from 89.4 in September.

Hungary: The central bank cut its policy rate by 75bps, taking the interest rate from 13% to 12.25%, larger than the 50bp consensus. It cited strong disinflation and improvement in Hungary’s external balance, and strengthening of the HUF, as motivations. Deputy Governor Barnabus Virag said 50bps and 100bps were also discussed at the meeting, but the 75bps cut was unanimous in balancing monetary policy easing to balance external risks. Economic sentiment remained unchanged at -17.0 in October relative to September.

Poland: Construction output increased 11.5% yoy in September, from 3.5% yoy in August, beating expectations of a 5.9% yoy increase. The unemployment rate in September remained unchanged at 5% from August, in line with expectations.

Russia: Industrial production for September rose by 5.6% yoy, up from 5.4% yoy in August, in line with expectations. The central bank hiked its policy rate by 200bps to 15.0%, 100bps above consensus, due to higher inflationary pressures as core inflation rose to 9.6% (compared to 5.7% in the second quarter)

Türkiye: Consumer confidence grew to 74.6 in October from 71.5 in September.

Central Asia, Middle East, and Africa

Nigeria: MSCI formally announced the removal of Nigeria from the Frontier Market equity indices, effective from 29 February 2024. Nigeria currently represents 3% of the MSCI Frontier Markets index and 11.6% of the MSCI (ex. South Africa) Index. In recent years, foreign share has fallen from 57% five years ago to 13%, as investing in Nigeria has become increasingly difficult owing to the issue of repatriation of funds.

South Africa: Central bank Deputy Governor Kuben Naidoo resigned with 18 months remaining on his term. With the South African next monetary policy committee final meeting of 2023 scheduled for the end of November, the departure leaves the committee with four members, with Governor Lesetja Kganyago with the deciding vote in the event of a tie. In data, PPI inflation rose to 5.1% yoy in September; up from 4.3% yoy in August, above consensus of 5.0% yoy growth.

Ukraine: The National Bank of Ukraine (NBK) cut the policy rate by 400bps, taking the key rate to 16% from 20%, against consensus at 18%. The NBK announced GDP is expected to grow at 4.9% in 2023 up from the initial forecast of 2.9%. The economy remains distorted by the war effort and the country’s budget has become totally dependent on western support. Nevertheless, Ukraine has been able to keep a lid on inflation, bucking the usual trend of wartime inflation, with 2023’s full-year forecast lowered to 5.8% yoy, down from 27% yoy growth at the end of 2022.

Developed Markets

Australia: The yoy rate of CPI inflation rose by 40bps to 5.6% yoy in September, 30bps above consensus, led by higher fuel and rent prices. The upside surprise led government bond yields higher, with the three-year bonds reaching 4.3% on Wednesday, the highest level since 2011. The Reserve Bank of Australia (RBA) is now expected to hike the policy rate by 25bps at the next meeting in November, taking the policy rate to 4.35%.

Eurozone: The European Central Bank (ECB) left the policy rate unchanged at 4.5% in October, in line with market expectations. Governor Christine Lagarde said credit conditions had tightened significantly and more effects are still likely to come due to the known transmission channel legs. Lagarde also acknowledged higher US interest rates have contributed to tighter financial conditions. Consumer confidence was unchanged at -17.9, above consensus. The Eurozone flash Composite purchasing managers’ indices (PMI) declined 0.7 to 46.5 on October, one point below consensus. Both services and manufacturing PMI declined by 1.0 to 47.8 and 0.4 to 43.0 respectively, against expected gains.

Japan: Manufacturing PMI remained unchanged at 48.5, while services PMI declined from 53.8 to 51.1 in October from September. The yoy rate of CPI inflation rose by 50bps to 3.3% in Tokyo as CPI ex-food and energy declined by 10bps to 3.8%, both above consensus. The yield on 10-year Japanese Government Bonds rose to 0.9%, approaching the 1.0% ceiling stipulated by the Bank of Japan.

United States: The yoy rate of real GDP growth rose by 4.9% yoy in Q3 2023, from 2.1% yoy in Q2 2023, above consensus at 4.5% yoy growth. Personal consumption contributed 2.7%; gross private investment 1.5%; net exports -0.1%; and government consumption 0.8%. There was a notable increase in inventories, suggesting higher GDP growth is likely to mean-revert next quarter. Durable goods orders rose 4.7% mom in September (1.8% consensus) from -0.1% notably as non-defence aircraft surged 92.5% mom after two consecutive months of double-digit declines. The less ‘noisy’ durable goods orders excluding transportation was unchanged at 0.5% mom in September. Initial jobless claims came in marginally higher at 210k for the week ending 21 October, but continuing claims rose by 63k to 1,790k in the prior week. The services PMI increased to 50.9 in October, from 50.1 in September, and the manufacturing PMI rose to 50.0, up from 49.8 in September, 0.5 above consensus. In housing, new home sales grew by 12.3% mom in September, the fastest pace since the beginning of 2022, with 759k new home sales, up from the 8.7% decline observed in August. However, homebuilders resorted to mortgage rate buy-downs through their own mortgage companies to fund those acquisitions. PulteGroup, for example, is currently buying down 30-year 8.0% fixed mortgages permanently to 5.75%, which is equivalent to a 25.7% discount. The core Personal Consumption Expenditures (PCE) deflator rose by 0.3% mom and 3.7% yoy in September, in line with consensus.

United Kingdom: The manufacturing PMI rose to 45.2 in October from 44.3 in September, 0.5 above consensus while the services PMI was virtually unchanged at 49.2.

1. See – https://twitter.com/heiko_wimmen/status/1716531014846050495

2. EBITDA stands for earnings before interest, tax, depreciation, and amortisation. EV/EBITDA is a valuation metric favoured by investors and bankers in the energy space.

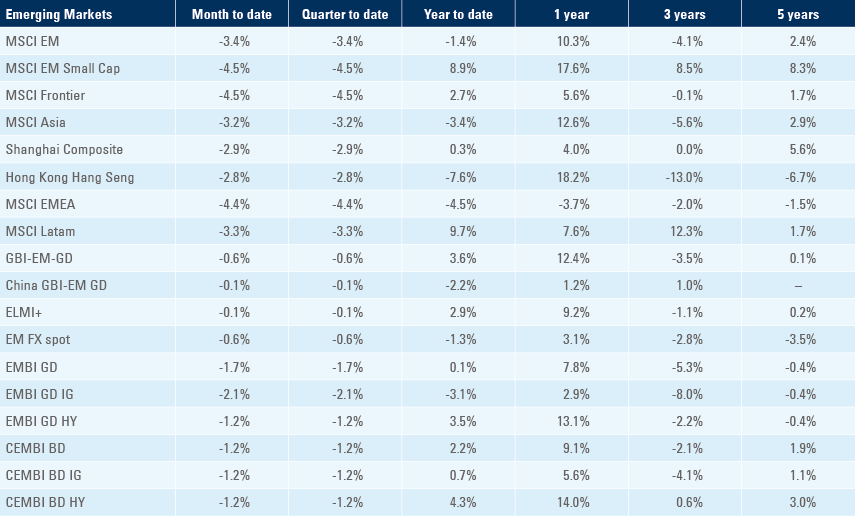

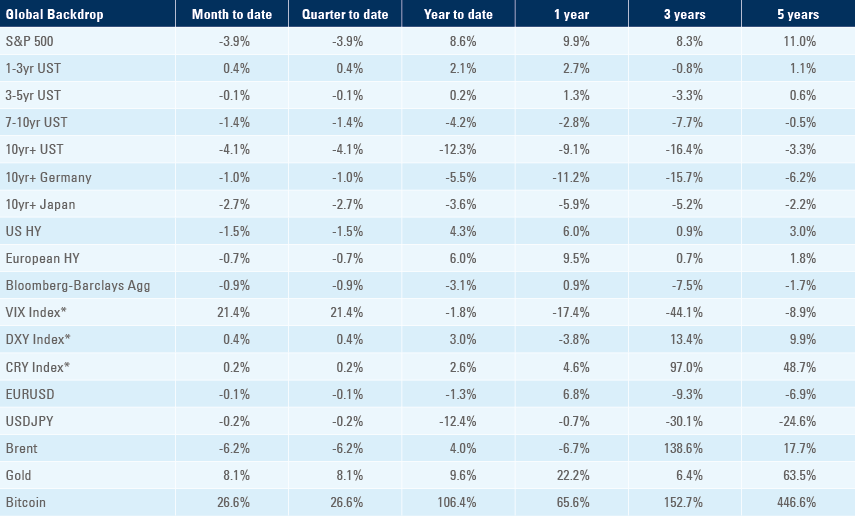

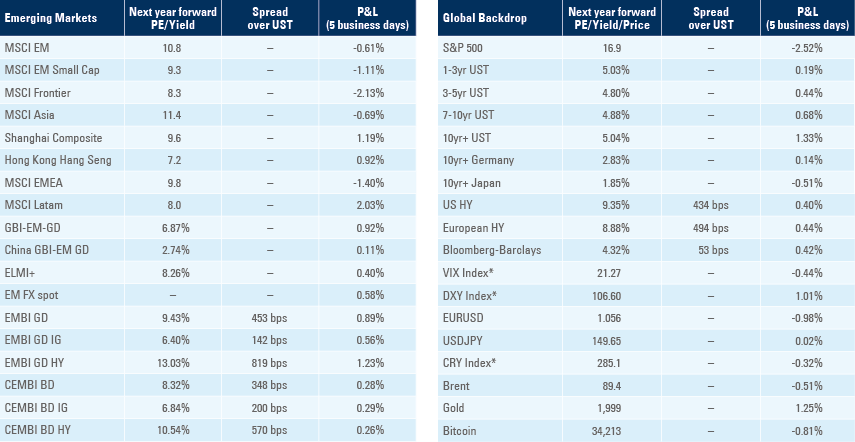

Benchmark performance