Bola Tinubu elected in Nigeria, Türkiye’s presidential election to be held on 14 May

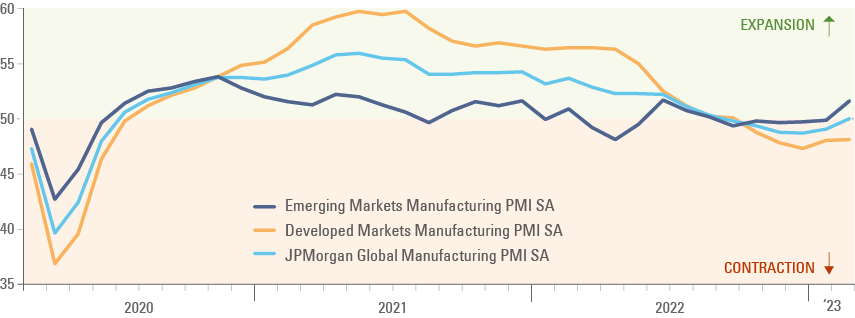

The global manufacturing Purchasing Managers’ Index (PMI) increased, entirely led by Emerging Markets (EM) and supported by the reopening of the Chinese economy. In Nigeria, the “father of Lagos” Bola Tinubu won the presidential election in the first round. Türkiye confirmed the date of its presidential elections as 14 May. China’s National People’s Congress unveiled a 5.0% growth target. Argentina’s economy struggles due to a drought and Pakistan took further steps to stabilise its economy, getting closer to a deal with the International Monetary Fund (IMF).

Global macro

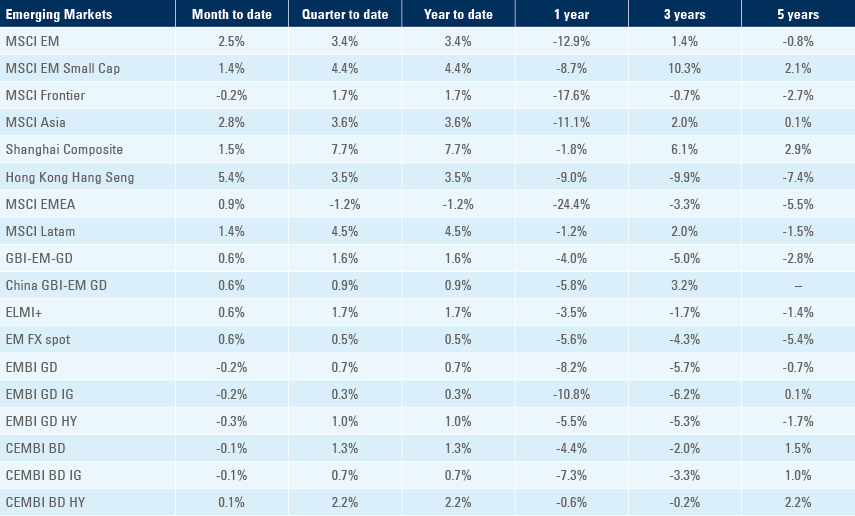

The global manufacturing PMI rose 0.9 points to 50.0 in February. The rise was entirely driven by the increase in EM PMIs, which rose by 1.7 points to 51.6, signalling a mild expansion in manufacturing conditions mostly due to the reopening of the Chinese economy. The S&P Caixin Manufacturing PMI rose by 2.4 points to 51.6 in February. Developed Markets (DM) manufacturing PMI was unchanged at 48.1. Overall, the EM manufacturing PMIs have outperformed the DM survey since October 2022 as per Figure 1, and the outperformance may well increase as the full reopening of the Chinese economy takes place.

Fig 1: Manufacturing PMI’s: Global, EM and DM

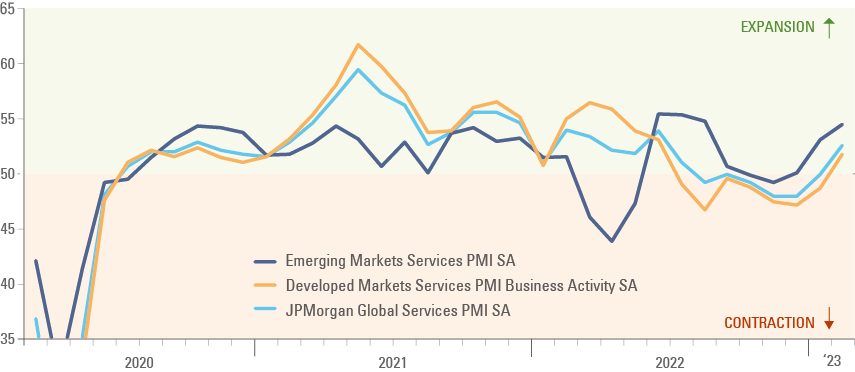

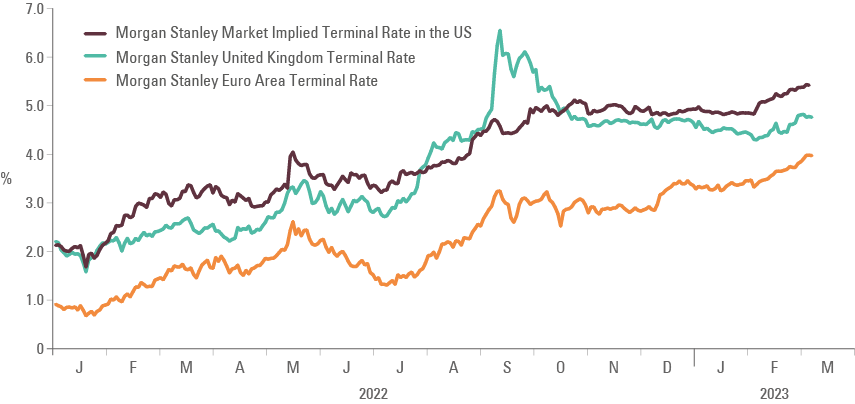

The global services PMI rose by 2.6 points to 52.6 with the EM component rising 1.4 points to 53.5, and the DM component was up 3.1 points to 51.8 as per Figure 2. The acceleration in the DM service PMIs, together with higher inflation numbers in February, led the market to reprice the terminal rate (for Fed Funds) in the United States (US) to 5.4% last Friday from 4.82% on 2 February. The European Central Bank (ECB) terminal rate was revised even more significantly, to 3.98% on 3 March from 3.33% on 2 February, while the Bank of England (BoE) terminal rate rose to 4.78% from 4.31% over the same period, as per Figure 3.

Fig 2: Service PMI’s: Global, EM and DM

Fig 3: DM terminal rates

Emerging Markets

Türkiye: President Recep Tayyip Erdogan confirmed the country’s presidential elections will take place on 14 May. Polls currently show a historically low level of support for the government, even before the recent earthquakes sparked a humanitarian crisis. Nevertheless, the opposition seems to be heading to the polls divided and without its most popular candidates (the mayors of Ankara and Istanbul), meaning the result remains uncertain. The consensus expects the AKP-MHP government alliance to lose its parliamentary majority, and many scenarios for post-election alliances and minority governments are possible. The economy is in desperate need of a new policy direction. Inflation averaged 72% in 2022, after peaking at 85.5% in October 2021 and declining to 55.2% year-on-year (yoy) in February. The cost-of-living crisis is weighing on growth, which declined to 3.5% yoy in Q4 2022 (60 basis points (bps) better than consensus) from 4.0% yoy in Q3 2022 and 10.0% yoy in Q4 2021. Gross domestic product (GDP) growth is expected to slow to 3.0% in 2023 from 4.5% in 2022. More worryingly, Türkiye’s unorthodox policy mix has resulted in a significant deterioration in the current account, which moved from a 2.1% of GDP surplus in Q3 2019 to a 5.5% deficit in Q4 2022. The large 2022 external deficit was funded by mysterious errors and omission items, potentially associated with Russia. This relieved pressure on the balance of payments last year, but is unlikely to prove sustainable, in our view.

Nigeria: The ruling party’s All Progressive Congress (APC) candidate, Bola Tinubu, is Nigeria’s new president-elect. He was elected with the lowest margin since democratic elections began, after a tightly contested race featuring three strong candidates. Bola Tinubu received 8.8 million votes (37% of the total vote), obtaining over 25% of the votes in 29 states, four above the minimum required to win without a run-off. Tinubu received 64% of its total votes from the north of the country, where most Nigerians live. Atiku Abubakar from the People’s Democratic Party (PDP) received 6.9 million votes (29%), and Peter Obi of the Labour Party, whom many polls predicted would win, received 6.1 million votes (25%), a disappointment for those expecting a new face in national politics, but nevertheless a strong showing for a third-party candidate. Initial indications suggest the APC will keep its majority in the National Assembly. The election cycle in Nigeria is not over, with some large states electing new governors. The opposition is challenging the results, as happened in previous Nigerian elections, and Tinubu’s inauguration is due on 29 May. Markets will be looking for signs of fuel subsidy cuts, or moves to let the Naira float. The current Central Bank Governor Godwin Emefiele is supposed to stay in power until the end of his term in June 2024, but parliament has the prerogative to recall him earlier, as long as a supermajority (two-thirds of votes) approves. In our view, Nigeria cannot afford to (and more likely will not) wait that long to enact thorough reforms of the foreign exchange system.

China: The NBS Manufacturing PMIs surged to 52.6 in February from 50.1 in January, the highest reading for the survey in ten years, while non-manufacturing rose 1.9 points to 56.3, corroborating a scenario of a strong economic recovery for the Chinese economy post reopening. The S&P Caixin Manufacturing PMI rose 2.4 points to 51.6 in February, while the Caixin Services PMI rose 3.1 points to 54.2 over the same period. Over the weekend, Premier Li Keqiang announced a more modest 2023 growth target of 5.0% (down from 5.5% in 2022) and an increase in the fiscal deficit to around 3% from 2.8% in the previous year. The revised growth target came at the lowest end of the expectations, setting a low bar for his successor, Li Qiang, the number two in the Communist Party, considering the large rebound from the reopening of its economy. Spending in defence will rise by 7.2% this year, the fastest in four years to RMB 1.55trn, while Li emphasised the aim of reaching “peaceful reunification” with Taiwan. In geopolitical news, the US is in preliminary stage consultations with close allies about the possibility of imposing new sanctions on China should it provide military support to Russia. On the other hand, Politico reported US President Joe Biden is likely to forego expansive new restrictions on American investment in China, only restricting investments in semiconductors, albeit the administration may require more transparency, requesting disclosure of investments in advanced industries such as quantum computing and artificial intelligence. If confirmed, that should be positive for global inflationary pressures, and for the development of several industries, including electric vehicles, batteries, renewable energy, and biopharma, in our view.1

Argentina: Tax collection declined by a yoy rate of 9.2% in February in real terms (adjusted for trailing 100.8% yoy consumer price index (CPI) inflation). This was led by a strong decline in export taxes following the end of the preferential foreign exchange (FX) regime, alongside the drought-led export taxes down 65.2% yoy while income tax and value add tax (VAT) declined by a more modest 2.0% yoy. Vehicle sales rose to 30.1k in February from 22.1k in January, still significantly lower than the 52.8 average monthly sales over the last ten years.

Pakistan: The central bank hiked its policy rate by 300bps to 20% (100bps above consensus) and allowed the rupee to depreciated by 7.2% last week to PKR 275 per USD, as CPI inflation rose to a yoy rate of 31.6% in February from 27.6% in January. The Chinese Daily Times called on all parties to play a constructive role in Pakistan’s economic development, specifically pointing out that “the financial policy of a certain developed country is the main reason behind the financial difficulties of a large number of developing countries including Pakistan”.

Snippets

- Brazil: Producer price index (PPI) inflation declined by 0.1% in February, 10bps below consensus, as the yoy rate declined to 1.9% from 3.8% yoy in January. The yoy rate of real GDP growth slowed to 1.9% in Q4 2022 from 3.6% in Q3 2022, bringing the overall 2022 GDP growth to 2.9%, from 5.2% in 2021. The budget balance moved to a BRL 46.7bn surplus (BRL 99bn primary surplus) in January from a BRL 70.8bn deficit (BRL 11.8bn primary deficit) in December and the ratio of net-debt-to-GDP declined by 90bps to 56.6%, 100bps below consensus. The trade surplus was unchanged at USD 2.8bn in February as both exports and imports declined by c. USD 3bn to USD 20.6bn and USD 17.7bn, respectively.

- Chile: The unemployment rate rose 10bps to 8.0% in January, but economic activity rose by 0.5% month-on- month (mom) in January (or 0.4% yoy) against a consensus for a 0.2% mom decline. Copper production declined to 426k tons from 498k, but the three-month moving average remains on an improving trend at 465k after troughing in April 2022 at 430k. Vehicle sales declined to 26.2k in February from 27.6k in January, remaining significantly below the average of the last ten years of around 33.7k.

- Colombia: CPI inflation rose 1.7% mom in February after 1.8% mom in January, leaving the yoy rate unchanged at an elevated 13.3% while core CPI rose by 43bps to 10.9%. The current account deficit narrowed to USD 4.9bn in Q4 2022 from USD 6.1bn in Q3 2022, in line with expectations. The Davivienda Manufacturing PMI rose 1.3 points to 49.8 in February. The urban unemployment rate rose to 14.5% in January from 10.8% in December, while total unemployment rose to 13.7% from 10.3% over the same period, in line with the seasonal patterns and close to the seasonally-adjusted average of the last ten years.

- Czechia: Bad economic news overall in Czechia as the S&P Global Manufacturing PMI declined 0.3 to 44.3 in February, keeping the economy in contraction territory. The yoy rate of real GDP growth rose 0.2% in Q4 2022 from 0.4% in Q3 2022, 20bps below consensus. PPI inflation surged 5.8% mom in January, significantly above consensus at 2.0% mom, after declining 1.1% mom in December, but the yoy rate still declined 110bps to 19.0% due to base effects.

- Hungary: Economic sentiment increased only marginally to -18.2 in February from -20.5 in January and -23.1 in October 2022. The National Bank of Hungary kept its policy rate unchanged at 13.0%, in line with consensus.

- India: Manufacturing PMI declined only 0.1 to 55.3 in February, remaining at very expansionary levels. The yoy rate of real GDP growth slowed to 4.4% in Q4 2022 from 6.3% in Q3 2022, 30bps below consensus, but leaving the 2022 annual estimate at 9.1%.

- Indonesia: The manufacturing PMI inched 0.1 down to 51.2, remaining at expansionary levels.

- Malaysia: The manufacturing PMI rose 1.9 points to 48.4 in February.

- Mexico: The trade balance moved to a USD 4.1bn deficit in January from USD 1.0bn surplus in December, in line with the seasonal performance. Nevertheless, both exports and imports had record numbers for January: exports declined by USD 6.7bn to USD 42.6bn and imports slowed by USD 1.6bn to USD 46.7bn. The yoy rate of private sector credit growth rose by 40bps to 20.1%, remaining at the largest levels since Q3 2016.

- Peru: CPI inflation rose to 0.3% mom in February from 0.2% mom in January in Lima, keeping the yoy rate unchanged at 8.7%.

- Philippines: Manufacturing PMI declined 0.8 points to 52.7, remaining at expansionary levels.

- Romania: PPI inflation rose 1.4% mom in January from 0.2% mom in December, but the yoy rate dropped 880bps to 24.0% due to base effects. The unemployment rate was unchanged at 5.6%.

- Saudi Arabia: The S&P Global All Economy PMI rose 1.6 points to 59.8, the highest level since March 2015,

- as new orders rose by 3.4 points to 68.7.

- South Africa: The Absa Manufacturing PMI declined 4.2 points to 48.8 in February, 1.4 points below consensus, while the S&P Global All Economy PMI rose 1.8 points to 50.5, 1.5 points above consensus. The unemployment rate declined 20bps to 32.7% in Q4 2022, 10bps above consensus. The trade balance moved to a ZAR 23.1bn deficit in January from a ZAR 5,0bn surplus in December, the worst trade deficit for January in ten years, except for 2018.

- South Korea: The manufacturing PMI was unchanged at 48.5 in February. The trade deficit narrowed to USD 5.3bn in February from USD 12.6bn in January, slightly lower than consensus. CPI inflation slowed to 0.3% mom in February from 0.8% mom in January as the yoy rate slowed by 40bps to 4.8%, and core CPI declined 20bps also to 4.8%, both slightly below consensus.

- Taiwan: The manufacturing PMI surged 4.7 points to 49.0, a sign that despite the tensions across the straight and the sanctions imposed on semiconductors purchases by China, the Taiwanese economy remains sensitive to mainland China.

- Thailand: The manufacturing PMI rose 0.3 points to 54.8 in February. The current account balance moved to a USD 2.0bn deficit in January from a USD 1.1bn surplus in December, a bad result for January as imports expanded much faster than exports, bringing the trade balance to a USD 2.7bn deficit in January from a USD 1.0bn surplus in December.

- Vietnam: The manufacturing PMI surged 3.8 points to 51.2 in February. The yoy rate of CPI inflation declined 60bps to 4.3% in February as industrial production surged to 3.6% yoy from -8.0% yoy and retail sales slowed to 13.2% yoy from 20.0% yoy over the same period. The trade surplus softened to USD 2.3bn in February from USD 3.6bn in January, nevertheless surprising consensus for a USD 0.2bn surplus.

Developed Markets

United States: Durable goods orders declined 4.5% mom in January, almost fully erasing the 5.1% mom increase recorded in December, while durable goods ex-transportation rose 0.7% mom in January after declining 0.4% mom in December. Pending home sales rose 8.1% in January, but remain depressed at similar levels to 2010. Surveys of manufacturing activity were exceptionally soft. The ISM manufacturing rose only 0.3 to 47.7, led by new orders which rose 4.5 points to 47.0 and prices paid moved up 6.8 points to 51.3. The Federal Reserve (Fed) Bank of Dallas manufacturing survey declined 5.1 points to -13.5, the Richmond Fed of manufacturing dropped five points to -16, the MNI Chicago PMI dropped 0.7 point to 43.6, and the Conference Board of Consumer Confidence slowed 3.1 points to 102.9 with a massive divergence between “present situation” which rose 1.7 points to 152.8 and expectations which declined another 6.3 points to 69.7. The service sector was more resilient with the S&P Global Services PMI rising 0.1 to 50.6 and the ISM Services index down 0.1 to 55.1, with new orders up 2.2 points to 62.6, employment up 4.0 to 54.0, but prices paid down 2.2 to 65.6.

Eurozone: CPI inflation in the Euro-area (preliminary) inched lower to 8.5% in February 2023, slightly lower than the 8.6% recorded in January, but markedly above market expectations of 8.2%. The core HICP Inflation Index was much stronger than expected, rising at 5.6% yoy from 5.3% in January. Energy inflation slowed to 13.7% from 18.9% in January, while prices rose at a faster pace for food (15.0 % vs 14.1%) and services (4.8% vs 4.4%). Among the Eurozone’s largest economies, inflation accelerated in Germany, France, Spain and the Netherlands, while in Italy inflation slowed. The data bolstered expectations that the ECB will remain hawkish for longer, and the market is now entirely pricing in a 50bps hike at its 16 March meeting.

Japan: The manufacturing PMI declined 1.2 points to 47.7, bucking the trend across EM Asia, where the manufacturing survey has risen significantly.

Australia: The yoy rate of CPI inflation dropped 100bps to 7.4% in January, 70bps below consensus expectations. The yoy rate of real GDP growth slowed to 2.7% in Q4 2022 from 5.9% in Q3 2022, in line with consensus.

1. See https://www.politico.com/news/2023/02/27/white-house-investments-china-00084473

Benchmark performance