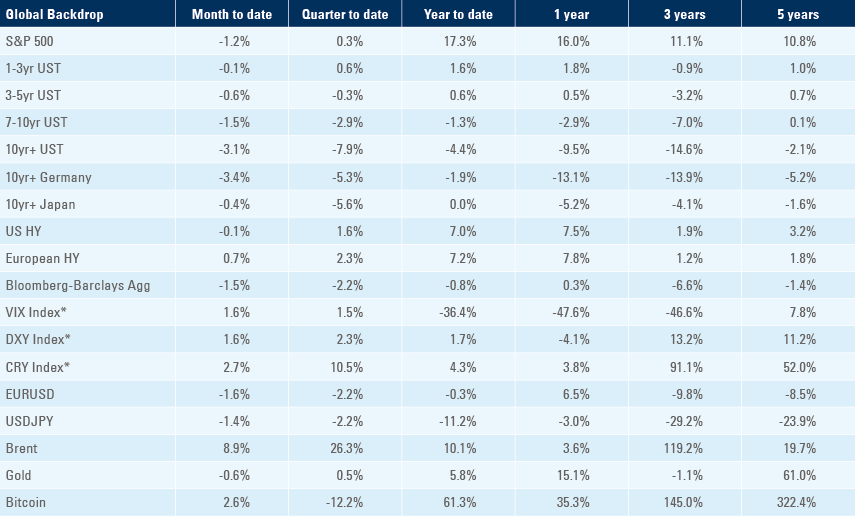

Chinese electric vehicle (EV) sales rose by 8.5% in August to a record level. China has surpassed both Germany and Japan as the largest exporter of vehicles in the world, as it leads the world in energy transition. Economic data surprised to the upside in China, the United States and the United Kingdom bringing the OECD G-20 leading indicator to expansionary territory. Inflation declined faster than expected in India. South Africa imports of solar panels from China quadrupled in the first half of 2023.

Global Macro

The United Auto Workers (UAW) union began an unprecedented strike across three significant carmakers: Ford in Michigan, General Motors in Missouri, and Stellantis NV in Ohio. The UAW is asking for a 36% pay increase over four years and the automakers have offered around 20%. The haggle is likely to end on a 25-30% increase, or 6.25% to 7.0% per year over the next four years. While the UAW represents only 0.1% of the labour force, the high-profile settlement is likely to boost demand for higher wages elsewhere; the negotiations come amid an increase in labour movements across the US as elevated inflation has stretched incomes alongside a very tight (and disrupted) labour market.

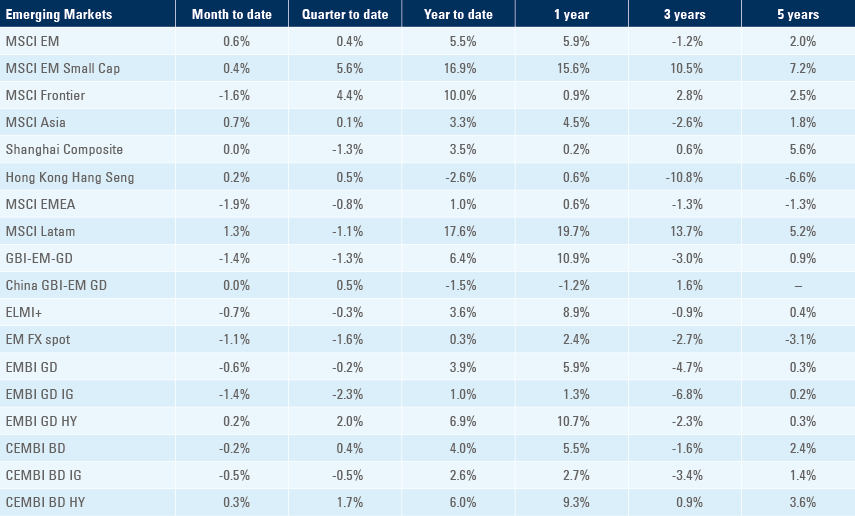

The US strikes take place during shifting patterns in the automotive industry. The once-dominant car exporting nations (Germany and Japan) have been usurped by the increased influence of China. Chinese vehicle exports had historically been between 50k to 100k a month until 2020, when a drastic increase in total unit sales took place (as per Fig. 1).

Two simultaneous changes have taken place during this period: China has been exporting more electric vehicles (EVs) to the rest of the world, and Chinese consumers have been buying cars domestically (primarily EVs), rather than importing them from the likes of Germany. EV sales rose to a record high in August, rising by 8.5% mom and 27% yoy.

The Chinese EV market has been both leading and pre-destined. The Chinese EV industry benefits from the country’s dominant position as market leader in the EV battery market – accounting for 56% of market share.1 Furthermore, China has leapfrogged the auto industry with high quality innovative solutions for EV. One Chinese EV automaker sells the car without the battery and leases the battery. Instead of recharging the battery, owners have the option to swap its uncharged battery pack to a new fully-charged one, saving time for individuals that do not have the ability to recharge their EV at home.

This, paired with possible state subsidies – an accusation levelled by European Commission President Ursula von der Leyen in her annual address to the European Parliament – has allowed China to become a dominant force in the global industry, as well as shifting their own population from imported, to domestically-produced vehicles. When we contextualise this change within the need for an energy transition and a move away from combustion engine vehicles, it reemphasises the important role that China will be required to play in supporting at least one aspect of the change that Developed Market (DM) consumers are likely to see.

Fig 1: 12-Month Moving Average Vehicle Exports (Thousands): Japan, Germany, and China

Fig 2: Monthly Electric Vehicle exports from China

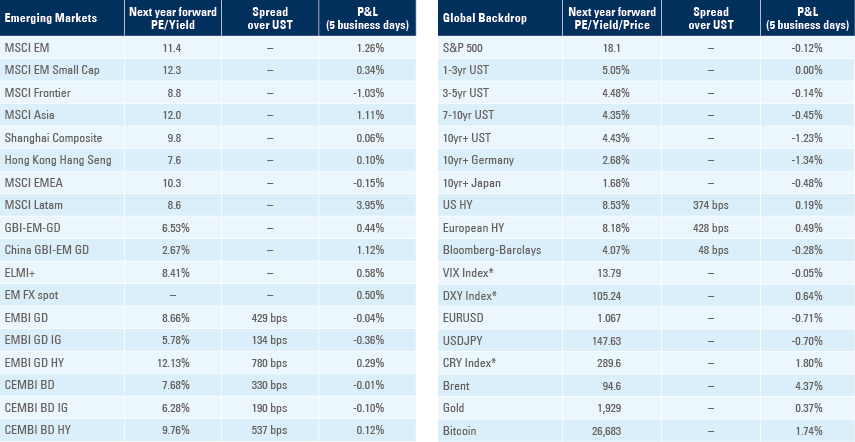

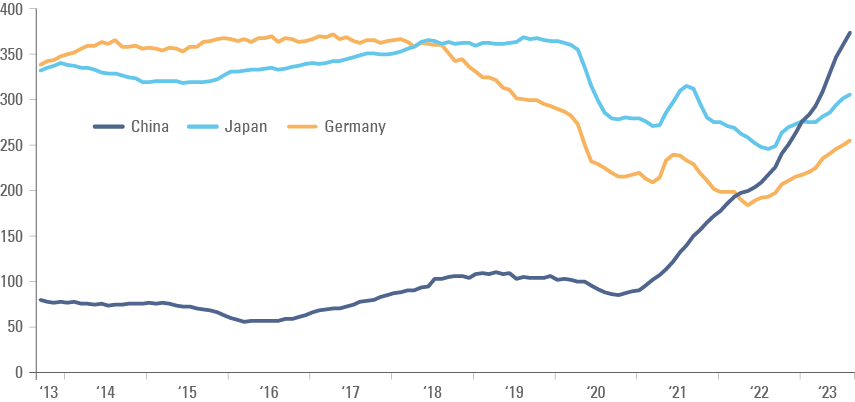

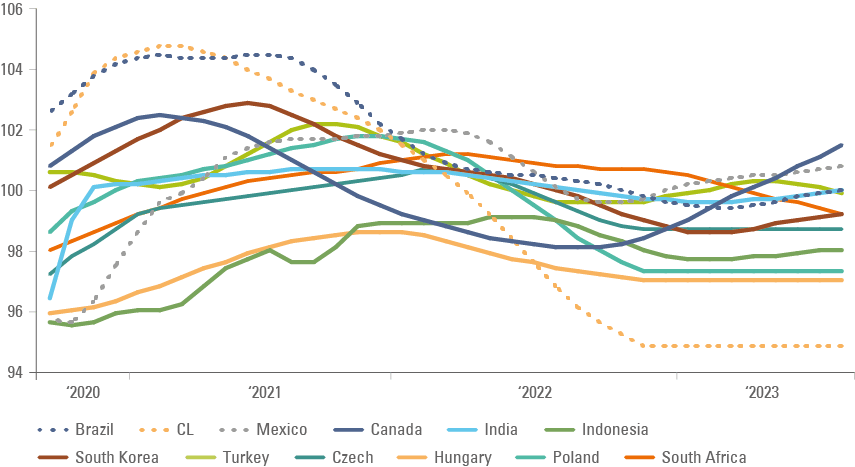

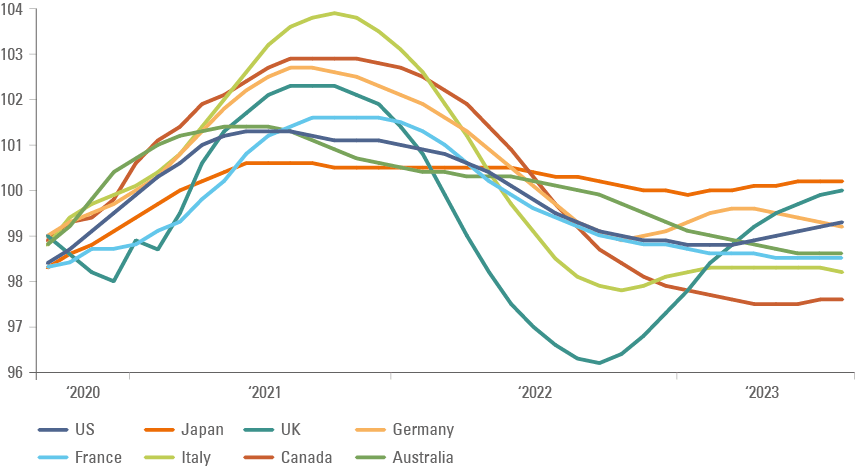

The OECD G-20 leading indicator rose by 14 basis point (bps) to 100.03, suggesting the business cycle is moving into ‘expansion’, usually the most supportive/bullish stage especially for commodities, such as copper. The improvement has been led by China, where credit and economic data surprised to the upside last week, as per Fig. 3. Within DM, the OECD G-20 leading indicator has improved only in the US and UK, as per Fig. 4, with the latter registering the largest improvement over the last 12 months:

Fig 3: OECD G-20 leading indicator – EM countries

Fig 4: OECD G-20 leading indicator – DM countries

Emerging Markets

China: Economic data was better than expected. The year on year (yoy) rate of industrial production rose 80bps to 4.5% in August, 60bps above expectations, as retail sales surged to 4.6% yoy from 2.5% yoy over the same period, 160bps above expectations. Fixed asset investment declined 20bps to 3.2% yoy, 10bps below consensus. A little before the data announcement, the People’s Bank of China cut the reserve requirement ratio (RRR) by 25bps for all firms with an RRR above 5.0%. Electricity consumption growth declined in the primary and tertiary sectors, 8.6% yoy and 6.6%, respectively, in August, from 14.0% and 9.6% in July. However, electricity consumption in the secondary sector increased to 7.6% yoy from 5.7% over the same period.

India: Consumer price index (CPI) inflation declined by 60bps to 6.8% yoy in August, 30bps below consensus, driven by lower vegetable prices, the cut in the price of liquefied petroleum gas (LPG) cylinder prices, and a capped core inflation. Nevertheless, price pressure on the broader food basket remains elevated, with food inflation moderating to 9.9% yoy in August, from 11.5% in July. Underlying drivers of inflation continued to ease, with core CPI inflation falling to 4.8% yoy in August, from 4.7% in July. Industrial production for July was 5.7% yoy, 40bps above expectations, up from a revised June figure of 3.8%. Industrial production dropped 1.9% month on month (mom) in July after -0.3% mom in June, but the yoy rate rose by 190bps to 5.7% over the same period, 40bps above expectations. Capital goods, infrastructure and construction outperformed. The trade deficit widened to USD 24.2bn in August from USD 20.7bn in July, significantly above consensus at USD 21.0bn.

Indonesia: Automobile sales rose by 8k to 88.9k in August. The trade surplus rose to USD 3.1bn in August from USD 1.3bn in July as imports declined more than expected.

Malaysia: Industrial production rose to a yoy rate of 0.7% in July, from -2.2% in June, and 90bps above consensus.

South Korea: The unemployment rate declined 40bps to 2.4% for August, 50bps below expectations.

Latin America

Argentina: The central bank kept its benchmark monetary policy rate unchanged at 118%. CPI inflation surged to 12.40% mom (and 125.2% yoy) in August from 6.3% mom (114.6% yoy) in July, 90bps above consensus.

Brazil: The yoy rate of CPI inflation rose 60bps to 4.6% yoy in August, slightly below consensus as electricity prices increased in line with scheduled, but food prices declined. Core inflation declined further with the average of core inflation measures down 40bps to 5.2% yoy, allowing the central bank to ease monetary policy by another 50bps to 12.75% in the coming week. Retail sales rose by 100bps to 2.4% in yoy terms in July, 40bps above consensus.

Colombia: Retail sales for July were -8.2% yoy, 40bps below expectations, up from -11.9% in June. Industrial production declined by a yoy rate of 3.6% in July from 2.2% yoy in June, significantly below consensus.

Mexico: Industrial production (NSA) rose 110bps to a yoy rate of 4.8% in July, 80bps above consensus. Nominal wage inflation softened by 70bps to 8.2% yoy in August.

Peru: The central bank cut its policy rate (for the first time this cycle) by 25bps to 7.50%, in line with consensus expectations. Governor Julio Velarde said the central bank cannot cut rates as fast as other countries as he sees inflation converting to the target only by the end of 2024. In other news, copper production rose to 230k metric tons in July (+17.7% yoy). The unemployment rate rose by 30bps to 6.6% in August in the capital city of Lima.

Central and Eastern Europe

Czechia: The yoy rate of CPI inflation declined by 30bps to 8.5% in, in line with consensus.

Poland: The yoy rate of CPI inflation was unchanged at 10.1% in August. The current account surplus declined to EUR 0.6bn in July from EUR 2.4bn in June.

Romania: CPI inflation was unchanged at 9.3% yoy in August, 30bps above consensus.

Russia: The key rate was increased 100bps to 13.0% on 15 September, expectations were for no change.

Central Asia, Middle East, and Africa

Egypt: The yoy rate of CPI inflation rose 90bps to 37.4% in August as core CPI inflation declined 30bps to 40.4%. Elevated food inflation has been a source of social unrest in the past – a risk to be carefully monitored.

Saudi Arabia: CPI inflation for August was 2.0%, down 30bps from July.

South Africa: Manufacturing production declined to a yoy rate of 2.3% in July, from 5.9% yoy in June and below consensus expectations at 4.8%. The country's energy situation is likely to improve in October after the scheduled maintenance of several of its power plants. In the meantime, South Africa continues to ramp-up investments in renewable energy. Data from Nomura2 showed that Chinese customs indicated solar panels exports to South Africa are increasing at the fastest pace in the world after Europe, as South Africa quadrupled imports of solar panels from China in the first half of 2023.

Türkiye: The current account deficit increased to USD 5.7bn in July from a USD 0.65bn surplus in June, USD 1.0bn below consensus. Industrial production contracted 0.4% mom in July after rising 1.6% mom in June, but the yoy rate surged to 7.4% from 0.6% yoy over the same period due to base effects. Inflation expectations for the next 12 months rose by 300bps to 45% in September.

Nigeria: CPI inflation rose by 170bps to 25.8% yoy in August, 80bps above consensus.

Developed Markets

United States: CPI inflation rose by 0.6% mom in August from 0.2% mom in July as the yoy rate rose 50bps to 3.7%, 10bps above consensus. Core CPI inflation rose 0.3% mom and the yoy rate declined by 40bps to 4.3%, in line with consensus. Although core inflation is still likely to decline over the coming months, due to lower service inflation, higher energy prices pose a real threat to the soft-landing narrative. The yoy rate of producer price index (PPI) inflation rose by 60bps to 1.6% in August, 30bps above consensus. Initial jobless claims rose by 3k to 220k in the week of 09 September, slightly below consensus. Other economic data was stronger than expected. Retail sales (ex-auto) rose by 0.6% mom in August, 50bps above consensus, from 0.7% mom in July and industrial production rose 0.4% mom in August, 30bps above consensus. The Empire Manufacturing survey rose to 1.9 in September from -19.0 in August, but the University of Michigan Sentiment survey declined to 67.7, from 69.5 over the same period.

The New York Fed’s Survey of Consumer Expectations for August highlighted a shift in perceptions across US households, namely that the probability of leaving or losing jobs had or will increase. The probability of voluntarily leaving one’s job increased to 18.9% in August from 17.0% in July, but more households were feeling insecure as the probability of losing one’s job increased to 13.8%, up from 10.9% in May, the highest level since April 2021. Furthermore, 59.8% of consumers reported that credit is “somewhat harder” or “much harder” to obtain.

Eurozone: The European Central Bank (ECB) hiked its deposit and lending benchmark policy rates by 25bps to 4.0% and 4.5%, respectively. The market was pricing 50% odds of a hike as the ECB is caught between a rock (inflation elevated and uneven across the Eurozone) and a hard place (growth declining due to cyclical and structural factors). The ECB lowered its GDP growth forecasts by 20bps in 2023 to 0.7%, by 50bps in 2024 to 1.0%, and by 10bps in 2025 to 1.5%. Inflation expectations increased 20bps for 2023 and 2024 to 5.4% and 3.2%, respectively and declined by 10bps in 2025 to 2.1%. The ECB signalled the end of the hiking cycle in its statement: “Based on its current assessment, the Governing Council considers that the key ECB interest rates have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to the target. The Governing Council’s future decisions will ensure that the key ECB interest rates will be set at sufficiently restrictive levels for as long as necessary”. The EUR sell-off reflects the lower growth forecast, but also the fact that European companies are much more reliant on floating rate and short-term fixed rate bank loans than their US counterparts, which have been lengthening the duration of their debt profile with 10 to 30-year capital market transactions.

United Kingdom: Industrial production was 0.4% yoy for July, in line with expectations, down 30bps from June. Manufacturing production was 3.0% yoy for July, 30bps above expectations, down 10bps from June.

Japan: PPI inflation was 3.2% yoy for August, 10bps below expectations, down 20bps from a revised July figure. Core machinery orders were -13.0% yoy for July, 270bps below expectations, down from 5.8% in July. Industrial production for July was -2.3%, up 20bps from June.

1. See – https://finance.yahoo.com/news/lithium-battery-production-country-top-183050554.html#:~:text=Chinese%20firms%20dominate%20the%20electric,manufacturers%20are%20based%20in%20China

2. See – Per market colour from James Burton, Nomura.

Benchmark performance